The recent recession had a negative effect in the performance of both private and pubic sectors in Greece (Athanassou, 2009, pp. 364-372). The financial markets experienced a lack of sufficient credit facilities and liquidity. The public sector on the other hand, had a huge budget deficit. Consequently, the government is currently heavily indebted because it has not been able to repay the funds it borrowed through various credit facilities (Sakellaropoulos, 2010, pp. 321-348). In response to this situation, the government adjusted its monetary and fiscal policies as follows.

Monetary Policy

First, the Central Bank of Greece used open market operation (OMO) in response to the financial problem in the country. OMO involves influencing the availability of money in the economy through trading in securities in the open market (Clapham, 2007, p. 12). Thus the central bank sold various securities such as bonds and treasury bills to the public. The citizens and the institutions that bought the securities were to redeem their investments at a future date. The main reason for using this policy was to enable the government to raise money through borrowing from the public in order to finance its budget deficit.

Second, the central bank lowered the rate of reserve requirement (Sakellaropoulos, 2010, pp. 321-348). The reserve requirement is the percentage of deposits received by commercial banks held by the central bank. This enabled the commercial banks to retain a greater percentage of their deposits (Sakellaropoulos, 2010, pp. 321-348). This means that they had more funds for creating credit. Thus the main reason for using this policy was to improve the liquidity of the economy through credit creation.

Third, the central bank lowered its lending rate (Sakellaropoulos, 2010, pp. 321-348). The lending rate in this case refers to the interest rate at which the central bank offers short term loans to the commercial banks. This was meant to encourage commercial banks to borrow short term loans from the central bank (Clapham, 2007, p. 45). The central bank lowered the interest rate from 6% in 2008 to 5% in 2009 (Sakellaropoulos, 2010, pp. 321-348). Consequently, the commercial banks found it cheaper to borrow short term loans from the Central Bank of Greece in 2008 (Sakellaropoulos, 2010, pp. 321-348). The low interest rate thus encouraged them to borrow more funds for credit creation (Sakellaropoulos, 2010, pp. 321-348).

Fiscal Policy

In response to its huge financial deficit, the government resorted to austerity policies (Athanassou, 2009, pp. 364-372). Austerity policies are meant to reduce the level of government deficit through cost reduction and it was implemented as follows in Greece (Hansen, 2003, p. 47). First, the government reduced the salaries of workers in the pubic sector in order to save on its expenditure (Athanassou, 2009, pp. 364-372). Such savings were meant to help the government to finance other development programs such as subsidizing education. Second, hiring workers in the pubic sector was stopped in order to avoid increasing the deficit (Athanassou, 2009, pp. 364-372).

Third, the retirement age was increased to 65 years (Athanassou, 2009, pp. 364-372). Thus the government was able to save the funds that were to be used to pay for the retirees’ benefits. The funds were instead used for other development programs. Finally, the government introduced more taxes and increased the rate of the existing ones (Athanassou, 2009, pp. 364-372). This was meant to help the government to raise more revenue to fund its budget effectively.

The second measure involved the use of expansionary fiscal policy (Athanassou, 2009, pp. 364-372). This involved increasing the level of aggregate expenditure. The increase in expenditure was funded by the money borrowed from the public, financial institutions such as IMF and other countries such as Germany (Athanassou, 2009, pp. 364-372). Stimulating economic growth was the main reason for using the expansionary fiscal policy. The government was interested in promoting economic activities in the country in order to increase its real GDP. This is based on the fact that increasing aggregate expenditure leads to a rise in national income (Clapham, 2007, p. 46). Thus the real GDP increases as the level of aggregate demand rises. The increase in real GDP implies that the economy is realizing positive growth.

Problems Experienced by the Government

The measures used by the government and the Central Bank of Greece created new problems that undermined their efforts to achieve the intended purposes (Nelson, Belkin and Mix, 2010, pp. 1-18). The new problems can be explained as follows.

