Executive Summary

Apple is the largest public company in the world, one that manufactures a variety of hardware as well as numerous software offerings. It has been able to succeed in the past by taking a position apart from the industry and compensating for its lack of alignment with market forces through disruptive and innovative excellence. As a result, it is currently a market leader in many device categories that possesses numerous valuable and inimitable resources and leverages them to its advantage.

However, as Apple’s competition catches up and its partners voice their discontent, these qualities may no longer be sufficient to guarantee continued success. While the company is still ahead of the competition, several recent incidents have revealed systemic flaws in its approach to product design and customer loyalty. As such, this report recommends a re-evaluation of Apple’s priorities and potential realignment to bring it in line with market needs while still retaining its strengths and prestigious reputation.

Introduction

Apple is an American company that manufactures and sells a selection of different hardware and software. Founded in 1984 and originally focused on producing PCs, it has since expanded into several other markets, most notably smartphones, which it pioneered with the original iPhone and in which it still occupies a dominant position. Currently, on the hardware side, Apple sells PCs, smartphones, smartwatches, wireless headphones, laptops, tablets, and a variety of miscellaneous devices such as the iPod touch. However, a large part of its revenue also comes from the operating systems it uses for its devices: iOS for smartphones and tablets and macOS for PCs and tablets.

Both feature app stores that are exclusively controlled by Apple, which takes a 30% cut of all sales made on the platform. Per Leswing (2020), this portion of the business accounted for 22$ of Apple’s revenue for the fourth quarter of 2020. With that said, there are accusations that this approach is uncompetitive and that the fees are too high, notably by Epic Games through its well-publicized lawsuit.

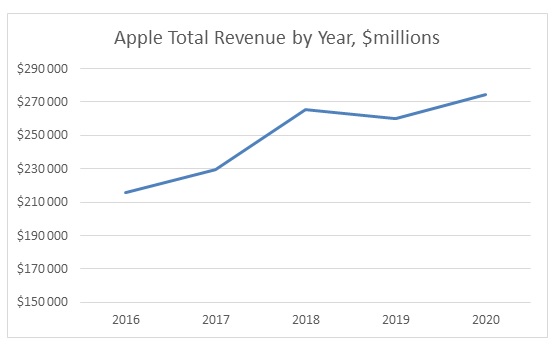

Apple has maintained a reputation for disruptive innovation for a considerable time, which has contributed to its massive success. Per Apple reports fourth quarter results (2020), its total revenue in the fourth quarter of 2020 amounted to $64.7 billion. At a market valuation of over $2 trillion (Apple Inc. (AAPL), n.d.), it is also the largest single public company in the world. Its primary competition on the desktop and laptop market would be Microsoft with its Windows operating system, though, as will be shown later, the two are not interchangeable. On the smartphone front, it competes with Google’s Android ecosystem and the manufacturers that use it, such as Samsung and Huawei. Overall, the company occupies a strong position in both of these markets, though its mobile device performance is substantially more dominant than that of the macOS offerings.

Market Environment Analysis

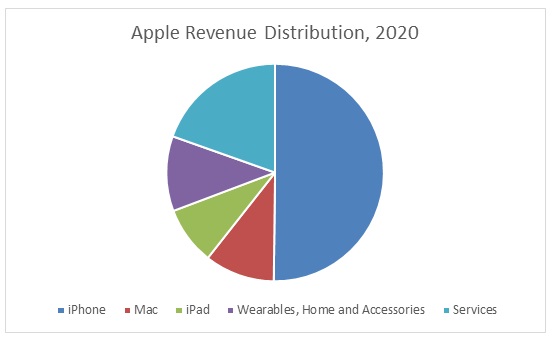

For the purposes of this analysis, the report will focus on the mobile device aspect of Apple’s business, as it is the largest revenue driver for the business by far per the Apple annual report 2020 (2020). The market consists of a large number of manufacturers that produce various devices, but they are nearly all based on one of two operating systems: Apple’s iOS or Google’s Android. With that said, only Apple devices may use iOS, while Google has made its system mostly open-source.

