Introduction

This is an American multinational company that offers banking and financial services located in San Francisco, California. This company achieved its current state by merging with Norwest Corporation in 1998 and acquiring Wachovia in 2008. Wells Fargo was by then known as Wells Fargo and Company. It has branches in other 35 countries that serve its over 70 million customers located in different parts of the globe. It held a record of the world’s largest bank by market capitalization in 2013 with a value of $ 236 billion in assets and savings (Wells Fargo).

This bank did not change its name after it merged with Northwest Corporation because of the rich history associated with its name. In addition, it wanted to maintain its trademark as a stagecoach associated with its previous slogan that ensured it offered financial alternatives for its clients (Moody 56). Therefore, the decision to maintain its trade name and mark was an appositive one because it ensured its customers and new ones identified with it despite the merger and subsequent acquisition. This company was founded by Henry Wells William Fargo and John G. Stumpf is its current Chairman, President, and CEO.

Today, it specializes in consumer and corporate banking services that include the offering of credit cards, finance, and insurance, currency exchange, investment banking, mortgage, loans, private banking and equity, wealth and savings management. Its revenue is about US$ 83.78 billion, operating income US$32. 62 billion and total assets are valued at US$ 1.527 trillion (Moody 87). It has more than 264, 900 permanent employees working in its establishments located in different countries. These figures were obtained from a survey conducted in 2013 by Forbes Magazine.

The 2007-2010 financial crises that affected most financial institutions in America caused this company to be bailed out by the government. This intensified public scrutiny on its performance and led to the cancelation of an employee recognition event planned to take place in a Las Vegas casino. The public perceived this plan as a misuse of taxpayers’ money and thought that it was not wise to engage in issues that did not have positive impacts on its performance at the expense of huge expenses involved. Cases of racism rose regarding the practices of this company that exposed Black Americans and Latinos to high-risk subprime loans. Money laundering and lobbying, tax evasion, and divesting its dispositive holdings were serious scandals that put this company under intense pressure to publish its financial performance records.

Company Analysis

Wells Fargo has a reputable history and this has been a major strength that enabled it to attract clients from different regions. It is believed that the impeccable financial performance of this company is an indispensable tool that enables it to penetrate new markets and establish strong foundations without threats from other existing competitors (Chandler 45). It is necessary to explain that money is a very important resource in the world and thus people conduct extensive research before they make decisions regarding where to invest in.

Most investors do not remember that this company was bailed out of the financial crisis of 2007-2010 because their perception about it was influenced by its past impeccable performance records. Therefore, its history shows that it has vast experience in the banking sector and this becomes a major strength that helps it to continue to dominate local and international markets.

However, there are some weaknesses associated with this company and this may affect its performance in the future. First, financial analysts argue that this company was on the verge of collapsing during the economic crisis witnessed between 2007 and 2010. Notwithstanding, the government stepped in and helped it to manage the crisis and this means that it could not control the effects of inflation. This means that this bank has no effective policies that cushion it from the effects of the financial crisis; therefore, its performance is at stake and there is no guarantee that it can survive a financial crisis without the intervention of the government.

In addition, the 2009 lawsuit filed by Lisa Madigan exposed racial undertones in the policies of this company. This was a major blow that affected its performance in branches located in Africa and other continents that have developing nations (Fradkin 31). In addition, it disfigured the properly crafted image of this company after it emerged that its policies supported and channeled black Americans and Latinos to acquire high-cost subprime loans that were difficult to finance and that affected the saving of its victims. The case exposed the poor policies and ineffective management style that considered race an important aspect in determining the creditworthiness of customers.

The opportunities available for this company to expand and compete effectively with others are many and it is just a matter of time, money, and research to ensure it maximizes on them. First, the internal structure of this company helps managers in various branches to use their skills, experiences, and abilities to improve the performance of its company. This means that there are no stringent policies that regulate the decisions of its branches.

Therefore, managers should use these chances to ensure that they develop effective policies that will help them to accomplish their objectives (Griffin 69). In addition, managers of these branches are selected based on their nationalities and this means that they are in better positions to manage them because they understand the political, social, and economic cultures of their nations. In addition, this company has a huge capital base. This is an effective opportunity that should be used to conduct research and invest in modern technology to ensure it offers effective banking services to its clients.

