Abstract

For any business, continuity and sustainability of success are very important goals to achieve. Most of the companies have set this as part of their strategic planned objectives. However, many organizations fail to balance between growth and their existing business capacity, resulting in earning a lot of profits at the start, then losing control and eventually losing the business. This normally occurs in the absence of a solid business model that runs and controls the operational activities within the organization. A brilliant idea can be developed into a real thing with effective planning and challenging work. An idea can create a business, which can be very successful and continue to exist for many years to come if it has the right business model to pursue, the right resources that will enable it to implement the strategic plans and cope with changes which are usually brought in by internal and external business factors.

Introduction

The difference between a bank and other business sectors is the raw materials used by these firms. For instance, a factory uses raw materials such as; plastic resins, oil, metal, additives among others to produce the final product to be sold to the end-users while a bank uses cash to generate cash, and adds up some services to cover its operational costs. For a bank or any other business to sustain good growth, a good business model is required which should have a certain degree of flexibility for it to become accustomed to change. The model can be adjusted in case there is a need to do so following frequent reviews typically conducted annually or every two years with an attempt to evaluate the company position in the market as well as give recommendations to the firm in case there is a need for changes.

The main source of income for any business is the customers, who direct and formulate the income of any organization. Companies review their customer service before and after-sales service quality continuously, creating quality divisions, and also try to enhance the brand image by mentioning their service standards. This report will compare two different business models is Caisse d’Epargne Bank and my own business which I started in January 2010.

Company Background

The Caisse d’Epargne Bank is part of a BPCE group; the group founded its first branch in 1818 and it now has 4,732 branches in total. It mainly provides retail banking and private banking services to its clients. The bank also has a large stake in the publicly traded investment bank Natixis and Caisse d’Epargne Bank is globally listed in the financial market under the name Natixis. The group has several brands as well as different networks and the most popular one is the Caisse d’Epargne saving mutual accounts. The Group has more than 51,700 employees, who enable the bank to meet its goals or objectives this implies that the bank has adequate human resources compared to the 4,732 branches it has (Caisse-Epargne.fr).

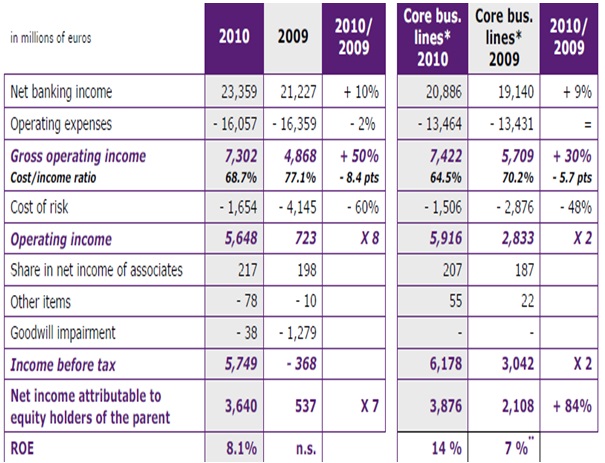

Since its foundation, the bank has expanded through innovation and the introduction of a variety of products and services meaning that it has undergone a transformation and it cannot be compared to the time that it was founded (Caisse-Epargne.fr). This can be shown by the table below.

Table 1. Source: Caisse-Epargne.fr.

