Introduction

The global insurance industry has undergone considerable growth over the past decades. One of the factors that have stimulated the growth is the high rate of economic expansion in different parts of the world. Islamic insurance is considered as the youngest and most vibrant insurance market. The concept of Islamic finance dates back to over 1,400 years. The term ‘Takaful’ refers to a form of Islamic compliant insurance and entails a way of sharing risk amongst customers based on cooperative principles. The responsibility of running the fund established by the contributors is delegated to the management of a well-established company, which leads to establishment of an agency relationship between the insurance company and the policyholders. One of the foundations of Takaful is social goodness. Therefore, Takaful is designed specially to protect individuals and businesses against loss risks just like the traditional insurance. Many Muslim countries are adopting the concept of Takaful as it is based on the tenets of the Islamic religion.

The first modern Takaful organization was established in 1979 in Sudan. The establishment of Takaful was motivated by the recognition of the view that conventional insurance is incompatible with the Shariah law, which makes most Muslims to avoid conventional insurance (Adam & Thomas, 2004). The Takaful sector has undergone remarkable growth in most markets especially in Muslim dominated countries. A study conducted by Moody’s Investors Service in 2007 estimated the industry’s worth to be at around $ 2 to $3 billion and it is expected to reach $ 7.4 billion by 2015. There are approximately 80 Takaful operators in the world (Rahman, 2009). The sector has managed to sustain its double-digit growth rate. During the period ranging between 2007 and 2012, the industry‘s compound annual growth rate [CAGR] was estimated to be 18.1%. Some of the countries that continue to lead the global growth of the Takaful industry include the Kingdom of Saudi Arabia and Malaysia. In 2013, the KSA and Malaysia generated over 43.7% of the total global Takaful contribution.

This paper assesses the concept of Takaful by analyzing different aspects such as how it works coupled with areas that it covers. A comparison between Takaful and conventional insurance is also illustrated by evaluating the similarities, differences, advantages, and disadvantages. Some of the countries, which lead with regard to growth of Takaful, have also been assessed. These countries include the United Arabs Emirates (UAE), the United Kingdom, Malaysia, and the Kingdom of Saudi Arabia (KSA). The industry’s future is also analyzed.

Analysis

Key elements in Takaful

A number of distinct features separate Takaful from conventional insurance. Some of these features are evaluated below.

Riba

The term riba refers to the interest that is charged on a certain amount of money. Riba is charged in order to cover the cost of investing, underwriting capital, and returns on the investments (Archer & Karim, 2002). Additionally, riba is charged in order to gain profit from money advanced as loan or investments. The prohibition of riba does not mean that Takaful does not take into account the element of cost of finance. Takaful ensures that an organization is within the business conduct and ethics. Therefore, underwriting capital is structured as an investment of the investor where the policy owner and the company share profits and losses. The profits and losses made are shared under a pre-determined ratio (Ali, 2006).

Takaful prohibits charging of interest, which is perceived as a form of exploitation, greed, miserliness, and selfishness under the Islamic teachings. The insurance company is also obliged to ensure that the money is invested in acceptable businesses according to the Shariah stipulations. When claims are larger than the premiums already deposited, this scenario amounts to unfair increase of money, hence usury (riba).

Speculation (maisir)

Takaful is designed in such a way that it prohibits companies and individuals from engaging in speculative transactions (gambling). Under the Islamic teachings, Takaful does not allow financial gains based on chance of an event happening, which illustrates the legal and financial connection between the insured person and the company. Additionally, gambling is perceptibly devoid of the cooperative spirit, which Takaful is greatly concerned with (Ma’sum, 2003).

The claimant is only eligible for compensation when he/she proves the existence of insurable interest. Forbidding speculation [maisr] has played a remarkable role in nullifying the element of gambling. Therefore, contracts that depict elements of speculation are reviewed comprehensively in order to revise possible speculative aspects.

Uncertainty (Gharar)

Any transaction that entails the possibility of occurrence and non-occurrence of uncertain eventualities in the future is not permitted (Billah, 2001). Islamic scholars have often referred to the traditional insurance structure as contracts of uncertainty and that they were just like a gambling game since the risk tainting the contracts was enormous. Takaful ensures the presence of a group to share the losses. Therefore, certainty is provided by deriving a finite cost.