In addition, the capital and huge income generated by this company can be used to reduce the interest rates on loans offered to its clients. Therefore, this will attract customers and ensure they do not have to struggle to repay their loans because they will have lower interest rates. It is necessary to explain that the managers of its branches are accustomed to the regulations that govern business activities in their locations.

The demand offered by clients in this sector is another opportunity that this company should utilize. People are shifting from traditional to modern business practices that involve the use of banking services offered. It is necessary to explain that the number of banks in developed and developing nations has increased significantly because of the huge demand for its products. Most people have realized the importance of saving money, investing in shares, and requesting bank loans and other financial services offered by banks (Eagle Traders).

Wells Fargo faces serious threats from two sections. First, it has to manage the threats posed by its competitors in offering banking services to clients (Griffin 93). Secondly, it must ensure that substitute services offered by other players should not affect its performance. There is no free market where competitors do not exist. The introduction and use of modern technology have improved the way people do things and enable them to acquire knowledge that helps them to offer quality products and services to clients. This has given rise to a high number of players in various fields. Wells Fargo faces stiff competition from two sections.

First, multinational companies that offer banking services to clients across the globe include Industrial and Commercial Bank of China, China Construction Bank, and HSBC Holdings among others offer stiff competition to this company. In addition, local banks located in all countries where this company has branches pose serious threats to the performance and success of Wells Fargo. This means that this company is surrounded by competitors in the international and local markets. Therefore, it has to develop effective marketing strategies and ensure it offers quality services to attract and retain its customers.

In addition, modern innovation has improved the use of online and mobile banking in all regions. This is a serious threat not only to Wells Fargo but also to all banking institutions. People no longer go to banks to deposit or withdraw their money because of the availability of mobile banking services. The need to improve the efficiency of money transfer services and ensure it takes the shortest time possible has pushed people to embrace mobile banking. In addition, the availability of this service all days of the week and at night motivates people to prefer it to physical banks. Therefore, Wells Fargo must be prepared to revolutionize its banking policies and practices to ensure it addresses the issues that motivate customers to seek mobile banking services.

Lastly, it is necessary to explain that this company faces serious problems when it comes to issues of financial performance. The recent economic crisis of 2007 exposed the inefficiencies of this company and the fact that the government was forced to bail it out of the inflation means that it is not stable. In addition, the price of its shares in the international market is not stable and this casts a dark shadow on its future. It is necessary to explain that most investors pay attention to the value of a company’s share in the international stock market and use it to determine its performance. Wells Fargo has a poor performance record and even though the government has intervened on several occasions to help it there is no hope that it can survive inflation. Therefore, the performance of this company is wanting and its clients will not risk investing in its shares if it does not take immediate measures to control the situation.

This company faces entry barriers in the international market and this means that it has a lot of work to do even it has already established its branches in some countries. First, the country of origin’s effects on the popularity of this company cannot be underestimated. The name of this company is exotic in most African and Asian countries and this means that efforts to market it in these regions will face stiff competition. It is necessary to explain that this company cannot change its name because this is its selling point. However, it should focus on establishing approaches that will ensure it does not face a lot of resistance when entering new markets.

People think that this is an autonomous company with unique policies because of its failure to involve the local community in its management. Most people believe that good companies should offer employment opportunities to the local communities to ensure they reduce the perceived psychic difference that affects the popularity and performance of multinational companies. It is necessary to explain that most multinational investors think that international trade is an easy task. The management of this company should understand that countries have different social, economic, and political cultures that must be respected.

Multinational companies should choose destinations for new entries wisely by ensuring that the planned markets have a lot of similarities with their countries of origin. However, Wells Fargo seems to have ignored this important procedure when investing in the international market. This explains that most of its branches located in Africa and Asia do not perform as well as those in America and Europe. In addition, this company should seek partnerships with those that have similar traditions and policies in foreign n countries.

