History and Background

Just for Feet Inc. was established by Harold Ruttenberg in the United States after escaping the political and economic troubles in South Africa in 1976. Ruttenberg was a thriving entrepreneur given that he owned ventures before the emergence of the political and economic instability in South Africa and in his home country he had established successful retail shops. After the eruption of the political and economic issues in South Africa, young entrepreneurs were allowed by the emigration law to get only $30,000 from their ventures. Just for feet was founded in 1988 by Ruttenberg; the initial capital was from money gained after selling his retail shops. From 1988 to 1990s, Just for Feet Inc. became the main supplier of athletic shoes in the United States with more than 300 retail outlets. Just for Feet went public in 1994, and in the late 1990s, Just for Feet’s stock was one of the highly demanded securities on the Wall Street because of the Company’s impressive operating profits that the firm had enjoyed for some time. Despite the severe over-saturation suffered by Just for Feet Inc., the profits did not decrease but instead they increased making the public to be pleased with the company.

In mid 1999, Just for Feet Inc. announced a first quarterly loss and a plan to default accruing interest payments to its bonds holders; this was a shock to the market because its financial position was good. These bonds had been sold to the public two months earlier with a negative turn on the company’s operations being experienced. In November 1999, Just for Feet was liquidated for bankruptcy (Russel & Ronald, 2012).

Investigations carried out by United States authority that is Federal and state law discovered the collapse of Just for Feet Inc. was as a result of accounting fraud; this was fraud was meant to cover the deteriorating financial state of the company. The main indicators of fraud included; false creditors accounts records, company’s refusal to give appropriate reserve for inventory wastage, and false recordings of high cash inflows in the income statements. This led to Deloitte and Touche being sanctioned by SEC (United States Securities and Exchange Commission) since they were the official Just for Feet auditors. This fraud incident led to suspension of Delloite and Touche for two years from the United States Securities and Exchange Commission, as the audit partner, fined, and lastly the suspension of the audit manager for a period of one year.

Deloitte and Touche as Just for Feet’s Inc. auditor was criticized for improper application of confirmation procedures, failure to investigate the company’s suspicious income, and failure to properly audit Just for Feet’s reserves for inventory valuation (Russel & Ronald, 2012).

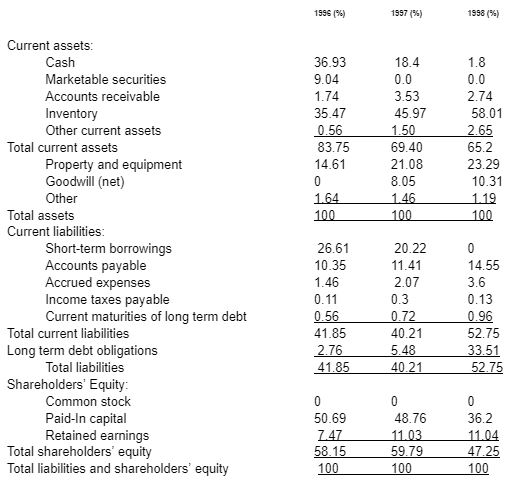

Balance sheet

Just for Feet Incorporation

Common-sized Balance sheet

For the financial period that ended Jan 31st 1998 as Compared to other previous periods

