Introduction

Mishkin (2007) advanced an argument that upside risks refer to the level at which the value of a security or any other specified capital investment rises past the forecasted value of the security. In addition, Myers and Nicholas (1984) proposed that upside risks denote opportunities and potential to gain from securities due to an increase in the value of the security. Myers and Nicholas (1984) identified three levels of upside risks based on probability namely high upside risks, medium upside risks, and low upside risks. Diamond (1984) further claimed in financial intermediation and delegation monitoring that downside risks imply likelihood or probability of a loss as opposed to gain from the value of the security. Contrary, Krishnamurthy (2008) in financial meltdown claims the potential to gain from upside risks of a security is not guaranteed.

Goals and objectives

This essay reports on the impacts of upside risks based on Lehman Brothers Company by identifying the role played by different upside risks.

Capital market liberalization as financial innovation

Stiglitz (2008b) claims GFC negative outcomes were elevated by capital market liberalization that was perceived as a form of financial market innovation before the crisis. Capital market liberalization as applied by the Lehman brothers presented an upside risk due to its lack of regulation. Consequently, the GFC could be attributed to internal systemic deficiencies. As a result, any effort to bring down the perceived innovation was “argued against from suppressing the financial innovation”.

The value of the capital market liberalization was not included in the financial institution’s net leverage which impacted the institution’s credit rating. The financial institutions rejected claims that “they should face regulations” to reduce opportunities for a financial crisis by failing to determine negative impacts of “anti-trust measures”. Stiglitz (2008a, 2008b, 2008c) has argued that although capital market liberalization was financial innovation “it was not in the ways that could have made the economy stronger”. Based on Patel (2010) GFC should not have occurred if organizations implemented appropriate financial control instruments through planned change.

The problems of capital market liberalizations could not support continuity of economic growth hence organizational management strategies failed to provide a rationale for mitigating risks of GFC. Rothwell et al (2009) advanced an argument that GFC as a systemic problem questioned structures for global competition and organizational framework for managing “collective mindset towards change management” (p.47).

Stiglitz (2008a) and Stiglitz (2008c) claim the Global Financial Crisis (GFC) that began in the USA and resulted in the collapse of the investment banking industry for instance Lehman Brothers and spread into financial institutions globally was a litmus test of organizational strategic tolerance towards managing systemic change. GFC (Gould, 2008) created an environment for the international financial crisis, increased demand for market analysis and transparency, structures for global capital flows and their influence on liquidity and demand for internal environment communication framework towards financial stability and creation of sustainable people value.

Market fundamentalism as a driver of the GFC fueled subprime crisis through financial instruments for instance securitization (Appel, 2009). Securitization resulted in a scenario where banks and financial institutions pooled credit facilities like loans into sellable assets. This created an environment where the financial institutions began to off-load risky loans into other financial institutions. The concept to off-load loans was an opportunity and financial innovation but it resulted in the build-up of inventory and non-performing loans which predisposed liquidity problems (Krishnamurphy, 2008). The financial institutions, by the presence of non-performing loans, borrowed more money by using non-performing capital as securities (Patel, 2010). The borrowing of funds by financial institutions was meant to stabilize securitization.

Financial institutions didn’t determine the risk profile of savers because they had a position to borrow or engage in inter-bank lending to sell off-loaded loans as securities. For instance, investment banks like Lehman Brothers engaged in mortgages with the objective interest of securitizing and making sales out of the risky loans. Increased credit facilities through securitization loans affected liquidity and decreased operating capital (Dell’Ariccia et al, 2008).

Securitization as a core competency and planned change management exhausted higher markets for investment which resulted in the exploitation of riskier markets like subprime markets. The increasing demand from the housing markets or corresponding housing bubble lessened risks perceived to be associated with subprime markets. Due to the prevalence of non-performing loans and corresponding re-acquisition of collateral through repositioning of high valued property, the liquidity of the financial institution decreased (Krugman, 2008a).

There were increasing inter-bank security purchases which further created an environment for Collateralized Debt obligations (CDO) as a form of spreading the financial risks. The emergence of CDO fueled investment banking through buying, selling, and trading risks which decreased capabilities for control and management (Traill, 2008). This created risk exposures and resulted in an investment crisis of confidence.

