Business sustainability is a concept that largely determines organisations’ market success and development opportunities both in the short and long term. According to Muntean (2018, p. 335), three key dimensions should be taken into account when discussing this indicator – “social, environmental, and economic aspects”. Business sustainability is the responsibility of managers who take the necessary steps and implement potentially productive strategies to address current challenges to achieve companies’ ultimate goals.

Organisations that have a high sustainability rating are able to cover a wide range of markets and obtain a stable competitive advantage due to highly productive tactical methods for assessing and maintaining this parameter. As tools utilised for analysing this criterion, key performance indicators (KPIs) are used as indicators that reflect the effect of management solutions and actions regarding the development of business sustainability. Also, such crucial instruments are essential as critical success factors (CSFs) and triple bottom line (TBL) reports, that imply considering the benefits related to environmental, social and economic benefits.

KPIs demonstrate how effective managers are in applying business management approaches and strategies based on financial and non-financial indicators. As Rezaee (2017) notes, these parameters are specific to each individual enterprise and can be focused on various objectives that a particular organisation seeks to achieve. Thus, their role is to reflect the activities of the business in specific conditions and in accordance with the planned assessment systems.

Tupperware’s Business Sustainability

Tupperware is the target corporation for analysis, and its movement towards sustainability will be reviewed based on current performance and a comparison of today’s KPIs with earlier management outcomes. According to the information proposed by the representatives of the organisation, the company pursues social and environmental goals as components of its sustainability strategy (Our sustainability approach, 2020).

The absence of an economic dimension may be considered an omission since this aspect of business activity is no less important than the other two aforementioned criteria. Tupperware’s management has a development plan and a list of 17 priority tasks that are planned to be implemented by 2030 (Our sustainability approach, 2020). These goals are based on following the cultural and ethical principles of entrepreneurial activity and include provisions on green production, gender equality, innovation and other objectives. Therefore, the current activities of the corporation are based on this plan and include measures to achieve the planned outcomes.

Since Tupperware is a joint-stock company, fluctuations in stock prices are a significant indicator that determines the success of the corporation in the market and the interest of investors in maintaining the company’s business. Based on the official data, the parameters of the organisation’s exchange success are steadily decreasing, which indicates the wrong economic tactics. In Figure 1, a comparison is shown between the stock price of Tupperware and the composite market, and judging by these results, the corporation’s management cannot ensure the stable operation of the enterprise and ensure potentially high stock prices (Tupperware’s stock potential, 2018).

Thus, one can note that Tupperware does not have stability in the field of exchange trading, which may affect the company’s incomes and the ability to invest in innovation projects adversely. The management of the organisation is responsible for these outcomes, and improving performance is a crucial practice to achieve. As additional justifications, KPIs may be cited, which reflect the results of the corporation over the past year.

Using KPIs as Monitoring Tools

KPIs reflect the value and productivity of managerial work and serve as indicators of success or failure in specific areas of activity. In relation to the company in question, Tupperware provides its data in the public domain, and the analysis of its production results may allow drawing conclusions regarding the value or, conversely, the failure of the applied strategic solutions. In Figure 2, the organisation’s performance over the past year is displayed, in particular, the volume of product sales, which is a direct reflection of the corporation’s managerial practices (Tupperware Brands Corporation, 2020a).

Importance of CSFs and TBL Reporting

CSFs are convenient tools that allow evaluating potentially effective interventions and implementing those solutions that may contribute to business growth. According to Nara et al. (2019, p. 1096), they are “concrete actions that need to be successfully developed from strategies for an organization to achieve its goal”. TBL reporting is another mechanism that aims to analyse the activities of business companies from the standpoint of significant dimensions. Nara et al. (2019) note that this assessment standard is one of the most accurate tools for evaluating the sustainability of a business by using the key variables that define this criterion.

For Tupperware that specialises in the wide sale of plastic food containers, one can cite significant CSFs. In particular, in this industry, Gardas, Raut and Narkhede (2019) mention the importance of reducing packaging costs, product safety, minimal transportation expenses and some other aspects that depend on competent management. Thus, the principles of optimisation and development implemented by leaders of organisations are the key prerequisites for CSFs and TBL reports as important tools for analysing enterprises’ business activities and performance success. Therefore, Tupperware’s sustainability may be determined due to these crucial factors.