First, the open market operations were used to raise funds for government expenditure from both the domestic and foreign markets (Nelson, Belkin and Mix, 2010, pp. 1-18). Even though the funds were used to stimulate activity in the economy, little result has been achieved. Besides, there was mismanagement of funds and inefficiency in the government (Nelson, Belkin and Mix, 2010, pp. 1-18). This means that the government has not been able to collect enough tax revenue. Consequently, the government’s deficit has increased instead of reducing. As at 31 December 2010, the deficit was as high as 12% of the country’s GDP (Nelson, Belkin and Mix, 2010, pp. 1-18). Besides, the government has not been able to service its maturing debts.

Second, the expansionary fiscal policy resulted into a decrease in the countries level of exports (Nelson, Belkin and Mix, 2010, pp. 1-18). Greece issued bonds in the international financial market in order to finance its expansionary fiscal policy (Nelson, Belkin and Mix, 2010, pp. 1-18). Thus the demand for Euro increased in the international financial market (Nelson, Belkin and Mix, 2010, pp. 1-18). As the demand for Euro rose, its value appreciated by 13% in the year 2009 when the fiscal policy was implemented (Nelson, Belkin and Mix, 2010, pp. 1-18). Consequently, the goods produced in Greece became more expensive in the international market than they were before the introduction of the policy. This is because those who imported Greece’s products had to purchase the Euro at a high rate in order to pay for the goods. The high price of the products led to a reduction in their demand.

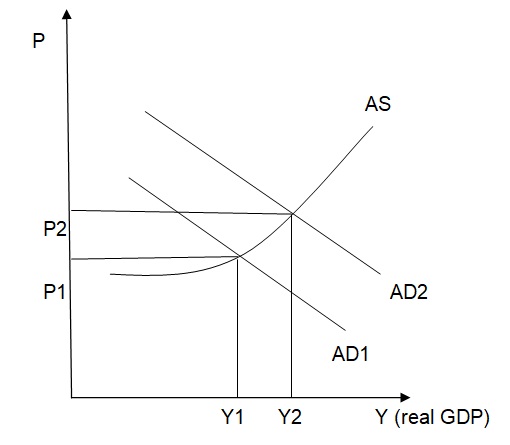

The appreciation of the Euro resulted into a reduction in the price of imports in Greece. This is because the importers purchased foreign currencies at lower rates in order to pay for the goods (Krugman and Wells, 2009, p. 69). The overall effect was a reduction in export and an increase in imports (Chrisochidis, 2011, pp. 144-162). The inflation rate rose from 4.4% in 2009 to 5.2% in 2010 as a result of the expansionary fiscal policy (Nelson, Belkin and Mix, 2010, pp. 1-18). Third, the expansionary fiscal policy led to an increase in inflation since the country was operating at full capacity (Blanchard, 2008, p. 89). This is illustrated by figure 1. As discussed earlier, an increase in aggregate expenditure causes an increase in aggregate demand. Thus as the equilibrium income increases from Y1 to Y2, the price also increases from P1 to P2. The rise in price thus signifies an increase in inflation.

