Introduction

Background

From the fourth quarter of 2007, many countries around the world started to experience an economic downturn that grew by the day to earn the unpleasant connotation of being the worst recession the world has ever experienced since the Great Depression of the 1930s. Starting from the well-established economies, mostly in the US and Europe, the global economic meltdown spread rapidly across the world to cause mayhem and anxiety even to the lowly-ranked economies. By January 2009, there was little doubt that the global economy had indeed fallen into a pronounced slumber.

But while most Asian economies kept the recession card close to their chests for fear of igniting more upheavals, the US and some western countries went public about their economic predicaments. During the early phase of the current economic downturn, some Asian economic juggernauts such as China and Japan held the misplaced conception that the crises were purely an American and European problem that could not scathe their economies (Zubair 2009). Contrary to expectations, most Asian economies have been hit as hard as the western economies.

While it is imperative to recognize the fact that global economic downturns and recessions are not new phenomena or new economic jargon in the world, the timing, magnitude, and the systematic manner in which the current economic recession has been experienced by individual countries seem to suggest much more than what meets the eye (Zubair 2009). According to Krugman (2009), the origins, causes, and systematic spread of the current economic crises call for greater clarity. Certainly, global oil hikes are no stranger to economic recessions as four of the last five downturns have been triggered by sharp increases in global oil prices.

But what has amazed many business analysts is the fact that the current global recession seems to have been ignited by factors other than global fuel hikes. It became even more complicated when analysts engaged in a voyage of discovery as to how some presumed housing bubble could have caused the global economy to crumble so abruptly without seeking assistance from surging oil prices like it has been the case (Zubair). In this perspective, this study aimed at evaluating if Hong Kong’s real estate and property sector acted as a trigger factor to the current economic crisis facing the country.

The Global Context

The US can be credited for being the first to announce the onset of the current economic downturn in mid-2007. However, economic analysts during that time were unsure of what was forming up in the financial markets, with some even predicting that the situation would go away on its own (Shah 2009). But some few months later, the economic landscape in major economies around the world took a nosedive. World stock markets were plummeting with an intensity that has never been recorded before, while major financial institutions especially in the US collapsed or were forced into uncharacteristic mergers with rivals. Large financial establishments such as Merrill Lynch, Bear Stearns, American International Group (AIG), and Lehman Brothers were forced to announce bankruptcies and mergers in a market that was increasingly experiencing financial turbulence and upheavals (Krugman 2009).

By the end of the first quarter of 2008, banks and other financial institutions in other economies around the world had started to raise the red flag, signifying a looming danger of eminent collapse. Indeed, financial rescue packages were announced by respective governments to bail out financial institutions from going under. Shah (2009) believes that this situation was brought about by a global financial bubble that inevitably burst after years of economic boom. It is widely believed that the sudden collapse of the American sub-prime mortgage business coupled with a coinciding turnaround of the housing boom in other major economies around the world produced a ripple effect that heralded an era of acute economic downturn (Shiller 2008). Other factors that have been cited as possible causes include soaring global commodity prices, volatile stock markets, and restrictive, unproductive monetary prices practiced in some economies around the world.

The Study Context

In 1997-98, the world witnessed an economic downturn that must have had an insatiable appetite for Asian countries. Although this economic crisis affected many other economies around the world, all available information points to the fact that the downturn was largely an Asian affair (Hill 2009). It originated from Thailand and spread throughout Asia, bringing great reorganization and collapsing political regimes that were previously thought to be impregnable. For instance, President Suharto’s regime in Indonesia collapsed under the strong sway of the economic crisis. While the Asian countries were the epicenter of the 1997-98 financial crises, the majority of them did not make substantial contributions in the process of kick-starting the current round of global economic turndown. As a matter of fact, many Asian economies have been perceived as innocent bystanders caught in the crossfire. But that notwithstanding, the effects have been immense.

Hong Kong is one of the most promising financial hubs in the world. Its status as an international metropolitan and global financial centre has been largely attributed to its autonomy from mainland China. According to IEF, Hong Kong has been leading the whole world in terms of having the freest capitalistic economy for 15 consecutive years (Kifle 2009). It is widely believed that any global economic turbulence occurring anywhere must reverberate across Hong Kong since the autonomous region has the greatest concentration of multinational and corporate headquarters in the whole of the Asia-Pacific region.

