Introduction

Assurant is an insurance company that is made up of four different companies that sell specialized insurance products and related services. These companies are Assurant Specialty Property, Assurant Solutions, Assurant Employee Benefits, and Assurant Health. “Assurant Solutions companies create, underwrite and advertise specialty insurance, other risk management solutions and extended service contracts in collaboration with leading financial organizations, automobile dealers, utilities, retailers and other entities” (Assurant Inc, 2011). “Assurant Specialty Property collaborates with the leaders of the industry in lending mortgage, renter’s insurance, manufactured housing, and other niche insurance markets to protect client and property of the customer” (Assurant Inc, 2009). “Assurant Health is the name of a brand for a family of products of health insurance directed on providing different plans, which are affordable, to consumers.

The list of health care products comprises fixed-benefit plans for individuals, major medical, small employers and supplemental families” (Assurant Inc, 2011). Assurant Employee Benefits are one of the largest marketers of employee benefits in the United States; they offer the product diversity and security that employers seek in a provider of benefits. Their main business is concerned with small to missive groups of employers” (Assurant Inc, 2011). The four businesses combined forms a fortune 500 organization that is listed at the Stock Exchange in New York. “Assurant is recognized on the New York Stock Exchange under the trademark AIZ. With estimated $US25 billion in assets during the year which ended 2010 and $9 billion yearly revenue, Assurant presently has a market capitalization of about $4.3 billion. In 2011, Assurant was placed No. 285 among the largest publicly traded firms in the U.S. on the Fortune 500 list. In the rating of the top 2,000 companies in the world, it emerged No. 1123 on the Forbes Global 2000. Assurant is part of the S&P 500 stock market index” (Assurant Inc, 2011).

The business that will be the focus of this paper is Assurant Specialty Property. Assurant Specialty Property was operating under Assurant Solutions in the beginning of the organization. Assurant Inc. is the Mother company (organization) but due to Assurant Solutions being its own company, the company was able to establish its own core values. Recently, as a result of the growth of both Assurant Solutions and Assurant Specialty Property it became more difficult for the two companies to operate under the same company because there would be conflicts on how to manage certain things, such as core values, company procedures and employee benefits/perks. It was decided by the CEOs of Assurant Inc. that it would be best to split the two companies and have them operate as separate companies in order to have more room for organized growth in each company. The split of the two companies caused Assurant Specialty Property to establish its own core values; therefore, there would also be a change in the vision statement to enable effective operation of the organization. “Making a change in these two areas of the organization also made a change in strategy because the focus was to be different,” (Palmer, 2008).

In order to keep it consistent with the mother company, Assurant Specialty Property went from the core values of Assurant Solutions (integrity, change, urgency, and excellence) to adopting Assurant Inc.’s core values. Those core values are common sense, common decency, uncommon thinking, and uncommon results. In a recent meeting between the employees, management and HR, they defined the core values to give a clearer understanding of what they were aspiring for. Common thinking was referred to as having the knowledge needed to be successful in your position. Showing respect to customers and your peers was how common decency was defined. Uncommon thinking was defined as thinking beyond what you have learnt and going over and beyond to complete your tasks. When you have common sense, common decency and uncommon thinking, you will get uncommon results. This change in the core values changes the focus from consistent, fast and accurate service to going over and beyond respectfully to provide the best possible service.

Assessment/Diagnosis

“There is always a need to identify and overcome internal barriers before the implementation of new changes in the setting of an organization before the actual new practices are implemented,” (Nadler, 1980). It was as a result of that a diagnostic analysis was used. However, there were limited approaches, which had been proposed. In this case, a mix of quantitative and qualitative methods were used, including analysis of documents, interviews and focus groups because these had been successfully used in other projects as well as Turrill and Newman. Information from this blend of methods identified an advanced combination of organizational, teamwork and specific factors related to assessment.

