Introduction

In marketing, several strategies are used to increase the organization’s market share and competitive advantage in the marketing environment. One of the strategies is mergers and acquisitions. With the increasing global marketing competition, an organization must choose the most appropriate strategy that can guarantee tangible returns and help it achieve the intended goals and objectives.

Mergers and Acquisitions (M&A) is both a marketing and corporate strategy aimed at buying, selling or combining two separate companies to have one large business without necessarily creating another separate business entity (Weston, Mitchell & Mulherin, 2004). It is a concept widely being used by many businesses to evade the increasing global competition. Though the two words may have different definitions, whereby mergers refer to the combination of two companies and creation of a new name for the newly created company while acquisition refers to one company buying the other company and the name of the target company ceases completely to exist the goal is always the same. Improving the company’s corporate image and the marketability of products is what drives M&A (DePamphilis, 2008).

Upon the successful implementation of the strategy, the concerned companies derive significant benefits that would not otherwise be available if a single company were to operate alone. The idea here is to increase the company’s competitive position in relation to its market competitors. The other reason for the desire to launch M&A is the fact that many companies have adopted the strategy and following suit is the only alternative.

The motive behind M&A about Merck and Medco

The principal objective behind the M&A is that the acquiring firms seek to improve financial performance through increased market share. However, this can be achieved through several ways in M&A. M&A helps a company enjoy economies of scale. The merged companies can easily reduce their fixed costs through the elimination of duplicate departments or sections (Cartwright & Schoenberg, 2006). The overall costs of the Merck Company can be reduced through the maintenance of the same revenue stream and the subsequent increase in the profit margin.

This will be possible if the company’s fixed assets were not used optimally and there was still room to increase their productivity. The other motive is the economies of scope that refers to efficiencies resulting from adjustments from the demand side. This is achieved through changes in the distribution of the particular product. It is anticipated that M&A will bring about changes in distribution channels either through the invention of new ones or modification of the existing channels for better service delivery. This is due to the fact there will be a generation of new marketing and financial ideas from the two merged companies. Acquisition leads to the absorption of major competitor and therefore the buyer increases the market power in the industry (Harwood, 2006).

The other major motive behind M&A is vertical integration. This takes place when an upstream merges with downstream to form one big entity. One characteristic feature of this concept is that it is usually applied by the firms having different levels of production, for instance, an enterprise dealing with production merging with the one doing the actual distribution and marketing such that one individual firm jointly carries out the production and marketing (Rosenbaum & Joshua, 2009).

Merck & Company, the world’s largest producer of drugs can immensely benefit from this strategy in the event that it acquires Medco Pharmaceutical Company that largely specializes in drug marketing and prescription services since the two companies have different levels of marketing activities. The production and marketing activities will have been integrated into one thing carried out by a Merck alone thereby reducing its distribution and marketing costs.

Merck & Company’s corporate governance and its influence in the proposed M&A plans

About information filed by the Securities Exchange Commission (SEC), concerning the company’s information, form 14A provides a brief analysis of the Merck’s corporate governance and its role in the running of the company. Merck & Company is managed through the guidance of the Board of Directors whose mission is representation and protection of members’ interests.

The Board’s involvement enhances its provision of guidance to the management team in formulating and implementing plans as well as practicing exclusive independence in decision making with regard to matters of importance concerning the company. Besides, the company’s Board overseeing the company’s affairs, they should be constantly updated on the company’s business and strategies. Therefore, the management board will be incorporated in the approval and implementation of the company’s mergers and acquisitions plan, which forms part of the company’s corporate strategy (DePamphilis, 2008).

Every year the company’s senior management sets aside a particular period to discuss the long-run operating plan and its entire corporate strategy. The key areas under discussion include research and development, international marketing and sales, production strategy and the political arena that may have adverse effects on the company’s affairs and operations (Weston, Mitchell & Mulherin, 2004). The Board’s discussion is incorporated into the management’s discussion and a conclusion is met concerning the company’s way forward. The proposed mergers and acquisition plan is one of the management’s discussion and has to be approved by the board before the final presentation to the shareholders who will be allowed to give an opinion concerning the same.

Brief analysis of Merck’s past Financial Performance

In the financial year 2010, substantial financial progress was made in a move to achieving the goal of becoming the best health care in the world. Despite encountering harsh economic times coupled with challenging regulatory and political environment in the healthcare field, the company excelled in achieving revenue growth for the principal products, extension of company’s international reach, restructuring of cost structure to make it more efficiency, investments improvement and the formulation of company’s post-merger legacy. During the year, earnings per share (EPS) grew by 5 percent to reach $ 3.42 higher than the expected internal targets.