Moreover, the company designs its own custom hardware (Apple announces Mac transition to Apple silicon, 2020) while the rest, with the partial exception of Samsung, use Qualcomm chips. As a result of these fundamental differences in the software and hardware architectures, Apple devices cannot be interchanged with Android-based alternatives as easily as internally. This state of the industry is further elaborated on in the following PESTLE and Porter’s Five Forces analyses.

PESTLE

- Political: medium importance. While incidents such as the Huawei ban recently extended by president Biden (Sanger and McCabe, 2021) are rare for now, many prominent mobile device manufacturers either are located in the US and China or rely heavily on suppliers there.

- Economic: high importance. Mobile devices are expensive, and the state of the economy influences buying decisions substantially.

- Social: medium importance. Ownership of a smartphone is seen as a necessity in modern societies, but most people already have one as a result.

- Technological: high importance. Much of the competition in mobile devices hinges on innovation and the introduction of new features and conveniences.

- Legal: low. It is possible to violate laws with mobile devices, as was the accusation for Huawei, but any such action would have to be deliberate.

- Environmental: medium. As any electronics, mobile devices contribute to pollution, but they do not do so directly.

Porter’s Five Forces

- Competition in the industry: varies. Competition in the Android space is intense, as companies try to undercut each other in price while offering as many features as possible. However, no Android phone is an equivalent replacement to an iPhone because of Apple’s ecosystem approach.

- Potential of new entrants into the industry: medium. There are substantial costs involved in establishing a new mobile device company, but new smartphone brands are constantly emerging and establishing themselves.

- Power of suppliers: high. Qualcomm and Apple both rely on a single silicon manufacturer, TSMC, for their chips (Friedman, 2021). The spaces for many other mobile device components, notably screens, are similarly heavily centralized.

- Power of customers: medium. The market for mobile devices is massive, but ultimately, each member will buy a smartphone. With Apple, in particular, customers have little price negotiating power if they want an iDevice.

- Threat of substitution: low. There are effectively no adequate substitutes for smartphones, which are a fixture of modern life. Alternatives such as flip phones are too niche and limited to secure a large market share.

Discussion

Overall, the key determinants of success in the mobile device sector appear to be technological superiority and pricing. Technology is constantly developing, and manufacturers are expected to integrate it into their devices quickly and effectively. As a result, new models are constantly being released that advertise having superior processors, cameras, screens, and other components to past iterations. Moreover, companies are trying to integrate innovative features, such as fast charging or high refresh rate screens, ahead of the competition.

Apple’s current position in this regard is disputed, with some claiming that its current version is not innovative but can still disrupt the market through sheer influence (Khan, 2021). Its phones are advanced in the conventional sense, but at the same time, they do not have many of the features their competition uses, such as high refresh rate screens or standardized USB-C charging.

In terms of price, until recently, Apple has stood out from the competition in a surprising way. The company used to offer a small range of models that were all in the premium price segment. However, recently, this tendency has changed with the introduction of the iPhone SE, followed by the iPhone XR and the iPhone 12 mini. All of these models are closer to midrange prices while still retaining many of Apple’s signature features. Apple still does not compete in the low price segment, and it does not appear to have any plans to do so, as the act would harm its premium reputation. With that said, despite its disregard for the price undercutting practices of the rest of the industry, the company has been able to achieve dramatic success. The cause likely lies with Apple and its unique qualities rather than some trait of the industry.

Overall, it is challenging to evaluate the industry relative to Apple because of its unique position and behavior. The company has a history of innovation, though following the death of Steve Jobs, this trend has not necessarily been continuing to the same extent (Umoh, 2017). Instead, some of its behaviors have been bizarre and not well-understood within the industry and not outside of it. Moreover, it blatantly disregards the importance of price, which informs much of its competition’s decision-making. It also effectively side-steps Porter’s Five Forces by carving out a unique niche for its products and limiting consumer choice if they want some of the features. To explain Apple’s success in spite of all these actions, its resources and strategy need to be evaluated in more detail.

