Introduction

The name.R refers to a software company that provides actionable and geo-localized data platforms to improve ecological transition—founded in 2017 by Gregory Labrousse in France. Nam.R has specialized in providing platforms for collecting customer data in various industries. The company offers its services in the following sectors: waste management, energy efficiency, agriculture, expansion of renewables, supply chain, and sustainable cities. The company has expanded its business to offer its products to customers worldwide.

Competitive Advantage

Competitive advantage over other businesses enables firms to sell more or earn more than their competitors. The VRIO framework provides an efficient way to examine the competitive advantage of the nam.R. The model offers a way for analyzing the organization’s resources that provide a competitive advantage (Dyer, 2020). The dimensions that create the framework are depicted by the acronym VRIO, which entails Value, Rare, Inimitability, and Organization to exploit. Competitive advantages develop when the capabilities or resources of the organization bear two features rarity and value. Other factors that ascertain a firm’s competitive advantage include inimitability.

Value

Value refers to the worth that a particular product offers to the customers. The company has developed different products that have enhanced the start-up’s value. The nam.R portal gives its customers a comprehensive analysis of other buildings in France. Different decision-makers and operational managers depend on the company’s platform to build their knowledge of the markets they operate in to develop effective and innovative solutions. The data is essential in meeting the demands of the public or private customers of the businesses. Another nam.R product that enhances the firm’s value focuses on renewables, where the company offers data on renewable energy potential to other firms as well as the government. The company also provides information on the location of local authorities, climate, weather, and the risks linked with the environment.

Information relating to geology like threats associated with soil type, soil, and any related changes has proven valuable for the business of nam.R. Other useful products include data on buildings where the company analysis the occupancy, purposes, facilities, and dimensions of client buildings. Regional data regarding plots of land, soil types, and plot occupancy has added value to the company’s provision of regional data (Amsrud et al., 2019). The mentioned products have been crucial in improving the company’s value as they meet the expectations and needs of the final consumers. These products enhance businesses, and the government makes vital decisions regarding strategic planning in either marketing, production, investment, or public policies.

Rarity

Rarity refers to the ability of the organization’s products not expected or similar to those of its competitors. Rare products tend to improve or sustain the competitive advantage of an organization. When a particular service or product becomes irregular, the customers are likely willing to offer premium payments to secure the products (Dyer, 2020). There is the prevalence of the development of different data and data analytics companies; other firms are focusing on data organization to formats suitable for consumer consumption. The world is constantly changing, and the need to access and analyze data to make crucial decisions increases. This situation has led to various data-centered companies where some offer high competition to the nam.R locally and internationally.

The company nam.R offers products such as analyzing buildings and their environment across France. The firm’s 3D model of every building in France provides a rare product to its customers. An estimated 34 million buildings depicted by the model give engineering companies, regional planners, and public service officials crucial data that helps their decision-making (Amsrud et al., 2019). This product is not common among other big data analytic companies in France. On the other hand, some company effects do not meet the cut to be considered rare. Global companies like Azavea provide data on soil types, climate, and weather-associated risks (Azavea, 2021). In addition, the company’s product about the provision of information of sociodemographic and information relating to the economy is not completely rare. Locally, companies like Oizom provide similar solutions to nam.R. Oizom provides its clients with environmental solutions like weather conditions. Nam.R engages in the provision of information relating to renewable energy potential.

Multinational firms seem to be reducing the rarity of nam.R products and services. The US firm CAPE Analytic provides data that helps insurance company’s value properties and risks associated with the property to derive a better price for the insurance policy. Through geospatial imagery, CAPE Analytics enables property insurers to obtain knowledge of the built environment. Similarly, nam.R categorizes buildings and environment and offers solutions relating to risk exposure and underwriting from its building models and geological database. Generally, the nam.R products and services seem to be rare only within France. Globally, firms from the US and UK are leading overseas markets. Azavea, the Philadephia-based Computer Systems Design and related services firm, has clients in the UK, Asia, and the World Bank.

