Introduction

In the current competitive business environment and the global economic volatility, the focus of C-suite managers in large and middle-sized managers is shifting from the growth of revenue to profitability growth. Mittal and Shah explain that companies are keen on cutting costs as much as possible to ensure that they maximize their profits (45). As such, they are taking measures to ensure that the entire process of making a product available to a customer is as lean as possible. This trend has made these firms to redefine their focus on their supply chain to identify and eliminate any wastage in the system. As such, the concept of inventory planning and optimization has gained massive attention over the recent past. Talbi et al. defines inventory optimization as a process that seeks to match supply to the expected customer demand in an effective manner (56). Increasing market competition and unpredictable customer demand makes it challenging for a firm to know the amount of inventory it should process and delivery to the market. However, the concept of inventory optimization helps these companies to overcome this challenge by having an accurate prediction of the products that should be made available in the market. As Grob notes, having excess inventory in the market increases the cost of warehousing and handling of products, which compromises the firm’s profitability (72). On the other hand, having fewer products reduces sales revenue and customer loyalty, which also compromises the company’s profitability. As such, the goal is to have the right amount of goods at all times. In this paper, the researcher seeks to investigate inventory management at Qatar Fuel Company to advise the management on how to embrace the concept of inventory optimization to enhance its profitability.

Summary of the Current Process

Qatar Fuel Company is a publicly listed oil and gas company in Qatar. As Al-Emadi observes, it is the only fuel retailer in Qatar (32). Despite enjoying the monopoly in the local market, the firm is always under immense pressure to ensure that it offers maximum value for its investors as well as customers. The firm must ensure that its products are conveniently available for all its customers at all times. It also has to ensure that it cuts its operational costs to the bare minimum as a way of increasing its profits for the benefit of its investors. Qatar Fuel Company has always remained committed to maintaining price stability for its oil and gas products based on government directives (Elbashir et al. 61). However, the volatility in this industry remains a major challenge as the overall market price keeps changing.

The supply department of this company has a critical responsibility of ensuring that it optimizes its inventory to reduce the cost. According to Mittal and Shah, in the past, companies in the oil and gas sector often made an effort to ensure that they have excess inventory to manage the market volatility and to ensure that its customers always have access to the commodity they need (45). However, it emerged that this was a counterproductive strategy because of two main reasons. First, cases would emerge where the oil price would drop even further instead of rising as was expected. In such a case, the firm would be forced to sell at a loss because of the prevailing low oil prices. Secondly, even if the price went up considerably, the cost of warehousing the inventory would wipe out the little extra profit that the firm would have made. As such, it became necessary for these companies to redefine their market strategy. They realized that inventory optimization would require having just enough products to meet customers’ demand. The supply chain department had to make accurate prediction of the market demand despite the volatility and unpredictable market forces, and ensure that it delivers the right amount of products to its customers. It is necessary to analyze Qatar Fuel Company’s capacity to use this concept to achieve increased profitability in the market.

The current processes in the firm’s supply chain department focuses on ensuring that products are made available to the customers all over the country at the right time and for the right price. The company has about 100 filling stations across the country where its customers can have access to various products. The firm also established its liquefied petroleum gas plant in 2009 in Doha’s industrial area (Balzacq et al. 49). These strategic moves were meant to ensure that its customers will have access to the products they need on time. The management of Qatar Fuel Company is fully responsible for the daily running of these gas stations across the country. It has been keen on embracing lean management practices to ensure that it keeps the right workforce as a way of trimming its cost of operation. However, the firm will need to focus more on its supply department to ensure that it has the capacity to deliver inventory to customers at the lowest cost possible.

SWOT Analysis

It is necessary to evaluate factors within the firm to understand internal forces can influence its current processes as it seeks to improve its profitability. The SWOT analysis would help in this evaluation. The strength of this company lies in its huge financial capacity. As the only firm responsible for the retail of oil and gas products in the local market, this firm has enjoyed impressive sales. The financial muscle can enable it to support research and development projects. The company has also been keen on hiring highly talented employees to help promote creativity and innovativeness in its operations. However, the firm also has some weaknesses that the management should find ways of addressing as it seeks to optimize its inventory. As Swain observes, Qatar Fuel Company inherited some large fuel storage tanks from Qatar Petroleum to help in its storage of inventory (71). The problem with this is that it increases its operation costs because most of them are underutilized. They may even become less necessary as the firm seeks to embrace inventory optimization.

The market offers a wide range of opportunities that this firm should embrace as it seeks to increase its profitability through cutting its cost of inventory management. The consistent increase in the country’s population means that the market size is expanding, and given the fact that the firm is a monopoly, it will enjoy all the accruing benefits. The 2022 FIFA World Cup scheduled to take place in Doha, Qatar, has also increased activities in the country, resulting in massive sale of petroleum products (Al-Emadi 90). However, the management of this firm must be keen on how to deal with the various threats that may harm its profitability. The volatility of the international oil prices is a major concern for this monopoly. The firm should also be keen on understanding emerging technologies in this industry because some of them are disruptive.

Need for Inventory Optimization at Qatar Fuel Company

Qatar Fuel Company is a monopoly in the market and one may assume that it does not have major threats in the market that would require unique strategies in its product delivery. However, Mittal and Shah warn that even monopolies must find ways of delivering high value to their customers and attractive returns to investors (78). As a publicly listed firm, this company must ensure that it remains profitable to make its shares attractive in the stock market. One of the areas that this firm should focus on is its supply chain management. The firm should ensure that it embraces strategies that will consistently lower its cost of production while at the same time increasing value for its customers. Inventory optimization offers that unique opportunity (Mittal and Shah 88). It will enable the management to have the capacity of matching its supplies with customer demand through accurate predictions. It needs this concept to enable it to deliver the right amount of products to its customers at the right price. It is necessary to analyze external environmental forces that may have a direct or indirect impact on the firm’s inventory management system.