In addition, Hong Kong has enjoyed tremendous and uninterrupted economic growth rates between the 1960s and 1990s. Globally, the Hong Kong Stock Exchange occupies an impressive sixth position in largeness, with a market capitalization of around US$2.97 trillion as of the last quarter of 2007. To amplify the economic prowess of the region, the Hong Kong Stock Exchange comes second in terms of the highest value of IPO’s, after the London Stock Exchange (Melton 2009). With a population of 7 million people and a landmass of 1,108 KM2, Hong Kong is undoubtedly one of the most densely populated regions in the world.

Problem Statement

The above notwithstanding, Hong Kong and other Asian economies largely felt the heat of the current economic recession. According to Mulhaupt and Dyck (2009), small and emerging open economies in Asia have been particularly hit by the ongoing recession. For instance, the real GDPs of Taiwan, Singapore, and Hong Kong contracted in the first quarter of 2009 by 10.2%, 10.1%, and 7.8% respectively.

Global economic recession in all three countries was transmitted via diminishing external demand, mirrored in waning exports, and huge declines in investment growth. The financial services sector is particularly crucial in Hong Kong as it generates almost 20% of the country’s GDP. Prior to the current recession, Hong Kong’s banks had been enjoying strong economic growth as they sought to expand their influence into mainland China.

The banks’ share of nominal GDP had risen progressively from about 7.5 percent in 1997 to over 12 percent in 2007 (Mulhaupt & Dyck 2009). The profitability of Hong Kong’s banks started to slump in mid-2008. This was largely attributed to a declining fee income brought about by a sharp decline of business in areas of wealth management, insurance brokerage services, and trade finance. The banks’ performance was also affected by their direct exposure to subprime and other structured financial products offered for credit.

The demand for the Hong Kong real estate and property market has declined substantially, a sudden change from its well-known tradition of sustained growth. According to Kifle (2009), the decline in demand has been occasioned by some unfavorable economic factors, which include the rising cost of living and declining consumer spending. The housing bubble thought to have occasioned the current financial crisis in the US has largely affected Hong Kong’s property market, sharply reducing investor confidence and credit supply from key financial institutions.

A multiplicity of factors has contributed to a sharp decline of all real and property market sectors in Hong Kong. For instance, the office sector fell by a staggering 18% at the close of 2008. Presently, the current uncertainties doing rounds in the office property sector will definitely occasion further declines. The situation is the same in the residential property sector. According to a recent report commissioned by Colliers International, the price in the luxury residential sector plummeted by over 22% during the third quarter of 2008. According to economic projections, more challenges await this sector, with experts approximating that the rental yields in this sector will go down by a further 15%in 2009.

In all the other real estate and property markets in Hong Kong – industrial and retail – things don’t appear any different. According to Savills, a renowned global property and real estate consultant, business in the industrial real estate market is flagging down (Kifle 2009). Collins International estimates that rental yields ploughed from the industrial real estate market plunged by over 15% during the last four months of 2008. Small and medium businesses have been worst affected by this crutch. In the same vein, Hong Kong’s retail real estate market has also declined tremendously. Rent in prime locations plummeted by 20% during the last quarter of 2008.

It is indeed true that largely unstructured subprime lending by financial institutions led to a housing boom in the US from 2000 to 2006. The subprime mortgages were soon rebranded and sold off to global investors prospecting for such opportunities. This particular type of financial innovation thrived unchecked by the relevant US financial institutions, including the US Federal Reserve (Cruz 2008).

Global investors were quick to utilize these loopholes in the property market to apply for financial securities offering higher rates than was the case with traditional values. However, the US Federal Reserve Board revised its interest rates upwards, occasioning a slow down in the housing and property market. After this, one thing led to another to ignite the current financial gridlock. According to Park (2009), Complex financial structure and globalization also helped to fuel the recession. Other major economies were also experiencing the housing boom.

Numerous studies have been undertaken to evaluate if and how the US housing bubble occasioned the most menacing financial crisis the world has experienced in recent times. However, most of these studies have concentrated on studying the economies of the US and other major European countries. There is a lack of data as to if and how the housing boom and the budding real estate and property sector in other countries triggered or was affected by the financial crisis. This study purposed to fill this void.

Objectives of the Study

The general objective of the study was to explore if Hong Kong’s real estate and the property sector were one of the major triggers to the current economic meltdown or if the sector was just one of the many other sectors that were innocently affected by the economic crunch. The study aimed to achieve this objective by undertaking a critical analysis of Hong Kong’s economy, especially from the fourth quarter of 2007. The objective was also to be achieved by analyzing and comparing studies done on various financial institutions and real estate firms during the course of the study. The following were the specific objectives:

- To develop a framework that can be used to understand the working relationship between Hong Kong’s financial lenders and players in the real estate and property sector.

