Abstract

Employees’ resistance to change in the banking sector is still considered to be a sophisticated exhibition because it has both positive and negative dimensions of the bank at large. Managing employees’ resistance is very important to the continuity of business in the banks. Successful implementation of the change implies that all factors have been considered and evaluated and that the final change will not make the bank more harm than good. Various works of literature have identified two components of employees’ resistance, for instance, procedural conflicts and goal conflicts should also be taken into account when handling the situation. Proper utilization of the current bank’s resources will mean that the management is in close contact with the rest of the employees. Employees’ resistance has a direct impact on the performance of the bank in the future.

Introduction

This chapter covers the background to the study, problem statement, research objectives and hypotheses and the significance of the study.

Background to the Study

From the bank’s context, resistance can be said to mean the subsequent reaction of the employee in regards to his/her disapproval of the bank’s change. Employee resistance has been identified as the main reason why many banks lag in regards to the implementation of their bank’s changes. The resistance of the employees to the bank’s change has consequences in regards to the management because of the significant role that the employees play to contribute to the success of any bank; therefore, employee resistance to bank’s change is a very vital element that needs to be given keen attention in the course of the development of the bank.

The Bank’s change is meant to improve the processes that the bank uses to meet its objectives. The processes entail the bank’s activities, the bank’s management style; the bank’s working environment, and the bank’s methodologies. The bank’s change, therefore, streamlines the bank’s activities with the bank’s goals. The new activities brought about by the bank’s change may not be welcomed by the employees, because the employees might already have their preferred methods of working. Many scholars have noted that unwillingness to accept change is a widespread response among individuals. One can refer to the survey of 1000 leading companies put on the Fortune list. It indicates that the success rate of the bank’s changes ranges from 20 to 50 per cent (Archie and Juha 52). Such problems can be observed in the businesses, representing different sectors of the economy, including the banking industry. This survey also shows that workers may find difficult to adjust to new policies. These people can be very skilled professionals; furthermore, people have many years of work experience.

It is very important for the top management and the owners of the bank to fully understand the factors that make employees resistant to change to come up with amicable solutions to the same. Chester, in his study, stated that “the resistance of the employees has a cause, which results in a situation” (324). Many scholars have researched to identify the early signs of resistance among the employees to provide ways in which it can be dealt with. When this is done, the bank will be able to identify the specific causes and solve them right on time. The resistance of the employees has concerns which are worth observing; the banks are highly affected in the long run in regards to the bank’s change programs. Employees’ resistance to change influences the bank by increasing the operating cost. Also, employees’ resistance has contributed to the high employee turnover that is experienced by many banks (Archie and Juha 52). In the long run, many banks are weakened by employees’ resistance to bank’s change.

Scholars distinguish several reasons why employees often struggle with change. In particular, the scholars attach importance to such details as the loss of control and lack of clear expectations. The scholars believe that their duties are not properly identified, and job design is very vague (Archie and Juha 52). Very often, employees feel that changes make them unable to plan their workplace activities (Archie and Juha 52). Apart from that, the new practices are very suddenly imposed on the employees (Kanter, 2012). So, employees do not have a sufficient amount of time to adjust to new practices. It should be noted that in many cases, these beliefs are not justified because employees can have the proper educational background. This is why researchers note that resistance to change can often be irrational (Archie and Juha 54). These are the main tendencies that researchers single out. To a great extent, these arguments are relevant to the work of the banking institutions which also need to change different elements of a bank’s design to reduce operational expenses and become more responsive to new trends.

The scale of this problem indicates that resistance to change cannot be attributed only to the lack of skills and motivation. One should not suppose that many workers are inherently opposed to change. In many cases, the problem can be explained by the fact that the bank’s changes are not introduced properly. In particular, one should pay close attention to such aspects as timing, clarity of managerial instructions, empowerment of workers, job design, motivation, and so forth. Additionally, the most common concerns of workers suggest that in many cases, the managers do not communicate with workers regularly. These are some of the main assumptions that can be made.

In this case, one can speak about the inability of managers to engage employees. In other words, managers cannot properly explain what kind of changes should be implemented, and why changes are needed. Therefore, this problem takes its origins in the lack of proper communication. More importantly, the bank’s leaders often fail to put themselves in the position of employees. Business administrators working in banking companies should consider these issues if their initiatives are not readily accepted by employees. Therefore, a company that faces such a problem should address the underlying causes that prevent people from accepting new practices.

Various researchers have researched the different causes of employee’s resistance. When the employees do not have confidence in the bank, it affects them mentally, and in the same way, employees will resist any business transformation that has been suggested. Obstructions of the employees at the workplace are another contributing factor in regards to the mental factors. Frustrations will affect the attitude of the employee, which in turn affects the same employee psychologically. In the same way, anxiety and fear will also influence the employee psychologically; thus, affecting the way the employees embraces the bank’s change. The employees’ resistance can be caused by emotional factors. This can be accredited to the outlook of the employees. The employees need to have a positive mind-set for their work. The previous downfalls of the employees also contribute to the resistance to the psychological factors hindering the bank’s change. When an employee had tried to change and work out something different but failed, the employee will not be motivated to change, but rather stick in the same way of doing things.

Many of the solutions to eradicate employee resistance to change have focused more on solving procedural conflicts, rather than goal conflicts. There is, therefore, a research gap in the area of goal conflict that needs to be addressed by future researchers. Many of the solutions have emphasized the changes in processes that are used to drive the bank. Changes in the processes cannot just be ignored as this phenomenon is considered to be very important in the eradication of employee resistance. The management of the chosen company does not know why exactly the workers resist the merging of different departments. Nevertheless, the management may assume that their reactions are related to the causes identified by researchers. So, to gain better insight into their views, management should poll workers. This poll can take the form of a semi-structured interview.

Statement of the Problem

The employees working in the banking sector are often reluctant to accept the bank’s change, even if this transformation can improve the performance of a business. In particular, employees do not readily adjust to the merging of separate departments. It should be noted that this transformation entails the adoption of new performance standards and workplace procedures. This resistance can take many forms; for example, one should mention that some people tend to adhere to the previous workplace procedures. Additionally, employees can display little commitment to the bank’s goals.

In turn, these responses to change can create challenges for the entire bank. In particular, the company will not be able to adopt new practices and strategies that can improve its sustainability. This issue has become particularly acute nowadays when companies have to face both global and local competition. In turn, business administrators need to understand how one can help employees embrace new practices. This problem has already been examined by various researchers; nevertheless, it is important to study this issue within the context of the banking sector. These are the main issues that should be addressed.

Objectives of the Study

The general objective of this study was to explore the ways to address employees’ resistance to bank’s change in the banking sector. In line with the general objective, the study examined the following specific objectives:

- To determine if educating the employees affects addressing their resistance to bank’s change;

- To explore the effect of employees’ participation in addressing the employees’ resistance to change;

- To ascertain whether facilitating the employees’ influences their resistance to change in the bank;

- To ascertain whether the use of coercion influences the resistance of the employees to bank’s change;

- To explore the effect of negotiation on addressing the employees’ resistance to change.

Research Hypotheses

To meet the above objectives, the following hypotheses were tested:

- Ho1: Employee’s participation does not address employees’ resistance to change in the bank;

- Ho2: Educating the employees has no impact on the employees’ resistance to change;

- Ho3: Employees’ resistance cannot be addressed by facilitating the employees;

- Ho4: Employees’ resistance is not determined through coercion;

- Ho5: The use of negotiations does not address the issue of employees’ resistance.

Justification of the Study

The findings of this study are of great value to policymakers and regulatory authorities. It provides the policymakers with a wide exposure about the assessment on how to successfully address employees’ resistance in a bank, thus enabling them to adopt the relevant strategies in line with the situation. The findings of this study also add to the body of knowledge of related studies concerning the resistance of the employees to bank’s change.

