A closed economy is that which is not influenced by external factors of demand and supply. Some of the external factors are international interest rates and international inflation rates. This economy’s GDP is dependent on consumer income and expenditure, government income and expenditure and taxation. It is however not affected by the level of imports and exports.

Assume that the policymakers in a closed economy want to increase output without changing interest rates. What kind of policy mix would you recommend and how would your policy mix affect the components of GDP? Explain your answer and the adjustment processes that take place with the help of an IS-LM diagram.

Assuming that the policymakers in a closed economy want to increase output without changing interest rates, identify the kind of policy mix that would be recommended and how the policy mix would affect the components of GDP. Explain your answer and the adjustment processes that take place with the help of an IS-LM diagram:

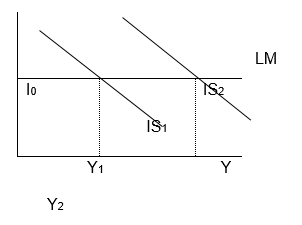

If the federal government or central bank wants to increase output without changing the interest rate, then the LM curve will not move in response to the above-mentioned changes. The best policy mix in this case would be a fiscal expansion and a restrictive monetary policy. This will involve an increase in government expenditure and a reduction in taxes. Therefore, there will be an increase in disposable income and public spending.

As a result, consumer expenditure, investment, consumption, and output will increase. For instance, more projects like public construction, businesses, and new investments will come up. This will make the IS curve to shift to the right to adjust to the increased output. On the other hand, the equilibrium output will remain at a constant (i0). This is because the level of interest is expected to be constant. For this interest rate to remain constant, the federal government will have to adjust the level of the money supply to stabilize money demand (Weerapana 2004).

Explain what is meant by income elasticity of money demand and interest elasticity of money demand.

Income elasticity of money demand is a measure of the rate of change of quantity demanded as a result of a rise or fall in a consumer’s income. It is calculated by dividing the percentage change in quantity demanded by the percentage change in consumer income. It is used to measure the sensitivity of demand as compared to a change in income. Positive income elasticity means that demand is increasing with increasing income. A negative figure will mean that a change in consumer income has little or no effect on demand (Moffatt 2012). Normal necessities and normal luxuries have a positive change in the elasticity of demand. For instance, the income elasticity of necessities is 0 and 1. On the other hand, luxuries have an income elasticity that is less than one. This is because their demand rises less proportionately with the rise in income. Negative elasticity of demand is associated with inferior goods. This is because their demand falls with an increase in income.

Interest elasticity of money demand is a measure of the change in money demand as a result of rising or fall in interest rate. It is calculated by dividing the percentage change in money demand by the percentage change in the rate of interest. Positive interest elasticity means that money demand is increasing as the interest rates rise. Negative elasticity means that the change in interest rates has little or no effect on demand for money (Vernon 1977). The level of interest can be affected by the level of demand for loans. For instance, the higher the level of loans borrowed by the public, the higher the interest rates and vice versa. Interest rates are raised to reduce the money supply, expenditure, and output. On the contrary, interest rates are reduced to increase the money supply, expenditure, and output (Hoffman & Rasch 1989).

The effect of an expansionary fiscal policy on the output level in a closed economy is very large when income elasticity of money demand is relatively high and interest elasticity of money demand is relatively low. Use the appropriate diagram(s) to explain if you agree or disagree with this statement

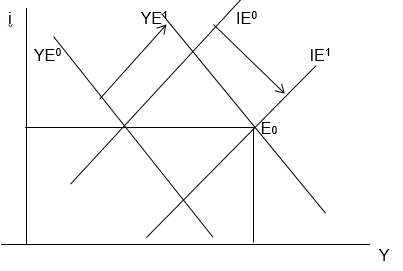

I agree. The effect of expansionary fiscal policy on the output level is very large when the income elasticity of money demand is relatively high and the interest elasticity of money demand is relatively low. This is because, when the income elasticity of demand is relatively high, it means that increased government expenditure and reduced interest rates cause an increase in income levels and consumer demand. This leads to increased output.

