Executive Summary

Netflix is a multinational technology and media company that is credited for popularising the concept of streaming media from modern electronic devices. However, before beginning this niche business, Netflix had an interesting history as a DVD rental-by-mail business competing directly with Blockbuster. However, the company’s founder and CEO, Reed Hastings, was a technology entrepreneur and saw the opportunity to enter the market with this streaming product. Gradually, Netflix developed the technology and improved streaming fidelity while also developing original content to attract subscriptions at affordable prices.

Eventually, other competitors began to enter the industry as technology became widely available, and firms saw opportunities to capitalize on their licensed content.

As Netflix has been the dominant force in the space for years, its value chain is not designed to compete in the current markets. The company’s structure and elements simply seek to present viewing content to the audience on the platform in an efficient and high-fidelity way. Through this technological reliability and the uniqueness of its original content, Netflix had hoped to attract subscriptions indefinitely, which it has, but as the competitive environment has become saturated, it no longer becomes sustainable.

Netflix has to resolve its strategic issues of the value chain being centered around non-unique technology and original content creation. While these have contributed to its growth, they are outdated in the context of the modern competitive environment. It is recommended that Netflix identifies its core competencies and develops through its technological potential via presented market opportunities in high-fidelity streaming, even venturing to other industries such as video games to horizontally diversify the company’s competitive advantage.

Introduction

Legend has it that Netflix came about as one of its founders, the charismatic Reed Hastings experienced facing a hefty late fee for a cassette rental at a local video store. The foundation of Netflix stems from a rich history of media consumption in the U.S., ranging from cassettes in the 1980s to DVDs in the mid-1990s, and eventually 1997 when unlimited Internet began to be offered via dial-up, and 2005 when broadband became widely available.

Netflix was founded in 1998 by Marc Randolph and Reed Hastings, both successful tech entrepreneurs (Lusted 2012). At first, Netflix was a DVD-by-mail service, making it convenient for users to ship and return DVDs via mail, choosing selections via phone or online on the Netflix website. After receiving the DVD, renters could ship them back or buy them, but it had the comfort of affordable pricing via a subscription and no late fees (Lusted 2012).

The main competition for Netflix at the time was the video-rental giant Blockbuster, with over 7700 stores across North America. Netflix made an offer to Blockbuster to join and become their online entity in exchange for a 49% equity stake (Lusted 2012).

The offer was refused, and Netflix continued to grow tremendously, slowly chipping away at Blockbuster’s market share. Netflix’s DVD business was expanding along with various partnerships, such as the McDonald’s Redbox kiosk. By the mid-2000s, Blockbuster began trying to diversify by offering kiosks and mail delivery. However, in development under Reed Hastings for several years, in 2007, Netflix launched its first on-demand streaming service. It was revolutionary at the time, with more than 1000 titles available immediately to watch from computer screens and eventually mobile phones and televisions (Lusted 2012).

By 2010, the struggling Blockbuster went out of business, and Netflix was acquiring subscribers at record speeds. In 2011, Hastings split the online streaming business and the DVD exchange business into separate entities, not wanting to be hung up in the past, and DVD shipments were slowly discontinued (Lusted 2012). By 2013 Netflix began making original content and was accounting for up to 35% of Internet traffic.

It is at this point that Netflix began technologically evolving, finding solutions for ISPs, improving the quality and efficiency of streaming (Spangler 2014). Over the years, various competitors have risen and become very popular in the online streaming space, challenging Netflix’s dominance in the space. The company now stands at a crossroads of how it chooses to proceed strategically and how it can continue to maintain a competitive advantage over virtually similar services.