Scope of the Study

The scope of this study was in line with the general objective, which was to determine the ways of addressing employees’ resistance to change in the banking sector. Using primary data and applying statistical techniques, the study explained the variables to meet the research objectives.

Literature Review

The main aim of this study is to explore the employees’ resistance to change in the banking sector. This chapter will, therefore, explore on the employees’ resistance and provide a clear understanding of the causes of the resistance and likely subsequent measures to be taken to provide solutions. This chapter will, therefore, review the related literature and empirical data in regards to the subject matter.

Resistance to Change

Meaning of Resistance

From the bank’s context, resistance can be said to mean the subsequent reaction of the employee in regards to his/her disapproval of the bank’s change (Archie and Juha 52). Employee resistance has been identified as the main reason why many banks lag in regards to the implementation of their bank’s changes. The resistance of the employees to the bank’s change has consequences in regards to the management because of the significant role that the employees play to contribute to the success of any bank; therefore, employee resistance to bank’s change is a very vital element that needs to be given keen attention in the course of the development of the bank.

Two notions of the bank exist, for instance, goal succession and goal change. Goal succession occurs when the bank has already met the previously set goals and now has to set new ones. Goal change, on the other hand, occurs when the bank has failed to meet its set goals and have to set new ones (Archie and Juha 52). The goals of a business are not permanent. Almost all establishments change their goals from time to time to remain viable. With the advancement of technology, new ways and processes of doing things have emerged. This has called for banks to modify their goals from time to time (Archie and Juha 52). The resistant employees were perceived to be radicals who believed that the goals and the views of the bank clashed with their own individual goals and needs. Resistance impedes to change, and for change to occur, banks need to eliminate resistance.

Many researchers have argued that conflicts in the banking sector are caused by employee resistance. The unity of the employees is considered to be a strength to the bank. But when the employees have divergent views and attitudes towards a new proposed change, the bank will be highly affected. These different precepts and approaches are the contributing factors to employee resistance. Some employees can argue that the proposed change will result, unemployment, others may have the belief that the proposed change can lower remunerations or allowances, while others might say that the change will no longer need their skills and talents. Therefore, this implies that the bigger problem to solve in this case is not resistant to change, but rather to look at the bigger picture of the outcomes of the change. Banks have basic goals and supportive goals. The supportive goals are aimed at helping them attain basic goals. The goals are changed in line with the vision of the bank. There are some instances where there is a great demand for change in regards to the ways of operation to enable it remains viable.

Employee resistance greatly impacts the stability of the banking sector. Today’s business in the banking environment calls for flexibility due to the pressure emanating from the inside and outside of the business environment. This has demanded the banks to try to strike a balance between the stability of the bank and the business continuity. Banks realize this by controlling the implementation of the change processes and at the same time keeping in mind the viability of the bank (Coch and French 537). Many scholars have outlined the fact that it is not the change that the employees are opposed to, but rather the likely aftermaths that come with the change.

In a nutshell, the management of banks will recognize the nature of the resistance to be the sign for the cause of the resistance. The management should eradicate the symptoms of change rather than wait to cure the consequences (Bales 440). The second advantage of the change process is the fact that it brings about an inflow of energy to the employees. The employees will realize that there is an urgent need of the bank for growth and expansion. Employee resistance has a positive element to it. It helps the banks to point out the harmful elements of the proposed changes (Bales 440). This is attributed to the fact that the bank will take time to investigate what it is that hinder the employees from embracing the change. After identifying the problem, banks will change certain aspects of the change to mould it in a way that the employees will appreciate (Archie and Juha 52). This will motivate them to put more effort into the existing procedures to improve the quality of the output and the efficiency of the same. Also, the implementation of the change will need extra energy.

When the resistance is intolerable to the bank, the management should use motivational techniques to address the situation (Coch and French 537). Another advantage that comes with the employee resistance to change is the fact that it creates an avenue to explore other substitute procedures to absorb the clash of interests. Management of banks should, therefore, make rational decisions which provide an avenue to explore other possible solutions to the existing problem of employee resistance. It is not easy to implement change in a bank when the employees are reflexive (Coch and French 537). This calls for an urgency to address the problem that is in existence. In the case of the existence of the employees’ resistance, the management should closely examine the nature of the resistance to devise the possible solutions. The management should keep in mind to maintain the balance between the stability of the bank and the implementation of the change (Coch and French 537).

Many researchers, in their studies, have pointed out to the fact that employee resistance remains a top obstacle to the development of banks (Coch and French 537). The scholars have categorised employee resistance into 2, for instance, attitudinal resistance and behavioural resistance (Bales 440). The resistance of the employees can be demonstrated by the employees’ not showing interest, having negative attitudes, having negative views, engaging in go-slows and boycotts, and violent behaviours (Bales 443).

Early Scholarly Articles on Employees’ Resistance

The first scholar to bring about the concept of resistance to change was Bales Fred, way back in the 1940s. Bales analysed the relationship between the behaviour of the individual and how it impacts change in the bank. Archie and Juha in their study focused on the inclusion of the employees to take part in the decision-making process of the bank. The scholars argued that “when the employees are not included in the decision-making process of the bank, the bank’s changes are opposed” (52). Therefore, the inclusion of the employees on the affairs of the bank is the primary weapon to fight the resistance to change.

Employees’ Resistance

It is very vital to fully understand the factors that make employees resistant to change to come up with amicable solutions to the same (Coch and French 537). Bales, in his study, stated that “employee resistance is a cause-effect situation” (347). Many scholars have researched to identify the early signs of resistance among the employees to provide ways in which the resistance can be dealt with. When this is done, the bank will be able to identify the specific causes and solve them right on time. The resistance of the employees has consequences which are worth noting; the banks are highly affected in the long run in regards to the bank’s change programs. Employees’ resistance to change impacts the banks by increasing the operating cost. Also, employees’ resistance has contributed to the high employee turnover that is experienced by many banks (Chester 70). In the long run, many banks are destabilised by employees’ resistance to bank’s change.

Many employees have a passion for their work and for the banks in which employ them. Many of them always look for their best interest in their work. Their resistance to change does not mean that employees want to negatively impact the bank, but it demonstrates the fact that employees are looking out for themselves and that employees want to work in an environment that is comfortable. This is why banks need to include their employees in the processes that lead to bank’s change (Coch and French 537). When the management realizes that there is some resistance by the employees, the management should understand the situation and explore the likely causes of the same in the bank. This will make them be in a better position to understand and manage the situation at hand (Drucker 183).

Many scholars have explored the different causes of employee’s resistance. The employees’ resistance can be caused by psychological factors (Coch and French 537). This can be attributed to the attitude of the employees. The employees need to have a positive attitude to their work. The past failures of the employees also contribute to the resistance to the psychological factors hindering the bank’s change. When an employee had tried to change and work out something different but failed, the employee will not be motivated to change, but rather maintain the same way of doing things (Drucker 183). When the employees do not have faith in the management of the bank, it affects them psychologically, and in the same way, employees will oppose any change that has been suggested. The frustrations of the employees at the workplace are another contributing factor in regards to the psychological factors. Frustrations will affect the attitude of the employee, which in turn affects the same employee psychologically. In the same way, anxiety and fear will also influence the employee psychologically; thus, affecting the way the employees embraces the bank’s change.

The second factor that causes the employees’ resistance is the money-oriented nature of the employees. When the wages or salaries are low, the employees will highly resist change because employees will feel that any change will make them worse off than the current situation at hand (Coch and French 537). The threat to the security of jobs will also hinder the employees from embracing change. Another element in line with this is comfort. Employees who feel comfortable with their current position and status in the bank do want to change. May be employees are enjoying certain rights and privileges which can be lost when the change occurs (James 665).