PESTEL Analysis

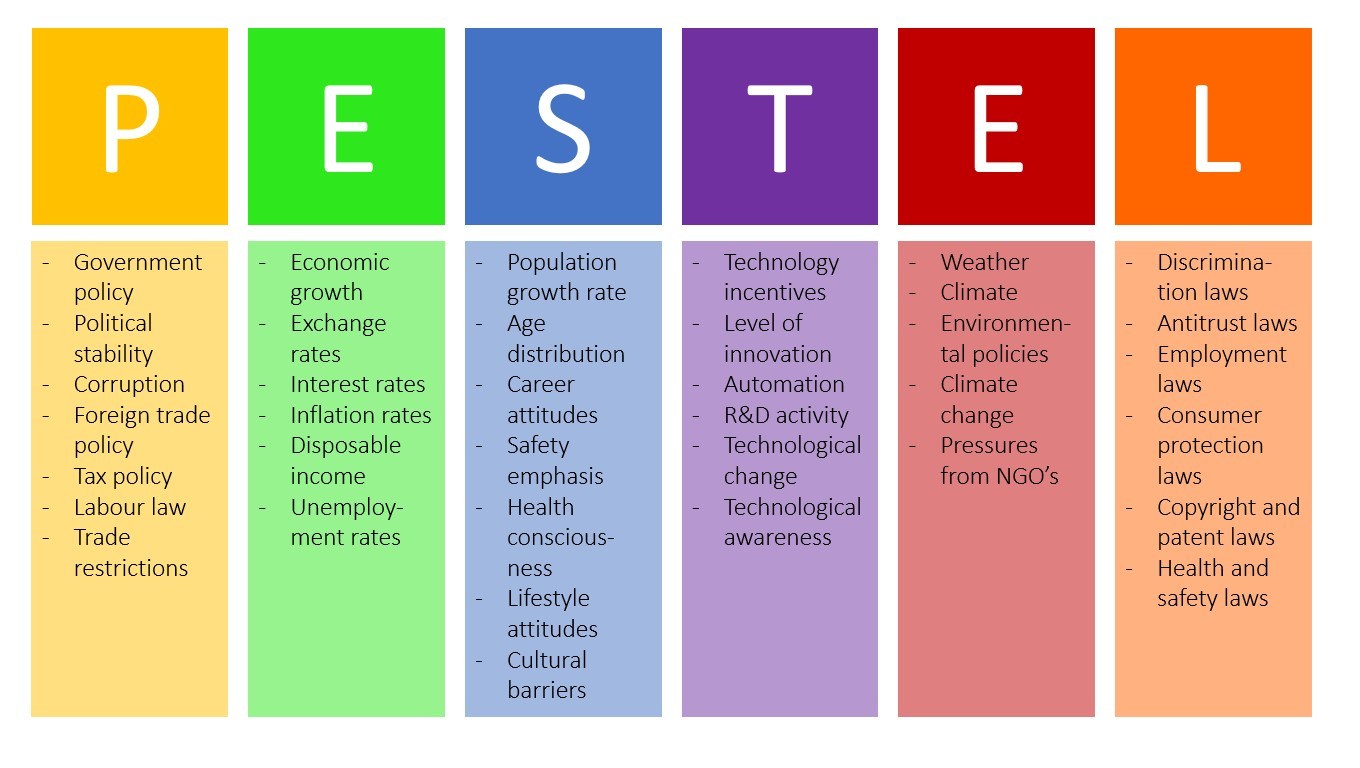

When planning to introduce a new concept or practice within a firm, it is always advisable to analyze external environmental factors to understand how they will affect the company during the implementation. The analysis can also help the management to understand if indeed it is necessary to change from one approach to another. The analysis of the external environment enables the management to determine if its current strategies are in line with external forces within the market. PESTEL analysis is particularly important for the management of Qatar Fuel Company to determine the need for inventor optimization. It identifies six core external environmental forces that have a direct influence on a firm’s operations in the market.

The first factor that the management of a firm has to consider under this model is the political environment. It focuses on government policies, political stability, and level of corruption, foreign trade policy, tax and labor laws, and trade restrictions. Qatar is one of the most politically stable countries in the Middle East. It was one of the few countries in the region that were not affected by the Arab Spring (Al-Emadi 69). Government policies are often focused on promoting diversification of the economy as a way of reducing overreliance on oil and gas products. As such, trade is often encouraged both for local and foreign companies. The level of corruption in the country is low, tax and trade policies favorable to the firm, and as a monopoly, the government cannot allow foreign firms to take over its operations unless there is a major change in the current laws. In such a highly favorable political environment, Qatar Fuel Company has a unique opportunity to deliver high value to its customers. It is assured that of the support of the government. It means that it can try new ways of operation without any interference from the government. As such, it needs to try inventory optimization as a way of lowering costs of operation while at the same time increasing its profitability.

The economic environment is another critical external force that a firm should consider when planning to introduce a new concept in the market. Factors such as economic growth, exchange rates, interest rates, disposable income, inflation rates, and unemployment rates should be taken seriously in such an analysis (Shah and Mittal 77). Qatar has experienced a long period of economic prosperity. The country has one of the highest per capita incomes in the world, with an impressive growth rate and high disposable incomes. The rate of unemployment in the country is also one of the lowest in the world. In such an economy, people can afford to buy products at relatively high prices if they are promised a higher value (Shen et al. 17). The management of this company should find a way of adding value to its products in a way that will justify an increase in price. Given that the focus is on lowering costs other than increasing the price, the management will need a model that will not compromise its ability to deliver high value to its demanding customers. Inventory optimization offers this firm the opportunity to do that. It will have the capacity of delivering high-quality products to its customers more efficiently if it embraces this model. Having an accurate projection of market demand means that cases will not arise where customers will miss the product they need.