Inimitability

Inimitability refers to the degree to which competitors cannot recreate a specific product through incorporating equal features of value within their services and products. This principle looks at analyzing how difficult it would be for a competitor attempting to imitate, copy, or mimic the value score of any of nam.R resources. The primary resources of value for the company include a platform that provides analysis of around 34 million buildings and the environment in France. The firm’s territories XYZ platform offers its users access to information on local authorities in France. Nam.R trees resource is a platform that provides its customers with strategies and education materials on energy savings. Finally, in collaboration with addicts, nam.R offers its customers crucial data for insurance innovative Home Pricing. Through geospatial technology, the firm provides data critical for home insurance companies. The company’s platform provides insurance companies with data relating to living area, wall-building materials, heating type, wall damage, period of construction, the value of the house, among other attributes necessary for determining the price of a policy.

In analyzing the firm’s product in the context of the inimitability dimension, nam.R products can be imitated easily by other companies. Locally, firms like TTI production can mimic some of the products and services of nam.R. Through the asknamR platform, the company provides services such as data on potential sources of renewable energy (TTI Production, 2021). Similarly, a local company, CGG, a geophysical services firm based in Paris, provides its customers with geothermal resource assessment. By using similar geotechnology, companies like CGG can easily imitate, copy, or mimic the resources of nam.R, thereby reducing their competitive advantage. These products are identical to those of the nam.R. If the US-based company enters the French market, it would significantly affect the valuable resource of the nam.R product portfolio. The path dependence of some of the company’s products is weak as similar processes or technology used to create these products can be easily imitated.

Organized

This dimension refers to the organization of the firm in a way to creates value for its products. The tool calls for analysis of firm management system, processes, structure, policies, and the organization’s culture. nam.R management is comprehensive and diverse, with a team of different nationalities within various firm divisions. The company CEO oversees a team of has leaders within the development department, Sales and Marketing, Research, Finance, Data production, and Intelligence divisions. This structure, coupled with a dedicated organizational culture, ensures that nam.R remains competitive.

Actively Targeting Countries for Business Expansion

PESTEL Analysis

The PESTEL analysis framework provides a method of analyzing the competitiveness of the nam.R if it were to expand in France, the US, the UK, and India. The decision criteria will be based on the nation, which offers an opportunity for the largest market share and the highest profits. The PESTEL analysis includes a situational analysis of the external environment of a given business to ascertain risks and opportunities that accrue to the company. The PESTEL analysis provides analysis of the political, economic, social, technological, environmental, and legal factors in France, the US, the UK, and India that might affect nam.R business.

Political

Political factors within the pestle analysis include governments’ actions and policies that affect the economy and conduct of business within the area. Political factors include tariffs, tax policies, bureaucracy, and trade restrictions in France. In the US, corporates pay a 21% tax while those in India and UK 25% and 19%, respectively (Trading Economics, 2021). Companies operating in France have to pay 6.5% taxation if their turnover is estimated to be less than USD2.8 million and 27.5% for companies recording revenues above USD 2.8 million. The French government’s push for digital taxation of digital firms draws the likelihood for future development of tailored tax for data and data analytic companies operating in the region. The country has stringent regulations and bureaucratic procedures that might be challenging when setting up business in the area.

Economic

Economic factors refer to different features within the economy and how this outlook might affect nam.R business within the area. Economic factors refer to the indicators measured by other government agencies and central banks that determine the state of the economy. Financial elements include inflation, interest rates, unemployment rates, exchange rates, and economic growth. These economic factors affect the ability of nam.R to source funding through loans, receive and pay funds globally, the value of products sold by the business. A report by O’Neill (2020) indicates that France experienced a 0.5% inflation rate for the year ending 2020. The US recorded a 1.4% inflation rate while UK and India respectively recorded a 0.85% and 6.18% inflation rate for the year ending 2020.

The inflation rate reduces purchasing power, thereby affecting sales due to reduced consumer spending. According to data from the European Central Bank, Bank lending rates in France indicate an average of 1.48% per October 2021. Lending rates mean the interests that lenders are willing to accept for loan advanced. High-interest rates tend to scare away potential borrowers, affecting a business’s ability to invest in aspects like research and development. France GDP for the year 2021 averages 6.8%, while it is estimated to moderate in 2022, which is estimated at 4.2% and 2.1% in 2023. The GDP is essential as it affects the firm’s sales and ultimately the profitability of nam.R.