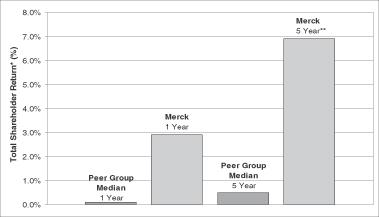

Despite increased competition from other leading drug dealers like Cozaar and Hyzaar, the company’s total sales reached $ 46 billion. In the same year, substantial investments in the emerging markets yielded approximately $ 7 billion in the pharmaceutical and vaccine sales. Also, the company introduced into the market five new drugs after they were approved by the United States and European Union (Weston, Mitchell & Mulherin, 2004). In addition, the company made full completion of $ 2 billion in public debt offering. Besides the company’s strong financial performance in line with its scorecard, the shareholder return for the 1-year and 5-year ended December 2010 as compared to the company’s pharmaceutical peer companies is described in the figure below.

Any company anticipating to do mergers and acquisitions ought to have sufficient financial resources since this is like buying the entire target company (Cartwright & Schoenberg, 2006). The financial performance of Merck Company indicates that the company can acquire the proposed company with the anticipated $ 6.6 billion. M&A is a costly strategy and requires the company to have a strong financial base otherwise, the mission might turn out to be a failure. If all the other basic requirements are met, then the company is qualified to go ahead with its plans. The company’s directors are the majority shareholders in the company and therefore the chances are that they will support the proposed plan for the mergers and acquisition and try to come up with the strongest implementations for its success.

Brief analysis of Medco Containment Services Incorporated

Medco Containment Services Incorporated is the leading prescription benefits management company (PBM) in the United States (Weston, Mitchell & Mulherin, 2004). It provides pharmaceutical services and drugs across the US and other countries. The company’s Board of Directors as illustrated under 14A in the SEC oversees the company’s major operations and gives direction to the senior management team of the company on the way forward. The management is responsible for the formulation and implementation of the company’s major strategies that are designed to help the country achieve its goals and objectives. Unlike Merck & company, the company has specialized committees established to tackle particular areas in the company. One of the committees is Mergers and Acquisition Committee

Mergers and Acquisition Committee

This committee is maintained by the Board of Directors. This is to review, analyze and recommending strategic transactions and marketing opportunities that prevail in the business environment. This committee conducts rare and irregular meetings every year. For instance, in the financial year 2010, the committee held only five meetings. It is the company’s subsidiary determinant on whether any mergers or acquisitions are going to take place on the part of the company. The committee does not have a written charter.

Medco’s past financial performance and its relevance to the proposed M&A plan

In the financial year 2010, Medco had excellent financial results. The earnings per share (EPS) went up by 21.1 percent to reach $ 3.16 as compared to $ 2.6 in the financial year 2009. Pharmacy sales in the Specialty section rose by 19.1 percent to reach over $ 11.3 billion. Return on invested capital (ROIC) hit 35.2 percent in 2010, a significant increase as compared to 27.1 percent in the fiscal year 2009.

This excellent performance does not include the acquisitions made during the year 2010 for example, BioSource Corporation (UBC). The company’s stock performance in the financial year 2010 flattened for the first time in history by attaining -4.1 percent and legged the peer group. The total net sales were more than $66 billion, an increase of 10.3 percent with service revenues marking a 28 percent increase to reach $1.08 billion. There was also a gross margin rise of 7.7 percent reaching $4.34 billion and a subsequent gross margin of 6.6 percent. Also, mail-order prescriptions recorded revenue totaling 109.8 million, which was a 6.5 percent increase with generic volumes hitting 67.6 million an increase of 13.4 percent.

The better financial performance for the Medco Containment Services Incorporated gives a sufficient reason for the Merck & company to increase the desire for its acquisitions. One major consideration before a company merges or acquires another is an analysis of its financial strength and performance. This is because based on a going concern concept, the acquired company will continue with its usual major business activities since in most cases what changes is the business owner. Though it is possible to acquire poor performing and loss-making company, this is not advisable as the revival of the company may cost the other company huge amounts of money.

