Executive Summary

Arrid is a deodorant and body wash brand created and owned by Carter-Wallace Inc. The report demonstrates Arrid’s analysis, including environmental scan and industry analysis. In addition, the findings indicate the current brand’s situation and its competitors, such as Dove, Secret, Degree Men, and Old Spice. Moreover, brands’ segmentation, targeting, and positioning strategies are described. The report also presents the brand’s significant strengths, weaknesses, opportunities, and threats. Consequently, the three brand recommendations are offered for improving Arrid’s strategy, such as creating new fragrances and designs, improving the formula based on ethical and environmental trends, and developing an improved value proposition through value co-creation.

Environmental Scan

Among various brands, similar customer trends and tendencies are apparent. For example, natural cosmetics and safe usage have become one of the significant trends of this sector. Obviously, people are becoming more aware of environmental issues and adapting their cosmetic use to a safer degree. Current trends of the segment also include comfort in usage, contemporary, and safety for the environment. Moreover, the consumer’s tendencies also have made past products famous again. It is one of the reasons why the Arrid brand is becoming famous again; however, people fail to find it in the market.

For ten years, Arrid was the most sold deodorant among other competitors’ products. However, some years ago, environmental and healthcare organizations started to review formulas of the most known cosmetic products. It turned out that Arrid deodorant contains aluminum zirconium tetrachlorohydrex gly in its composition. It is a regulatory issue that affects the brand due to the established standards of the product technology (Kerin et al., 2020).

The substance is considered averagely dangerous for the skin, as it clogs sweat glands and provokes multiple skin diseases. The usage of this component is limited in the United States and Canada currently by the Food and Drug Administration and Canada Health regulations. It is one of the reasons why Arrid disappeared from shelves in supermarkets.

Indeed, some brands started to promote the naturality of their production and produce vegan and safe goods. For instance, Unilever, which owns Degree Men and Dove, reports that their products are cruelty-free and are not tested on animals. Competing brands of the deodorant segment constantly improve their technology and adjust the product to the consumer’s desire. For example, it is noticed that people are more likely to buy products with recyclable packaging and safe formula (Kerin et al., 2020).

In addition, the sales increased significantly; for instance, Dove and Degree Man are the leading U.S. deodorant brands, as shown in Figure 1 (Leading deodorant brands in the U.S., 2021). Therefore, brands attempt to change the technology of their packaging to be more sold and famous among customers. The changes in the technology and adjusting the product enable many deodorant brands to be available worldwide; thus, they are not affected by political limitations.

Shifts in political, regulatory, and competitive areas are mostly connected to the impact of COVID-19. Many stores were closed during the limitation period, and the production of multiple brands was not sold to a great extent. These quarantine measures affected the group because of the inability to approach the store and buy the product. However, it is possible to find Dove, Old Spice, Secret, and Degree Men products in online markets. Moreover, Arrid, which was discontinued and disappeared from the shops in late 2012, became available on Amazon (Parker, 2020). Therefore, this brand becomes an equal competitor to those on online platforms. Essentially, e-commerce is becoming a trend that impacts the industry heavily.

Overall, Arrid is a brand that used to have enormous success. Nonetheless, deodorants became unavailable in the United States and Canada due to updated and maintained regulatory, medical, and political issues. The brand’s competitors, such as Dove, Old Spice, Secret, and Degree Men, adjusted their formula to correspond with common standards. The rivalry companies attempt to follow new customer trends and adapt to safety for the environment and convenience. Arrid appeared online, and it made the product competitive again.

Arrid Analysis

Arrid is the brand that was created and owned by Carter-Wallace Inc. Arrid is a brand of deodorant and body wash, and it was prevalent several years ago. Nevertheless, recently, people from the United States started to report failing to find the production of Arrid in supermarkets. It might have happened for many reasons; perhaps little information about the situation is available. It is essential to examine the current situation with the brand and its competitors to conduct an analysis.

Industry Analysis

Currently, there are many rivals of the brand appeared. For example, Dove, Secret, Degree Men, Old Spice are competitors to Arrid. Unfortunately, there is no updated information on Arrid’s sales in recent years. Nevertheless, it is known that the company’s sales were high due to the enormous success at the beginning of the brand establishment (Parker, 2020). Nevertheless, Arrid’s production disappeared almost completely. Indeed, it is possible to look at the sales of Arrid’s competitors. For instance, according to the statistics, in 2019, Dove brand made 203,9 million dollars in sales (Sales share of the leading deodorant brands in the U.S., 2021).

Secret’s sales constituted about 150 million dollars, while the Old Spice brand reached sales of 123,3 million dollars in 2019 (Sales share of the leading deodorant brands in the U.S., 2021). As seen from the statistics of 2019, Dove became the most sold brand of deodorants among others, and it is hard to compare its success to Arrid’s sales.

