Introduction

Croda International Plc. Company is a holding firm to a group of companies that produces a wide range of chemicals. These companies supply manufacturing products such as personal care, plastics, food processing, fire prevention products, and pharmaceuticals (Hans Zweifel, 2006). They provide line chemicals for the health care, personal care, home care, and manufacturing specialties markets globally. Additionally, the company provides a variety of pharmaceutical merchandises and nutritive ingredients, including actives, carriers for drug delivery, essential fatty acids, protein derivatives, and biopolymer. According to Kramer (2008), the company operates in many nation world-wide with branches in France, the UK, Holland, Italy, Germany, Spain, the US, Brazil, Singapore, Korea, Indonesia, Japan and India. Moreover, the company is the prominent suppliers of Omega 3 fish oil concentrates internationally. The company has edge out its competitors due to its advanced technologies such as Super Refining and Puremax

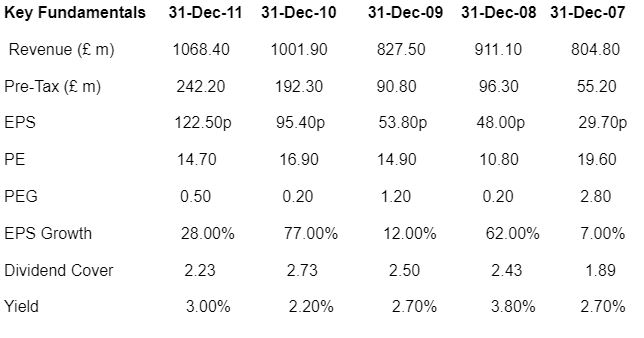

Foots (2007) states that the Croda international Plc. Company strategic plan is to increase research activities including the marine and herbal lipid concentrates. The company concentrated in developing natural based fields for skin and hair care. The company has reported an uptrend growth in its financial strength by 6.64%, which rose from 1.00bn-1.07bn while net income enriched 28.06% from 130.80m-167.50m. Moreover, the dividend share price has seen an upsurge increase in growth, which is the highest for the last five years. Notably, the company cash reserve has reduced by twenty five millions (25 millions).

Strategy and forward planning

The future of the company is focused on the strong, effective and rigorous recruitment process. This will ensure that the company has the much needed right leaders and specialist. These leaders will enable the company to spur growth. The company strategy is concentrated on the market niches that are motivated by strong, health and well-being, positive trends in beauty, and the growing need in the sustainability and protection of the environment. Foots (2007) states the company future growth is based on the increasing disposable income, population and the consumer spending. The company provides performance in the products that they offer, which has made people to look and feel good. The products of the company are safe to use and are within the regulatory requirements by the government.

According to Icon Group International (2209), Croda International Company is focused on innovation in order to drive growth in prosperous new products. The company is well placed in taking advantage of their brand name and market command since the raw materials come from natural sources. The company has embarked on the strengthening of the presence in the new emerging markets such as the Asia and the Latin America (Plunkett Research Ltd, 2007). Moreover, differentiated technology, innovative marketing and the emphasis on the market niches are fronted as the main drivers of future growth of the company. The company is capitalising on the businesses that create profitable invention that can withstand great operating margins. There has been a strong request for an innovative, great performance goods and a less differentiated commodity.

The company strategic and forward plan is to repeat the achievement they observed in the customer care and human resource. They intend to launch innovative products into cost-effective market niches that they have command in (Kramer, 2008). The company uses the renewable resources in producing their goods hence their sustainability. The company has embarked on a scientific research in screening new products

The accounting policies

The Company’s accounting guidelines have been agreed by the management, which demands that the estimates and the assumptions are made in the going concern. The judgments are evaluated continually, basing on the upcoming expected happenings (Hans Zweifel, 2006). There is a change in the accounting policies over the years due to re-evaluations.

Financial Analysis

This analysis will measure the corporate risk, studies the liquidity of the stock, monetary strength, success and company growth features of Croda International Plc. Additionally, this will review the financial results of Croda International Plc. Versus the Porvair PLC. This review will focus on the comparative analysis of the companySales, Company Valuations and Financial Position. Also included for Croda International Plc. are the Company Description, Recent Stock Performance, Profitability Analysis, Dividend Analysis, and the EPS.

