Introduction

The last months of 2007 saw unprecedented economic growth with the Dow Jones stock market index hitting its peak in October with the real estate market flourishing as homes hit peak prices as well. However, there were clear macroeconomic red flags across the board that a recession was coming, ranging from banks refusing to conduct business with each other and showing internal struggles to a growing bubble in the housing market and the infamous subprime mortgage and predatory lending practices. By September of 2008, the economy began to collapse as the stock market fell rapidly, the housing market bubble burst, and financial institutions either closed or needed bailouts. The macroeconomic impact was enormous, affecting the global economy and trade and influencing industries and people with no connections to the major causes of the crisis. It was the worst economic recession since the historic Great Depression of 1929 and has had profound impacts on the American economy, financial industry, regulation and policy, and models of risk assessment and forecasting. The objective of this paper is to determine the major causes of the 2008-2009 financial crisis (Great Recession) and determine the consequences of the recession and how it has changed the listed macroeconomic aspects in the context of the general U.S. economy.

Literature Review

Beginnings

The foundations to the Great Recession began in the early 2000’s when the market experienced a brief recession due to burst of the dot-com bubble, terrorist attacks, and some scandals in the finance sector. People and policymakers were scared of a greater recession arriving. In order to stave off recession, the Federal Reserve began an expansionary monetary policy and reduced interest rates a total of 11 times by almost 5% in a matter of a year, reaching as low as 1.75% in December of 2001 (Amadeo, 2020). This resulted in liquidity flooding the economy, resulting in bankers, businesses, and private individual to jump on the opportunity to borrow large sums of money, but often without the assets or ability to repay it.

Housing Market and Subprime Mortgages

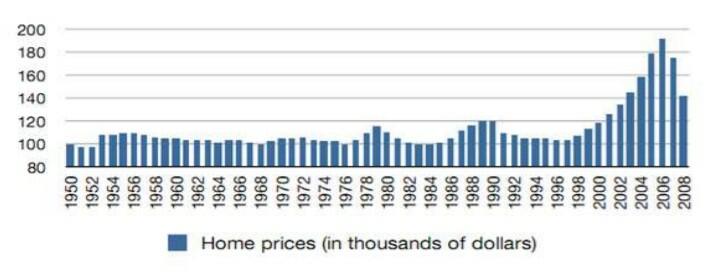

One of the primary causes of the financial crisis is attributed to the housing market which was directly tied in with subprime loans and mortgages described earlier. Subprime loans are defined as a category of credit given at a high interest rates and fees given to less than ideal borrowers that do not have the necessary credit history or financial stability to manage the credit burden (Coghlan, McCorkell, & Hinkley, 2018). In the early 2000’s, the U.S. government adopted the policy approach of providing homes to more Americans. In the context of low federal interest rates, borrowers flooded to capitalize on the opportunity of purchasing a home, the epitome of the American suburban dream. Banks were more than willing initially to provide these loans since the federal rate was so low and they could charge higher interest rates for consumers. The demand for home loans and buyers, resulted in a rapid rise of property values.

Encouraged by this illusionary economic boom and low inflation rates, the federal interest rate was lowered to 1% by mid-2003. This economic environment of easy credit and high-yield subprime mortgages became a highly profitable enterprise. Consumers were encouraged to fulfill their immediate desires using credit with huge discounts and low down- payment but few considered long-term financial planning or consequences. In economics, it is the axiom of institutions to maximize profit. For banks investing in housing was profitable as they enticed consumers with low down-payments (~10%) and thirty-year loan rates of 3%, but subprime mortgage contracts allowed for banks to adjust interest rates after three years (Sorkin, 2009). When the consumer could no longer pay the mortgage, the bank would take ownership of the home, gain profit from interest percentages and essentially repeat the process.

This ties into the next cause of predatory lending practices and irresponsible risk management by financial institutions. The banking system developed a new system of repackaging the subprime mortgage loans into collateralized debt obligations (CDOs) and sold to to other financial organizations. The subprime mortgages were collected into CDOs and sold as a derivative to raise more funds for even more loans, with the collateral being the very fact that these mortgages and loans would be repaid by households. At the same time, deregulation by the government relaxed net capital requirements for major investment firms, allowing them to leverage more than 30 times the initial investment (Michello & Deme, 2012). In a sense it was a looping pyramid scheme which resulted in continuous profits and rising prices.