The third factor that contributes to the employees’ resistance is the constant abilities of the employees (Coch and French 537). Some employees have existing skills and have not added more skills on top of their current skills. Bank’s change may make their skills obsolete and in the process, the employees will lose their jobs. These employees will seriously oppose any form of bank’s change for the sake of their sustainability. In the same way, a bank may have a big gap between the highly capable employees and the lowly capable employees. Bank’s change is meant to bridge that gap by introducing new concepts in regards to the execution of duties, but unfortunately, many banks find it expensive and time-consuming, thus, the banks take a step back in regards to bank’s change (Correa and Slack 60).

The fourth and the last factor that has been identified by scholars as a contributing factor to the employees’ resistance is the employees’ concern for their bank (Drucker 183). When the employees identify faults in the bank and realize that the change is not beneficial to the bank or the employees, then the employees will strongly disagree with the change. In the same way, the employees and the management of the bank might have a big clash of opinions in regards to how the bank’s change should be implemented. In such a scenario, employees could be at loggerheads for quite some time, and it can take long before the employees and the bank reach an amicable solution (Coch and French 537). Also, the owner of the bank and the employees can have a clash of opinions in regards to the bank’s goal. The owner of the bank might have goals which are materialistic and self-centred to him, while on the other hand, the employees will need goals which are beneficial and safeguard their future (James 665).

Employees’ Resistance to Change

There are many causes of employees’ resistance to change as pointed out by many scholars. Out of the many causes, there is one main cause that stands out, and that is the clash of interest between the employees and the owner of the firm. The clash of interest can be in terms of the procedures in the bank, for instance, in regards to the ways of discharging the duties of executing the work procedures. Also, the clash of interest can be in regards to the long term goal of the firm; whereby, the owner of the bank might have a goal that conflicts the goals of the employees (James 665). These two goals (goal of the bank and the employees’ goals) are considered to be parallel units. The main cause of the employees’ resistance is the conflict of the goals, as pointed out by several scholarly articles.

In any given competitive work environment, the goals of the bank change from time to time, for instance, reducing the operating cost, innovation, expansion, and so forth (Drucker 183). The new goal of the bank is the new target, and the bank, therefore, has to look for a new means to meet the set targets. The goals of the bank can be considered to be basic or supportive goals. A basic goal is the topmost goal of the bank, while a supportive goal helps the bank to meet the basic goal (Coch and French 537). The commitment of the bank to achieve its basic goals and the supportive goals gives rise to the conflict between the bank’s goals and the employees’ goals.

In another scenario, a bank can decide to stick to its original goals but changes the bank’s procedures to steer the bank to achieve the set goals. This will require the bank to focus on some areas where it concentrates its activities. This change of procedures and activities will limit the bank’s employees from meeting their own goals, thus, arising to a conflict of interest between the owner of the bank and the employees (James 665). The definition of goal conflict is a situation in which employees in a bank feel insecure that the goals of the bank are not in conformity with their own goals (Drucker 183). When such a situation occurs, the employees find it difficult to meet their own needs. The resistance of the employees to change will, therefore, affect both sides: the bank will not meet its goals, and the employees will also not meet their personal goals.

The Bank’s change is meant to improve the processes that the bank uses to meet its objectives. The processes entail the bank’s activities, the bank’s management style; the bank’s working environment, and the bank’s methodologies. The Bank’s change, therefore, streamlines the bank’s activities with the bank’s goals. The new activities brought about by the bank’s change may not be welcomed by the employees, because the employees might already have their preferred methods of working. A procedural conflict will then arise in such a scenario. James in his study exploring on the relationship between bank’s change and employee resistance stated that “every new change that a bank brings about already, has a conflict in waiting, because employees have their way of working, even though the bank is adamant to change” (53). Conflict is therefore considered to be part and parcel of the change.

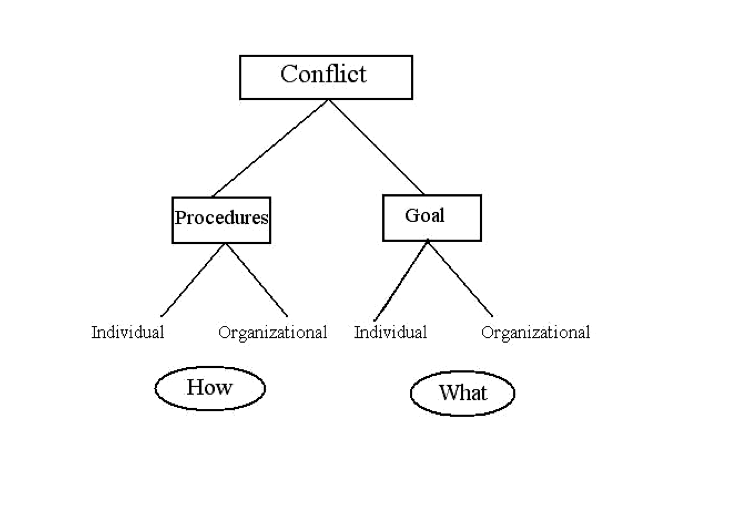

Goal conflict has been explored by several scholars. Drucker explored the nature of goal conflict in a new dimension by stating that “resistance to change is always present because all the change recipients do have their interests and goals that need to be pursued” (145). The employees’ resistance to change can be said to be composed of goal conflicts and procedural conflicts. The conflicts arising from the employees’ resistance to change can be demonstrated in a linear representation, for instance: Y = X1 + X2 + e. Whereby, ‘Y‘ represents the employees’ resistance to change, ‘X1’ represents the goal conflicts, ‘X2’ represents the procedural conflicts, and ‘e’ represented the various causes of employee resistance to bank’s change. Figure 2.1 gives a brief overview of the categories of conflicts.

Procedural conflict occurs in a situation whereby the bank has set new goals and has come up with new procedures to of working to achieve the goals, while on the contrary, the employees appreciate the goals, yes, but want to achieve the same goals using their procedures of working (James 665). Goal conflict, on the other hand, arises when the employees of the bank consider the goals of the bank as a hindrance towards achieving their own goals and needs. Also, goal conflicts occur when the set goals of the bank are not in conformity with the employees’ personal goals and needs.

Correa and Slack argued that the main ways of eradicating employee resistance in a bank are: improving the employees’ participation in decision making, constant communication with the employees, creating a sense of job security, and empowering the employees through constant on the job training (35). The same sentiments were echoed by James, who argued that “the needs of the employees should be addressed with much urgency” (46). James in his study pointed out that “employee resistance in a bank can be eliminated through coercion and proper communication” (37). The above-identified solutions can also help to solve the procedural conflicts that arise between the management of the bank and the employees of the bank. Constant on the job training is helpful for the employees as this will equip the employees with the new concepts and procedures of discharging their duties.

Many of the solutions to eradicate employee resistance to change have focused more on solving procedural conflicts, rather than goal conflicts. There is, therefore, a research gap in the area of goal conflict that needs to be addressed by future researchers. Many of the solutions have emphasized the changes in processes that are used to drive the bank. Changes in the processes cannot just be ignored as this phenomenon is considered to be very important in the eradication of employee resistance (Guth and MacMillan 57; Coch and French 537). This study will focus on the research gap by bringing out clearly on how the employees respond to the proposed change concerning their individual goals and the goals of the bank. The banks will be charged with the mandate to streamline the bank’s goals to be in line with the personal goals and needs of the individual employees. This study will seek to address the goal conflict as the biggest factor that contributes to employee resistance, particularly in the banking sector.