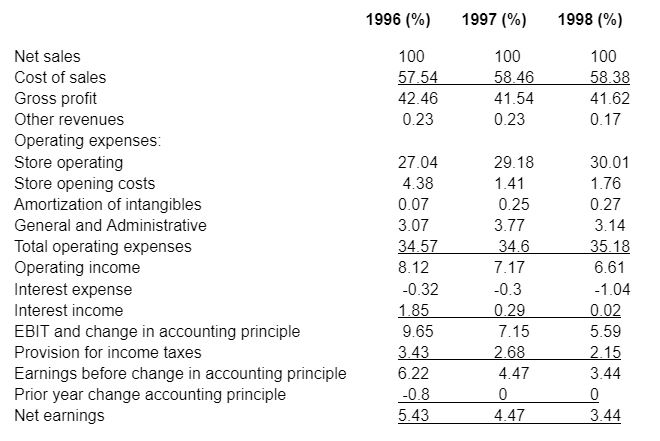

Income Statement

Just for Feet Incorporation

Common-sized Income statement

As at 31st January, 1998, 1997, and 1996

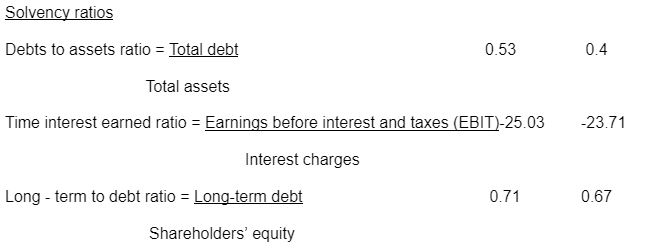

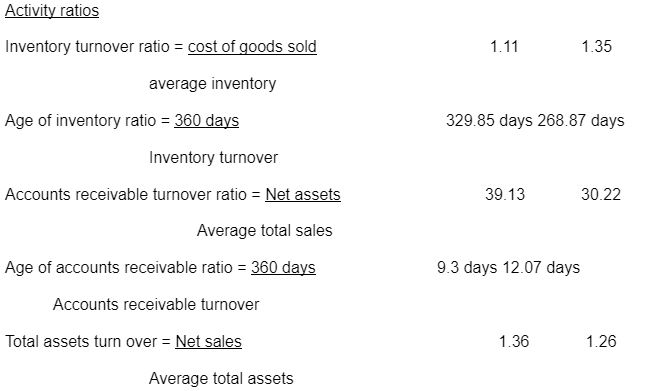

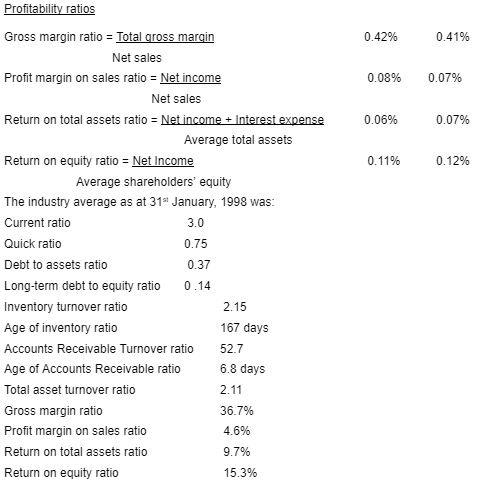

Financial ratios calculation

From the ratio calculations carried out and with the actual ratio values, Just for Feet Inc. performance can be compared to the industry average as follows. Current ratio for the two years (1997 and 1998) was below the industry average leading to a conclusion that current liabilities were overweighing the current assets (Blake, Amat, & Oriol, 1996). The liquidity ratio shows a dropping liquidity for the company which means that the company is collapsing and the debts are over weighing the assets. In the solvency ratios measurement, Just for Feet Inc. recorded a negative time interest earned ratio for both years (1997 and 1998) meaning the company had no power to pay for any of its current debts. The solvency ratios for determining the industry average holds no negative ratio, this means that Just for Feet is holding a negative cash inflow (Yadav, 1986).

In the activity ratios measurement, the company’s inventory is staying in store for 329 days while the industry average is 167 days, this indicates that the company sales are declining from the declining demands and burden of debts. The company has little money to promote its products in the market so they are becoming unpopular. Lastly, the profitability ratios are indicating a below industry average performance of the company, in terms of the profits. With this analysis, a conclusion can be drawn that the company is performing extremely poorly not to match the expected industry average. A company to be considered stable, it should perform above the industry average.

Auditors need to closely monitor cash and cash equivalents when taking an audit. The cash sources reflect the company’s recorded cash inflows, whether they are over stated or under stated and their accuracy in stating. In 1996 to 1998, the company had to rely on the bonds as the sources of income; this was used to boost the company’s operations. The current ratio in 1997 was 2.14 and in the end of financial year of 1998, it was 2.0 declining by 0.14 (Russel & Ronald, 2012).

