Arguments in favour of a free market system of resource allocation

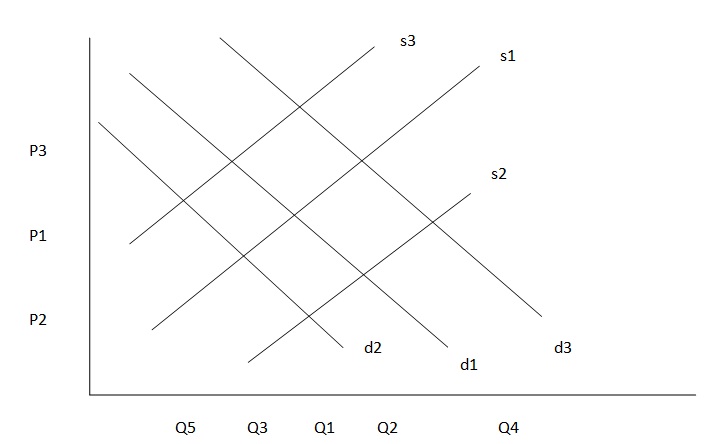

Free market of system is also referred to as the capitalistic economy. In this kind of market economy, the resources are controlled by private sector (Zhang & Zhao 2011, p.106). This further implies that the government has little control of resource allocation (Webster 2003, p.13) and the functioning of the activities taking place in the economy. In a free market economy, demand and supply determine the market prices (Adams & Periton 2008, p.62) and it is not left in the hands of the business people to determine the prices. For instance, the increase in the supply of goods and services in the free market economy leads to the decrease in the prices of the goods and services and vice versa. When the demand of the goods and services increases, the price increases and the privately-owned firms are bound to increase their production through more allocation of their resources (Riley 2006). Therefore, in a capitalistic market economy the allocation of resources are determined by the price mechanism.

Since the prices of goods and services are determined by the forces of the markets, the sellers can make high profits when the demand of goods and services increase. Because of the nature of the free market economy to allow entrepreneurs to own the resources of production, they can increase the prices of commodities when the demand increases while supply remains stagnant. This allows profit maximization in the economy as the entrepreneurs have the freedom to make profits through the increase of prices (Lameiro 2011). However, because of the free knowledge of the market and competition, the buyers will determine from which producers to buy their products. The freedom to set prices (Lameiro 2011) will create different prices in the economy where the producer with low prices will attract more customers. On the other hand, producers with high prices will lower their prices to meet the demand of the buyers and continue making profits.

Free market economy allows innovation and producers can create better, faster, and cheaper products than those existing in the economy (Lameiro 2011). This allows competition and the production of high quality and variable goods and services. For example, perfect substitutes can be produced which would create competition in the market hence the need for high quality goods. In a free market economy, both the entrepreneurs can make independent choices. It allows the freedom of choosing the industries to operate from and creation of capital (Lameiro 2011). For example, because of the perfect knowledge of the market, entrepreneur can make choices on which sector to invest depending on the forces of demand and supply. This is necessitated by the need to make profits in free market economy.

Austria which is a member of the European Union operates under the social market economy (U.S Department of State 2011). However, the ownership of state-owned firms has since been transferred from the government to private ownership. The move by the government has made the economy a free market economy. The privatization of the firms (U.S Department of State 2011) is believed to have left the reallocation of the resources to the free hand that controls its allocation. It has also left them under the influence of the demand and supply which is both played by the consumers and the producers.

Although the government has privatised the ownership of the firms, it still has limited control some aspects of resource allocations. For instance, the government provides external defence and legal structures that regulate the market operations like the formation of labour unions and the issuance of property rights. This characteristic of the free market economy does not however make the government the controller of resource allocation. Instead the markets are left to control the prices in the economy. (Lipsey & Chrisystal 2007, p.12). With most of the firms being controlled by the private sector, it implies that some of the firms enjoy monopolies. For example, the postal service providers in Austria enjoys limited monopoly even after the liberalization of the market (Flecker & Herman 2009, p.2).The oil industry in Austria like any other in the world is controlled and operated by cartels.

How ‘market failure’ can occur and how the Austrian government has sought to ‘correct’ the market failures

Market failure happens when the market is unable to efficiently allocate its scarce resources. This is may be caused by numerous reasons like externalities, asymmetric information (Izquierdo & Izquierdo, 2007, p.858; Chiappori & Salanié 2000, p.57), common pool of public goods, and market power. In free market economies, externalities occur since they are not regulated by the price mechanism (Dwivedi 2008, p.570). Private companies are driven by profits at the expense of the people. This detrimental effect affects the society because the firms may not pay the cost associated with this negative externality. An example of a negative externality is the dumping of industrial wastes in rivers.

Free markets are characterized by the private ownership of resources where some of the owners may have market power. For example, the demand for oil is ever high and being a scarce commodity, the owners may lead to monopoly and control the resource and prices thus gaining market power. In this situation the firm charges more price that the cost of production. Another example of market power in Austria is the limited monopoly enjoyed by the Austrian postal services (Flecker &Hermann 2009, p.2).

