Introduction and Discussion

Maximizing the bottom line has become the most dominant yardstick that profit-oriented entities use in assessing their performance. The growing significance of the bottom line can be explained by the emergence of diverse ideologies, social, and economic transformations that have been experienced over the years. Cohn, Kanner, and Ryan (2007) cite the transformation from the social-communism and the barter trade economic systems to the contemporary capitalist economic environment as some of the core indicators of the changes that have occurred. Cohn, Kanner, and Ryan (2007, p. 3) further argue that the ‘capitalism perspective has become the central means of organizing economic life around the world’. Inclination towards capitalism has led to remarkable economic transformation and technological advancements. Thus, the recognition of the benefits associated with capitalism has entrenched its significance amongst economies around the world.

According to Cohn, Kanner, and Ryan (2007), the capitalist approach is profit-oriented. This aspect explains why companies are mainly concerned with amassing properties, wealth, and developing a competitive advantage. On the flip side, the proliferation of the capitalistic approach in the business environment has affected the development of a democratic society. For example, companies are adopting unethical and unfair competitive practices such as offering bribes, kickbacks and lobbying for laws, which are likely to amount to a higher competitive advantage as compared to their rivals. The prevalence of unethical practices such as offering bribes, kickbacks, and lobbying for fair treatment by certain stakeholders, such as governments in the policymaking and law formulation process, shows that businesses are fostering the development of inequality in society. Such practices further highlight the extent to which ‘everything is for sale’ to gain affluence and power.

Despite the view that the benefits associated with capitalistic tendencies amongst businesses trickle down to consumers, for example in the form of low product prices and high-quality products, capitalist corporations are guided by self-interests (Cohn, Kanner & Ryan 2007). The prevalence of capitalistic behavior amongst businesses has limited the efforts to develop a free market, which is a major indicator of a democratic society.

Companies appreciate the view that their long-term sustainability is directly correlated with their ability to coexist with the general society. This aspect has led to the incorporation of corporate social responsibility [CSR] as one of the strategic management practices. CSR is supposed to be an approach through which companies give back to society for the economic profits attained. However, most corporations only invest in corporate social activities if they are sure of receiving a positive return regarding improved public relations, viz. positive image, fame, and status. Thus, profit orientation amongst businesses is motivated by self-interest, which culminates in the development of a negative reputation.

Democracy or the development of free markets has entrenched capitalism, hence the businesses’ pursuit of economic profits. Corporations are engaging in extensive profit-oriented production activities. Some of the activities culminate in environmental degradation, increased wealth, income inequality, and heightened job insecurity, thus increasing the negative reputation amongst businesses. Therefore, one can argue that the prevalence of the capitalist mentality amongst businesses has increased their self-interest towards profit and wealth creation at the expense of society’s welfare. For example, corporations are restructuring their operations by implementing different strategies such as downsizing.

One of the downsizing strategies that companies around the world are adopting is reducing the workforce to attain efficiency. The negative influences of such strategies entail increased unemployment, hence the loss of income. Organizations that have implemented the downsizing strategy in the past decade include DaimlerChrysler, which retrenched 26,000 employees and closed six of its production factories in 2001 to cope with financial loss. Despite an 87% increment in the level of its profitability, Deutsche Bank announced a plan to reduce its workforce by 6,400 jobs (Reich 2007). The adoption of the downsizing strategy was instigated by the need to cope with the prevailing competitive pressure. This aspect underscores the extent to which companies are profit-oriented at the expense of social welfare. The massive job cuts hurt the businesses’ overall reputation due to the destructive impact of such strategies, viz. the impoverishment of the masses.

The pursuit of the bottom line has made businesses adopt aggressive profit-oriented approaches, hence affecting their inclination towards social and moral aspects negatively. Furthermore, the quest for profits amongst corporate capitalists has made businesses extremely powerful, hence limiting their quest for universalism values. Cohn, Kanner, and Ryan (2007, p. 9) affirm that universalism advocates the development of ‘understanding, appreciation, tolerance, and protection for the welfare of all people and nature’. In summary, one can argue that the failure to incorporate universalism has made businesses ‘get a bad rap’.

Corporation, Society, and Stakeholders

The concept of CSR in businesses’ operations has been overemphasized over the years. However, the debate on whether businesses should engage in CSR has been in existence over the years. Different perspectives support the need for CSR and those against such involvement. First, businesses are established with an economic motive, which entails profit and wealth maximization. In their quest to achieve this objective, businesses have developed substantial power, hence their ability to control resources.