The third external factor is the social environment. In this context, the focus is always on the population growth rate, culture, lifestyle, age distribution, safety emphasis, and health consciousness (Mittal and Shah 67). Qatar has one of the best socially sustainable business environments in the region. The government has made it easy for foreign nationals and business to come to the country and be involved in the national development. Although its laws are deeply entrenched in Islamic teachings and culture, the government has ensured that foreigners can undertake their activities freely in the country as long as they do not break the law. The company needs to take advantage of this social environment and invite foreign nationals who can help in the implementation of inventory optimization (Talbi et al. 119). Some of the local stakeholders may not have a proper understanding of this relatively new concept. In such a case, they would need someone with the right knowledge and experience to lead the process. The socially sustainable environment in the country has attracted experts from North America, Europe, Asia-Pacific, and Africa. These expatriates have the unique capacity to implement inventory management in the firm’s normal operations as a way of cutting the overall cost of operation.

The technological environment has become another major force in the external environment that directly influences its operations. The management of Qatar Fuel Company should monitor factors such as technological incentives, automation in the industry, level of innovation, and technological awareness. Grob explains that successful firms have learned the significance of the technological environment in their effort to lower production costs (89). In the energy sector, firms are embracing automation as the best way of reducing costs. They are reducing the use of major trucks. Instead, they are relying on oil pipelines as the best way of eliminating spillage, pilferage, and a massive need for human resources. The sector has also embraced technology research to find ways of making their products more environmentally friendly. For this company, technology offers the best opportunity to embrace inventory automation.

By using some of the emerging technologies, this firm can predict, with a high level of accuracy, the market demand for the product for as long as one year using unique modeling tools. The demand can then be broken down to monthly or weekly as may be necessary. By using an automated system, the firm can ensure that it makes available products needed in the market within a week instead of a month or longer period. The additional costs that the firm spends to store these products for several weeks will form part of its profits. Having an automated system of delivering products would mean that it can take less than a day for the firm to move products from its primary supplier to the market. As such, the concern of the management about a consistent availability of products in the market will be addressed.

The ecological environment has increasingly become critical when analyzing external factors because of the need to preserve the planet. Issues such as pressure from environmental institutions, government policies regarding environmental degradation, and climate change should be critical in such an analysis (Shah and Mittal 54). Qatar Fuel Company primarily sells fossil fuel to its customers. Environmentalists and scientists have warned against the dangers of using this product. It is now clear that global warming is a reality and climate change is already having a devastating impact on the environment. However, Grob notes that despite these unfortunate realities, the world is still driven by energy from fossil fuel (51). The only socially responsible action that this company can do is to ensure that it embraces practices that would lower the threat to the environment.

Inventory optimization is one of the best ways that can ensure that this firm operates in an environmentally responsible way. Using this model, this firm will ensure that it does not hold more petroleum products than what customers need. As such, it will lower the rate at which these products are extracted and processed. Large oil tanks pose a disastrous threat to the environment, immediate infrastructure, and people in case there is an explosion. By eliminating or significantly reducing these reserves, this firm will be reducing the level of threat. There is also the environmental concern of possible leakage at these facilities. A substantial leakage from these tanks may have a major negative impact on the environment. Inventory optimization will help in eliminating or minimizing such challenges.

The legal environment is the last factor under this model of external environmental analysis. Issues such as antitrust laws, consumer protection laws, health and safety regulations, and employment laws should be considered. The government has set strict consumer protection laws and guidelines that this firm must follow. They are meant to ensure that all residents of this country have access to energy from this company. Inventory optimization will help in meeting this regulatory requirement more effectively (Saberi et al. 2122). Demand forecasting will help the firm to avoid cases of having excess inventory at one time and under-stock at another time.

Health and safety laws, under occupational health and safety laws, will also be adhered to more effectively when inventory optimization is embraced. This model will ensure that the number of people handling petroleum products is significantly reduced. Such a move will help the firm to reduce the number of its workers who are at risk of getting into harm’s way. The management may be concerned about labor laws, especially the possible need to retrench some of its workers with hefty compensation. When this model of inventory management is introduced, the firm will only need to redeploy its workers to other departments (Talbi et al. 121). For instance, those who are currently working at the storage plants can be moved to operate new petrol stations that the management plans to set up across the country. Figure 1 below summarizes the six factors of the external environment discussed above.

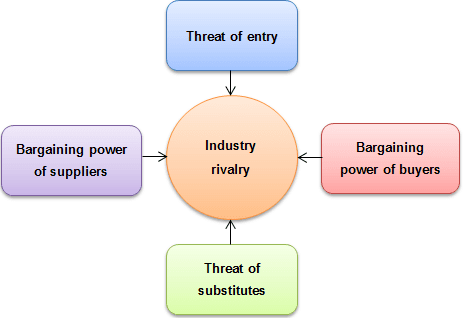

Porters Five Forces Analysis

Porter’s five forces model is one of the popular tools often used to analyze the industry within which a firm operates. It helps in analyzing the power of various stakeholders in the market and how their power may affect the normal operations of a company (Mittal and Shah 112). In this industry, the threat of rivalry from other is non-existence. This firm enjoys a monopoly in the market, which means that it does not have to worry about strategies that its competitors may be employing to expand their market share. The threat of entry by other potential competitors is also very low. It is the only company that the government has mandated to facilitate the distribution of oil and gas in the local market. The threat of substitutes was low, but the emerging technologies are redefining this space. Al-Emadi explains that renewable energy is gaining massive popularity in the global market (55). Environmentalists have been championing the use of renewable energy sources as opposed to fossil fuel. Technological advancements have seen the emergence of electric cars. Renewable energy has received acceptance in the region because of the regular sunshine throughout the year (Talbi et al. 75). It means that the biggest threat for this company will be the introduction of cars and other appliances that use renewable energy as opposed to fossil fuel. This threat makes it necessary for the firm to redefine its operations.

