Domestic market demand in China’s property sector has been on a steep decline in the past 12 months. The decline is significant to China because the real estate sector usually accounts for 25 percent of the country’s gross domestic product (GDP). Additionally, Magner and Silk (n.pag.) note that due to the interconnected nature of different sectors of the Chinese economy, the slump in the property market “has hurt everything from cars to cement.” This paper proposes to find out the exact cause of declining domestic demand for property in China. Specifically, the paper will seek to answer the question: ‘what factors have contributed to the declining domestic demand for property in China?’

Problem Statement

The high debt levels, and price pressures facing the Chinese property market is worrying. Property developers are facing increased pressures from financial institutions that might have advanced them development loans, and they also have to deal with high inventory levels. With low demand in the domestic property market, the future of China’s real estate sector looks bleak.

Purpose of the Study

The proposed research acknowledges that a slump in the property sector affects the entire Chinese economy. Consequently, the paper has the following goals and objectives:

Goal

To find out what is obstructing domestic demand for real estate property in China

Objectives

- Indicate the reasons for continued slowdown in China’s property market

- Identify countermeasures that can improve domestic demand in China’s real estate sector.

- Identify what needs to be done in order to avoid a total collapse of the property market in China.

Literature Review

The decline in China’s property market is being perceived as an indicator of an economic slowdown in the country (Xu n.pag.). Since 1978, the Chinese economy has been growing at an average rate of 9.5 percent per year (Nie and Cao 1). The property sector had played a significant role in China’s economic growth since 1998 when the country reformed its housing policies. Specifically Nie and Cao (1) note that the annual growth in the real estate sector has been an average of 20.2 percent since the 1998 reforms. Before the reforms, the Chinese government would provide housing to the people. With the reforms, however, Chinese citizens were given government approval to start developing or purchasing real estate properties. At the time of the reforms, property development only accounted for four percent of China’s GDP. In 2013, however, real estate properties represented an approximate 15 percent of China’s GDP (Nie and Cao 1).

A close look at the China’s property market in the domestic front reveals some interesting facts. For starters, the country today has about 90 percent home ownership rates (Nie and Cao 3). In other words, only 10 percent of China’s population does not own homes. The high rates of homeownership in China result from government efforts that have made houses affordable to both the high-income and low-income groups. Since high-income groups can afford to purchase their preferred properties in the free market, the government’s attention is on lower income-earning groups. According to Ulrich (2-3), the national and local governments in China have deliberately enhanced homeownership through affordable housing programs. The affordable housing programs are divided into four categories namely: economic housing; low-rent housing; price-capped housing and shantytown resettlement (Ulrich 2-3).

China’s demographic change also contributes to the current situation in the property market. Nie and Cao (3) note that like most other economies, first-time homeowners usually increase the demand for property. In China, first-time homeowners are typically in the 24 to 30 year’s age bracket. Unfortunately, people in the foregoing age bracket are on a steady decline in China. In 2000, for example, 13.4 percent of the Chinese population was aged between 24 and 30 years. In 2013, however, only 10 percent of the Chinese population was in the same age bracket (Nie and Cao 3). The declined numbers of first-time homeowners, albeit with a three percent margin, has a negative impact on the property market since few people compared to past years, are buying their first houses (Nie and Cao 3)

Another possible contributor to declining domestic demand for property in China is the decline in the percentage of working-age population. According to Nie and Cao (3), 70.1 percent of China’s citizens were aged between 15 and 59 years in 2010. In 2013, however, the share of people in the same age bracket had declined to 68.7 percent (Nie and Cao 3). Consequently, the number of persons who had disposable incomes (that they can use to purchase property among other things) had declined by 1.3 percent in just three years.

Another possible reason that has been cited for the declined demand for property in China is the oversupply of property (Nie and Cao 3). Buoyed by the promising market in the country, Chinese property developers have been developing properties hoping to sell them in the future. Barth, Lea and Li (4) note that until 2011, property developers in China were struggling to meet the demand for housing in urban areas. As such, they got into a practice dubbed as ‘overbuilding’, whereby too many properties were developed thus leading to an oversupply of the same (Nie and Cao 3). With the declining domestic demand, property developers have been left with a large inventory (i.e. unsold properties). Incidentally, even with declining demand in the domestic market, some property developers are still hoping for better times in the future. As a result, they are still developing more properties. The resulting situation is one where the inventory-to-sales ratio is increasing with every passing month. Nie and Cao (3), for example, note “the average inventory-to-sales ratio in China rose 50 percent in the past 12 months.” The inventory-to-sales ratio is defined as the time (usually in months) it would take customers to buy existing properties under prevailing market conditions. Barth, Lea and Li (4) notes that the current properties awaiting sale can take three years to sell under prevailing market conditions. If the property that is currently under construction is factored in, China will need at least four years to sell off the entire property inventory. Notably, the slump in the property market has not come as a surprise to many economic analysts. According to Barth, Lea and Li (13) macroeconomic experts have always warned that the supply of property in China would soon or later, outstrip demand for the same.