Billah (2001) posits that under conventional insurance, “the insurance firm and the policy owner do not know the outcome of the contract and the policy provider is entitled to receive premiums in spite of the outcomes while the policy owner may not receive the claim as it depends on probability of loss” (p. 111). Takaful transactions are designed in a way to remove the uncertainty where there is an element of donation of their contribution, and thus this aspect offsets the uncertainty.

Takaful models

Takaful companies have developed different operating models. Most of these models are based on prevailing relationship between the insured and the insurance company. The most common models include

- Wakala (agency)

- Mudarabah

- The hybrid model

All the above models are effective, which means that there is no unique Takaful model. The Wakala model follows the design of an agency and service provision accords and it is essentially a financial agreement where the fixed fee is charged by the insurance firm for the services that it offers to the principal (El-Ashker & Wilson, 2006). A classic agreement occurs in cases where the managing agency sets a fixed rate for the underwriting services offered to the policy owners.

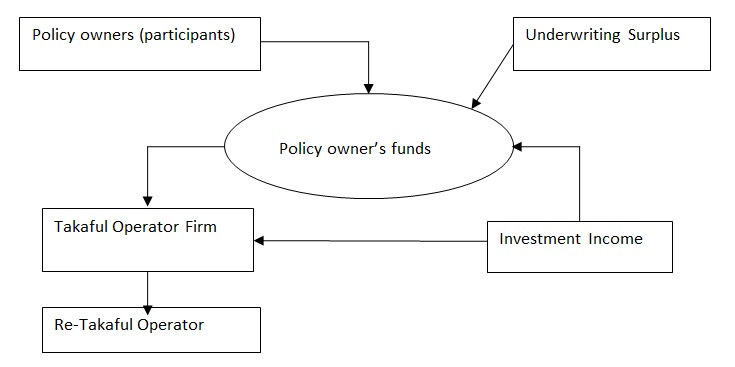

The Wakala model

Under the Wakala model, the Takaful firm acts as an agent (Reid, 2008). The model ensures that the surplus of the policy owner’s financial investment, which is the net of the fee deducted for management and other expenses are channeled back to the owners. A premium is charged from the shareholders’ fund in order to meet the various administrative costs that the firm may incur in the course of its operation. The rates to be charged are pre-determined every year through consultation between the policyholders and the Shariah committee. Sole (2009) adds that the rates of sharing are determined based on company performance.

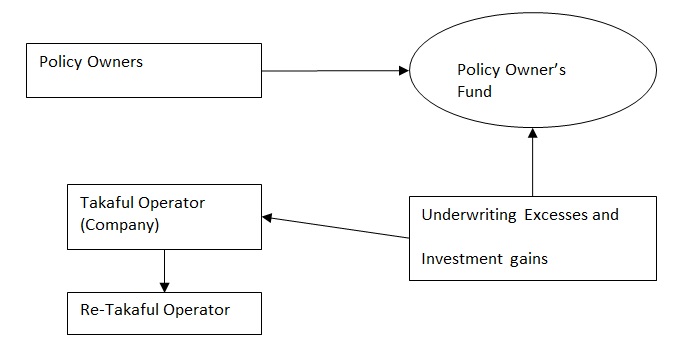

The Mudaraba model

This model refers to a profit-sharing arrangement between the insurance firm and the shareholders. Under this model, the policyholders receive a certain proportion of earnings generated from the policyholders’ fund (El-Gamal, 2000). This aspect means that the insurance company shares the profit generated from different investments. If the policyholders’ fund experiences a loss, the shareholders are issued with an interest free loan.

The rate of sharing the income generated from the policy owners’ fund is a function of the growth and returns of the firm. El-Gamal (2000) is of the opinion that the responsibility of determining the rate of sharing, which is undertaken annually, is delegated to the company’s Shariah board. Any expenses incurred in the course of managing the fund is charged on the shareholders. Therefore, the Mudarabah model can be defined as a partnership whereby the policyholders provide the financial capital required while the Takaful Company provides the labor and management expertise required to manage the policyholders’ fund.