Social

The other factor within the PESTEL analysis framework includes social factors. These factors entail the demographic and cultural trends within France. Social factors have a massive contribution in developing the consumer behaviour of nam.R customers. These factors include the population growth rate in France, age distribution, health consciousness, cultural perceptions and aspects, and career attitudes. With the business and products of nam.R, population growth rates include a crucial factor in the company’s business. According to a Worldbank (2021) record, the population growth rate in France was estimated to be around 2.3% in the year 2020. Population growth indicates increased demand for housing, increased C02 emissions, and increased energy consumption. An increase in population in France suggests an increase in business for the company as it engages in housing, sociodemographic, energy, and land occupancy.

Technological

Technological factors within the pestle analysis framework refer to technological development that can influence the industry or French market. Technical aspects related to the rate of change in technology, automation, research, and product or specialized incentives affect how a business operates. France is one of the technologically advanced nations engaging in Information technology, science, and space technology advancements. The nation launched its first satellite around 50 years ago while also accompanying nations like Canada, the UK, Russia, and the USA in maintaining a satellite orbit. The country’s technological status offers an opportunity for nam.R to advance its technology in mapping and designing building models. The prevalence of high-speed internet connections enables firms to launch and manage research and development initiatives efficiently.

Environmental

Environmental factors refer to the ecological aspects that might affect the business of nam.R. Factors such as extreme weather conditions, pollution, natural disasters, temperature, and climate change in France significantly affect how nam.R conducts its business. France experiences some of the most breakdowns of industrial carbon dioxide and reduces forest cover. Instead of negatively affecting the firm’s business, different environmental factors like increased carbon emission, weather, and climate change are likely to affect nam.R positively. While the company is a leader in France in providing solutions relating to climate change, carbon emission, and pollution, the prevalence of these factors in France is likely to improve business.

Legal

Legal factors refer to the French legal environment that might affect the business of nam.R either negatively or positively. The legal framework in France necessitates that the proper length of working hours should not be more than 35 hours in all kinds of companies. The legal environment requires the company to provide its employees with sick leave, annual leave, paternity leave, maternity leave, overtime, and sabbatical leave, among other provisions. Regulations regarding CO2 emission reduction and energy conservation in France offer an advantage for nam.R. This policy is a significant opportunity for the business as it provides it with the chance to sell its building XYZ product. This product enables building managers and local authorities to assess the level of CO2 emissions and energy conservation amongst millions of buildings in France. The legal environment in France regarding CO2 emissions provides the nam.R with a further opportunity for growth.

Sustainability Analysis

Sustainability refers to the process of conducting business without cases of any adverse effect on the environment, society, or the community. Sustainability ensures that businesses activities provide long-term creation of value within the social, ecological, or economic environment (Abdulhafedh, 2021). The analysis of the nam.R incorporates reviewing the firm’s business practices ascertaining the organization’s sustainability. The company’s target market in US, India, UK, and France highly values the sustainable development goals (SDGs) and requires businesses operating within their market to adhere to the SDGs.

Nam.R business processes revolve around providing information to governments, companies, or individuals who use it to make crucial decisions. Nam.R ensures that the welfare of the people and the environment is achieved by developing various products and services. One way nam.R ensure equity within their area of operation is through the development of the territories XYZ product; this product is a portal that guarantees access to information relating to local authorities. This product ensures communication of public policies, the building of amenities, and other services for the public is anchored on a platform that has all the data about the region. Through the portal, citizens can obtain knowledge about the available public infrastructure as well as prevailing public policies and their effects on the environment.

The product ask nam.R is a platform that enhances the sustainability of the company through analyzing millions of buildings across France and analyzing the environment they occupy. Through the nam.R platform, engineers, operational decision-makers, regional planners, or delegates from the public service commission can access data relating to the nature of the soil before building, and the climate within the area. Information within the platform centers on sociodemographic, and the economy is essential for planners, engineers, local authorities, and investors. The future of the next generation depends on the development of buildings, infrastructure, economic policies, and environmental interventions that offer sustainable solutions. Through the firm’s asknamR product, the nam.R organization provides sustainable solutions to help engineers and planners develop better buildings. The platform also provides solutions towards green energy initiatives by providing data relating to features of building roofs and facades. Information such as the photovoltaic power capability of a building is essential in the transition towards green energy.

