Introduction

Company background

Kmart Corporation is a parent company of Kmart Australia. The giant Kmart Corporation was founded in 1899 by Kresge and John McCrory.As partners, they ran the stores in Detroit and Memphis but later they disagreed and dissolved the partnership. In 1907 Kresge acquired McCrory’s stake and later listed the company in the New York stock exchange. From 1912-62 Kmart expanded rapidly, opening over 254 stores and its share rising from $1 to $10.In 1977 Kresge corporation was renamed Kmart Corporation and sold out the remaining stake to McCrory stores. The stores in Australia continued with their operations until 1994 when they became bankrupt. In 1978, Kmart Australia was brought into existence through a merger between Kresge Corporation and G.J Coles and Coy Limited which resulted in S.S Kresge Company holding a 51% stake in Kmart Australia.

Kmart Australia is a private retail company that is located in Karratha; Australia. The Company has a gross revenue of 31,713,371,200 dollars and has employed a total of 113,000.The company stores are widespread in different parts of Australia. They are a total of 238 stores with the one based at Victoria being the headquarters. The first store opened in Victoria and was known as Burwood. The launch of the brand was much anticipated and on the first day, it attracted over 40,000 people who were curiously waiting to shop.

In 2006 Coles limited announced its plans for the brands by cutting down on the number of new stores and rather embarked on a mission to restock and restructure the existing units with more appealing merchandise. Kmart’s performance has been dwindling with a reported sales drop of 3% which caused Coles group to sell its stake to Wesfarmers. Wesfarmers took over the control of the firm and injected capital estimated to be $300m.

Industry background

In a book by Bair & Gereffi (1998) the clothing and textiles industries have been reducing drastically since the early 1970s.The structural framework of clothing and its related industries in Australia differ significantly from those in Europe and United States in four aspects. First, the Australian space economy restricts growth of the market since it results in the formation of multi-national companies with high volumes of output that dominate the market on a national scale. Consequently, small firms emerge that focus on niche markets creating “multiple quasi-monopolistic” markets. This scenario is accelerated by the informal lifestyle and moderate climate of Australia which curtails expenditures on clothing thus encouraging firms to concentrate on fast-moving casual and sportswear.

Secondly, according to (Button 1986) Australia’s southern location means that its seasonal rhythms are reverse of those in Europe an incident of geography that effectively outs Australia six months behind the leading edge of global fashion trends. Button (1986) stated that “due to this drawback the fast stylistic innovation periods in European markets are less noticeable in Australia”. China’s massive production capacity has also endangered the small firms leaving the large firms with huge sales volumes to control the market.

Thirdly, Australia has a unique textile and clothing policy. This trade policy liberalized the markets allowing importation of clothing in the early 1990s which was a couple of years ahead of “trade liberalization schedules of the world trade organization agreement on textiles and clothing”. Therefore Button (1986) concluded that Australian firms had not developed efficient structures and mechanisms to fully support the clothing and textile industry. As a result of all these aspects, a big number of garments being sold in Australia at the moment are originating from China. However, experts in Australia are beginning to put structures and frameworks that will protect and cushion its markets from cheap imports from Asian countries namely; Hong Kong and China.

Throughout the urbanization period of Australia the government insisted on developing policies that would cushion the local clothing and textile industry from cheap imports. The industry was a major source of employment for low-skilled workers and immigrants. The government forced international companies to set up their operations base in the country but the parent firms were not keen on establishing their production or research units which escalated the price of imports. During the economic crises of the mid-1970s it became difficult to maintain the demand management policies and the economic theories gained momentum (Blair & Gereffi, 1998).

In a study by Gereffi & Korzeniewicz(1994) economists were increasingly concerned that Australia was falling behind in terms of economic growth and the industrial policy was singled out as the main cause. Economists advocated for the policy to be abolished and wanted its economy to be internationalized by integrating with global trade flows (Blair & Geriffi, 1998).

However; disagreements emerged on the best method of achieving this strategy. Some believed that promoting agriculture production in which Australia had a competitive advantage while others supported the emerging industries where a competitive advantage could be developed. In 1983 a Labor government came to power and promised to revive the market by drawing a strategic plan that would entail developing high technology industries which would put Australia back on the global economic map. Four arguments that advocated for the abolishment of trade barriers were: First, Australian clothing and textile manufacturers were inefficient and given the high wages paid in the country the government was hindering the flow of capital which would develop the export industries.

Moreover, the protective quota-based system greatly altered the local industry structure and encouraged mal-practices such as hostile take over. Secondly, allowing imports from other countries would increase welfare by providing more choices for the Australian consumers. Also encouraging imports would drastically reduce the prices of garments allowing the people to redirect expenditures to other high-tech products and services. Lastly, this would a clear indication that Australian government is serious about trade liberalization thus boosting its economy (Australian Financial Review, 2007, p.15-20).