Upside risks as an outcome of managing risks through creating risks

It could be argued that GFC arose from the need to manage risk through the creation of risks. Securitization was adopted towards risk management although the framework didn’t adopt measures towards risk management like insurance of the risks that could have resulted in the transfer of the risk to a third party. Still, this could have predisposed counterparty credit risks which could further have fueled the downturn. Securitization was a legitimate risk management strategy (Gould, 2008).

Hedge funds and other forms of financial investments were confident that securitization and capital market liberalization was a better option for capital creation compared to insurance. Securitization was preferred as a method of risk mitigation while making effectively capital growth.

This resulted in a scenario where risk was spread (Agazzi, 2010). The problem arose due to market s[speculation on the sustainability of hedge funds and credit default swaps as financial legitimate instruments. This affected multinational companies that AIG that had credit default swaps amounting to over USD 400 billion hence financial industries suffered increasing risk exposures at the expense of decreasing regulations. The degree of mortgage credit default swaps determined if the company exit market or continued operations.

Structured products as upside risks

Krishnamurthy (2008) argues that Lehman Brothers insolvency provided upside risk of the need for determination of mechanism through which different investment banking products performed through cost-benefit analysis and determination of appropriate tradeoffs that ought to be made before investing. The crisis provided an opportunity for evaluating the profitability of structured products of investment banking (Stiglitz, 2008c).

The economic value of structured products of investments results from the market performance of underlying assets that may include varieties like stock or market index. The crisis, therefore, provided upside risks of evaluating investment returns as a function of capital preservation or capabilities for returns. As a result, the crisis that resulted in the insolvency of the Lehman brothers provided an environment for investors to evaluate the long-term impacts of their investments and determine if they could avoid structured products or not (Chang, 2009).

The crisis demonstrated that structured products of investment banking create value for providers as opposed to the investors. Thus, securitization as an investment could not be structured on the need to attract capital to market the investment product to be risk-free on the capital. The crisis provided upside risk to investors by demonstrating the increasing need to invest in low-cost products.

Pay for performance as an upside risk

Acharya and Phillipp (2009) claim the collapse of the Lehman brothers was subject to upside risks that had a linear relationship with executive pay. The shareholders were satisfied with Dick Fuld’s performance and awarded the CEO unreasonably high pay. Before the 2008 GFC, Dick’s pay was above the alignment zone for a CEO that creating an upside risk. Korobkin (2003) proposed that the alignment zone for executive compensation determines if CEO compensation is “reasonable compared to other industries in the market” and if it is a function of other secondary factors for instance sensitivity to performance subject to Total Shareholder Returns (TSR).

Gillette (2009) advanced an argument that Lehman’s compensation was a function of “sensitivity of performance”. The payment of Fuld was subject to the moderate performance of Lehman relative to other competitors in the industry. The upside risk qualified to be enriched about Fuld’s compensation. Fuld’s is documented to have restricted stock awards for sustainable performance subject to the realization of minimal financial hurdles relative to other market players. This implies Lehman Brothers was subjected to increasingly high upside opportunities while maintaining minimal loss on the downside risks that didn’t conform to standards of pay-for-performance.

This didn’t present a winning formula for sustainability and the creation of value to the shareholders (Patel, 2010). Shareholders were not in a position to identify the contribution of upside risk of unreasonably high compensation because they were satisfied with the results. The loss of liquidity of Lehman Brothers provided an opportunity for the shareholders to understand the role that Fuld’s pay contributed in the loss of liquidity and demand for reforms to standardize the compensation structure.

Due to a lack of alignment of the CEO compensation to market standards or to Total Shareholder Returns over a specified duration of time, Lehman Brothers Executive compensation provided an opportunity for upside risks. Traill (2008) indicated that financial organizations that demonstrated alignment of executive pay with TSR had the higher capability to survive impacts of GFC. Equity-based compensations tend to contribute to loss of liquidity and predispose crisis of confidence in the long term.

This arises due to failure to misalign shareholders’ interests. Acharya et al (2008) posed an argument that equity-based compensations have been employed as a form of executive motivation to reduce opportunities for failure. Equity-based performance as an upside risk reduces the capability to control and manage risks in the long term. Chang (2009) similarly noted that upside risks ought to be managed through sensitivity to a performance by claiming that compensation ought to be “reasonable relative to financial company standards for performance payment”.