Organisational Failures Leading to Sustainability Challenges

Tupperware’s business covers a wide spectrum of the market, and although the organisation has a large network of branches all over the world and has been operating for more than a dozen years, a trend towards a decrease in sustainability has been observed in recent years. The drop in sales and stock prices proves that the corporation is experiencing challenges, despite the desire to innovate and promote its products through various channels. In Figure 3, the current Tupperware stock price curve is shown, which confirms the management crisis and problems with maintaining business sustainability (Tupperware’s stock fluctuations, 2019).

When evaluating the factors that influence failures leading to Tupperware’s sustainability challenges, one can focus on social, economic and environmental indicators, which are the main areas for evaluating management practices.

Problems in these areas of work have caused financial and other barriers that the organisation has encountered over the past few years. Temporary increases in stock prices and sales do not affect the general trend of a decrease in market interest in the products of the corporation, and as a justification, appropriate explanations may be given, which suggest the analysis of the aforementioned three dimensions. The review of the company’s work from the perspectives of these areas may help find the causes of the crisis and become a background for productive management solutions aimed at increasing brand value and business growth.

Environmental Failures

One of the crucial aspects of Tupperware’s activity is the sale of goods that comply with the principles of green production and are harmless to daily consumption. Since plastic is the main material used in this industry, the task is complicated due to everyone’s awareness of a long period of the decomposition of this material and its negative impact on the environment. As a result, the desire to achieve harmless production has led to challenges in the financial sector.

Amankwah-Amoah and Syllias (2019) provide an example of green organisational activities when leaders miss significant business trends, focusing on intermediate goals. In the area in which Tupperware provides services, production optimisation may have caused problems in other aspects of activities, and falling stock prices proves that the leadership of the corporation was unable to cover all important areas of work due to additional obligations for resource management.

The emphasis on green production is a factor that can adversely affect the competitiveness of the enterprise, and the above figure 3 proves this assumption. Tupperware lost its position in the exchange market, which, as Baiquni and Ishak (2019) argue, might be caused by green brand positioning. Given the general availability of environmentally friendly products, the organisation found itself in difficult conditions and could not offer the target audience products that would have unique properties. This, in turn, led to a drop in consumer interest, and despite the desire to introduce innovations, the company’s management faced the issue of the lack of demand. Therefore, an excessive focus on one aspect of activities may be considered a potential reason for reducing the sustainability of the business.

Social Failures

Choosing a product that does not have harmful properties and simplifies life has always been one of the mottos that Tupperware promoted among the target audience. Nevertheless, falling stock prices and lower sales volumes prove that public interest in the company’s goods has fallen and people are not ready to join the corporation’s network and make a personal contribution to the development of its business. According to Evans (2018), the social focus of activities promoted by organisations that provide consumer goods plays an important role in ensuring the sustainability of activities and largely determines market recognition.

For Tupperware, the inability of the company’s leaders to provide unique and useful products to the target audience has led to a significant drop in demand and current challenges expressed in the absence of profit growth. Thus, development prospects are largely based on the social aspects of interaction with consumers, and the weak activity of leaders of organisations in maintaining this practise is fraught with losses and regress.

Economic Failures

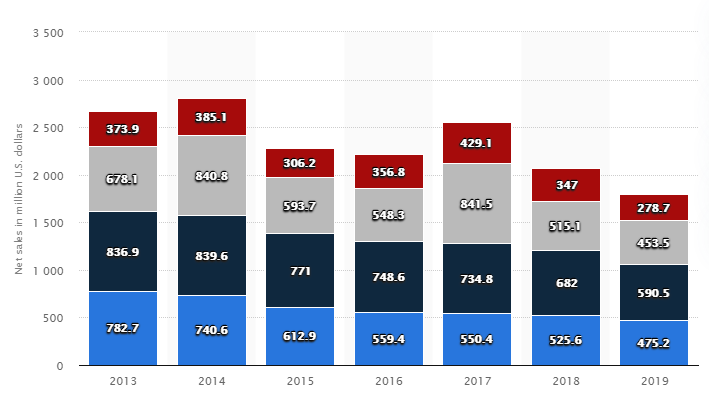

In terms of economic challenges, Tupperware’s management has proven its inability to keep the company’s profits adequately, which led to a crisis and resonance among both consumers and investors. For comparison, one can pay attention to net sales over the past few years and see how corporate profits have declined. According to Gallego-Schmid, Mendoza and Azapagic (2018, p. 980), in 2013, Tupperware’s net sales were $ 2.35 billion.