Based on this perspective, the involvement in corporate social responsibility contravenes an organization’s wealth and profit maximization objective. This perspective is based on the view that an organization is required to divert a certain proportion of its budget to finance CSR initiatives, which are non-profit courses. CSR is undertaken at the expense of economic benefits, which exist in a free market. Thus, the involvement in CSR amounts to misappropriation and misallocation (Strauss 2015). This dimension further accentuates the bottom-line mentality as emphasized by Friedman. Secondly, the objection on businesses’ involvement in CSR is based on the view that corporate social responsibility is aimed at alleviating the existing social problems. CSR should be left to non-profit and government institutions, but not business entities. According to Strauss (2015, p. 19), the shareholders’ interests ‘are the corporations’ sole obligation even at the expense of other stakeholders’. The economic objectives in business operations are separate and distinct from the social objectives.

Despite the above opposing views, some propositions explain why businesses should engage in CSR. Strauss (2015) asserts that despite the view that organizations have specific rights bestowed on them by laws and conventions, organizations are also social artifacts, and thus the society imposes certain responsibilities on them. First, businesses derive their profits from society. Therefore, businesses owe the community for being permitted to operate and benefit from society. Conversely, society has developed certain expectations from the organizations’ operations. Thus, one can argue that businesses and society are interwoven. The businesses’ capacity to maximize wealth and profit arises from the skill and expertise of their workforce. Consequently, regarding their ‘interwoven existence’, businesses have the responsibility to assist in resolving and improving the social conditions despite the view that they might not be responsible for such problems (Strauss 2015).

The justification for businesses’ involvement in CSR in the absence of economic motivation is based on the moral ground. This argument means that organizations should operate morally as a way of sustaining their existence in society. Accordingly, businesses should accept a certain proportion of efficiency loss to enhance the development of an equitable society. Strauss (2015) argues that businesses derive extraordinary benefits by engaging in CSR, which are fundamental to their competitive success.

Embracing the CSR approach minimizes the probability of a firm adopting the economic perspective, which tends to be skewed to benefiting only the firm and its stockholders. Moreover, engaging in CSR culminates in the ‘legitimization’ of an organization’s activities by the public, hence the overall corporate acceptance. The integration of the CSR increases the probability of an organization, thus improving its long-term returns.

Consumers are becoming intelligent, and thus they are not only concerned with the consumption of products. On the contrary, consumers are concerned with the impact of the production process on the environment. Due to their capitalist economic approach, businesses engage in practices that increase social problems. For example, their production activities lead to climate change such as carbon emission, hence increasing climate change. Thus, one can argue that businesses are a source of some of the social problems. To align with the change in consumer behavior concerning the demand for responsibility, organizations do not have a choice, but to operate in a socially responsible manner. Investing in CSR promotes an organization’s brand image and corporate reputation amongst the various stakeholders, hence the overall competitive edge. Nevertheless, businesses should be careful in their approach towards CSR to minimize the likelihood of misallocation and misappropriation. This situation is well illustrated by the Enron Corporation’s failure. Enron operated an extensive CSR program, but it did not implement effective accounting and auditing measures.

The benefits that can be derived from the businesses’ involvement in CSR outweigh the costs significantly. Thus, shareholders must formulate an effective framework that promotes business engagement in CSR and at the same time enable a firm to derive economic benefits from the CSR initiatives. One of the approaches that organizations are adopting in implementing CSR while at the same time deriving the benefits include the cause-related-marketing, which seeks to benefit the society and furthering business goals. However, businesses need to ensure that their involvement in CSR is not only inclined towards profit maximization. On the contrary, the businesses’ approach towards CSR should also be motivated by the need to resolve the prevailing social problems.

Prioritizing Stakeholders

Stakeholder management is fundamental to an organization’s long-term sustainability. One of the fundamental issues that organizations should take into account in implementing stakeholder management is the stakeholder prioritization. To undertake stakeholder prioritization successfully, the organization’s management team should consider several issues. First, management teams should identify the external and internal stakeholders, which are critical elements in an organization’s existence. Consideration of the involved stakeholder groups will aid in ensuring that an organization adopts a holistic approach to the management of stakeholders. Furthermore, during the identification process, the organization’s management teams must determine the various stakeholder categories that are impacted by the firm’s existence and those that affect the firm’s operations. Taking into account these dimensions will aid in entrenching due diligence in the stakeholder management process.

Stakeholder prioritization should also take into account the impact of the organization on a specific stakeholder group and the stakeholders’ capacity to influence the firm. Effective stakeholder identification is paramount in an organization’s quest to develop a ‘winning coalition’. Moreover, stakeholder identification further aids in separating the stakeholders from non-stakeholders.