A major inquiry was set up on the future of the clothing and textile industry which came up with certain recommendations (IAC 1986) (a) liberalization of the tariff, quota, and bounty provisions that had cushioned the textile and clothing industry (b) introduction of incentives to encourage industries to restructure their operations and increase efficiency (c) a labor scheme to help workers who had been laid off (d) setting up of the statutory body to modernize the sector {TCFDA}. The reforms encountered some resistance from industry players but finally, they were adopted (Button 1986).

Competitive review

Overall many firms that were pure retailers have incorporated wholesaling operations or formed alliances with individual wholesalers. Since liberalization, the four forms of clothing retailing namely: department stores, boutiques, specialty chain stores and other retailers have had varying marker shares depending on their degree of competitiveness. According to a TCFDA report (2000) specialty chains and boutiques held 40% share while Department stores held a 34% share in the Australian clothing market.

David Jones and Myer stores

This is a high-end store that competes for dominance in fashion-oriented clothing market. The store has distinguished itself from other retailers by hiring Australian and New Zealand designers who appeal to consumers thus increasing its turnover. David Jones and Myer stores specialize in elite designer garments, affordable clothes at multiple price points including diffusion labels. Its latest innovation is the introduction of less costly “diffusion” versions of Australian designs. The retail chain concept of favoring local designers to high-profile established brands has created a fashion enthusiasm in Australia.

Target Australia

This is a discount department store that is owned by Cole’s group of companies. Target stocks quality, reasonably priced Target brand garments made by preferred designers such as Stella McCartney and Josh Goot. The garments are made according to their own standards and specifications. A large proportion of Target’s clothing sports Australian icon brands which are manufactured in China.

Big W Australia

This is one of the largest chain stores in Australia. It is owned by Woolworths Limited and has over 164 stores located in different parts of Australia including Victoria and Queensland. Big W’s main strategy is on a low price which is emphasized by its famous slogan, “everyday low prices”. Big W’s famous services include home delivery, point of sales services and parcel pick-up. In terms of sales, the firm has performed exceptionally well rivaling its main competitors Target and Kmart (Encyclopedia for Business, 2009).

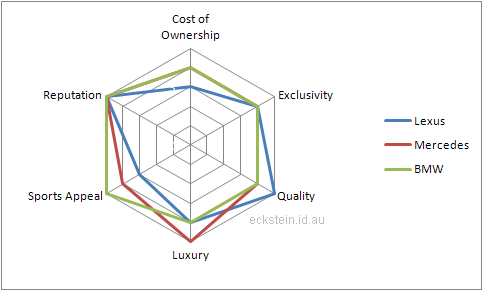

Market positioning graph

Customer profile

Kmart clothing targets a more budget-oriented market and its stock is largely imported from China. The current ranges of analysis of Kmart styles for men are Bonds, Alpha and Holeproof while the women’s brands include Contempo, Girl Xpress, Now Solutions, Bonds and Secret Love. Fashion trends for the winter 2012 winter season will depend on individualism and the different aspects of our lives. This year will be the year for innovation, re-invention, and contrast in fashion meaning leaving the past and embracing the diversity of our unique looks. Color will be an important ingredient for winter with warm and positive colors dominating. Besides, black and brown bright colors such as yellow and red will be visible. The texture of the fabric especially silk will be keenly followed. Its surface hair, blend and print will emerge as a favorite among trendsetters. Fur and the leopard will be the material for cats, shoes, bags, and skirts bondage.

References

Bair, J, Gereffi, G. (1998). Inter-firm Networks and Regional Divisions of Labor: Employment and Upgrading in the Apparel Commodity Chain. Geneva: International Institute of Labor Studies.

Button, J. (1986). Revitalizing Australia’s Textiles, Clothing & Footwear Industries. Statement by the Minister for Industry, Technology and Commerce. News Release 166/86.Canberra.

Coles Group third quarter sales. (Coles Group (News Release). (2007). Web.

Commonwealth of Australia. (1994). Future Strategies for the Textiles, Clothing and Footwear Industries.Report of the TCF Future Strategies Committee. Canberra: AGPS.

Gereffi, G, Korzeniewicz, M (1994). The Organization of Buyer-Driven Global Commodity Chains: How US Retailers Shape Overseas Production Networks. Commodity Chains and Global Capitalism. Westport Conn.: Greenwood Press, pp. 95–123.

Kmart Coles Group. (2009). Web.

Mini-Kmart’ to hold off rivals. (2007). Australian Financial Review: pp. 15-20.

New Zealand Herald. (2007). Coles defers supercentre strategy as sell-off looms. Web.

S.S. Kresge. (2009). Reference for Business, Encyclopedia for Business. [Online]. 2nd Ed.

Sears reopening some Kmart auto centers; Test drive expected to start in Detroit-area outlets. (2006). Web.

Strategy Update (2007): Driving Value for our Shareholders. Coles Group (News Release). 2006.

Wesfarmers plans Coles investment, restructuring. Reuters. (2007). Web.