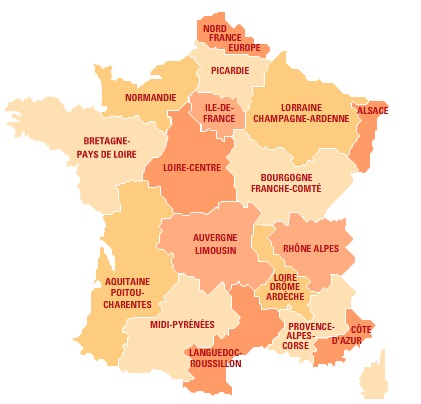

In France, the Caisse d’Epargne has 17 branches all distributed by regions. These branches include; Caisse D’epargne Aquitaine Poitou-Charentes, Caisse D’epargne et de Prevoyance D’auvergne et du Limousin, Caisse D’epargne Normandie, Caisse D’epargne et de Prevoyance de Bourgogne Franche-Comte, Caisse D’epargne et de Prevoyance de Bretagne – Pays de Loire, Caisse D’epargne et de Prevoyance cote D’azur, Caisse D’epargne et de Prevoyance ile-de-France, Caisse D’epargne du Languedoc Roussillon, Caisse D’epargne et de Prevoyance Loire-Centre, Caisse D’epargne et de Prevoyance Loire Drome Ardeche, Caisse D’epargne de Lorraine Champagne-Ardenne, Caisse D’epargne de Midi-Pyrenees, Caisse D’epargne Nord France Europe, Caisse D’epargne de Picardie, Caisse D’epargne Provence Alpes Corse, Caisse D’epargne Rhône Alpes, Caisse D’epargne de Nouvelle Caledonie and Caisse D’epargne D’alsace. These branches of Caisses d’Epargne are fully centralized in management and customers. Each department has its own branches, staff, managers, and executives who report to the head of the Caisse d’Epargne which is part of the group BPCE (Bpce.fr).

The bank values

The bank has three values that include ambition, confidence and commitment (Bpce.fr). The bank’s value ambition represents the energy of a banking group that knows all challenges while respecting its identity and roots, confidence, on the other hand, is a fundamental value of the Caisses d’Epargne that inspires its professional practices and its relationships with all stakeholders like the customers, employees, shareholders and suppliers. And lastly, Caisses d’Epargne is committed to maintaining an active relationship with the world around, contributing to local development and promotion of sustainable development (Bpce.fr).

Products and Services

The Caisse d’Epargne provides several services and financial solutions to investors, savers, companies and workers. The bank’s financial products include; Current accounts, Savings accounts, Mutual funds, Loans, Credit cards, Historical records keeping, and Letter of credit and Letter of Guarantee (Bpce.fr). While financial services consist of; Market analysis, Portfolio constructions, Wealth Management, Investment Services, Corporate and Individuals (Bpce.fr).

The BPCE group has more than 4376 branches, serving 27 million customers and the majority of the clients are not from the new generation (Bpce.fr). The bank is moving toward attracting the youth generation for the time being, and changing the image of a saving bank by providing additional services such as; Internet banking services and Private banking services. The analysis of the market in France in the year 2008 indicates that the Caisse d’Epargne bank has the largest portion of the market share (Bpce.fr) as shown below.

In 2010, the firm earned higher revenue of €5.749 Billion while in 2009 it made losses worth €0.368 Billion (Bpce.fr). This implies that the firm was more efficient in 2010 compared to 2009 has it had a return on equity of 8.1% therefore the shareholders receive 8.1% for investing in the company (Bpce.fr).

Company Structure and Corporate Ladder

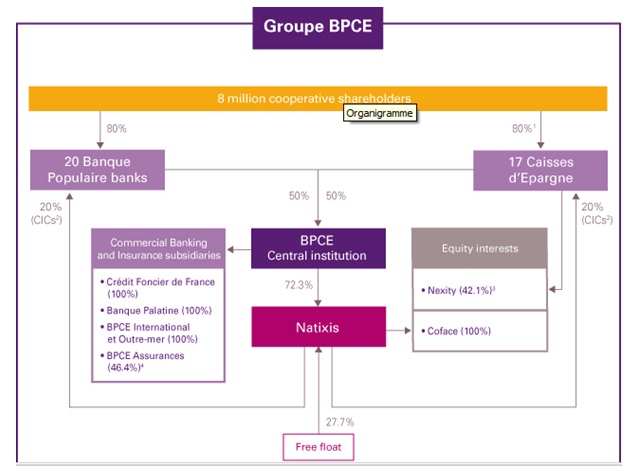

The chart below shows the BPCE group structure and corporate ladder.