- To evaluate if unconventional banking laws may have been used to finance the housing boom prior to the onset of the economic recession in Hong Kong.

- To determine the influence held by foreign investors over Hong Kong’s real estate and property sector.

- To develop effective policy framework that can be used by the government and financial institutions to seal loopholes in financial laws and regulations of the world’s freest economy

Theoretical Framework

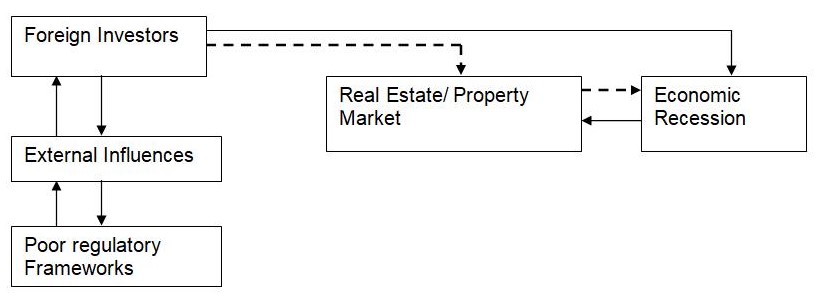

According to Sekaran (2006), a theoretical framework “is a conceptual model of how one theorizes and makes logical sense of the relationships among the several factors that have been identified as important to the problem” (p. 87). A theoretical framework must map out and discuss the various interrelationships that exist between variables that are viewed to form an essential component to the situational dynamics under investigation. This study aimed at evaluating if the real estate and property sector in Hong Kong acted as a trigger to the current economic recession. Based on the objectives of the study, the ongoing economic recession became the dependent variable while factors seen to trigger the recession became independent variables. These independent variables included foreign investors, external influences, and poor regulatory frameworks. Based on the above, the study developed the following theoretical schema. It represents the two paths that the recession may have followed.

Value of the Study

The value of this study can never be underestimated. Businesses and economies around the world are reeling under the heavy pressure of the current economic crisis, which has already claimed some big-time casualties. Major conglomerates such as the Lehman Brothers and Merrill Lynch have already gone under, and many more organizations are doing everything within their reach to remain afloat in the turbulent economic waters. This study came up with a body of knowledge that could be used by organizations, especially in Hong Kong, to know what really went wrong to trigger an economic downturn of that magnitude.

The study filled the information gap that existed about the real triggers of the economic crunch in major Asian economies, in addition to shedding light on the role financial institutions played to fuel the credit crunch. According to Garry (2009), many financial institutions from major economies around the world created a monetary bubble that was then used to nourish an asset price boom, effectively distorting the pricing of risk. Other financial institutions encouraged uncontrolled high-risk lending. Could this have been the case in Hong Kong? What was the role of the real estate and property market in the current economic crisis? By conducting this study, such lingering questions were effectively answered.

Literature Review

Introduction

In the field of economics, the term ‘recession has largely been attributed to a period of slow economic activity, often characterized by low consumer spending and high unemployment levels. The term has also been defined as a sustained decline in GDP for a period of at least two or more successive quarters in a financial year (Davis 2009). NBER defines a recession as a considerable turn down in economic activity that normally spreads across a country’s economy, lasting more than a month and taking its toll on key sectors of the economy including real GDP, manufacturing and industrial production, per capita income, wholesale-retail sales, service industry, consumer spending levels, and employment opportunities (Hall et. al 2003).

Many economists agree that a recession kicks in immediately after the economy climbs to the peak of activity and diminishes as the economy reaches its bottom line.

According to Davis (2009), economic recessions, normally on a mild scale, are common occurrences in many countries around the world as their respective economic cycles negotiate and adjust to changes in consumer spending power, consumer consumption, changes in prices of goods, and labor, among others. Normally, economies have found a way of negotiating around these changes to cause minimal upheavals in the market. However, a multiplicity of these factors can strike an economy simultaneously, an occurrence that can inevitably lead to a serious recession like the one being experienced in the world today.

The 1930’s Great Depression that reverberated across the US and Europe was occasioned by a multitude of such negative factors hitting economies all at once. It should be noted that many critical economic recessions, though foreseeable, are aptly not detected until they have already started to cause havoc to the economy (Melton 2009).