Croda International Plc.

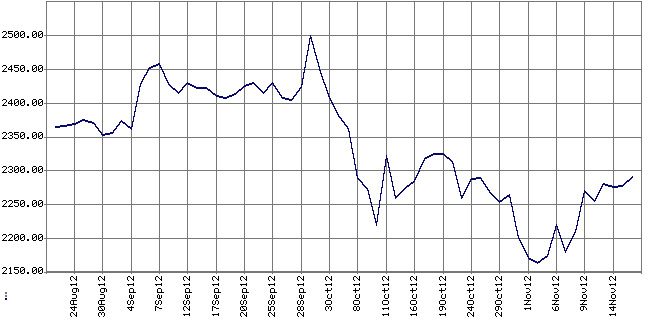

The share chart for Croda international Plc. Company

Risk management

Croda has been committed to the effective management of the risk management in order to deliver value to the investors, safeguard its reputation, as well as, maintain good corporate management (Foots, 2007).

Notably, the company is transparent in disclosing material information to its stakeholders. This has given them stakeholders’ confidence to the company.

Porvair PLC.

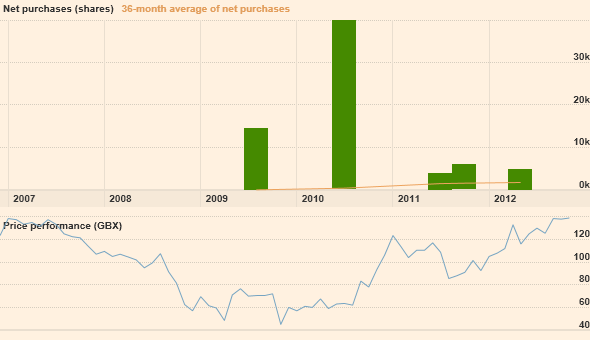

Porvair PLC shares during the last thirty-six months

The company has indicatedconfidence in the prospects for their growth company in the future, outlined in the figure below. The company strategic and operating directives have been consistence over the year leading to good performance.

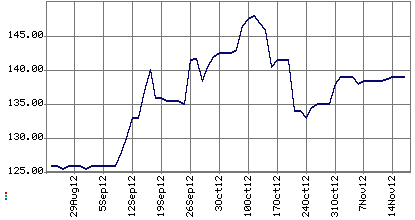

Share Price Information for Porvair (PRV)

Three months Porvair Share Graph

Just like the Croda International Company, this company has focused on the emerging market in the Far East. This has made the company to continually broaden the market segment hence the steady market share margins.

Questions to the director:

- Are you developing all kinds of expertise available in your company?

The reason for asking this question is because any company needs to ensure that there is a right staff mix to meet the current and future economic events. - Do you have access to the right external advice?

This question is meant to know if the company outsources advisors to complement to the company expertise. - Is the company forecast realistic and current

Forecasting is an indispensible tool for operating any company and it is critical that they are realistic in their estimation. This means that the expectations be regularly tested and rationalised. - Is the company risk management getting to the real risk?

Risk is an intrinsic part of business operation. Therefore, companies need to have efficient risk management, which will identify, evaluate, monitor and lessen risk. - What is the company policy on community development

This is meant to investigate if the company is interested in uplifting the living standards of the local population or making profit.

References

Commission, GB 1991, Prosper De Mulder Ltd and Croda International Plc, Stationery Office, London.

Foots, S 2007, Croda’s man with the chemistry for success, The Telegraph, vol. 11.

Hans Zweifel, RD 2006, Plastics Additives Handbook, Hill and Lindsey, Chicago.

Icon Group International, IS 2000, Croda International Plc:Labor Productivity Benchmarks and International Gap Analysis, Icon Group International, Incorporated, Ney York.

Kramer, J 2008, Worldscope Industrial Company Profiles, The Service, vol. 11.

Plunkett Research Ltd, JW 2007, Plunkett’s Chemicals, Coatings & Plastics Industry Almanac 2007, Adventure works, Chicago.