Brief Description of the Company

The bank of America was formed in 1904 and was first known as the ‘bank of Italy’ in 1904 and ‘National bank’ in 1874. The bank’s headquarters is in charlotte USA. It has branches in major cities of the world and offers various products. Walter E. Massey is the bank’s chairman while Brian Moynihan as its president and CEO. Some of the products being offered by the bank include; Credit Cards, Corporate Banking, Global Wealth Management, Finance & insurance, Consumer Banking, Mortgage, Investment Management, Investment Banking and Private Equity. The revenue of the company as in 2008 was around one hundred and thirteen billion dollars and its net income was four billion. Its total assets in 2009 were 2.25 trillion dollars and the total equity was one hundred and seventeen billion dollars in 2008. By June 2009 the company had a total of 282, 408 employees.

The bank has expanded its services in the major cities of United States and also internationally. This has mainly been due to the demand for the services in other countries especially by American businessmen that are involved in international business. There has also been a lot of immigration which has prompted the bank to expand its coverage for it to retain clients. The bank has the plans of making its products to sell and be known worldwide. One of its future plans is, therefore, to ensure that all its international clients are access to all the financial services that they need. Electronic money transfers have already been initiated in various countries where the branches are and there are also plans to ensure that such services are more effective and reliable. The company enjoys a substantial market share considering the period in which it has been in the market and the fact that it has continued to upgrade its services. The bank makes good use of modern technology and ensures that the new inventions are implemented in the day-to-day running of the business. This is due to the rising need of customers which has prompted the bank to make sure that its clients are not inconvenienced with outdated technology.

A review of the income statement

The bank of America has been the people’s bank for a long time and is preferred due to its quality services. Things have however changed in the past three, when people realized how it was cheating them and mismanaging their finances. Various complain have been received from the clients on how the services of the company have not been satisfactory enough. There are a lot of allegations that have been out across and thus costing the bank a lot. Since the bank started facing scandals in the mid-2000s, many people have left the bank and looked for better financial provides that can be relied on. There have been a lot of cases reported concerning the misappropriation of funds and unfair treatment of clients. Interest rates on savings continued to decline as that one charged on loans increased. There has been nothing much that the consumers are benefiting from and thus making them transfer their savings. A look at the financial data of the company we realize that it had a steady income growth before 2005 but things changed in 2006 onwards as clients realized the unfairness of the bank.

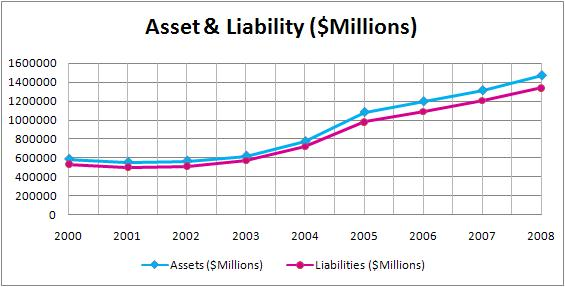

The graph above gives a vivid description of the assets and liabilities of the bank since 2000. The substantial rise in such in both gives that position of the bank. Even though the company has continued to increase its investments, it has also had a number of expenses to pay off which has made the company do less in terms of savings (Sich, 2008). This could have contributed to the high expenses that the company is charging its clients to cater for the extra expenses that are being incurred. The company has also continued to expand on its investment capability to ensure that the clients are access to modern technology. From the charts, we also see that the rate of investment in banks was highest between 2005 and 2005. The rate was reduced thereafter due to the many scandals that were being faced by the bank. It was not easy for the bank to effectively carry out its activities as complaints were numerous.