- P: price level

- Y: national income

- AS: aggregate supply

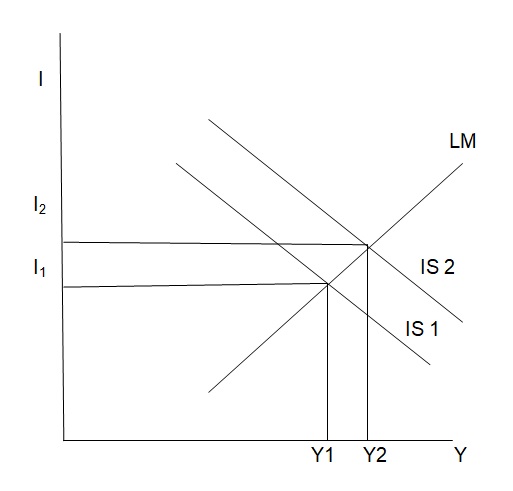

The increase in government expenditure also led to an increase in interest rates and this can be illustrated by figure 2. The effect of an increase in aggregate expenditure is similar to that caused by a reduction in savings (Boyes and Melvin, 2007, p. 193). This effect leads to a rise in the demand for various products at different levels of interest rates (Blanchard, 2008, p. 90). This means that the IS curve will move upwards if the government increases its expenditure and this is shown in figure 2 below (Blanchard, 2008, p. 90). As the curve shifts to the right, the equilibrium interest rate will rise from I1 to I2. The increase in interest rate discouraged the private sector from investing. Thus the long-term economic growth objective was not realized due to the increase in interest rate.

- I: interest rate

- Y: national income

- IS: investment-saving curve

- LM: liquidity-money curve

Finally, the austerity measures resulted into the following setbacks in regard to economic growth. The freeze on recruitment in the public sector led to an increase in the level of unemployment. The reduction in wages or salaries of the public sector employees resulted into a reduction in the level of welfare and quality of life in the economy. This is because the affected citizens were not able to maintain their normal living standards due to a reduction in their disposable income (Krugman and Wells, 2009, p. 69).

Arguments in Favor of a Free Market System: Netherlands

A free market system describes the type of economy in which the allocation of resources is based on the forces of demand and supply (Baumol, 2002, p. 13). It is characterized by private ownership of property with little government involvement or interference. The limitation of government’s involvement in the economy is meant to increase efficiency and to promote rapid economic growth (Baumol, 2002, p. 14). The roles of the government include regulation, enforcing law and order and protecting consumers from potential exploitations (Baumol, 2002, p. 15). Resource allocation in Netherlands is based on the free market system whose merits are as follows.

First, the free market system gives the citizens the opportunity to make independent choices in regard to production and consumption (Gravelle and Rees, 2004, p. 104). Since there is no limitation on production, the entrepreneurs have the power to choose the industries to join. Besides, they have the power to deicide on what to produce and the quantities to produce. Thus they have the opportunity to create competitive advantages due to the fact that they can utilize their full capacity (Gravelle and Rees, 2004, p. 104).

Besides, they are able to take control of their expansion plans by adjusting their production capacities when necessary (Gravelle and Rees, 2004, p. 97). The consumers on the other hand, benefit from a wide variety of goods to choose from. This is based on the fact that the free market system is associated with differentiation and mass production of a variety of products (Gravelle and Rees, 2004, p. 98).

Second, the free market system leads to an increase in efficiency. As more firms join various industries due to lack of entry barriers, the level of competition becomes intense (Griffiths and Wall, 2011, p. 67). This prompts the incumbent firms to improve their efficiency levels in order to reduce costs. This leads to economical use of resources.

Third, the competition associated with the free market system leads to innovation (Griffiths and Wall, 2011, p. 81). As the competition intensifies, firms aim at positioning their products as the best in the market. This means that they must focus on the best production methods in order to lower cost while maintaining or improving on product quality. Firms that are not able to improve their competitiveness through innovation and cost reduction normally realize losses or even collapse (Griffiths and Wall, 2011, p. 82). It is for this reason that Netherlands is investing heavily on research and development in order to develop better production technologies (Melvyn and Lee, 2000, pp. 104-113). This leads to both product and process innovation which is beneficial to both the consumers and the producers.

The free market system leads to best quality of products and lower prices (Baumol, 2002, p. 25). This is based on the fact that the consumers have the power to decide on what is to be produced through the demand and supply forces (Baumol, 2002, p. 26). Production of goods and services in a free market system is informed by the tastes and preferences of the consumers (Baumol, 2002, p. 27). This means that poor quality goods will be rejected through low demand and thus their supply will cease. Since the market is competitive, the sellers will lower their prices in order to attract customers (Baumol, 2002, p. 28). For example, the prices of foodstuffs in Netherlands are very low since there are very many producers of food products (Melvyn and Lee, 2000, pp. 104-113).