The bargaining powers of suppliers are limited because the technology used in the banking industry evolves slower than in other sectors. It is necessary to explain that most banks take too long to embrace modern technologies because of the need to ensure their systems and policies do not violate their security protocols. Therefore, they take a lot of caution before they adopt the use of any new technology. In addition, the banking industry deals with money, which is a sensitive commodity; therefore, it is not easy to embrace and use any modern technology before evaluating its effectiveness in promoting the security and privacy of customers’ information and money.

The bargaining power of buyers is limited by the high-interest rates and long time for processing loans. This makes this bank to be unpopular, especially in developing nations. In addition, the management of this company does not have the necessary experience and ability to read the minds and needs of its customers. Therefore, the company develops products that become unpopular and causes losses.

Stock Evaluation

The 2007 financial crisis exposed banks to huge losses and their effects continue to be felt by some of them. The growth of Wells Fargo earnings has been very slow due to the fear of investors putting their money in shares. This company has registered consistent earnings growth even though it continues to trade at a very cheap valuation. However, its shareholders want to ensure that this company trades at a higher valuation than its current rate. The 1971 lowering of interest rates ensured more people borrowed money from this institution.

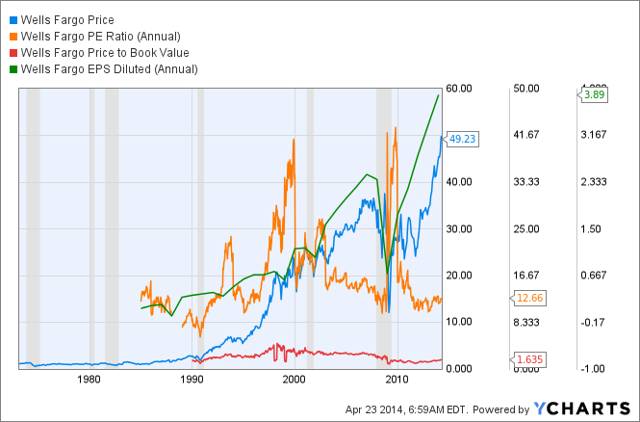

However, this decreased its earnings from the loans it offered. On the other hand, the economic growth rate since this time has been very slow and this bank is unable to balance its low earnings generated from interest rates yet the cost of servicing loans is high. However, Wells Fargo had experience in this field and this enabled it to be the brightest star in the banking group. The table below shows the stock evaluation for Wells Fargo compared with other companies from January 1st, 2013 to April 30th, 2014.

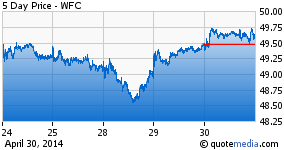

The figure below shows how the performance of Wells Fargo’s stock on the international market for a five-day period from April 24th-30th, 2014. The fluctuations in values shown are caused by mid-week trading activities that occur when traders invest in various stocks.

Wells Fargo registered the largest corporate offering on July 23rd, 2013 by an increase of 0.34% by placing $5 billion across four tranches. This included two-year senior bank notes and three-year notes at the senior holding companies that are considered to have low values. The reputation of this bank in the stock market has improved significantly and today investors are keen to expand their shareholding in this company.

The present value of its equity is 13.26 which represent a yield return increase of 2.08%. Its cost of capital was considered to be very low in 2009 and this was supported by Warren Buffet’s recent remarks that the dividends of this company are poor. This forced Wells Fargo to cut its dividend from $0.34 per share quarterly to $0.05 in 2009. However, the results that followed since 2010 to early this year shows that the dividend roared to $0.12, $0.22 to 0.30 per share in 2011, 2012 and 2013 respectively. This performance has enabled Wells Fargo to replace Coca-Cola as the largest holding company in Berkshire portfolio.

Wells Fargo has registered good performance in its shares that rose by $ 1.2 annually from 2011. The earnings on shares were $3.36, $3.48 and $ 3.53 in 2011, 2012 and 2013 respectively; therefore, there are high chances that it will hit $3.70 this year (2014). This means that investors will enjoy 32.5% earnings on their shares. This will have a major positive impact that will attract investors and decorate the public image of this company. The figure below shows the financial performance of this company that has enabled it to displace its competitors in the stock market.