Organizational factors are recognized to be vital in determining the outcome of change practiced. The importance of investigating history of change in and organization in planning developments to come was stressed by Pettigrew. In this company, examples of successful change were characterized by effective planning and communication with main stakeholders, and the introduction of training when new skills were required due to change of environment. Resistance was majorly caused by haste implementation, poor communication and lack of consultation. These findings agree with those of Miller et al., Beer et al. and Palmer et al., who postulated that, “creation of a conducive environment in an organization was very important in the implementation of any change”. The change of the strategy of management required to build on past positive experience by elaborating and creating avenues of communication with main persons and groups across all levels of organization and fostering employee ownership by engaging in face-to- face meetings with the concerned individuals. A careful consideration was made as far as the decision to use training to implement change was concerned. Existing commitment of the organization to continuing professional training enhanced the case for such as academic intervention. This approach was supported in the latest systematic review. The company was also committed to insurance based on evidence, operational effectiveness, multidisciplinary working, and training in research and development methods, including critical appraisal. The recommendations were that guidelines based on the evidence for assessing the change were to be developed. It was also suggested that, “as part of the strategy tailored the organization was to consider using a multiprofessional guideline group of development for important appraisal,” (Palmer, 2008).

“Instability as a result of restructuring an organization is known to create a huge barrier for change,” (Nadler, 1980). This constituted a great potential challenge for managing change in this project because; it would be hard to eliminate the sources of instability. Some of the factors which were likely to remove the chances of instability included positive comments from the staff’s rating of the working environment. The shortage of permanent insurance agents would be another issue that was likely to cause disintegration in the assessment of change. This shortage of manpower reflected recruitment shortcomings, and was found in other studies to hinder change and was unlikely to be dealt within the timeframe of the current project. Although, the availability of a stable base of experienced and professional staff is likely to eliminate this barrier, implementation of strategies would have to take place to involve insurance agents in any training required to assess the structural change. The importance of educational outreach was stressed by the reviews of Beer et al. “Offering client based training for the agents on an everyday basis thus offered one solution”. However, this would have impacts on the leader of the project. Insufficiency of labour and workloads also meant that, “Planning for the training was to offer different sessions so as to allow attendance by all the concerned individuals,” (Nadler, 1980).

The diagnostic findings and superb leadership were critical as far as the success of the change project is concerned. “The scope of the role of the project leader was to involve the establishment of a support in the organization at all stages, creating networks of communication, local ownership and operating across boundaries of the organization. All these are known as key elements of working in partnership,” (Nadler, 1980). These leadership requirements are in line with the roles of opinion leaders and are seen in some studies to benefit the intended change.

The systematic representations of change emphasize that change takes place linearly and is predictable. This underpins diagnostic analysis. The theory of implementation supports this notion and additionally, recommends diagnosis of an organization and the intended change. However, the theory of complexity suggests that change is a spontaneous event which can not be planned. This poses a challenge to the above approach. It further suggests that large organizations are systems that are alive and co-evolve with the surrounding. Furthermore, organizations can not be broken down to their components but instead need to be treated holistically. “The theory of complexity suggests that large organizations show behavior that is non-linear and its linkage to in put is unpredictable” (Nadler, 1980). This complex behavior falls between unpredictability and predictability. This wholly suggests that change can not be organized or planned, but it rather supports spontaneous change that emerges with no or little contribution from the management. This brings the need of diagnosing an organization and planning before effecting change forth. Diagnostic analysis would be understood as a temporary instead a permanent exercise to monitor the performance of organizations. This is considered within the framework of theory of complexity. The nature of the method of collecting data will determine the frequency of gathering information.

