Introduction to the country

The United Arab Emirates is located in the Gulf Region and borders Saudi Arabia, Qatar, and Oman. The UAE covers seven emirates federations, which were constituted in 1971. The federations include Abu Dhabi, Sharjah, Dubai, Ras al-Khaimah, Fujairah, Umm al-Qaiwain, and Ajman. The country has adopted a monarchy system of government, which has significantly contributed to its political stability (Shihab 3).

Additionally, UAE prides in a high level of social stability and effective legislation. Its current total population is 5.4 million residents. The country’s leadership is committed at nurturing positive economic growth. Consequently, it has appreciated the importance of economic integration with other countries. Some of the organisations and international groups that the country is a member include the Gulf Co-operation Council, Organisation of the Islamic Conference, Organisation of the Petroleum Exporting Countries, the United Nations, and the Arab League (Shihab 3). The country stands out as an ideal model for other countries to follow (National Bureau of Statistics 3).

The government’s commitment towards stimulating the country’s economic growth has considerably enhanced its investment attractiveness. Eighty percent (80%) of the country’s GDP is due to economic growth and in Abu Dhabi and Dubai (Haque 4). Its richness in oil reserves has transformed the country into the second largest oil exporter in the world. The country has established “new economic sectors” in an effort to stimulate economic growth (National Bureau of Statistics 3). This paper entails economic analysis of UAE by evaluating various performance indicators.

UAE-The economy

UAE has undergone significant economic transformation since the discovery of petroleum three decades ago. One of the most notable changes relates to the country’s transformation from being an impoverished desert country to a modern country characterised by high standards of living. In its quest to stimulate the country’s economic growth, the government has increased its spending on infrastructure and establishment of utilities that aim at enhancing job creation. Economic integration is also another factor that has contributed to the country’s economic growth. In 2004, the UAE entered into an economic integration agreement with the US by signing the Trade and Investment Framework Agreement (Central Intelligence Agency Para. 1).

Its free trade agreements with other countries are playing an important role in improving the country’s attractiveness to foreign investors for the agreements provide foreign investors with an opportunity to have full ownership of their businesses. Additionally, foreign owners enjoy zero tax rates. Additionally, the country’s economic growth has also improved significantly due to the adoption of effective macro and micro economic policies (Central Intelligence Agency Para. 1). One of the policies that the country has adopted relates to economic diversification, which has considerably reduced the country’s GDP dependence on oil and gas with a margin of 25 % (Abu Dhabi Council for Economic Development 6).

Economic data and highlights of the eras

There are various types of economic data that can be used to analyze a country’s economic performance. One such type of economic data is the Gross Domestic Product [GDP]. Mankiw defines GDP as ‘the market value of all final goods and services produced in a country over a given time period’ (p. 494). Countries GDP fluctuate from one period to another depending with economic changes.

1991-2000

The UAE has been experiencing varying GDP growth. During the period ranging from 1990 to 2000, UAE’s GDP was greatly depended on oil. Consequently, the country experienced fluctuations in it GDP growth as a result of changes in oil prices. The oil price recovery in 1999 led to the country experiencing a 10% growth in GDP. This trend was experienced in 2000 whereby the economy nominal GDP grew with 20.4% (Azzam 197). During this period, the country’s economic growth was relatively low.

2001-2007

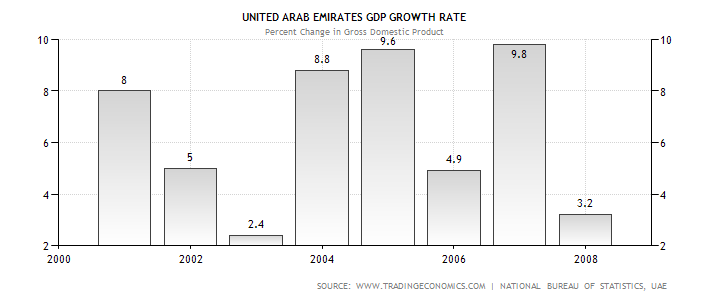

However, the positive growth in the country’s GDP was reversed in 2001 to 2007 as illustrated by the chart below. From the chart it is evident that the country experienced a negative growth in its GDP from 2001 to 2003. During this period, GDP growth rate declined from 8% to 2.4%. The negative growth was reversed in 2004 whereby the country experienced a positive GDP growth of 8.8% and 9.6% in 2005. In 2006, the country’s GDP growth rate declined to 4.9% and later increased to 9.8% in 2007. The trend in the country’s GDP growth shows that the era has been characterised by varying economic environment.