Long-Term Causes

In addition to the short-term causes described above, economists attribute certain long-term causes to the crisis as well, many dealing with government macroeconomic policies. As mentioned earlier, the Federal Reserve did not maintain proper long-term planning in lowering the interest rates in combination with strong deregulation of the financial sector leading up to 2008. There was an evident excess supply of liquidity in capital markets globally which can be attributed to the failure of central banks of advanced economies failing to restrain such liquidity and speculative increases in prices. Furthermore, there was an inherent global trade imbalance, with the United States having trade and public sector deficits. When the Federal Reserve lowered the interest rates too low for a prolonged period of time, it compounded the issue of excess liquidity induced by global imbalances. Some economists also note that growing inequality and wage stagnation became a long-term cause of the crisis, with the bottom 90% of the population having only a 10% inflation-adjusted increase in wages between 1976 and 2006. This results in lower aggregate demand and decreased consumption, that was capitalized on by predatory lenders prior to the crisis by promoting and engaging in high-risk capital investments (Wisman, 2013).

The Crisis

By 2005-2006, home prices began to fall as home ownership reached a peak of 70%. The Federal interest rate also began to rise to approximately 5.25%. Since many subprime mortgages interest rates were dependent on the federal one, the higher interest rates began affecting their ability to pay, beginning a cascade of defaults on subprime loans. In turn, subprime lender organizations also began to default, beginning with the well-known New Century Financial. Information began to emerge that large banks and investment firms owned trillions in securities backed by the failing subprime mortgage CDOs (Sorkin, 2009). Financial institutions began to seize funds from hedge funds to stay afloat and the interbank market completely froze internationally, with many facing significant liquidity problems that required intervention by government central banks around the world. Federal funds and discount rates were reduced to approximately 1% and various bailout packages were released such as the National Economic Stabilization Act of 2008 to purchase mortgage-backed securities (Mehdian, Rezvanian, & Stoica, 2019).

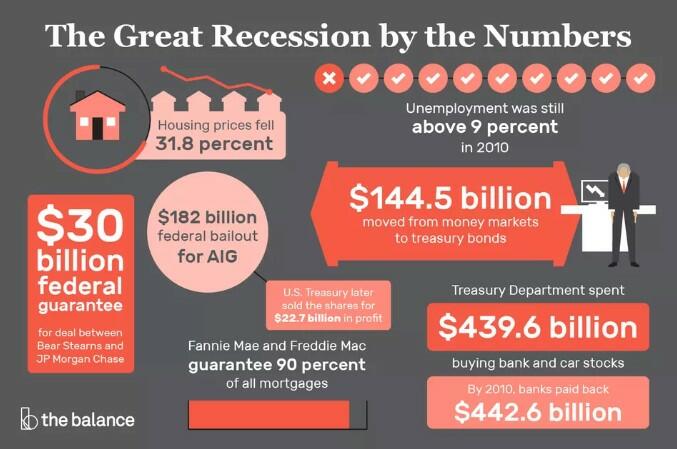

At the time, no one realized the full extent of the subprime mortgage crisis and its damages. The insatiable demand for mortgage-backed securities leading up to the crisis resulted in an irresponsible approach to risk management. Banks divided up mortgages and sold them in tranches, making derivates difficult to price. Meanwhile, not just financial institutions were invested in mortgage-backed securities but also corporate assets, mutual funds, and pension funds. Even the pension funds that typically approach investment safely invested into subprime mortgages, believing they were insured by what was sold as credit default swaps by the American Insurance Group (AIG) which would technically cover costs if the mortgage was defaulted upon. However, when the system began to collapse, AIG could not cover cash to cover all the swaps it had sold. Despite the belief of the Federal Reserve at the time, the crisis was not confined to the housing sector alone, affecting banking and industry who stopped lending to each other fearing worthless collateral in the form of subprime mortgages (Sorkin, 2009).

Bailouts by the federal government began by mid-2008 as the situation deteriorated in the housing and financial market. JP Morgan Chase and AIG were offered multibillion-dollar packages, while Congress authorized the purchases of mortgage companies Fannie Mae and Freddie Mac which are still largely owned by the government (Coghlan et al., 2018). Stock markets began to collapse rapidly and series of bailout and restructuring deals had to be made with the government.