According to Nadler, “the basis of the theory that explains this diagnostic analysis is large and comprise of competing theories” (Nadler, 1980).This gave a strong basis that is not only limited for use in the management of change in this company but also applicable to other insurance organizations. When carrying out a diagnostic analysis using an empirical approach, limited data is collected. Therefore, it is advisable to use a theoretical approach to execute a diagnostic analysis. The importance of this approach in gathering vital information is highlighted by the volume of data collected in this study. Such an approach is specifically designed to give information on the combination of techniques of implementation depending on the prevailing situation of the organization. According to Nadler, “the outcome is that a combination of qualitative and quantitative consisting analysis of documents, interviews and questionnaires to identify the climate of the group that can be used to gather information, identify with those likely to ring change and those likely to offer resistance” (Nadler, 1980). In addition, such a wide approach to data collection provides a variety of main stakeholders a chance to give their perspectives, opinions and raise their concerns. This is very important since these main stakeholders are the ones to facilitate change. The more far reaching impacts of this approach can be known in the hindsight after the findings have used to inform the strategy of managing change and evaluation of the results has been done.

Analysis of the Strategy of implementing Change

Company’s top management explained the vision and set the pace while managers and employees in the entire company were involved in the process of change. There were several approaches that were employed in the process of implementing changes successfully. These are:

- Identifying the need for change. “A careful examination of the current situation was vital to determine the level of opportunity or problem, if the persons affected by the change did not concur with the challenges, the process of change did not move on without thorough investigation and communication among all staff” (Beer, 1993). A sense of urgency was required to make people freeze and make them ready to invest energy and time to adapt to a new structure. The employees and administration began small group meetings to deliberate on the importance of change, especially on how they could review their work in an attempt to ensure that the organization realized positive development.

- Finding ideas that fitted the need for change. This included search procedures for example, engaging other managers, reaching out to suppliers, creating a taskforce to tackle a problem or seeking solutions from creative folks within the organization. To come up with new ideas, it required a conducive environment. This was a good chance to encourage involvement of workers, since they needed a space to think about and come discover new options. The company set up a program which was aimed to collect input from all staff. “In a total of ten group gathering, in a span of three weeks, the leaders gathered 1000 suggestions, which were later reduced to 50 items of important actions. These items specifically addressed the challenges that were likely to affect the morale and output of the employees” (Nadler, 1980).

- Getting support of the top management. The apex management came up with clear objectives of innovation. For this structural reorganization, it needed the top two leaders to give their support and blessing. This was done since lack of top management support could lead to failure in implementation.

- Outline a step-by-step plan of implementing the change. Such a large change could not be implanted at once or else the staff would be overwhelmed, and the result would be resistance to change. The success of such a major change resulted from breaking down the change into its components and each part was to be adopted sequentially. “The architects of the innovation made relevant changes in order to improve the project as well as the staff who had first doubted the project but were then seeing it succeeding” (Palmer, 2008).

- Formulation of strategies to counter any resistance that was to arise in regard to the change that was to take place. To increase the chances of a successful implementation, the management recognized the threats, the conflicts and the potential loses already indicated by the employees. It was clear that, “many valuable ideas are never implemented; this is due to failure by management to prepare to counter the resistance to change by other managers, employees and the customers” (Beer, 1993; Nadler, 1980; Palmer, 2008). However, good idea may be it will always face resistance as a result of conflicting with other interests and, this may endanger some coalitions within the organization.

The management employed the following strategies to conquer the challenge of resistance:

- Positioning to needs and expectations of the consumers. By overriding the opposition, the goal of ensuring that the change met the needs of the consumers were achieved. The process of implementing the changes ensured that the change was good to the concerned parties.

- Communication and training. Communications is the process of conveying the information to the individuals concerned with the importance of executing the proposed changes and its benefits. This was to be done in a way likely to prevent misunderstanding, resentments and false rumors. Effective communication helped the management to guarantee the employees of their job security as much as change was to take place.

- The other strategies comprised of early and extensive participation in change by all concerned stakeholders, forcing and coercion, creation of change teams and fostering ideal champions.