2008-2012

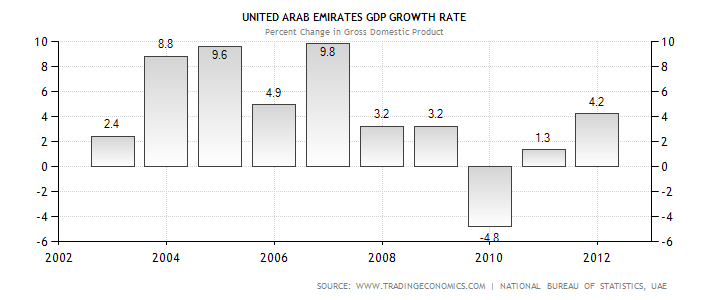

Over the past four years, UAE’s GDP has experienced substantial growth. This is well illustrated by the graph below. The country’s GDP experienced a constant growth with a margin of 3.2% between 2008 and 2009 despite the global economic recession. However, in 2010, the country’s GDP decline to -4.8% as a result of rise in oil prices which is one of the major components of the country’s GDP. In 2011, the UAE’s GDP expanded significantly to settle at 1.3% which represents a growth with a margin of 6.1% (Trading Economics “United Arabs Emirates GDP growth rate” Para. 1).

In 2012, the country’s GDP growth was positive as illustrated by its expansion with a margin of 4.2%. The country’s GDP growth over the past few years illustrates that government’s commitment to restoring the country’s economic growth after the adverse effects of the economic recession. The country’s economic recovery from the adverse effects of the 2007/2008 economic recession has been enhanced by integration of economic stimulus package. In 2009, a stimulus package amounting to Dh 193.2 billion was implemented by the government in an effort to enhance the country’s economic recovery (Arnold para. 1).

The country’s effectiveness in enhancing its GDP has also emanated from its adoption of an open economic system, effective oil exploration, and adoption of economic diversification. The chart below illustrates the trend in the country’s GDP from 2002 to 2012. Predictably, the country will experience a positive GDP growth into the future (Economy Watch Para. 1-3).

Key performance indicators as on date

Interest Rate

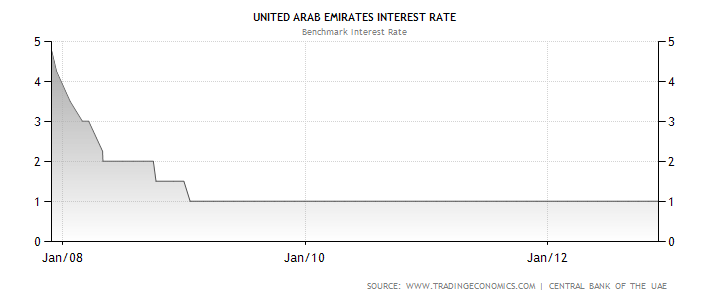

The UAE Central Bank carries the responsibility of regulating the country’s rate of interest. The Central Bank has managed to maintain a stable interest rate. From 2007 to 2012, the UAE’s interest rate averaged 1.4 per cent. However, in November 2007, the country experienced an increment in the rate of interest, which averaged 4.8 per cent while the interest rate in 2009 marked the lowest rate of interest rate at 1 per cent as illustrated by the chart below:

Unemployment rate

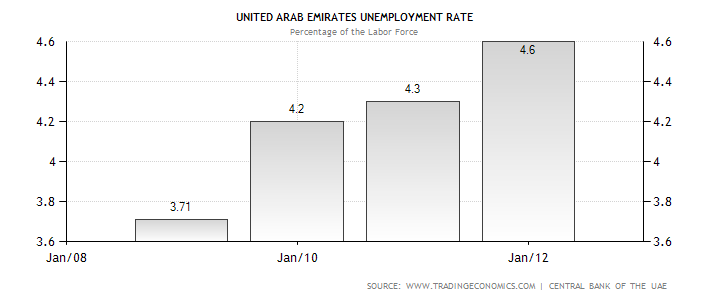

The UAE has a relatively low unemployment rate. From 1985 to 2011, the country’s average rate of unemployment was 3 per cent. However, the country has experienced a steady increment in the rate of unemployment over the past few years as illustrated by figure 3. In 2011, the UAE’s rate of unemployment increased to 4.6 per cent from 4.3 per cent in 2010. Its lowest rate of unemployment was 1.2 per cent in December 1985. During the period ranging between 2008 and 2012, the UAE experienced an increment in the rate of unemployment from 3.71 per cent to 4.6 per cent as illustrated by the graph below.

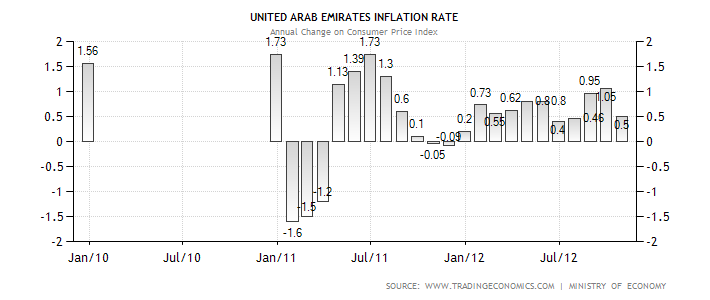

Inflation

The country has been experiencing fluctuations in the rate of inflation over the past few years. From 1990 to 2012, the country’s average rate of inflation amounted to 2.4 per cent. Currently, the UAE is experiencing a relatively low rate of inflation. Findings of a study released in October 2012 revealed that the country’s rate of inflation averaged 0.5 per cent. However, the country’s rate of inflation has been fluctuating over the past 4 years. For example, the UAE’s rate of inflation in 2008 was 12.3 per cent. On the other hand, the rate of inflation in 2009, 2010, and 2011 was 1.6 per cent, 0.9 per cent and 0.7 per cent respectively (Trading Economics “United Arabs Emirates GDP growth rate” Para.1). The chart below illustrates the changes in the country’s rate of inflation from 2010 to 2012.

The period ranging from 1991 to 2000 was characterised by mixed economic performance. However, the country’s general economic performance was positive as illustrated by various economic indicators. Firstly, its GDP increased from Dh 126.0 billion to Dh 19.5 billion. Additionally, its real GDP growth increased from 11.9 per cent to 6.9 per cent. The period also experienced an increment in oil production from 2.12 million barrels per day to 2.3 million barrels per day. During this period, the UAE government had adopted a fixed exchange rate regime. The government had pegged the exchange rate of the Dhiram against that of the dollar at 3.671, which greatly contributed towards ensuring stability in the country rate of exchange. The country’s total exports increased from Dh. 21.25 billion to Dh 32.28 billion while imports increased from Dh 5.09 billion to Dh 4 billion. During the period ranging from 2001-2007, the UAE experienced an increment in the volume of its exports from Dh 21.2 billion to Dh 63.3 billion.

Comparative benchmarks with other GCC countries

Foreign Direct Investment [FDI] is one of the major components of economic growth. One can evaluate a country’s economic growth by comparing the level of FDI inflows. The high rate of globalization coupled with the challenging global economic environment has made various countries to consider attracting FDI as one of the avenues for attaining high economic growth. Growth in FDI leads to increment in capital inflows hence promoting economic growth. Most GCC countries have been committed at attracting FDI over the past few years. The attractiveness to FDI varies across countries.

In the GCC region, Saudi Arabia is ranked as the most attractive foreign investment destination. The difference in the countries attractiveness to FDI has led to variance with regard to FDI inflows. The chart below illustrates a summary of FDI inflows in the GCC over the past few years. From the figure, it is evident that The UAE has had a strong performance with regard to FDI inflows compared to other GCC countries over the past decade (Hassan & AlYaqout 3).

