The summary of the finding and the rationale for investing in Yamama cement

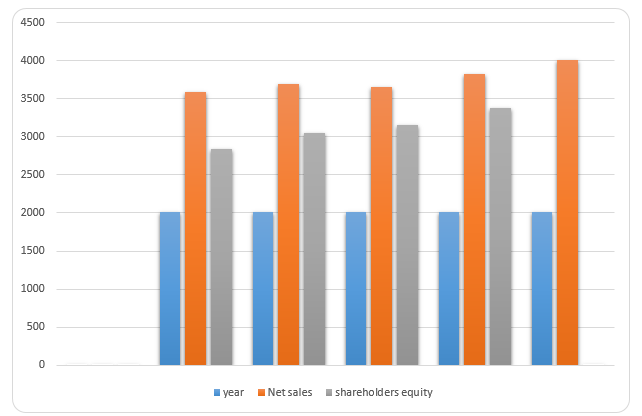

One of the major findings is that the company stock prices have been increasing over the last five years. There have been little fluctuations in the prices of the stock. In addition, the equity prices will increase in the last quarter of this financial year. The increases in stock prices have also caused the increase in the price earnings ratio, which measures the value of the company for investments.

The company earnings have been increasing over the years meaning that the values of its stocks have also been increasing. The increase in the company stocks is directly proportional to its price earnings ratio. The higher the company price earnings ratio, the more it is attractive for investment. The meaning of higher earnings per share is that the investors are willing to invest more to the company.

The trend indicates that the Yamama Cement Company is more valuable hence, the best company to invest. The P/E ratio shows that the securities for Yamama Cement Company in the stock market is cheaper and has a higher propensity for returns. The yearly trends also indicate that the P/E ratios were increasing in the past three years but have seen a drop in the current financial period (Yamama Cement, 2012). The drop is attributed to the general market imperfections in the industry and therefore affects all the firms.

The company overview and its reputation in the market

Yamama Cement Company (YCC) LTD is a listed company within the Saudi stock exchange. Headquartered in the city of Riyadh, the corporation produces numerous categories of cement products ranging from normal cement to sulphate resistant cement. In addition, the corporation manufactures finishing cement as well as amended cement. Moreover, the corporation undertakes the promotion and trade of its produce locally. An amount of 6 million tons of clinker, which corresponds to 6.3 million tons of cement annually, is the present production capability of the firm.

The company is the leading cement producer within the Saudi market. With its expansion and establishment strategy within the Saudi market, the company regional market share is expected to increase by over 12% in the first quarter of this financial year. The company expects to take advantage of the rapidly growing Saudi building and construction market particularly with the growth of the estate development, which is the major target market.

Industry overview and competitive positioning

The cement industry market is expected to grow in the next five years, approximately an increase of 0.55% annually. Currently, the Saudi Arabian cement market share is valued at approximately five billion dollars with Yamama Cement Company’s products claiming 1.6 billion dollars. In Saudi Arabia, Yamama Cement Company’s market share is robust with expected growth of 1.67% annually. This growth in the market share is driven by the popularity of its brands particularly among the estate developers and road contractors. Another advantage the firm has towards its expansion is that its brands are very popular. Most of the company brands are highly welcomed by majority of firms involved in the building and construction industry. The popularity of the brand has enabled the company to be successful and become the leader in cement and related products market within the highly competitive and volatile industry.

Investment summary

The company has put in place various strategies to ensure that its operation costs are streamlined to increase the quality of production as well as maintain its market share. In addition, the company has diversified its portfolio in various industries to avoid risks and increase its income (Yamama Cement, 2011). In the first quarter of the year, the company increased its portfolio by purchasing 20% stakes in the Yemeni Saudi company.

Moreover, the company has diversified its investments through takeovers and opening up several subsidiaries. Currently the company fully owns the Batais Cement Plant, as a Yemeni subsidiary, originally owned by the Yemeni Saudi company. Besides increasing the company revenue, the diversified investments have drastically reduced the risks associated with economic and political risks that are common in the region.

Valuation

The company value is measured by the cost of its portfolios. The company value is calculated through the valuation ratios. The most common valuation ratios that provide the face value of the company are the price-earning ration (Follett, 2011). Price earnings ratio takes cognizant of the current security prices. Using the current prices of the company stocks with per share earnings, the company value can easily be calculated. The most important value in this sense is the current price of the company stocks. In other words, the company price-earnings ratio measures the company value of stocks (Charles, 2008).

Generally, the securities for Yamama Cement Company are more attractive according to the analysis of all the valuation ratios. As can be seen, Yamama Cement Company P/E ratios are increasing in value over the years despite the current drop. Therefore, considering investment prospects, Yamama Cement Company will be the best to invest in since investors will be willing to put their money where there is a greater growth prospect. Other ratios also indicate that Yamama Cement Company is more valuable.

Financial analysis

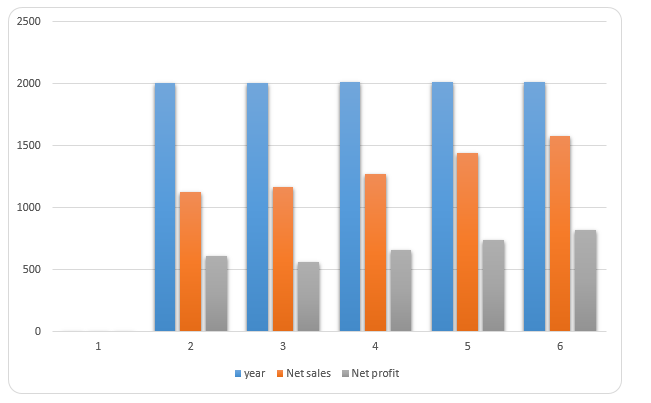

Over the last five years, the company has been successful over its revenue growth. In the last financial year, the company revenue grew by 46% up from last financial year. That is from SR740 million in 2011 to SR818 million in 2012. This upward trend is consisted with the previous year’s growth. The growth in profit before tax and exceptional items grew by 43% up from the year before (Yamama Cement, 2011). The profit before tax consists of unusual object costs that are connected to the stockroom transformations, which rose from SR15 million in 2010, SR16 million in 2011, and SR30.3 million in 2012.