The Principal force driving the planned acquisition by Merck & Company

The past few years have been marked by significant change in managed care. This has changed the healthcare industry completely. The outcome has been increased mergers and acquisitions to improve performance, service delivery and meet customer satisfaction for those companies offering medical care. This is because managed care plans offer integrated services consisting of beneficial medical insurance and primary health care services.

This is enhanced through the use of volume and long-term contracts that aims at negotiating discounts from those providing healthcare services. Such improved services from the companies that have upgraded into managed care levels threaten companies like Merck and it has to respond to improve its competitive advantage in the market industry. This is one of the reasons why the company has opted to acquire to increase its chances of survival (Cartwright & Schoenberg, 2006). Managed care programs are well known for meeting customer satisfaction as they provide comprehensive coverage for any drugs in higher frequency as compared to other traditional medical insurance plans.

According to medical experts, it is estimated that in the next few years, more than 90 percent of all the American residents will have their drug expenses incorporated in some designed managed health care plans. More than half of all the outpatient pharmaceuticals will be catered for by managed care programs. This is a significant move towards improving the country’s health services and the consumers will have access to affordable medical services.

After the realization of what consumer wants, that is why the entire medical and health industry has undergone drastic changes. Every market player is using everything at its disposal to meet the market expectations. This has seen the collaboration if not mergers and acquisitions between different companies to improve the marketability of their products (Harwood, 2006). Relatively small pharmaceutical companies are being absorbed by giant companies through acquisitions and the target ones are those dealing with actual distribution and marketing while the ones absorbing the small companies are those producing the drugs themselves.

Merck Company has weighed all the options and evaluated all the risks that may be involved and that is why the company’s Chief Executive Officer is seeking the advisory opinion from the three associates within the company. There is no guarantee that every M&A must emerge successfully. It may bring out disappointing results when the plans are miscalculated and this may lead to incurring huge losses. In every marketing environment, there are always many market players especially in a perfectly competitive market (Rosenbaum & Joshua, 2009).

The nature of medical and health services is a perfect one in the sense that there are so many drug dealers and pharmaceutical companies whose goal is to attain the largest share of the market. In such markets, the competing agents use many strategies to beat their rivals and what follows after is the reaction of other market players. That is what the Merck Company is doing due to the action of other market competitors.

The overall responsibility of managing the provision of prescription drugs is vested in the hands of managed care organizations to PBMs. This means Merck & Company alone cannot effectively handle this demanding responsibility. For this to handle the task there is a need to merge its operations with another successful company and in particular a prescription company like Medco Containment. PBMs specializes in the management of insurance claims, negotiation of quantity discounts with the leading drug dealers and manufacturers and advocating the use of relatively cheap generic substitutes. Again, prescription benefits are managed through the use of special formularies and other drug utilization reviews.

The pharmacist’s committee design and compile drugs in collaboration with physicians that are to be availed in the market. This, they do on behalf of managed care organizations. From the overview, managed care is an extensive and comprehensive activity that requires expertise and skills. This makes Merck Company to qualify without any queries. Registered members of the managed care organizations are advised to make the required prescriptions whenever possible.

On the other hand, drug utilization reviews comprises of monitoring and analyzing the physician’s prescriptions trend to the patients. They can identify when the physician is not performing the duties accordingly (Weston, Mitchell & Mulherin, 2004). Under managed care programs, costs can be monitored easily and therefore give the decision-making authority green light on the way forward. This is what the Merck & Company plans to achieve in its proposed idea, a plan that is seen to increase the shareholders’ equity.

The other reason why Merck & company have and need to proceed with its proposed M&A is that under its proposed M&A is that, under the managed care, the payments’ and receipts’ responsibility is directly linked to decision making about the provision of pharmaceutical and healthcare services than the existing system of traditional indemnity plans. The implication here is the doctors no longer make prescription decisions but rather the responsibility is shifted to the managed care and PBM providers. The marketing strategies used by drug manufacturers will shift from hundreds of thousand doctors to only countable formulary and plan managers.

Other changes that are likely to be affected are that only a single drug company will be depended on by managed care providers unlike in the past when several drug companies were being used in delivering all the pharmaceutical products and health services. This will be in favor of those companies with their own manufacturers, distribution, and marketing and prescription abilities (Weston, Mitchell & Mulherin, 2004). The experts believe that eventually, only a few pharmaceutical companies will be left in the industry and due to stiff competition, declined income among other factors and only those which will have managed care programs will survive and therefore there is a great need for the Merck Company to speed up its M&A implementation process.