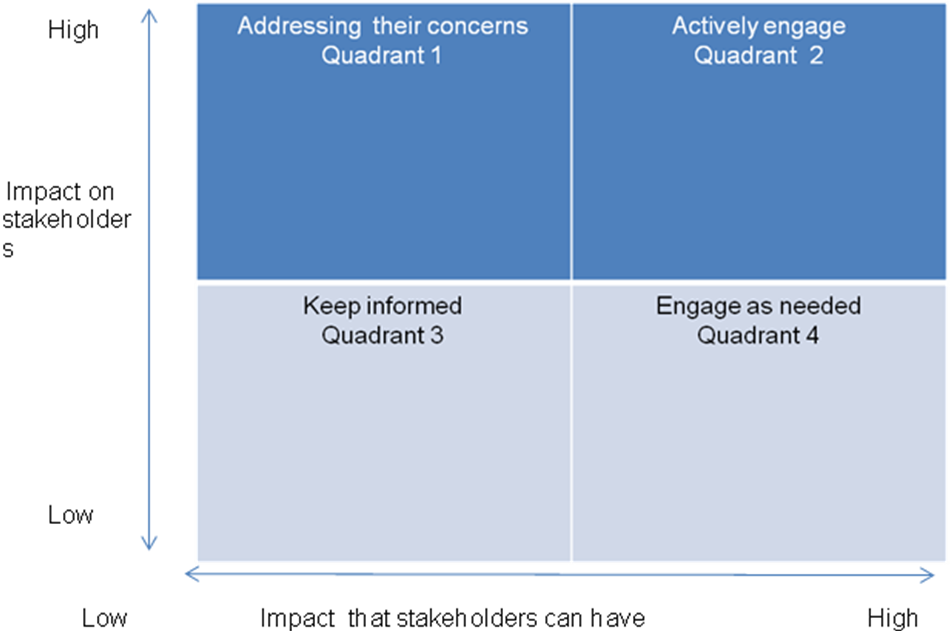

The various stakeholder categories affect an organization’s resource allocation and strategy formulation processes. Moreover, stakeholders are essential in an organization’s value creation process. Thus, considering the most valuable stakeholders in an organization’s operation promotes a firm’s operational efficiency. Furthermore, the prioritization process ensures that only those stakeholders that drive an organization’s existence are considered. Stakeholder prioritization entails clustering stakeholders based on different dimensions. Aston and Knight (2014, p. 54) argue that one way ‘to do this is by comparing the level of impact on stakeholders to the level of impact that stakeholders can have’. By focusing on the two dimensions, an organization is in a position to evaluate the extent to which employees need to be engaged. The quadrant below illustrates some of the dimensions that an organization should consider in prioritizing stakeholders.

Figure 1 above illustrates the dimensions that an organization should consider in undertaking stakeholder prioritization. Quadrant 1 is comprised of group categories characterized by high power and regarding their impact on stakeholders. These stakeholders are mainly the opinion formers, and an organization should ensure that they are satisfied by providing them with information on the performance. Examples of stakeholders in this category include the organization’s management team. In the course of executing their roles and responsibilities, the organization’s management teams are concerned with understanding the performance of the different organizational units. By seeking such knowledge, they are in a position to suggest how to undertake the necessary improvements.

Quadrant 2 is comprised of the key stakeholders. An organization should ensure that these individuals or groups are engaged fully via continuous consultation and communication. One of the stakeholder groups in this category is an organization’s employees. An organization’s management teams should ensure that employees are involved or engaged extensively in an organization’s operations. The purpose of their involvement arises from the view that they are affected directly by an organization’s operations. For example, an organization’s management team should ensure that employees are engaged in formulating different strategies such as work-life strategies. This move will ensure that the formulated strategies culminate in the generation of the desired organizational value by addressing the employees’ needs. Furthermore, the organization’s management team should ensure that employees are empowered adequately to promote their contribution to the organization.

Prioritizing employees is also fundamental in an organization’s quest to implement change. The continuous consultation and communication allow employees to air their views and opinions. Thus, employees feel valued, hence limiting the tendency to resist the intended organizational change.

Conversely, quadrant 3 is comprised of stakeholders characterized by low power, and thus they are less interested in an organization’s operations. Examples of such stakeholders include community members. The organizations’ management teams should monitor these stakeholders continue to assess the likely changes regarding their capacity to influence the organization. As companies grow in their pursuit of economic profits, some of the stakeholders become more relevant as compared to others. Additionally, new stakeholder groups emerge.

Stakeholders in quadrant 4 are comprised of individuals or groups that have low power but affected significantly by an organization’s operations. An example of individuals in this stakeholder group includes society and contractors. The organizations ‘management teams should involve the community and other external stakeholders such as consultants in their strategic management process. This move will enable the firm to gain substantial market intelligence that can shape the organization’s strategic decision significantly. Involving society provides insight into the external stakeholders’ opinions regarding the certain investment decision. For example, involving the society in making significant investment decision aids in understanding the ethical inclination associated with certain decisions.

In summary, the stakeholder prioritization constitutes an important aspect that firms should take into account in their strategic management practices. Prioritization enables an organization’s management team to understand the impact of different stakeholders on the organization. Conversely, the organization understands how its operations are likely to affect the different stakeholder groups.

