Executive Summary

This report summarises the internationalisation strategy for Wi Yu Motors (an automotive company based in China). It outlines the country of choice in Europe and proceeds to assess the competitiveness of the automotive industry in the UK. It outlines how the company can deal with the institutional and cultural differences that have hindered the success of many Asian firms that have ventured into European markets. In addition the report provides information on Wi Yu’s most suitable mode of entry into the identified market and the preferable organisational structure and control strategies.

Introduction

Wi Yu Motors (hereafter referred to as the company) is a Chinese automotive corporation that is located in the city of Shenzhen in the Chinese province of Guangdong. The firm was started in 2000 and its production capacity had increased to 500,000 units per year by the end of 2011. This has made Wi Yu Motors to become a leading car maker in Asia. In 2009 the company entered into a joint venture with a German MNC. A year later the company began planning on how to enter the European market using a wholly owned subsidiary. The main objective of entering Europe is to develop its Research and Development (hereafter referred to as R&D) capabilities and gain ground as a leading corporation in the automotive industry. The technological capacity that will be attained from investing in Europe will be used to develop products and processes in the Shenzhen base. This will expand the ability of the company to export cars to the United States of America and Europe. This report outlines the international strategy that the company should use to enter the European car making market.

Internalisation Strategy for the Company

Country Choice

Overview

In 2008 and 2009, the global demand for automobiles plummeted by almost 50 percent as financial systems collapsed because of ruthless speculation and cheap credit in most of the developed countries (Yang, Su & Fam 2012). Emergency loans and government bailouts became necessary for manufacturers and suppliers of cars for them to remain afloat in the market. In light of the financial and general economic state in Europe, many service providers, suppliers, and makers of cars will still suffer from the impacts of the struggling global economy. It has been speculated that smaller firms may even become extinct at least in their present state (Harris 2012). According to Hellens (2012), the big question is not whether Asian companies can invest in Europe but where specifically they can invest in the continent. Another important question has to do with the kind of cars that will be in demand some few years to come. This is especially so with the current focus on green technology. This section of the report focuses on outlining the competitiveness of the United Kingdom (UK) as a favourite location for Wi Yu Motors.

The UK Automotive Industry

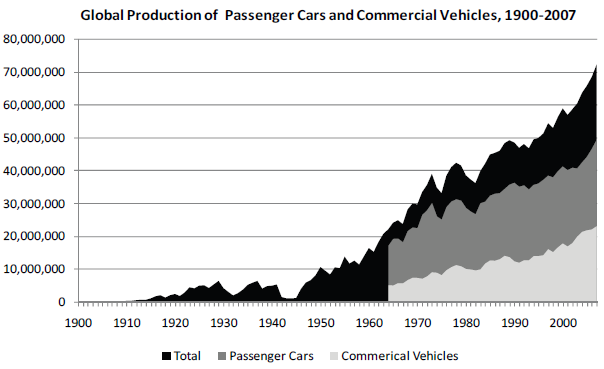

The global automotive industry is currently undergoing many changes. Over the past ten years some companies have made record profits while others have gone into bankruptcy, merged and de- merged with others. Within the same period, the demand for vehicles has continued to increase courtesy of emerging markets especially in the developing nations. However, it is important to note that the increase in demand is in the markets that use cheap cars. The market for premium vehicles has continued to shrink while the one for lower priced vehicles has endured the economic challenges. Figure 1 below shows how the production of commercial and passenger vehicles has increased from 1900 to 2007 (Harris 2012):

Jamesr (2012) notes that despite this apparent industry growth, drastic changes have seen some European giants such as MG Rover close down. The industry in Europe is marked with a lot of uncertainties as displayed by the crises at Fiat and the losses that Chrysler, Ford and GM have incurred in their attempts to survive in the contracting market. It is still very much probable that many established companies will exit the market and give way to makers of cheaper vehicles such as Wi Yu Motors.

Sector Overview

Overview

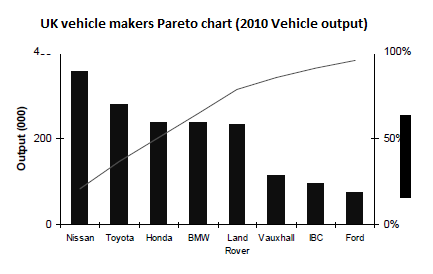

In 2010, the UK produced 1,856,789 vehicles hence remaining the 11th top automotive manufacturer in the globe and 4th in Europe (Smith & Crotty 2011).