The BPCE group

Groupe BPCE provides a comprehensive range of banking, financial and real estate services to all types of customers with its two historical Banque Populaire and Caisse d’Epargne brands and its specialized subsidiaries (Bpce.fr). Each expert in its business area pursues and provides a full range of commercial banking and insurance activities, on the other hand, financial solutions are provided through its corporate & investment banking division (Bpce.fr). Its innovative full-service banking model is based on a three-tier structure that includes first, the two cooperative banking networks with the 20 Banque Populaire banks and the 17 Caisses d’Epargne (Bpce.fr). Second, the central institution with BPCE, and lastly a number of subsidiaries that include Natixis, a publicly listed entity that encompasses corporate and investment banking activities, investment solutions and financial services, Crédit Foncier, Banque Palatine, the banks belonging to the BPCE International et Outre-mer network among others (Bpce.fr). The group has adopted a guarantee and solidarity mechanism set up between all the credit institutions affiliated with it (Bpce.fr).

The group ambition is to be the banking group most capable of supporting and serving its customers over the long term, thereby becoming the group of banking institutions most preferred by the French and their companies (Bpce.fr).

The group financial figures

The group financial figures are as shown below.

Table 2.

The group has 8,000 branches and it is owned by 8 million co-operative shareholders and has 125,000 employees who serve 36 million customers of the group (Bpce.fr).

Group rating

The group’s Senior Long-term debt is rated by Standard & Poor, Moody’s Investors Service and Fitch Ratings and given an A+, Aa3 and A+ respectively implying that it was stable (Bpce.fr) as shown by the table below.

Caisses d’Epargne

The Caisse d’Epargne was founded in Paris in 1818 to promote, collect and manage popular savings; recognized as “private institutions of public utility,” the Caisses d’Epargne has pursued missions of the public interest since 1895 (Bpce.fr). In 1950, the bank was authorized to grant loans to local authorities and in 1999, they became cooperative banks (Bpce.fr).

Through successive business creations and acquisitions, Groupe Caisse d’Epargne has extended its activities towards corporate customers, investment banking with the acquisition of Ixis, insurance, private asset management and, with Nexity, the Group became a full-fledged operator in the real estate sector. Today, the Caisses d’Epargne network is part of Groupe BPCE (Bpce.fr).

The 17 Caisses d’Epargnes are mainly driven by key forces in and at the service of, the local economy ranked among the principal banking institutions in their respective regions. Offering a comprehensive range of products and services covering bancassurance (collection and management of savings, loans, means of payment, asset management, insurance, among others) (Bpce.fr). They also support all economic agents whether private individuals, professional companies, associations, local authorities, among others in the realization of their different projects (Bpce.fr).

In order to provide solutions tailored to the needs of each customer, the Caisses d’Epargne draw on the personalized advice of its network of experts. They also offer their customers, access to banking services tailored to their profiles through their network of more than 4,250 branches, 17 online branches, the Internet, text messaging, the telephone and so forth (Bpce.fr).

Since 1818, the French saving banks have been in the vanguard of social solidarity and local services and have constantly reinvented and renewed their style of customer relations. This is why 4 million customers have decided to share this social commitment by becoming cooperative shareholders of the Caisses d’Epargne. This has also made Groupe BPCE be the second-largest banking group in France and to serve its market the group is distributed widely in France (Bpce.fr) which is in all the regions of the country as shown below.

Internship position

I was offered an assistant position in the bank in the engineering division of private banking, which has a supportive role to the branches and its main operation is to evaluate investment options, taxation, and lending options (Bpce.fr). The private banking department found in most of the banks is responsible for delivering financial services and products to wealthy clients. Caisse d’Epargne has four different departments which include Efficiency division, Branches support, Nonresident clients and Commercial (Bpce.fr). The head of the department of private banking is Mrs. Anna Linnaress who uses the latest methods in management, including open book management which allows anyone to participate in offering new ideas for development. A friendly environment helps the staff in being more productive, efficient, and also more creative.