Despite the high sales in rival brands, the market shares of rivals vary significantly. For instance, Dove’s share constitutes 6,4 percent among the most famous deodorant brands (Leading deodorant brands in the U.S., 2021). Degree Men is a company owned by Unilever, the agency which production includes various cleaning products. Degree Men’s share in the market is 7,6 percent of the total (Leading deodorant brands in the U.S., 2021). Old Spice brand market share constitutes 4,8 percent among leading deodorant brands, while the share of Secret is 3 percent, according to 2019 statistics (Leading deodorant brands in the U.S., 2021).

Therefore, it is seen that sales and market shares of the most sold brands are not similar. In addition, the deodorant segment holds the most significant share, and it is suggested to expand its rate during the forecast period, namely 2021-2026 (Deodorants, 2021). It is important to note that the deodorant market is expected to grow annually.

Moreover, such brands as Dove and Old Spice are ready to offer consumers non-paraben natural deodorants, which are currently in high demand. Thus, the sales for these brands are expected to be higher during the forecast period. Sandler (2019) states that the clean-beauty trend, emphasizing paraben-free products, continues to grow. In general, significant trends of the subsectors (cosmetics, body wash, face, and body products) involve safety for the environment, adjustability, and comfort usage and follow current customers’ desires and needs.

Segments, Targeting, and Positioning

According to the official website, Arrid offers three types of deodorants: stick protection, aerosol protection, and gel protection, as presented in Figure 1. The product range is scarce, and most deodorants are designed in the brand’s classic blue color. Therefore, the brand is focused on offering quality to its potential customers rather than product variety. Significantly, the brand states that its products are suitable for both men and women through its value proposition; namely, deodorants decrease underarm wetness and reduce underarm sweating due to stress (Arrid, n.d.). Nonetheless, the products are more popular among men.

The biggest target group, based on the customer’s reviews, is male. Kunst (2019) informs that approximately eighty percent of U.S. male customers between 30 and 59 years old apply deodorants daily. According to the Simmons National Consumer Survey (NHCS) and U.S. Census data, approximately 2.29 million U.S. citizens use Arrid’s products eight or more times per week (Usage frequency of Arrid deodorant, 2020). Essentially, the Arrid deodorants are available again in 2020 and can be purchased from Amazon or the official Arrid’s website.

Essentially, each category has various types of scents that will be discussed further. For instance, Table 1 illustrates segmentation for Arrid’s stick protection products. In addition, the brand offers deodorants to potential buyers with varying preferences. For example, among stick protection products, customers can choose a light scent of spring flowers, shower freshness, citrus notes, or deodorant without smell, as illustrated in Table 1. The deodorants are targeted at different age groups from 14 to 59 years old.

Table 1. Segmentation for Stick Protection Products.

To summarize, Arrid target segments include women and men from various age groups that value the efficiency of the deodorant over variety and design. In addition, potential customers have active lifestyles that require them to choose Arrid’s efficiency among other brands.

Positioning refers to the strategy of how a brand displays its products in front of potential buyers. Additionally, the positioning also explains how shoppers perceive a brand and its products through specific associations. Arrid positions its products through a unique value proposition statement: “STRESS STINKS! ARRID WORKS!” (Stick protection, n.d., para 2). Therefore, Arrid creates a value for customers emphasizing the efficiency and good quality of deodorants. The brand says that customers have to trust Arrid because it works even in the most stressful situations because the product “performs best when you need it most!” (Arrid, n.d., para 1). Lecours (2017) suggests that in order to create value for customers, companies should offer at least one unique component. The concrete values that Arrid offers to its consumer segments are efficiency and a high level of protection.

Consequently, the major brand’s advantage is that Arrid’s positioning strategy is based on the quality of deodorants. Arrids’ positioning is based on product characteristics and about offering good quality. The brand includes a limited range; many competitors, such as Dove and Secret, offer a greater variety of scents and designs. The color palette of packaging is rather masculine than feminine; therefore, the brand is not taking advantage of the opportunity to target women through products design. In addition, the brand scored 6 out of 20 in the environment, people, animals, and politics categories (Turner, 2017). Turner (2017) states that the brand has the worst rating for toxics policy. Thus, Arrid does not follow ethical, animal-protection, and environmental trends.

Brand Analysis

As was mentioned above, Arrid offers three types of deodorants, namely stick protection, aerosol protection, and gel protection. The company is using an economy pricing strategy by targeting the mass market and setting prices relatively low. The price is affordable, varies from approximately $2 to $10, and is comparatively equal to competitors (Walmart, n.d.). The price of deodorants depends on size and category; for instance, deodorant spay is more expensive than solid deodorant. Important to add that Arrid uses a long-established pricing strategy. This strategy is especially suitable for mass sales of products in markets saturated with competitors. Thus, the brand has been selling its deodorants at a specific price over time. The fundamental goal of this pricing strategy is to generate large profit margins in the long term.