The Hybrid model

This model is a blend of the wakala and mudaraba models. Under this model, “the policy operator receives a mudaraba for managing the policyholders’ investment fund and a wakala fee for managing the policyholders’ funds” (Jaffer, 2004, p. 82).

Differences between Takaful and conventional insurance

Conventional insurance is simply a contract where the outcomes, for instance claims to be paid or compensation, depends on the happenings of future events, which are yet to be identified at the time of entering into the contract. This scenario is described as mu’awadat by the Shariah laws and it is a prohibited activity in Islam. There is uncertainty of whether or not the insured people will get back their money and when they will be paid or how much they will be paid. This uncertainly makes the contract void under the Shariah law.

The policyholders under conventional insurance do not receive any monies if the insured event does not occur (Jaffer, 2004, p. 101). On the other hand, the company will run into deficit in case the misfortune eventually occurs before the premiums are fully paid or if the claims happen to be higher than the premiums already paid. A number of differences distinguish conventional insurance from Islamic finance. Some of the striking differences are evaluated below.

Advantages of Takaful

A number of advantages are associated with the concept of Takaful as evaluated herein.

- Investment without interest – Takaful prohibits the application of interest on investment. On the contrary, Takaful is based on a profit sharing technique referred to as Al Mudarebah. Under this technique, the insurer invests the cumulative total in the policyholders’ fund in different investment vehicles that are acceptable under the Shariah law such as mortgage and security loans.

- Insured gets a share of the profit – the insured gets a substantial proportion of the total profit generated from the company’s investment, which is different under conventional insurance whereby the insured receives a bonus. Additionally, Takaful is based on Islamic teachings, which advocate high moral values in society.

- Return of premium under general insurance policy – under the general insurance policy in Takaful, the insured gets back all or part of his/her premium in addition to the profit in case the insured event does not occur. This aspect is different in conventional insurance whereby the policyholder does not receive anything if the insured event does not occur by the maturity date.

- High ethical standards – another crucial feature of Takaful is that it is ethically sensitive and its operation entails investment in schemes that do not contain social vices and usury (interest). This element is very beneficial for the people who would like to operate on morally high grounds. The general advantage to the community is the investment that actually promotes development for all stakeholders rather than dubious schemes that could profit one part at the expense of the other parties.

Disadvantages of Takaful

Despite the above benefits, the concept of Takaful hinders the extent to which Takaful operators can increase their firms’ level of profitability. This assertion arises from the view that the Takaful operators are restricted from investing in speculative transactions such as derivatives under the Shariah law. Thus, the extent to which the policyholders can maximize their returns is limited.

Comparison of Takaful in the UK, the Kingdom of Saudi Arabia, the UAE, and Malaysia

Takaful in the United Kingdom

The concept of Islamic insurance has undergone substantial growth over the past few decades. London is ranked as one of the largest Takaful markets outside the Middle East. Nevertheless, the rate of penetration of the concept of Takaful in the UK is relatively low, which is evidenced by the few Islamic insurance products available in the market. By 2006, there were approximately 1.5-2 million Muslims living in the UK (Macfarlane, 2006).

Additionally, Macfarlane (2006) asserts that Takaful is based on Islamic principles, which are likely to attract non-Muslims. Therefore, the introduction of Takaful products in this market cannot be ignored. The high market potential in the UK has attracted different players in the financial services market such Lloyds of London, Principle Insurance, HSBC Amanah, and Lloyds TSB (Macfarlane, 2006). One of the factors that have hindered the growth of Takaful in the UK relates to regulatory issues (Basit, 2014). The Financial Services Authority [FSA] requires potential investors in the Takaful industry to meet a number of thresholds. First, the investors must have adequate resources to meet claims if they fall due and effective risk control measures and mechanisms.

According to the Malaysia International Islamic Financial Centre (MIFC), it is imperative for Takaful operators to implement effective strategic risk management strategies (Macfarlane, 2006). The Financial Services Authority (FSA) requires investors in the financial services market to meet certain solvency rules, which are aimed at ensuring that investment is spread effectively. Most Takaful insurers in the UK have trouble in meeting the required solvency margin.