The mission, assigned tasks and goals

Tasks were assigned to me by the head of the department Mrs. A. L. and in order to achieve my goals she assigned me some of these tasks which are as follows:

- How to increase the number of private banking customers?

- How to motivate employees?

- How to link job title to the employee?

- How to increase the number of private banking customers?

Since the Caisse d’Eargne Cote d’Azur private banking has been recently added to the regional head departments, it requires a lot of effort to compete internally with other regions. The most challenging task for the private banking management director is how to increase the number of customers in the region even as numerous customers are already having bank accounts in other banks in the region. For instance, Monaco banks are getting more popular and have attracted a lot of foreign investment amounts.

Analyze and suggest what needs to be done to increase the number of private banking customers?

For the bank to attain its goal they should highlight briefly some statistics about where they stand now and what percentage increase is set as a target with the time frame. Secondly, one of the things that might help the bank establish its goal is to design an advertising campaign highlighting the features and benefits of the product. Third, to increase the number of private banking customers, the management should revise incentives schemes. Fourth, create new programs for the outsiders who help in having new customers.

Fifth, create an incentive scheme for existing customers and the bank can also use word of mouth to increase its customer base this marketing tool will be more effective if the bank motivates its employees who then spread the word about the bank. Lastly, create a competitive advantage, in form of six-sigma, which can make sure the quality of the service provided is superior.

How to motivate employees?

To ensure that the employees are fully motivated and willing to give their best efforts to achieve their goals the bank should review job security, incentives on any outstanding result to add to the basic salary and lastly the firm should think about various options available to motivate employees. Most organizations use the RAAM model which says that you have to make the employee Responsible, Authorized, Accountable and Motivated. If the first 3 elements are fulfilled, the employee can in due course indirectly be motivated and thus contribute and add value to the job and eventually to the bank. Other direct elements that can keep the employee motivated include; pay package, job security, career path, training, good appraisal and rewarding scheme, strong corporate culture, among others.

The bank can link the job title to the employee by including the employee distinctive participation value as follows;

Job title +0= job title

0+ employee name= employee name

Job title + employee name= should add the role of the person to his or her job title.

Therefore, job requirements highlighted in the job description have to match the qualifications and experience of the employee and shortcomings can be overcome by specific training.

The link between the subject matter and mission

By this year of GDBA, I have had a wider view of working procedures and practices. I have used many ratios in analyzing the stock prices of many companies. In the domain of finance, I found many things related to many courses I have taken such as accounting, economics and financial management. In addition to all these subjects, operation management and the transformation of a company from a functional-based one to a project-based one will defiantly increase the accuracy of achieving the goals and even achieving more than what was required. By giving the employees a sense of direction, a clear path to their future which depends on the company’s strategy the bank can achieve its objectives hence its mission.

Internship goals

The goals which I was asked to reach were:

- To have a plan on how to increase the number of private banking customers,

- Rearrange and modify a training course on a certain date for the employees,

- To suggest how to improve employee job motivation, and

- How to synchronize the job title with the personal qualifications

Contribution to the company

What I can bring to the company is related to the direction and the image of the bank, based on my experience in HCBC and the National Bank of Saudi Arabia, I found that the only issue in the bank is the image and reputation and I have some ideas on how this image can be enhanced such as;

- Brand redesign,

- Improve services provided,

- Employees’ motivation,

- Shifting from group working classification to teamwork,

- Introducing the Islamic banking products, and

- Increase corresponding banks in the Middle East, Saudi Arabia and Dubai.

