Internal Analysis of Almarai Company

Internal Strengths and Weaknesses

The strengths and weaknesses of any business refer to the internal environmental indicators of a company. Almarai is a Saudi dairy farming company, which was created in the year 1971 to change domestic dairy farming to meet the needs of the expanding market in the Gulf region. The strong points of the Company Almarai are its strong brand recognition and the top position of the sustainable market player, which is covering a huge portion of the Gulf region by its variety of product lines (Husain, Shahid, and Alnefaee, 1689).

Almarai is a market leader in the manufacturing of fresh dairy products. Research studies have revealed that the company gained more than 56% of the market share in the last decade and maintained continuity (Alhumoudi, Hamad, Yuosef, p. 113). Another strong point of the Almarai Company is its sustainable growth and development due to the lowermost percentage of the wastage of raw material, which is only 2% as compared to other rival companies.

The management has maintained its sustainability and, thus making it a source of incorporating efficiency in the business operations. Another strong point of Almarai is the maintenance of an effective quality system, which involves an integrated supply chain, effective marketing, and sales expertise, and an extensive distribution network (Ali, Sajid, et al, p. 601). In addition, the involvement of advanced technological innovations in farming tactics is an additional strength of the company. However, the management has to deal with some of the weak points of the corporation. The company is trying to grab the Gulf market but is unable to achieve the milestone of the top position in the market share (Khan and Rahatullah, p. 359). The company management is a solo or individual brand, i.e. there is no backup for the brand to continue the operations in case of any incident.

Internal Factor Evaluation

The internal factor evaluation (IFE) matrix is a strategic tool for analyzing the core strengths and weaknesses of any business. The internal factor analysis of the Almarai Company actually helps to highlight the significance of each factor depending upon its necessity (Mahjoub, Lassaad, p. 92). The IFE analysis of the Almarai Company is given below:

Table 1: IFA Matrix.

As the weighted average score for the IFE matrix is 3.5 therefore, this means that the strengths of the company are minor. This is not a bad thing and this shows that there is still much room for improvements for the management of Almarai Company.

External Assessment

Competitor Analysis

The market of dairy farming is highly competitive, and thus the management of Almarai has to maintain the pace of the competitors by using highly intensive growth strategies. The two highlighted competitors of the company Almarai include Nadec (National Agricultural Development Company) and Al-Safi Danone Company (Tadawul). Both of these are highlighted growing companies in the food and beverages market. However, in the year 2001, the management of Nadec announced too but Al-Safi Danone to make local joint venture involving the management of both companies’ previous organizational structure (Mahjoub, Lassaad 92). Nadec has purchased all the shares of ASD thus making a new joint venture in the market to compete with the strong and sustainable position of Almarai in the KSA market.

The joint venture of ASD and Nadec is standing at the second competitive market position by grabbing 49% of the market share in the last decade. The joint venture company is the largest agriculture and food processing company covering major regions of the Gulf. Another additional feature of this public limited company is that it has 20% shares of the Saudi Government (Alhumoudi, Hamad, Yuosef, p. 113). The main strength of this business is that it is one of the largest vertically integrated dairy businesses in the concerned market. In other words, the company is giving tough competition to Almarai in the market of Saudi Arabia.

Opportunities and Threats

The opportunities and threats refer to external environmental indicators. There is an opportunity for the Company Almarai, which is associated with the change in the currency value after introducing GCC currency. The trade duties will be lower down for the management, and thus the revenues will go higher (Ali, Sajid, et al, p. 601). The increase in population may reap additional benefits in the future in the Gulf region.

The increased health awareness in the people has positively affected the demand cycle of fresh dairy products, fresh juices, and milk. The low-interest rates on the capital investment by the banking institutions also ensure an increase in capital investment (Mahjoub, Lassaad, p. 92). On the other side of the picture, the company operations depend upon the fluctuations of petroleum prices in the market and indirectly get affected. In addition, the higher market share of the competitors in the Gulf region is also a threat for the Alamari in the future for its presence in the Gulf

External Factor Evaluation Matrix

Table 2: EFA Matrix.

The EFA score for the opportunities is greater than 2.5 and this suggests that the company is strong, however, the weighted score for the threats is less than 2.5 and this shows that the management of Almarai is not counteracting its threats and they are overcoming the opportunities for the company.

Competitive Profile Matrix

Table 3: CPM Matrix.

Strategy Formulation

SWOT Matrix

Table 4: SWOT Matrix.