The bargaining power of buyers is another factor that may make it necessary for the firm to redefine its operations. As Grob observes, when buyers are powerful, it may force the firm to discount its products to attract and retain a pool of loyal customers (33). The power of buyers is often defined by the number of firms selling the same products to the same market. In this case, Qatar Fuel Company is the only supplier of oil and gas to the local customers. The monopoly means that the power of buyers is significantly low. They have no other choice but to buy from this company. However, as renewable energy sources become relevant in the country, the landscape may change and customers may have wide options to choose from when they need energy. This firm should be prepared for such a possible eventuality. The bargaining power of suppliers is another major concern that this firm has to take into consideration. Qatar Fuel Company obtains its supplies from Qatar Petroleum, which is a larger corporation with a larger mandate. It cannot manipulate this supplier because it also enjoys a monopoly in the market. It means that the two companies must develop a mutually beneficial relationship in the market. Figure 2 below summarizes the five forces that the management of this company should focus on as it seeks to embrace inventory optimization.

Business Case

The researcher considered it necessary to have a business case that would help in justifying for the need for inventory optimization at Qatar Fuel Company. As a monopoly, this firm’s main focus has always been to make a regular and timely delivery of its products to its customers and in the process make some profits. However, the new management unit has been concerned about the firm’s profitability even though it is enjoying a monopoly in the market. One of the main concerns for management is the high cost of inventory management. A significant amount of products would be stored at various facilities at the expense of Qatar Fuel. It emerged that these products would stay in the storage facilities for several weeks, and sometimes even months before they are released to the market.

The problem is that the management feels that this high cost of inventory management can be reduced by eliminating some of these storage plants. However, there is a concern that eliminating some of these storage plants may result in cases where this firm runs out of its stock, creating a shortage at its stations. It is also apparent that the entire team had been used to the previous system because it was convenient and eliminated concerns about the volatility of oil prices in the market. It makes the management comfortable. These issues must be addressed to ensure that management can embrace the concept of inventory planning and optimization. The following are some of the key issues that the firm will need to address to enable it to embrace the concept.

Ineffective Master Data Management

One of the main concerns at Qatar Fuel Company is the ineffective master data management. When this company was established, the primary goal of the management was to ensure that there was a consistent and effective delivery of oil and gas to customers within the country. Conducting market research was not considered a priority. Along the way, the management realized that it was necessary to understand customers’ concerns and to monitor emerging market trends (Mittal and Shah 78). However, the emerging issue currently is that this information is not used to help this firm redefine its operation. It has created a scenario where the firm has a huge system of data that is disorganized and less meaningful to the supply chain department.

The firm’s own analysis revealed that the company has numerous oil storage plants which are only increasing expenses for the firm’s supply chain department because sometimes the products are kept her for months. However, there is no clear course of action to address this concern because there is another report indicating that top managers are concerned about the possibility of the stock running out at most of the stations if these storage plants are eliminated. As such, there is an important piece of information that shows how this firm can reduce the cost of inventory management. However, there is no master data management that outlines how this information can be used to the benefit of the firm. This weakness explains the need for inventory optimization at this plant. It is the only way that this firm will cut its operational cost and increase its profitability.

Overall Objectives Not Aligned to Individual Goals

Analysis of the firm’s operations also shows that there is no proper alignment between overall objectives of the firm and individual goals among major stakeholders in the company. The regular board and shareholders meetings of the company have helped redefine the vision of the firm. These meetings have made it clear that Qatar Fuel Company can deliver its products to customers in the country efficiently and at fair prices but still make impressive profits for the shareholders. As such, there has been pressure to find ways of cutting costs at various levels of operations. As a firm that is primarily responsible for the delivery of the already processed oil and gas, the only way of lowering its operational costs is to reevaluate its supply chain system. Inventory optimization is the best approach of finding ways of cutting down operational cost. The firm must find specific areas in its supply chain where it is spending money unnecessarily. Its own analysis revealed that the problem that it faces is that inventories take too long at the firm’s storage facilities before they are released to the market (Talbi et al. 40). For the firm to meet the overall objective of lowering costs to increase profitability, it may have to eliminate some of these storage plants.

The big challenge that the firm faces is the lack of alignment between the overall objective and individuals’ goals. Top managers feel that their primary responsibility is to ensure that oil and gas is available for all the residents of Qatar irrespective of the market volatility. They know that having shortage in the market may have more devastating consequences to them as individuals and to the company’s normal operations and profitability. As such, they are willing to incur the additional costs of running these facilities other than to eliminate them. This lack of alignment between the overall goals and individuals’ objectives is limiting the firm’s ability to lower costs of operation. Using inventory optimization model, the management should learn how they can eliminate some of these plants without compromising the firm’s ability to maintain steady flow of oil and gas across the country.

Lack of Proper Communication and Collaboration

To streamline the supply chain of this firm and lower the overall cost of operations, it is critical to ensure that there is proper communication and collaboration among stakeholders, something that is yet to be achieved fully at this firm. Grob explains that the logistics unit needs a clear directive about the specific amount of inventory that it needs to deliver to the market within a specific period (42). That data can be obtained easily from each of the fuelling stations across the country. The management will only need to determine the specific amount of products purchased per day, per week, and per month at each of the stations. It can also have information about how events such as hosting of major sporting activities influence the demand. This information can then help in the demand projections. They can use that statistics to know how much of the products will be needed within a given period, preferably one month.