Making Ethical Decisions – Personal Principles

The term ethics refers to the moral principles that define what is wrong or right. Therefore, morals act as the guiding philosophy of an individual’s decision-making process. The concept of ethics is fundamental to the businesses’ quest for sustainability. In the long-term, companies that operate within sound ethics are sustainable and they can run for generations. On the contrary, companies that do not observe ethics are bound to fail in the long-term. For instance, Enron failed to observe financial ethics, which led to its failure. Therefore, the organizations’ management teams should be concerned with developing a culture of doing the right thing always amongst the internal stakeholders. Firms can adopt several guidelines for establishing this culture. Some of the core guidelines that should be considered are explained in the following section.

Code of Conduct

Businesses should consider developing a competitive advantage as a vital aspect of surviving in an environment that is undergoing remarkable transformations. Some of the notable changes entail the increase in consumer knowledge and the emergence of capitalistic economies. ‘Doing the right thing’ should form the foundation on which businesses pursue the desired competitive positions. One of the aspects that businesses should take into account in their endeavor to develop this culture is aligning their operations to a comprehensive code of conduct. The code of conduct should act as the roadmap that directs employees in undertaking their job roles.

The code of conduct should entail a document that outlines basic issues that employees should take into account. One of the fundamental guidelines for establishing a culture of ‘doing the right thing’ involves encouraging individual employees to act professionally. The organizations’ management teams are obligated to ensure that employees deliver professional service to clients following the stipulated company policies and standards. In line with the pursuit of professionalism, employees should ensure that they only engage in ethical and legal activities. This move will play an essential role in safeguarding the company’s reputation. Another issue in achieving professionalism in the workplace as one of the guiding principles involves adhering to a contractual obligation.

In the course of executing their job roles, employees should act with honesty, courtesy, dignity, fairness, and respect towards the clients’ privacy and confidentiality. Moreover, employees must comply with the stipulated laws and regulations. Acting professionally should involve avoiding conflicts of interests in the course of undertaking the assigned job roles. Besides the above issues, employees must respect other people’s independence of mind. Furthermore, employees should appreciate the significance of diversity in the workplace. Respecting the stakeholders’ opinions is paramount in promoting objectivity in an organization’s decision-making process. By appreciating the importance of diversity in the workplace, an organization is in a position to develop and expand the sustainable competitive advantage. Integrating respect in the workplace will also play a fundamental role in eliminating discriminative, harassment, and retaliatory tendencies in the workplace.

Doing the right thing in the workplace can also be achieved by establishing a balance between the individual’s private and work life. Moreover, the organization’s management teams should focus on ensuring that the environment is safe for work. These aspects will play a vital role in improving the efficiency with which an organization entrenches an enabling environment for working. To improve the employees’ adherence to the guidelines set out in the code of conduct, the organization’s management teams should ensure that workers understand the inherent values upon which the guidelines are founded.

Employees have the responsibility to ensure that a culture of doing the right thing is proliferated within the entire organization. Therefore, employees should be encouraged to report any issues that do not comply with the intended culture. To promote a culture of whistleblowing in the workplace, organizations must ensure that the individuals who report unethical practices in the workplace are protected adequately from possible retaliation. This goal can be achieved by ensuring absolute confidentiality on informers (Tugend 2013).

Despite the significance of the code of conduct in ensuring that employees do the right thing, the organization’s management teams need to appreciate that the code cannot address all the issues that arise in their operations. Subsequently, organizations should appreciate the importance of continuous improvement. Through this approach, an organization will be in a position to foster the establishment of the desired culture.

Corporate Responsibility

Despite the view that businesses are profit-oriented to maximize the shareholders’ value, they should ensure that their operations do not affect adversely the society in which they operate. Achieving this goal requires businesses to incorporate the ethics of care. According to White and Taft (2005, p. 466), the ethics of care postulates that essential to ‘ethical behavior are the basic principles of being responsible towards others, maintaining a relationship with others, minimizing harm to others, and considering both one’s own and others’ feelings and emotions’. The application of ‘ethics of care’ in making decisions on corporate responsibility requires individuals to understand the circumstances surrounding the situation and the specific context. Ethics of care further stipulates that corporate responsibility is unique, and thus it requires situation-specific solutions. White and Taft (2005) support this view by asserting that business management ‘teams should adopt individualized response rather than relying on abstract, universal, and generalized principles, rules, laws, or policies’.