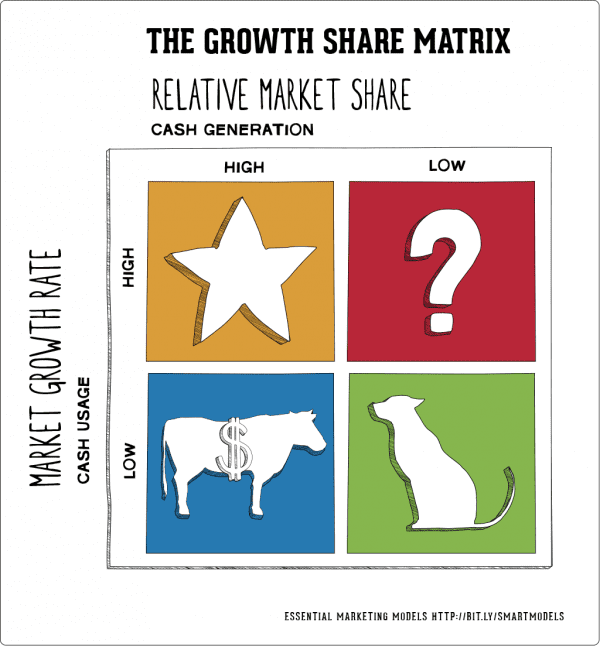

BCG Matrix

The BCG or Boston Consulting Group matrix refers to the segregation of certain SBU or product lines within a business to evaluate their revenue generation capabilities (Aldosari, Abdullah, and Atkins, p. 60).

- In the BCG matrix evaluation of Almarai Company, the milk products or the fresh dairy products are the stars of the BCG matrix, which have a high growth market and high market share.

- The fresh juice and beverages are the question while having a low market share in a highly growing market

- The butter and cheese products are the cash cows while having a high market share in low growth markets.

- The yogurt and desserts are the dogs of the BCG matrix while having low growth and low market share.

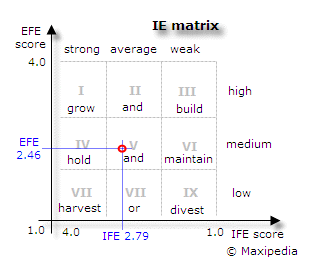

Internal-External matrix (I-E Matrix)

The I-E matrix of Almarai Company contains the number of EFE as 4.6 while IFE as 7.65. The sample I-E matrix is given below:

Quantitative Strategy Planning Matrix (QSPM)

The quantitative strategy-planning matrix is another strategic management tool, which is used for the evaluation of possible growth strategies. This matrix actually involves the evaluation of all feasible analytical alternatives for growth and development for the Alamarai Company (Khan and Rahatullah 359).

Table 5: QSPM.

The results show that the first alternative growth strategy is highly attractive because of the internal and external evaluation of the environment of Almarai Company (Tadawul). Therefore, the management must go with the more focused approach on the Gulf region to buy sing the particular brand power of its fresh milk products, which are the stars of the BCG matrix in the KSA market.

Advantages/Disadvantages of Alternative Strategies

The first alternative growth strategy is to move out of the box and gain maximum market share in the Gulf region. The reason behind this alternative growth strategy is the attractiveness of the target market. The main advantage of this growth strategy is that the company of Almarai is already serving in the Gulf region but with a low extent of business operations. The disadvantage of this growth strategy is that the competitive power of Nadec is higher in the Gulf region (Husain, Shahid, and Alnefaee, 1689). Therefore, the management has to plan for market penetration by offering a high-quality product to lead the competition in the Gulf region.

On the other side of the graph, the second alternative growth strategy is to vertically integrate the supply chain in the strategic business unit of the milk and dairy products which is already very revenue-generating. This growth strategy will help to gain sustainability and increase market share in the KSA market. The biggest advantage of this growth strategy is the minimization of the cost of raw materials. On the other side, the disadvantage is the increased cost of transportation in case of fluctuations in petroleum prices (Almarai). In addition, Nadec is already following the vertical integration, and thus the management of Almarai has to do some sustainable competitive moves to lead the market competition.

Recommendation of Any One Strategy

Based on the evaluation of the internal and external environmental factors, the competitor matrix and all other significant results of the key success factors suggest that the growth opportunity to cover the Gulf region by using the strong SBU of fresh dairy products is the most attractive and potential decision. The management at Almarai is famous for its market penetration using aggressive growth strategies (Tadawul). Therefore, in the case of the Gulf region, market penetration is the best and suitable growth strategy to grab the increased market share as compared to the competitor force of Nadec.

