Differences between the United Kingdom’s GAAP and IFRS

In the United Kingdom, companies have the option of either preparing their accounts in accordance with the International Financial Reporting Standards (IFRS) or the local Generally Accepted Accounting Principles (GAAP). The two methods however have some provisions that differ significantly. Some of the differences relate to the issues highlighted below.

Goodwill and Intangible assets

UK GAAP (FRS 10) requires mandatory amortization on assets that are expected to have a maximum useful life of 20 years. IFRS (IAS 38 and 36) on the other hand does not require goodwill and indefinite life intangibles to be amortized; however, it requires them to be assessed for impairment on annual basis (Paul 2007, p.14).

Deferred Tax

The temporary differences are composed of all timing differences and permanent differences. While the FRS permits the discounting of deferred tax, IAS 12 prohibits discounting (Needles and Powers, 2011).

Properties for Investment

IFRS SSAP 19 on the other hand does not allow the use of depreciated model in calculating the value if investment properties (Wiley 2000, p. 36).

Financial Statements

Under the generally accepted accounting principles, the financial statements are referred to as the balance sheet, profit and loss account, statement of recognized gains and losses, cash flow statements, and finally notes are required at the end of the financial statements. Under the International financial reporting standards, the name of the statements have been changed such that the balance sheet is now referred to as the statement of financial position and the profit and loss accounts is now referred to as the statement of comprehensive income. Furthermore, it requires the preparation of the statement of changes in equity (Needles and Powers, 2011)

Cash flow Statements

GAAP require only the movement of cash to be included in the cash flow statement. It does not provide for cash equivalents. Cash and cash equivalents are provided for under the International financial reporting standards (Dodge, 1997).

Assets held for sale

The GAAP do not require the reporting of assets held for sale i.e. the decision by an entity to sell an asset is considered as an impairment indicator. According to IFRS 15, non – current assets should be presented as held for sale. This means that the carrying amounts of the assets will be realized after the assets are sold (IASC 2008, pp.12).

Employee Benefits

IAS 19 Employee Benefits: requires entities to provide for actuarial gains and losses. The local GAAP also require actuarial gains and losses to be provided for in the statement of total recognized gains and losses (Saudagaran, 2009).

Statement of Financial Position and Income Statement

The entity was established in 2009: The opening Statement of financial position included Cash of 100,000 and Share capital of the same amount. The entity follows the accounting requirements of the United Kingdom (UK GAAP).

In the United Kingdom;

Training costs will be accounted for as per the provisions of the local GAAP i.e. they will be capitalized and amortized on straight line basis over a five year period (Saudagaran, 2009).

All leases are accounted for as operating leases.

The provision for future losses is allowed and the amount is tax deductible in the current period.

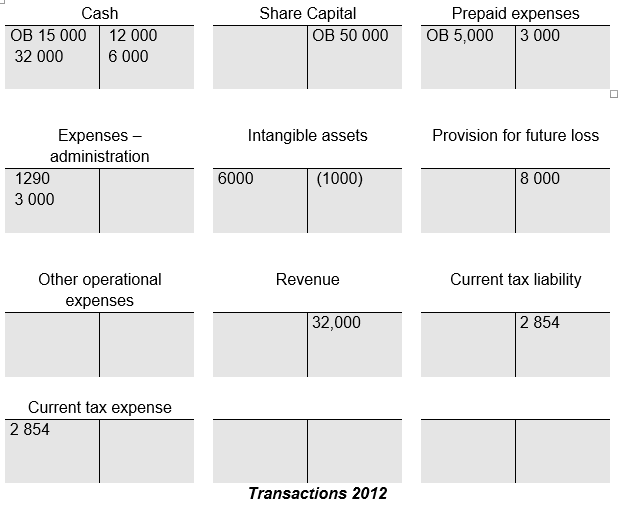

Transactions in 2011

On 1st January, the company entered into a five year agreement for the lease of a machine that had an economic life of ten years. At the end of the lease, the machine will have a residual value of 500. At the beginning of the five year lease, the asset had a cost of 15, 000 (fair value). The company treats depreciation as part of distribution costs including depreciation arising from leased machines. Depreciation is computed on a straight-line basis.