Employee Resistance

Employee Resistance to Change in the Banking Sector

The bank came up with positive change programs which received hostility from senior managers and other employees. These proposed changes have created a paradigm shift in regards to the relationship between the owners of the bank and the employees. The change was necessary as it was to determine the survival of the bank in the new future. The owners of the bank came up with a plan that would ensure the introduction of the change and its successful implementation. The plan was to be executed for a period of within six months. It involved creating awareness in regards to the urgency of the situation. Also, several pieces of training and facilitation were done to the employees to prepare them to embrace the change.

The change in this bank came with the setting of new goals and new targets and operational activities have therefore been highly concentrated in some areas, thus, creating a conflict between the goals of the bank and the goals and needs of the individual employees. The new targets were high and the newly set goals were not in conformity with the personal goals of the employees. This brought about a slowdown in operations as the employees slowly started to resist the proposed changes. The new policies and procedures of working demand for the behavioural changes from the employees. Also, new skills and knowledge were required from the employees. All these brought about discomfort at the place of work, and as a result, the bank started registering high rates of absenteeism and high rates of the employee turnover. The employees were less motivated, which compromised on the quality and the quantity of the output. The bank experienced increased costs of operation as resources were wasted the productivity lowered. The employees, on one hand, believed that the bank’s changes are meant to frustrate them in one way or the other, while the bank, on the other hand, believed that the employees were intentionally sabotaging its operations.

The Procedural Conflicts in the Bank under the Study

The introduction of the change demanded that the usual procedures for performing tasks be changed. New mechanisms and machinery have been introduced for the sake of achieving the new set targets, thus, improving the bank’s efficiency and the quality of output. The employees, on the other hand, considered the old methods to be superior to the newly introduced procedures, even though the management of the bank still insisted on the new methods. This gave rise to procedural conflict in the bank. The solutions suggested curbing the menace of procedural conflict are the constant training of the employees to equip them with the new methodologies of performing tasks. In the same line, the management of the bank communicated on time in regards to the proposed changes and this prepared the employees psychologically.

The Goal Conflicts in the Bank Under the Study

The bank had the intention to survive in the industry and this is why it shifted its focus towards profit maximization. Profit maximization was considered to be the basic goal and it was backed by other supportive goals, for instance, innovation, quality enhancement, and developing new products. The bank embarked on this journey by concentrating its efforts in achieving the basic goal, which the employees considered to be self-centred. The goals were not in line with the ambitions of the employees, thus, creating a scenario of goals conflict.

The Solutions Proposed to Deal with Employees’ Resistance

The bank took a step back to understand the nature of the problems and the cause of the problems. The change in the procedures and processes called for more training to improve efficiency and quality. The bank achieved this through initiating on the job training aimed at improving the skills of the employees. This training also helps to change the behaviours of the employees by helping them to be more flexible and responsible. All these tactics helped the bank to deal with procedural conflicts because the banks entailed the change of processes and tactics. Even though these tactics worked to some extent, the bank did not fully curb the menace of employee resistance. Several employees still did not change after the bank’s efforts. This was attributed to the goals of conflict that was not solved.

The Concept of Goal Conflict

Scholars have defined goal as the main objective behind the setting up of the bank (Correa and Slack 60). All the employees and the owners of the bank usually work as a team with the motivation to meet the bank’s goals. It is through the goals of a bank that its identity is created. The goal also provides motivation to the employees, thus, giving them the enthusiasm and psyche to discharge their duties in an appropriate manner (Correa and Slack 60). A bank can have short term goals, mid-term goals and long term goals. The top management of the bank uses the bank’s goals as a cornerstone for designing the bank’s policies. The goals of the bank are very helpful to the firm to realize maximum revenue, providing exceptional customer service, enhancing the quality of the products, and helping the bank to give back to the society (James 665).

Change in the Bank’s Goals

The goals of a bank are not permanent. Almost all banks change their goals from time to time to remain competitive. With the advancement of technology, new ways and processes of doing things have emerged. This has called for banks to change their goals from time to time (Correa and Slack 60). Resistance is a convincing factor that changes an individual’s attitude and makes him resistant to any form of change. Scholars argue that any form of change that receives great opposition from the employees is viewed as a change that has great benefits – no wonder it is highly opposed. Any bank has basic goals and supportive goals. The supportive goals are aimed at helping the bank to achieve the basic goals. The goals of the bank are changed in line with its vision. There are some instances where there is a great demand for change in regards to the ways of operation to enable it remains competitive. Two concepts of the bank exist, for instance, goal succession and goal change. Goal succession occurs when the bank has already met the previously set goals and now has to set new ones. Goal change, on the other hand, occurs when the bank has failed to meet its set goals and have to set new ones (James 665).

The Concept of Employee Resistance

Many scholars have pointed out the fact that conflicts in banks are caused by employee resistance. The unity of the employees is considered to be the strength of the bank. But when the employees have divergent views and attitudes towards a new proposed change, the bank will be highly affected. These divergent opinions and attitudes are the contributing factors to employee resistance. The resistant employees were perceived to be radicals who believed that the goals and the views of the bank clashed with their own individual goals and needs. Resistance impedes to change, and for change to occur, the bank needs to eliminate resistance (Correa and Slack 60).

Employee resistance greatly impacts the stability of the banks. Today’s business environment calls for flexibility due to the pressure emanating from the inside and outside the business environment. This has demanded the banks to try to strike a balance between the stability of the bank and the business continuity. The banks achieve this by moderating the implementation of the change process and at the same time watching the steadiness of the bank (Drucker 183). Many scholars have outlined the fact that it is not the change that the employees are opposed to, but rather the likely aftermaths that come with the change. Some employees can reason that the perceived change will result in job losses, others may have the belief that the perceived change can result to decreased salaries or allowances, while others might argue that their skills and talent will become obsolete and no longer needed by the bank (Drucker 183). Therefore, this implies that the bigger problem to solve in this case is not the resistance to change, but rather to look at the bigger picture of the outcomes of the change.

Employee resistance has a positive element to it. It helps the bank to point out the harmful elements of the proposed changes (Drucker 183). This is attributed to the fact that the bank will take time to investigate what it is that hinder the employees from embracing the change. After identifying the problem, the bank will change certain aspects of the change to meld it in a way that the employees will appreciate (Correa and Slack 60). In a nutshell, the management of the bank will consider the type of resistance to be the sign for the cause of the resistance. The management should eradicate the symptoms of change rather than waiting to cure the consequences (Drucker 183). The second advantage of the change process is the fact that it brings about an inflow of energy to the employees. The employees will realize that there is an urgent need for the firm for growth and expansion. This will motivate them to put more effort into the existing procedures to improve the quality of the output and the efficiency of the same. Also, the implementation of the change will need extra energy.

It is very hard to implement change in a bank when the employees are passive (Correa and Slack 60). This calls for an urgency to address the problem that is in existence. In the case of the existence of the employees’ resistance, the management should closely examine the nature of the resistance to devise the possible solutions. The management should keep in mind to maintain the balance between the stability of the bank and the implementation of the change. When the resistance is unbearable to the bank, the management should employ motivational techniques to curb the menace (Correa and Slack 60). Another advantage that comes with the employee resistance to change is the fact that it creates an avenue to explore other substitute procedures to absorb the clash of interests. Management of banks should, therefore, come up with rational decisions which provide an avenue to explore other possible solutions to the existing problem of employee resistance.

Resistance is a compelling factor that shifts an individual’s mindset and makes him impermeable to any form of change (Correa and Slack 60). Scholars argue that any form of change that receives great opposition from the employees is viewed as a change that has great benefits – no wonder it is highly opposed. The act of resistance that exists between two rival parties (in this case the employees and the bank) always brings out a heated debate, and in the process pumps in energy through the airing of different opinions. The employees’ resistance will, therefore, call for a closer examination of the change implementation process and in the process allowing for the trial of other alternatives. When a proposed change is implemented with little or no resistance, a lot of questions can be asked in the process, meaning that the purported change might not have undergone a good scrutiny process (Dent and Goldberg 35).