Engine and Vehicle Manufacturing

In 2010, there were 765 companies in the UK that were involved in the manufacture of engines and vehicles. Only 20 companies account for 90 per cent of the sales in the sector and 85 per cent of employment in the sector (Smith & Crotty 2011). This information is captured in the figure below:

Component Supply

This sector has close to 2,700 active business units. Three of these companies are based in the country but have a worldwide reach. These are TI, Tomkins and GKN (Smith & Crotty 2011).

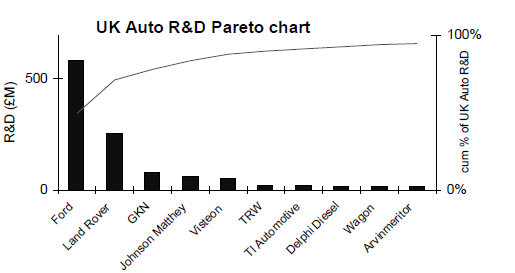

Research and Development

As shown in figure 3 below, the R&D scoreboard for the UK automotive industry is led by Ford and Land Rover.

UK Investment Competitiveness

Trade Deficit

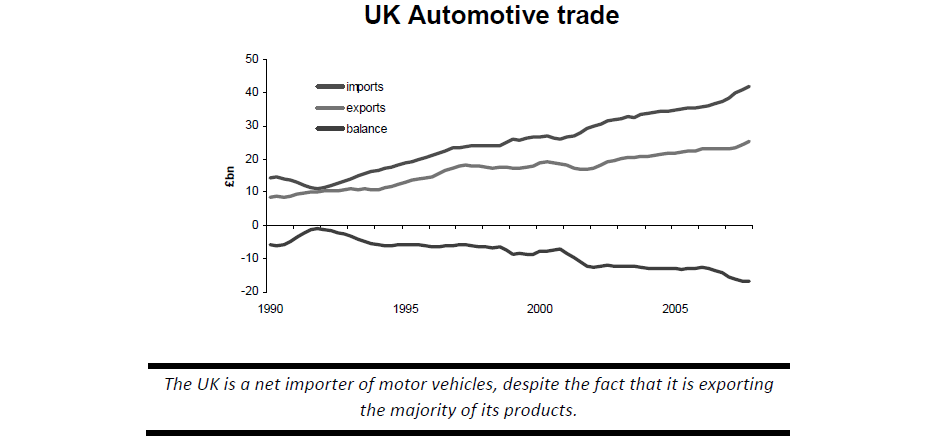

Services are currently the main source of trade balance in the UK. Jamesr (2012) points out that the manufacturing sector has encountered a great deal of trade deficit leading to import of cheaper products. It is obvious that the automotive sector is following the same trend. The implication is that the economy is currently (and most probably in the near future) inclined towards cheaper automotive products from the East. This is from countries such as China, Singapore and Taiwan. This creates the perfect opportunity for a company like Wi Yu Motors. Jamesr (2012) adds that 2009 data indicates that the automotive industry in the UK is the largest exporter of manufactured products but it is also by far the largest importer. This large deficit between imports and exports creates an ideal chance for other companies to come and invest in the UK. This is vividly illustrated in figure 4 below:

Cost of Labour

When compared to other countries in Western Europe, the UK seems to have a high cost of labour; just behind France and Germany. However, statistics outline that the rate of increase in labour cost is lowest in the UK. In the next one decade, the cost of labour in the European automotive industry will be the cheapest in the UK (Hellens 2012).

Level of Skills

According to the country’s Department of Skills and Education, UK is ranked second in Europe when it comes to the level of skills in the manufacturing and automotive industries. As a company that is interested in investing in a country that has high potential for R&D growth, Wi Yu Motors would find UK to be an ideal spot. When compared to other countries such as France and Italy, UK appears to have made more capital investments in the automotive industry in the past five years (Harris 2012).

Institutional and Cultural Differences

Overview

The cultural fabric of a nation influences the behaviours and attitudes of its citizens (Chui, Titman & Wei 2010). It is noted that cultural values and attributes are confined to one’s unconscious level of thinking because they are internally constructed. Therefore, they are very difficult to change unless there is an enormous shift in the external, social, technical, and economic conditions. Even in such a case, the transformation is very gradual and only affects the behaviours of people and not their deep seated belief systems. In this regard, investing abroad requires effective measures to deal with institutional and cultural differences. According to Yang, Su & Fam (2012), the most important aspect when it comes to dealing with such differences at the organisational level is the management of human resource. Human resource is one of the most important factors in cross- border operations which aim at obtaining and sharing managerial and technical competencies as well as market knowledge.