At the beginning of the lease, the company paid 5,000 pounds to the lessor. It was then agreed that the lesee will pay the lessor 2, 500 at the end of each year for four years. The lessee would then take ownership of the machine at the end of the lease. The implicit interest rate is 12 per cent per annum. According to UK GAAP, the lease payments are accounted for as administrative expenses on the straight-line basis (Bhattacharjee, 2009).

The entity paid 6,000 for the training costs. According to United Kingdom’s GAAP, the training costs are Intangible assets. The amortisation is part of administrative expenses.

The entity has created the provision for future losses of 8,000.Corresponding losses are expected to be incurred in 2013. The expense is a part of other operating expenses in the Income statement (The Institute of Chartered Accountants, 2004).

The entity has recorded cash revenue of 32,000.

The corporation tax rate in the United Kingdom is 20% of taxable income.

Workings

Leases

Deferred Tax

Leased asset at December, 31st, 2011:

Depreciation: (15,000 – 500 ) ÷ 10 years = 1450

Net Book Value: 15,000 – 1450 = 13,550

Deferred tax

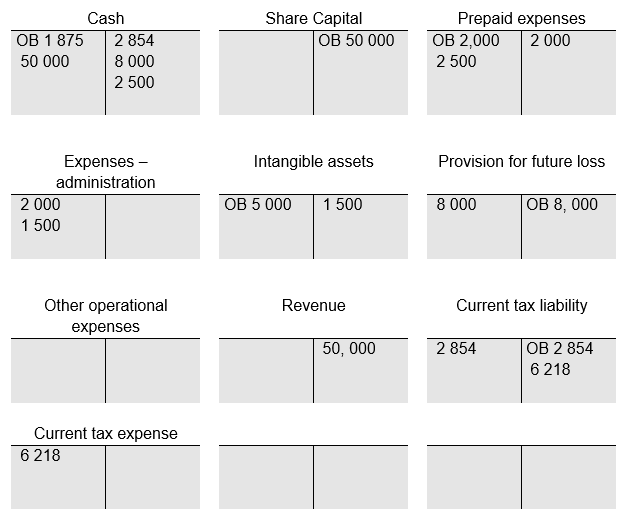

The entity paid the lease payment of 2,500 in cash. Regarding the lease, the expense in the Income statement was 2,800.

The entity has accounted for amortisation of Intangible assets. The amount of amortisation was 1500.

The loss for which the provision was created has occurred. The amount of 8,000 was paid in cash and accounted for against the provision.

The entity has recorded cash revenue of 50,000.

The entity paid tax for 2011 in cash.

The tax rate in the United Kingdom is 20% of taxable income.

Deferred tax

Translation

Translation table for IFRS Opening Statement of Financial Position as at January 1st, 2012

Translation table for IFRS Opening Statement of Financial Position as at January 1st, 2013

Income statement – translation table

IFRS tax computation

Profit before tax (31,090) × tax rate (20%) = current tax expense (6,218) less deferred tax income (1,634) = 4584

Notes to the changes on

Statement of Financial Position

IAS 1 Presentation of Financial: requires entities to change the naming system such that the balance sheet should be referred to as the ‘Statement of financial position’ as done in our case above. However, the use of the title is not mandatory and an entity has the option of using the previous title used such as ‘Balance sheet’ provided the changes are made therein. The meaning of the title should not be vague and should not cause misinterpretations (IASC 2008, p. 4).

IAS 1.10, 39 requires that the statement of financial position to have the related notes that may be used by the users of the statements for guidance. For instance in the case above, the translation tables have highlighted the potential differences that have been raised due to the changes such as in the deferred tax section and the prepaid expenses. The IAS does not however provide on how it should be interpreted by companies and other affected parties (IASC 2008, p. 5).

IAS 1.60-61 deals with the presentation of current and non – current assets. It also deals with the treatment of current and non – current liabilities. It requires the items to be classified separately in the final accounts. For instance in the above case, the four items have been presented separately. Entities have the option of presenting more information regarding assets and liabilities. The additional disclosures should however provide more information and not repeat matters already reported (IASC 2008, p. 8).