Causes of Global Economic Recessions

Many economists will readily agree to the fact that it is often hard to come up with an all-inclusive answer as to what triggers global economic recessions. However, factors relating to confidence or lack of it in financial markets, uncertainties, and plain pessimism have all being accused of fueling economic recessions (Melton 2009). These factors are brought about by major underlying themes in an economy, which analysts believe are difficult to quantify. This notwithstanding, successive analyses on economic recessions have pointed towards blunders in monetary and financial policies and upheavals in the productive capacity of a country’s economy as likely culprits (Labonte 2002). According to Labonte, errors in fiscal policies have largely been accused of destabilizing the aggregate demand within an economy. Below, some of the causes are evaluated

Policy Errors

Although monetary and fiscal policy errors have been accused of causing economic recessions around the world, it is indeed true that the same, if properly utilized, could have been used to prevent or at least alleviate some of the most serious economic recessions that have been experienced to date. Most economic downturns are triggered by sharp declines in aggregate demand, a situation that arises when individuals and organizations no longer crave to procure as much as the economy can create (Labonte 2002).

The problem with the global market economy is that prices of goods and services don’t adjust themselves quickly in the event of the aggregate demand going down. If the prices adjusted much more quickly, they would be capable of averting a looming economic recession by making sure that the aggregate demand is capable of purchasing what the economy is producing. But sadly, economic recession beckons in as prices do not adjust speedily, occasioning a fall in output in response to the coinciding fall in demand. According to Melton (2009), this factor played a significant role in shaping up the economic recession being experienced today.

To drive the point home, it is imperative to look at how policy errors arise to ultimately lead an economy into recession. First, an economy may find itself growing at an untenable pace due to policy errors made by managers of the economy. To curtail economic imbalances such as inflation from widening, these managers engage other unconventional techniques to try and correct the situation, leading to disastrous results.

Some of these techniques have been accused of directly triggering recession by making the economy ‘overshoot’ beyond its capabilities (Melton 2009; Labonte 2002). This kind of thinking can ideally explain why many economies bust into a sustained recession after a period of economic boom. Second, some policymakers react to the onset of a recession much more slowly, in the process making critical judgmental, fiscal, monetary, and policy errors. Such errors often cause a simple recession to entrench itself much more seriously as the most needed stimulus package is not delivered in time (Labonte).

Supply Shocks

Prior to 1970, economists believed that economic changes could only be attributed to fluctuations in aggregate demand. Afterward, an extensive body of knowledge opened up yet another concept that economic fluctuations could indeed be caused by shocks or upheavals to aggregate supply (Labonte 2002). Earthquakes, terrorism activities, hurricanes, tsunamis, and other natural disasters are all known to impede the productive abilities of an economy. For example, the 9/11 terrorist bombing of the World Trade Centre in the US almost inducted a recession in an economy that was otherwise performing well (Melton 2009).

Shocks also occur when abrupt price changes on crucial commodities and services fail to be reallocated and adjusted with speed to avert an economic contraction. In small open countries such as Hong Kong, a quick and unprecedented change in commodity prices or the exchange rate is enough to ignite such a shock. The oil shocks continue to be the most treacherous cause of supply shocks in many economies around the world, the US included.

Financial Crises

Although crises in the financial sector are quite uncommon, they are virulent and lethal when they strike if the current economic recession is anything to go by. The 1930’s Great Depression and the infamous Japanese experience of the 1990s were both offshoots of financial crises (Labonte 2002). A sound financial sector forms a core component of an expanding economy since it facilitates capital to be channeled from savers to borrowers. When this symbiotic relationship breaks down, negative spill-over effects reverberate across the economy as the viability of economic production almost becomes a difficult, expensive, disorganized, and slow exercise (Zubair 2009). According to Labonte, an economic recession brought about by financial crises is the most difficult to deal with as it cannot be resolved amicably through the use of conventional monetary and fiscal expansion programs.

The Current Financial Crisis

Leading economists the world over have all agreed in unison that the current economic recession is undoubtedly the most lethal since the Great Depression of the 1930s. From the last financial quarter of 2007, there has been a sharp decline in economic activity coupled with the massive failure of large institutions mainly in the financial sector. Within a short period of time from its onset, financial and mortgage institutions started to close shop or effect mergers to stay on the safe side.

Consumer purchasing and spending power reduced drastically, while potential home-buyers found it increasingly challenging to obtain a mortgage. Unemployment figures in major economies were threatening to spiral out of the ceiling. Although the pressure of the financial crisis may be waning out, key economic strategists are often at a loss to explain how this could have happened so abruptly (Mills 2009).

The United States Case

According to Melton (2009), the United States housing bubble of 2005-2006 is largely credited for causing the current round of financial crisis. From as early as 2000, the US housing prices had been on a steady increase, encouraging borrowers and real estate investors to undertake mortgages from financial institutions in the misplaced belief that they would be able to refinance the loans at more favorable conditions. The unregulated mortgage lending was further fueled by loan incentives that were being offered by financial institutions to encourage the borrowers. But out of the blues, the US reserve bank upped interest rates on loans to reign in the unhealthy lending laws and regulations practiced by individual banks.