According to a report by the World Bank, 80 per cent of chief executives in China- based firms and which are operating abroad attribute their failures to differences in corporate culture and managerial styles. It is possible to solve these problems but it takes a great deal of attention. To this end, Wi Yu managers will have to familiarize themselves with the mind-set, priorities, cultures, and management styles of the English people (Giannetti & Yafeh 2012). Hofstede (2001) outlined a theoretical framework that contains four intercultural dimensions. These are individualism, power distance, uncertainty avoidance and masculinity (Hofstede 2001).This part of the study uses this framework to outline the cultural differences between China and the UK which the company has to take into consideration.

Individualism

The western culture has invariably been associated with individualism. Each person is simply supposed to mind their own business and that of their immediate family. On the other hand, eastern societies function more or less as groups. China is regarded as a collectivist society. This makes employees and managers from China to be more loyal to organisations. Chinese corporations do not support assertion and individual initiative. On the contrary they support group expression (Chui et al. 2010).

According to an earlier study that Hofstede had conducted in 1984, the United States of America scored the highest on individualism while Taiwan and Hong Kong were the highest in collectivism (Hofstede 1984). In the 2001 study, the United Kingdom had an individualism score of 89 per cent, making it one of the most individualist societies in the world. As Wi Yu ventures into the UK market, the management should remember that people in their target market make decisions depending on their individual convictions and not as groups. Moreover, as the company enters the European market, it will have to exercise workplace tolerance because European employees value personal initiative.

Power Distance

This relates to interpersonal inequalities and hierarchies in power. Lauring (2011) posits that in the case of societies such as those in China which are associated with high power distance, the decisions of the management are unquestionable. The leadership is expected to be in control and to make sure that the organisation attains its objectives while subordinates are not involved in making corporate decisions. However, the society in UK is accustomed to independent initiatives and autonomous behaviours. In this case, Wi Yu Motors has to embrace a strategy that encourages the inclusion of all stakeholders in decision making.

Avoidance of Uncertainties

Job security is very important in the West. This is because the society has a high index of uncertainty avoidance. Employees work better if they are certain about their future in the job. This is not the case in China where most employees are not threatened by uncertain and ambiguous job descriptions. In the East most people do not have lifetime employment but they still feel comfortable in their jobs even in the absence of formal contracts and rules (Lauring 2011). As Wi Yu Motors expands to the UK, the management must understand that it can only get the best of its UK human resource by providing a high level of job security and certainty.

Masculinity

According to Yang et al. (2012), Asian communities have had distinct gender roles for many years. Traditionally, men and women simply have different occupations in such cultures. Women are allowed to take inferior job positions and are rarely included in top management. This is quite different in the UK where women have been empowered to take positions of leadership. In order to succeed in Europe, Wi Yu Motors has to embrace a low masculinity organisational culture.

Mode of Entry

This is a very important aspect in any internationalisation business strategy. It is noted that if a firm is able to acquire 50% of another business entity’s voting stock, “…..it is able (to) gain (the acquired company’s) operational control” (Vosselman 2012: p. 23). As a result of this, the company that is acquired becomes a subsidiary of the other company. The two companies form an affiliation and the parent firm can become a holding company. If the parent company goes ahead to own the entire stock of its subsidiary, the acquired company becomes a wholly owned subsidiary of the acquiring company (Simons 2010).

There are two ways through which Wi Yu Motors can enter the UK market by the use of a wholly owned subsidiary. First, it can enter through the establishment of a new subsidiary in the UK or by acquiring a company that has been in operation in the country. In light of the cultural diversity between Chinese and UK companies, acquiring a company would be the preferred option in the case of Wi Yu Motors. This would allow the company to fit flawlessly into the culture of the English people in addition to having access to a large pool of qualified human resource. Wi Yu Motors can acquire a wholly owned subsidiary by either buying the stock of its subsidiary or through exchange for Wi Yu’s shares (Simons 2010).