Finally, the free market system is associated with profit maximization (Griffiths and Wall, 2011, p. 72). Since the prices of goods and services are determined by the forces of the markets, the sellers can make high profits. This is because they are able to increase the prices when the demand is high in order to make more profits. Besides, they are able to develop their factors of production in a manner that leads to increased productivity (Delson and Poutsma, 2005, pp. 169-196). For example, the producers in Netherlands focus on staff training and use of modern technology in order to improve their productivity (Delson and Poutsma, 2005, pp. 169-196). This translates into high profits.

Causes of Market Failure

Market failure refers to the situation whereby the free market system is inefficient in regard to resources allocation (Cowen and Crampton, 2002, p. 80). This occurs as follows. The presence of public goods causes market failure due to the fact that such goods are non-rival (Winston, 2006, p. 49). Besides, the sellers are usually not able to control access or use of public goods. Consequently, such goods are not supplied by the free market system. Market failure is also caused by merit goods such as education. These are products that can be under-consumed if supplied solely by the private sector (Winston, 2006, p. 50).

The use of merit goods is associated with a greater social benefit as compared to private benefit. This leads to market failure since the social and private benefits are not at equilibrium (Winston, 2006, p. 51). The presence of monopoly can also cause market failure and this can be explained as follows. Due to lack of competition in a market characterized by monopolistic tendencies, the prices will be higher than the equilibrium amount. This results into a reduction in the quality of life among the citizens (Winston, 2006, p. 52). Thus the market will fail to allocate the resources efficiently.

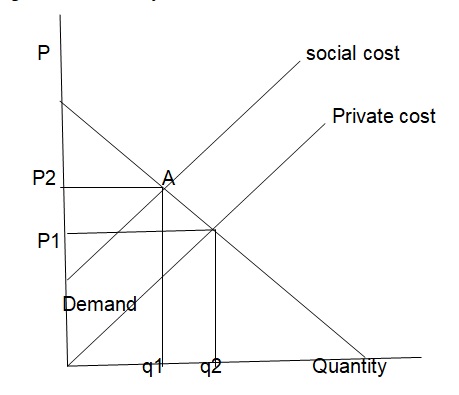

Finally, the failure is caused by externalities (Winston, 2006, p. 54). External benefits lead to under-production of a product since such benefits are never accounted for by the consumers and producers (Winston, 2006, p. 55). Negative externalities on the other hand lead to excess production of a product (Mankiw, 2008, p. 78). This is because such costs are not paid for by the market agents. Figure 3 illustrates the effect of negative externalities.

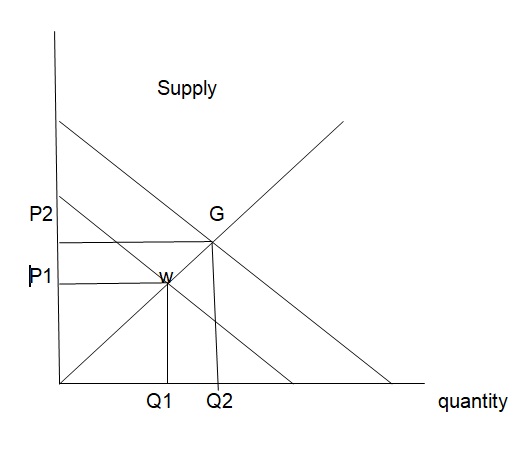

In this case, the marginal cost associated with the private sector is less than that associated with the public sector (Winston, 2006, p. 54). This is denoted by the distance between A and B. This causes inefficiency since the optimal price and quantity should be P2 and Q2 respectively. Figure 4 illustrates positive externalities. In this case, the marginal benefit associated with the private sector is less than that associated with the public sector (Winston, 2006, p. 55). Thus it leads to inefficiency and market failure since the public can still benefit from an increase in the production of the product.