In addition to the above issues, attempts to establish a functional Takaful market in the UK have failed due to lack of expertise with regard to the provision of Takaful services. Gatehouse Napier Limited [GNL] is one example of Shariah compliant companies that had ventured into the UK market. GNL ceased its operations in 2011. Potential investors are collaborating with Muslim institutions in an effort to deal with the prevailing regulatory issues. In 2006, the Bank of England approved the establishment of a working party through partnership between the Union of Muslim Organizations and the Muslim Council of Britain with the intension of addressing the regulatory aspect (Macfarlane, 2006).

Takaful in the GCC and Asia

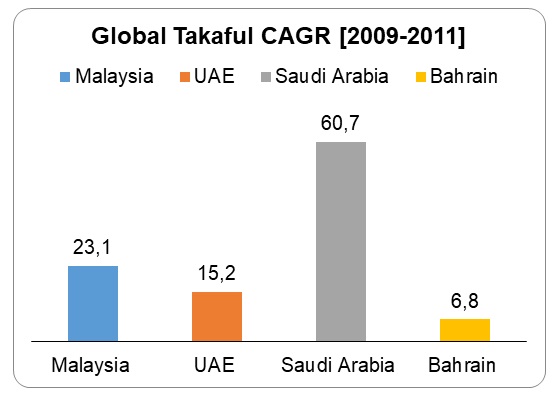

Countries in the Gulf Region and Asia such as Bahrain, the United Arabs Emirates, Malaysia and Saudi Arabia remain at the forefront with regard to the Takaful market. It is estimated that countries in the Gulf Region account for 62% of the total global Takaful premiums and the market is expected to grow to over $20 billion by 2017 (Abdulzaher, 2011). The graph below illustrates the market share of the UAE, Bahrain, the KSA, and Malaysia with regard to the global Takaful CAGR between 2009 and 2011.

Kingdom of Saudi Arabia

The Kingdom of Saudi Arabia (KSA) is ranked as the largest market with regard to the growth of Islamic insurance. According to the Oxford Business Group (2007), Takaful market has continued to experience an annual growth rate of 20% to 25% per annum since the KSA’s ascension to the World Trade Organization. A study conducted by Ernst & Young in 2010 on the growth of the global Takaful industry showed that the industry would experience steady growth and would increase from $9.15 billion to $12 billion between 2010 and 2011 (Abdulzaher, 2011).

The Takaful industry has experienced remarkable growth since 2005. The growth of the Takaful industry has arisen from effective government policies. For example, in 2009, the KSA government issued licenses to 20 companies. By 2009, the Takaful industry accounted for 19% of the total market share in the insurance sector in the KSA. Furthermore, Parker (2013) asserts that Saudi Arabia’s “cooperative insurance contributions are forecast at $5.645 billion for 2012 and projected to increase to $6.352 billion in 2013 and $7.149 billion in 2014” (par. 7). The market’s growth rate is expected to increase to 28% by 2015 (Capital Standards, 2013).

Saudi Arabia’s Takaful industry accounted for $3.9 of the total global Takaful market followed by Malaysia, whose total size of market averaged $1.2 billion. This aspect indicates the high market potential for Takaful industry in the KSA (Deloitte, 2012). Most Takaful providers in the KSA have adopted the hybrid model, which is comprised of the mudaraba and the wakala as aforementioned.

Malaysia

The Malaysian Islamic insurance sector is amongst the fastest growing markets in Asia. A report released during the World Takaful Conference in June 2014 asserts that the Islamic insurance industry has undergone remarkable growth over the past two decades (The World Takaful Conference, 2014). The number of industry players and insurance products has increased exponentially. A study conducted by the Bank of Negara shows that the industry has grown with 27% from 2005 to 2010 (The World Takaful Conference, 2014). During the period ranging between 1997 and 1995, the sector’s contribution to the country’s Gross National Product increased from 0.7% to 1.2%. Additionally, the growth in the total Takaful fund asset increased from 1.6% to 4.8% (Rahman, 2009). By estimation, the Malaysian Takaful industry experiences an annual growth rate of 19.6% as opposed to 8.4% growth in the conventional market. By 2012, there were 12 licensed Takaful operators in Malaysia. In 2013, the market was projected to grow with a 20% margin over the next two years. The growth was expected to emanate from the high rate at which consumers are accepting Shariah-compliant finance products. A report released by OSK Investment Bhd in 2013 shows that individual and institutional customers are accepting Takaful products (Jamil, 2013). Additionally, Takaful operators are improving their capacity in an effort to cater for the rising demand (Jamil, 2013).