IAS 1.55,58 advises on the use of line items, headings and subtotals. These items should be included in the financial statements if necessary to help the users understand the matters contained therein more clearly. The decision to use them however should be made based on (1) the nature and liquidity of assets (2) the nature of use of the assets and (3) the carrying amounts, and timing of liabilities (IASC 2008, p.14). For instance, a bank overdraft may be included as a line item to give more information.

IAS 1.57 describes the manner in which items should be presented i.e. the format. This includes the use of line items as indicated above which is mainly based on the size, nature or function of the item that need to be disclosed. The order of disclosing the items is however subject to the company (United Nations, 2006). IAS 12.74 deals with deferred taxes and liabilities. Deferred taxes and liabilities should be resented since they are legally enforceable in a court of law. A company in financial distress needs to offset the current tax liabilities and assets obligations. Deferred tax liabilities on the other hand are related to income tax required by the tax authorities.

It further states that that the entity can offset the current tax assets if it has a legally enforceable right to do so. This therefore depends on the local accounting principles (GAAP) used within the country. In the case of the United Kingdom, entities have the right to offset the current tax assets if they deem it appropriate to do so (IASC, 2008).

Statement of Comprehensive Income

During the time of transition, the statement of comprehensive income should be prepared according to the provisions of IAS 1.7, 81. According to the IAS, total comprehensive income should highlight the change in equity that occurred during the accounting period. It should however not highlight the changes that have occurred due the private dealings of the owners of the entity (Gee, 2006). Items that concern income can be presented in one statement or two statements; the decision to use one of the options lies with the company. One statement is the statement of comprehensive income while the two – statement option should begin with the profit or loss incurred by the entity. The other components should them follow. In our case, we have used the two – statement option (IASC, 2008).

IAS 1.85 provides guidelines for using additional line items, headings and subtotals. The inclusion of these items is critical for the understanding of the financial condition of the entity. IAS 1.99,100 requires an entity an analysis of the expenses incurred by an entity. The standard also requires entities to adopt a means of showing additional items in the financial statements. The additional is critical since it helps in clarifying matters and enhancing the reliability of the financial statements.

The analysis should be done either in the notes or on the face of the statements. Each item should be categorized based on its nature and its respective functions in accordance to the guidelines that govern classification of items that are not material on their own. In the above case, the presentation is made based on the function of the expenses in the entity (IASC 2008, p.46).

The IAS does not however guide on the presentation of revenue. This remains as a decision for the entity to make. Either revenue can be presented as a single line item or the entity can break it down to its constitutive components. In our case, the revenue in the income statement has been presented as a single line item (Ernest & Young & International Accounting Standards Committee, 2001).

Lastly, the last guide is IAS 1.90 – 91. The individual items of the statement of comprehensive income can be included in the statements without tax effects or with the related tax effect. They are included net of the tax if it has not been charges on the items. The entity can also decide to either indicate this on the face of it or in the notes to the accounts. However, for published accounts, it is recommended that tax matters be reported in the notes for the users of the accounts to understand them easily (IASC 2008).

IFRS Statements

Indirect Method

Direct Method

Impact of first adoption of Requirements of IFRS

The impact of the adoption is due to the following requirements:

Requirements of IFRS 1

IFRS 1 acts as a guide for companies that would like to transform from using the local GAAP to using the IFRS (Meek & Morsicato, 2000). The transition table in the above case has provided the position of the company during the GAAP period and during the time when the company adopted the IFRS. The transition table has also indicated the differences that arise as required by IFRS 1.Lastly, the IFRS require firms to consider whether to apply optional provisions or not and apply the mandatory exceptions retrospectively. Moreover, firms could make detailed disclosures regarding the transitions (Nobes & Parker, 2010).