Upside risk of a stock market index

Lehman Brothers investment presented an upside risk characterized by benefits of protecting the investor through the stock market index and utility of uptick rule where stocks could be sold when prices were rising (Choi, 2000). Capital market liberalization was characterized by a product whose minimum returns were equivalent to the original investment. This included returns attached to the performance of the product through stock market indexing (Langevoort, 1996).

The security of investment was such that a drop in the stock market index resulted in investors getting their original investment but an increase in the stock market index created an opportunity where an investor would gain from growths which resulted in gain through the cost of the capital guarantee. This form of investment was however not regulated as well as independent investment banks and hedge funds which created an opportunity for liquidity crisis as GFC impacts spread (Krugman, 2008b).

The upside risk of securitization

Krishnamurthy (2008) documented that Lehman Brothers collapsed due to upside risks that were predisposed by the asymmetry of the risk-reward ratio. The Lehman Brothers risk-reward ratio was short in the stock market. A long risk-reward ratio is characterized by the capability to own stock while a short risk-reward ratio implied the inability to own a stock hence is characterized by sales of stock that a company doesn’t own (Gillette, 2009).

Lehman Brothers had a long risk-reward ratio that had resulted in the post-acquisition of five companies that invested in a mortgage. After the fourth quarter of 2006, Lehman Brothers’ risk-reward ratio decreased due to loss of liquidity. Before 2006, the impact of the risk-reward being short influenced in creating unlimited potential on upside risks as well as decreasing exposure to the downside risks (Morris & Hyun, 2008).

As liquidity loss increased, the risk-reward ratio created an opportunity for limited potential and created an opportunity for unlimited exposure to risks. The upside risks of asymmetry arise from loss of long position which decreases organizational risk exposure. At the same time, a short position augments risk exposure. The asymmetry plays a vital role in reducing opportunities of engaging in short selling of stocks (Dell’Ariccia et al, 2008). Lehman Brothers’ upside risks were shorted by the use of credit default swaps that were subject to investment in credit default swaps that provided an opportunity for shorting bonds and stocks.

The upside risk brought about by asymmetry of risk-rewards had opportunities that were indirect in that the capability to go short on stocks and bonds could create an environment where CDS contracts had decreased risk exposure and an economic gain characterized by the unlimited potential for profitability. Contrary engagement in sales of CDS had threats of downside risk where profitability was limited and constrained and risk exposures were unlimited (Dwyer et al, 2010).

This creates a market environment that breeds speculation on the short side and creates opportunities for downward pressures on shorting on stocks and bonds. Lehman Brothers priced CDS as warrants which resulted in a condition where investors purchased them without understanding risks of default but with expectations that the CDS would in the long run appreciate.

The securitization gains a competitive advantage from the exp0loutration of investor confidence and trust. Thus upside risks are self-validating which resulted in Lehman Brothers liquidity being affected by shorting of stocks (Bohn et al, 2005).

Engagement in CDS and shorting of stocks complemented each other but unlimited shorting and its unlimited risk exposures created an opportunity for loss of liquidity when the uptick rule was implemented on short stocks through recommendations that short selling could be carried out when the prices were increasing. Diversification of risks by Lehman Brothers through the acquisition of companies that engaged in mortgage investment and securitization didn’t add up into the economic added value of diversification which increased downside risk exposures (Krishnamurphy, 2008). This created opportunity where the diversification brought down the Lehman brother’s investment.

Upside risks of the uptick rule

Implementation of uptick rule played a leading role towards liquidity crisis of Lehman brothers hence predisposed downside risks (Archarya & Phillipp, 2009). If the uptick rule was applied, Lehman Brothers would have sold its depreciating stocks to reduce the liquidity crisis. However, the asset bubble could have taken a different course by providing an environment for the competitiveness of Lehman Brothers (Archarya & Matthew, 2009). The long-term impact would have a gradual decrease of asset bubble which could have acted as a shock absorber for the GFC. The economic benefit of short-selling however is based on the capability to achieve continuity and resilience due to the self-validation capacity of short on bonds. This however required control and regulation.

Upside risks of credit contraction

The collapse of Lehman Brothers provided an opportunity for managing threats associated with asset-bubble that resulted in credit contraction and mandatory liquidation of assets. As a result of loss of liquidity, Myers and Nicholas (1984) claim, results into the accumulation of debts that has the potential to predispose economic downturn. As a result, financial institutions could manage threats associated with asset bubbles through the increase of reserves to reduce opportunities for credit contraction (Patel, 2010). This further demands adoption of macroeconomic policies that could contribute to the management of inflation and increasing coordination of financial institutions towards managing threats of the unregulated capital market.