Currently, the brand is using e-commerce mostly to distribute its products. The distribution channels include Arrid’s official web-site, Amazon, and Walmart. The official website of the company is a direct distribution channel. But Arrid also uses indirect distribution channels, where resellers, mainly an online store, buy products and resell to end customers from their website. Arrid has two crucial types of distribution, namely sales though retailers and wholesalers. Therefore, Arrid’s resellers and wholesalers are mainly online stores. As the product disappeared from the stores’ shelves to be reformulated, the only distribution channels available for the brand are e-commerce.

Notably, point of sale merchandising (POS) refers to promotions that take place immediately when transactions are done in order to enhance impulse sales. POS’ goal is to attract the attention of potential customers when a purchase is made. For instance, when customers purchase a product, they might be offered new products or special discounts. Unfortunately, Arrid is not available in-store; thus, the suitable promotion type is digital marketing, which includes online advertising via websites and social media. The most crucial elements of the communication mix for Arrid are digital advertising and sales promotion. The brand is recommended to focus on social media advertising through cooperating with Facebook, Instagram, and TikTok influencers.

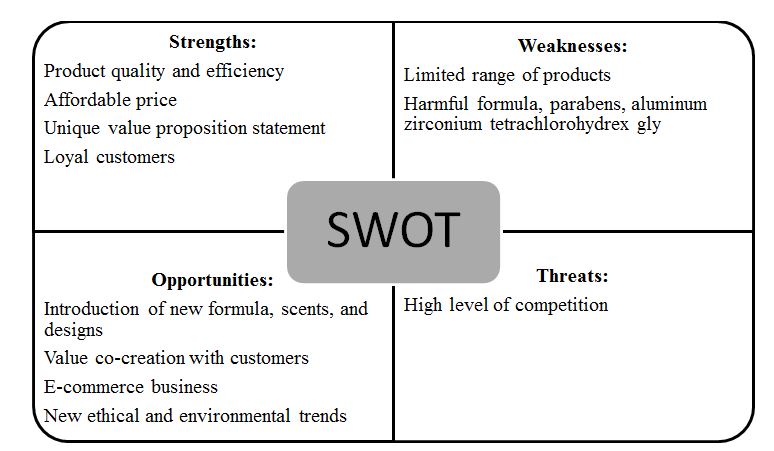

Arrid’s SWOT Analysis is presented below. The brand’s strengths include product quality and efficiency, affordable price, unique value proposition statement, and customers’ loyalty. Important to add that Arrid has many opportunities that offer business growth, such as the introduction of a new formula, scents, and designs, value co-creation with customers to better understand their needs and preferences, and e-commerce business, which assists in expanding fasters. In addition, new ethical and environmental trends offer to reveal new customers’ segments. Consequently, the weaknesses are the limited range of products and Arrid’s harmful formula, which includes parabens and aluminum zirconium tetrachlorohydrex gly. The major threat for the bran is a high level of competition; for instance, Dove, Degree Man, and Old Spice.

Brand Recommendations

In order to help Arrid to set itself apart from the competition, enhance sales, and achieve success, the three well-defined ideas for improving the distinctive competitive position were created. Therefore, the ideas for improving Arrid’s strategy include:

- Creating new fragrances and designs.

- Improving the formula based on ethical and environmental trends.

- Developing an improved value proposition through value co-creation.

Firstly, the company offers a limited range of deodorants, which can negatively affect the interest of potential customers. According to the reviews on Arrid’s official website, customers are searching for uniqueness. For instance, customers suggest that they want better scents and more variety (Stick protection, n.d.). Thus, they offer to introduce feminine scents, such as lavender or tropical flowers. With the help of new fragrances and thoughtful designs, the company will be able to enter new segments and gain loyalty among women.

Consequently, there are several steps a company needs to take to be successful. First, Arrid must improve the design of his deodorants to maximize the visual experience of potential customers through bright colors. While Arrid offers high product performance, design plays a significant role in attracting customers. Moreover, one of the most vital factors of a company’s success is the customer’s first impression of the product design. It is also important to enhance the tactile experience through the unique form of deodorants and sustainable materials. The company is advised to conduct a preference analysis and select the most desirable fragrances for women and men. For example, as mentioned in one customer review, a company can create a lavender-scented deodorant and use pink and purple colors to design a product.

The second recommendation is to change the deodorant formula based on ethical and environmental trends. As the finding showed, the brand is not in the best position in the green rating. More and more people are now buying ethical vegan products that are free of animal-tested parabens and aluminum. Therefore, to gain a competitive edge, Arrid must re-formulate and offer potential buyers updated deodorants that have not been animal tested and are free of parabens and harmful chemicals.