Nam.R commitment to ensuring environmental sustainability is vivid through its involvement in fighting carbon emissions and climate change. Through the asknamR database, the company provides data essential for discovering areas rich in renewable energy. The nam.R company provides critical information vital for planning the economy or business investment. Through the asknamR product, the firm offers data relating to sociodemographic characteristics and the economy of a particular region. This information is critical when seeking business opportunities, thereby helping develop sustainable business strategies.

Financial Analysis

Financial analysis provides data crucial in determining the performance of the business and making a recommendation regarding future investment or change in business strategy to ensure sustainability. A company’s financial statements like the cash flow statements, income statements, balance sheets, or records regarding shareholder equity are essential when conducting an economic analysis. A proper financial analysis helps develop business goals that are feasible and realistic for the organization. As nam.R intends to expand to different regions outside France, it becomes critical to analyze the organization’s financial health.

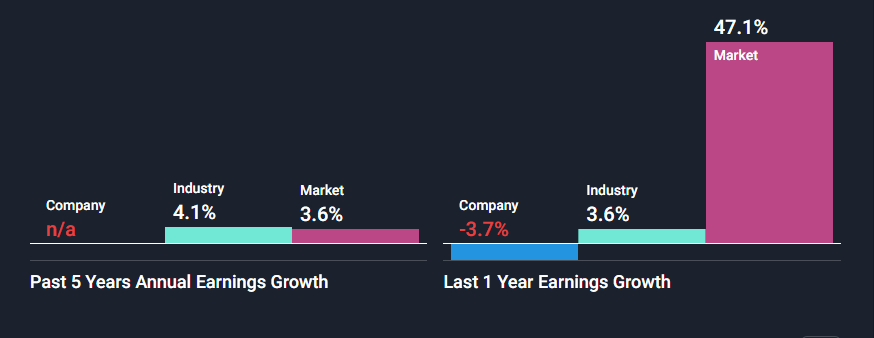

The past performance Data published within Wall Street indicate that for the past five years, nam.R annual earnings growth rate was estimated to be around -3.7%. Revenue for the year ending 31 December 2019 was recorded to be approximately USD 5.6 million per annum, while the earnings for the years were around USD 230,000 per annum (Simply Wall St, 2021). It is challenging to determine the company’s year to year earnings growth rate for the past five years due to a lack of data. However, for the past year, the company has experienced negative growth of its earnings, thereby making it difficult to compare it to the firm’s five-year duration. For the past year, the firm’s negative growth in revenues (-3.7%) falls below the average 3.6% earnings growth for firms within information technology.

The total current assets for nam.R for the year ending December 31, 2018, were around USD 660,000, USD 398,000 for the year ending 2019, and USD 3.98 million for December 31, 2020(Simply Wall St, 2021). The total current liabilities for the organization in the year ending 2018 were recorded at USD 1.1 million, USD 4.96 million in the year ending 2019, and penalties totaling USD 5.31 million for the year ending 2020. An overview of the firm’s short-term assets indicates that it cannot meet its short-term liabilities. In addition, the firm’s short-term assets can only meet the organization’s long-term liabilities. Nam.R income statements indicate the total revenue for the company for the year ending 2018 to be around USD 1.03 million, USD 3.13 million for the year ending December 019, and an estimated USD 3.61 million revenue for the year ending 2020.