Given the fact that this firm is not importing these products, it can opt to make orders for supplies that will last for a month based on the projections that they have. This information will help in eliminating cases where the firm has more products than it would require. However, this goal can only be realized when there is proper communication and collaboration among all the stakeholders involved. It should start with the management advising station managers to collect data about daily, weekly, and monthly sales. The information should include how various external forces influence sales volume at the firm. Once collected, the information should be relayed to the management for appropriate decision to be made. The information should be shared with all the relevant stakeholders, especially the purchasing and logistics departments. They need to be informed about the amount of products that should be made available for sales within a given period, preferably one month or less.

Project Implementation Plan and Strategy

When the management of Qatar Fuel Company decides to introduce inventory optimization as the approach that defines its operations in the market, it will need to take the approach of project implementation. Having an effective implementation plan and strategy will help in ensuring that the process is a success. According to Evans et al., firms have come to embrace the project plan approach of undertaking major activities or introducing major concepts in their operations because of the obvious benefits (78). First, it makes it possible to have a clear timeline when a given project must be completed. The management will be aware of the success, or lack of it thereof, of an initiative within that period. Secondly, taking the approach of project management also makes it easy to understand the resources needed to undertake the project. When introducing such a new concept, the management may be required to make some investments. For instance, it may be necessary to train workers on the new approach of operation.

It may also be necessary to have a new data management system that will facilitate sharing of data among workers. At this stage, the focus is to determine how this firm can introduce inventory planning and optimization in its operations as a way of enhancing its ability to lower operational costs and increase profitability. According to Mittal and Shah, when planning to introduce a new system, it is often advisable to identify models that can help define the right approach of operations (34). These models can help in stating a step-by-step procedure that should be embraced. It may also help in identifying areas that should be emphasized to ensure that these goals are achieved. In this section, it is necessary to start by identifying some of the models that should be used to facilitate the introduction of inventory optimization at Qatar Fuel Company.

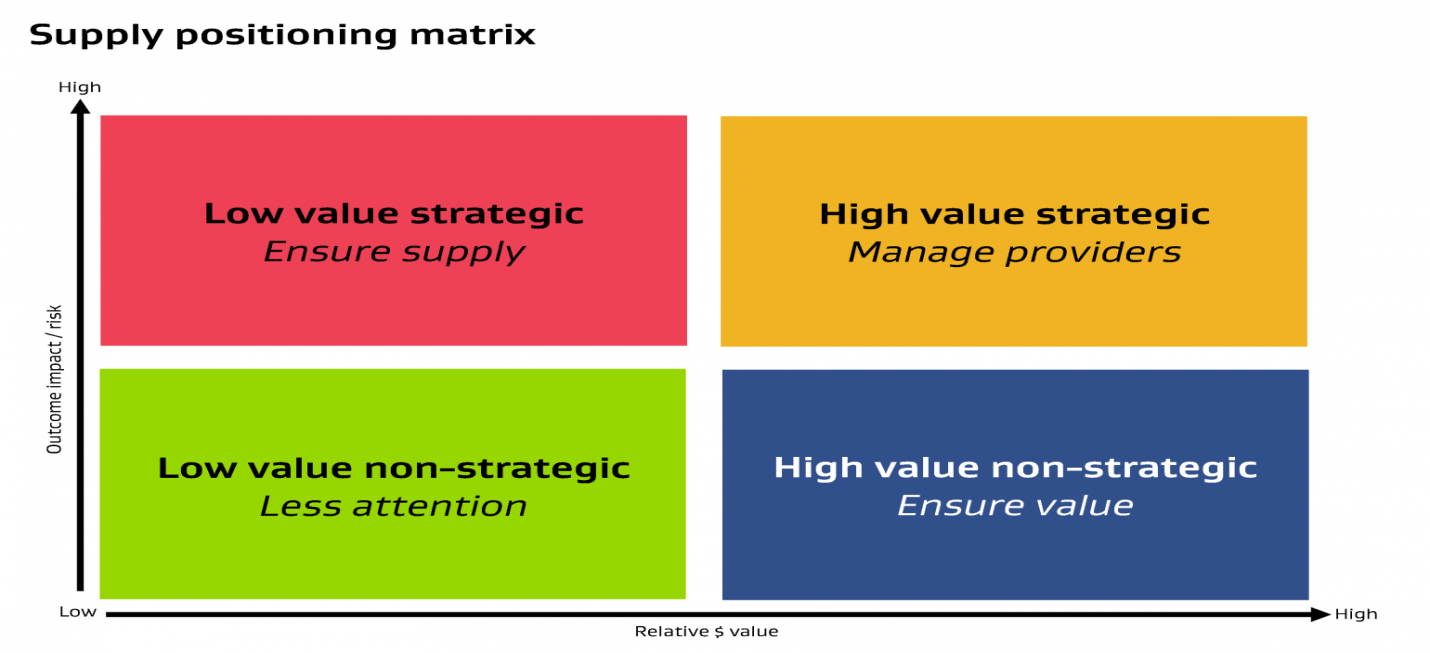

Supply Positioning

The primary goal of implementing inventory optimization at this company will be to lower the overall cost of activities in the supply chain, especially that of delivering products to the customers. Supply Positioning Model creates a system where this firm can rank their supplies based on the amount that it spends on each supplier (Mittal and Shah 68). In this risk and opportunity model, the management will need to analyze the spend portfolio to ensure that it is using its resources effectively to achieve specific goals. The model helps in ranking suppliers in terms of their significance to the firm. The goal is to ensure that the firm understands its susceptibility in case one of these suppliers fails. Classifying the suppliers into four categories, shown in the figure below helps in determining the nature of relationship that the firm should have with each supplier. Some of these suppliers are indispensible and their failure may spell dome on the ability of this firm to operate in the market. Other suppliers may have a less significant impact on the firm because they can be replaced easily. Figure 3 below shows the different segments that that one can classify a supplier in this supply positioning matrix.