Resource and Capability Analysis

Apple has several key resources that have contributed to its overall success. The first would be its technological base, which enables it to manufacture advanced electronics in-house that compete with other producers’ best offerings. Another would be its brand value and worldwide reputation as a manufacturer of reliable, convenient, and premium devices. The third would be its ability to design products that are carefully tailored to customer needs with as few minor inconveniences that interrupt the overall experience as possible. Finally, customer loyalty to Apple has to be considered, as it is a large reason of why people do not leave the brand to seek cheaper or more feature-rich alternatives. VRIO analysis will be conducted for all four of these resources.

Technological Capability

- Value: Apple has been producing its A-series iPhone chips for a substantial time and has been able to match and outperform Qualcomm, its primary competitor in mobile chip manufacturing, consistently. With that said, this ability is not necessarily as relevant as any iOS apps would naturally be tailored toward the available processing power. A more relevant recent development is Apple’s development of the mobile M1 chip, which outperforms Intel’s x86 processors previously used in MacBooks in several vital metrics and cannot be matched by any existing or upcoming ARM offerings (Hachman, 2020).

- Rarity: Only a few firms in the world produce CPU and GPU chips, and even fewer work with the ARM architecture.

- Inimitability: Only Qualcomm can currently hope to compete with Apple’s ARM capability, but it has historically not been able to keep pace with it. Moreover, Apple can customize its chips for specific purposes, which is a capability that is effectively unavailable to any of its direct competitors.

- Organizational support: Apple uses its technological capabilities extensively, as demonstrated by its usage of in-house chips on various devices, such as iPhones, iPads, AirPods, AirTags, and the recently released new generation of MacBooks. Due to this integration as well as the ability to customize the hardware to specific purposes, Apple’s various devices are often recognized as best in class or near the top of all available options.

Brand Value

- Value: Apple is a household name that is recognized worldwide and seen as prestigious. People trust it as a brand from which one can purchase a device and have it work flawlessly without the hassle of choosing different Android models and considering their trade-offs (Cullen and Parboteeah, 2018).

- Rarity: only other industry giants, such as Samsung, can expect the same degree of recognition, and no other competitor is likely trusted as much as Apple. Samsung, in particular, is still affected by the controversy surrounding its exploding phone incident in 2016 (The European Business Review, 2020).

- Inimitability: Apple has built its reputation over decades of excellent and innovative performance in a field where it was the first mover. Matching its reputation is challenging, if not impossible, as long as the company remains in direct competition with it.

- Organizational support: Apple is well-positioned to take advantage of its powerful reputation, especially when it comes to the introduction of new products. Khan (2021) mentions the recent release of AirPods Max, which competed with headphones of similar quality that cost half as much but immediately sold out regardless. A less well-reputed company would likely have seen the product fail.

Product Design

- Value: Ever since the first iPod, Apple products have been optimized to provide customers with a flawless experience. As Morris (2017) notes, the company’s design team consists of brilliant professionals, and its Senior Vice President of Design, Jonathan Ive, was awarded a British knighthood for his work.

- Rarity: Apple is the golden standard of design excellence, but few if any other companies have been able to match its quality.

- Inimitability: As the efforts of the businesses above show, Apple’s unique combination of talented staff and culture of innovation is nearly impossible to replicate.

- Organizational Support: Apple’s characteristic design excellence applies to all of its products. The guidelines set by many of its offerings, such as the characteristic stem look of the AirPods, are reflected in the designs of many competing products.

Customer Loyalty

- Value: Loyal customers contribute heavily to Apple’s overall revenue by purchasing new versions of its products as well as offerings beyond iPhones or Macs. They also provide extensive word-of-mouth marketing, which can reach the level of social pressure to use Apple products in some groups.

- Rarity: Non-Apple customers tend to be substantially less loyal to a brand, in part because of the substantially larger selection of products available to them. As a result, they seek the best value, which Apple’s products provide by default when used together due to their synergies.

- Inimitability: Though companies such as Samsung have tried to create loyal ecosystems that imitate Apple’s model, they have largely failed. Building a loyal customer base takes time, a concerted strategy, and favorable circumstances, which are nearly impossible to create.

