Introduction

Southwest Airlines Corporation is one of the largest and low cost airlines of America for carrying passengers worldwide and providing commercial services. This airline is mainly recognized as a short haul, low fare, high frequency, and point-to-point carrier in the United States, withholding a constant growth rate in the airline industry. In 2006, it was observed to be the highest number of passengers attending an airline in both domestic and international markets. It is also considered as the most profitable airline of 2010; running its business quite efficiently in the market by means of inexpensive aircrafts (Southwest Airline, 2009).

It is getting successful day by day by offering lowest fares to the customers, which is maintained by lowering operating costs. According to customers’ service records, in 2001, it was best in the domestic airlines industry; which was made possible by 35,000 employees and 68.1% passenger load factor (Achtmeyer, 2002). The stock symbol of this airline is LUV, which focuses on proper employee and customer relationship unlike top 10 airline businesses worldwide. According to the American Customer Satisfaction Index, Southwest Airlines is ranked first for its customer service satisfaction in 2002, and enlisted in the 100 Best Corporate Citizens according to public companies and various stakeholder groups.

Value Chain Analysis

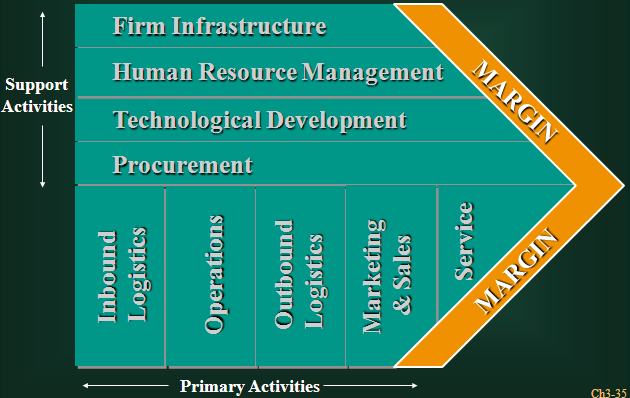

Chopra & Meindl (2008) and Pearce & Richard (2006) stated that value chain analysis is a business management concept that is described by Michael Porter in 1985, and shown in the graph below:

For Southwest Airlines, the value chain analysis is briefly described in below:

Support Activities

There are four types of support activities in the value chain analysis, which is being discussed with accordance with Southwest Airlines.

Firm Infrastructure: There are three criteria that would to be analyzed in the firm infrastructure of Southwest Airline, which are financial management, organization, and culture.

Financial Management- Positive:The success of financial management depends on the inventory control and ordering costs of distributing services by Southwest Airlines. The liquidity and solvency of SA are better than any other competitors like AMEX. In operating activities, it has used $1.5 billion in 2008, which was mainly provided to airport transportation of customers and other additional services.

With net cash balances of $418 million, and liabilities of $240 million, in 2008, the current ratio of the company was 1.74, indicating a stronger cash position than any other competitors. Long-term debt of SA in 2008 was $3498 million, equity was 4953 million, and measured debt to equity ratio was 0.71; this means SA is capable of being solvent to its stockholders by liabilities. (SWA Annual Report, 2008)

Organization- Positive: Although SA has different options to manage its business successfully, still some losses cannot be predicted by the organization. As a major passenger airline, SA is enlisted in U.S. Department of Transportation (DOT) for its customer service in United States. It is also successfully operating 537 Boeing and 737 aircraft in 64 cities and 32 states worldwide. It retained bankruptcy protection in 2008. (SWA Annual Report, 2008)

Culture- Positive:SA maintained a low cost structure for providing low fares and less expense in aircrafts for passengers. It is effectively maintaining employee and customer relationship in the organization. As it is charging lower costs with strong bonding in the organization itself, it has positive cultural attitudes in value chain analysis.

Human Resource Management- Positive: SA is committed to its employees and managers with its mission, which is customers’ satisfaction. It has 35,499 active full time employees, with the responsibilities of flight, maintenance, ground, customer and fleet services, management, marketing, and clerical workers (Southwest Airline, 2008).

Technological Development- Neutral: SA is operating the largest airline transportation, so it has to adopt technological advancement as first mover advantages in the competitive market. However, the organization does not maintain any specific R&D sectors. It is regulating according to security, environment, and customer service practices to adopt technological development. Therefore, it is in neutral position in technological adoption

Procurement- Positive: The services of SA would continue because of demand from customers at low fares airlines transportation costs. For this reason, SA is maintaining its procurement with forecasted demand of customers on a continuous basis of business. There are several possible business procurements, which have been established by SA and there are:

- It has assembled procurement policy in accordance with a price competitive environment with best possible services with profits and morale to employees and customers.

- It aimed to build liberal flight and turn around times within schedule and self-fulfilling profit implications.

- It emphasized redesign in passengers and baggage handling processes with sustainable boarding costs.

- Procurement policy has faced to alter passenger-boarding policies with direct contradiction of regulations and advertising agencies.