The role of Prescription Benefits Management (PBM) Companies

PBMs perform so many roles in the pharmaceutical and health industry that are relevant to the health of the end-users of the designed drugs. It aids health plans in the management of all costs related to drugs through designing and implementation of formularies, negotiation for fair prices with drugmakers through discounts and processing of any claims raised by the interested members. PBMs have considerably helped in cutting down necessary expenditures incurred by government and self-insured entities.

The studies have shown that the tools and systems applied by PBMs reduce employer’s costs by more than 20 percent. PBMs also have excelled in the promotion of their services throughout America and an estimated 200 million civilians have enjoyed their services. Effective use of PBMs by the employers and other sponsors who have enrolled in the designed programs lead to high quality and cost-effective prescriptions. The costs of administering the drugs are extremely low as compared to other systems. How health issues are handled has been significantly improved by the use of PBMs. The PBMs offer both promotional and marketing services (Weston, Mitchell & Mulherin, 2004).

The contribution of Medco’s database towards the Proposals’ Success

Medco Containment Services Incorporated is believed to host a significant database that will make the proposed acquisition a success. Though one of the Merck’s associates, Chief Operating Officer, differs with the proposed plan arguing that the synergy and integration issues between the Merck, a leading pharmaceutical research institution and those of a simple prescription medicine marketing company may not match, the plan has great prospects for the company’s future.

His view is that the organizations have different cultures and operations that are not likely to match and the overall result might be a total failure. This is not enough reason to prevent Merck & Company from going ahead with the planned acquisition since these are aspects that can be synchronized and new common cultures and operations created or formulated. Though it may be an obstacle, the forecasted benefits that are likely to accrue from the proposed plan cannot be compromised with the cultural and operational differences between the two companies (Weston, Mitchell & Mulherin, 2004).

As pointed out earlier, M&A between the two companies will form a kind of vertical integration (DePamphilis, 2008). One major reason why the proposed plan may work out successfully is because these are two companies with excellent performance and global image. The major reason behind the Merck’s acquisition is to have managed care programs that have all the products and services clients require. Merck Company being the world’s largest drug manufacturer is compatible with the world’s largest prescription benefits management company.

The merger reflects significant changes in the entire pharmaceutical industry. What may threaten Merck & the company currently is the fact that it cannot offer prescription services more effectively. With the company’s ability to produce world-class drugs and vaccines, an additional strength in terms of offering better prescription may make it better than the current status and thus compete more effectively with other companies that have integrated their operations and services into managed care programs.

Merck & Company and Medco Containment services have full confidence that the merger between the two companies will give them impressive results and a strong competitive position in the market thus making them effective to compete with other rivals. Medco’s comprehensive database is the principal motivating factor for the proposed merger. Over the years, Medco has succeeded in maintaining a computer profile of each of its customers that is estimated to be over 33 million. This covers close to 26 percent of all the people under a pharmaceutical benefit plan.

Also, Medco clients comprises of 100 Fortunes and over 500 companies that are served by the company. Also included is the government benefit plans together with some insurance groups and companies. To Merck & company, this is an excellent opportunity the company cannot afford to lose since after the plan succeeds all these customers will be under Merck’s control. This will fulfill the Chief Financial Officer’s (CFO) dream of increased earnings per share for the shareholders that cannot be attained by Merck standing alone. The stock price is also anticipated to grow tremendously according to CFO and the subsequent decrease in operating costs.

The customer base for Merck & company is expected to double after the success of the proposed merger. The Medco’s database contains beneficial information that is of much help to the Merck. The database is very crucial in the sense that it will allow Merck to identify prescriptions that could be shifted from the Medco’s drug to a Merck drug. This is one way of harmonizing the operations between the two companies, a move that will see the operational and cultural differences eliminated and avoid the duplication of operations within the merged companies (Weston, Mitchell & Mulherin, 2004). The success and extensive database in Medco has made the Merck to willingly volunteer to part with $6.6 billion to acquire the company.

The Medco’s database will also help Merck Company in identifying customers /patients who do not refill prescriptions. This is due to ignorance or negligence and the company loses huge amounts of money every year due to failure to refill the required prescriptions. Currently, Merck does not have such a database and that is the reason why huge losses are being witnessed.

The Medco’s database will facilitate the use of the system’s computerized patient record system for the consumers. The premium price charged is comparable to the Merck drugs. The Merck & Company will be in a better position to establish the supremacy of its services as well as products. Other benefits that are likely to accrue from the Mergers include $ 1 billion annual savings from the marketing operations. This will be achieved due to improved marketing efficiencies brought about by the Medco’s marketing strategies.

