Introduction

For this assignment, I chose to analyze M industries which is a manufacturing company located in India. The company deals with metal activities such as mining and refining. As of 2004, M industries was dealing with zinc and aluminum only. The company had a significant market share of 48% for aluminum and 75% for zinc. In addition, the company exported its products to an average of 35 countries.

Engineering Economic Decision and Recommendation

In the year 2004, the demand for copper and copper products had risen in China and neighboring countries by over 2.6%. Due to the increased demand and limited supply of the commodity, prices for copper were at the US $136. After conducting its analysis, M industries discovered that the cost of mining and refining copper was the US $450. I recommend that M industries should pursue the project.

Manufacturing Cost Breakdown

The company conducted its research and found out that copper ores were found in Africa, South and North America, and Australia. However, M industries were determined to set the industry in India due to the availability of cheap labor and proximity to the market. Its target markets were China, Malaysia, and Indonesia, among others. The most suitable place to set up the plant was in Tuticorin, found on the south coast of India.

Cost Quotations

Table 1: Machinery Price Quotation

M Industries required various equipment to set up the mining and refining industry. They requested proposals from two established dealers of equipment globally; CRL in Australia and ASARCO in the USA. The company compared the costs of every piece of equipment from the two dealer companies and the cost of transportation, as shown in table 1 above. The cost of purchasing from CRL was the US $98 million, while ASARCO was the US $94. Some of the equipment to be purchased by M industries were; smelters, refineries, APM (Anode Preparation M/C), CSM (Cathode Stripping M/C), ASWM (Anode Scrap Washing M/C), CCR (Continuous Copper Rod) Plan, STP (Slime Treatment Plant), and ETP (Effluent Treatment Plant).

Engineering Economics Tools Applied

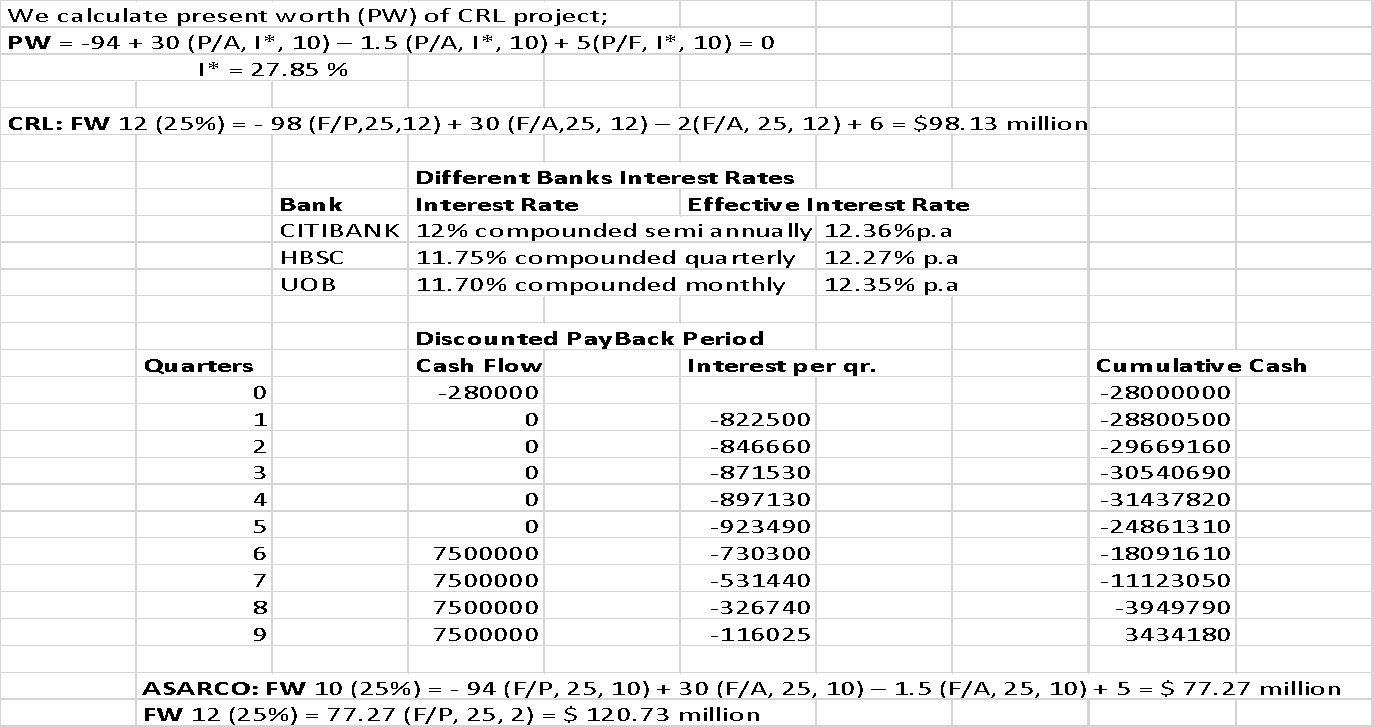

To be sure of the best supplier of the equipment, M industries conducted an internal rate of return analysis (IRR). IRR is a tool used in engineering economics to determine the future value of a project. During its calculation, the interest rate is set at zero. The time value of money is cash flows of the given period that the project exists is put into consideration when calculating IRR.

IRR Factual Analysis

The company set its MARR at 25%; the lifetime of the machinery from CRL is set at 12 years, while that of ASARCO is set at ten years. The cost of maintenance CRL is $2 million, and ASARCO is $1.5 million. The salvage value of equipment from CRL and ASARCO was $4 and $6, respectively.

IRR Calculations

M industries evaluated the present and future worth of the two projects before making a purchase decision. Since the future worth of the second project is greater than that of the first one, the company decides to purchase its machinery and workstations from ASARCO. The company also researched for the best bank to finance the project. After comparing interest rates from various banks, M industries decide to borrow a loan from HSBC due to its effective interest rates. M industries set up a copper mining and refining industry at Tuticorin at the US $100 million. It also purchases copper and two copper ores from Australia, Thalanga and Mt. Lyall mines, at $150 million and $ 200 million, respectively. The new industry has a production capacity of 120,000 tons of copper per annum.

Break-Even Point

After pursuing the project, M industries wanted to determine the period that the project would take to recover the incurred cost. They used break-even point analysis, where they set the cash flows to quarterly; K=4. Since the project was initiated in September 2016, the first cash flow statement was in January 2017. The new plant was producing 120,000 tons of copper per year. After deducting all production costs and expenses, the expected profit per product was $250.

Discounted Payback Period

With the profit per product being $250 and the production capacity of 120,000, the total profit is $7,500,000. They used the same discounted payback period as in IRR calculations. The compounding period (M) was the same as the number of cash flows (K). They used the interest per quarter calculated as I* = r / M. It resulted in 2.9375%. Using the quarterly cash flows, the project will be in a position to recover from debt by the end of the 9th quarter.

Conclusion

The company made a good decision by pursuing the project as, from the engineering economics tools used, it is a very profitable business. The company used IRR calculations to find ASARCO as the best supplier of its equipment while placing all important points into consideration. The company was also able to identify when it will pay back all its debt which emerged to be in the 9th quarter, less than two years’ time.