Theoretical knowledge

In the unit of Management Principles and Organizational Behaviour, I learned how the globalization process has affected the private sector, how the public sector resists this change, meaning that companies are getting more power and are reaching their customers all over the world even if the public sector has enforced limits on the flow of products and information. Another interesting topic is competitive intelligence which analyses off the wall information about the competition and gives signals to management to make better decisions. Another interesting unit was Information Systems for Management which can be used as a powerful tool for managing a business.

Proficiently using computer applications can ease a lot of tasks since the trend these days requires a shorter time in the decision-making process. In the Financial Management course, I learned how to use the cost of capital method to set the best rate of return to investors and to identify the best combination of stock to form a portfolio. Lastly, in Marketing Management I learned about brand image, positioning and segmentation which are essential for all businesses.

Development

The bank Human resources department had rigid policies in terms of incentives and empowerment. What I found in the bank is that the HR department role is not only in hiring and training rather its role is more complex which extends to payment approval for outstanding results. The bank cannot adapt paying customers or anyone an incentive without the approval of HR. The private banking department tries to find other solutions to be implemented to increase the number of customers. The HR policies do not allow additional payment for employees who bring new customers to the bank, and this blocks the sense of motivation of the employees and also stops the employees’ sense of entrepreneurship.

Comparison of the bank with my own business on the models used to increase the number of employees in the private banking

Tree Marketing – which is a system I used in increasing the number of customers, by converting existing clients to salespersons. Normally customers mostly spontaneously do Tree marketing after they try a service or a product of any company. Sometimes the customer is satisfied but he or she does not begin to talk to the group that they belong to and this is because there is no motivation for the customer to do so. Creating a motive is so essential if the company is sure of its products and service qualities. In my case, I started to follow up with the customers regularly, and by trying to discover whether the customer is satisfied or not, if yes I start to offer them an incentive of 20% for any business deal that he or she brings. By this method I found that customers are more satisfied, they are willing to increase their income, and they are also willing to speak more about the service quality that they are having.

The bank can use this method with the existing customers, by offering them 1% of any new accounts that come through them. Through this method, customers will be doubled in number in a very short time. In order to apply this method, the bank need to do or have a;

- Frequent service quality review,

- Service evaluation forms or applications, and

- Flexible business model to adapt to paying customers fees for their services in helping to connect people.

My business

The business was started in 2010 and the company profile is registered in Saudi Arabia under the name of Bafail Trading Ltd. The company has two main departments that are Cosmetics products department and the Tourism department. It’s mainly distributed geographically; currently, we are selling mainly in several countries such as Saudi Arabia, Dubai, Lebanon, England and Qatar. The company sells products and services as a wholesaler and a retailer. The cosmetics market is saturated thus we have tried to create value by selling not only beauty products, rather we sell results, meaning that if the customer is not satisfied for any reason, a 100% money-back guarantee will also take place, or free products replacement will be in place. The customer has the full power to choose between the two options.

My business uses the following steps to find the correct products for the market:

- Searching for new products that are available in these areas.

- Testing them: which takes around 4-7 weeks of testing and verifying the sources

- Buying in huge quantity after furcating the demand based on the last months

- Creating the insurance internally truly adds value to the business

- Selling to customers

- Following up with customers weekly

- Transforming customers to salespersons once they are satisfied

The business products range from Vitamins for anti-ageing through Wight loss supplements to Hair re-growth products. All products are not considered to be medicines; rather they are categorized as nutrition supplements. Since that medication sector is difficult to enter, and thus requires a lot of documentation and approvals.

On the other hand, in the tourism business services, we use personal contacts in several countries, and finding agents who are normally friends of friends we have also started a project-based activity with the agents. That the agent gets paid only if the customer is 100% satisfied compared to the experience, he or she has learned from other countries that he /she has visited, and if there are no claims within or after the trip. By these conditions, the agents started to be more motivated and are willing to work 24/7 to increase their income as if it’s their own business. In this department, the firm offers services such as;

- We offer company in the country, helping tourists to travel alone since that they will find new friends in the country where they are visiting.

