Nike Swot Analysis

Strengths

Nike is a global company engaged in the design, development, marketing and distribution of athletic footwear and equipment. Other products include apparel and accessories. The headquarters of the company is in Beaverton, Oregon. It has a workforce of 38,000 people on average. It operates mainly in the Americas, Africa and the Middle East. It also has markets in Asia and Europe.

The company has high brand recognition. It is popular and well-known. It, therefore, has a strong brand name. The products produced by the company are also of high quality causing it to have a great reputation in the market place as the customers are pleased. They have high-quality customer relationships and ensure satisfaction. The company has effective marketing strategies that enable it to deal with the intense competition from its rivalries. There are various tools used to market the products.

The company staffs have a large capacity for innovation. A great example is shown by the Nike+ package. Nike worked with Apple to deliver the Nike+ package where the customer is provided with Nike+ shoes and an iPod Nano and sports kit. There is a sensor fitted into the sole of the shoes and a receiver for the customer to listen to it. As the person runs, he is informed of the distance covered, the pace and calories burned in the exercise. The company also invests highly in research and development. In addition, the company works with the athletes who endorse its products on the new performance features that they would desire their shoes to have (Gamble & Thompson, 2008)

Weaknesses

There are certain weaknesses the company should be constantly addressed. Due to its operations in different countries and continents, there is high currency exposure that has to be mitigated. The manufacturing of Nike products takes place in overseas markets. This creates high overseas manufacturing dependency. In case labour conditions change adversely in these countries, the company will be highly affected. The prices of its products are quite high compared to other companies such as Adidas. The company could end up losing a lot of customers. In the United States, the market share has been decreasing and there is a medium retail presence.

Opportunities

There are various opportunities that the company should focus on in order to increase its profit. There has been an increase in the sporting events in the world therefore the company can target these events to increase sales. The number of female athletes in the world has been growing rapidly. The company should pay more attention to designing and developing innovative products for them. The company also has an opportunity to expand into emerging markets where economic activities have been increasing and thriving. There is also a high demand from customers for innovative products that utilize two or more technologies. The company may invest more in research and development in order to introduce more innovative products.

Threats

There are certain threats present in the external market that should be handled well so that they do not affect the company’s revenues. There is a lot of fierce competition in the market from companies such as Adidas and Reebok that desire to increase their market share. In the developed world, there have been economic challenges and recession which affects the customer’s ability to purchase company products. The company’s revenues are dependent on the customers’ discretionary income. In the different markets and the United States where the company sells its products, there are currency fluctuations that affect the profits of the company.

Nike’s Ethical Challenges

The company has faced challenges in the recent past in defending its reputation once reports were released by media companies and other researchers on the adverse labour practices in the manufacturing locations in Asia. These ethical challenges may adversely affect the profit of the company as customers prefer to deal with competitors who have better working conditions for their workers. The company is expected to behave in a responsible manner despite its complex production strategies (DeTienne & Lewis, 2005). The company faces accusations of sourcing its products from factories or countries with poor labour conditions.

There is high child labour in Cambodia and parts of Pakistan. The workers in the factories are paid poorly and yet they mostly work on overtime schedules. There are verbal and some of the women are sexually harassed. The factories do not provide safe and healthy environments and the workers face restrictions when it comes to accessing clean drinking water. Nike outsources its manufacturing requirements to independent companies who provide the products to the companies. Initially, when the allegations started, Nike emphasized that these employees were not Nike’s employees but employees of the independent suppliers.

The hands-off approach however did not calm the public forcing the company to release a code of conduct that potential suppliers would have to observe (Locke, Kochan, Romis & Qin, 2007). The company has appreciated the challenge of global operations and is committed to ensuring responsible behaviour (Charter, 2001). There are however certain challenges in changing the labour climate as it also depends on the regulatory practices and the acceptable practices of the people, economic and educational status.

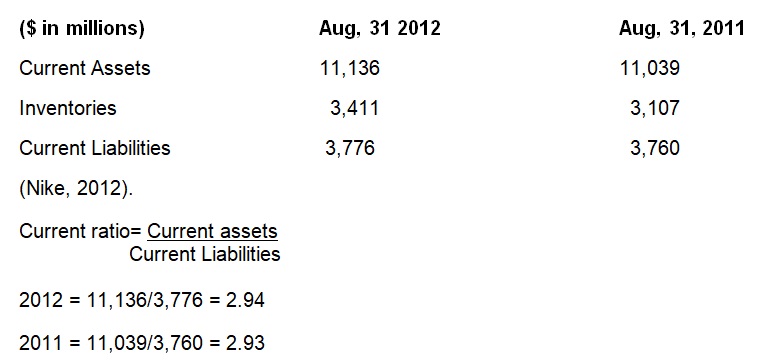

Financial Analysis: Liquidity analysis

In analysing the liquidity of the company, one is interested in knowing whether the short-term assets of the company are adequate or sufficient to cover the short-term obligations of the company. The volumes in the third quarter 2012 and third quarter 2011 were as follows:

The current assets are able to cover the short-term liabilities adequately. This is a company that is managing its liquidity well. It will not face challenges in fulfilling its obligations. The liquidity was fairly constant in both years. There was no significant increase. The company should not increase liquidity beyond this point since the excess money should be used for investment purposes. It is not advisable to tie up high amounts of cash in short-term assets.

Acid test ratio= Current assets- Inventories

Current Liabilities

2012 = 11,136- 3,411/3,776 = 2.05

2011 = 11,039-3,107/3,760 = 2.11

The ratio reduced however not significantly. It is recommended that the liquidity ratio should be at least two and above therefore the company is still operating at a safe margin. However care should be taken to ensure the ratio does not go below two.

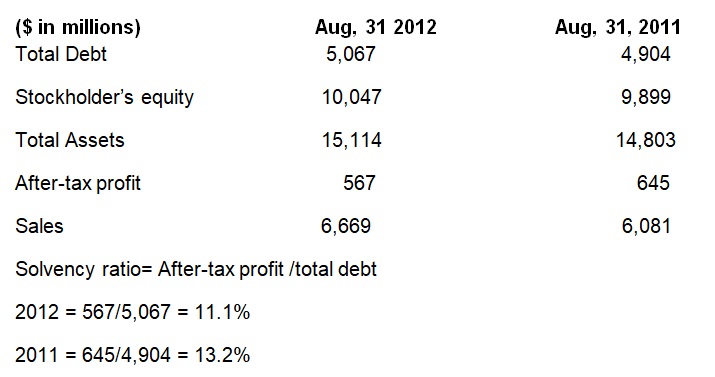

Solvency analysis

These are ratios that analyse the ability of the company to cover its debt using the after-tax profit. The debt to assets ratio shows the level at which the company is utilizing debt to enhance the company’s return.

It is recommended that the solvency ratio should be higher than 20%. The ratio went even lower in 2012 therefore the company should work on debt management strategies.

Debt to Equity ratio = Total Debt/stockholder’s equity

2012 = 5,067/10,047 = 50%

2011 = 4,904/9,899 = 49.5%

The ratio was fairly consistent over the two years.

Debt to Asset ratio = Total Debt/total assets

2012 = 5,067/15,114 = 34%

2011 = 4,904/14,803 = 33%

The ratio was fairly consistent over the two years. Investors are wary of highly geared companies as it may come to a point where the company is not able to pay off its obligations, invest or maintain adequate liquidity.

Profitability analysis

These are ratios that compare the revenue performance for consecutive years. The return on asset ratio shows the earnings that the company achieved from the total assets.

Return on asset ratio = Net Income/total equity

2012 = 567/15,114 = 3.75%

2011 = 645/14,803 = 4.36%

The ratio went down showing that the earnings on assets decreased.

Return on equity ratio = Net Income/total equity

2012 = 567/10,047 = 5.64%

2011 = 645/9,899 = 6.52%

The ratio went down showing that the earnings on equity also decreased.

Profit Margin = Net income/sales

2012 = 567/6,669 = 8.5%

2011 = 645/6,081 = 10.6%

The profit margin also decreased due to the decrease in sales and net income.

The company’s profitability has reduced compared to last year. The management may need to put extra effort in the last quarter of this year to ensure that the profitability is enhanced.

Overall, the company should continue handling its liquidity well and work on the solvency and profitability of the company.

References

Charter, M. (2001). Darcy Winslow, General Manager, Sustainable Business Strategies, Nike Inc. US. The Journal of Sustainable Product Design, 1(1), 53-56.

DeTienne, B., & Lewis, L. (2005). The pragmatic and ethical barriers to Corporate social responsibility disclosure: the Nike case. Journal of Business Ethics, 60(4), 359-376.

Gamble, J., & Thompson, A. (2008). Essentials of Strategic Management: The Quest for Competitive Advantage. United States: McGraw Hill.

Locke, R., Kochan, T., Romis, M., & Qin, Fei (2007). Beyond corporate codes of conduct: Work organization and labour standards at Nike’s suppliers. International Labour Review, 146(1), 21-40.

Nike (2012). Nike, Inc. Reports Fiscal 2013 First Quarter Results. Web.