- P: price level

- Q: Quantity

- A: Ideal equilibrium

- W: Actual equilibrium

- G: Ideal equilibrium

Netherland’s Response to Market Failure

The following measures have been used by the government to prevent market failure. First, negative externalities are being controlled through taxation (Wijnia, 2009, pp. 74-92). The government imposes taxes on the pollution caused by various companies in order to pay for the social cost accruing from the pollution (Wijnia, 2009, pp. 74-92). Second, the government uses taxes to discourage monopoly. For example, windfall tax has been introduced to discourage monopolistic tendencies in various industries (Wijnia, 2009, pp. 74-92). Besides, the government has enacted laws that prohibit monopolistic tendencies in the country.

Third, the government is regulating various industries in order to encourage fair competition (Pavy and West, 2009, pp. 531-575). This has been achieved by establishing regulatory bodies for each industry (Pavy and West, 2009, pp. 531-575). The regulators formulate and enforce policies that encourage fair competition and adherence to ethical standards. For example, the tobacco and alcohol industries are regulated in order to prevent oligopolies and cartels from emerging (Pavy and West, 2009, pp. 531-575). These industries are regulated because there are only a few firms operating in them.

The government also complements the private sector in the production of goods. The public goods that are not produced by the free market are produced by the government (Joshua, 2006, pp. 401-452). Such goods include security and defense (Joshua, 2006, pp. 401-452). Besides, the government provides merit goods such as education through subsidies in order to encourage their consumption (Joshua, 2006, pp. 401-452). Finally, the government has deregulated various industries such as the manufacturing sector In order to increase competition in the market (Joshua, 2006, pp. 401-452).

References

Athanassou, E., 2009. Fiscal policy and the recession: the case of Greece. Review of European economic Policy. 44(6), 364-372.

Baumol, W., 2002. The free-market innovation machine. Princeton: Princeton University Press.

Blanchard, O., 2008. Macroeconomics. Upper River Saddle, NJ: Pearson Prentice Hall.

Boyes, W. and Melvin, M., 2007. Macroeconomics. New York: Cengage Learning.

Chrisochidis, M., 2011. Promotion of export driven growth: the first pillar of our progressive response to the crisis. Europe Journal. 5(2), pp. 144-162.

Clapham, J., 2007. Monetary theory. New York: Lightening Source.

Cowan, T. and Crampton, E., 2002. Market failure or success: the new debate. Boston: Elgar.

Delson, L. and Poutsma, E., 2005. Labor market institutions of and economic performance of Netherlands. International Economic Journal. 19(2), pp. 169-196.

Gravelle, H. and Rees, R., 2004. Microeconomics. New York: Prentice Hall.

Griffiths, A. and Wall, S., 2011. Economics for business and management. New York: Financial Times/ Prentice Hall.

Hansan, B., 2003. The economic theory of fiscal policy. New York: Routledge.

Joshua, H., 2006. Positive externalities and government involvement in education. Journal of Private Enterprise. 3(4), pp. 401-452.

Krugman, P. and Wells, R., 2009. Macroeconomics. London: Worth Publishing.

Mankiw, G., 2008. Principles of economics. New York: Cengage Learning.

Melvyn, K., and Lee, T., 2000. The Dutch door to prosperity. International Economy. 23(1), pp. 104-113.

Nelson, R., Belkin, P. and Mix, D., 2010. Greece’s dept crisis: overview, policy responses and implications. Congressional Research Service. 2(1), pp. 1-18.

Pavy, I. and West, S., 2009. Fiscal and externality relationships for alcohol policies. B.E Journal of Economic Analysis and Policy. 9(1), pp. 531-575.

Sakellaropoulos, S., 2010. The recent economic crisis in Greece and the strategy of capitalism. Journal of Modern Greek Studies. 28(2), pp. 321-348.

Wijnia, D., 2009. Dutch economy takes nosedive. Digital Journal. 13(2), pp. 74-92.

Winston, C., 2006. Government failure verses market failure. Brookings: AEI-Brookings Joint Center for Regulatory Studies.