Introduction

Business is a complicated matter that develops according to its own rules and regulations. Changes that happen in business are also conditioned by specific business-related issues and concepts. Accordingly, the phenomenon of business process re-engineering (BPR) is the embodiment of changes that every business organization needs to have from time to time to ensure modernization, time- and cost-effectiveness, improvement of product quality, and increasing the customer satisfaction rates (Drury, 2008, p. 547).

As a rather important procedure, the BPR is divided into specific stages presented and discussed by Mathis and Jackson (2007, p. 164). These stages require the people charged with the re-engineering to (1) re-think the current business process in an organization, (2) re-design the existing business process, and (3) to re-tool with the updated equipment, necessary innovations, and cost-effective solutions (Mathis and Jackson, 2007, pp. 164 – 165).

Activities’ Analysis

Value-Adding Activities

Thus, the first thing that should be done for the BPR’s success is the re-thinking of the currently exercised activities (Drury, 2008, p. 549). The value-adding activities (VA) include the following points:

- Retrieve check;

- Verify with the issuer that there is no request;

- Mark “Stop Pat/Reissue”;

- “Void” is written across the payment.

These activities are value-adding as far as they bring value to the company, although not directly, by allowing the company to reduce its unnecessary losses and avoid fraudulent payments.

Non-Value Adding Activities

The non-value-adding activities (NVA) are the ones that constitute the whole check payment system in the organization under discussion but do not add to the company’s value in either a direct or indirect way. The list of the NVA for the discussed company includes:

- Prepare to issue;

- Sings in to retrieve overnight mail;

- Check for missing items;

- Void placed in the system;

- Stored in a separate file with other voids, etc.

The above-listed activities are essential for the company as they allow it structuring the check payments properly, although without adding value to it in any way.

Business Value-Adding Activities

Finally, the most important group of activities implemented in the check payment process by the discussed company is BVA or business value-adding activities that include:

- Check for clerk’s initials;

- Complete lot listing;

- Check initials on photocopies;

- Photocopy and maintenance in file;

- Verify the system;

- Issue check;

- Mark “Stop Pat/Reissue”;

- Stored in a separate file with other voids, etc.

The above activities add business value to the company that implements them. The list duplicates certain items from VA and NVA activities’ lists, which evidences that such activities have emphasized the importance of the company’s check payment process.

Objectives and Risks

The final stage of the re-thinking process is the identification of the business objectives and putting them in accord with the associated risks (Mathis and Jackson, 2007, pp. 14 – 16). Thus, the major objective that the discussed company pursues with its check payment system is to develop the method of prompt and accurate payment of valid, properly approved business expenses. The risks associated with this include:

- Fraudulent payments;

- Delayed payments;

- Growing rates of customer dissatisfaction.

The listed objectives and risks should be permanently referred to, in the sense of the potential of achieving the former and eliminating or minimizing the latter, while the revolutionary and evolutionary re-engineering is developed.

Re-engineering Models

Revolutionary Design

Thus, keeping in mind the results of the activities’ analysis and understanding the relation of the company’s objectives and risks, it is possible to apply the revolutionary design for the business re-engineering process (Drury, 2008, p. 291; Mathis and Jackson, 2007, p. 128). The revolutionary re-engineering suggested for the issue, retrieve, and verify check procedures have the potential and financial and timing feasibility to help the company achieve its goals and eliminate the risks associated with the currently used system.

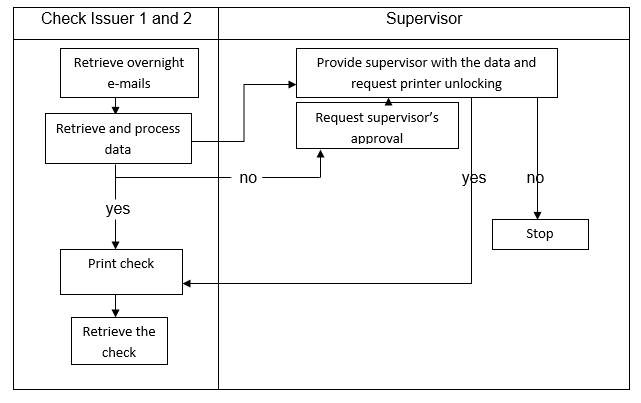

Thus, the check issue process can be revolutionary re-engineered in the following way to achieve the minimized-risk and effective objective-achievement conditions (Figure 1):