Considering the growth in the relevance of corporate responsibility in the businesses’ survival, the management teams should adopt the ethics of care as the guiding framework for making decisions about the same. This approach will play a fundamental role in promoting adherence to corporate responsibility

The successful integration of corporate responsibility will require the management team to consider several issues. First, organizational operations should support fundamental human rights. Therefore, businesses should ensure that activities amounting to the abuse of human rights are avoided. Moreover, businesses need to ensure that their operations respect the customs, laws, and traditions governing the society within which they operate. Additionally, firms should be concerned with the overall development of society. Some of the issues that businesses should take into account involve protecting the environment, supporting community service activities, and other charitable activities. Social responsibility should not be limited to the above issues. On the contrary, businesses should focus on positioning themselves as role models by avoiding unethical practices such as corruption and other forms of economic and financial crimes.

Making Ethical Decisions: Biases and Rationalizations

Over the past decades, the business environment has been characterized by emphasizes the importance of entrenching ethical practices. This aspect has arisen from the increment in unethical practices as evidenced by the prevalence of corrupt practices amongst the internal and external organizational stakeholders. Some of the most notable cases of corruption in the business environment include the collapse of major corporations such as Parmalat, WorldCom, and Enron. The collapse of these firms is largely associated with the existence of fraudulent acts amongst employees. Anand, Ashforth, and Joshi (2005, p. 9) accentuate that the ‘involvement in corrupt acts by individual employees can partly be explained by the rationalization tactics used by individuals committing unethical or fraudulent acts’. Anand, Ashforth, and Joshi (2005) define rationalization as the mental strategies that individuals adopt in justifying the engagement in fraudulent and corrupt acts. In most cases, individuals associated with white-collar crimes such as fraud tend to deny the criminal tag associated with such practices.

White-collar crime culprits use different dimensions in rationalizing their crimes. First, corrupt individuals argue that their acts do not amount to any harm to individuals. The second dimension entails the denial of the victim by countering the accusations of engaging in corrupt behaviors. Another strategy adopted in rationalizing corruption involves social weighting. Under this strategy, individuals associated with corrupt practices tend to objurgate the whistleblower. Additionally, rationalizing corruption is based on the need to appeal to higher authorities, which is based on the belief that the end justifies the means (Anand, Ashforth & Joshi 2005). Denial of responsibility also constitutes a form of rationalization that individuals use in justifying the engagement in corrupt activities. Anand, Ashforth, and Joshi (2005, p. 11) emphasize that this ‘rationalization tactic involves situations whereby individuals convince themselves that they are participating in corrupt activities due to circumstances that they have no real choice’. Some of the factors that lead to the development of this rationalization tactic include peer pressure, working in a coercive system, the preference of the ‘everyone does it’ mentality and dire financial constraints.

Besides rationalization, corruption in business operations is further entrenched by the existence of biases amongst employees. Chelst and Canbolat (2011) assert that ethical decision-making in organizations is hindered by the biases inherent in individuals. Biases arise from different sources such as an individual’s environment, upbringing, social circles, and experiences. Bias might be entrenched extensively in the individuals’ minds, hence blinding their appreciation on the ethical issues associated with their actions and the decisions made. The three major biases that hinder decision-making include in-group favoritism, conflict of interests, and implicit prejudice (Chelst & Canbolat 2011).

The assessment above illustrates some of the reasons that make corruption be entrenched in business operations. Despite these issues, efforts to promote ethics in organizations should be upheld. Developing a culture of “doing the right thing” can minimize instances of corrupt practices amongst businesses. The organizations’ management teams can consider different practices in limiting the likelihood of employees involving themselves in corrupt activities. First, organizations should focus on developing an ethical climate in the workplace (Simha & Cullen 2012). To achieve this outcome, firms should ensure that they develop a culture of care amongst employees. Thus, the internal stakeholders such as employees will understand that their actions have a direct impact on other internal stakeholders. Moreover, establishing a climate of care will ensure that individual employees make decisions that contribute to an improvement in the overall organizational welfare. Another issue that organizational management teams should take into account is promoting a climate of independence.

Improving the probability of ‘doing the right thing’ in the workplace should also involve developing the work environment by implementing optimal strategic management practices. One of the strategic management practices that businesses should take into account is job satisfaction. A firm’s management team can take into account different strategic aspects to achieve this goal. One of these aspects entails designing jobs in such a way that the job roles culminate in an improvement in the employees’ personal goals. This approach will minimize the likelihood of conflict of interest regarding the employees’ personal goals and organizational goals. For example, employees will develop the perception that the organization is concerned with their personal development (Simha & Cullen 2012).

Another issue that organizations should consider in improving job satisfaction entails ensuring equitable and fair remuneration. This aspect will improve the likelihood of employees engaging in corrupt activities. Additionally, developing a high level of organizational identification and commitment amongst employees will play a remarkable role in the organization’s quest to minimize unethical practices amongst its workforce. By promoting a high degree of organizational identification, employees will appreciate the importance of acting in the best interest of the organization. According to Simha and Cullen (2012), the identification behavior will arise from the view that employees will understand the interdependence between the firm and their well-being.