The UAE has also had a substantial increment in the volume of outflows. One of the factors contributing to an increment in the volume of its outflow is the high rate at which the government is investing in the international market. State owned enterprises are the largest foreign investors in the UAE. A report released in 2011 showed that the UAE’s FDI outflows were more than $15.8 billion. Compared with other GCC countries, Kuwait follows with regard to FDI outflows. In 2011, Kuwait’s total FDI outflows amounted to $8.5 billion. The large size of Kuwait’s FDI outflow is due to the acquisition of major firms such as the Jordan Kuwait Bank by Burgan Bank. Acquisition of IRAQNA Company by Zain Group in Iraq is also another reason explaining the large outflow

Comparative benchmark outside GCC

Different economies such as China, Hong Kong and Iran have experienced varying GDP growth over the past decade. For example during the period ranging from 1990 to 1995, China, Hong Kong and Iran experienced a GDP growth rate of 11.6%, 5.1% and 3.7% respectively compared to UAE’s which averaged 3.6%. This trend continued during the period ranging from 2000 to 2010. During this period China, Hong Kong and Iran experienced a GDP growth rate of 10%, 4% and 6% respectively compared to UAE’s which was 4.3%. This illustrates that the rate of UAE’s economic growth was relatively slow compared to these countries (‘Asian Productivity Organization’ 29).

Central bank of UAE

The UAE Central Bank was established in 1973. It operates as a non-corporate entity with the UAE government as the major shareholder. The bank carries a number of responsibilities aimed at promoting the country’s economic growth. Some of its responsibilities include maintaining price stability, regulating the rate of interest, and ensuring a low rate of inflation.

Outlook for the future

The UAE has experienced a significant increment in the size of its population over the past decade. Its population growth has increased to 8.3 million according to official estimates that were released in 2011. The country’s population can be described as male-deviated because 75 per cent of the country’s total population entails males while females account for the remaining 25 per cent of the total population. Male expatriates also constitute the largest proportion of the country’s population compared to female expatriates. Considering the high rate of globalization, improvement in the country’s health care system and its economic growth, it is expected that the country will experience an increment in its total population in the future. Growth in the size of population is one of the aspects that enhance a country’s economic growth due to increment in the volume of consumption hence stimulating GDP growth.

UAE’s economic environment looks promising. This is illustrated by the prospected growth in various economic sectors. The country’s economic growth revolves on a number of economic sectors. The country’s economic sectors fall in two categories, viz. oil based and non-oil based sectors. The main non-oil based sectors include oil and natural gas, industries and manufacturing, construction, tourism, and financial services. Most UAE federations have appreciated the importance of diversifying their economic sectors and thus they not only rely on hydrocarbons (KAMCO Research 7). Economic diversification is one of the reasons that explain why the UAE will undergo a high rate of economic growth in the coming years.

The oil and natural gas is one of the economic sectors that will stimulate the country’s economic growth, a large proportion of the UAE’s economy is dominated by gas and oil. The large oil reserves will enable the country to meet most of its domestic and international demands. Currently, it is estimated that the sector accounts for more than 30 per cent of the country’s GDP (KAMCO Research 7).

Approximately, Abu Dhabi oil accounts for approximately 96.2 per cent of the country’s oil GDP component. Other sectors that contribute to the country’s oil GDP include Sharjah and Dubai. Despite the sector’s contribution to the economy, one of the major challenges expected to be experienced relates to high oil prices. The periodic increment in oil prices is leading to a decline in the volume of export from the sector, which is culminating in a decline in the country’s GDP (KAMCO Research 7). Despite the fluctuation in global oil prices, the enormous oil and natural gas reserves in the country presents an opportunity for the sector’s dominance in the country’s GDP growth continuing into the future.

Despite the positive outlook in the oil and natural gas sector, there are a number of uncertainties clouding the sectors economic growth. Firstly, the prevailing geopolitical risks in the Arab countries have led to significant disruptions in the distribution of oil and nature gas in the GCC region. Secondly, the escalation of the sovereign debt crisis in the European region is expected to negatively impact the country’s oil and natural gas sector due to existence of financial and trade linkages (Gulf Cooperation Council 8). This will reduce the country’s oil export revenues.