- Translation and recommendation in buying anything for the customer, including where to buy and helping in bargaining as well

- Basic language course, by this the tourist will have a social benefit which is a new language basic. Normally it’s 30 new short sentences that open the door for continuing to learn this language.

Tourism activity plays an important role in free shipping when the stock of cosmetics products in Saudi Arabia gets low, and there is a new order which we can’t meet. We try to use the tourism activity for free, fast and reliable shipment, for small quantities normally in order to avoid embarrassment with the customers. People from Saudi Arabia for example like to help with such a service and mostly for free. But this depends as well on the level of satisfaction they had on their trips.

Growth and stability

For growth and stability, we thought that the best way to maintain stable growth is by involving customers in the sales process, by giving commission on new deals reaching 20% and sometimes 30% depending on the value of the deal. Many customers did want the 20% commission rather they have started to resell the products themselves with a margin they set on their own.

Threats of the business

Revaluation in Egypt, for example, has forced us to stop selling in that market and this is a matter that was never expected and even after revaluation impacted people are not willing to pay.

Conclusion and Recommendations

After my first week, I asked the colleagues and managers the reason as to why Caisse d’Epargne is different from the other banks for example BNP and SG banks and they answered that the banks are the same, providing the same services and products. I still think that any organization should be different from the others and should have its thump print exactly like human beings, to achieve a unique objective.

I started my second week having my reasons for being in the bank. Instead of being just a summer trainer where many other trainees are doing their internships. I wanted to discover the true needs of my internship and not only to graduate from a master, rather add value. By asking myself who are my stakeholders. And I found that my supervisor, the academic supervisor and the staffs I work with are my stakeholders in the workplace. Then asking and expecting their needs, then trying to improve the results that they anticipated.

By this method, I found my reason of being that serves my academic degree, the organization, and myself. Normally this process should start from the top management to the bottom. However, I had to make an example of this. Thus, I started on my own by;

- Identifying my stakeholders.

- Identifying their needs,

- What do I have to do to achieve these goals?

- Asking how can I improve the results?

- Print these two lines of paper and put them on my desk so that everyone knows what I am doing.

An Example;

My stakeholders

- Caisse d’Epargne Management, Mr Kairm Hacen and Mrs. Anna Linnaress

- IAE: Mr Tobleem

- Stuff I work with such as Mr. Yhan

Their needs

- KYC application, and Islamic products introduction

- To understand how to put the study materials into real-life example

- Support in translation, and in preparing any document they need

What do I have?

- Skills such languages: English, Arabic, French, Spanish, and some Italian

- The use of excel application helps a lot in analyzing stocks

How can I improve?

- Searching the best KYCs applications in the banking sector, comparing them to create the most suitable application.

- Understanding and writing a great presentation of the Islamic products

- Be available for any inquiry and ready to participate in any process on-demand from the department I work for.

The firm carried out an objectives status evaluation in increasing the customer number and a presentation was done and sent to the head of the department. Also, an employee’s motivation presentation was done and delivered to the head of a department reviewing the current situation. And how the departments can increase the level of motivation for the employees by allowing them to participate and produce and earn more if the required results are achieved. Arranging a training course for employees was a task assigned to me and the deadline was 10 days, I worked with Mr Yaan on this task since he was a presenter of this course in the bank and the title of the course was a valuation of assets.

Recommendations

For the Caisse d’Epargne to grow steadily, the bank should revise the authority of the human resources department, since its role is controlling all departments while its ultimate objective is to support and develop employees.

The tree marketing can help increase the number of customers in the Caisse d’Epargne, by allowing customers and employees to participate in this objective that will end with remarkable results.

The objectives’ setting process was clear and challenging and was done in the first week of the internship and the tasks assigned were corresponding to the internship objectives which I urge the bank to continue with the same spirit.

Works Cited

Bpce.fr “Investors Relations”, 2011. Web.

Caisse-epargne.fr. “About Caisse-d’Epargne”, 2011. Web.