In Figure 4, this indicator is displayed in the last few years, and it is easy to verify that the economic activity of the corporation has deteriorated significantly, and the net sales indicator fell to approximately $1.6 billion (Tupperware Brands Corporation’s net sales, 2020). As Brown (2016) argues, economic growth is a positive force for the social and environmental transformation of any company. Thus, addressing the issue of financial difficulties, along with environmental and social aspects, is highly significant in the context of increasing the sustainability of Tupperware’s business in the international arena.

Appraisal of the Resilience of the Organisation

One of the most convenient approaches to assessing the sustainability of Tupperware’s business is the use of KPIs as an analysis tool. Unlike CSFs that are usually qualitative and potentially effective methods of intervention, KPIs are quantitative parameters that reflect the actual results of managerial work based on the development indicators of any business. In the case of the organisation in question, a fall in net sales and a significant decrease in stock prices accompanied by constant fluctuations allow stating the instability of the company in the market.

In addition, in accordance with the organisation’s official report, from 2015 to 2017, Tupperware invested more than $3.2 million in environmental improvements, and this emphasis on green production may be considered too narrow in a dynamic and flexible market environment (Sustainability report 2016-2017, p. 7). As a result, the financial results of the business confirm a continuous decline in its economic indicators, and this aspect of activities is the weakest dimension of Tupperware’s work.

The social landmarks promoted by the organisation may be assessed as straightforward, and a full emphasis on one specific category of the population can be seen as a barrier to successful business activities. Despite the fact that, as D’Antonio (2019, p. e12692) notes, in 2016, women accounted for 74.4% of all sellers of Tupperware’s products, over time, trends may have changed. The drop in profits and exchange challenges are the reasons in order to seek new sales channels for goods and establish partnerships with potential investors and various market participants.

However, Tupperware’s management did not make significant efforts to reorganise the business based on current KPIs and take into account additional social prospects of work. Mangore, Lumanauw and Tielung (2015) remark that customer loyalty is a criterion that allows leaders to maintain business sustainability and provide a specific brand with a significant competitive advantage. Based on the results of the corporation, Tupperware was unable to maintain consistently high profits, which may be associated with a drop in consumer demand for the company’s products.

One of Tupperware’s most successful business lines is to expand its influence in various global markets. Tandon and Sharma (2016, p. 236) argue that the overwhelming majority of corporate profits (about 85%) come from overseas points of sale, even though the company itself is based in the USA Emerging markets are a target area of activity since the ability to expand into new regions contributes to monopolising Tupperware’s production and undeniable leadership in its segment.

Also, the corporation offers jobs all over the world and establishes a system of interaction among the branches, thereby supporting a corporate culture and creating a sustainable mechanism of communication among all interested parties. The official report confirms that in 48 states, Tupperware provides 12,700 jobs, thereby contributing to maintaining the labour market (Sustainability report 2016-2017, p. 7). Therefore, this aspect of work is sustainable, although economic development indicators leave much to be desired and require implementing appropriate management initiatives that might address the current challenges successfully.

Data Utilised for Decision-Making

In order to make competent decisions regarding potentially effective and valuable management interventions, Tupperware needs to use the necessary data that may be utilised as a background for changes. As such an information base, not only production outcomes can be presented, which are freely available, but also additional aspects of business activities, for instance, the aspects of partnerships, the practices of engaging external resources and other types of information. These indicators can help identify priority areas for interventions and make a plan for actionable strategies. Therefore, the internal and external data of the organisation in question will be considered, which may be applied as justifications for specific decision-making practices.