Findings

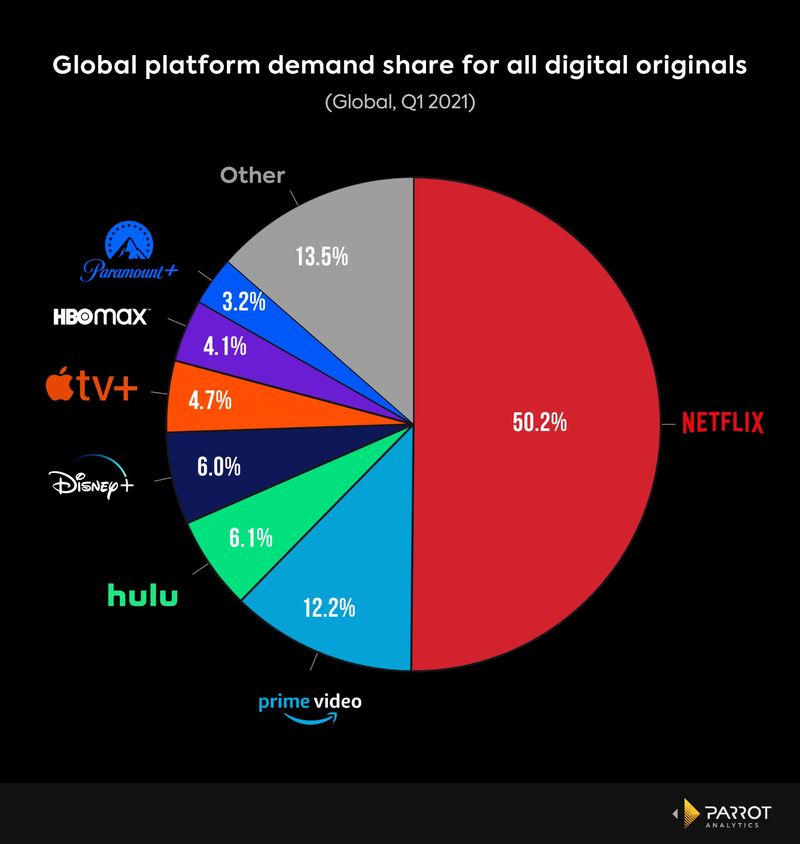

Taking into account the internal and external analysis, Netflix should adhere to the “outside-in” business-level strategy as it has done historically as it is the drive towards their success. The outside-in perspective focuses on monitoring the environment and identifying opportunities within the market, responding with long-term strategy and positioning, especially beneficial for high market share and industry leaders (DeWit 2017). Although Netflix’s market share is declining, it still maintains a robust 50.2% dominance over all other streaming providers (can be seen on graph Appendix 1.1).

Combined with data that U.S. subscriber count has dropped by as much as 31% in one year, Netflix may seem in a highly desperate situation. However, the market is shifting naturally, and Netflix was never going to have a monopoly on the technology nor on the original content creation as it shifted towards entertainment (Shaw 2021). At the same time, Netflix is playing that long-term strategic game of adapting to the market, just as it once did with its sudden transition from DVDs. The company has historically shifted its core nature of business twice while maintaining the same identity and success, known as the Larger Goal Pivot (Pant & Yu 2019).

It can be argued that Netflix’s long-term strategy focuses on maximising competitive advantages of its high operational efficiencies of information technology, with the current focus is on aggressive expansion to multinational streaming and subscriber acquisition, given the company’s business model is prime for market penetration.

Findings from Internal Analysis

Netflix has established itself as the founder of streaming and online content thanks due to its breakthrough in the industry. The components of Netflix’s business model are based on the premise that it is the first and only player in the industry (Hosch 2020). Based on the relational resources and core competencies identified in Appendix 1.1, Netflix is an evolutionary technology and content company, but its cultural standing as synonymous with streaming is beginning to fall away and is no longer as effective, even in new markets for long-term company’s health.

As seen in Appendix 1.2, Netflix’s value chain is based on taking content, either through licensing or original content creation, and getting the finished product to consumers in high quality via the technology that Netflix has developed for cloud storage, speed buffers, efficient distribution, and high fidelity (Kyncl 2017). As demonstrated further in Appendix 1.3, the value chain of Netflix is based on the technological capabilities of Netflix to generate and stream high-quality content on various devices at affordable prices. Once again, this value chain was innovative in the early years upon Netflix’s entry as the sole streaming service into the market.