Consequences

The consequences of the 2008 financial crisis were both short-term and far-reaching, with impacts felt to this day. It is first important to consider the human and social cost of the crisis, resulting in mistrust in the financial system, massive losses of employment and residency, and even lives lost due to increased levels of crimes and suicides related to the crisis. Short-term consequences resulted in hundreds of billions of dollars of government bailouts and strongly reduced public spending across all levels of government, with measures mostly helping corporations rather than individual households. U.S. households lost on average of $5,800 in income during the acute stages of the recession, with an estimated $648 billion income lost due to slow economic growth post crisis. At least 5.5 million jobs in the U.S. were lost during the crisis.

Home values dropped with a $3.4 trillion decline in real estate wealth between 2008-2009. The stock market value also dropped by $7.4 trillion in the same period (Pew Charitable Trusts, 2010). The macroeconomic and financial costs Long-term consequences include instability of the global financial system that has led to deep austerity and political instability across the world. However, there are some positive changes, such as structural changes and shifting dynamics in the macroeconomic field, discussed in the next section (Arora & Rathinam, 2011). There is increased regulation, even with some rollbacks of the current U.S. administration, the government and international bodies are greater aware of red flags and necessary decision-making to prevent repetition of such a devastating economic crisis.

Analysis

The 2008 financial crisis is unique among economic recessions which occur periodically, not only in its scale, but its inherent complexity. Although most recessions are driven by macroeconomic factors, there is often an evident identifiable cause which is often self-correcting. The subprime mortgage concept is often seen as the major cause of this particular crisis, but it is simply a reflection of the greater disarrangement in the financial system at the time and highlights the other significant underlying cause of the crisis which is government deregulation leading up to it. However, now that more than a decade passed since the crisis and its repercussions, it is evident how the 2008 recession ultimately changed U.S. macroeconomics.

Leading up to 2008, the world ranging from policymakers to bankers to educators saw U.S. macroeconomics as a straightforward, predictable, and benign concept. As a highly developed economy, the United States was seen a country which saw stable economic fluctuations that were essentially self-correcting, based on the rational expectations macroeconomic approach of the 1970’s. Over decades, little changed other than models of assessing and predicting the future, once again expecting regularity in economic fluctuations, and thus being able to analyze previous events and decisions to predict the future. Macroeconomic models were linear, and a small shock such as a decrease in house prices could not have big impact, making it impossible to predict or solve. At the same time, since the 1980’s, advanced economies existed in a manner of ‘great moderation’ where there was a decrease of variability of output and its elements such as consumption and investment. Monetary policy was safe with low and less variable inflation, and mostly small shocks in the economy. These strict economic policies were thought to be a failsafe against small shocks devastating the economy. Even such events as bank runs that are taught in history and economic courses as the worst event in a recession were now largely preventable due to federal insurance and central bank protection policies (Blanchard, 2014).

However, the 2008 recession largely blindsided everyone as it is the matter of small shocks ranging from the housing bubble to liquidity issues in banks and corporations that led to the collapse and malfunctioning of the economy. Financial institutions and regulators underestimated risks as financial structures were exposed to shocks due to their liquidity structure, often without realizing it. When the U.S. housing market burst, it led to concerns on which claims were held by which financial institution and which were essentially solvent in the context of the subprime mortgage crisis. It led to ‘liquidity runs’ not on banks but mostly on financial organizations which were operating like banks without the proper protections or regulations (Blanchard, 2014). Prior to 2008, economic stimulus in advanced economies would be used as part of accommodative monetary policy which would support aggregate demand. Central banks would increase money supply to reduce interest rates that allowed businesses to borrow and expand at lower costs, potentially positively impacting employment rates and thus, consumer spending in the country. As interest rate was reduced to boost economic activity, the zero lower bound level was quickly reached and posed a risk of deflation that increases the real value of public and private debt. There was little availability for monetary maneuvers in this scenario (Dequech, 2018).

Expansionary fiscal policy is another method of strengthening aggregate demand. Fiscal policy was used to increase public spending to supplement private demand as well as reduce taxes. However, this led rising government debt levels and perceived sovereign risk, which was inconceivable before the crisis (Blanchard, 2014). Furthermore, this macroeconomic approach is commonly mistrusted by the public and investors due to the theoretical crowding out effect which states that government spending discourages private investment. The government policy also indirectly impacts borrowing costs due to an increased demand for loans, raising interest rates. Without stimulation to invest by firms, neither the production sector nor the labor market would grow. Fiscal stimulus police may have a short positive effect but would effectively stagnate the economy in the long-term. Nevertheless, the 2008 crisis required fiscal stimulus as economists believed the zero-bound levels of interest rates would prevent a decrease of private investment given the circumstances (Dequech, 2018).