Asymmetric information occurs when one party posses more information on a product or service than the other party (Lofgren, Persson & Weibull 2002, p.196). For instance, in the health insurance sector, the people always have more information on their health situation and the health-related risks than the healthcare insurance companies (Lofgren, Persson & Weibull 2002, p.196). This kind of situation leads to market failure since the healthcare insurance companies increase their costs/price because of the high demand for the scare resource. This leads to market failure as the resources are not efficiently allocated (Schinasi 2004, p.22).

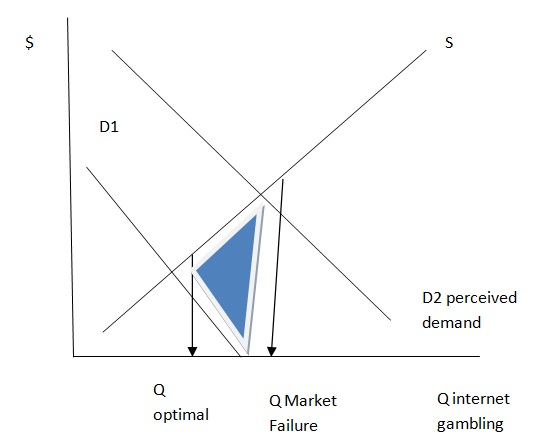

Public goods and common pool of goods often lead to market failure since there are non-excludable. This implies that the usage of public good does not make it unavailable to other people. Example of these public goods includes internet, public parks, and the national defense. Common pool resources on the other hand can be overcrowded or depleted leading to market failure. Gambling involves asymmetric information where because of the perceived demand it leads to market failure (Ronosto n.d, p.11). This can be caused by the presence of trustworthiness of unregulated sites where the employees can alter the chances of winning a game causing house advantage (Ronosto n.d, p.10).

The graph shows the effects of internet gambling a public good legalized in Austria. Sites can be altered to ensure the win instead of the people thus increasing the perceived demand. When the perceived demand is greater than the actual demand then output becomes more than the social output leading to market failure (Renosto n.d, p.11). To make sure that internet gambling does not cause market failure, the Austrian government has put into place gambling rules and regulations that monitor the internet gambling activities.

One of the methods used to encourage competition is through industrial deregulation. The deregulation law of 1992 was established in Austria to reduce the restrictions and regulations with the aim of making the market more competitive (p.10). This was one of the requirements Austria had to meet before joining the European Union. One the deregulation policies include the reduction of price regulation policy which endured that entrepreneurs would set competitive prices (Clemenz 1999, p.11).

The Austrian government has also encouraged market liberalization and privatization of the state-owned companies to increase competition (Clemenz 1999, p.7). Liberalization has been encouraged in the electricity and the Austrian telecommunication industries (Flecker &Hermann 2009, p.2). This has ensured that monopolies and market powers are not experienced in the Austrian economy. On the other hand, Austria has introduced emissions trading schemes and carbon tax laws (Europa 2007). This is based on the European Union requirement that expects its member states to control the carbon emissions. These policies are further transmitted to the Austrian industries which are expected to reduce their carbon emissions by 2.1 million tonnes (Europa 2007).

Reference List

Adams, S., & Periton, P. 2008. Fundamentals of business economics. Amsterdam: CIMA/Elsevier.

Chiappori, P. & Salanié, B., 2000. Testing for asymmetric information in insurance markets. The Journal of Political Economy, Vol. 108, No. 1, pp. 56-78.

Clemenz, G. 1999, Privatization, liberalization and deregulation –The Austrian experience. Web.

Dwivedi, D. N., 2008, Microeconomics: Theory And Applications. New Dehli: Dorling Kindersley Pvt Ltd.

Europa. 2007. Missions trading: Commission adopts decision on Austria’s national allocation plan for 2008-2012. Web.

Flecker, J. & Hermann, C. 2009. How companies react to the liberalisation and privatization of public services. Web.

Izquierdo, S. S., & Izquierdo, R. L., 2007. The impact of quality uncertainty without asymmetric information on market efficiency. Journal of Business Research, Vol. 60, pp. 858–867.

Lameiro, G. F, 2011. Characteristics of a Free Market. Web.

Lipsey, R. G., & Chrystal, K. A., 2007. Economics. Oxford: Oxford Univ. Press.

Lofgren, K., Persson, T., &. Weibull, J. W., 2002. Markets with Asymmetric Information: The Contributions of George Akerlof, Michael Spence and Joseph Stiglitz. The Scandinavian Journal of Economics, Vol. 104, No. 2, pp. 195-211.

Renosto, A., 2010. Correcting market failure in the internet gambling industry: An economic analysis of legalization and licensing regulation in the United States. Web.

Riley, G. 2006. Scarcity and choice in resource allocation. Web.

Schinasi, G. J., 2004. Private finance and public policy. Washington: DC.

US Department of State. 2011. Background Note: Austria. Web.

Zhang, J., & Zhao. N., 2011. Research on the market economy model. IPEDR, vol.7, pp. 106-109.