The model utilized in this study was the force field analysis model for analyzing and managing problems of an organization. This model was developed in 1951 by Nadler. Nadler called it “Force field analysis” (Beer, 1993; Nadler, 1980; Palmer, 2008). This model is fairly easy to understand and visualize. A demonstration of the model typically indicates both limiting and dynamic factors in the company. The dynamic factors such as environmental factors, seeking the transformation inside the organization while the limiting forces for example, the environmental factors (lack of motivation or inadequate resources), becomes obstacles to change. To comprehend the challenges present in the business, the limiting forces and the compelling forces are first indicated and then elaborated. Policies and objectives stirring the organizational balance in to the favored course can then be planned.

The model depends on the procedure of transformation, with the collective forces assembled into the model (such as imbalances are likely to happen until the reestablishment of the balance). “The key objective of this model is to progress into a favored state of balance by adding compelling forces, where necessary, and getting rid of limiting forces appropriately. The transformations are considered to happen concurrently within the organization that is active”.

The change was structured and sequenced as follows (Beer, 1993; Nadler, 1980; Palmer, 2008);

- Identification of the mission statement. This is the statement that explains the reason for existence of the organization i.e. the basic purpose. The statement explained how the needs of the client were going to be met with what kind of the services and what kind of communities. The top management developed and agreed on the mission statement.

- Establishment of a vision statement- This described the future state of customers and organization in the future.

- The goals that the organization must reach if it effectively works toward its mission and thus achieve its vision. These are general statements about what was to be accomplished for example, in this case restoring organizational order.

- Identify specific strategies that must be implemented to realize each goal or objective. These strategies were often the change as that the majority of the organization eventually conducted stronger strategic planning, especially by keenly observing the internal and external environments of the company.

- Identification of specific guidelines to implement each strategy. These are particular objectives that each major function (for instance a department) may undertake to ensure it is implemented effectively for every strategy of attaining each goal. The goals were clearly worded to the level that individuals could assess the set objectives. Simply put, the top management instituted various committees that each had a plan of work.

- The vision, mission, action plans and strategies were compiled into a strategic plan document. Efforts were made to ensure that the plan was approved by top management.

- Monitor the process of implementing the plan and update the plan as required. Strategists often examine the extent of meeting the goals and whether plans of action are being met or not. The most important indicator of the progress of the organization is positive feedback from the clients of the organization.

Momentum for change was built through various strategies, which were put in a sort of framework. The cross functional teams were given space to form groups as forums were provided and point gathering through social networking and recognized with publicity and awards. Some characteristics were added to the above strategies. These included being flexible with boundaries, for instance support activities that might influence insurance activities outside the job environment if that is what people want to focus on. Also, the leadership accepted trivially in that the employees built their trust in the position of the employer from what they saw possible more than what they heard in corporate communications. Therefore, they found that, “supporting what was visible was important even if it was trivial” (Beer, 1993). And then when these people had an opportunity at their capacities they influenced something material and took right actions. The addition of these characteristics to the framework of the company enabled the company to build momentum. The company harnessed the momentum through the following approaches; First of all was helping individuals understand how their contribution fitted in the whole idea of change. The leadership looked for avenues of drawing quantified bridge between action as an entity and the goals of the organization. Secondly, the leadership took action on trivial impacts to build momentum. Lastly, “the leadership challenged organizational departments to look into how they could affect the organization’s goals of sustainability within their main business operations and use of the responses to subdivide the goals into functionally appropriate goals and targets” (Nadler, 1980).

The monitoring of the project was carried out to ensure that the project met its goalless. This helped the company to know whether it was on its way to realize its planned goals. The organization also examined whether the re engineering showed the results as expected or whether the process was improving after re engineering.