- Organizational Support: Apple has created a device ecosystem that both encourages brand loyalty and rewards it (Villas-Boas, 2019). As a result, people who invest heavily in Apple’s products may be unable to leave it without considerable expense, even should they want to.

Strategic Fit Analysis

SWOT Analysis

TOWS Matrix

Discussion

Apple’s strategy has enabled it to succeed in the past and present, and the case can be made that, in spite of its apparent flaws, it also has advantages that make continuing with it advisable. The company is still growing and regularly releasing new successful offerings to the public, as discussed above. With that said, the company may be reaching the limits of its current strategy as it saturates the market and as competitors catch up. Companies such as Epic Games now feel confident enough to challenge its policies, revealing the underlying dissatisfaction of many of Apple’s partners. Recently, the European Union found that the company’s App Store violated its competition law with regard to music streaming (Wakefield, 2021). This incident, alongside others, suggests that Apple’s isolationist policy may no longer be accepted by the rest of the industry, which may begin increasingly pushing for more openness.

Apple’s effective monopoly within its ecosystem is also associated with other problems, such as the lack of innovation observed on its iPhones. Many other smartphone manufacturers now have offerings that are comparable to the iPhone in both price and quality. They also do not have the vulnerability Spence (2020) identifies, where the ban of a crucial app from the App Store may heavily discourage entire populations, the massive Chinese market in that specific case, from choosing Apple. Even if a similar removal occurs on the Play Store, there are other marketplaces Android users can resort to, and users can bypass them and install the application directly, given they have the file. Overall, Apple’s strategy is showing signs of failure already that are likely to become more intense as it continues on its current course.

Conclusion and Recommendations

Overall, Apple occupies a powerful position in the market, especially that of mobile devices. It is influential enough to go against the broader industry trends due to its established position and possession of unique and valuable resources. With that said, the situation is changing as other manufacturers start being able to match Apple in quality, if not the overall design aesthetic and seamless design.

Moreover, its position of creating a separate ecosystem and keeping customers in it through loss of features should they try to leave is drawing ire from many of its prominent partners. With time, Apple may lose its prominent position as it is supplanted by alternatives and important apps abandon its framework. As such, the recommendation for Apple would be to consider expanding its ecosystem and integrating itself into the broader market. Considering its differences from the rest of the industry and the reputation it has built for itself, doing so will likely be challenging. As such, it is advisable to begin early, while Apple is still a market leader that can afford to take some short-term damage to improve its long-term prospects.

Reference List

Apple announces Mac transition to Apple silicon. (2020) Web.

Apple annual report 2020. (2020) Web.

Apple Inc. (AAPL). (n.d.) Web.

Apple reports fourth quarter results. (2020) Web.

Chao, C. and Shen, J. (2021) ‘TSMC to give top priority to car chips, Apple orders’. Digitimes. Web.

Cullen, J. B. and Parboteeah, K. P. (2018) Business ethics. 2nd edn. Abingdon: Taylor & Francis.

Diorio, S. (2020) ‘Realizing the growth potential of AI’. Forbes. Web.

Epic Games, Inc. v. Apple Inc. (2021) Web.

Friedman, A. (2021) ‘Chip delays reach crisis territory; Apple, Qualcomm and others are affected’. PhoneArena, Web.

Hachman, M. (2020) ‘Where is the Qualcomm Snapdragon that will challenge Apple’s M1 Macs?’. PCWorld, Web.

Howley, D. (2021) ‘The chip shortage has finally come for Apple’, MSN News. Web.

Khan, I. (2021) ‘Is Apple truly innovative?’. Tom’s Guide. Web.

Leswing, K. (2020) ‘Apple will cut App Store commissions by half to 15% for small app makers’. CNBC. Web.

Morris, R. (2017) The fundamentals of product design. London: Bloomsbury Publishing.