Thus, the above-suggested scheme of re-engineering of the check issue process is revolutionary changed to include fewer steps and adopt a time-effective approach. The peculiarities of the re-engineered system concern its ease of operation as, first of all, instead of preparing for check issues, the system should be prepared for this 24/7. Further on, the new system receives data via e-mail, which does not require clerk services and associated expenses. In addition, effort and time are economized by the direct access to the data that were formerly requested from the clerk.

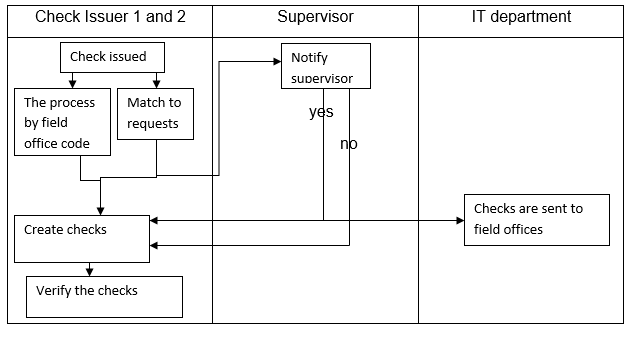

As soon as the documents are received, issuer 1 or 2 inquires about a supervisor’s approval via special software and either prints the check or stops the operation of the approval is not granted. The cabinet unlocks automatically as the supervisor’s approval arrives, which also saves time, and checks are issued much faster, while all possible mistakes are eliminated in such a process and make the check retrieving process simpler (Figure 2):

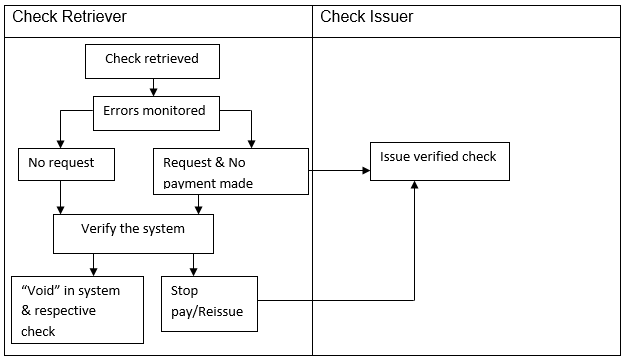

Once again, it is obvious that the revolutionary re-engineering is rather feasible in the areas of time- and cost-effectiveness. The reduced total number of activities and the increase in simultaneously completed operations make the process of check retrieving faster and eliminated the need for clerk services and time-consuming deliveries. This way, employer and customer satisfaction levels can be improved, which will be expressed in increased incomes of the company over time. Check verification is also simplified as a result of the re-engineered issue and retrieving processes (Figure 3):

The process of check verification can also be revolutionary re-engineered with the help of carrying out operations simultaneously and, most importantly, the implementation of innovative and modernized IT solutions instead of the formerly used traditional mail and clerk services. Thus, the most notable changes that the revolutionary design brings to the re-engineered check payment system elements include:

- The all-time readiness of the check issue system to receive and process check requests 20 hours per day, 7 days per week;

- Use of IT solutions instead of mail and clerk services:

- Check requests are received via e-mail;

- All necessary documents and data accompanying the requests are placed in the e-mail;

- Verified checks are sent to field offices by e-mail or fax, which enables the field office staff to print the checks and operate them.