Upside risks of inflation

Lehman Brothers gained competitive liquidity from upside risks associated with inflation which resulted in increased economic growth which was subject to increased investor confidence and trust and diversification (Mishkin, 1991). Increased financial channels provided the foundation for economic gain. As a result, Lehman Brothers’ profitability increased at a high rate which was fueled by increasing domestic demand. The strength of the US dollar and increasing portfolio management, although creating upside risk opportunities, also had downside risk through the creation of downward pressures on inflation (Meza, 2008).

The upside risks of inflation could have formed the basis for economic recovery post-GFC. However, the recovery could have been delayed by downward pressures subject to the low self-sustaining capacity of private demand. Upside risks played a leading role towards the capability of Lehman Brothers to manage the flow of credit as a function of aggregate demand which satisfied the Keynesian theory of economics (Gillette, 2009). The upside risks as a function of inflation were affected by Lehman Brothers shadow bank default.

Upside risks and inter-connectedness of financial systems

Lehman Brothers’ risk management capabilities were affected by upside risks arising from her inter-connected financial systems (Dwyer et al, 2010). This created a scenario where Lehman Brothers exposed herself to implied quantification of credit risks via her credit default swaps spreads. According to the Merton Model approach, the Lehman brothers got exposed to increasing correlations between credit risks and market risks which further created an environment for increasing crisis of investor confidence.

This demanded strategic management of the crisis of confidence which under low liquidity forced Lehman brothers to engage in increasing risk talking management of risk through taking risks (Traill, 2008). This was however in line with Lehman financial system architecture. However, mathematical modeling of the risk structure was not sufficient which affected the capability to maintain equilibrium between credit risk and market risks. Lehman Brothers investment banking was subject to inadequate risk assessment and management which was brought about by inadequate disclosure requirements.

As a result of deficiencies in disclosure, the case of Lehman Brothers and other financial institutions that collapsed post-GFC were characterized by common equity that had decreased to levels that the financial institutions could not absorb any short-term loss of liquidity (Appel, 2009). This has further created an upside risk for the application of Basel III regulations that demand financial institutions to increase their common equity to at least 4.5%. The case of the Lehman brothers also provided an opportunity for the adoption of a leverage ratio that has the effect of abandonment of net leverage as was used by the Lehman brothers before the 2008 GFC (Chang, 2009). The standards of Basel III as an upside risk demand financial institutions to account for all assets owned.

Upside risks and counter cyclical capital relationships

The capability to manage threats of unregulated market as observed in 2008 GFC with regard to Lehman Brothers demands managing influence of counter-cyclical capital through creation of buffers to absorb shocks resulting from asset bubble (Mishkin, 2007). The capacity of a financial institution to create financial buffers through counter-cyclical capital creates environment of stable economic patterns that decrease probability of volatility and negative impacts of economic downturn (Morris & Hyun, 2008). The Lehman Brothers case presented upside risk for increasing demand to keep economic bubbles under check.

Upside risks and counterparty credit risk relationship

The Lehman Brothers insolvency was catalyzed by increasing counterparty credit risks. In order to manage threat of asset bubble in investment banking, there is increasing demands for adoption of measures that could contribute into reduction of counterparty credit risk amongst the financial institutions (Archarya et al, 2008).

The upside risks associated with counterparty credit risks include increased liquidity in investments which also predispose a downside risks when one party suffers risk exposures which affects the entire industry due to influence of counterparty credit risk. This implies financial institutions ought to develop and implement strategies that could reduce threats associated with counterparty credit risks through capacity to settle debts and hence gain value for probability of common equities. This has further demanded increased internal control and reporting (Archarya & Matthew, 2009). This further demands implementation of unified approach to counterparty credit risk management.

Upside risks relationship with quantitative liquidity ratios

The 2008 GFC provided opportunity to determine relationship between upside risks and quantitative liquidity ratios (Agazzi, 2010). The GFC provided opportunity where financial institutions needed to identify strategies fro managing portfolio in order to ensure the financial institutions liquidity was sufficient to hedge against any economic recession. Thus, the financial crisis provided basis for financial institutions to conduct ongoing liquidity stress testing. This demands data integration across various players in the industry to identify threats to economic recession (Diamond, 1984). The financial crisis therefore provided environment for financial institutions to determine their business integration capabilities through capabilities to share data.