Results/Outcomes

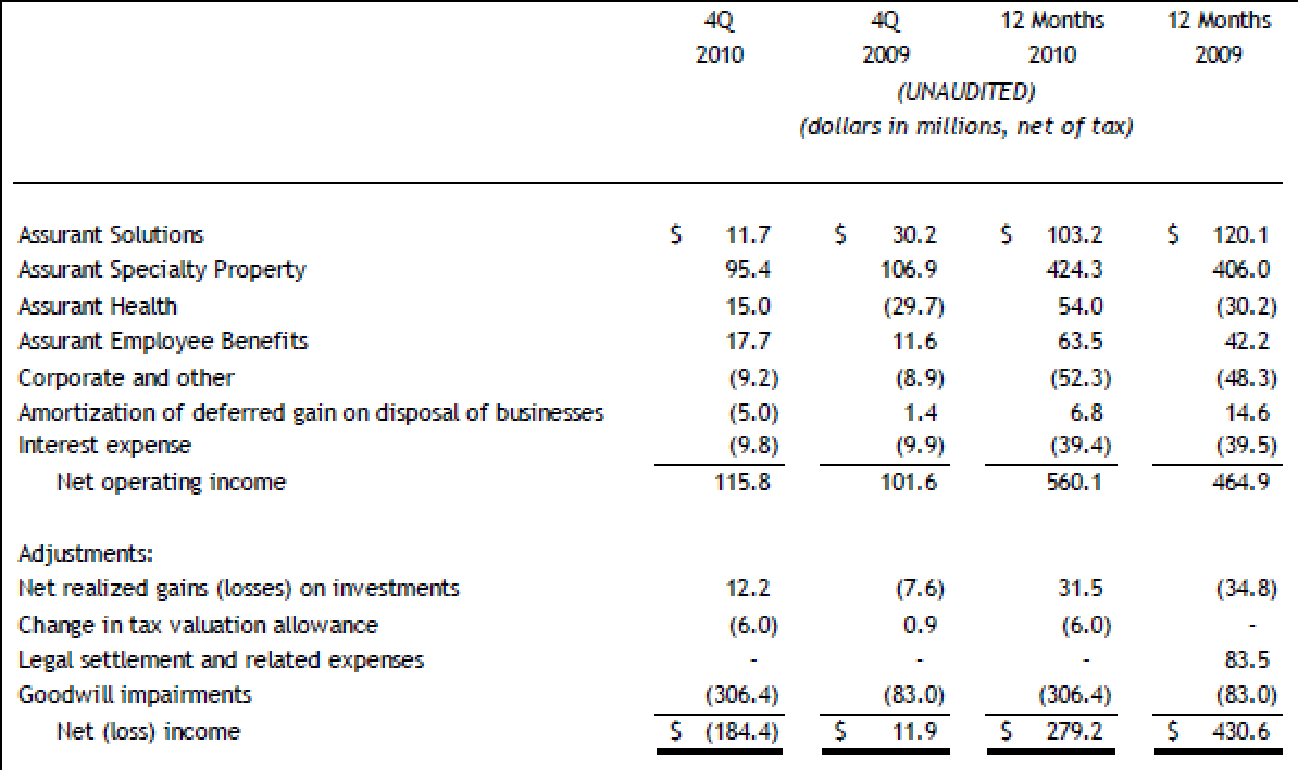

The results of the change had many positive benefits than negative benefits. This is apparent from the declaration of the President and CEO of Assurant Inc. Robert B. Pollock who declared that, “In 2010, it was clearly demonstrated that, the company’s capacity to adapt to changes touching the business while conveying the best results to its shareholders. We forged ahead to advance the efficiency in operation and to display better management of the capital. Also, we were able to generate revenue openings that we created in 2011″ (Assurant Inc, 2011).