How the Resistance Is Managed

Many scholars have written articles about managing employees’ resistance in the bank. The top managers need to understand the concept of resistance to come with the appropriate methods of handling employee resistance. Once the management goes wrong from the onset, then an amicable solution cannot be forthcoming. The employees also have a role to play when the resistance to change do no work to their advantage. Therefore, understanding the concept of resistance is a dual concept which involves both parties, for instance, the management and the employees (Dent and Goldberg 35).

Many scholars have identified employee participation in the decision making the process of the bank as a potential remedy to their resistance to change (Dent and Goldberg 35). Many scholars have explored this concept of employees’ participation since the 1940s. The employees should be involved in the process like planning for the change, facilitating for the training programs aimed at equipping the employees with the relevant skills, and also the implementation of the change itself. When this happens, the attitude and the perceptions of the employees in regards to the change will be streamlined in line with the goals of the bank. This will make them to be receptive to the proposed change, rather than oppose it. Experts in the field of human resource management also support this fact (Drucker 183).

Employee participation ensures that the employees not only support the change but also be part of the change process. The employees put their heads together with the management in a roundtable and consult heavily through constant communication and sharing of information (Drucker 180). This represents the fact that the employees are committed to the change process rather than them being just compliant. Many banks who anticipate a higher resistance level often resort to employee participation in the change process to avoid the instances of heavy debates and arguments. The management of the bank wants to keep the resistance level to a bare minimum to adopt the change that the bank needs. Before the initiation of the change process, the top management should know the level of the anticipated change for the sake of preparation in advance. This will guide them on the parameters to use in the process of implementation. Also, the nature of the resistance should be evaluated pre-emptively to find out the pros and cons of the resistance (Drucker 180).

Employee resistance can also be managed by constant communication with the employees. The employees need to know about the proposed change in advance and the employees should be given time to fully understand the nature of the change and the likely benefits that the change will have on their role as employees holding various positions. Change is inevitable, and at some point in any bank, it has to occur. Communication, therefore, is seen as an act of preventing a likely fall out in the structure of the bank (Grusky 62). The structural change in the bank should not take the employees by surprise, but rather the employees should anticipate it in advance. Communication involves a lot of sharing of information and presentation of facts. The management who is mainly the proponents of change should have an in-depth preparation in advance in regards to the benefits of the proposed change; and in this case, the benefits should outweigh the demerits (Guth and MacMillan 320).

Planning for the change is very important for the stability of the bank. There are changes which if implemented will positively impact the bank. On the contrary, there are some changes which, if implemented can destabilize the bank (Hill and Jones 140). There are changes which are costly and expensive to implement. When such a change backfires, the bank can be in deep trouble. Similarly, some changes can lead to massive employee turnover, which is a reputational risk to the bank. Planning, therefore, is a necessary element for the successful implementation of the change. Planning involves carrying out an overview or an assessment of the situation in advance to have an idea of what the people on the ground say. The surveys involve directly interviewing some selected employees as a representation of the entire population of the workforce. The aim here is to have a feeling and an understanding of their perceptions (James 665).

Employees’ resistance to change is still considered to be an intricate spectacle because it has both positive and negative dimensions of the bank at large. Managing employees’ resistance is very important to the survival of the bank. Successful implementation of the change implies that all factors have been considered and evaluated and that the final change will not make the bank more harm than good (Kathleen 502). The two components of employees’ resistance which are procedural conflicts and goal conflicts should also be taken into account when handling the situation. Proper utilization of the current bank’s resources will mean that the management is in close contact with the rest of the employees. Employees’ resistance has a direct impact on the performance of the bank in the long run. Keen argued that “just one-third of the many corporate changes end up succeeding” (30). The employees’ resistance is instigated by the natural behaviour of the employees. Normally, in any given scenario of employees’ resistance, the management often has their interests at heart over the interests of the rest of the employees; this is what causes them to resist change.

A structural change in the bank that involves the introduction of machinery to replace the work efforts of the existing employees will be met with hostility by the employees as this will be viewed as a plot to get rid of the employees (Correa and Slack 60). Structural changes in regards to moving the office to a new location will be opposed by the employees because the employees will have additional transportation expenses. In the same way, moving the office from one location to another will make the employees shift to a new location and in the process losing touch with family or friends. Structural changes that involve the introduction of a new boss will be met with hostility if the potential boss is a no-nonsense and a ruthless person (Terry 82). Also, there are structural changes that come with the restructuring of the bank’s hierarchy. These changes can lead to potential loss of some job titles which the employees feel is not safe (Coetsee 79). Some structural changes in the bank normally come at a bad time when the bank or the employees are already facing problems. At this point, it is not easy to embrace the proposed change because of the current problems that are in the bank (Correa and Slack 60). For instance, if different heads of department clash over an issue regarding a proposed change, their various supporters might also clash in regards to the proposed changes. Timing, therefore, is of the essence in regards to the implementation of the change process.

While other employees spend much of their energy in resenting change, there is another group that is more than willing to welcome and accept the change. Many factors are attributed to the welcoming of the change by a section of the employees. Many scholars have pointed out to the fact that the main reason as to why employees welcome change is because the employees want to send a sign to the top management that the employees are willing to take the bank to the next level, but first some issues need to be selectively addressed to achieve this objective (Coch and French 537). The employees who jump in to embrace the proposed change normally have high expectations in terms of the benefits that are expected to come by. The structural change can come with a pay rise or elevation to the next level in terms of status and position. Also, it can bring about a sense of job security which pacifies the anxieties of the employees (Terry 82).

The other factors that have been identified by scholars as to contribute to the employees’ reception of structural change are: additional responsibilities brought about by the structural changes. These responsibilities build on the level of experience of the employees which is very beneficial to the employees. Also, the employees will be motivated to embrace change if there are expectations to increase the volume of self-satisfaction (Terry 82). Satisfaction comes with a feeling that an objective has been accomplished and a new status has been achieved. Employees also embrace change because of the urge to explore new challenges in the course of their careers, thus, allowing them to have a challenging job with many benefits.

Research Methodology

The methodology is the process of instructing the ways to do the research. It is, therefore, convenient for conducting the research and for analysing the research questions. The process of methodology insists that much care should be given to the kinds and nature of procedures to be adhered to in accomplishing a given set of procedures or an objective. This part includes the research design, the sample and the methods that were used in gathering information. It also contains the data analysis methods, validity and reliability of data and the limitation of the study.

Research Design

There are three types of research design: exploratory research, descriptive research and causal research (Chester 70). Exploratory research mainly explores the nature of the problem to draw inferences. In this scenario, the researcher is in a good position to understand the problem under investigation. The flow of exploratory research involves identifying the problem and seeking to find the appropriate solutions and new ideas (Chester 73). Exploratory research is mostly applicable in circumstances where the structure of the research problem is not definite. The interview is a good example of the methods that will be used to gather information in this kind of research (Chester 70).

On the other hand, descriptive research is mostly applicable in circumstances where the structure of the research problem is explicit. This kind of research is used when the researcher expects to distinguish the various observed facts in a sample or a population (Chester 72). Also, descriptive research is normally used by the researcher when the researcher has a prior understanding of the problem under investigation. Causal research is the kind of research whereby there is a clear structure of the research problem. In this case, the researcher is interested to explore the cause-effect relationship. The causes are identified, analysed and the extent of the effects are reviewed (Chester 70).