Currently, Malaysia has 11 Takaful operators as opposed to 34 Takaful operators in Saudi Arabia. The Takaful market is expected to pose a major challenge to the Saudi Arabian market due to the adoption of effective Takaful model and improvement in the regulatory environment (Parker, 2013). The Malaysian government is also committed to improving the Takaful sector. This goal is being achieved by implementing a risk-based capital framework that will support the Takaful industry. The regulatory changes in the Malaysian Takaful and Islamic banking sectors are expected to stimulate the industry’s competitiveness. Consequently, there is a high probability of Takaful operators adopting the concept of mergers and acquisition in an effort to remain competitive (Jamil, 2013).

The United Arabs Emirates

The Takaful market has undergone substantial growth in the UAE insurance sector. Its growth arises from the attractiveness of Shariah compliant insurance products as opposed to conventional insurance products amongst the Muslims. A report released by Ernst & Young (2012) shows that the total contribution with regard to family and general Takaful amounted to $ 818 million in 2010. The UAE Takaful market is the third largest in the world [After the KSA and Malaysia]. The Takaful market in the UAE is growing at a faster rate as compared to the conventional market segment (Jamil, 2013).

The market is expected to grow due to the high demand for Shariah compliant products by both Muslims and non-Muslims. Firms in the Takaful industry are investing in product diversification in an effort to meet the market demands. Furthermore, the strong economic growth in the UAE is likely to enhance the growth of the Takaful market.

The future of Takaful

Takaful has proved to be very sustainable. In addition, it has great viability in both Muslim and non-Muslim dominated countries. The concept of Takaful has not been fully exploited, which explains the low rate of penetration for Takaful products around the world. Consumers have not yet fully appreciated the importance of Shariah-compliant life and non-life insurance products.

A report released in 2008 shows that the ratio of written Takaful premiums in comparison to the Gross Domestic Product in Muslim countries to be only 1.4% (Jamil, 2013). This rate is lower as compared to the global average rate of 7.1%. The world is experiencing an increment in the size of Muslim population. The Muslim countries in the Gulf Region account for over 40 million of the total world population (PricewaterhouseCoopers, 2008).

In most Muslim dominated countries such as Bangladesh, Nigeria, Egypt, and Pakistan, the Takaful industry is still in its formative stages, which means that the market potential is still not adequately tapped. In these countries, the insurance market accounts for less than 2% of the total Gross Domestic Product. The global Takaful industry is estimated to grow with an average rate of 20% per annum, which is relatively higher as compared to the 2.5% growth rate in the conventional insurance market sector. The Takaful market is likely to grow due to improved regulations targeting the Takaful market sector. Other factors that will promote the growth of the Takaful market include growth in organized savings and increased availability of Takaful products.

Over the past few years, the penetration of family Takaful has been relatively low in the Gulf Region due to the low level of awareness on the benefits of Takaful. This trend is expected to change following the increase in the consumers’ per capita income, which will emanate from the high rate of economic growth in the GCC and the Middle East regions. A report released by PricewaterhouseCoopers (2008) shows that over 60% of the total global Muslim population is below 25 years. This market segment is increasingly becoming affluent in its consumption patterns.

A study conducted by Milliman (2013) on the global family Takaful shows that the family Takaful sector is expected to achieve long-term sustainability. This trend is likely to arise from the attractiveness of Takaful such as compliance with the Shariah laws and surplus sharing (Milliman, 2013). By successfully tapping this market segment, there is a high probability of Takaful operators exploiting this market for over 40 years. Emerging economies such as the ‘Tiger Economies’ are likely to adopt the concept of Takaful, as it plays a key role in the economic development of the countries where it is accepted. Fluctuation in the rate of inflation in the Gulf countries is likely to increase demand for life insurance. This assertion arises from the view that consumers will seek for cost-effective investments that will enable them maximize their returns (Alpen Capital, 2010).