Additionally, implementing a practical deterrence mechanism should be considered as one of the basic approaches to establishing an ethical culture. The whistleblowing approach is one of the deterrence mechanisms that a firm should consider. Organizations should ensure that employees who report unethical practices are protected. For example, employees who report unethical practices should be assured of their job security. Thus, whistleblowing should be based on the values of confidentiality and privacy. Whistleblowing will make employees avoid unethical practices due to the repercussions associated with such practices. The concept of whistleblowing should be entrenched in a comprehensive legal framework. This aspect will ensure that the whistleblowers are protected adequately. In summary, integrating the concept of whistleblowing will play an essential role in nurturing the development of positive behavior such as transparency and honesty. By taking into account the above issues, organizations can establish a culture of doing the right thing.

Stakeholder Model for Change

Investing in social responsibility has become an essential element in organizations’ quest for long-term sustainability. Different models have been formulated to explain how organizations can implement corporate social responsibility successfully. However, controversy exists regarding the most appropriate model that organizations can use in implementing CSR.

Traditionally, shareholders were regarded as the most important organizational stakeholders. This aspect explains why organizations are integrating the capitalist approach to maximize profit and wealth. Based on the capitalistic approach, organizations have the responsibility to create value and maximize returns to the shareholders. Therefore, most profit-oriented organizations are focused on generating value for the shareholders. Such organizations base their approach towards corporate governance on the shareholder model. Therefore, one can argue that the shareholder model is founded on an economic perspective.

In the quest to attain the profit and wealth maximization objective, the shareholder model as one of the approaches towards corporate governance emphasizes the importance of managers aligning their activities with the overall organizational objectives. Subsequently, managers are offered incentives such as stock options to motive them to act in the best interest of the organization. Moreover, managers may be fired for failure to maximize shareholder value. Proponents of the shareholder model think that it is an effective model for making a firm to be competitive by ensuring that managers are transparent and prioritizing their job responsibilities.

Despite the significance of shareholders in an organization’s existence, it is relatively difficult to attain long-term sustainability by focusing on the shareholders’ model solely. This assertion arises from the view that attaining long-term sustainability through corporate governance depends on the extent to which a firm adopts a holistic approach in implementing strategic changes. Therefore, the stakeholder model forms the foundation upon which organizations integrate corporate change successfully.

The stakeholder model as one of the approaches towards corporate governance is dominant over the shareholder model. The stakeholder model recognizes the importance of internal and external stakeholders to an organization’s long-term success. The stakeholder model stipulates that business entities should be accountable to a wide range of stakeholders. Businesses must recognize the significance of addressing the issues raised by different stakeholders such as consumers, regulatory authorities, employees, and the community in their corporate governance. The different internal and external stakeholders should be considered in an organization’s strategic decision-making process. However, to implement the stakeholder model in formulating organizational strategies, managers must prioritize stakeholders based on their impact on the organization’s overall success. Prioritization increases the efficiency with which an organization addresses the stakeholders’ needs.

Businesses are adopting different approaches to implementing the stakeholder model over the stockholder model. First, organizations are increasingly being concerned with understanding the stakeholders’ needs and requirements. For example, to maximize sales revenue, businesses have appreciated the importance of developing products and services that are aligned with the customers’ needs. Therefore, businesses are increasingly investing in market research. Through market research, organizations are in a position to gather market intelligence, hence developing products that address the customers’ product needs. An example of organizations that have incorporated the stakeholder model successfully is Apple Incorporation. Over the years, Apple Incorporation has based its production activities on the concept of customer focus. Subsequently, the firm emphasizes the element of the customer first. Due to this approach, Apple Incorporation is in a position to develop products that delight customers. This goal is achieved by ensuring that the products are of high quality and technology. By pursuing the customer-first approach, Apple Incorporation is in a position to maximize profitability, hence meeting the shareholders’ needs.

Moreover, organizations are using market research to identify society’s perception regarding the organization’s operations. Through this approach, firms understand how their operations affect the society either positively or negatively. Based on the stakeholder model, organizations are increasingly seeking the input of different stakeholders such as the community and governments in making decisions on investment, which might indirectly or directly affect the society, for example through environmental degradation. Through the stakeholders’ involvement, organizations are in a position to explain how they will ensure that they are accountable for their operations.

By gaining market intelligence, organizations are in a position to identify areas of improvement in their operations to align with social needs. Thus, the capacity of a firm to make an effective decision on how to design approaches towards CSR is improved considerably. Therefore, an organization is in a position to position itself as responsible and accountable entities. This goal is attained by investing in CSR that contributes towards resolving the prevailing social problems.