Research Techniques

Two principal techniques are popular in the field of research. These approaches are deductive approach and inductive approach (Chester 70). The distinguishing factor between the two approaches relates to the building of the theories. In the deductive approach, the hypotheses and theory are constructed after exploring the available relevant literature. In the inductive approach, the theory is constructed after the data has been explored and analysed. This study used the deductive approach; whereby the theory and the hypotheses were formulated after going through the relevant literature.

Data Collection

In any research that is conducted, there are basic stages that are involved in regards to the shaping of the research. These stages include: understanding the research problem, the conceptual framework of the research, data collection, data analysis and interpretations, and drawing of inferences and making recommendations (Chester 70). In this study, a quantitative research method was used to test the hypotheses that were formulated. The quantitative research method is very instrumental in harnessing mathematical models that are enshrined to natural facts. This type of research can be measured and the researcher can construct a conceptual framework using the existing theories.

Sources of Data

There are two broad categories of data sources, for instance, primary data and secondary data. This study used both primary and secondary data. Primary data is whereby the researcher collects first-hand information which does not already exist in any form. Secondary data is whereby the researcher uses information that is already in existence (Chester 70). Secondary data were used in the literature review whereby the past data/information was used to present the theories of this research. The data were collected from textbooks, journals, relevant articles and the internet. Primary data, on the other hand, was used through the administering of questionnaires, interviews and observation.

Reliability and Validity

The validity of the data represents the data integrity and it connotes that the data is accurate and much consistent. Validity has been explained as a descriptive evaluation of the association between actions and interpretations and empirical evidence deduced from the data (Chester 70). Reliability of the data is the outcome of a series of actions which commences with the proper explanation of the issues to be resolved. This may push on to a clear recognition of the yardsticks concerned. It contains the target samples to be chosen, the proper sampling strategy and the sampling methods to be employed (Chester 70).

Reliability of the data is subjected to four main challenges. These are: the respondents having insufficient knowledge on the area of the research, the mental or physical shape of the respondents at the time of questionnaire administration, biases in observation by the researcher, and error in making observations. To enhance the reliability of the findings, a pre-test of the questionnaire was done to eliminate the challenges. Some questions were then changed in respect to this.

Survey Questionnaire Construction

To aid in data collection towards achieving the general objective of this study, a questionnaire was formulated with the intent to investigate what the customers thought about eating out in restaurants. The collection of the data and the analysis of the same were directed to the employees who are working in the banking sector.

The questions in the questionnaire captured all the objectives of this study. Also, the questions were related to addressing the issue of employee resistance. The specific objectives of the study were: to explore on the effect of employees’ participation on addressing the employees’ resistance to change; to determine if educating the employees affects addressing their resistance to bank’s change; to ascertain whether facilitating the employees’ influences their resistance to change in the bank; to ascertain whether the use of coercion influences the resistance of the employees to bank’s change, and to explore on the effect of negotiation on addressing the employees’ resistance to change.

The first three questions in the questionnaire sought to find information in regards to the demographic attributes of the respondents. The questionnaires were issued to 450 respondents who were mainly employees in the banking industry. The participants’ responses were treated with much confidentiality.

Focus Group

A focus group consists of a small number of respondents (for instance a group of six to ten respondents) who have the same interest of seeking information on some given issues. In this study, each respondent in the focus group was asked to describe their perceptions of employees’ resistance. The responses were recorded by the researcher for further analysis.

Sampling Procedure

There are two popularly used procedures for sampling. The sampling procedures include prospect sampling and non-prospect sampling. In a probability sampling procedure, the samples are representative of the population. This is because all the entries have a chance of being selected. On the other hand, items in the non-probability sampling do not have an equal chance. In this scenario, all the items in the population do not have equal chances of being selected (Chester 70).

The data for the study was collected among the employees of the banking sector. These employees are potential candidates for employee resistance. The employees were used because their profile fits the context of this study. Therefore, the employees were an excellent choice because many of them have had employment experience. Because all the employees could not be accessible, a non-probability sampling procedure was employed in this study. The questionnaires were distributed over lunch hours between Mondays to Friday at a strategic location near the institution’s cafeteria. The order of asking the questions was interchanged over and over from one respondent to another to reduce chances of bias. In total, 450 questionnaires were issued in this study for data collection. Out of all the issued questionnaires, only 237 got a positive response.

Pre-Test Study

A pilot test was conducted to ensure that the questionnaires were reliable and valid. The test was conducted with a sample of fifty respondents. The respondents were not aware that it was a pre-test. After the pre-test, the questionnaire was edited by removing and changing some words. A pre-test was done again to ten additional respondents just to be sure that the questionnaire was now very reliable and very valid.

Limitations of the Study

There have been a lot of concerns on additional budgetary expenses for collection of the data, regardless of whether the gathered data is genuine or not and whether there may be an explicit conclusion when interpreting and analysing the data. Also, some employees were reluctant to offer some information that was confidential and unsafe in the hands of their competitors. This posed a great challenge to the research as the researcher had to take a longer time to find employees who were willing to give out adequate information.

Findings, Data Analysis and Interpretation

This section covers the analysis of the data, presentation and interpretation. The results were analysed using SPPS, ANOVA, regression and correlation analysis.

Descriptive statistics

Biographical information

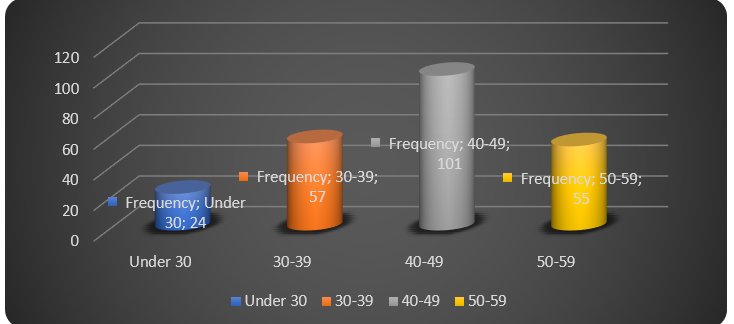

237 respondents (52.6%) of the expected 450 respondents completed the questionnaires. The respondents had varied age distribution which is summarized in Figure 4.1 below. The respondents were the employees at the bank.

The figure indicates that many respondents were from the age group 40-49 years (43%, n=101). This was followed by respondents in the age group 30-39 years (24%, n=57). The third-largest age group was 50-59 years, which had 55 respondents (23%). The age group under 30 years had the lowest number of respondents (10%, n=24).

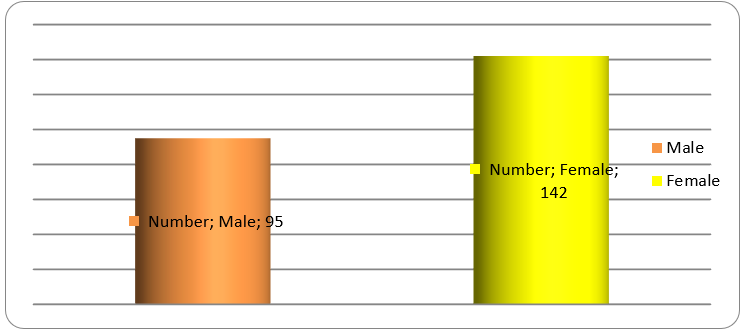

An analysis of the gender of the total respondents was made. The gender distribution is summarized in Figure 4.2 below.

The figure indicates that many respondents (60%, n=142) were female, whereas only 40% (n=95) were male employees.