The company financial strategy is to maintain the upward trend in the growth of revenues through international investments and expansions in sales volume. The average three years growth in the retail sales is 49.1% representing a general growth from SR1442 in 2011 to SR1576 in 2012. This tremendous growth in sales has been attributed the company subsidiaries averaging 103% growth in the last three years. The commitment to the internal expansion in the last three years have resulted into the general sales growth with the subsidiaries contributing 59% in the last financial year and 43% growth in the financial year 2011. In 2010, the growth was not so huge though 7% increase in sales was recorded.

The profit margins also grew in the last three years with gross profit margin increasing from 29% in 2010, 37.6% in 2011, and 59% in 2012. This represented a shift from SR809 billion in 2010 to SR914 billion in 2012. This growth in gross profit margin has been attributed to the rapid profitable industrial expansion from 2010 to 2012. The launch of new products in the last three financial years has contributed to the growth in sales revenue attributing to the huge increase in the gross profit margin (Yamama Cement, 2012).

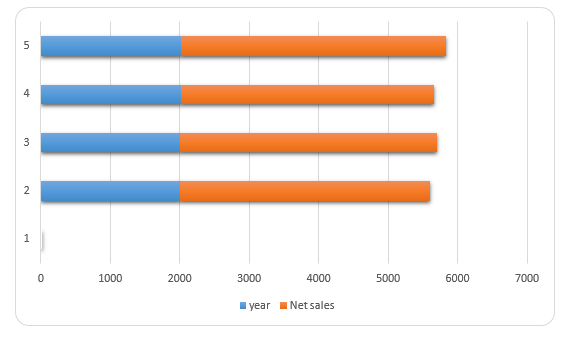

In the last four financial years, the company basic earnings per share have increased tremendously. On average, the underlying basic earnings per share increased by 51% (Yamama Cement, 2012). This represents 5.48 in 2011 financial year up from 4.04 in 2010. Over the last three financial years, the company has proved to be having strong financial position. This included strong cash balance and clean stock positions. Net assets improved from SR3653 million in 2010 to SR4005 million in 2012. Total net assets in 2011 were SR3821.

Finally, the company has been in the last three years keen on its working capital movement. The scrutiny of the capital employed resulted in enhancement cash expenditures from SR1177 million in 2011 to SR9130 million in 2012. The movement in the working capital is because of the tight stock management (Brigham & Daves, 2009). In fact, the capital expenditures have been reduced from SR4319 million in 2011 to SR2525 million in 2012. Most of the fixed assets additions were attributed to the improvements in the company technical infrastructure.

Contingent liabilities, pension fund situation, investment risk, legal and regulatory changes

Pension fund situation

The board of administrators, in order to enable its workforce achieves the organization goals and their burning desires, has initiated colleagueship lending as well as encouraged their employees to invest in pension schemes (Yamama Cement, 2012). In a bid to sustain as well as inspire its laborers, it has come up with a decision of putting 0.4% of its annual revenue as pension fund for its members of staff. The resolution emphasizes on the equality principle amongst its workforce.

Investment risks

The firm puts a lot of emphasis in recognizing the probable hazards that are likely to occur. The perils are likely to come about from the surfacing of latest firms that offer competition to YCC. In addition, the risks are expected to rise the spreading out of additional firms whose production capabilities are higher. Therefore, the company undertakes cyclical assessment of the threats arising from its competitors (Yamama Cement, 2012). However, a part from the threats caused by the development of other competitive firms, there are no other hazards.

Contingent liabilities, legal and regulatory changes

Currently the company has no contingent liabilities. The firm has not been subjected to any conditional liabilities whether long-term or short-term. In addition, legal or regulatory changes have not taken place within the industry or country that affected the operations of the firm. However, the company changed its accounting policies in this current period to accommodate changes in effect to the changes in the accounting regulatory body.

Investment risks

Investors are highly advised to evaluate risks that may occur because of investments. In YCC risks range from credit risks to currency risks (Yamama Cement, 2011). Credit risks may result from the failure of the creditors to fulfill their liability obligations. The other noticeable risk that may lead to the loss of investment is the interest risks. Interest risks may result from unpredictable changes in the current rate of interest. The liquidity risk is also likely to be incurred by the company. The liquidity risk may result from the failure of the firm to secure the needed cash to offset the current liabilities. The last risk is the currency risk that may result from the variation of the exchange risks.

References

Brigham, E. & Daves, P. (2009). Intermediate financial management, Farmington Hills, MI: Cengage Learning.

Charles, H. T. (2008). Introduction to financial accounting, Upper Saddle River, NJ: Pearson Education.

Follett, R. (2011). How to keep score in business: accounting and financial analysis for the non-accountant, Upper Saddle River, NJ: FT Press.

Yamama Cement (2011). Annual report 2011. Web.

Yamama Cement (2012). Annual report 2012. Web.

Appendices

Appendix 1: Quarterly earnings/share

Appendix 2: Assets and Shareholders equity in the last five years

Appendix 3: Net sales and net profit in the last five years