It is however not possible to apply IFRS 1 in all cases (Epstein & Jermakowicz, 2010). It is applicable to companies that reconciled their financial statements from a previous GAAP to the IFRS. Such as in our case, the financial statements have been reconciled from the UK GAAP (KPMG, 2012). Furthermore, it is applicable if the entity is a group reporting package using IFRS principles and if the entity was not preparing financial statements prior to the decision date (Perera & Doupnik 2011, p.111).

Another case is where an auditor issued a qualified statement with regard to the financial statements (Choi & Meek 2010, p.57). For instance, in its balance sheet an entity must: report all assets and liabilities, omit the assets and liabilities not required by IFRS, group all assets, liabilities and equity according to the provisions of IFRS and evaluate all items as required by IFRS (Choi & Parker 2010, p. 58).

Effect on Financial Position and Performance of the company

The change from the use of the local generally accepted accounting principles to IFRS has no significant impact on the performance of the company. This is because the adoption has only affected the financial statements and not the operations of the company. However, the adoption has some impacts on the financial position of the company. The inclusion of the leased item in the fixed assets of the company has increased the value of fixed assets of the company. The omission of intangible assets has however negated to some extent the effect caused by the inclusion of the leased items in the fixed assets column.

Additionally, the preparation of the balance sheet under the GAAP had included prepaid expenses under the fixed assets column. The adoption of IFRS has omitted prepaid expenses. The net effect of this omission is reduction in the value of fixed assets of the company by 2,000 pounds. During the translation, for instance in 2012, the following adjustments were made on the retained earnings: the following items were added :- the value paid for the lease (1,456), provisions (8,000) and the following were deducted, training expenses paid which amounted to 4,000 pounds and the deferred tax of 1,497 pounds. The net effect of the changes is an increase of the value of retained earnings from 11, 419 to 15, 378 pounds. This subsequently increased the value of the company’s equity by 3,959 pounds i.e. the difference of 15, 378 and 11,419 pounds.

Moreover, the inclusion of the lease liability in the IFRS statements has increased the value of non – current liabilities by 5,613 pounds. In the opening statement of financial position, there is an increase in the value of non – current liabilities by 1,497 pounds due to the inclusion of deferred tax. The local GAAP do not provide for the inclusion of deferred tax in the balance sheet/statement of financial position. The deferred tax has also has an effect on the statement of financial position but in this case, it has been treated as an asset. This has increased the value of fixed assets by 137 pounds.

As noted earlier, the change in reporting standards did not affect the performance of the company significant therefore much of the items in the income statement were not affected except for the inclusion of deferred tax effect in the tax payable and inclusion of lease expenses in the distribution expenses. The effect therefore is a reduction in the tax payable to 4, 584 pounds from 6,218 pounds.

Problems to first adoption of IFRS

Difference in GAAP and IFRS

By adopting IFRS, this means that the whole set of financial statements will have to undergo drastic changes. This is due to the differences between the United Kingdom GAAP and IFRS. It would be therefore hard for the entity to bring the required awareness of IFRS and its impact to the users (Frank, 2008). For instance, the IFRS requires the recognition of costs previously recorded as assets, start up costs and reclassification of treasury shares as marketable securities. Furthermore, some intangible assets not previously recognized as assets must be recognized. This includes the valuation of the useful life of the asset. This new regulations may bring about complications to the entity and significant changes to its position (Walton & Haller, 2003).

GAAP Reconciliation

Reconciling some of the issues that arise from the various differences may be costly to the country and the entity. In the case of the United Kingdom, some matters also arise regarding European Union rules therefore harmonizing them may be not easy for the entity and the relevant accounting bodies (Samuels & Piper, 1985).

Training and Education

Educating some of the users of financial statements about the changes will be a challenge to the entity. Additionally, there will be need to train staff on the new changes in accounting standards. This may be costly to the firm (Belvard & Powers, 2011).

Legal and Regulatory Considerations

Currently, various bodies in the United Kingdom and the European Union provide guidelines that govern reporting of financial information. The international financial reporting standards do not recognize such guidelines. The conflict may be challenging to some companies since they may be confused on the most appropriate model to adopt (Nobes & Parker 2010, p. 46). It is also essential to note that the professional body of accountants has the mandate to regulate its members, however it does not have the legal mandate to set accounting standards.