At this point, technology has caught up so that almost everyone has the same level of access. Notably, Netflix was one of the first companies outside of traditional cable/ISP firms to use a subscription model, and that is what allowed it to achieve the multi-billion-dollar revenue and evaluation (Pham 2020). However, as a single company that relies purely on the streaming business for revenue, it is detrimental to the future success of the business.

As Netflix’s competitive advantage erodes, the sources of this advantage are found in the ability of management to consolidate corporate-wide technologies and production skills into empowering competencies. The key for Netflix is to translate the core competencies it has in terms of its streaming, algorithms, and original content to the core product of the consumer experience. As described by Prahalad and Hamel (1990), core competencies are skills that, when developed, allow a company to achieve a competitive advantage in a specific type of industry and potentially release various types of products to establish its dominance.

So, Netflix has a very reliable, fast, and high-fidelity system, which it has developed over the years that can be used for streaming. However, as traditional streaming has become regular, that same technology can be applied to interactive media, which Netflix has been testing in some markets through its original content, allowing the viewer to impact the plot (Shaw & Gurman 2021).

The technology can also be taken to the greatest level of interactivity, which is video game streaming and virtual reality, with Netflix is potentially exploring as an option to become a ‘game streaming library’ – something that industry players have not been able to achieve at high fidelity (Shaw & Gurman 2021). External analysis in Appendix 2 suggests other content forms may be a viable complement or substitute to current streaming, and technological advancements under PESTLE suggest that new forms of content are gaining popularity as there is fatigue from the streaming market. By any means, the key for Netflix has always been to evolve.

It started as a DVD shipment logistics company transitioning to a technology streaming company and then became a leader in content production. Everything, while utilising its core values to offer consumers the best experiences at the time of streaming with the comfort of their screens (Pant & Yu 2019).

Findings from External Analysis

The external analysis of the environment surrounding Netflix identifies two primary issues – the extremely competitive environment and the ability of the company to add new subscribers. At this point, the main product for Netflix and these other companies is entertainment, the content that they can offer on their respective platforms. Porter’s Five Forces are seen in Appendix 2.1 as a highly competitive environment in a seemingly mature market with low barriers to entry and an onslaught of new competitors simply because streaming is the new means of media consumption. Meanwhile, buyers have power since both practically and financially, it makes sense to have a limited number of subscriptions (Graham 2020).

Companies are vying for the share of the domestic market by offering new features, unique content, and some perks to consumers. At the same time, sellers who are content creators, in the forms of these streaming platforms themselves with licenses to syndicates (HBO, NBC, CBC) or independent studios also have strong bargaining power, especially for franchises with huge fan followings (Katz 2018). This environment is largely supported by the PESTEL analysis in Appendix 2.2, where the biggest factors are licensing of content and market regulations related to that content. Therefore, as Netflix transitioned from being a technology company to an entertainment-focused company, its primary concerns shifted towards licensing and creation of content to achieve a competitive advantage.

It can be argued that the streaming market is oversaturated. While Netflix’s monopoly was not appropriate, every network having a streaming platform, usually focused around one IP (i.e., The Office for NBC) and offering little more than syndicates, is also detrimental. Subscriptions, particularly recurring ones, are what matters to each of these platforms to generate revenue (Pham 2020). Netflix has chosen to differentiate itself through original content, the basis for which it began building in 2013 before other streaming services even appeared. However, original content is expensive to produce and, for most of it, does not result in the explosive popularity that Netflix desires (Moore 2019).

Few other streaming platforms have produced original content since inception, relying on syndicates or spin-offs of culturally popular franchises (i.e. The Mandalorian on Disney+). While original content is unarguably necessary, it is not a sustainable business model to attract subscribers (Levine 2019).