- Software is used to connect to supervisors and requests their approvals and decisions:

- Supervisor’s approval is requested and received via e-mail;

- Cabinets are unlocked and printers enacted automatically after the supervisor’s approval is determined by the software;

- Any errors or mismatches between checks and requests are monitored by the system automatically as soon as the request data are placed into its database;

- The overall total number of activities in each of the three discussed processes is reduced;

- The number of operations carried out simultaneously (due to the use of software) is increased.

Accordingly, the above figures (Figure 1, 2, 3) and the list of the changes that the revolutionary re-engineered system will display allow seeing the whole picture of the potential of the revolutionary approach. The major argument in favor of the suggested revolutionary re-engineering is its potential for developing the method of prompt and accurate payment of valid, properly approved business expenses, i. e. achieving the major company’s objective (Drury, 2008, p. 212).

The above will be achieved mainly through the elimination of the risks that the company associates with its check payment system. In particular, the possibility of fraudulent payments will be minimized by the check verification system software that will automatically match the check payments with the requests. Thus, the possibility of issuing a check without a proper request will be eliminated together with the risk of fraudulent payment (Mathis and Jackson, 2007, p. 460).

The obvious time-effectiveness of the suggested revolutionary re-engineered check payment system minimizes also the second major risk, i. e. the possibility of a delayed payment being observed. The point here is that the speed of activities’ completion determines the payment’s being on time (Drury, 2008, p. 195; Mathis and Jackson, 2007, p. 517), and the use of IT solutions greatly improves the time-consumption rates required for reception, processing, and delivery of checks to field offices. For instance, while using the traditional male the company adopts the overnight check delivery policy under which an applicant gets the check the next day after the request is properly formulated and submitted. Under the new system design, this process will take minutes to be completed as far as formerly the most-time consuming operations will now be carried out via e-mail and using modern software solutions.

Further on, the suggested revolutionary design for the re-engineered check payment system is a cost-effective solution for the company. The check request delivery and the delivery of the actual checks back to field offices is currently the basic expense point for the company. It takes considerable funding to cover the services of the mail clerk as well as his/her travel needs. The use of IT solutions eliminates these expenses. The costs associated with the IT modernization of the company are expected to be outweighed by the savings promised by the strategy, as well as by additional income retrieved from improved levels of customer satisfaction and respective increase in sales (Drury, 2009, p. 298).

“As-Is” and “To-Be” Systems Compared

So, the revolutionary design of the re-engineered system proves to be feasible and applicable in all aspects of interest for the company, i. e. time- and cost-effectiveness, development of the prompt payment system, and elimination or minimization of the risks associated with it. For the better visualization of the basic changes and improvements that the newly suggested system provides, the comparative analysis of the “As-Is” and “To-Be” systems is rather useful.

Accordingly, the “As-Is” system can be characterized as a considerably reliable way of check payments that uses the services of the traditional mail and practices overnight check request deliveries from field offices to the central one and deliveries of checks back to the field offices. The “As-Is” system is thus associated with considerable time consumption and costs needed for mail clerk services and travel expenses, as well as for the system maintenance.

At the same time, the “To-Be” system is expected to be a completely computerized technique of check payment processes that would use IT solutions instead of traditional mail. The total number of activities in every stage of the “To-Be” system is reduced, and so are the costs and time needed for the check request to turn into a check payment. The “To-Be” system allows the company to eliminate or minimize the risks of its check payment system, by which the customer satisfaction levels are expected to be improved. The combination of all these factors is expected to provide the company with the proper and safe payment system and increase the financial conditions of its operation (Drury, 2008, p. 212).

Concluding Remarks

So, the whole above presented discussion allow concluding that the revolutionary method of business process re-engineering has proved to be effective. The design developed using this method has proved to be feasible in respect of time- and cost-effectiveness and safety of the payment system used by the company. At the same time, the similar method of re-engineering is not always applicable to all cases, and often the evolutionary design might be needed if the preliminary analysis shows the infeasibility of the revolutionary one.

Works Cited

Drury, Colin. Management and Cost Accounting. Cengage Learning EMEA, 2008. Print.

Mathis, Robert and John Jackson. Human Resource Management. Cengage Learning, 2007. Print.