Introduction

In today’s economic environment, the growth of the role of pricing policy is primarily driven by two factors. First, depending on the market situation and the nature of the impact of the marketing environment, the enterprise can formulate a level of product prices, which will be able to obtain the planned amount of profit and to solve other strategic and tactical tasks. Secondly, as one of the effective means of winning the consumer in competition, the right or wrong pricing policy has a positive and negative impact on the whole process of sales in the market.

Products Review and Analysis

The conducted review of Joe’s strategy for the 2013-2016 years indicates that the prices for all three markets remained the same. In this case, Joe decided to hold the fixed costs at the same level, suggesting that such tactics will reduce expenses on product manufacturing.

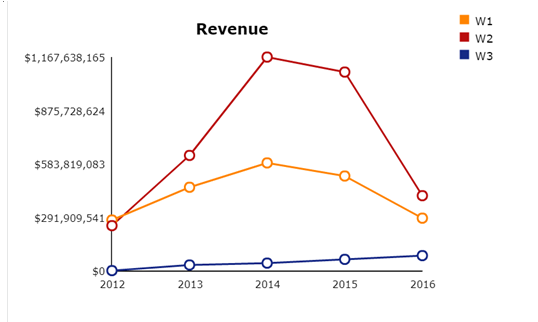

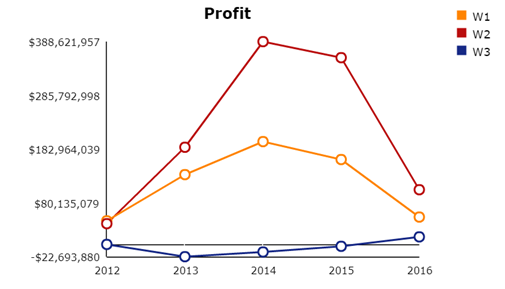

However, with market development and maturity, this strategic decision showed inconsistency due to the rapid growth of the variable costs for each product. In this instance, the 2013 and 2014 years were profitable, as revenues skyrocket and exceed all expectations. Nonetheless, the lack of alignment between market development and price policies contributed to the fast decay of all products, especially the W2 product line.

The product performance was also damaged by Joe’s decisions. The W2 and W1 products showed a rapid shift from the introductory phase to the maturity stage. Nonetheless, the products’ life cycle did not comply with the market demands, where customers shifted their demand from W2 product to W1 and further to W3. In this instance, the rapid growth of the W2 and W1 products was followed by the upward trend in demand, making 2015 the last profitable year for the company in these markets.

The situation is a bit different from W3 product behavior. The company did not invest funds in this product line so that the development of the third market was postponed. Such a delay and inability to support the simultaneous growth of all products led to the late maturity of the product. Only in 2015, W3 began to expand the market share and bring profits to the company. While such strategic fraud has damaged market opportunities to have all three products on the unified line and stage of development, at the end of 2016, W3 is the only product that has positive returns and revenues statements.

Recommended Strategy

Joe’s decisions remained unchanged during each year. Such a strategy was a mistake, which leads to the decay of the W2 product and further W1 and W3. In this instance, the problematic field is the price policies and tactics, which Joe avoided and neglected. Critical areas for improving pricing policy include: analyzing price elasticity in different markets; improving the cost structure of products; reducing the level of fixed costs; use of modern methods of calculation and justification of prices; explanation of the system of discounts due to the “effect of the scale of production” and projected cost reduction and many others.

The main factor that determines whether a product will be purchased at different prices is how much the buyer needs the product. In vain, according to the buyer, the goods will not be bought for any money. The importance of one’s own needs also affects the price a person can pay for their satisfaction. For example, for young people (21-35 years old), there is higher importance of entertainment than leisure, which implies a willingness to pay a high price for goods associated with the need for active leisure activities. The older age group (36-50 years) is characterized by the desire to buy health and nutrition-related products at a higher price.

However, the subjective nature of the value of goods to buyers makes the process of setting retail prices that meet the expectations of different target audiences relatively time-consuming. This leads to the fact that retail pricing for most goods is carried out by placing the optimum percentage markup for specific categories of goods, taking into account the level of demand and price positioning of competitors. In this case, the essential component of the retail price of the product will be the cost of its production, as well as the margin of the wholesale link and the operating costs of the retail operator, which determine the minimum level of retail margin.

The advertising activity of manufacturers and retailers has a significant influence on the price of the product. Advertising brings to the buyer information about non-obvious consumer properties of the product, thus increasing its value in the eyes of the buyer (Parida & Tang, 2018).

In a limited supply of goods, the buyer is prepared to pay a higher price. However, the market for consumer goods, especially food, is now quite saturated. Out of a dozen products that differ in nothing but value, the buyer chooses the most reasonable price for themselves. The manufacturer and the seller either have to “play” with prices, which leads to increased price competition, or to come up with new beautiful and economical packaging, or to seek or create unique customer needs.