The marketing will be cost-effective and relatively cheaper. Merck’s sales and marketing force will also reduce because more precise and excellent marketing strategies will be put in place in the process of adoption of Medco’s database. The company aims to capitalize on the most important and valuable asset in the modern pharmaceutical industry which is information through the proposed mergers and acquisitions (Rosenbaum & Joshua, 2009). In this, the company will increase its market share and offer its products at affordable prices due to cost leadership that will result from economies of scale.

Competitive reactions that took place after Merck’s acquisition of Medco

It is usual for market players to react when one of their rivals takes a position that is likely to wipe all the other rivals from the market. This happens mostly in perfect competition markets (Harwood, 2006). The strategy adopted by Merck & Company is a threat to other health and pharmaceutical suppliers and may diminish their chances of survival in the market. Immediately after Merck Company revealed its plans to acquire Medco, other companies were not left behind and they decided to follow suit to enhance their competitive advantage.

For instance, British drug manufacturer Smithkline Beckham showed interest in acquiring Diversified Pharmaceutical Services Incorporated, well-known and large drug wholesalers in the United States for $ 2.3 billion. Roche Holdings announced it planned to acquire Syntex Corporation and in the year 1994, Eli Lilly indicated its interests in acquiring PCs Health Systems. These are some of the reactions that took place after the Merck’s plans were revealed to the public. What is likely to happen after the reactions are increased benefits to the consumers through improved health care services, reduced prices for drugs and high customer base reach such that all the people in need of health and medical services are adequately covered.

Recommendation

Mergers and Acquisitions, when implemented appropriately, can be a profitable venture. Based on the analysis of the Merck & company the company is eligible to go ahead with its proposed plan. Though the decision whether to acquire Medco may be upon many people’s hands, this is a strong corporate strategy and the concerned parties must be fully convinced of the benefits that are likely to accrue. Merck & Company has got all that it requires to make an acquisition. The past and the latest financial results of the company show how the company is in a position to utilize the newly emerging asset-information, to boost its performance.

Again, the company’s corporate image that it has built over the years is good enough to accommodate another company that will still be under its control. Medco Company too has demonstrated its capabilities in customer hunting through its intelligence by creating a customer base that will have positive impacts on the marketing of Merck’s products. Despite cultural and operational differences, the two companies can merge to form a company that will increase the shareholders’ equity and profitability as predicted by one of the company’s associates.

Medco has had strong financial results in the last five years and its increase in profitability has been significant. Failure to implement this merger and acquisition the company is likely to face stiff competition from those companies that have already made acquisitions and are now enjoying the benefits of managed care programs (DePamphilis, 2008). It should be noted that the proposed plan is in line with the changing industry and this is a strategic decision to increase the chances of survival for the company as well as meeting the consumers’ changing needs.

Conclusion

Companies need to use all the available strategies at their disposal to survive in the market. It is every company’s goal to remain in the market industry (Rosenbaum & Joshua, 2009). Merck & Company has earned itself a good reputation and being the largest drug producer in the United States is a privilege it will enjoy when its expansion plans succeed. Mergers and acquisitions have greatly helped many companies expand their operations. The financial results and other performance strengths reflected by the company’s statements are a clear indication that it will emerge one of the reliable and efficient health providers in the United States and other countries. Considering that the other companies that have emulated Merck are merging with relatively smaller companies than Merck that has chosen the leading drug prescription company in the United States, the company’s competitive advantage is much far than those of other companies.

References

Cartwright, S. & Schoenberg, R. (2006). Thirty years of mergers and acquisitions research: Recent advances and future opportunities. British Journal of Management, 17(4), 21-25.

DePamphilis, D. (2008). Mergers, acquisitions, and other restructuring activities. New York, NY: Elsevier Academic Press.

Harwood, I. A. (2006). Confidentiality constraints within mergers and acquisitions: gaining insights through a ‘bubble’ metaphor. British Journal of Management, 17 (4), 347-359.

Rosenbaum, J. & Joshua, P. (2009). Investment banking: Valuation, leveraged buyouts, and mergers & acquisitions. Hoboken, NJ: John Wiley & Sons.

Weston, J. F., Mitchell, M. L., & Mulherin, J. H. (2004). Takeovers, restructuring and corporate governance. 4 Edn. New Jersey: Upper Saddle River.