This made the process of refinancing the mortgages difficult, heralding an era of massive defaults from borrowers who had earlier benefited from subprime lending and Adjustable Rate Mortgages (ARM’S). The process of refinancing the mortgages was further complicated by a moderate decline in housing prices in 2006-2007 in many regions of the US. Analysts believe that the housing sector could have reached its peak activity and had to start plummeting downwards. The figure below shows how the US Subprime lending expanded.

An easy inflow of funds from emerging economies in Asia and some oil-producing countries in the Gulf further complicated matters for the US. This significant inflow of foreign money coupled with low-interest rates enjoyed in the US between 2002 and 2004 brought about an environment where financial institutions competed for customers in need of credit facilities.

In the competition, banks and other financial institutions discarded internationally recognized banking laws and regulations in the pursuit of locally arranged financial innovations to ensure that they leaped maximum benefits from what was happening on the financial front. Many borrowers within and outside the US were given easy access to loans without first scrutinizing their creditworthiness, a scenario that was blamed for bringing about the housing and credit bubbles later in 2006.

As housing prices plummeted, major international financial institutions such as the Lehman Brothers and Merrill Lynch posted significant losses because they had extensively borrowed and invested profoundly in the failing subprime and mortgage market. As the economy approached the last quarter of 2006, the housing prices had indeed fallen below the value of the mortgage loan, providing fertile grounds for borrowers to enter foreclosure. Many analysts believe that the wealth drain that was ignited by these foreclosures and loan defaults must have run into trillions of US dollars.

The US economic policymakers failed miserably to comprehend the increasingly significant functions played by the shadow banking system, largely comprised of investment financial institutions and hedge funds (Mills 2009). Financial analysts believe these institutions had almost assumed the roles of typical commercial banks in the provision of credit facilities to the US economy.

However, they were not subjected to similar rigorous banking laws and regulations like other mainstream depository banks. According to Melton (2009), the investment banks, in conjunction with some commercial banks, went further to depart from international banking practice by assuming alarming debt burdens without given much thought to the idea of having a financial cushion capable of mopping up large loan defaults and mortgage losses. This was against the traditional banking practice.

The above policy errors impacted negatively on the financial institutions’ ability to lend, effectively slowing the economy down. According to Mills (2009), the concerns raised regarding the solidity of core financial institutions and investment banks drove the US Federal Reserve Bank to provide more funds to the already ‘sinking ships’ in an effort aimed at restoring faith and integrity in commercial markets and encourage lending. Such efforts aimed at bailing out crucial financial institutions in order to stimulate growth were not limited to the US only. The UK reserve Bank also came up with similar financial packages to rescue key financial institutions including the Royal Bank of Scotland. Whether these financial packages were successful remains a matter of discussion.

Hong Kong and Greater Asia

Due to Hong Kong’s economic orientation, the country was inevitably sucked into the ongoing global economic crisis. The country is well known on the global economic map for its sound management fundamentals, a resilient regulatory framework, and a healthy Exchange Fund. The country is also well known for practicing a free and open economy. The overall economic performance of the robust country dragged due to moderation in exports that had been triggered by the US subprime mortgage lending (Hong Kong Themes 2008).

According to Beckford, Houlgate, & Cushing (2008), most of the Asian financial institutions had negligible experience with the esoteric and innovative financial regulations and instruments that came into play to send other major world economies into a spiral. The financial crisis that had swept across Asia ten years earlier had offered Asian financial institutions some vital lessons about risk management and issues of maintaining higher liquidity ratios. These issues played a major role in the collapse of major financial institutions in the US.

However, Asian governments knew too well that their economies were not immune to upheavals in the general market dynamics. In many countries, Hong Kong included, the stock markets took a nosedive as major financial institutions constricted credit facilities due to uncertainties of counterparty risk (Beckford, Houlgate, & Cushing 2008). In a concerted effort geared towards preventing instability in the banking system, the governments of Hong Kong and Singapore took the initiative to guarantee all bank deposits held in major banks. This served to slow down an otherwise intense financial crisis, but fell short of nipping it in the bud.