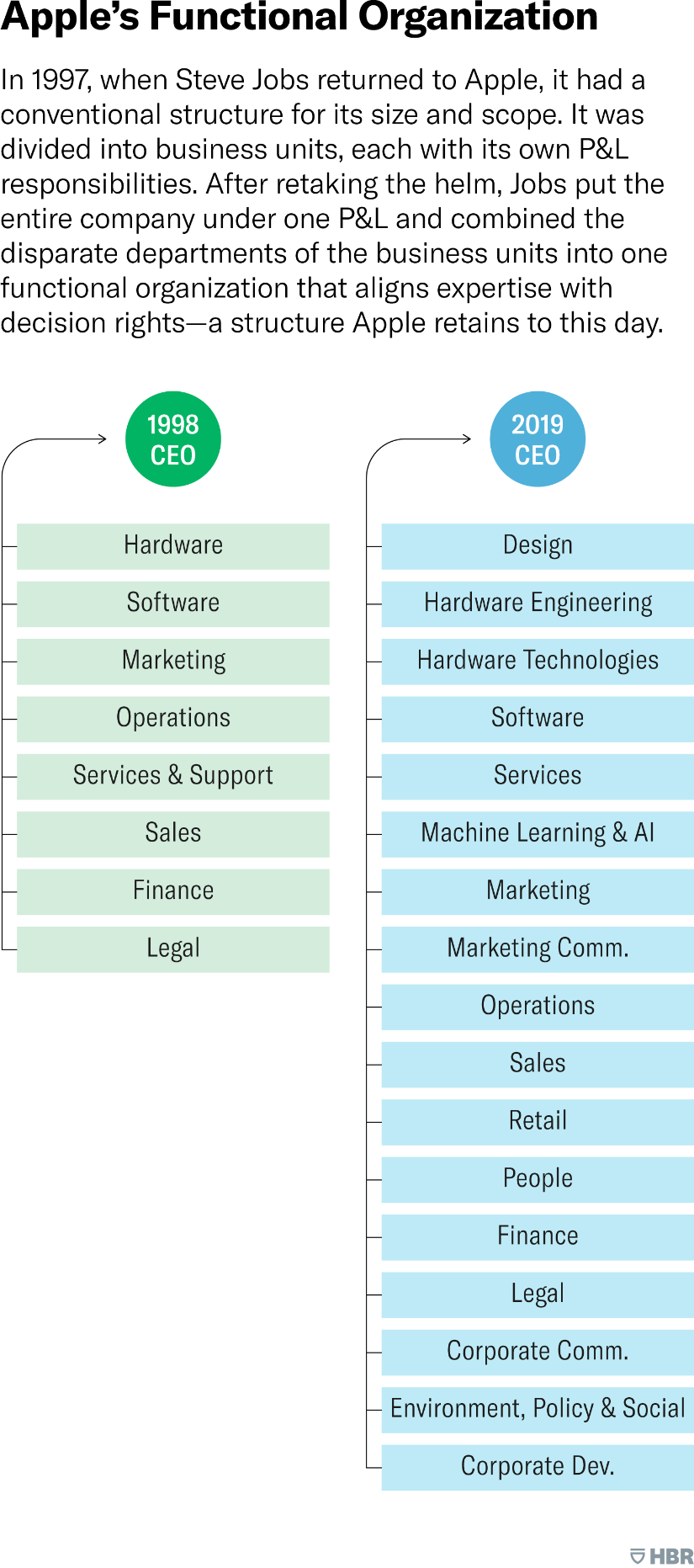

Podolny, J. M. and Hansen, M. T. (2020). ‘How Apple is organized for innovation’. Harvard Business Review. Web.

Sanger, D. E. and McCabe, D. (2021). ‘Biden expands Trump-era ban on investment in Chinese firms linked to military’. The New York Times. Web.

Spence, E. (2020). ‘New iPhone danger revealed in latest Apple controversy’. Forbes, Web.

The European Business Review (2020). ‘Are Samsung phones still exploding?’. Web.

Umoh, R. (2017). ‘The No. 1 reason Apple has been so successful can be traced to Steve Jobs’. CNBC, Web.

Villas-Boas, A. (2019). ‘I don’t want to switch from Android to iPhone because Apple’s ecosystem is too good’. Business Insider, Web.

Wakefield, J. (2021). ‘Apple charged over ‘anti-competitive’ app policies’. BBC News. Web.