Strategy Implementation

EPS-EBIT Analysis

The EPS or EBT analysis is a capital structure approach, which is used to evaluate the best possible ratio between the debt and equity financing for making the capital investment structure of any growth alternative. This particular ratio analysis for Almarai’s growth alternative can check the financial effectiveness of the decision of making a more focused entry in the Gulf region. In order to fulfill the ratio analysis involving the EPS-EBIT factors, the financial data has been taken from the website sources (Tadawul). For a particular estimation, there is a need for the value of earning before tax and interest, which is nearly 17.97%.

The annual report data shows a continuous increase in the value of EBIT in the past five years (Husain, Shahid, and Alnefaee 1689). However, the EPS value is Rs 1.97, which is fluctuating in the past five years. Therefore, the capital structure should be more equity-focused and less debt-based. These are the high points of the facts and figures of Almarai Company, which depicts the proposed capital investment structure of the company’s new investment decision. The EBIT shows that the earning of the company before taking out the value of interest and taxes is attractive enough to carry with the equity financing. On the other side, if the company goes with debt financing then the rates of interest will ultimately minimize the net earnings.

Strategy Evaluation

The most important part of making growth and development decisions is to evaluate the effects of any strategy implementation. Strategy-making or implementation is not the only success factor for determining the success or failure of any growth or development plan. There are many other factors including managerial leadership, luck, supportive organizational culture, and a valid strategy, which can collectively lead the business towards success (Aldosari, Abdullah, and Atkins 60). In the same way, in the case of Alamari, the growth strategy formulation is significant; however, it is not an exclusive key success factor. There are different procedures to check the success or failure of valid strategy implementation.

- Internal consistency – which means that the company’s internal organizational infrastructure is highly consistent with the influence of the proposed changes

- External consistency with micro and macro factors – this refers to the consistency between the internal and external environmental factors for the Alamarai Company in the Gulf region

- Appropriateness with the usage of available resources – the management is already famous for its sustainability and having low wastage of raw materials, therefore this measure is significant in the Almarai

- The controllable degree of risk – this refers to the identification and mitigation of the risks existing in the market and the existence of pre-planning to deal with them

- Appropriate time horizon – this entity refers to the time factor in every possible regard and business operational planning

- A high degree of workability of growth strategy – this refers to the feasibility of the adopted growth strategy by Almarai

These are the significant factors to check the effectiveness of the newly incorporated growth strategy of market entry of Almarai in the Gulf region with market penetration tools.

Works Cited

- Aldosari, Abdullah, and Jill Atkins. “A Study of Corporate Social Responsibility Disclosure practices in Saudi Arabia.” CentAUR: Central Archive at the University of Reading, 2015. pp. 54-90.

- Ali, Sajid, et al. “Impact of Activity Based Costing on Firm Performance in Saudi Arabia.” Science International. vol. 27, no. 1, 2015, pp. 597-607.

- Almarai. “Almarai In Community.” Almarai. 2019. Web.

- Alhumoudi, Hamad Yousef. “Corporate Governance Mechanisms and Firms’ performance: An Empirical Analysis of Firms Listed on the Saudi Stock exchange.” International Journal of Accounting and Financial Reporting, vol. 6. no. 2, 2016, pp. 101-145.

- Gashgari, Reema. Exploring the implications of corporate governance practices and frameworks for large-scale business organizations: a case study on the Kingdom of Saudi Arabia. Diss. Brunel University London, 2017. pp. 23-45.

- Husain, Shahid, and Saad Alnefaee. “The effects of working capital management on the profitability of firms: Evidence from agriculture and food industry of kingdom of Saudi Arabia.” Journal of Emerging Issues in Economics, Finance, and Banking (JEIEFB) An Online International Research Journal, vol. 5. no. 1. 2016. pp. 1684-1698.

- Khan, Muhammad Rahatullah. Towards Sustainable Ethical Culture in Family Owned Businesses. Preprints, 2019.

- Mahjoub, Lassaad Ben. “Sustainability Reporting and Income Smoothing: Evidence from Saudi-Listed Companies.” Sustainability Assessment and Reporting. IntechOpen, 2018, pp. 87-98. Web.

- Tadawul. “Almarai Co.” Tadawal. 2019.