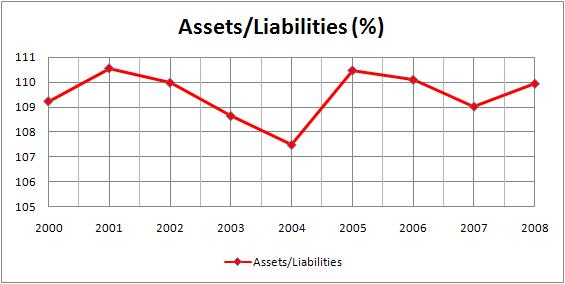

This other graph shows the percentage growth of the assets/liabilities of the bank. The percentage growth between 2000 and 2001 was very high which shows that the company was high in its activities. From 2001 to 2004, the percentage growth continued to decline substantially meaning that there was something wrong. This could have been the season when the company was going through a crisis probably due to the serious competition it was facing from other financial services. There could also have been something wrong with the management where nothing much was being done to improve the services of the bank (DeMille, 2004). Money could have been received during season, but it was being channeled to do some other things that were not necessarily beneficial to the company. It is usually expected that an organization makes substantial investments in the income that they receive so as to improve its services. When the bank stopped making such investments, it meant that it was not fostered towards growth. After 2004, something happened and the bank started investing more. This was also the time when there were a lot of complaints from clients who thought that the company was charging a lot of fees on overdraft. The bank could have been doing this to ensure that what was lost is recovered so that more investments were done.

In the efforts of the bank to cover up for the losses it has incurred over the years, it started cheating on the clients that had trusted it for long. Even after few cases that were reported, the bank seemed not to care about it. This made the clients angry and felt as if the management cares less about them. They expected the management to employ urgent actions by probably terminating the services of the employees that were involved. a lack of concern proved to the general public that the bank schemed to rob off its clients to cover for the losses it had incurred. This caused an exodus of clients that had even trusted the bank for years. Most of them that could not take it in any more decided to bank elsewhere and gave a very negative report of the bank.

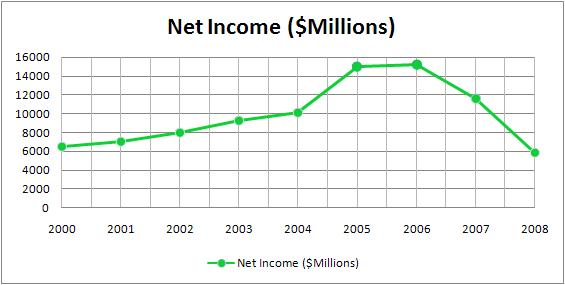

The graph above shows the net income of the company from 2000 to 2008. The income has been growing substantially from 2000 to 2005. This was the time when the bank had gained a lot of publicity and was thus expanding its services. As the bank established its services worldwide, many people opened their accounts with the bank and also increasing the number of services they obtained from it. This might have been a boom to the bank that should have made it more effective. The trust the bank received from the clients was taken for granted and made it not perform well. Probably the management thought it had reached the peak of its performance. This reluctance and the flow of funds made some of the managers misuse the funds instead of using them to better their productivity (Buchanan, 2002). Their schemes however reached the end when it was discovered that they took no keen interest in the injustice that was reported from consumers. The audit reports revealed that there were a lot of funds that were unaccounted for and thus making most of its clients back off from it.this is the reason why the income of the bank started reducing from 2005. The products of the bank were not selling much as clients waited for further reports from the auditors. Every report that came was discouraging g and revealed a lot of misappropriations. The bank is still in shock as its activities in the US are being tampered with by the scandals.

The Nature of the Infraction or Accounting Irregularity

Most complaints from clients about the bank are high charges on the bank’s overdraft. There are some extra charges that the clients have to pay for carrying out a bank overdraft. The process had become too complicated that the clients were left in confusion. What made the things even worse was the fact that they were not getting any clear clarification from the management about the actions the high expenses. Efforts of some clients to follow up on the same have proved fruitless and frustrating as they continue being robbed of their money. It has come to their realization that some of the abnormal procedures that they were forced to take were actually unnecessary was like the more they followed what they were being told, the more they were robbed of more money. There were some transactions charges that they were given of which they could not understand. They realized all of a sudden that the rate of interest charged on them was very high and was increasing within a very short period of time.