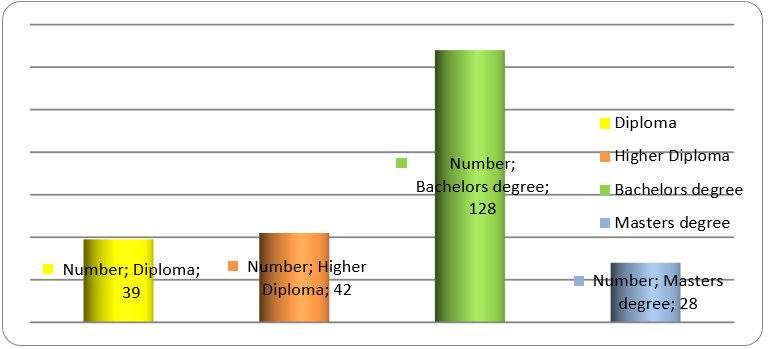

An analysis of the employee qualification was made. The qualification level is summarized in Figure 4.3 below.

The figure shows that many employees (54%, n=128) hold Bachelors degrees. This was followed by employees who had Higher diplomas (18%, n=42), Diploma holders (16%, n=39) and Masters degree holders (12%, n=28) in that order.

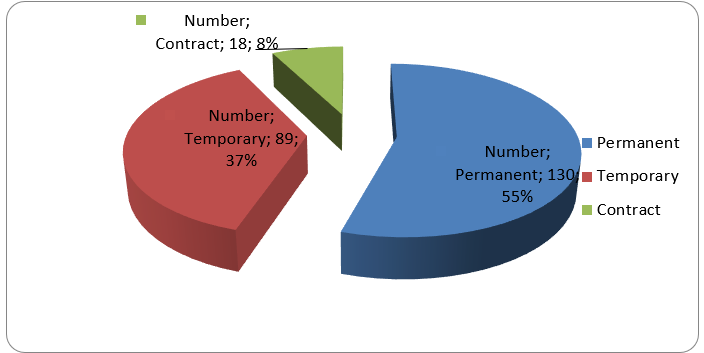

An analysis of the employment category of the respondents was done. The employment category is summarized in Figure 4.4 below.

The figure shows that the majority of the respondents (55%, n=130) was employed permanently. This was followed by 89 respondents (37%) who were temporarily employed. Only 8% (n=18) of the respondents were employed on contract.

Summary of Descriptive Statistics

Descriptive statistics using the measures of central tendencies were computed from the results gathered from the questionnaires. The questionnaires focused on the methods of addressing employees’ resistance to the bank’s changes.

Summary of Results

Respondents who were majorly employees in the banking industry were issued with questionnaires to express their responses regarding the methods of handling the employees’ resistance. The summary of the results is in Table 4.1 below. The results show that from the sample of 237 respondents, the mean for employees’ participation in the decision-making process is 113.20 with a standard deviation of 14.30. From this computation, it can be deduced that many employees believe that involving the employees in the planning, facilitating and implementing the change is the best method for addressing the problem of employees’ resistance; this is indicated by the higher value of the standard deviation. Also, the calculated arithmetic means for addressing the employees’ resistance through education, facilitation, and negotiation is less than the calculated arithmetic means for addressing the employees’ resistance through coercion. It is, therefore, evident that employees’ resistance can be handled more through coercion. Addressing the employees’ resistance through coercion (Mean=127.20, SD=15.30) is more effective than addressing it through negotiation (Mean=114.35, SD=14.22), through facilitation (Mean=103.10, SD=10.80), and addressing it through education (Mean=102.12, SD=11.30).

Table 4.1 Summary of the descriptive statistics

Inferential statistics

The results of inferential statistics were used to establish the relationship that exists among the variables that address the issue of the employees’ resistance to bank’s change; inferential statistics were used to ascertain the connection among the variables. The results are summarized in Table 4.2 below.

Table 4.2 Pearson correlation matrix for the variables

NOTE:

* = p<0.05

** = p<0.01

The results in the table above show that there are major correlations between educating the employees and the employees’ resistance (r = 0.598, p < 0.01), coercing the employees and the employees’ resistance (r = 0.585, p < 0.01), negotiating with the employees and the employees’ resistance (r = 0.386, p < 0.01) and between facilitating the employees and the employees’ resistance (r = 0.268, p < 0.05). There was also a significant relationship between the participation of the employees and the employees’ resistance (r = 0.273, p < 0.05).

A regression analysis to analyse how the variables predict the employees’ resistance was done and the results are summarized in Table 4.3 below.

Table 4.3 Summary of regression analysis

NOTE:

* = p<0.05 ** = p<0.01

The result found out that the multiple R-value is 0.602. The R-Square value of 0.361 indicates that 36.1% of the variables explained the dependent variable. The F-statistic (5.295) is statistically significant at 0.01 level; meaning that the economic variables significantly enlighten 36.1% of the variance in addressing the employees’ resistance. Facilitating the employees is the best predictor of the employees’ resistance as it has a beta coefficient value of -0.3189 and is statistically significant at the 0.01 level. Also, education, employees’ participation and negotiation are statistically significant at 0.05. The negative value of the beta coefficient of negotiation growth indicates that the employees’ resistance is greater in bigger banks than in smaller banks. In the same manner, the negative beta value of the employees’ participation coefficient shows that the participation of the employees is very important in addressing the employees’ resistance.

Conclusions and Recommendations

This chapter presents a summary of the findings and discussion of the results following the objectives of this study. Also, this chapter contains recommendations which can be applied to various banks to address employees’ resistance.

Conclusion

This study explored the existing literature and came up with results that conform to the previous findings. Of all the many causes of employee resistance, there is one main cause that stands out, and that is the clash of interest between the employees and the owner of the firm. The clash of interest can be in terms of the procedures in the bank, for instance, in regards to the ways of discharging the duties of executing the work procedures. Also, the clash of interest can be in regards to the long term goal of the firm; whereby, the owner of the firm might have a goal that conflicts the goals of the employees. These two goals (goal of the firm and the employees’ goals) are considered to be parallel units. The main cause of the employees’ resistance is the conflict of the goals, as realized in the bank under study.

It is a routine for banks to change their goals from time to time, mostly annually. These new set goals will mean that the targets of the company are also changed. For example, the bank can resort to reducing the operating cost, innovation, expansion, and so forth. The new goal of the bank is viewed as the new target, and the bank, therefore, has to look for a new means to meet the set targets. The goals of the bank can be considered to be basic/primary or secondary goals. A basic goal is the main goal of the bank, while a supportive goal helps the bank to meet the main goal. The commitment of the bank to achieve its basic goals and the supportive goals gives rise to the conflict between the bank’s goals and the employees’ goals.

In another set-up, a bank can decide to maintain its original goals but transforms the bank’s procedures to steer the bank to achieve the set goals. This will require the bank to focus on some areas where it concentrates their activities. This change of procedures and activities will limit the bank’s employees from meeting their personal goals, thus, arising to a conflict of interest between the owner of the bank and the employees. The definition of goal conflict is a situation in which employees in a bank feel insecure that the goals of the bank are not in conformity with their personal goals. When such a situation occurs, the employees find it difficult to meet their individual needs. The resistance of the employees to change will, therefore, affect both sides: the bank will not meet its goals, and the employees will also not meet their personal goals.

Recommendations

Based on the findings of the study, employee resistance can be managed by constantly keeping in touch with the employees. The employees need to know about the proposed change in advance and should be given time to fully understand the nature of the change and the likely benefits that the change will have on their role as employees holding various positions. Change is certain, and it is part of the development of any bank. Communication, therefore, is seen as an act of preventing a likely fall out in the structure of the bank. The structural change in the bank should not take the employees by surprise, but rather the employees should anticipate it in advance. Communication involves a lot of sharing of information and presentation of facts. The management who are mainly the initiators of the change should have an in-depth preparation in advance in regards to the benefits of the proposed change; and in this case, the benefits should outweigh the disadvantages.