Categorization of stress-events as upside risks

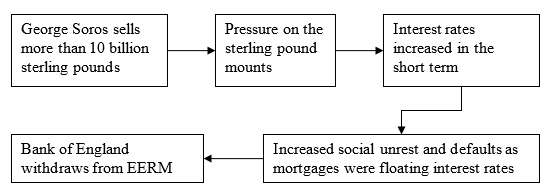

Morris and Hyun (2008) identified that classification of stress-event factors impacts on upside risks management capabilities. Classification of industry stress factors for instance push factors or pull factors for economic downturns, market-risk events, and variability of liquidity conditions influences level a financial industry tolerates financial stress. The increasing high returns on Lehman brothers before crisis is indicator of Lehman Brothers stress intolerance. Similar trend was evident in England as example of impacts of stress testing (Krishnamurphy, 2008). In September 1992, a fund that was owned by George Soros sold more than ten billion Sterling Pounds, an event that had impact of making Bank of England to withdraw from European Exchange Rate Mechanism (EERM) and whose secondary outcome included devaluation of sterling pound.

Managing upside risks

Krugman (2008a) and (2008b) advanced an argument that upside risks should be managed through determination of vulnerability analysis. The organization ought to identify holistic approaches that could be used to reduce risk exposures based on assessed risk profile. Organization should conduct internal rating based on inventory status of the company, adequacy of capital to finance investments, ability of the company to raise resources independently, quality of assets to manage sustainability threat of investor crisis of confidence, quality of management on the assets, quality of the earning as a function of upside risks and health of organizational liquidity.

The organization ought to identify rationale for adjusting economic analysis to conform to standards and accounting best practices (Meza, 2008). The organization ought to conduct ongoing financial forecasts to identify opportunities for risks by using through-the-normal business cycle and through-the-cycle-stressed scenarios. The organization should ensure its risk assessment and appraisal identifies upside risks presented by risks of interest rate, threats of credit risks, liquidity risks and operational risks which should be governed by implementation of sovereign ceiling analysis. This has capability to identify slips in organizational financial fundamentals that could affect business sustainability (Korobkin, 2003).

Managing executive compensation to balance downside and upside risks

Mishkin (2007) determined that organizations ought to balance upside and downside risks through adoption of a compensation structure that rewards pay-for-performance, leverage and risk orientation. The pay-for-performance should be reasonable. Agazzi (2010) claimed markets fail to regulate themselves hence need for statutory regulations and adoption of a performance-adjusted-compensation that satisfies alignment zone for executive compensations.

Compensation should be commensurate of organizational financial size, industry specification and performance that is delivered by executives. The financial industry needs to review measures of executive performance when developing their executive incentive plans through adoption of absolute and relative components in order to arrive at package for executive pay. Dwyer et al (2010) advanced an argument that executive compensation should be based on organizational Returns On Investment (ROI) over four years, use of Total Shareholder Returns (TSR) and Pre-tax profit measures for a period of four years.

Other authors for instance Krishnamurthy (2008) proposed that executive compensation should be arrived at based on set goals for performance and performance milestones. Myers and Nicholas (1984) claimed that executive compensation should be a function of media market compensation levels. The rationale for compensation should be a function of projected future performance that have capacity to vary compensation above or below media market level. As a result, executive compensation should appropriately be leveraged in order to create sustainable value to the company, industry, economy and investors (Appel, 2009).

Conclusion

The essay achieved its goals and objectives by determining impacts of upside risks with regard to Lehman Brothers Company. The essay determine role played by different upside risks like executive compensation as a form of managing upside and downside risks, rationale managing risks through creation of risks impacts on inflation and depression, influence of capital market liberalization, structured products, stock market index, securitization as capital market liberalization, credit contraction, interconnectedness of financial systems thus predisposing counterparty cyclical capital and counterparty credit risks, influence of quantitative liquidity ratio, risk-reward ratio and stress-events and mechanism they create upside risks.

References

Acharya, Viral V., and Matthew Richardson, eds. (2009). Restoring Financial Stability: How to Repair a Failed System. New York University Stern School of Business/John Wiley & Sons.

Acharya, Viral V., and Philipp Schnabl. (2009). “Securitization without Risk Transfer: The Anatomy of Hidden Bank Debt.” Working Paper, New York University Stern School of Business.

