Introduction

Economics is a social science and that deals with structure and performance of national economy as a whole. People who seek to understand the trends of economy are known as economists. Macro economy is also a branch of economics and the specialists of macro economy are known as Macro economists. Macro economists focus on the trends of national income, inflation, investments and international trade. On the other hand, Microeconomics has primarily focused on the prices of goods and the allocation of scares resources in an economy. While Macro economics is a broad field. There are three major macroeconomics policy tools:

- the burden of the debt and functional finance;

- optimal macroeconomic policies;

- monetary policies.

Let us now start with the first one i.e. “the burden of the debt and functional finance”, it can also be termed as deficit-financing. Keynesian first challenge was about deficit financing. It has always lead to the unbalanced budget as the employment act of 1946 also stated the same. For a layperson, government deficit financing would always mean that government’s expenditures are high and his income is low. A layperson might think that due to government’s deficit financing today, the future generation is burdened to pay back all the debts, resulting in lower living standards.

Keynes and many other great economists railed against this idea of deficit financing. Abba Lerner said, “national debt is not a burden on posterity because if posterity pays the debt it will be paying it to the same posterity that will be alive at the time when the payment is made”. However, as no story is complete without critics, Alvin Hansen argued that the maintenance of government budget deficits is not appropriate when we talk about the long run. Infect they still believed that budget financing is a useful policy tool that can help in reducing government deficits and introduced it to a new term as “sound finance”. Keynesian and Abba Lerner worked very hard to express that the government should have such an objective. However, in response Alvin Hansen objected that “functional finance” is a principle through which government should run their government policies.

Lerner believed that there are some tools available for the government by which it can influence its economy, these tools are:

- Apart with the intention of generating revenues or lowering the deficit, government should control the inflationary pressures by adjusting taxes and by controlling government spending. This can help in generating the output to its full employment level.

- Government can also raise funds by borrowing debt and repaying it after a specific amount of time, just like the people who but bonds and share and take interest on its return.

- Merge the first two polices, print money if necessary and destroy it later.

The last major macroeconomics policy tool is monetary policy. It is a process in which government itself or the central bank manages the supply of money to the market. Expansionary policy and contractionary policy is also referred as monetary policy. Expansionary policy is helpful at the time of high unemployment where interest rate is lowered down to overcome unemployment. While in contractionary policy, the interest rates are increased to beat inflation in an economy. Normally, open buying and sales of instruments such as credit and debt used to change base currency liquidity and these operations followed in an open market environment. In this regard, by related authorities, constant transactions adjust the supply of currency and in normal economic condition, this effects many variables like short-term interest rates and exchange rates.

There are many types of monetary policy that is used to overcome the problem to increasing supply of money such as:

- Inflation Targeting;

- Price level targeting;

- Monetary Aggregates;

- Fixed Exchange rate;

- Gold Standard;

- Mixed Policy.

Many types of policy are also called policy regimes that are same as exchange rate regimes. In normal economic conditions, fixed rate is also under the heading of exchange rate regime. Targeting inflation or the price level is also known as floating exchange rate in anticipation of the management of the foreign currency is tracking the similar variables.

Inflation Targeting

As mentioned above Inflation Targeting is a type of monetary policy that is used in tackling inflation. The rate of interest used inter-bank rate is mainly to lend each other the overnight cash for flow function. Depending on the situation of the country, the interest rate can vary. This helps the banks in such a way that people now save money and stores it inside the bank this allows the inflation rate to decrease due to less supply of money in the open market and therefore the spending is less by the individual. New Zealand was the first one to practice this policy.

Monetary Aggregates

This policy was developed to include diverse classes of money and credit. In USA this approach.

To monetary policy was no longer practiced when Alan Greenspan was selected as Fed chairperson. This approach just focused on monetary quantities.

Fixed Exchange rates

In this fixed exchange rate approach, normally it is maintains through external currency. Usually in flat fixed rate, domestic monetary authorities and domestic government declare the fixed exchange rate, however, both government and domestic authorities does no buy or sell the currency to maintain fixed exchange rates. In these circumstances, both government and domestic authorities maintain rate by non-convertibility measures like export & import license and capital control..

Gold Standard

In this approach the price of the local currency depends upon the unit of gold bars which is kept constant through buying and selling it to other nations. The marketing of gold is very significant in order to increase the growth rate. Because gold is a natural resource which sells at a very high price. Today, this approach is not used everywhere in the world. Before 1971, most of the countries used this approach but during 1971 people found it difficult to trade due to very low supply of gold in the open market.