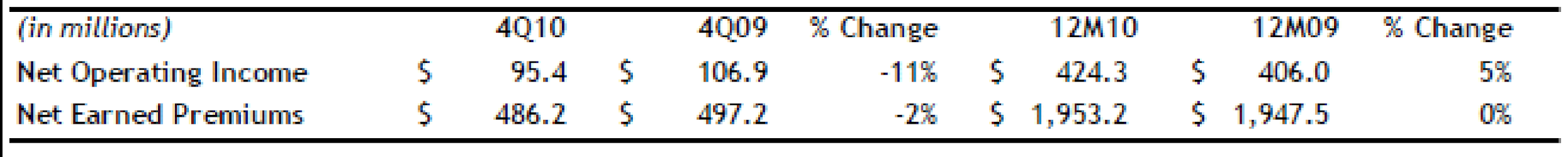

“A part from the above, there was also enhancement in members of staff benefits throughout the year 2010. Therefore, the overall net operating returns for 2010 went up by 20%. The net operating returns in the fourth quarter of 2010 went down chiefly as a result of $9.8 million of after tax reportable losses due to calamity which happened in Arizona and winds and hail storms. The reportable losses as a result of calamity were 14.7 million after tax throughout the year 2010 as compared to non reportable calamities in 2009. The working income the year 2010 rose due to fewer expenses. The outcomes of year 2010 comprised a $7.8 million favorable modification after tax from an undeserved review of premium” (Assurant, 2011).

“Net gross payments dropped slightly in almost in the most part of the quarter and were flat in the rest part of the year 2010, as a result the concede payments went up. There was an increase in the homeowners who were lender-placed, renters’ and overflew premiums in the quarter and the whole year 2010” (Assurant, 2011).

The company experienced fast service delivery to customers. There was a straightforward organization arrangement which eased customer getting the relevant department incase of any disappointment in the services of the company. “Some customers were lost due to a feeling that the company had lost its reliability by altering its management structure and; therefore, they doubted the value of services that would be offered by the new organizational structure” (Beer, 1993).

Effort Evaluation

The assessment of the mission statement was important in ensuring that the organization was achieving its objectives. The revised objectives which were put in place as a result of shake-up in the organization were met. To carry out a thorough assessment, different aspects of the organization were put into consideration.