The first quadrant is classified as low value but strategic suppliers. These are suppliers offering strategic products considered of low cost. For instance, Qatar Fuel Company uses a team of highly trained officers to help provide security and offer other services at the filling stations around the county. The firm has made arrangements to ensure that these officers are outsourced from countries such as India and parts of Africa (Evans et al. 78). They often accept a significantly low salary compared with what a local would require when doing the same job. However, the service they provide is strategic to the success of the firm. It helps in improving efficient delivery of services at the station. The goal of the management will be to ensure that there is a consistent supply of their services. They will help in maintaining a low cost of operation. The firm should maintain long-term contracts with such suppliers because of the direct cost-related benefits that it gets.

The second quadrant has the high value and strategic providers. These are suppliers offering highly critical products to the firm but also charge relatively high prices. The susceptibility of this firm is highest at this stage because of two reasons. First, this supplier offers critically important products to this firm, and as such if it fails, the operations of this firm may be paralyzed. Secondly, this supplier offers its products at high price and the management has no option but to continue buying from it (Talbi et al. 112). For Qatar Fuel Company, that supplier is Qatar Petroleum that sells it the oil and gas. Without the products from this supplier, operations of this firm will be paralyzed. In such a case, this model encourages the affected firm to manage the provider. Managing the provider in this case involves developing a close working relationship because of the level of sensitivity. The management should sign long-term contracts with the supplier and ensure that it gets the best deals as much as possible.

The third quadrant has high-value but non-strategic suppliers. They are the suppliers that offer expensive products but they can easily be replaced because of the availability of alternatives. Qatar Fuel Company introduced new fuel pumps that are energy efficient. They can be operated by renewable energy (Evans et al. 65). These fuel pumps are highly valuable because they can help the firm to cut operational costs in long term. However, it is possible that this firm can find other suppliers offering similar products are better prices. In this case, this firm should focus on managing the value. It should have short-term contracts with these suppliers and ensure that in case a better value can be obtained from a different supplier, the firm can easily switch to that supplier.

In the last quadrant is a class of suppliers believed to be of low value and non-strategic. Their products may be essential but not strategic to the survival of the company. These products are also considered to offer low value to the firm. For instance, this company still uses fire extinguisher cylinders at its petrol stations. These products are essential in facilitating the normal operations of the firm. However, new technologies are emerging with new tools that have better capacity of managing fire (Mittal and Shah 85). It means that this firm cannot only move from one provider of these cylinders to another but also switch from the use of this technology to a different one. When handling these suppliers, the management should have short-term contracts so that in case something of a higher value emerges, it can make a swift switch. Less attention should be paid to these suppliers. The four classes are summarized in the supply positioning matrix shown in figure 3 below

Kraljic Matrix , as Mittal and Shah observe, works almost in the same way as supply positioning matrix, based on the importance of purchasing and complexity of the supply market (119). It has similar matrices as shown above, helping the management to decide which suppliers the firm needs to develop a close relationship with and which products should always be made available because of their importance to the firm. Given that this study has described in details the relevance and application of supply positioning matrix, it is not necessary to use this model for the sake of avoiding repetitiveness because they are meant to serve almost the same purpose.

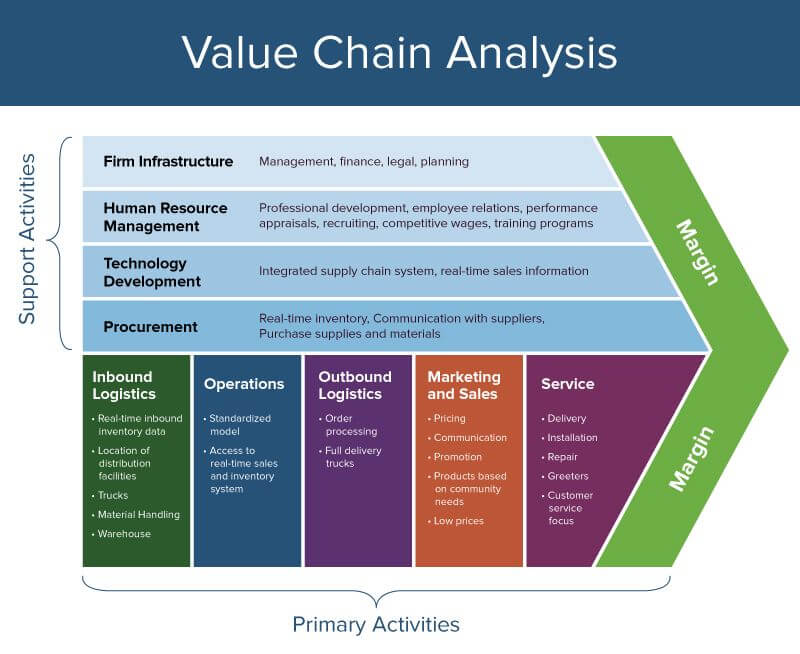

Value Chain Management

When planning to embrace inventory optimization, the management will need to understand how it can use the concept of value chain management to achieve the intended goals. Evans et al. define supply chain management as “the integration of all resources starting with the vendor of the vendor. It integrates materials, information, labor, logistics, and facilities, among other things into a time-responsive, capacity-managed solution to maximize financial resources and minimizes waste,” (96). The definition emphasizes on the need to integrate all the systems within an organization so that they can work as a unit. Managing the resources and systems of the organization makes it easy for departments to share information and resources and assist one another towards a common organizational goal. The definition also shows that value chain management helps a firm to realize two goals. The first goal is to minimize waste. When Qatar Fuel Company embraces this model, it will have the capacity to identify sources of waste within its operational system and find ways of eliminating them. The process helps in cutting the overall cost of production.