The company further indicated an annual earnings growth record at 6.9% per annum, which is way above the firm’s rate of 0.3%. However, the forecasted earnings growth is slower than the French market, which is at 11.8% per annum. Though the company’s earnings are expected to grow, the change is significant. However, the firm’s annual revenue growth rate (29.9%) is estimated to grow faster than the French market, at 6.6% per year. In addition, the firm’s revenue is forecasted to rise higher than 20% per annum (Simply Wall St, 2021). Nam.R financial information signifies a great growth potential; however, there is a concern about the firm’s rising debt. For the year ending December 31, 2020, nam.R recorded around USD 2.2 million deficit with company equity amounting to an estimated USD763, 366. A 217.9% debt to equity ratio is too high for the company. A major challenge in analyzing the company’s financial analysis is insufficient information. Conclusion: There is not enough data to ascertain if the firm’s operating cash flow can sufficiently cover the debt. Information on reducing the nam.R debt to equity ratio for the past five years is also lacking.

Target Sectors for Expansion

Besides energy, nam.R can further its business to other sectors like transport. The organization can further add navigation solutions through the firm’s existing mapping resources. The need for security and safety is paramount; schools, businesses, and other organizations want their fleet secure and drivers working seamlessly. Offering navigation solutions for truck and bus drivers can add another product to the company’s portfolio. The organization can also target the health sector by developing a platform that safely uses clinical and patient data to improve patient experience, manage treatments and interventions. Clinical data is one of the most critical data within any healthcare setting; however, accessing this data is hard or impossible. Providing this solution to care facilities could significantly improve the process of care, leveraging the existing firm’s social data and mapping. Another sector nam.R can target marketing and advertising; the need to deliver impactful marketing campaigns is limitless. Through its current data database, nam.R can improve its clients marketing strategies relying on sociodemographic information. The Customer Sustainability Audit is demonstrated in Appendix 1.

Nam.R’s Competitors

Some of the strongest local competitors for the organization include Earthcube; since 2005, the company has been providing analytic solutions based on image-based aerial and satellite imagery. The company remains a solid opponent for nam.R due to its vast experience in AI technics coupled with automated analysis anchored on VHR satellite imagery and geospatial data. The nam.R competitive advantage over Earhcube can be realized by enhancing research and development by relying on the firm’s talented group of founders. The team can improve the firm’s product portfolio by bringing in AI technology to compete with nam.R. Another likely competitor for the firm is LuxCarta, a French company that started in 1989 and specialized in providing 3D elevation models for network and wireless planning. The company similarly provides an identical product in digitally remodeling buildings.

In addition, with vast experience in the market, the company cements itself as a strong competitor for the startup nam.R. However, though nam.R provides the same type of products (building designs), nam.R has employed different aspects on their product that improve its value. The company further gives information like heating, roofing, soil structure, and weather conditions. Azavea is another strong competitor of nam.R; the company provides data relating to soil types, climate, and weather-associated risks. The multinational company has clients across the globe with great financial capacity than nam.R. The company’s geospatial technology and machine language make it a formidable competitor of namR. Nam.R can derive a competitive advantage over Avazea by leveraging its data on its niche market. This aspect gives nam.R the ability to study better and understand their market to offer more customized services.

New Business Model

A new business model is necessary for the company to improve its company’s profitability. Adoption of providing navigation solutions to track and bus drivers across France could act as a good investment opportunity for nam.R. The company can rely on resources like maps, demographic data, and satellite data to offer navigation solutions. Launching the product can cost the company less than USD 50,000 based on the most recent cost made for such investment. Sharing value with data producers and knowledge partners is essential as it opens athletic opportunities for further growth. Responsibly sharing data with these partners improves service delivery as the data offers decision-makers precise details crucial when making decisions. Data sharing improves collaboration while tapping in free expertise to process and analyze the data without paying for the service. The method enhances collect responsibility for protecting sensitive data and enhances response when dealing with an emergency.

Implementation Plan

References

Abdulhafedh, A. (2021). The analysis of a corporate sustainability. Journal of City and Development 3(1), 6-11. Web.

Azavea. (2021). Azavea. Web.

Dyer, J., Godfrey, P., Jensen, R., & Bryce, D. (2020). Strategic Management: Concepts and

Cases. Wiley.

Simply Wall St. (2021). Nam.R Société Anonyme – stock price, News & Analysis. Nam.R Financial Report. Web.

Trading Economics. (2021). India corporate tax rate2021 data: 2022 forecast: 1997-2020

Historical: Chart. India Corporate Tax Rate 2021. Web.