The financial services sector has also played a significant role in the country’s economic growth. In 2007, the financial services sector accounted for 7.1 per cent of the country’s GDP. Abu Dhabi and Dubai account for the largest proportion of the country’s financial sector. The 2007 economic recession adversely affected the performance of the financial sector. One of the ways through which this aspect occurred due to constrains in the sector’s profitability. Consequently, the citizens could not easily access credit facilities. Over the past few years, the financial sector contribution to the country’s GDP has continued to increase. For example from 2005 to 2008, the sector’s contribution increased from 38.7 per cent to 41.4 per cent (KAMCO Research 7).

The industry and manufacturing sector have also been significant to the country’s economic growth. Some of the major industries established in the country include construction, power, manufacturing, and mining. The manufacturing sector contribution to the country’s GDP amounts to approximately 12 per cent. The industries and manufacturing economic sectors provide a substantial amount of employment to the country’s citizens. The main industries in the UAE include aluminium, steel, cement, and fertilizer. Due to the high degree of correlation between oil and gas and the heavy manufacturing industries, most of these industries are located in Jabal az Zannah-Ar Runways industrial zone and Jabal Ali Free Zone (Library of Congress 6).

The tourism sector will also promote the country’s economic growth. In the 21st century, most of UAE’s cities are increasingly being regarded as ‘future cities’. The high rate of growth in the country’s real estate sector explains the elevation of most UAE’s cities into future cities. The country hosts the tallest hotel in the World. Over the past few years, growth in tourism has led to the sector’s revenue exceeding those of the oil sector. The country has approximately 302 classic hotels that host visitors from different countries. Some of the factors that have led to an increment in the number of tourists visiting the UAE include the expansive and attractive beaches, shopping, luxurious accommodations, and nightlife. The country has a coastline that extends for 1,318 kilometres (Library of Congress 7). During its 2011 fiscal year, the tourism sector contributed 31 per cent of the country’s GDP (Rai Para. 1). The high rate at which the country is investing in infrastructure development presents a high opportunity for tourism growth.

Due to the UAE’s government commitment in creating a better and stable investment climate, the country has experienced significant growth in investment flows. In 2011, the country’s FDI inflow was more than $75 billion. Consequently, it ranked second in the Arab world with regard to attractiveness to foreign investors. This trend is expected to continue into the future hence increasing the probability of future growth.

The UAE has consistently derived 70 per cent of its revenue from oil and natural gas (Arnold Para. 2). Consequently, fluctuations in global oil prices have significantly affected its revenue. The rise in demand for oil during the period ranging “between 2003 and 2005 led to the country experiencing a budget surplus of $ 10.7 billion” (Ministry of Economy 9). This trend was sustainable in 2007 whereby its budget surplus increased to 18.8 billion. However, the 2008 economic recession led to a decline in budget surplus as government invested in various stimulus programs aimed at promoting economic growth. However, given the increased economic growth, through investment in other non-oil sectors such as tourism, construction, trade, and manufacturing, the country will probably continue to experience an improvement in its budget surplus. In 2012, predictably, the budget surplus will increase to $ 12.5 billion (Ministry of Economy 11).

The UAE’s economy is greatly dependent on foreign trade with specific reference to oil. The country exports most of its oil to the US, China, India, Iran, and Germany. Services also constitute a significant proportion of the country’s trade. From 2009 to 2011, total commodity and services trade increased with a margin of 13 per cent to settle at Dh 1340 billion. The country’s trade with these countries account for 40 per cent of the country’s total trade (KAMCO Research 21). Adoption of the open economy system of government will increase the probability of the country’s growth in foreign trade hence increasing its foreign exchange reserves.

Financial institutions in the UAE form part of the most important economic sectors. The growth in the financial sector over the past five years has contributed towards increment in credit availability to investors (KAMCO Research 21). Due to the growth in the sector, it has become possible for real estate, construction, and other international trade investors to source for credit finance from banks. However, the effects of the 2008 economic recession slowed credit growth in the country. However, the trend reversed in 2010 despite the growth being sluggish. Over the past five years, financial institutions in the UAE have experienced a significant improvement in their capitalisation. Consequently, it has managed to deal with challenges emanating from the private and public sectors. The country’s banking sector from 2008 has become healthier as evidenced by the considerable growth experienced (KAMCO Research 21).