It is widely believed that the 2008 global financial crisis was less intense in Asia than it was in the US and other western countries. But still, it managed to claim casualties in Asia, the same way it did in the US and Europe. In Hong Kong, an electronics retailer store by the name of Tai Lin Radio Service Limited was forced to announce bankruptcy because of an HKD 100 million debt it was unable to service due to due to reduced consumer purchasing power (Brown 2008). Other companies, including Smart Union Group, Bailingda, and 3D-Gold Holdings Limited, went under.

The recent financial crisis can earn accolades for the precision and uniformity of its characteristics across major Asian economies. In many Asian countries, commodity prices went down, closely followed by a sharp decline in demand for manufactured goods. According to Loser (2008), stock market valuations in many Asian countries declined steadily, and currency depreciations hit hard. In addition, capital inflows that used to fuel the massive economic growth of countries such as Hong Kong and Taiwan were disrupted as countries sought to play their cards much more cautiously. However, many countries still lost enormously in financial wealth despite the precautionary measures taken. Going by the GDP figures, the table below clearly reveals an economic recession in the Newly Industrialized Countries of China, Hong Kong, Singapore, and South Korea.

Table 1: GDP and Inflation for Selected Economies (2002-2009).

Hong Kong’s Real Estate Sector and the Financial Crisis

By any standards, real estate and property issues are sensitive issues in Hong Kong. The real estate sector accounted for over 40% of the country’s GDP and total credit by 2000. A large proportion of profits of some of the largest corporations in Hong Kong come from real estate. In the same vein, property groups account for over 40 percent of Hong Kong’s stock market capitalization (Haila 2000).

The property market is a major player in Hong Kong’s economy as it provides employment opportunities for over 20% of the country’s labor force. Furthermore, the government significantly depends on land-related sales such as profit taxes from private property developers and financial institutions, land-use premiums, and direct land auctions to finance its operations. Therefore, the fact that real estate forms a fundamental component in the functioning of Hong Kong’s economy is undeniable.

Hong Kong’s real estate and property market, like many others around the world, is purely driven by financial markets. Many analysts argue that Hong Kong’s property market is also driven by pure pessimism. Prices in the property market are largely dependent on what is happening at the international scene since the sector has been overly penetrated by foreign investors (Haila 2000). It, therefore, means that prices in the real estate and property market tend to oscillate more vigorously, based on international financial booms and busts. Limited regulations existing in the property market do not help matters either.

From the above analysis, it is vividly clear that the Hong Kong real estate and property market was not given a break by the ongoing financial crisis. According to experts in the industry, prices in the market dropped by over 20% in 2008, and expect to dip further by the end of 2009. Such a slump in the sector was last witnessed in 2003 when a highly contagious disease – Severe Acute Respiratory Syndrome (SARS) – severely devastated Hong Kong’s economy in its entirety (Ralph 2009). To document the bleak condition the Hong Kong’s real estate sector, one brokerage firm – GFI Colliers – concentrating on derivatives estimated the real estate prices would plummet to rock bottom in the final quarter of 2009, stagnating at -25% of the February 2009 prices (Ralph).

Investors in the industry cannot find ready buyers for their homes and financial institutions have upped their requests for down payments from 10% prior to the onset of the financial crisis to between 30% – 40% presently. The Hong Kong real estate and property market reached one of its darkest moments for over 17 years in November 2008 when its transactions went down by almost 87% in value since 1997. The figure below shows how Hong Kong’s house prices have been changing from 1994 towards the 2009 projections (GPG 2008).

According to GPG 2008, Hong Kong’s real estate and property market have five interrelated features:

- Prices in real estate are extremely unstable.

- Price fluctuations in the real estate and property market are among the highest globally.

- Land for construction is exceptionally limited and can only be released by Hong Kong’s government at will.

- New real estate developments are often concentrated within a few international developers with large-scale interests in the country.

- Hong Kong’s public housing sector is ranked highly among the biggest housing sectors in the world.

The Connection

Many people would want to question why an increase in interest rates In the US subprime and mortgage sector prior to the onset of the financial crisis triggered the Bank of China in Hong Kong as well as HSBC to raise mortgage rates back in Hong Kong (Ralph 2009). But industry analysts are well versed with the fact that interest rate movements around global economies powerfully affect Hong Kong’s real estate and property market prices since over 90% of the country’s mortgages are held at variable rates (GPG 2008). The country must accept the US interest rates since it operates a system of fixed exchange rate regimes. This kind of seems awkward and counterproductive sometimes since the US interest rate movements may prove counter-cyclical to Hong Kong’s economy.