The model of value chain analysis can help explain how Qatar Fuel Company can create higher value in its operations as it embraces the concept of inventory optimization. According to Pagano and Liotine, a value chain refers to a set of activities that a company undertakes to enable it deliver the best value to its clients in the market (72). These activities and processes are classified as primary and supportive activities based on their significance. The primary activities are those that involve acquisition of raw materials, processing the final products, delivery to the market, and sales and marketing activities, including the related services. It is necessary to discuss each of them in relation to this company and its effort to embrace inventory optimization as it seeks to lower the overall cost of operation.

Inbound logistics are activities that involve acquiring products from the suppliers to the premises of the firm. For Qatar Fuel Company, it involves acquiring oil and gas from Qatar Oil, its primary supplier of these products. The firm has to ensure that there is a regular flow of these products from the supplier to the premises of the company located across the country. Inbound logistics require this firm to have effective structures that will facilitate timely delivery of these products. The nature of these products makes it more desirable for the firm to have pipelines to facilitate movement of the products to service stations within the country. In places where the firm cannot use pipeline, it will require oil and gas trucks to facilitate the movement of the products. The management should have a real-time inbound inventory data showing the exact amount of oil and gas that will be available at the stations or storage tanks within a given period (Kakhki and Gargeya 16). The information will help the management in planning various activities.

The next stage in this chain is the operations. In manufacturing companies, this will involve processing raw materials to finished products that customers need in the market. However, Qatar Fuel Company receives already processed products from Qatar Petroleum. In this case, the operations stage will involve ensuring that the received products are safely stored in various facilities across the country ready for delivery to the market. They have to ensure that the products are not contaminated in any way and that they are classified appropriately based on how they need to be distributed in the market. Mittal and Shah observe that it also involve standardization of these products (90). The management will need to have access to real-time data of sales at all the service stations to understand how its products should move to the market.

Outbound logistics is the third stage when using this model to deliver the highest value to customers in the market. It involves delivering inventory to the market. Qatar Fuel Company has a responsibility of ensuring that these products are availed to its customers all over the country. The firm has specially designed fuel trucks that it uses to deliver oil and gas to the national market. Grob notes that this activity relies heavily on real-time data (113). When a truck arrives at a filling station, it needs to offload the product immediately and leave. It means that by the time it reaches the station, there should be space to offload the product. If that space is lacking, it will be forced to wait for some time. The company loses a lot when its truck is stuck at one station at a time when its services are needed elsewhere. There is also a greater risk of fire outbreak when the truck full of fuel is packed in a refilling station for long. As such, there should be a real-time data shared among all the officers within that chain to ensure that products are delivered based on need.

Marketing and sales is the next stage in this value chain. As Evans et al. observe, once the product is made available in the market, the management will be expected to undertake sales and marketing activities (90). At this company, one of the first things that the management has to do is to set appropriate prices for these products. When setting the price, the firm has to take into consideration the cost of delivering the product to customers. After determining the cost, it should set a realistic profit margin and then set a reasonable price (Mittal and Shah 76). The firm may also need to invest in promotion of the products. Although it enjoys a monopoly in the market, regular communication with its customers about its products and any other technological changes may be advisable. It should have a public relations department that will enable it to coordinate with its customers in the market.

The last primary activity in this value chain is service delivery. The management of Qatar Fuel Company will need to ensure that its customers feel there is value whenever they purchase fuel. The mode of serving these customers should be full of respect and understanding. In other parts of the world where this business is highly competitive, companies have come up with after-sale services such as cleaning the windscreen and a simple inspection of the engine. Although this firm enjoys a monopoly, it may consider embracing such after-sale services to its customers just to enhance the value they get from their purchases. The management should also establish feedback channels where customers can express their concerns or joy after making their purchases.

Supportive or secondary activities help in facilitating the primary activities. The firm’s infrastructure will help in ensuring that these products move from the supplier to the individual fuel stations around the country. Human resource management will facilitate all the primary activities in the value chain. Grob notes that the ability of a firm to achieve success in the market largely depends on skills, experience, and dedication of its employees (40). This firm should focus on recruiting highly skilled workers, train them, and offer them attractive remunerations to ensure that they remain loyal workers. The use of technology will also facilitate effective undertaking of the primary activities. The company will need to introduce advanced technological systems to help in managing data and in delivering its products to customers all over the country. Procurement is the last factor that the management should take seriously. The firm should ensure that it acquires the products needed to facilitate its operations at the right time and in the right quantity. Figure 4 below provides a summary of these activities as a firm moves towards offering the best value to its customers.

Primary Elements of Inventory Optimization

An optimized inventory system means that the management will have the capacity to determine the amount that should be ordered in each of the stock keeping units (SKUs) and when that order needs to be made to facilitate a smooth flow of products in the market. Inventory optimization seeks to create stability in a market that may be characterized by various volatile forces. In the energy sector, the volatility is often experienced in the international pricing. However, the demand often remains consistent. Qatar Fuel Company can develop a database and communication systems that will enable it have accurate information about market demand. Grob advises that when using this concept, one also needs to understand the relevance of Just-In-Time as a tool that can help achieve organizational goals (75). This tool helps in ensuring that raw materials are made available to the firm at the right time to avoid both delays and cases of storing products for unnecessarily long periods. The following are the key elements of inventory optimization that this firm will need to understand to achieve the desired goals.