In summary, investment in CSR comprises one of the critical approaches that businesses are increasingly adopting to achieve long-term sustainability. Corporate social responsibility acts as a catalyst in enhancing corporate governance in organizations. However, Tan (2013, p.202) corroborates that a firm’s ‘response to CSR has been lukewarm, and it lacks urgency’. However, the extent to which a firm achieves this goal is subject to whether a holistic approach is adopted by integrating the stakeholder model. The stakeholder model improves the effectiveness with which an organization is in a position to make itself accountable to society. The dominance of the stakeholder model over the shareholder model is explained by the view that it is long-term oriented as opposed to the latter model, which is short-term oriented. Subsequently, the stakeholder model enables firms to achieve long-term sustainability.

Personal Experience

Scenario

In the quest to develop my skills and expertise in business and economics, I enrolled in an internship program with a renowned multinational organization in the financial services sector. The internship program lasted for one year. During the internship, my role entailed assisting the organization’s Accounting Officer in preparing the firm’s financial statements. Subsequently, the program was a great source of insight into the practical application of different financial management practices in the real business environment. Furthermore, during the internship program, I gained substantial knowledge of the significance of implementing different management concepts in the organization’s quest to attain long -term sustainability. Apart from understanding the significance of the organization’s management practices, the internship provided an opportunity to understand the challenges that a firm’s management team encounter in the effort to steer the company towards the attainment of an optimal market position.

In the course of assisting the Accounting Officer, I experienced a significant ethical issue. The Accounting Officer required the value of the various components in the financial statements to be overstated. The motive behind the Accounting Officer’s intention was to conceal the misappropriation of the company’s resources. By overstating the financial statements, the Accounting Officer would have made the financial statement attractive to internal and external stakeholders. The overstated price values in the financial statements would have depicted a strong financial performance.

Despite the pressure from the Accounting Officer to be an accomplice in financial malpractices, I desisted from engaging in such unethical practices. On the contrary, I ensured that the components in the financial statements [balance sheet, cash flow, and income statement] were stated at the correct price. Moreover, I informed the regulatory authorities on the accounting malpractices within the organization. The decision to take this action was motivated by my understanding of the view that the organization had a responsibility to different stakeholders. Investors mainly rely on financial statements in making decisions on the most profitable companies that they can invest their money in by purchasing stocks.

Stakeholders affected by the decision

The decision to act ethically in preparing the company’s financial statement had a significant impact on different internal and external stakeholders. One of the categories of internal stakeholders who were affected directly by my actions includes the company’s shareholders. Investors within the company were in a position to understand the actual financial position of the company. Additionally, avoiding the pressure to overstate the values in the firm’s financial statement made investors more knowledgeable on the management team’s effectiveness and efficiency in running the organization. The organizations’ management teams have the responsibility to ensure that the company’s assets are utilized effectively in enhancing the firms’ capacity to generate additional income, hence creating value for the investors.

Secondly, the decision to act ethically affected the public significantly. Individuals who are intending to invest in a company’s stocks assess specific financial statements to determine the efficiency with which the management team uses the money sourced from investors in generating income. Therefore, the financial statement illustrated the true picture of the organization’s performance. Thus, the reliability of the company’s financial statement in making feasible investment decisions will be improved substantially.

The other category of stakeholders affected by the decision includes the firm’s employees. As internal stakeholders, employees are affected directly by the firm’s financial performance. A firm’s financial performance depicts its capacity to meet its financial obligations. By assessing the firm’s financial performance, employees are in a position to determine the firm’s ability to meet its operational expenses such as compensating employees.

Reporting the fraudulent accounting practices within the organization had an impact on the regulatory authorities. The effect is that the regulatory authorities understood the importance of enacting strict rules and regulations to curb such fraudulent behaviors. Moreover, the regulatory authorities understood the importance of ensuring that organizations adhere to the stipulated financial accounting standards.

What would have been considered as the Right Outcome?

Considering the situation faced during the internship, the right outcome would have entailed the organization engaging in effective and truthful financial reporting. Thus, the data contained in the financial statements would have been reported accurately. The organization’s management team should understand the significance of developing a culture of ‘doing the right thing’. This aspect will prevent the likelihood of newcomers being drawn into corrupt behaviors. Under the culture of ‘doing the right thing’, the organization’s Accounting Officer would have focused on promoting ethical accounting practices, hence improving the credibility of the firm’s financial statements, thus protecting the image. Chouinard, Ellison, and Ridgeway (2011, p. 56) support this view by asserting that companies that want to develop positive public image should provide a level of transparency into their operations that go beyond regulatory reporting requirements’.

What would have been considered wrong and why?

As a business and economic specialist, it would have been wrong and unethical to assist the Accounting Officer to engage in accounting malpractices. This assertion arises from the view that the financial information contained in the firm’s financial statement would have misinformed the current and potential investors. Therefore, making investment decisions based on the misrepresented facts would have limited the effectiveness with which the investors generate value from the company’s stocks.