This is possible because when an expansionary fiscal policy is implemented, the federal government or the central bank aims at increasing the money supply. It does this by increasing government expenditure and cutting interest rates and taxes. On the other hand, when the interest elasticity of money is relatively low, it means that increased government expenditure and reduced interest rates lead to increased consumer income and demand (The IS-LM Model: Adding Financial Markets to the Real Side 2011). As a result, this leads to increased output. This can be explained in the diagram below:

Explanation as to why an increase in government spending has a larger effect under a fixed exchange rate system and perfect capital mobility than in a closed economy model: Use appropriate diagram(s) to explain your answer:

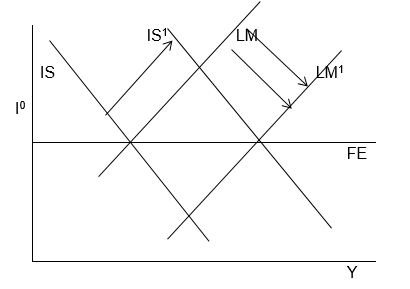

An increase in government spending makes the IS curve to shift to the right resulting in the increased interest rate. The IS curve takes into consideration, income, and government spending. The upward shift causes a rise in the exchange rate. This is because the inflow of foreign funds is increasing to take advantage of high-interest rates. However, in a fixed exchange rate system, the exchange rate is determined by the local monetary body. The government can regulate or determine the exchange rate. Therefore, to make the exchange rate to remain constant, the monetary authority buys a domestic currency with foreign funds so that the LM curve moves to the right. Finally, the exchange rate remains the same while the output increases. Due to the guaranteed fixed exchange rate, producers feel secure therefore increasing their production levels (Haggart 1999). This can be explained by the figure below:

In a perfect capital mobility system, an expansionary policy results in an upward shift of the LM curve. This results in an increased capital outflow. The effect of this is that it counters the intended increase in the domestic supply of money. Instead of the money supply increases, it reduces since people spend more on imports. As a result, the domestic money supply will fall. Consequently, the LM curve will remain constant and the rate of interest will be the same as the world interest rate. The main aim of this system is to ensure that the interest rates are the same as the global interest rates so that production remains high. Therefore, interest rates are not affected by factors such as increased government expenditure. As a result, the level of output will continue rising because the economy is shielded from the interest changes (Fixed and floating exchange rates 2011).

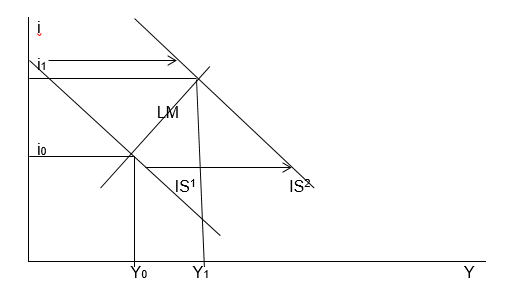

On the contrary, in a closed economy, the output is affected by the interest rates. This is because external factors like government intervention and international interest rates have no control over the domestic interest rates. Since the economy is closed, it is shielded from external forces of demand and supply. For instance, in the closed economy model, when the federal government or the central bank increases its spending, the production of goods and services increases. This causes the IS curve to shift to the right. However, interest rates also rise since money demand becomes higher than the supply. The change in interest rates is not constant because it is determined by market forces. Therefore, this reduces the level of output because producers incur higher costs in production (Weerapana 2004). This is shown in the diagram below:

Conclusion

In a closed economy, external factors like imports and imports do not influence supply and demand. There are fiscal and monetary policies that are used to control demand and supply in the market. These policies can be expansionary or contractionary in form. A government can also decide to use fixed exchange rate systems, a perfect capital mobility system, or a closed system. These policies have their advantages and disadvantages. Therefore, their applicability will depend on the size and nature of the business being carried out.

References

Fixed and floating exchange rates. 2011. Web.

Haggart, B. 1999. Exchange-Rate Regimes: Possible Options. Web.

Hoffman, D & Rasch, R. 1989. Long- Run Income and Interest Elasticities of Money Demand in the United States. Web.

Moffatt, M. 2012. Income Elasticity of Demand: A premier on the Income Elasticity of Demand. Web.

The IS-LM Model: Adding Financial Markets to the Real Side. 2011. Web.

Vernon, J. 1977. ‘Money demand interest elasticity and monetary policy effectiveness’. Journal of Monetary Economics, vol. 3 no. 2, pp. 179-190.

Weerapana, A. 2004. The Closed Economy: IS-LM Model. Web.