Based on sustainable competitive advantages outlined in Appendix 1.4, original content has provided Netflix with high-value IP, but it only leads to periodic subscriber boosts, and results in many leaving the platform until the next season is released for them to ‘binge-watch.’ The brand is centred around streaming and technology as its recognisable factors. Netflix finds itself in demand for market adaptation as a leader that is losing its leadership position in a market it created and misunderstanding the ‘rules of the game.’ Netflix needs to identify attractive market opportunities that could be exploited and defended from rival firms as it would be immune to substitutes (DeWit 2017).

Conclusion

The two primary strategic issues for Netflix are 1) the inability to utilise its leading market position and forward streaming technologies to maintain a sustainable competitive advantage and 2) its overreliance on original content as a driver for new subscriptions is unsustainable in the long term. Netflix has notably stagnated by offering very few significant breakthroughs in its business formula since entering the streaming business. Positive changes in UI and technology are occurring incrementally behind the scenes, while Netflix marketing is focused on the production and advertisement of a wide variety of original content as major licensing deals are taken away in favour of other streaming platforms (Levine 2020.

The subscriber-based model is leading to the company accumulating billions in debt, and the cost to acquire those new subscribers is unexplainably high. As seen in environmental consonance of Appendix 1.4, Netflix has no other revenue streams compared to its competitors. Annually, Netflix may come close to breaking even, but it has a $14 billion debt liability that cannot be financed forever (Collins 2020). The value chain of the company, alongside its departmentalisation structure, is not offering healthy means for Netflix to develop as a company.

As part of the outside-in approach and market adaptation, Netflix should recognise the true core competencies that make it truly stand apart and invest heavily into such market opportunities and innovations. Appendix 1.1 lists some of the core competencies of the company, which as strategic navigation of the industry, its state-of-the-art prediction algorithms, strong consumer service and orientation, and finally the ability to support a larger range of content (McCord 2015).

Netflix has always, at its core, been a technology firm despite the juxtaposition of its other departments. Currently, Netflix employs a backward vertical integration corporate strategy, once again with reliance on suppliers for licensing and creation of original content. In Appendix 1.3 of Positioning within a business, all areas indicate towards Netflix positioning as the central hub of visual media streaming driven by original content This growth strategy is ineffective in the long term. Going forward, Netflix may need to engage in horizontal diversification efforts to utilise its core competencies for product and service delivery outside the industry and potentially formulation of interesting partnerships (DeWit 2017).

It is recommended by experts that Netflix evolve in the technology sector by either changing the streaming formula, shifting the way media is viewed, or entering new markets such as video games. Otherwise, Netflix will simply continue to lose market share, and although it may remain at the lead, an equilibrium will be established where the business model of continuously adding more subscribers at the cost of ultra-expensive original content will be unsustainable.

Netflix has the unique advantage of being an industry pioneer when its rivals have little experience or data on streaming. Netflix has also maintained a high level of depersonalisation for its users through its services (Morgan 2020). This offers insights into user behaviours and can be strategically utilised in further differentiation and success of any future products or technologies that Netflix may choose to develop as part of its core competencies and competitive advantage.

References

Collins, J 2020. ‘Netflix’s Business Model Does Not Work’ Forbes. Web.

DeWit, B 2017. Strategy: An International Perspective (6th ed), Hampshire, United Kingdom: Cengage Learning.

Graham, M 2020. ‘Streaming wars will force media companies to choose between pricey subscriptions and ads’ CNBC. Web.

Hosch, WL 2020. Netflix. Web.

Kyncl, R 2017. ‘The inside story of how Netflix transitioned to digital video after seeing the power of YouTube’. Vox. Web.

Katz, B 2018. ‘Is TV Giving Up? All Major Networks Are Expected to Offer Streaming Services by 2022’. Observer. Web.

Levine, B 2020. The Future of Netflix: In the Shoot-Out with Apple, Disney and Comcast, What Should Netflix do?. Web.

Lusted, MA 2012. Netflix: The Company and Its Founders, Minneapolis, United States: ABDO.