Basic economic thought indicates prices decline when there is an increase in supply. The trends in China’s property market, however, appear to have defied the foregoing notion. Despite the oversupply of real estate property in China, Falzon (267) notes that property prices are still high. Although the high prices do not entirely explain why China is experiencing low demand for property, it has been theorized that most people are not earning enough incomes to enable them purchase property in most cities in China (Barth, Lea and Li 4). In other words, not many people can afford to purchase houses in the prevailing sale prices. The disequilibrium that occurs when the demand is low and supply is high is, therefore, likely to persist into the future especially if the sale price will remain high. As the International Monetary Fund et al. (26) note, the property prices perhaps remain high for valid reasons. Such reasons include the possibility that a fall in the prices could damage “the balance sheets of households, firms, financial intermediaries and disrupting economic activity” (IMF et al. 26).

In other words, lowering property prices in order to attain market equilibrium could interfere with the returns that investors intended to have from the investments, and such interferences could have a spiral effects on their supplier, some who include the financial lenders. In 2010, IMF et al. (27) found out that in the larger part of China, marketing fundamentals appears to have been followed when pricing real estate properties. However, market fundamentals were clearly ignored in cities such as Beijing, Nanjing, Shenzhen and Shanghai. Consequently, properties in the four aforementioned cities were clearly overpriced. Notably, overpricing could affect the affordability real estate properties in the short- and long-term. The market fundamentals that arguably play a major role in the pricing of real estate properties include “a rapid income growth, a rising urbanization trend, abundant liquidity, low cost of home ownership and low mortgage debt of households” (Falzon 267).

Discussion

From the literature review above, it would appear that the declining domestic demand for real estate properties in China is brought about by a combination of factors. Demographic causes (i.e. the reduced number of first-time homeowners; a reduction of people within the active age bracket- i.e. 15-59 years; and the fact that about 90 percent people in China already own homes) specifically appear to play a major role in the low domestic demand for real estate properties. The oversupply of real estate properties, which is brought about by overbuilding is also another valid reason for low domestic demand. It is worth noting that when real estate investors built the properties that have not been sold yet, they were expecting the properties to be sold off within a specified time. As indicated in the literature review section, however, the Chinese market currently has a surplus of properties that can be sold in the next three years. If the properties that are under construction currently are to be factored in, it would take the country at least four more years to sell all the properties under prevailing market conditions.

The literature review section also reveals that overpricing of properties could also be another major reason why domestic demand is low. The foregoing argument is sensible especially when combined with the possibility that the wages of the targeted market may not be as high as to guarantee affordability. As indicated elsewhere in this paper, different government levels in China have embraced programmes intended to enhance the affordability of real estate property. The foregoing position by the Chinese government means that if the citizens cannot afford the commercially available properties, they can always consider the highly subsidised property offered by the government. Arguably, therefore, it would appear that the government is competing (albeit not for profit reasons) with the private investors in the property market. High property prices would most likely not pose a major hindrance to house ownership because consumers can always apply for government houses.

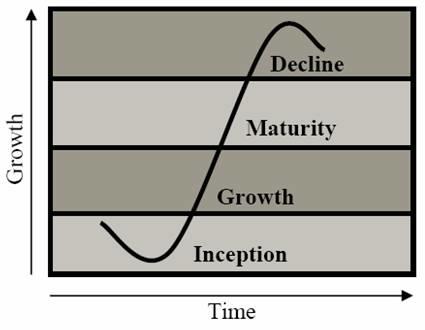

There is also the possibility that China’s property market is stabilizing. After several decades of high demand for real estate property, the economy might have outlived its growth phase. Consequently, it could be that the real estate sector is at the maturity stage, especially as the market becomes saturated, and the number of new homeowners declines. Figure 1 below is the Sigmoid Curve, which is an illustration of the foregoing argument. The diagram shows what happens after a substantial growth in the market. Inevitably, the growth phase has to end, and give way to the maturity stage, which later gives way to the decline phase. Arguably, China’s property market may not have hit the decline stage yet, but it may have hit the maturity stage, which means that the demand, supply and prices for real estate properties will sooner or later, stabilize. Perhaps the stability in the market could explain the prevailing lower demand in the domestic market when compared to previous years.