Internal Data

Financial indicators of development may be considered the basic data for interventions and the revision of the current business strategy. Based on such an economic parameter as revenue growth, recent evidence suggests that in Tupperware, this figure has fallen 7.16% over the past year (Tupperware Brands Corporation, 2020b). The company’s net profit margin, as another crucial parameter, has also declined 39.09% over the past few years, which is an extremely significant drop (Tupperware Brands Corporation, 2020b). As a result, these data indicate problems in the financial sector of the corporation, and the reorganisation of its economic activity based on them is a necessary intervention.

Another aspect of the internal developmental features of Tupperware is its tax practices. According to the official statistics, due to the increase in reserves for tax assets in 2019, the income tax rate increased by 16% (from 84% to 100%), which is also a significant financial challenge (Tupperware Brands reports preliminary 2019 results, 2020). These changes are an occasion to revise the existing tax policy and determine the best ways to ensure business sustainability in order to increase the organisation’s credibility and preserve valuable assets that could be used for the needs of the corporation.

The nature of interaction with the target audience may be considered an indicator that allows addressing the social difficulties of business development and increasing customer loyalty. In order to maintain a stable level of sales, in 2019, Tupperware launched a notification system in Canada and the USA, and involving potential consumers through personalised emails may be useful for analysing the current market interest in the organisation’s products (Baburajan, 2019). As a result, the review of the information about the number of customers involved through such an updated communication system can help determine the significance of digital communications as tools that stimulate sales growth.

Finally, as internal information that may be necessary for a competent decision-making process, it is essential to monitor reporting parameters. Despite assurances from Tupperware’s management that reporting was kept at a high level in the organisation, at the end of 2019, the company had challenges with its annual report (Shareholder alert, 2020). This suggests that more robust financial control practices are necessary, and corporate management should develop a strategy for enhanced collaboration among all the departments of the organisation to prevent mistakes. All the proposed internal data carry important information and may be useful in planning the activities of Tupperware in the conditions of the impaired sustainability of its business.

External Data

External data that may be useful in analysing opportunities for decision-making practices include partnership principles promoted by Tupperware and macroeconomic trends. The information on investor relations can be valuable in the context of increasing market interest in the organisation and expanding its sphere of influence.

For instance, as Deutscher (2019) states, the corporation’s mutually beneficial partnership with Facebook allows the company to disseminate the data about its products to a wide audience and use social media as a platform for successful promotion. The information on the number of users who prefer Tupperware’s products, including social characteristics, can be a valuable tool for developing productive business growth strategies.

The foreign economic aspects of trade are factors that largely influence the nature of the company’s business and determine the measures that may be required to enhance Tupperware’s sales outcomes. According to Linnane (2020), today, the corporation has difficulties while promoting products in the markets of China, Brazil, Mexico and some other countries and is forced to suffer losses due to macroeconomic barriers. The company needs to carefully analyse the liabilities that individual markets impose in order to avoid unintended losses and prevent losing potential customers due to unique trading conditions in different regions.

In Mexico, in particular, reporting legislation differs from that in the United States, which is a good reason to implement a preliminary analysis of the market and study trends that may affect sales stability (Tupperware investor alert, 2020). Thus, all the aforementioned internal and external information is of high importance for the productive activities of Tupperware and should be taken into account when planning its business growth.

Managing the Challenges Through the Viable Systems Model

In order to overcome the existing challenges and establish productive management strategies in Tupperware to ensure the sustainability of its business, the Viable Systems Model (VSM) may be applied as an effective theoretical framework. According to Preece and Shaw (2019), this mechanism is a planning algorithm that allows understanding the current gaps in management, reorganising the relevant areas of activities and supporting the implemented intervention strategies. This model may be a valuable approach to enhancing the sustainability of Tupperware in the face of the existing difficulties, in particular, economic and social problems.

As Rezaee et al. (2019) argue, the VSM stimulates assessing the state of business organisations and contributes to evaluating what resources and types of relationships leaders may need to engage in order to strengthen financial, corporate and other aspects of work. Preece and Shaw (2019) note that the model includes five systems that affect business viability – implementation, coordination, control, intelligence and identity. In relation to Tupperware, utilising this methodology can help determine the ways out of the economic crisis and opportunities for the growth of the corporation’s credibility among investors, consumers and shareholders.