McCord, P 2014. ‘How Netflix Reinvented HR’. Harvard Business Review, vol. 92, no. 1, pp. 71-76. Web.

Morgan, B 2019. ‘What is the Netflix Effect?’. Forbes. Web.

Moore, A 2019. Netflix’s Generic Strategy, Business Model & Intensive Growth Strategies. Web.

Netflix Inc. 2020. 2020 Annual Report. Web.

Pant, V & Yu, E 2018. ‘Conceptual modeling to support the “larger goal” pivot – An example from Netflix.’ In R. Buchmann, D. Karagiannis & M. Kirikova (Eds.), The practice of enterprise modeling. PoEM 2018. Lecture notes in business information processing (vol. 335) (pp. 394-403). Cham, Switzerland: Springer.

Pham, L 2020. Netflix Subscription: How Netflix become a billion-dollar Giant?. Web.

Prahalad CK & Hamel, G 1990. ‘The Core Competence of the Corporation’. HBR.

Rosenberg, S & Mosca, J 2011, Breaking down the barriers to organisational change’, International Journal of Management and Information Systems, vol. 15, no. 3, pp. 139-146. Web.

Shaw, L 2021. ‘Netflix Is Losing Market Share. But Is It Losing Customers?’ Bloomberg. Web.

Shaw, L & Gurman, M 2021. ‘Netflix Plans to Offer Video Games in Push Beyond Films, TV’ Bloomberg. Web.

Spangler, T 2020. ‘Netflix Streaming Eats Up 35% of Downstream Internet Traffic: Study’ Variety. Web.

Appendix 1: Components of a Business System

Resource Base/Stock of Assets

Tangibles

Current assets: $9,761,580,000

Non-current assets: $3,174,646,000

Property and equipment net: $960,183,000 (land, buildings, headquarters, furniture, IT, aircraft, machinery, capital work, leasehold improvements, studios, equipment).

Staff – core employees in the various departments and levels across the company).

Information from Netflix 2020 Annual Report (Netflix Inc. 2020).

Intangibles

Content assets, net: $25,383,950,000 (released, licensed, and unreleased content) (Netflix Inc. 2020).

Intellectual property such as algorithms and digital interfaces that are not tangible but can be patented. The significant value of Netflix stems not from the content itself but the ability to bring the content to the consumer in a timely manner recognising input factors that utilise algorithms to suggest the right piece of media to continue watching and keep subscribing to the platform (Lusted 2012).

Relational Resources

- Netflix is recognised as the founder of streaming professionally produced films and series for home entertainment as it is known today, acquiring a large customer base in the process.

- Netflix has a cultural standing, with the company name sometimes used as a verb “to Netflix and chill” (Lusted 2012).

- Netflix is known for producing original proprietary content from both licensed material and its own original creations, which continually drive customer engagement and new sign-ups (Kyncl 2017)

- The company continually evolves, first being a streaming library, then developing an algorithm and interface design, then transitioning to become a content creation firm as well, forming new dedicated departments for each function (Pant & Yu 2018),

- Netflix cooperates with numerous other firms, just as any large film studio, having significant connections to license and create its content, support logistics, and information technology needs.

Core Competencies

- Knowledge:

- Essentially created the media streaming industry and are familiar with navigating challenges within it.

- Great awareness of strategies on how to attract consumers and generate popular content, something that rivals are struggling with.

- Long-term strategic investment into content and technology that pushes the boundaries of traditional streaming and creates a competitive advantage for Netflix (Kyncl 2017).

- Capability:

- Top-tier artificial intelligence system which ensures top results for consumers are relevant, and recommendations are tailor to each viewer.

- High-speed service and easy-to-navigate UI for rapid load and watch capability across multiple devices.