Methodology

The proposed research will use a qualitative method of research, where data regarding past and current occurrences in China’s real estate market will be gathered. The researcher will use a detailed literature review to find out the reasons for the prevailing low domestic demand in the real estate sector. Additionally, the researcher will seek explanations in the literature about what needs to be done in order to improve the current situation. The researcher will then analyses the findings and write an informed conclusion about the factors that are responsible for the declining domestic demand for real estate properties in China.

As a research method, literature review has its advantages and disadvantages. The advantages include: access to comprehensive information as written and analyzed by other scholars; access to insightful information from other people; access to background data; the method is inexpensive; the results are often valid and reliable; and it is easy to analyze the data obtained from a review of literature (Marrelli 43). The literature review approach also has some shortcomings. They include: it can be time consuming; some of the available information may be incomplete; some literature sources may contain biased analysis; the literature sources may not capture everything that describes the research questions; and some of the available literature may be dated (Marrelli 43).

Reliability

The researcher will use reliable literature sources only in order to enhance the reliability of the proposed research and its findings. Credible sources include peer reviewed journals, books, and internet sources from reputable companies (e.g. The Wall Street Journal and the Financial Times). The researcher will not rely on blogs, Wikipedia or other opinion columns whose details may not be based on scientific thinking or evidence.

Validity

To enhance the validity of the proposed research, the researcher will ensure that he remains within the context of the research question. In other words, the researcher will ensure that the research provides findings that answer the research question accurately and reliably.

Time Table for the Proposed Research

Budget

The budgetary allocation for the proposed research is minimal considering that most of the literature that will be used in the research will be accessed through the university library. When working off campus, the researcher may need to use internet bandwidth, which will be purchased from the researcher’s personal resources.

Conclusion

This paper proposes a study to be conducted with the intention of finding out what is negatively affecting the demand for real estate property in China. The paper suggests the use of a detailed review of the literature in the methodology section. Based on the preliminary review of the literature, the paper provides a discussion section which details the possible reasons for the declined domestic demand for property in the Asian country. The paper notes that a combination of factors may have led to the low demand for property. Demographic reasons, which include the a reduced percentage of first-time homeowners when compared to the past decade; a reduction of people within the 15-59 years active age bracket; and the fact that about 90 percent of the Chinese people already own homes, all contribute to the current situation in China. The oversupply of real estate properties in China combined with the overpricing of the same properties seemingly lead to market disequilibrium. Other factors that seem to contribute to the low domestic demand for real estate property include government programmes that have offered alternative house-owning avenues to the low-incoming earning citizens. Finally, there is a possibility that the Chinese property market has now matured thus leading to stability in demand. Eventually (and this is based on the assumption that the foregoing assumption is true) the supply side will stabilize, thus leading to market equilibrium prices. Overall, it appears that the prevailing domestic demand for real estate properties can only be explained by a combination of different but interconnected factors.

Works Cited

Barth, James R., Michael Lea and Tong Li. “China’s Housing Market – Is a Bubble About to Burst?” Milken Institute Working Paper Series, (2012): 4-27.

Falzon, Joseph. Bank Performance, Risk and Securitization. Basingstoke: Palgrave Macmillan, 2013. Print.

International Monetary Fund (IMF), John Porter N., Ashvin Ahuja, Lillian Cheung, Gaofeng Han and Wenlang Zhang. Are House Prices Rising Too Fast in China? Washington D.C.: IMF, 2010. Print.

Magner, Mark and Richard Silk. “Weak Demand, Real-Estate Slump Signal Headwinds for China.” Wall Street Journal. Wall Street Journal, 2014. Web.

Marrelli, Anne F. “The Performance Technologist’s Toolbox: Literature Reviews.” Performance Improvement 44.7(2005): 40-44. Print.

Nie, Jun and Guangye Cao. “China’s Slowing Housing Market and GDP Growth.” The Macro Bulletin (2014): 1-3. Web.

Ulrich, Jing. “China’s Housing Imbalance – Is Affordable Housing the Cure?” JPMorgan.com. J.P. Morgan’s Hands-On China Series, 2010. Web.

Xu, Yingying. “The Economic Consequences of China’s Housing Market Slowdown.” Mapi.net. Manufacturers Alliance for Productivity and Innovation, 2014. Web.