- It also concerned to open retraining regular passengers, and probability of assigning employees for each customer.

These procurements system has provided about customers’ behavior and reducing costs according to changing preferences.

Primary Activities

According to primary activities of Southwest Airlines, there are five issues must be discussed, which are:

Inbound Logistics- Positive: The most important reason for success of SA is its inbound logistics with the development of services and its distribution system. The aircrafts are collected from outsourcing or assembling them from strategic partners. The inventory is managed by maintaining agreement with Travel port’s Galileo to maintain global expansion and distribution system. Therefore, it is successfully maintained its inbound logistics.

Operations- Neutral: The estimated operations costs are direct passengers costs, like fuel, food, and other operating costs directly related with the service delivery to the customers. Therefore, SA is mainly generating its operations by expenditures in service delivery. As Southwest has incurred about 32% of total expenses for employment benefit issue, by applying a positive but tricky concept, it should gradually try to lower such portion of expenses for cost efficiency.

Outbound Logistics- Positive: Southwest Airlines is successful because of having extensive communications networks with all assemblers, advertisers, suppliers, and ultimate customers etc. The company is operating as largest aircrafts in United States and other regions with the help of proper outbound logistics.

Marketing and Sales- Neutral: With lowest fare strategy, SA has expensed a budget for promotional activities, with 1.5% in total operating costs in 2009. According to the Annual Report (2008), this company is providing services, so it is generating revenues $775 million from operation of services in 2008.

Services- Positive: The company provides services, so its main goal is to satisfy its customers. Therefore, SA is successful in service delivery to the customers and passengers with low fares and good quality of services.

VRIO Analysis

VRIO analysis is another analysis, which is determining the competitive positions of any firm in accordance with core competencies of the firm. For Southwest Airlines, VRIO analyses are focused in below with some core issues:

- Value: With the value of SA, it has recognized as 100 best places to work at in worldwide. Therefore, employees have maintained very bonding relationship with its customers by creating values to services in competitive environment (Gallagher, 2007).

- Rare: The Company has achieved 3rd position within the global airlines industry due to huge customer base not within the country but beyond the world for which it has to adopt a number of general and differentiated strategies ranging from domestic business- level to international surroundings (Southwest Airlines, 2008). However, airlines industry is very competitive in its business, so, SA has to face potential competitors in various factors, like price, costs, customer services, frequency, and convenience of scheduling, frequent flyer benefits, efficiency, and productivity related with use of aircrafts (Southwest Airlines, 2008).

- Costly to Imitate: The low fares provided by aircrafts services by SA, it is hard to imitate for its competitors. It has already established as low fares services in the competitive market (Bhasin, 2009).

- Organization’s Exploiting: SA has to be exploited with competitive potentials with the brand name and competitive advantages in the market.

After analyzing VRIO of Southwest Airlines, the competitive consequences and performance implications are figured in below:

Table: VRIO Analysis of Southwest Airlines

Brand Name: Southwest Airlines has increased its brand name by low cost structures and collecting low fares from the customers. It is also ranked as largest customers’ satisfaction services over the world, so brand name can be major sustainable competitive advantages with the assumptions of above average returns in forecasted future.

Low Costs: It is really difficult to get aircraft services with lowest fares in United States or other countries. However, SA is proving itself as provider of lowest possible fares for aircraft services to the customers or passengers. Therefore, it is most important competitive advantages with above average returns in futures.

Quality Services: SA is also maintaining quality services to its customers, but it cannot provide high quality services like other expensive aircraft serves to its customers and passengers. For this reason, it can be enlisted as competitive parity, because it can be imitated and it can earn average returns from its services’ quality.

Conclusion

For maintaining and sustaining competitive advantages, Southwest Airlines with its core competencies and value chain analysis combines to know and evaluate the success factors of the company. SA is focused on its strategies with the factors of positive issues in the value chain. The neutral issues should be developed to attain current dominance in the competitive environment of the aircraft industry. The capabilities of SA must be enlarged for expanding its business in the global market. Thus, its international operations must be maintained by competitive advantages and aggressive uniformity of the company to other competitors in the global stage.

Reference

Achtmeyer, W. F. (2002). Southwest Airlines Corporation. Web.

Bhasin, H. (2009). VRIO Analysis: Competitive Advantage. Web.

Chopra, S., & Meindl, P. (2008). Supply Chain Management. (3rd ed.). New Delhi: Pearson Prentice Hall.

Gallagher, S. (2007). Internal Analysis. Web.

Hitt, M. A., Ireland, R. D., & Hoskisson, R. E. (2000). The Internal Environment: Resources, Capabilities and Core Competencies. Web.

Pearce II, J. A & Robinson, R. B. (2006). Strategic Management. (10th ed.). New York: McGraw Hill.

Southwest Airline. Annual Report 2008 of Southwest Airline. Web.

Southwest Airline. (2009). Southwest Airlines Co. Corporate Fact Sheet. Web.