- Provides a wide range of content for adults, teens, and children across a variety of genres to appeal to everyone. Invests billions annually into “original content” more than all competitors combined to deliver the best watching experience (Morgan 2019)

- Attitude:

- The company has an unusual horizontal organisational structure and two co-CEOs, Ted Sarandos, and long-time CEO and founder Reed Hastings. The structure at the company allows for a department-focused approach and much less bureaucracy (McCord 2015)

- Netflix internally is a company where more employees are given freedom and choice, with strong responsibility as they are evaluated for their results, and if those do not meet the high standards, those employees usually are forced to leave the company. It is a thriving culture and business (Rosenberg & Mosca 2011).

- The company is highly innovative, and despite many seeing it as a content provider, it is first and foremost a technology company. It essentially created streaming as a service and has continuously pushed forwards the boundaries of technology in this industry, currently rumoured for even greater technological developments to revolutionise streaming.

Market Share

Netflix maintains approximately 50% market share (Shaw 2021).

Activity System/Value Chain

Primary Activities

- Inbound logistics – these are partnerships that Netflix holds with various production houses and studios as the firm both licenses and creates its own original content. Netflix has some of its in-house production but often partners with outside firms and distributors to supply the necessary elements, actors, and other requirements for production.

- Operations – Netflix seeks to improve productivity and improve efficiency as it seeks to transfer inbound logistics to outbound. The primary aspect of Netflix is a streaming platform. It uses cloud architecture to host the content, connecting with customer devices to stream that content in the most effective, non-disruptive manner (Moore 2019).

- Outbound logistics – Netflix’s outbound is the website and app where customers view its licensed and original content. The key is to deliver the content seamlessly and provide customers with a fast and enjoyable streaming service (Lusted 2012).

- Marketing and sales – Netflix gradually increases its marketing budget each year ($2.63 billion in 2019), promoting the service internationally and domestically to attract new subscriptions. Its marketing is revered for its transparency, promising consumers just what they pay for. Netflix has been adding subscribers, especially internationally, as it enters or expands in more regional markets. While initially, when the pandemic began, the company was adding up to 10 million subscribers per quarter, that growth has since slowed to 1.5-2 million as there is streaming fatigue and competition has intensified (Netflix 2020).

- Service – Netflix seeks to improve its streaming service continuously through back-end technological and software improvements. It seeks to appeal to consumers by creating interesting and diversified original content and attempting to listen to consumer feedback. The company’s recommendation algorithm is one of the best in the industry and continuously improving (Moore 2019).

Supporting Activities

- Procurement – For Netflix, procurement consists of acquiring licenses for streaming or copyrights to produce content based on existing media. It is a complex and expensive process as streaming services are vying to host the most popular franchises to attract subscribers.

- Technology development – Technology is vital to the functionality of Netflix, and the platform is technological by nature, creating significant value for consumers. Various features of its platform have provided Netflix with a competitive advantage, and the company consistently invests in research and development for further enhancement (Kyncl 2017)

- Human resource management – The company is known for tremendous support and trust in its employees. It seeks to attract and retain top-level talent but also has high expectations creating a competitive environment within the company. Netflix hands down decision-making to teams working on specific projects while executives only make large strategic moves. The company offers substantial rewards and perks for its high-performing employees (Rosenberg & Mosca 2011).

- Firm infrastructure – As any corporation, Netflix has the infrastructure to manage a range of activities such as quality management, customer support, financing, planning, legal department. The effective infrastructure management at Netflix has allowed increasing its value throughout the value chain. Netflix utilises its infrastructure smartly, and despite spending billions on content creation and other activities, it has been profitable for years (Moore 2019).

Product Offering/ Value Proposition

Segmented Market

- Departmentalisation of Netflix:

- Executive management.

- Legal.

- Finance.

- Talent/HR.

- Product.

- Content.

- Communications.

- Customer Segmentation:

- Micro customer, taste clusters.

- Usage-based, based on browsing patterns and watching behaviours.

- Geographical segmentation used for content localisation and targeting.

- Divisions for Products and Operations:

- Licensed content.

- Original content.