There are diverse managerial and financial reasons why it would be better for Wi Yu Motors to acquire such a subsidiary. In the perspective of effective management, a wholly owned subsidiary is preferred as it makes it possible to have decentralisation of power. To this end, the different subsidiaries have their own semi- independent management teams. The subsidiary will be responsible to Wi Yu Motors with respect to losses and profits. When compared to divisions in a consolidated enterprise, it is easier to sell off a loss making subsidiary. The subsidiary would still maintain a corporate identity while the parent company would benefit from the recognition and goodwill of the name of its subsidiary (Hill, Hwang & Chan 2012).

Mei-Fang (2009) notes that the amount of investment required to establish or acquire a subsidiary is considerably less than that which will be required in case of a consolidation or merger. When compared to setting up an operating division, Wi Yu Motors will raise additional “start-up” funds from the sale of some of the stock in the subsidiary (Sea-Jin & Rosenzweig 2011).

The taxes charged in acquiring or establishing a subsidiary is also lower. The law recognises subsidiaries and the parent company as different entities. This means that Wi Yu Motors will be protected from any claims that creditors would make against its subsidiaries abroad. On the other hand, Wi Yu Motors will be holding the subsidiary’s stock as a company asset. This means that it will help the company to acquire collateral for further financing. Moreover, unlike in the case of a consolidation or a merger, the company will not need the approval of its stakeholders to acquire additional stock in other companies (Sea-Jin & Rosenzweig 2011).

The subsidiary will be filing its financial reports with Wi Yu Motors. Simons (2010) outlines that although the parent company and the subsidiary are legally separate, they are regarded as the same economic entity when it comes to filing financial reports. In the case of a wholly owned subsidiary, Wi Yu Motors will be in a position to file tax returns.

Mei-Fang (2009) points out that many technology firms prefer using wholly owned subsidiaries because they provide adequate protection of the company’s competencies and wealth of knowledge. As a company that has highly invested in developing its technology, Wi Yu Motors can protect such knowledge by the acquisition of a wholly owned subsidiary. The company would also have tight control over the activities it is involved in overseas. This is very important for international strategic coordination. For instance it would be easy to use profits in China to come into terms with the competition in Europe..

Organisational Structures and Control Strategies

The structure of an organization determines its decision making processes, formal reporting procedures, controls, and authority. The process of coming up with an organisational structure that is perfectly in line with the strategy of a firm is quite difficult because there are always uncertainties (Csaszar 2012). As the strategy of a business organisation changes, the organisational structure also changes. When Wi Yu Motors enters the UK it would grow first in volume and then geographically by integration and finally by business and product diversification. The growth pattern would then dictate the structural form of the organisation.

According to Vosselman (2012), a simple structure is always sufficient in the case of a firm that is just starting up. However, the coordination and control of sales becomes a challenge that is ultimately solved by adopting a functional organisational structure as the strategy of the firm is implemented. In addition, it is noted that further growth makes the structure inadequate and the firm either gets into a strategic drift or changes to adopt a multidivisional organisational structure.

As aforementioned, Wi Yu Motors will find it preferable to enter the European market using a wholly owned subsidiary. In this case, a multidivisional organisational structure would be the best option. This is necessitated by the fact that as the company grows, its products will become highly diversified and in such a case only a multidivisional structure would suffice.

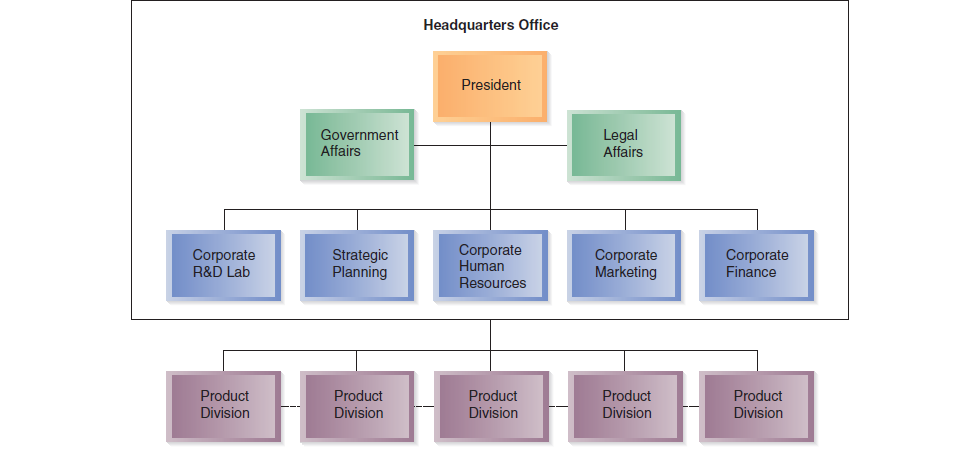

Of the three forms of multidivisional organisational structures (cooperative, strategic business unit, and competitive), the cooperative organisational structure would be the ideal choice for Wi Yu Motors. This structure is illustrated in the figure below:

According to Csaszar (2012), all the divisions of the firm will share their corporate strengths among themselves. These strengths may include channel dominance, marketing competencies, and production competencies. In the case of Wi Yu Motors, production expertise would be an important strength to be shared among all the divisions of the firm. This sharing of competencies goes a long way in facilitating the efforts of the company to develop scope economies (Rajaeepour, Azizollah, Mahmoud & Solmaz 2012).

Conclusion

Wi Yu Company has experienced high level of success in Asia. To give it room for growth, the company has the option of either globalising or diversifying its business. Because the product diversification option can be very capital intensive, it is much easier to find new markets in other continents. However, globalisation comes with its own organisational challenges. Wi Yu has to find a suitable location from where to expand to the rest of the world. The trade deficit, lower cost of labour (compared to countries like Germany and France) and high level of skills make the UK a perfect destination for Wi Yu to enter into the European car manufacturing market.

References

Chui, A Titman, S & Wei, K 2010, ‘Individualism and momentum around the world’, Journal of Finance, vol. 65 no. 1, pp. 361-392.

Csaszar, FA 2012, ‘Organizational structure as a determinant of performance: evidence from mutual funds’, Strategic Management Journal, vol. 33 no. 6, pp. 611-632.

Giannetti, M & Yafeh, Y 2012, ‘Do cultural differences between contracting parties matter? Evidence from syndicated bank loans’, Management Science, vol. 58 no. 2, pp. 365-383.

Harris, S 2012, ‘Is the UK automotive industry on the road to revival?’, Engineering Journal, vol. 6 no. 2, pp. 6-7.

Hellens, G 2012, ‘Automotive aftermarket industry profile: the United Kingdom,’ Automotive Aftermarket Industry Journal, vol. 8 no. 1, pp. 1-32.

Hill, C Hwang, P & Chan, K 2012, ‘An eclectic theory of the choice of international entry mode’, Strategic Management Journal, vol. 11 no. 2, pp. 117-128.

Hofstede, G 1984, Culture’s consequences: international differences in work-related values, Sage Publications, Beverly Hills.

Hofstede, G 2001, Culture’s Consequences: comparing values, behaviours, institutions, and organizations across nations, 2nd edn, SAGE Publications, Thousand Oaks, CA.

Jamesr, TT 2012, ‘Turning over a new leaf [automotive manufacturing]’, Engineering & Technology, vol. 7 no. 5, pp. 64-67.

Lauring, J 2011, ‘Intercultural organizational communication: the social organizing of interaction in international encounters’, Journal of Business Communication, vol. 48 no. 3, pp. 231-255.

Mei-Fang, C 2009, ‘Multinational firms’ entry mode: technology spillovers in an infra-industry differentiated product market’, International Research Journal of Finance & Economics, vol. 28 no. 1, pp. 187-197.

Rajaeepour, S Azizollah, A Mahmoud, Z & Solmaz, S 2012, ‘Relationship between organizational structure and organizational alienation’, Interdisciplinary Journal of Contemporary Research in Business, vol. 3 no. 12, pp. 188-196.

Sea-Jin, C & Rosenzweig, P 2011, ‘The choice of entry mode in sequential foreign direct investment’, Strategic Management Journal, vol. 22 no. 8, p. 747.

Simons, T 2010, ‘International management’, Strategic Management Journal, vol. 2 no. 2, pp. 23-29.

Smith, M & Crotty, J 2011, ‘Environmental regulation and innovation driving ecological design in the UK automotive industry’, Business Strategy & The Environment, vol. 17 no. 6, pp. 341-349.

Vosselman, E 2012, ‘Organizational structure, operational coordination and relational signals: how voluntary actions by organizations lead to formal control structures’, International Journal of Management, vol. 1 no. 1, pp. 745-759.

Yang, Z Su, C & Fam, K 2012, ‘Dealing with institutional distances in international marketing channels: governance strategies that engender legitimacy and efficiency’, Journal of Marketing, vol. 76 no. 3, pp. 41-55.