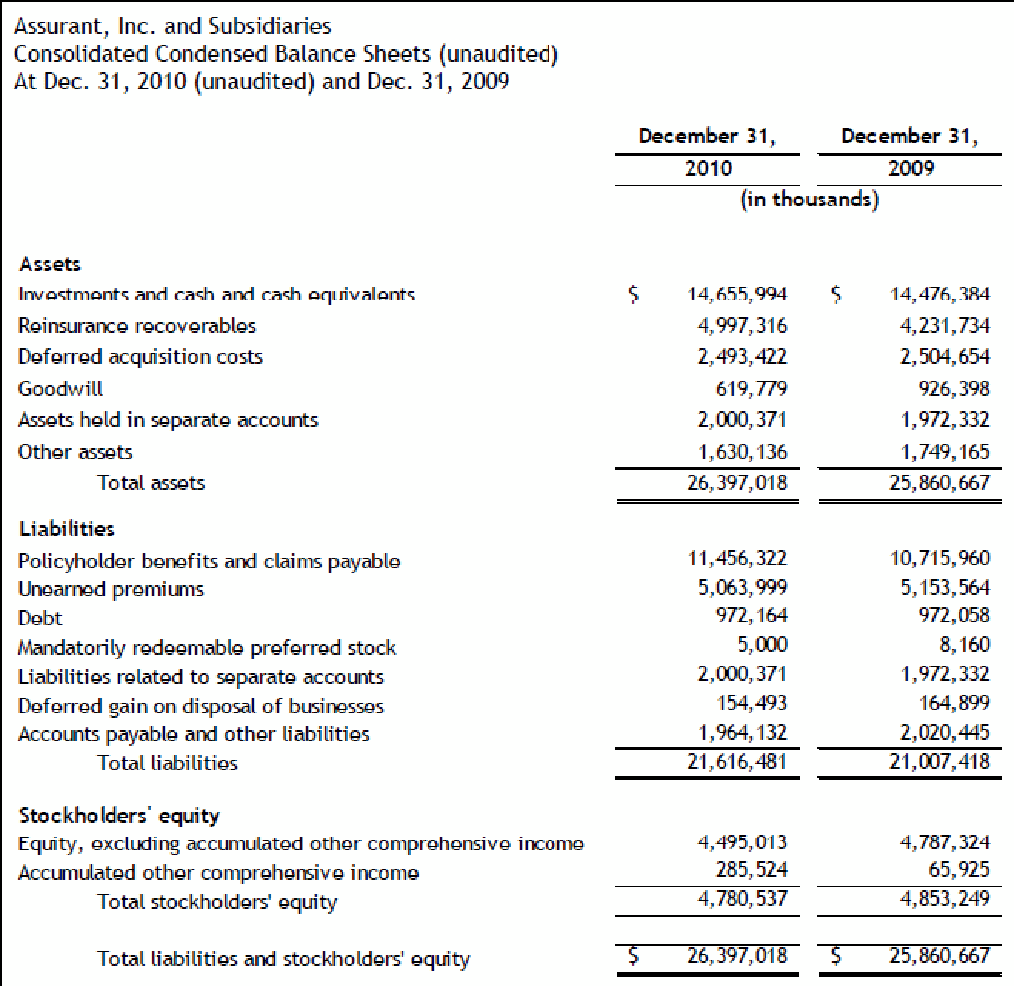

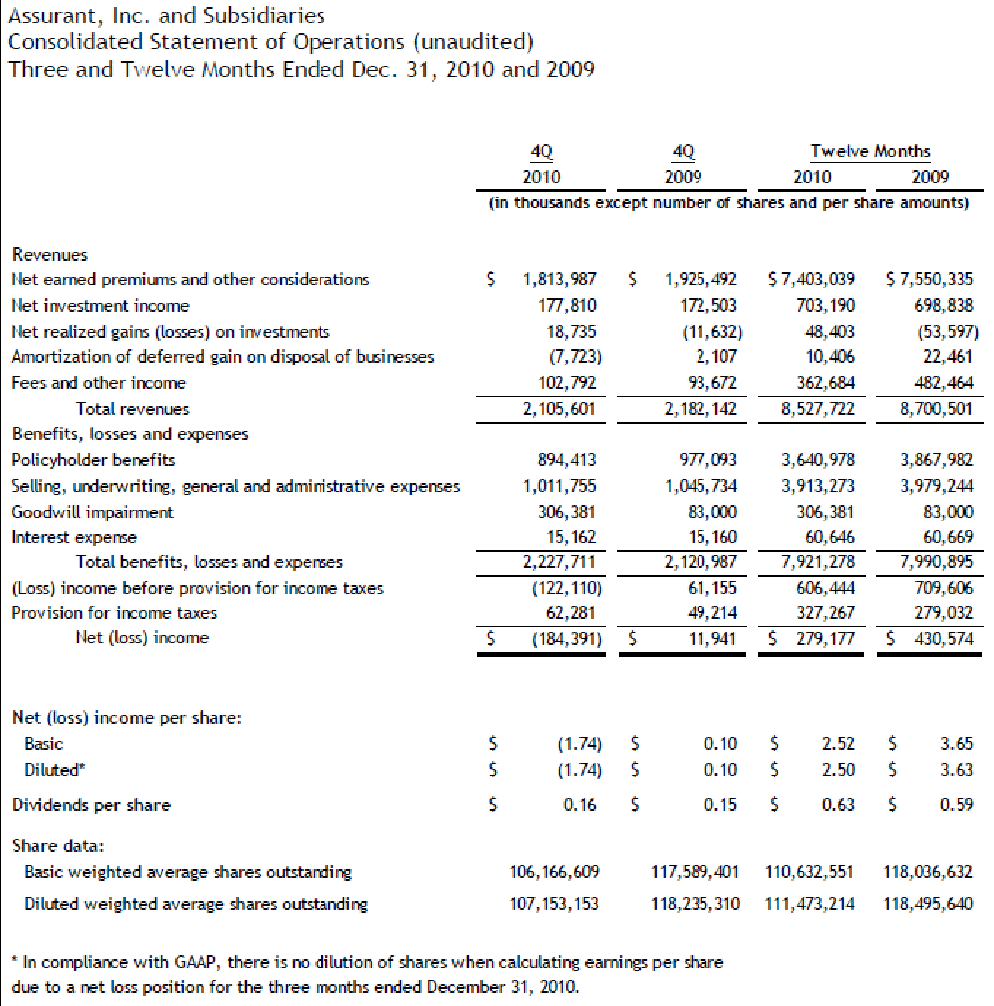

According to the company’s 2010 report, non-GAAP financial measures were used examine the performance of the business for the periods 2009 and 2010 (Assurant Inc, 2010). As shown in figure 1 in the appendix, “net operating returns is equal to net returns with the exception of net gains realized (losses) on investments and other irregular and intermittent items” (Assurant Inc, 2010).

The report continues to show that, “ Assurant used the book value per diluted share with the exception of AOCI as a significance measure of the value of stakeholder of the business. The value of the book value per diluted share with the exclusion of AOCI summed up to stockholders equity excluding AOCI divided by exceptional diluted share” (Assurant Inc, 2010). The organization believes book value per weakened share with the exception of AOCI gave the investors a precious measure of stockholder value. This is because it eliminates ”the idea of unattained gains on investment, which has proved to be varying highly from time to time” (Beer, 1993).

The group also used yearly operating returns on equity (ROE). This is a critical measure for the business’s operating performance. The report continues to show that, “ operating return on equity per year is the same as the net operating returns for the periods predicted divided by average stockholders’ equity for the recent period” (Assurant, 2010).

Conclusion

It is clear from this study that implementing organizational change is a very challenging and cumbersome issue that requires a lot of expertise and strategy in order to realize the objectives of the process of change. This is due to the changes involved such as opposition from the stakeholders which may arise due to focusing excessively on costs, failure to perceive benefits, lack of cooperation and coordination, avoidance of uncertainty and fear of loss of power and status or even their jobs.