Ethical Perspective

The decision to counter the accounting malpractice propagated by the organization’s Accounting Officer arose from my deep conviction on the importance of integrating the utilitarianism ethical perspective in organizations’ operations. The utilitarianism ethical perspective accentuates the significance of moral reasoning by assessing the impact of one’s actions on other parties (White & Taft 2005). Consequently, individuals must assess the benefits and costs associated with one’s actions. The utilitarianism perspective further affirms that individuals must focus on minimizing the negative impacts and maximizing the benefits. By pursuing the utilitarianism ethical perspective, organizations will be in a position to promote a culture of ‘doing the right thing’. This goal will be achieved by ensuring that organizations are not focused solely on promoting the well-being of the shareholders. On the contrary, the utilitarianism perspective forms the foundation upon which firms can integrate the stakeholder model successfully. The outcome of the successful adoption of the utilitarianism ethical perspective includes the optimal integration of corporate responsibility.

Biases That Might Have Hindered Engagement In The Right Action

Several biases would have hindered the action undertaken in this scenario. Amongst the biases that would have affected the likelihood of engaging in a moral decision-making process entails the conflict of interest. By the virtue of being an assistant to the organization’s Accounting Officer, I would have developed the perception that assisting him in covering up the intended malpractices would have amounted to financial benefits. For example, I would have received a certain proportion of the amount fraudulently acquired by the officer. However, engaging in such practices would have amounted to bias towards the various organizational stakeholders such as the employees and shareholders. Thus, the biases of conflict of interest would have led to the proliferation of corrupt behavior in the organization.

Besides the above aspect, the decision to act right would have been hindered by the existence of in-group favoritism. This type of bias mainly arises from offering favors to colleagues or individuals with whom one shares the same social class and job amongst other forms of connection. By offering favors to the accountant’s request, I would have acted in bias towards other stakeholders who do not have that opportunity.

Actions that the Organization might have Done to Prevent or Remedy the Situation

The situation outlined in this scenario depicts the existence of poor organizational culture within the firm. The organization’s employees do not appreciate the importance of ‘doing the right thing’ in their duties. Subsequently, the organization’s management team must consider an effective mechanism that can deter such unethical behaviors successfully. One of the actions that the firm’s management team should take into account entails formulating a comprehensive code of conduct. All employees should understand the issues stipulated in the code of conduct. The issues that the code of conduct should outline include the need to ensure integrity, professionalism, respect, and honesty. These elements should act as the core values to guide employees. By ensuring that employees understand the issues outlined in the code, it will be possible for the organization to develop a positive organizational culture. For example, individual employees will develop a high level of identification towards the organization. Thus, employees will understand the interdependency between an organization’s success and the quest to achieve the desired level of success.

Another approach that the organization should have taken into account entails promoting a culture of reporting unethical practices in the workplace. This aspect ensures that all stakeholders function within the set of laws and ethics. The organization should ensure that employees, who report unethical practices, are not discriminated against or exposed to retaliation from their colleagues. One of the ways through which the organization can achieve this goal is by ensuring confidentiality. The identity of individuals who report such issues should be concealed. This aspect will contribute significantly towards the entrenchment of a culture of doing the right thing.

Reference List

Anand, V, Ashforth, B & Joshi, M 2005, ‘Business as usual: The acceptance and perpetuation of corruption in organizations’, Academy of Management Executive, vol. 19, no. 4, pp. 9-35.

Aston, J & Knight, A 2014, Smart engagement: why, what, who and how, Dō Sustainability, Oxford.

Chelst, K & Canbolat, Y 2011, Value-added decision making for managers, CRS Press, New York.

Chouinard, Y, Ellison, J & Ridgeway, R 2011, ‘The sustainable economy’, Harvard Business Review, vol. 4, no. 3, pp. 52-64.

Cohn, S, Kanner, A & Ryan, R 2007, ‘Some costs of American corporate capitalism: a psychological exploration of value and goal conflicts’, Psychological Inquiry, vol. 18, no. 1, pp. 1-22.

Reich, R 2007, How capitalism is killing democracy. Web.

Simha, A & Cullen, J 2012, ‘Ethical climates and their effects on organizational outcomes: implications from the past and prophesies for the future’, Academy of Management Perspectives, vol. 3, no. 10, pp. 21-32.

Strauss, J 2015, Challenging corporate social responsibility: lessons for public relations from the casino industry, Routledge, Mason.

Tan, E 2013, ‘Molding the nascent corporate social responsibility agenda in Singapore; of pragmatism, soft regulation and the economic imperative’, Asian Journal of Business Ethics, vol. 2, no.1, pp. 185-204.

Tugend, A 2013. Opting to blow the whistle or choosing to walk away. Web.

White, J & Taft, S 2005, ‘Framework for teaching and learning business ethics within the global context: background of ethical theories’, Journal of Management Education, vol. 28, no. 4, pp. 463-477.