In the first system of implementation, Tupperware’s management needs to create conditions for increasing stock prices and profits from sales by establishing interaction with investors and revising strategies for working in individual markets. According to Agrawal, Khan and Shukla (2019), partner organisations tend to evaluate the financial performance of companies when planning share purchases. Consequently, by investing in the production and optimisation of promotion programmes, Tupperware can ensure the confidence of potential partners in the sustainability of its business.

In the coordination system, it is essential for the management of the corporation in question to develop the system of interaction with stakeholders. In addition to traditional advertising mechanisms, modern digital channels can be used as tools for communication with a wide range of interested parties. As Iandolo et al. (2018) argue, due to productive interaction mechanisms, companies can contribute to increasing the interest of potential investors in each of the three important dimensions of activities (social, environmental and economic), which, in turn, allows strengthening the business.

The control system included in the VSM involves establishing rules and resource allocation algorithms that are crucial to implementing interventions. The heads of all departments of the organisation should be informed about the methods of strengthening financial performance and follow the programme of communication with stakeholders. Fedotova, Shynkarenko and Kryvoruchko (2018) consider this system as a background to utilise all available resources to evaluate the success of interventions. As a result, reporting and regular discussions of subtotals are the important elements of work.

The system of intelligence offers the management an opportunity to evaluate the business environment for implementing planned optimisation tasks and identifying potential threats. Tupperware’s leaders can instruct those in charge to monitor the dynamics of the exchange market and report any changes in stock prices. Also, the management may look for new areas for spreading the sphere of influence, for instance, not only the production of plastic containers for food storage but also other items that are aimed at different target audiences. These measures can increase the likelihood of the corporation’s recognition by different categories of consumers and investors.

Finally, in the latest identity system, appropriate drivers should be offered to balance business activities and support the achievement of goals. Improving Tupperware’s competitiveness by monitoring all the aspects of the corporation’s work is a necessity since, as Fedotova, Shynkarenko and Kryvoruchko (2018) state, this indicator influences the success of interventions significantly. As a result, the company’s management needs to create a mechanism that will enable leaders to compare the performance of the organisation for individual periods and match the results of activities, thereby strengthening the entire intervention system.

Reference List

Agrawal, M., Khan, A. U. and Shukla, P. K. (2019) ‘Stock price prediction using technical indicators: a predictive model using optimal deep learning’, International Journal of Recent Technology and Engineering (IJRTE), 8(2), pp. 2297-2305.

Amankwah-Amoah, J. and Syllias, J. (2019) ‘Can adopting ambitious environmental sustainability initiatives lead to business failures? An analytical framework’, Business Strategy and the Environment, pp. 1-10.

Baburajan, R. (2019) Tupperware rides on digital transformation for business efficiency. Web.

Baiquni, A. M. and Ishak, A. (2019) ‘The green purchase intention of Tupperware products: the role of green brand positioning’, Jurnal Siasat Bisnis, 23(1), pp. 1-14.

Brown, T. (2016) ‘Sustainability as empty signifier: its rise, fall, and radical potential’, Antipode, 48(1), pp. 115-133.

D’Antonio, V. (2019) ‘From Tupperware to Scentsy: the gendered culture of women and direct sales’, Sociology Compass, 13(5), p. e12692.

Deutscher, M. (2019) With Tupperware and Delos, Facebook brings automation to millions of servers. Web.

Evans, D. M. (2018) ‘Rethinking material cultures of sustainability: commodity consumption, cultural biographies and following the thing’, Transactions of the Institute of British Geographers, 43(1), pp. 110-121.

Fedotova, I., Shynkarenko, V. and Kryvoruchko, O. (2018) ‘Development of the Viable System Model of partner relationship management of the company’, International Journal of Engineering & Technology, 7(4.3), pp. 445-450.

Gallego-Schmid, A., Mendoza, J. M. F. and Azapagic, A. (2018) ‘Improving the environmental sustainability of reusable food containers in Europe’, Science of the Total Environment, 628, pp. 979-989.