It is crucial that Arrid’s new deodorants should be free of aluminum, parabens, triclosan, and phthalates. All of these chemical ingredients are harmful to human health (8 natural & non-toxic deodorant brands, 2020). For instance, the aluminum found in antiperspirants blocks pores and potentially influences the formation of kidney stones. Parabens, found in most deodorants, can negatively affect hormone regulation, triclosan is exceptionally harmful to the environment, and phthalates affect testosterone regulation. For instance, the aluminum found in antiperspirants blocks pores and potentially influences the formation of kidney stones. Parabens, found in most deodorants, can negatively affect hormone regulation, triclosan is highly harmful to the environment, and phthalates affect testosterone regulation.

The third and the most crucial recommendation is to enhance value proposition through value co-creation. Gligor and Maloni (2021) suggest that co-creation, or in other words, customer involvement, improves customer satisfaction and helps companies to differentiate themselves from rivals. Briefly, co-creation is co-joint actions between customers and the company. Thus, together with customers, the brand creates a new value proposition that will benefit both sides. Co-creation is solely based on communication, and customers should be willing to collaborate with the brand in order to improve Arrid’s offerings.

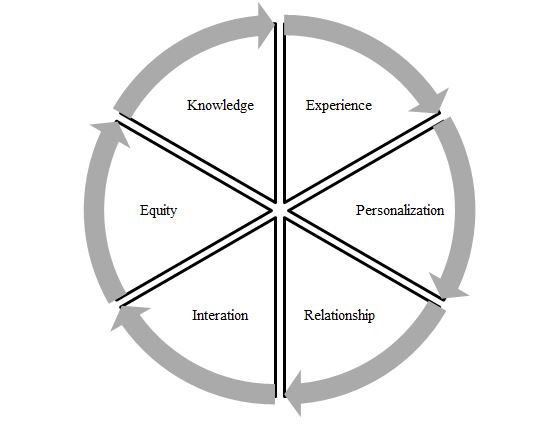

Thus, Kezner (2019) suggests that co-creation is a powerful tool that enables companies to identify unique opportunities and overcome competition. According to Ranjan and Read (2021), co-creation includes six fundamental elements, such as experience, personalization, relationship, interaction, equity, and knowledge, as shown in Figure 3. Consequently, co-creation benefits include current product improvement, a high level of customer orientation, better customer needs understanding, and early monitoring of market reactions.

Therefore, Arrid will be able to identify innovative ideas and reveal market opportunities through value co-creation with customers. Essentially, B2C companies aim to create stronger customer relationships and maintain a competitive advantage through collaboration with customers (Ranjan & Read, 2021). The company is encouraged to conduct questionnaires to determine what customers want and what product characteristics can best meet their needs. Thus, it is essential to enable current and potential customers to share their ideas.

Arrid can add a feedback page on the site where customers can send their requests. In addition, it is also vital to regularly conduct surveys about deodorants online and in stores and malls. Thus, questionnaires and surveys can assist in comparing Arrid’s strengths and weaknesses with competitors to create a better value proposition. To conclude, Arrid can use co-creation to better customize deodorants regarding customers’ preferences and recognize innovative opportunities based on knowledge and ideas integration.

References

Arrid. (n.d.). Performs best when you need it most. Arrid. Web.

Deodorants (2021). Statista. Web.

Gligor, D. M., & Maloni, M. J. (2021). More is not always better: The impact of value co‐creation fit on B2B and B2C customer satisfaction. Journal of Business Logistics. Web.

Kerin, R., Hartley, S., & Rudelius, W. (2020). Marketing (15th ed.). McGraw-Hill Education.

Kerzner, H. (2019). Innovation project management methods, case studies, and tools for managing innovation projects. John Wiley & Sons, Inc.

Kunst (2019). Frequency of deodorant use among male U.S. consumers 2017, age group. Statista. Web.

Leading deodorant brands in the U.S. 2019, based on sales. (2021). Statista. Web.

Lecours, M. (2017). Developing a framework to craft a value proposition. Journal of Financial Planning, 30(3), pp. 23-25. Web.

Parker, E. (2020). Is Arrid extra dry clear gel deodorant discontinued? (With update!). Conspiracy of Good. Web.

Ranjan, K. R. and Read, S. (2017). The six faces of value co-creation: a field guide for executives. Rutgers Business Review, 2(1), 24-31. Web.

Sales share of the leading deodorant brands in the U.S. 2019. (2021). Statista. Web.

Sandler (2019). ‘There’s a stigma’: Clean beauty insiders weigh in on the ‘paraben-free’ label. Glossy. Web.

Stick protection (n.d.). Arrid. Web.

Turner, J. (2017). Deodorant. Ethical consumer. Web.

Walmart. (n.d.). Deodorants & antiperspirants.Walmart. Web.