Just for Feet Inc. had an increasing long term debt at the end of the year 1997 which became persisted by the end of the financial year of 1998. An increasing debt is a threat to a company since it shows that the company’s cash inflows are affected by the current state of the market or the funds are being mismanaged. The rate in which the long-term debt was increasing at was alarming in 1996 was 2.76%, in 1997 the debt increased to 5.48%, and in 1998 the debt further increased to 33.51% (Blake, Amat, & Oriol, 1996).

Highest Risk areas associated with Just for Feet Inc.

High-risk financial statement items

In reference to the information reflected by the financial statements of Just for Feet Inc and the data calculated, there are several high-risk financial items for the 1997 to 1998 Just for Feet’s especially in disclosure, account balances, and presentation. The stock of the firm inceased from 35.47% of the entire assets in the year of 1996 to 58.01% in the year of 1998, and the accuracy and distribution of creditor allowances were noticeable as the main risk areas. Just for Feet’s exercise of accuracy, creative accounting, and categorization of dealings or events have to be kept on a close watch as well. On the other hand, the calculations of store opening expenses fluctuated; store running costs had a gross increase from $69,329 in the year of 1996 to $232,505 in the year of 1998 (Knapp, 2012).

Inherent Control Risk

Some of internal control risks exposures in large vend shops and companies are probable deceit and inherent limitations. Internal control aid in managing the normal and fair internal operations and conduct of the employees; this is towards the realization of the company’s common goal of an organization. A strong internal control system in a company, its effectiveness is determined by the employees; an example is that, the management may instruct the assistant accountant, internal auditor or the finance officer of the company to alter with the company accounts and make the wrong postings to the financial records. This may lead to employees planning or arranging to steal the company’s assets or the company’s money (Kumar & Sharmer, 2005).

Inherent Risk Factors

Companies under stiff competition are vulnerable to frequent inherent risks factors. The size of the auditor’s appraisal of the possibility that there will be a material recording in a balance of account before looking at the efficacy of internal control. Complicated assessment issues and associated party dealings are some such conditions that will affect audit preparation decisions.

Evaluation issues may head the audit group to request for more confirmation, if company chooses to allow the check at all. Inherent risks like stock turnover that leads to a possible misstatement of stock, expense associated with the goods sold, or outdated stock may manipulate the audit firm’s resolution to employ outsider professionals to aid in the audit. Lastly, inherent risk factor that is customer business risk (competitive benefit), will additionally stress on the need to comprehend the customer’s trade in the audit preparation process (Knapp, 2012).

Parties affected by the Audit Fraud

The audit fraud and Just for Fleet Inc. affected numerous parties in the company and outside the company. Some of these parties include Just for Feet’s stockholders, lenders, independent auditors, and the stakeholders. The government was also a party that was equally affected by the fraud committed by Just for Feet Inc. in the 1998 Just for Feet audit; the auditors discovered the following key audit risks there was high- risk business tactics applied by Just for Feet. Additionally, the aggressive application of accounting standards by the management indicate the consistent trend of Just for Feet Inc. cash inflows (Yadav, 1986).

Impact on Strategic Plan of Just for Feet Company

Just for feet Ltd engages in formulating strategic plans that are depicted in terms of short term and long term strategic plans. Short term plans are for a short period such as five year plans for the for the company while long term plans include what the firm plans to do in a long period such as ten years. These strategic plans are affected by the auditing report given that the implementation of the plans depends heavily on the financial performance of the firm. An audit report that indicates fraudulent activities in the firm could affect the implementation process of the plans since the report may indicate some material issues that are sensitive and touch on the company’s operation effectiveness.

References

Blake, J., & Amat, O. (1996). Interpreting Accounts. London: International Thomson business Press.

Knapp, C. M. (2012). Contemporary auditing : Real issues and cases. Mason, OH: South-Western Cengage Learning.

Kumar, R., & Sharmer, V. (2005). Auditing: principles and practice. New Delhi: Prentice Hall of India.

Russel, J., & Ronald, C. (2012). Just for Feet. New Delhi: Book on Demand.

Yadav, A. R. (1986). Financial Ratios and the Prediction of Corporate Failure. India: Concept Publishing Company.