The perfect storm of problems and events which cascaded into the 2008 crisis brought to light important but largely forgotten macroeconomic theories, the primary of which is the Hicks-Hansen investment savings (IS) – liquidity preference-money supply (LM) model, otherwise known as the IS-LM model. The timeline and consequences of the recession described in the literature review describe an economy which responded to negative shocks through lowered demand for goods across all industries. The Keynesian IS-LM model developed in the 1980’s places demand at the center of business cycle fluctuations along with the ‘paradox of thrift,’ stating that during recessions households tend to reduce spending and save more, while the complete opposite is necessary to kickstart economic growth, but in turn leads to businesses decrease production based on demand and the recession deepens. This was clearly evident during the Great Recession during which savings in American households increased from 2.9% to 5% (Christiano, 2017). A modern version of the IS-LM model has become central to macroeconomic policy and planning as it shifted dynamics from the view that markets are self-managing and inflation is a failure of policy to the fact that the economic system can become dysfunctional independently and government intervention is necessary to manage the broader national economy (Krugman, 2018).

The 2008 financial recession had these evident macroeconomic impacts as well as influences on monetary policy. The crisis resulted in large accumulations of debt for individuals, organizations, and the government which all of the involved parties are still attempting to deal with. The crisis resulted in the financial system, which was the problematic epicenter of this recession, being more regulated and less opaque, largely due to the efforts of the Dodd-Frank Act of 2010. Long-term macroeconomic policies must consider margins for maneuver in cases of crisis, allowing for management of inflation rates, nominal interest, and investment. Economists are now aware of the numerous non-linearities of the modern economy both macroeconomic policy and financial regulation are set to maintain the economy away from these non-linear, unpredictable causations and systemic risk.

Summary and Conclusion

The 2008 financial crisis was the largest recession in modern world economic history. Its impact and complexity were driven by profit-driven finance instruments and lack of regulatory measures in place for certain sectors of the economy as well as numerous other short- and long-term macroeconomic factors. This recession was unique in that it defied any prediction, means of protection and self-correcting for the economy, and existing economic models at the time. The consequences for macroeconomics were enormous across the world, resulting in economic stagnation, unemployment, loss of income, and massive bailouts to prevent the system from completely collapsing. However, analyzing macroeconomic elements and theories, it has allowed for major changes to the manner that the economy is studied, regulated, and driven. While recessions will continue to be a periodic occurrence based on economic cycles, it is the avoidance of critical errors and red flags in long-term economic planning that is key to preventing such devastating crises again.

References

Amadeo, K. (2020). 2008 financial crisis. The Balance. Web.

Arora, D., & Rathinam, F. (2011). The Macroeconomic Impact of Financial Crisis 2008-09. Web.

Blanchard, O. (2014). How the crisis changed macroeconomics. World Economic Forum. Web.

Christiano, L. J. (2017). The Great Recession: A macroeconomic earthquake. Web.

Coghlan, E., McCorkell, L., & Hinkley, S. (2018). What really caused the Great Recession?. Web.

Dequech, D. (2018). Institutions in the economy and some institutions of mainstream economics: From the late 1970s to the 2008 financial and economic crisis. Journal of Post Keynesian Economics, 41(3), 478-506. Web.

Krugman, P. (2018). Good enough for government work? Macroeconomics since the crisis. Oxford Review of Economic Policy, 34(1-2), 156-168. Web.

Mehdian, S., Rezvanian, R., & Stoica, O. (2019). The effect of the 2008 global financial crisis on the efficiency of large U.S. commercial banks. Review of Economic and Business Studies, 12(2), 11-27. Web.

Michello, F. A., & Deme, M. (2012). Communication failures, synthetic CDOs, and the 2008 financial crisis. Academy of Accounting and Financial Studies Journal, 16(4), 105-122. Web.

Pew Charitable Trusts. (2010). The impact of the September 2008 economic collapse. Web.

Sorkin, A. R. (2009). Too big to fail: The inside story of how Wall Street and Washington fought to save the financial system—and themselves. New York, NY: Viking Press.

Wisman, J. D. (2013). Wage stagnation, rising inequality and the financial crisis of 2008. Cambridge Journal of Economics, 37(4), 921-945. Web.