Demand forecasting is the first element. Talbi et al. explain that a company that embraces this concept must have the capacity to forecast market demand, which is the most critical factor in the entire concept (63). As explained above, inventory optimization focuses on eliminating instances where the firm orders more than is needed in the market or less than what customers need. It requires an accurate understanding of customers demand. Evans et al. advise that such a firm will need a system that will help in predicting demand based on the current forces in the market (53). For instance, currently when the global society, including Qatar, is facing lockdown, reduced industrial activities because of the COVID-19 pandemic it is obvious that there will be a significant reduction in the demand for these products. Forecasting involves having the knowledge of the current demand and determining how possible socio-economic and political trends may affect it in the future.

Inventory policy is the second element of inventory optimization. As Grob observes, an organization will need to develop its internal policies that define how much of a given stock it will keep within a stipulated period (88). Qatar Fuel Company will need to develop its policy based on the market demand for each of the products that it sells in the market. For instance, it may have a policy that explains the amount of petrol, diesel, and kerosene that should be in stock at a specific period. With such an internal policy, it will be easy to know when it is necessary to restock each of the products in line with the company policy. The last element is the replenishment. With the right calculation based on demand forecasting and company policies, the management will know when and how to replenish its products. The replenishment should be in direct response to the expected market demand and the firm’s internal policies (Pagano and Liotine 78). This company can achieve a greater success by maintaining close coordination with its primary supplier.

Conclusion and Recommendations

Inventory optimization is a concept that has gained massive popularity in the current business environment where firms are keen on lowering their cost of operation as a way of improving their productivity. This management concept focuses on matching market demand with supply. The goal is to cut the overall cost of delivering products in the market by reducing the cost of storage and handling of these products. It seeks to ensure that a firm only purchases enough products to meet the market demand within a specific period. As shown in the discussion above, it heavily relies on real-time data management system. The data system helps in forecasting the demand and monitoring the flow of inventory in the market. This way, the firm will eliminate cases of shortage of products in the market while at the same time eliminating cases where it purchases excess products that may take too long to be absorbed in the market.

The analysis focused on how Qatar Fuel Company can use this concept to improve its profitability. The information gathered from secondary sources strongly suggests that inventory optimization will help in cutting the cost of operation at this firm. When used appropriately, this model of management will ensure that cases of fuel shortage at the filling stations are eliminated. The management will be aware of when to make these products available in specific quantities at given locations. It will enhance consistent flow of products in the market, which in turn will improve sales and profitability of the firm. This concept will also help the company to avoid cases where it has to store oil for a very long time because it purchased excess products that exceed market demand. Streamlining market demand and supply is one of the best ways through which this firm can enhance its competitiveness in the market. The following are the recommendations that the management of Qatar Fuel Company should consider as it seeks to introduce the new concept in its operations:

- The management will need to train its workforce to ensure that they understand what is expected of them when the new system is introduced. They need to understand how to meet specific goals under the concept of just-in-time (JIT) as a way of cutting operational cost.

- The firm may need to introduce a new integrated data management system. This new approach of operations heavily relies on real-time data sharing. The management will need to ensure that the right communication infrastructure is installed to facilitate sharing of information.

- Qatar Fuel Company will need to engage Qatar Petroleum, its primary fuel supplier, on how they will operate under the new system. The supplier should be made to understand the significance of the new system. It will also need a communication platform that will help it to know when to deliver specific amount of products to this firm.

- Qatar Fuel Company should embrace emerging technologies to help improve internal and external communication, improve customers’ experience, and lower the overall cost of delivering products to its customers.

- In its effort to increase its profits and value for its shareholders, the management of Qatar Fuel Company should avoid upward price adjustment. As a monopoly that has the responsibility to deliver this important commodity to customers, it is expected to behave responsibly and in a way that protects consumers. Its efforts should be on cost reduction.

Works Cited

Al-Emadi, Talal. Joint Venture Agreements in the Qatari Gas Industry: A Theoretical and an Empirical Analysis. Springer, 2019.

Balzacq, Thierry, et al. Comparative Grand Strategy: A Framework and Cases. Oxford University Press, 2019.

Elbashir, Nimir, et al. Natural Gas Processing from Midstream to Downstream. Hoboken, 2019.

Evans, Gerald, et al. Analytics, Operations, and Strategic Decision Making in the Public Sector. Information Science Reference, 2019.

Grob, Christopher. Inventory Management in Multi-Echelon Networks: On the Optimization of Reorder Points. Springer, 2019.

Kakhki, Mohammad and Vidyaranya Gargeya. “Information Systems for Supply Chain Management: A Systematic Literature Analysis.” Journal International Journal of Production Research, vol. 57, no. 1, 2019, pp. 15-16.

Mittal, Mandeep, and Nita Shah. Optimal Inventory Control and Management Techniques. Business Science Reference, 2016.

Pagano, Anthony, and Matthew Liotine, Technology in Supply Chain Management and Logistics: Current Practice and Future Applications. Elsevier, 2019.

Saberi, Sara, et al. “Blockchain Technology and its Relationships to Sustainable Supply Chain Management.” Journal International Journal of Production Research, vol. 57, no. 7, 2019, pp. 2117-2135.

Shah, Nita, and Mandeep Mittal. Optimization and Inventory Management. Springer, 2019.

Shen, Bin et al. “A Review on Supply Chain Contracting With Information Considerations: Information Updating and Information Asymmetry.” Journal International Journal of Production Research, vol. 57, no. 1, 2019, pp. 17-18.

Swain, Ashok, and Anders Jägerskog. Emerging Security Threats in the Middle East: The Impact of Climate Change and Globalization. Rowman & Littlefield, 2016.

Talbi, El-Ghazali, et al. Metaheuristics for Production Systems. Springer International Publishing, 2016.