Considering the global demographic changes with regard to increase in the size of Muslim population and the attractiveness of the concept of Takaful amongst non-Muslims, there is a high market potential for Takaful operators to exploit. One of the ways through which this goal can be achieved is through cross-border exploitation. Takaful operators can exploit the market opportunity by adopting diverse market strategies such as the formation of joint ventures, mergers and acquisitions, and through organic growth.

Conclusion

The above analysis shows that the concept of Takaful has undergone remarkable growth over the years. Its growth has arisen from adoption of the concept of mutuality, elimination of riba, speculation, and uncertainty. The different models that have been formulated in Takaful make it attractive to a large number of consumers. The high rate of growth in the Takaful industry is being experienced in Muslim dominated countries. Despite this, a new trend is emerging whereby non-Muslims are increasingly appreciating the benefits associated with Shariah compliant insurance products. Currently, only a small proportion of the Muslim population has adopted the concept of Takaful due to lack of adequate awareness, which means that a significant proportion of the Takaful market is still unexploited. Additionally, the global Muslim population is expected to increase in the future, which is an indicator for the Takaful industry experiencing substantial growth in the future.

The extent to which Takaful penetrates the non-Muslim countries such as the UK will be subject to the government’s commitment in establishing effective regulatory frameworks. Governments in both the developed and the developing economies should formulate effective policies that will attract potential investors. One of the ways through which this goal can be achieved is by reviewing the minimum threshold required to enter into the insurance industry. It is fundamental for governments to ensure that the potential investors in the Takaful industry meet the minimum requirements in order to protect the policyholders. Moreover, the Takaful operators will be required to create sufficient level of awareness regarding Takaful products. This goal can be achieved by ensuring that the general population understands the significance of general insurance.

Reference List

Abdulzaher, M. (2011). Takaful insurance market in Saudi Arabia to reach around USD 7.7 billion in 2012. Web.

Adam, N., & Thomas, A. (2004). Islamic Bonds: your guide to issuing, structuring and investing in sukuk. London, UK: Euromoney Books.

Ali, K. (2006). Introduction to Islamic insurance. Bangladesh, Pakistan: Islamic Foundation.

Alpen Capital: GCC Takaful industry. (2010). Web.

Archer, S., & Karim, R. (2002). Islamic finance: innovation and growth. London, UK: Euromoney Books

Basit, A. (2014). Sustainable growth with profitability is way forward for Takaful industry. Web.

Billah, M. (2001). Principles and practices of Takaful and insurance compared. Malaysia: International Islamic University.

Capital Standards: Saudi Arabian insurance industry. (2013). Web.

Deloitte: The global Takaful insurance market; charting the road to mass markets. (2012). Web.

El-Ashker, A., & Wilson, R. (2006). Islamic, economics: a short history. Boston, MA: Brill Academic Publishers.

El-Gamal, M. (2000). A basic guide to contemporary Islamic banking and finance. Houston, TX: Rice University.

Ernst & Young: Global Islamic insurance industry insight. (2012). Web.

Jaffer, S. (2004). Islamic asset management: forming the future for sharia compliant investment strategies. London, UK: Euromoney Books.

Jamil, A. (2013). Strong growth predicted for Malaysia’s Takaful sector. Web.

Macfarlane, B. (2006). Takaful in the UK; ripe for development. Web.

Ma’sum, B. (2003). Islamic Insurance (Takaful). Kuala Lumpur, Malaysia: Ilmiah Publishers.

Milliman: Global family Takaful report; industry growth and unfolding family Takaful potential. (2013). Web.

Oxford Business Group. (2007). The report; emerging Saudi Arabia 2007. Oxford, UK: Oxford Business Group.

Parker, M. (2013). Saudi Arabia’s, Malaysia’s Takaful markets thrive. Web.

PricewaterhouseCoopers: Takaful; growth opportunities in a dynamic market. (2008). Web.

Rahman, Z. (2009). Takaful; potential demand and growth. J.KAU: Islamic Economics, 22(1), 171-188.

Reid, J. (2008). Takaful insurance; an introduction. International Insurance Journal, 31(5), 36-39.

Sole, J. (2009). Introducing Islamic banks into conventional banking systems. New York, NY: International Monetary Fund.

The World Takaful Conference: Competing for growth and profitability; fresh thinking and new research insights for Takaful players in Asia. (2014). Web.