Despite the OPEC quota, oil production in the UAE is expected to grow. In an effort to stimulate the country’s economic growth, the UAE government has become aggressive in spending, with the objective of reversing the adverse effects of the recent global economic recession. Since the inception of the global recession, the government spending has increased with a margin of 6 per cent to 10 per cent. Some of the areas in which the government has become concentrated its spending on include infrastructure, subsidies, and job creation (Haque 5).

The private sector in the UAE ranks as the most susceptible to global developments (Haque 5), which arises from the country’s attractiveness and openness to international trade and its diversified economy. Additionally, the country is greatly dependent on global capital markets in sourcing finances and has high debt levels. Consequently, the private sector is likely to be affected by development from other trading partners such as China, India, and other Asian countries. From 2008 to 2009, private sector growth in the UAE declined significantly (Haque 5). In a bid to deal with this challenge, the UAE government should formulate policies aimed at stimulating growth both in the private and public sectors. One of the ways through which the government can achieve this goal is by implementing fiscal and monetary policies that contribute towards private and public sector growth.

Observations

The prospected growth in various economic sectors is an indicator that the country will experience significant economic growth and development. The growth and development will arise from the government’s commitment to promoting international trade through integration of an open economic system and implementation of effective fiscal and monetary policies. The consequential effects will be improvement in the citizen’s living standards.

Suggestions to improve the economic performance

In a bid to promote the country’s economic growth, it is vital for the UAE’s government to take into account the following issues.

- In the wake of the economic recessions emanating from the international market, it is important for the UAE’s government to incorporate strategies that will limit the adverse effects because of contagion.

- UAE’s government should continuously conduct economic analysis to determine the country’s economic state and its prospects of attaining its economic development goals.

- The government should focus on promoting price stability, reducing the rate of unemployment, promoting economic growth, and ensuring a stable rate of interest. To achieve this, effective fiscal and monetary policies should be developed.

Conclusion

The UAE’s economy has undergone significant economic growth and development over the past two decades. One of the factors that have contributed to the country’s economic growth is adoption of an open economic system and economic diversification. The open economic system has enabled the country to attract capital inflows in the form of FDI. On the other hand, the country’s diversification strategy has reduced its overreliance on oil and gas as the main source of government revenue. In a bid to stimulate the country’s future economic growth further, it is paramount for the government to formulate effective monetary and fiscal policies. Additionally, it should focus on diversifying its economy in order to enhance economic development and growth.

Works Cited

Abu Dhabi Council for Economic Development 2012, Abu Dhabi’s economic performance in the last 10 years. Web.

Asian Productivity Organization 2012, APO Productivity Databook. Web.

Arnold, Tom. UAE economy to post 3% growth, 2009. Web.

Arnold, Tom. UAE budget surplus set to triple. 2010. Web.

Azzam, Henry, Arab world facing the challenge of the new millennium, I.B Tauris, London, 2008. Print.

Central Intelligence Agency. United Arabs Emirate. 2011. Web.

Economy Watch. United Arabs Emirates, the economic statistics and indicators, 2012. Web.

Gulf Cooperation Council. Annual meeting of ministers of Finance and Central Bank Governors. 2012.

Hassan, Faisal, and Turki Alyaqout 2010, FDI in the GCC; Saudi and the UAE attracting lions share. Web.

Haque, Khatija. Research from Emirates NBD: GCC outlook 2012, 2012. Web.

KAMCO Research 2011, United Arab Emirates, economic brief and outlook. Web.

Library of Congress 2007, Country profile. UAE. Web.

Mankiw, Gregory, Principles of macroeconomics. Mason, OH: Cengage Learning, 2009. Print.

Ministry of Economy 2011, Annual economic report. Web.

National Bureau of Statistics 2009, Analytical report on social and economic dimensions in the UAE. Web.

Rai, Bindu. Tourism contributes 31% of Dubai’s GDP. 2012. Web.

Shihab, Mohamed 2009, Economic development in the UAE. Web.

Trading Economics. United Arabs Emirates GDP growth rate. 2012. Web.

Trading Economics. United Arabs Emirates interest rate. 2012. Web.

Trading Economics. United Arabs Emirates unemployment rate. Web.