Taxation

IFRS guidelines require use of fair value as the standard of measurement of most items contained in the financial statement. The adoption of fair value measurement may bring about significant volatility and subjectivity to the entity’s financial statements. Additionally, fair value accounting is complicated and may require the intervention of experts. Furthermore, the treatment of differed tax may bring changes to the tax obligation in the books of the company (Friedrich, 2008).

Re – Negotiation of Contracts

The financial implications of the financial statements on contracts under GAAP are different from the implication under IFRS. This therefore means that some of the contracts entered into before the adoption of the IFRS will have to be re – negotiated for the effect to be the same (Belkaoui, 2004). The re – negotiations may pose challenges to the entity since some contracts may have been clinched with significant difficulties therefore getting the parties down for a re – negotiation may be costly to the firm. Furthermore, the other parties may be disgruntled due to the changes in costs, which may lead to some parties walking out of the contracts (Perera & Doupnik 2011, p.37).

Reporting Systems

The entity will be required to adjust the current business – reporting model to suit the new requirements required by IFRS. This means that the systems should be re – designed to incorporate new regulations that relate to some aspects such as fixed assets, segment disclosures, related party transactions among other items (Nobes & Parker 2010, p. 63). Additionally, the system will have to be adjusted so that some items such as receivables and tax liabilities are recorded on specific lines and deferred tax is now separate from current taxes. Moreover, the system will be required to reclassify minority interest as a separate equity item in addition to present a full breakdown if exceptional income. These changes are many and therefore may consume substantial resources for the changes to be effected.

List of References

Belkaoui, A 2004, Accounting Theory, Thomson, London.

Belvard, N & Powers, M 2011, International Financial Reporting Standards: An Introduction, Cengage, New York.

Bhattacharjee, S 2009, ‘Problems of Adoption of International Financial Reporting Standards (IFRS) in Bangaladesh ’, International Journal of Business Management, vol.4, no.12, pp. 1-11.

Choi, F & Meek, G 2010, International Accounting, Pearson, New York.

Davies, M & Paterson, R 1999, UK GAAP : Generally Accepted Accounting Practise in the United Kingdom, Butterworth’s Tolley, London.

Dodge, R 1997, Foundations of business accounting, Thomson Press, London.

Doupnik, T & Perera, H 2011, International Accounting, McGraw – Hill, New York.

Epstein, B & Jermakowicz, E 2010, Interpretation and Application of International Reporting Standards, Wiley, New Jersey.

Ernest & Young & International Accounting Standards Committee, 2001, IAS/UK GAAP Comparison, International Accounting Standards Committee, London.

Frank, W 1999, Business Accounting, 2 ed., Financial Times Pitman Publishing, London.

Frank, W 2008, Business accounting UK GAAP 1, Financial Times Prentice Hall, London.

Friedrich, B 2008, International Financial Reporting Starndard 1.

Gee, P 2006, UK GAAP for business and practise, Elsevier, London.

Greuning, H & Scott, D 2012, International Financial Reporting Starndards : A Practical guide, World Bank, Washington D.C.

IASC, 2008, A guide Through International Financial Standards (IFRS), IASCF Publications Department, London.

KPMG, 2012, Illustrative financial statements, KPMG IFRG Ltd, London.

Meek, G & Morsicato, H 2000, Accounting: An International Perspective, McGraw-Hill, New Jersey.

Nobes, C & Parker, R 2010, Comparative International Accounting, Pearson, New York.

Paul, R 2007, International Accounting Starndards : From UK Standards to IAS, Elsevier, London.

Samuels, J & Piper, A 1985, International Accounting : A survey, Croom Helm, Sydney.

Saudagaran, S 2009, International Accounting : A user perspective, CCHGroup, Chicago.

The Institute of Chartered Accountants, 2004, Auditing Implications, ICCA, London.

United Nations 2006, Conference on Trade and Development: International accounting and reporting issues, United Nations, New York.

Walton, P & Haller, A 2003, International accounting, Thomson, London.

Wiley, 2000, International Accounting Standards, Wiley, London.