According to Law (2008), there is too much reliance on the real estate and property sector. It is believed that up to 51% of all loans advanced by the commercial banks in Hong Kong end up in the property sector. As already mentioned elsewhere, the Hong Kong Stock Exchange is profoundly loaded with real estate and property shares. This sort of arrangement has been largely blamed for bringing about a property cycle that destabilizes Hong Kong’s financial sector every now and then. In the same vein, Hong Kong has on more than one occasion received accolades as the worlds’ best economic hub that has a weak local financial sector. In many other global financial centers – New York, London, Paris, Tokyo, Johannesburg, Frankfurt -, local financial institutions play a leading role in the provision of domestic financial services. But in Hong Kong, the opposite appears to be true.

Commercial banking, mortgage, and investment banking, stocks market, insurance, and fund management sectors are largely owned and dominated by foreign firms. This, therefore, means that global financial upheavals must directly reverberate across Hong Kong. The financial regulatory system in Hong Kong is also wanting, as Law points out.

Key Study Propositions/ Hypothesis

Based on the above literature review, the following study propositions were formulated.

- A large concentration of foreign investors in Hong Kong’s real estate and property market caused the country to be more vulnerable to the prevailing global economic recession

- Hong Kong government’s over-reliance on real estate and property markets made the economy to be vulnerable to the raging economic recession

- Foreign investors contributed to the near-collapse of the real estate and property market sector since they could not get funding from their respective domestic financial institutions abroad after the onset of the recession

- Most financial institutions in Hong Kong rely on homegrown financial laws and regulations instead of making use of internationally recognized banking and standards.

Methods Section

Introduction

This study aimed at evaluating if Hong Kong Real estate and property sector played an active role in triggering the country’s economy into recession or if the sector was just one of many innocent bystanders. It was conducted in the metropolitan city of Hong Kong, and participants were selected from leading real estate and property firms, financial analysts, and commercial bank institutions. The study utilized a structured questionnaire as the primary instrument for data collection. The study also relied heavily on secondary data collected from key financial institutions, investment banks, real estate firms, and HSBC’s website.

The Study Subjects

According to Sekaran (2006), a “population refers to the entire group of people, events, or things of interest that the researcher wishes to investigate” (p. 265). The study population consisted of financial analysts, key investment bankers, real estate and property managers, and bankers from credible financial institutions in Hong Kong. Boundaries were drawn between those firms that were largely owned by foreign investors and those that were locally owned to ensure equal representation. A purposive sample of 40 elements was selected, 10 from each of the 4 groups stated above. An element comprises an individual member of the population. Purposive sampling was used for this study since it was absolutely necessary to obtain data from particular groups of individuals who were capable of providing the information according to the criteria set by the researcher (Sekaran).

Data Collection Instruments

This study utilized a questionnaire as the primary data collection instrument. A questionnaire can be described as a printed self-report form specifically designed to elicit information from the sample elements. This information comes to inform of written responses. The information acquired through a questionnaire is uniquely similar to that obtained by a key informant interview, but the responses tend to carry less depth (Sekaran 2006). Data for this study was collected with the help of a questionnaire to evaluate if the Hong Kong real estate and property market acted as a trigger to the current round of economic recession. The researcher chose to use questionnaires because they ensured a high response rate, in addition to requiring less time to administer and offering the possibility of privacy.

The self-administered questionnaires consisted of both closed-ended and open-ended questions. However, the open-ended questions were restricted to a few areas where a more fuller and detailed explanation was needed from the respondents. According to Sekaran (2006), closed-ended questions are mostly included in questionnaires since they are easier to administer to the elements and also easier to analyze. The questions were set in both English and Chinese to cater to respondents who were not very comfortable with either one of the languages.

Secondary methods of data collection were also utilized. According to Stewart & Kamins (1993), secondary data are essential for any organizational research to achieve success. These forms of data are usually derived from sources other than the researcher involved in conducting the study. The study extensively relied on secondary data obtained from published books, economic and financial abstracts, internet sources, company performance reports, and other publications.

Research Design

The correlational study utilized a quantitative research design to try and conceptualize the associations that existed between the country’s economy and the real estate and property sector. According to Hopkins (2000), a quantitative research design is best used when the objective of the researcher is to determine the relationship between the dependent variable and the independent variables. In this perspective, a quantitative research design was utilized to establish if any associations existed between Hong Kong’s real estate and property market and the current economic recession facing the country.

Sekaran (2006) is of the view that correlational studies ultimately assist the researcher to delineate the fundamental variables that are associated with a given problem. This was the purpose of this research. The associations needed to be brought to the fore, including establishing any cause-and-effect relationships that could have contributed to the problem that was being studied.