It was also clear that when seeking to monitor the performance of an organization, it would be important to conduct regular assessments of the performance of the company. These assessments might be systematic, planned and explicit (this is usually the best kind of performance assessments) or planned and implicit. Assessments had been done well usually by use tools such as Strength, Weaknesses, Opportunities and Traits (SWOT) analyses, questionnaires, diagnostic models together with comparison of results of different standards. Therefore, it is good to think of organizational change in line with performance of the organization.

Reference List

Assurant Inc. (2009). Assurant Specialty Property: Products and Services: Our Businesses. Web.

Assurant Inc. (2011). Assurant Solutions: About Us. Web.

Assurant Inc. (2011). Assurant Health: About Us. Web.

Assurant Inc. (2011). Assurant Employee Benefits: Our Company. Web.

Beer et al. (1993). Organizational diagnosis: Its role in organizational learning. Journal of Counseling and Development. 71, 642-650.

Nadler et al. (1980). A model for diagnosing organizational behavior. Organizational Dynamics. Autumn: West Sussex, UK.

Palmer et al. (2008). Managing Organizational Change. McGraw-Hill: New York.

Appendix

Appendix 1. Provides a reconciliation of net operating income to net income for Assurant

Appendix 2. Assurant Specialty Property

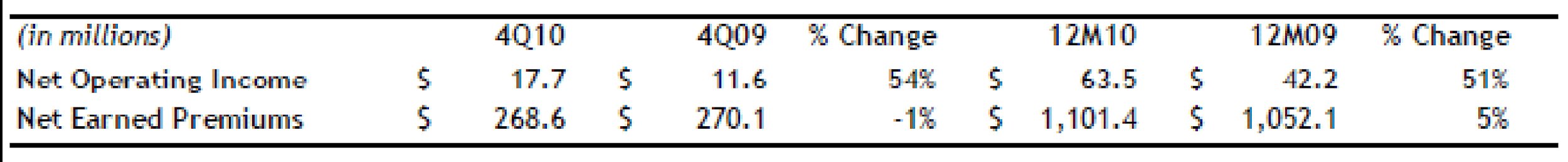

Appendix 3. Assurant Employee Benefits

Appendix 4

Appendix 5