Positioning Within a Business

- Netflix takes on a compartmentalisation approach to each aspect of its business and respectively content. There is the technology element of Netflix and the content creation side, respectively focusing on original and non-original content.

- Netflix is one unified brand (outside of Netflix for Kids) at this time and positions itself as one central hub of visual media entertainment for everyone, driven particularly by its original content (Moore 2019)

Price

- The upper range of pricing for its unlimited tier, second only to HBO Max in price.

- Offers lower tiers but lower quality and streaming options for such price

- The whole Netflix catalog is available at all three pricing tiers, new content streamed on release

- The company raises prices every few years by several dollars.

Features

- A whole catalog of content can be streamed or downloaded on devices to be watched without the Internet.

- Original Netflix content remains on the platform forever, licensed content switches out every few months.

- Smart recommendation algorithm and voice search available.

- Pause, rewind, fast-forward, all playback features available on all devices.

- High fidelity content in 4K, with some 8K already being available.

Bundling

- Netflix does not offer any traditional bundles.

- The company has three monthly plans of basic, standard, and premiums. The only difference between them is the maximum streaming quality (standard definition being the lowest) and the number of devices simultaneously streaming.

Quality

- Netflix offers 4K or Ultra-HD quality on most of its newest releases with the highest-paid plan.

- Netflix runs special coding to ensure the best quality of streaming at available speeds with minimal data usage.

Availability

- Netflix is available in over 190 countries in the world, the only major market where it does not operate in any capacity is China.

- Anyone with a phone number/email and credit card can sign up for Netflix with a simple two-step process.

- Original content generally available across all regions, but licensed content differs significantly based on regional licensing laws and agreements.

Image

Netflix relies on its universal brand recognition as a streaming giant, a simple yet carefully crafted experience of streaming entertainment, and a cultural zeitgeist (in the West) that defined media consumption of modern-day.

Relations

- Netflix can be used in-browser or via app for all major ‘smart’ devices.

- Netflix customer support known for its effectiveness and responsiveness.

Sustaining Competitive Advantage

Competitive Dependability

- Netflix holds the competitive edge of being a culturally engrained brand associated with streaming, being likely the first company that people will choose to sign up for when entering the market or for existing customers, the subscription that most households would keep

- The heavy investment into original content has allowed Netflix to create recognisable media franchises that have people coming back as new seasons are released. Some of the other content has garnered critical and commercial appraisal. As more streaming platforms are taking popular syndicate TV shows licenses away from Netflix to benefit their own, Netflix is continuing to rely on originally produced or partnership-produced content, which has seen both extreme popularity and significant failures (Collins 2020).

- Netflix is associated with a phenomenon known as ‘binge watching’ as for both old and new shows, it releases all episodes at once and does not use manipulative practices such as releasing an episode per week to artificially maintain subscriptions for popular newly released content.

- Netflix is primarily a technology company with a strong competitive edge based on its algorithmic technology to help users navigate the platform and be offered the best form of content to browse. There are also numerous behind-the-scenes elements Netflix uses to improve the smoothness and speed of experiences as being one of the only streaming services available on every habitable continent (Lusted 2012).

Environmental Consonance

- Unlike many of its competitors, Netflix does not have other market segments in live television, theme parks, or cable networks to bring in revenue. It is consistently reliant on maintaining shareholders by adding new subscribers both domestically and internationally, which is unsustainable. Netflix needs to ultimately change its business model approach as subscriber growth will slow (Shaw 2021).

- Netflix is investing billions into original content but haemorrhaging money this way. It needs to adapt and better read the audience’s desires to create original content that would produce the most engagement and subscriber growth due to popularity in mass media (Collins 2021).

- As streaming technology has become the norm, Netflix has the potential to invest in R&D for the future of media consumption in order to be ahead of the market while competitors are still getting accumulated. Netflix has been testing various innovative technologies in all content, software, and interaction with hardware such as smartphones and virtual reality kits (Shaw & Gurman 2021).