Investment Opportunities

Money is an important commodity in the share sector because it determines the level of participation of an individual. In addition, it determines their returns because the higher an individual invests in the stock market the better the returns on his investment. The amount of cash required to invest in the share of Wells Fargo remained stable for the last one year at $0.30 per share. However, the recent result obtained from the New York Stock Exchange Market is currently quoted at $49.45 this is an increase of $0.17 that represents a 0.34% on the value of its share. The figure below shows the value of Wells Fargo shares recorded on April30th, 2014.

The future investment opportunities exhibited by this company are immense. This means that investors will have higher chances of reaping huge dividends from their investments. The stock market is stabilizing because governments established effective measures of managing the effects of the 2007 economic crisis. This means that the stock market is going to record improved performance and this company will not be left out. It is necessary to explain that this company has a bright future for investors because it has already registered improved performance in its last quarter that ended on January 28th, 2014.

In addition, Wells Fargo is known for its huge capital; therefore, its expansion plans through mergers and acquisitions will increase the number of shares offered to the public. The company’s financial performance has stabilized and this means that the existing low financial payout will soon be replaced by what its clients deserve. It is estimated that this company will earn $3.70 per share this year, which means that investors will enjoy a 32.5% earnings on their shares. The plans by the American government to bailout companies that were threatened by the 2007 economic crisis increased the number of shares floated by Wells Fargo.

This led to an increase in the number of shares held by its clients and this lowered its value in the stock market. Therefore, the company had to buy back stock to ensure the number of shares in the public’s hand is reduced. This is an effective way of ensuring that the value of its share is stabilized. An increase in stock shares in the market means that supply is higher than demand and this lowers its value. Therefore, Wells Fargo initiated a $24 billion capital return to investors through hiking dividends and an enormous share purchase program.

Recommendations

Wells Fargo offers an attractive investment opportunity for its workers and this means that there is going to be an influx of interested partners in the shares of this company. However, not everybody will have the opportunity of becoming its shareholder because this company has strict policies that will ensure it does not issue excess shares like it did after the 2007 economic crisis. Most people are apprehensive about the performance of this company in the stock market because of what it experienced in 2009. The downward trend of the value of its shares discouraged most investors from putting their money in this company.

However, the company has established effective mechanisms that will ensure the value of its share improves and stabilizes. This trend has been made possible by its recent plans to buy back shares and ensure there is stability of its value. Clients that thought they would never reap reasonable dividends can now smile because of the effectiveness of the measured established to ensure there are no excess shares in the market. Therefore, investors should not be reluctant to buy its shares because this company has a bright future.

The company forecasts a major revolution in the value of its shares. The recent financial statements show that the value of its share has maintained a stable digit in the last four quarters that ended on January 28th, 2014. This company has surpassed the performance of Coca-Cola in the stock market and thus. This shows that there is hope that this company will continue to be the only one with the most traded shares in the New York exchange market. The figure below shows the dividend forecast for the next four quarters. The company targets a median rate of 51.50 with a high estimate of 60.00 and a low estimate of 45.00. The statistics reflect a 3.75% increase from the previous 49.64 recorded in the previous year.

This company has bought-back shares from its investors several times even though the major one is set to take place in 2014 by its $24 billion capital return plan. This has predicted the company’s growth that will enable shareholders to get high dividends.

Works Cited

Chandler, Robert. Wells Fargo (CA) (Images of America). South Carolina: Arcadia Publishing. 2006. Print.

Eagle Traders. 2014. The Top 30 Banks in the World Based Ranked According to Market Capitalization in 2012. Web.

Fradkin, Peter. Stagecoach: Wells Fargo and the American West. New York: Free Press, 2010. Print.

Griffin, John. The Wells Fargo Express Series – Remington Colt – Volume 3 – The Texas Trail. New York: High Noon Press, 2014. Print.

Moody, Ryan. Wells Fargo. Nebraska: Bison Books, 2011. Print.

Wells Fargo. Wells Fargo, 2012. Web.