Acharya, Viral V., Douglas Gale, and Tanju Yorulmazer. (2008). “Rollover Risk and Market Freezes.” Working Paper, New York University Stern School of Business.

Agazzi, Isolda (2010) Markets Can’t Self-Regulate; State Should Step In – UNCTAD, Inter Press Service. Web.

Appel, Adrianne(2009) Economy-US: Trillions to Banks as Taxpayers Left in the Dark, Inter Press Service. Web.

Bohn, Jeff, Arora Navneet and Korablev Irina, (2005) “Power and Level Validation of the EDF Credit Measure in the US Market”.

Chang, Ha-Joon (2009), Painting carmakers green; Developed nations are trying to get around WTO subsidy rules by portraying their industry bail-outs as green initiatives, The Guardian. Web.

Choi, Stephen J. (2000) “Regulating Investors Not Issuers: A Market-Based Proposal” 88 California Law Review, 280.

Clayton P. Gillette, (2009) “Standard Form Contracts” NYU Law and Economics Working Papers No 181.

Dell’Ariccia, Giovanni, Deniz Igan, and Luc Laeven. (2008). “Credit Booms and Lending Standards: Evidence from the Subprime Mortgage Market.” Working paper, International Monetary Fund.

Diamond, Douglas. (1984). “Financial Intermediation and Delegated Monitoring.” Review of Economic Studies 51:393-414.

Dwyer, Douglas, Zan Li, Shisheng Qu, Russell Heather and Zhang Jing, (2010) “CDS-implied EDF™ Credit Measures and Fair-value Spreads”.

Gould, Bryan (2008). Who voted for the markets? The economic crisis makes it plain: we surrendered power to wealthy elites and fatally undermined democracy, The Guardian.

Korobkin, Russell B. (2003). “Bounded Rationality, Standard Form Contracts, and Unconscionability” 70 University of Chicago Law Review 1203.

Krishnamurthy, Arvind. (2008). “The Financial Meltdown: Data and Diagnoses.” Working paper, Northwestern University.

Krugman, Paul (2008a). The Madoff Economy. New York Times, Opinion. Web.

Krugman, Paul (2008b). Bad anti-stimulus arguments. New York Times. Web.

Langevoort, Donald C. (1996). “Selling Hope, Selling Risk: Some Lessons for Law from Behavioral Economics about Stockbrokers and their Sophisticated Customers” 84 California Law Review 62.

Meza, David de Bernd Irlenbusch and Diane Reyniers, (2008). “Financial Capability: A Behavioural Economics Perspective”. FSA Consumer Research 69, p.15.

Mishkin, Frederic S. (1991). “Asymmetric Information and Financial Crises: A Historical Perspective,” in R. Glenn Hubbard, ed., Financial Markets and Financial Crises (Chicago: University of Chicago Press: Chicago): 69-108.

Mishkin, Frederic S. (2007). “Inflation Dynamics,” International Finance 10( 3): 317-334.

Morris, Stephen and Hyun Song Shin. (2008). “Financial Regulation in a System Context” Brookings Papers on Economic Activity (Fall): 229-274.

Myers, Stewart C. (1977). Determinants of Corporate Borrowing. Journal of Financial Economics 5(2): 147-75.

Myers, Stewart C., and Nicholas S. Majluf. (1984). “Corporate Financing and Investment Decisions when Firms Have Information Investors Do Not Have.” Journal of Financial Economics 13: 187-221.

Nicholas L. Georgakopoulos, (1996). “Why Should Disclosure Rules Subsidize Informed Traders?” 16 International Review of Law and Economics 417.

Patel, Raj (2010). Flaw: The Value of Nothing, (Picador), pp.4, 6-7. Web.

Stiglitz, Joseph (2008a) Good day for democracy; Now Congress must draw up a proposal in which costs are borne by those who created the problem, The Guardian. Web.

Stiglitz, Joseph (2008b) A crisis of confidence. The Guardian. Web.

Stiglitz, Joseph (2008c) Let’s throw away the rule book; Bretton Woods II must establish economic doctrines that work in emerging economies as well as in capitalism’s heartland, The Guardian. Web.

Traill, R.R. (2008). Problems with Economic Rationalism- Psychology, Green-issues, and Jobs, Melbourne: Ondwelle.