Gardas, B. B., Raut, R. D. and Narkhede, B. (2019) ‘Identifying critical success factors to facilitate reusable plastic packaging towards sustainable supply chain management’, Journal of Environmental Management, 236, pp. 81-92.

Garner, N. (2016). 15 Tupperware™ facts from the back of the fridge. Web.

Iandolo, F. et al. (2018) ‘A system dynamics perspective on a viable systems approach definition for sustainable value’, Sustainability Science, 13(5), pp. 1245-1263.

Linnane, C. (2020) Tupperware shares crater 43% to record low after profit warning and news of Mexico accounting probe. Web.

Mangore, I. I., Lumanauw, B. and Tielung, M. (2015) ‘Analysis of product quality, service quality and brand image to customer loyalty at Tupperware Manado’, Jurnal EMBA: Jurnal Riset Ekonomi, Manajemen, Bisnis dan Akuntansi, 3(2), pp. 616-627.

Muntean, M. (2018) ‘Business intelligence issues for sustainability projects’, Sustainability, 10(2), p. 335.

Nara, E. O. B. et al. (2019) ‘Analysis of the sustainability reports from multinationals tobacco companies in southern Brazil’, Journal of Cleaner Production, 232, pp. 1093-1102.

Our sustainability approach (2020). Web.

Preece, G. and Shaw, D. (2019) ‘Structuring organisational information analysis through Viable System Model knowledge domains’, Journal of the Operational Research Society, 70(2), pp. 338-352.

Purpose, vision & values (2020) Web.

Rezaee, Z. (2017) Business sustainability: performance, compliance, accountability and integrated reporting. New York: Routledge.

Rezaee, Z. et al. (2019) ‘Application of Viable System Model in diagnosis of organizational structure’, Systemic Practice and Action Research, 32(3), pp. 273-295.

Shareholder alert: Robbins LLP announces Tupperware Brands Corporation (TUP) sued for misleading shareholders (2020), Web.

Sustainability report 2016-2017: cultivating confidence. (2017). Web.

Tandon, R. and Sharma, N. P. (2016) ‘Empowering women through direct marketing: a case of Tupperware’, International Journal of Innovative Research in Computer and Communication Engineering, 4(4), pp. 233-238.

Tupperware Brands Corporation (2020a). Web.

Tupperware Brands Corporation (2020b). Web.

Tupperware Brands Corporation’s net sales worldwide from 2013 to 2019, by region. (2020). Web.

Tupperware Brands reports preliminary 2019 results. (2020). Web.

Tupperware investor alert: class action lawsuit filed (2020). Web.

Tupperware’s stock fluctuations (2019). Web.

Tupperware’s stock potential (2018). Web.

Appendix 1

Tupperware Brands Corporation is an American organisation that provides sales services for consumer goods, in particular, plastic food storage equipment. According to Garner (2016), the company was founded in 1938, and since then, it has expanded its business to more than 100 countries. Tupperware is listed on the stock exchange and provides shares for sale. One of the key areas of the corporation’s activity is the involvement of participants in the distribution network, and women are the target audience.

The principle of network marketing is one of the approaches that the management promotes as a branding strategy. However, despite covering a wide range of markets and millions of customers, Tupperware has challenges with the resilience of the business, which has been observed in recent years. The fall in the stock price is one of the consequences of the corporation’s failed development, and the loss of its market positions, in turn, affects sustainability negatively.

Expanding the customer community through network marketing is one of the company’s missions. According to the official vision statement, the corporation seeks to accumulate profits due to the involvement of participants and the activities of stakeholders (Purpose, vision & values, 2020). However, even with the innovations that the company promotes, a fall in stock prices proves the instability of the business. Detailed analysis of the activities of Tupperware, including its key performance indicators, may be one of the tools for assessing development prospects and measures that are necessary to increase market positions.

The organisational failures made by the management of the corporation confirm the importance of an emphasis on changing the course of work in accordance with current trends and production results. As a result, achieving Tupperware’s business resilience, as one of the performance parameters, can be described as a set of measures to strengthen environmental, social and economic dimensions.