There are two proven product placement options. The company can give it an image of a novelty or a picture of a traditional, time-tested product. These benefits for the relevant target audience of “innovators” or “traditionalists” give the product additional weight, increasing the price the buyer is prepared to pay for it. Yes, novelties declare the presence of the goods some advantages over their previous modification. These benefits can be directly related to the basic properties of the product. The product may become tastier or cleaner, or with new additional features, for example, to contain any beneficial ingredients. The image of a traditional product, on the contrary, is intended to increase the value of the product in the eyes of the buyer at the expense of recognition and the established habit of consuming this product year after year.

Changes in prices for substitutable or related products, as well as the appearance of new products in the market, entirely actively change the cost structure familiar to the buyer. Tracking such changes and adjusting retail pricing, taking into account the promotional activity of manufacturers of new products, and changing customer preferences are essential elements in the process of determining the optimal retail price. Retail price competition leads to the need to clearly define the boundaries of the target audience of buyers to determine the level of affordability. If the customer considers the prices for products that do not meet his expectations, he or she will likely lose the trading network.

The price expectations of customers are formed not only based on the assessment of the degree of usefulness of the product but also the actual offer of the product on the market at different prices. In other words, the affordability of prices to buyers is primarily determined by the competitiveness of the established amount of a product at a given point of sale compared to rates in other stores. The price of a product may cease to be available if the cost of the product is significantly reduced in competing stores, or if a similar product appears on the market at low prices.

However, the decrease in price harms buyers’ assessment of the quality of the goods. Thus, after reaching a guaranteed low price level of the goods, most buyers begin to doubt their quality and switch to middle-price products. On the other hand, higher prices can tell the buyer about the top condition of the goods. Besides, several products that satisfy buyers’ need to own prestigious items increase their value in the event of a price increase.

The company can lose a customer dissatisfied with product prices for the following reasons. First, the importance of pricing to most shoppers is inferior to the significance of convenience of the store location. Second, the buyer may abandon the general store if the price difference becomes very significant. Almost three-quarters of buyers compare prices for essential goods at different outlets. Only loyal customers who do not shop at competing stores are unable to compare prices.

To avoid tough price comparisons with competing networks, the company can organize its own branded products. At significant volumes of purchases of the given goods, the retail operator possesses all levers of influence on the purchase policy and establishment of the retail price. Such products are unique because they are not present in the range of competitors’ networks (Chen et al., 2017). Savings on the promotion of the product by the manufacturer and relative freedom of pricing by the retail system allow the company to offer the buyer the product at favorable prices and, at the same time to earn a significant profit for sale.

If the number of retail outlets has not yet reached thirty, it is considered premature to organize deliveries through its distribution center. The outsourcing of business processes will increase the risks associated with additional control and organization of company interaction. The use of a supplier distribution system will directly charge the shipping costs in the price of the goods in the form of a distributor markup. Organizing your product delivery system will divert some of your management and financial resources from your core business.

On the other hand, the distribution center helps to optimize and control inventory management. A specialized logistics company with experience in this field will undoubtedly be more efficient than its own logistics service. Deliveries made through distributors may not divert the company’s resources to logistics (Shen, 2017).

Improvement of the pricing mechanism in a trading enterprise can be carried out through strategic planning and implementation of modern pricing strategies and methods, as well as through the application of an effective pricing policy. Effective pricing policy will help achieve the following goals for a trading company:

- maximize your return on sales,

- maximize the return on the company’s net equity,

- maximize the return on all assets of the enterprise,

- stabilize prices, profitability,

- restore or improve the position of an enterprise in a competitive market for a specific type of product

- increase the net profit of the enterprise.

If a firm has chosen for itself a strategy of “rough passing on a competitor,” it is guided by the level of prices used by the firm – the market leader, then it is doomed to passive pricing. Meanwhile, a firm can only then be at peace for its future if it pursues an independent, that is, active pricing policy and its policy aimed at ensuring its stable competitiveness and high return on investment. The pricing strategy should be continuously reviewed based on the results achieved and the need to adjust. And most importantly, it must be consistent with the marketing and overall strategy followed by the trading company.

Conclusion

In a market economy, trading companies should apply a system of price adjustments that would ensure prompt response of prices to changes in the internal and external environment and facilitate the development of economic entities. The method of correction of costs of trade enterprises is based on carrying out commercial work aimed at a justified increase or decrease of trade margin under the influence of various factors.

Therefore, the price adjustment system consists of the implementation of consistent interdependent measures, which result in an adjusted trading margin. However, depending on the reason for putting such a system into effect, the adjustment may refer to both the trade markup for a specific product or commodity group and to be implemented throughout the enterprise.

References

Chen, G. R. (2016). Dynamic model for market competition and price rigidity. Applied Economics, 48(36), 3485-3496.

Chen, G., Korpeoglu, C. G., & Spear, S. E. (2017). Price stickiness and markup variations in market games. Journal of Mathematical Economics, 72, 95-103.

Parida, S., & Tang, Z. (2018). Price competition in the mutual fund industry. Economic Modelling, 70, 29-39.

Shen, Y. (2017). Market competition and market price: Evidence from United/Continental airline merger. Economics of transportation, 10, 1-7.