Proper planning should be done for the change before a further initiative to introduce it is taken. This is very important in maintaining the sustainability of the bank. There are changes which if implemented will positively impact the bank. On the contrary, there are some changes which, if implemented can destabilize the bank. There are changes which are costly and expensive to implement. When such a change does not work, the bank can be in deep trouble. Similarly, some changes can lead to massive employee turnover, which is a reputational risk to the bank. Planning, therefore, is a necessary element for the successful implementation of the change. Planning involves assessing the situation in advance to have an idea of what the people feel about. The surveys involve directly interviewing some selected employees as a representation of the entire population of the workforce.

On the whole, resistance to change indicates at the inefficiencies in the work of business administrators who represent the banking sector. Indeed, the merging of different departments can be challenging for workers, but these difficulties can be overcome. These professionals do not consider several important premises. In particular, even well-intended initiatives can be misunderstood or even rejected, if their rationale is not properly described. Overall, the implementation of changes is a process that affects various stakeholders, for example, clients, investors, owners, and workers. The key issue is that the needs of workers are often disregarded. As a result, the performance of a bank can be impaired for a long time. The aim here is to have a feeling and an understanding of their perceptions. Apart from that, this transformation affects customers who are often dissatisfied with the services that are provided to them. Overall, this argument is based on the study of relevant academic literature and my observation of the client bank.

This problem can be effectively addressed if the management regards workers as active participants of the bank’s change. This solution incorporates several important steps. In particular, management should prompt workers to express their opinions about new workplace procedures. To a great extent, this goal can be achieved with the help of surveys or in-depth interviews. In this way, one can better identify the strengths and weaknesses of new policies. In many cases, it may be necessary to modify some of the new policies. These are some of the improvements that can be achieved in this way.

Additionally, the management should clearly explain why new practices should be adopted and how this goal can be achieved. Apart from that, the management should show that this change can benefit workers as well. These people should see that the adoption of new practices will produce better results. This task is vital for strengthening their commitment and motivation. Much attention should be paid to the peculiarities of job design. In particular, it is vital to identify the duties of various employees. This step is vital for avoiding the uncertainty and perceived loss of control that workers often experience during the bank’s changes. As it has been said before, the lack of clarity in job design and workplace requirements is one of the factors that intensify a person’s resistance to change. This is why this problem should be addressed by the senior executives of companies. Apart from that, the management should rely on the assistance of those workers who can be viewed as role models by their colleagues. In this case, one should speak about the most skilled employees whose actions are often emulated by other people. These are the main elements of the solution.

This solution can be implemented in the company representing the banking industry. It is a medium-sized bank, and its employees can resist structural changes. At first, the management should distribute a list of open-ended questions that prompt people to express their views about the transformation of the departments. This method has been chosen because in this case, it is not necessary to interview a large number of workers. In particular, managers should encourage workers to speak about the specific difficulties that are encountered.

Additionally, the management should enlist the support of the most experienced workers. In particular, the management should focus on employees who have worked in the company for at least five years. Furthermore, these people should be distinguished in terms of their expertise. These individuals will play a critical role in explaining the new requirements to other employees. This solution does not require considerable investments. Moreover, it is not very time-consuming. These are the main details that should be taken into account. Overall, this approach can be important for increasing the company’s readiness for change in the future.

Works Cited

Archie, Ben and Noah Juha. “Understanding Stakeholder Thinking: Themes from a Finnish Conference”. Business Ethics: A European Review 6:1 (1997): 46-52. Print.

Bales, Fred. “Task roles and social roles in problem-solving groups.” Readings in social psychology 2:4 (1958): 437-47. Print.

Barnard, Chester. Functions of the Executive. Cambridge: Harvard University Press, 1938. Print

Besser Terry. “Rewards and organizational goal achievement: a case study of Toyota motor manufacturing in Kentucky.” Journal of Management Studies 32:3 (1995): 0022-2380. Print.

Coch, Leo, and French John. “Overcoming resistance to change.” Human Relations 1:4 (1948): 512-32. Print.

Coetsee, Leon. From resistance to commitment. New York: Southern public, 1999. Print.

Correa, Henry and Slack Nick. (1996) “Framework to analyse flexibility and unplanned change in manufacturing systems.” Computer Integrated Manufacturing Systems 9:1 (1996): 57-64. Print.

Dent, Eric and Goldberg Susan. “Challenging “resistance to change.” The Journal of Applied Behavioral Science 35:1 (1999): 25-41. Print

Drucker, Peter. Management: Tasks, Responsibilities, Practices. New York: Harper and Row, 1990. Print.

Grusky, Oscar. “Organizational goals and the behavior of informal leaders.” The American Journal of Sociology 65:1 (1959): 59-67. Print.

Guth, Will and MacMillan Ian. “Strategy implementation versus middle manager self-interest.” Strategic Management Journal 7:4 (1986): 313—27. Print.

Hill, Charles and Jones Thomas. “Stakeholder-Agency Theory.” The Journal of Management Studies 29:1 (1992): 131-155. Print

James, George. “The Business Firm as a Political Coalition.” The Journal of Politics 24:1 (1962): 662-678. Print.

Kathleen, Molly. “Agency- and Institutional-Theory Explanations: The Case of Retail Sales Compensation.” Academy of Management Journal 31:1 (1988): 488-511. Print.

Keen, Peters. “Information System and Organizational Change.” Communications of the ACM 24:1 (1981): 24-34. Print.

Appendices

Appendix 1: Survey Questionnaire

This is an academic research study and your participation is voluntary. Information provided will be confidentially and individual data will be reported. THANK YOU!

Part A

- Are you a part-time or a full-time employee?

- Are you satisfied with your work?

-

- Not satisfied B. Less Satisfied C. Moderately Satisfied D. Very satisfied.

- What kind of relationship do you have with the management?

- Do you prefer working as a part-time or a full-time employee?

- How do you rate your work conditions?

Bad [] Not sure [] Good [] Excellent []

Part B

The following 17 statements describe your degree of attachment and loyalty to the bank you are now employed with. Please respond by indicating the degree to which each of the statements applies to you using the following Likert scale:

There is no right or wrong answer. Write the number that best indicates to what extent each of the statement is true or not true in the parenthesis provided at the end of each statement

- I would be very happy to spend the rest of my career in this bank [ ]

- I enjoy discussing my work with people outside it [ ]

- I feel as if this bank’s problems are my own [ ]

- I think I could easily become as attached to another bank as I am to this one [ ]

- I do not feel like “a member of the family” at this bank [ ]

- I do not feel “emotionally attached” to this bank [ ]

- This bank has a great deal of personal meaning for me [ ]

- I do not feel a strong sense of belonging to this bank [ ]

- I am not afraid of what might happen if I quit my job at this bank without having another one lined up [ ]

- It would be very hard for me to leave my job at this bank right now even if I wanted to [ ]

- Too much of life would be disrupted if I decided to leave my job at this bank right now [ ]

- It would not be too costly for me to leave my job at this bank shortly [ ]

- Right now, staying with my job at this bank is a matter of necessity as much as desire [ ]

- I believe I have too few options to consider should I decide to leave my job at this bank [ ]

- One of the few negative consequences of leaving my job at this bank would be the scarcity of available alternative elsewhere [ ]

- If I had not already put so much of myself into this bank, I would consider working elsewhere [ ]

- One of the major reasons I continue to work for this bank is that leaving would require considerable personal sacrifice; another place may not match the overall benefits I have here [ ]

- The management involves the employees in implementing the bank’s change [ ]

- There is enough motivation for the employees to change [ ]

- The management educate the employees regarding the change process [ ]

- There is enough coercion of the employees during the change process [ ]

- Negotiation is well done in the change process [ ]

Part C

Biographical Characteristics

- What is your Sex?

- Male Female

- What is your Job Title?

- Do you supervise others?

- Yes No