‘The RED FLAGS’ That Were Available Prior to the Discovery of the Accounting Problems

Before the fraudulent came to light, the clients realize that the management had become tough on their loans and required them to pay faster or face a risk of higher interests. The process of making a simple transaction took long and customers were put on waiting for long. By the time the transaction was completed, they discovered that there were some higher charges that they had to pay which were not normal. Whenever they sought an explanation from the customer care personnel, they received an even more confusing answer. The audit reports of the company also revealed that there were a lot of debts that the company was unable to pay. The bank had to borrow some money from the government to enable it manage some of its activities.

Internal Control Recommendations to the Board of Directors

The situation that is being faced with the bank has occurred to several organizations whose outcome depended on the decisi0ns that were made by the board of directors. These are the times when they need to take action to ensure that the bank is back on track. Considering that there are audit reports that show how the company has been performing, it will be easier for them to know where the problem started and thus taking action against the employees that are involved. Thorough investigations should be done by the board of directors to ensure that the victims are discontinued from their responsibilities (Collins, 2001). The measures taken by them should also be made public to assure their clients that their issues are being taken seriously. to buy back the trust of their clients, they need to assure them that they will be compensated for any unfair transaction that had to pay for. This might bring back those that had left as the bank looks for a perfect road forward.

Incentives offered to management

Kenneth D. Lewis is the current CEO and president of the company, his total compensation is 7.4 million dollars. Among the compensation he receives is a salary of 1.5 million dollars, a bonus of 5.7 million dollars and 0.2 million dollars for other expenditures. This is contrary to other CEO in other subsidiary banks that earn a total compensation of 5.5 million dollars. This is a deal that is no doubt the best to make an individual feel that there is more where that emanates from. The compensation package reveals that the top management is well placed and may not work seriously. There is also no insurance offered to the workers to ensure that the package will not be reduced and this does not motivate the management towards hard work. This could have been enough to tell them that the bank is riding on a high note in the market and that nothing can threaten it. When a CEO is earning a slightly lower amount, they are reminded that there is a lot more to be done to expand on is production so that their salaries also increase. They will hence take a serious concern on the accounts of the company and ensure that any trace of fraud is eliminated. The good remuneration package could have hence motivated the management not to take keen interest in the financial reports of the bank as they assumed that all was well.

Good remuneration packages are usually to motivate employees into high productivity. This is because it is a place of security that will make them perform better so that they continue reaping from the same. Some other factors may have led to the fraud which may have had nothing to do with the salaries. There could be some irregularities that included incompetent managers who were not careful to realize the frauds taking place. Other employees who are not necessarily the managers of the company could have had a plan where they stole from it without being noticed. The scheme may have been there and only came to light when it became disastrous. It must have been too late for the company considering the harm that had already been caused to the company (Buchanan, 1994). The boards of directors are the main owners of the company and the procedure in which they were put to the task may have also affected what the bank is currently facing. A board that is not dedicated to their work by frequently looking into the accounts of the bank may have not been chosen on merit but rather to fill the spaces.

There are federal securities that need to be adapted and followed by banks to ensure that clients are not robbed of their money. The issues of fraudulence and misuse of bank funds are addressed by Sarbanes-Oxley, FASB, PCAOB, and AICPA. It is required that the board of directors have a reliable financial auditor that will look into the financial reports of the bank and verify all entries. Anything that is not clear in the books of accounts needs to be reported to the board for necessary action. The continuous fraud in the bank, therefore, reveals there was something wrong with the auditors who failed to report the misappropriations on time or the board of directors that failed to take necessary action. There is however still hope for the bank that can always do its level best to ensure transparency in its management activities.

References

Buchanan, J. (1994). Biography of a bank: the story of Bank of America. N.T. & S.A., Harper.

Buchanan, M. (2002). The Story of Bank of America: Biography of a Bank. Beard Books.

Collins, J. (2001). Good to great: why some companies make the leap–and others don’t. Harper Business.

DeMille, N. (2004). The Best American Mystery Stories. Michigan: Houghton Mifflin Company.

Sich, R. (2008). Defrauding America. Silver-Peak Enterprises.