Mixed Policy

In practice, mixed policy is same as “inflation targeting”. Still some considerations is also given to economic growth and unemployment. Federal Reserve used this type of policy in 1998.

In this regard, United Nations normally uses combined policy and afterwards the 1980s; in Taylor rule that the fed fund rate responds to the share in inflation and output. U.S monetary policy effects all the decisions that the citizens of United States makes in the country. It can be whether to buy a house or a car, whether to save in the bank or purchase bonds or it can be whether to invest in the business to purchase machinery or rent one. Furthermore, USA is one of the largest economy in the world its policies also effect other countries (financially or economically) and there policies. Most of the people are familiar with the fiscal policy in USA such as government spending and taxes. Whereas many of the citizens are less familiar with the monetary policy and its tools.

United states has so many natural resources and has a good fertile land, is rich with mineral resources and a mild climate. The second plus point it has is the labor, who can convert the raw material into finished goods. Labor’s productivity and how large they are in number matters a great deal to determine the health of the economy. Every country has to suffer from a dreadful era, it was the case with United States, and they have gone through such a time when there was high unemployment. There was a time when immigrants tented to work but there were no jobs, workers agreed to work on lower wages and earned comparatively well as what they would have earned in their native countries. This was the economy grew faster and welcomed more and more newcomers to their country. (Basic Ingredients of the U.S. Economy, n.p.)

Over the last three years, American government has been very successful in some areas and has faced great challenges in some areas but they somehow managed in developing their economic stat.. In the year 2005, it was forecasted that air travel would face a challenge and have to increase the number of regional jets and super-jumbo jets. America tried to put back their age facilities and meet the terms and conditions they made by the safe drinking water regulations. Federal funding for drinking pure water was $ 850million and Bush claimed to continue the same level the years ahead. While the US power transmission system is not in its good condition and has to be modernized as soon as possible, this was the case in the year 2005. No new transmission facilities were designed to meet the level of demand in the year 2005. It also resulted in traffic jams and created haphazardness among the public. The rail capacity also created some problems. It was expected that if the same thing continues the problem would increase by 50% by the year 2020. A worth rail tracking system is about to develop. Roads conditions has worsened the economy of America, this is noticed that America waste 3.5 hours a year stuck in traffic. The nation has to improve their transportation facilities. An area where America is having a powerful hand over is the “security”. America has built more secure ways and has provided with a critical infrastructure-which is the only drawback in the year 2005.

In the year 2006 The National Alliance on Mental Illness, presented an analysis on each state on the mental health over the last 15 years. Each US state was judged on the 39 specific areas, which would result in an overall grade. Average grade of US was D. No country received as but five received a B.

In the year 2006, the economic condition of US was far better from what is experienced in the past few years. It already had a good over the raw materials and on the energy but control tightly the fiscal policies. Steel consumption increased in the year 2006 it accompanied a rise in demand for carbon steel flat products.

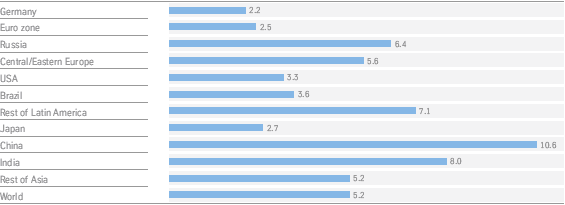

GDP (Gross Domestic Product) 2006 in real terms, change vs. prior year in %1 ).

Whilst in the year 2007 as compared to years mentioned earlier in the paper there was no far improvement in the economy of United States. The only thing that improved was parks and recreations in the economy.

Many countries are continuing in an old traditional way but many has adopted the changes and are trying to follow the modernize way to compete with the globalization. America is one of them who are trying to have an edge over their competitors. They have advanced themselves in technology and have a more flexible organizational structure, they have skilled labor because they emphasize on literacy rate. They believe in delegating tasks to the lower level managers, which increases confidence and gives the country more mature and experienced people.

Works Cited

Basic Ingredients of the U.S. Economy, n.d. Web.

Koop G. Analysis of Economic Data, 2005. Web.

Newnan, D.G, Eschenbach, T G, Lavelle J P. Engineering Economic Analysis, 2004. Web.

Ok E A. Real Analysis with Economic Applications, 2007. Web.

Posner, R A. Economic Analysis of Law, 2007. Web.

Rifkin J. The Hydrogen Economy: the next great economic revolution, 2000. Web.

ThyssenKrupp AG. n.d. Web.