Some information existed before the commencement of this study to show the interplay between the housing boom and the resulting economic crunch of 2007-2009, especially in the US and some other western economies. However, scarce and disjointed information existed to map out the interplay that existed between the two variables in Hong Kong. This researcher utilized the scarce information to initiate a hypothesis-testing study in an attempt to explain the nature of the unique relationships that existed between Hong Kong’s real estate and the property market on one hand and the onset of the current economic recession on the other. According to Sekaran, a hypothesis-testing study is best in this type of situation as it “goes beyond a mere description of the variables in a situation to an understanding of the relationships among factors of interest” (p. 119).

Research Procedures

The study was largely concentrated in the metropolitan city of Hong Kong, a prime location at the economic epicenter of Asia. The city is centrally placed in the Asia Pacific region, making it an ideal location for many regional operators who would like to have easy access to critical economic and financial markets in Asia. Hong Kong city is geographically positioned on the Southeast coast of China and has the largest single market globally by its 1.3 billion people (Unrivalled Location 2009).

The selection of all the elements included in the sample size was based on some specific criteria. However, the criterion was standardized to serve the four sub-groups since they were all interrelated. The four – financial advisors, investment bankers, commercial bankers, and real estate and property managers – performed interrelated roles and made nearly the same contributions to the economy of Hong Kong. However, they had to pass the following criteria to be encompassed in the sample.

- Elements managing high portfolios in their respective organizations.

- Elements must have been actively engaged in employment in their respective organizations for a period of 3 years

- Elements must have stayed in Hong Kong for a period of five years to be well equipped with knowledge about the financial and economic landscape of the country

- Elements must be well versed with Hong Kong stock markets and interest rates

Reliability and Validity

Reliability

Reliability refers to the degree of consistency with which a data collection instrument is able to measure the attribute or variable that it is designed to measure (Handley 2005). The questionnaire that was used for this study revealed admirable levels of consistency in the responses given. The researcher also actively reduced data collector’s errors by personally administering the questionnaires to the respondents. This in itself helped to reduce sources of measurement error, eventually ensuring the reliability of the data collected. Also, the researcher took the initiative to guarantee comfort, privacy, confidentiality, and physical comfort to the respondents who took part in the exercise.

Validity

According to Handley (2005), the validity of a research tool is the extent to which this particular tool is able to measure what it is intended to measure. A research instrument must aptly be able to represent all the factors that are being studied. This was well catered for in the study by including questions that measured the knowledge of respondents about wide-ranging economic and financial issues that were of interest to the study. Also, questions were mostly formulated based on the extensive review of literature that had been carried out.

This ensured the questions were wholly representative of what the respondents were supposed to know about Hong Kong’s economic scene and recessions. The questions were also prepared in an easy-to-understand language and structure to ensure clarity of the responses elicited by the respondents. Through the above measures, internal and external validity was ensured. According to Sekaran (2006), external validity ensures that the study findings can be transferred or generalized beyond the sample size used to other subjects within a population.

Ethical considerations

Before the commencement of the data collection process, the researcher sought written consent from the management of the selected financial institutions. Verbal consents were also obtained from the selected respondents after the researcher gave them a detailed analysis of the study’s purpose and the procedures that would be employed in the process of data collection. They were duly assured that information elicited from their own responses would not be made public in a manner that would jeopardize their confidentiality. All the other rights – anonymity, self-determination, and informed consent – were strictly observed to give the study its ethical credibility (Sekaran 2006).

Results

Introduction

The main purpose of this research was to determine if Hong Kong’s real estate and property market played a significant role in bringing about the ongoing economic recession. A variety of measures was utilized to determine if the real estate sector was one of the trigger factors. Data collected from the field was cleaned, organized, and analyzed to bring out the interplay of factors between the real business sector and the economy of Hong Kong. All quantitative data obtained from the closed-ended questions were analyzed using a computer statistical program called SPSS. Some open-ended questions were analyzed through concept analysis and qualitative content analysis to produce data that could later be analyzed quantitatively. Below, a summary of key findings is presented based on the study’s objectives and hypotheses.

Statement of Results

This study presented interesting findings that should be incorporated into the economic decision-making framework of the country. The respondents were 54% male and 46% female, aged between 26 and 72 years. Interestingly, two-thirds of the respondents said Hong Kong’s tumultuous economic and financial scene was headed for more challenges due to overreliance on other global economic markets. 63% of the respondents felt that the spending and purchasing powers have decreased by an average of 22.7%. Unstable world markets and rising unemployment levels were given as the two foremost causes of the decline. Other factors are included in the following pie chart.

The study findings revealed a steady correlation between the huge number of foreign investors in Hong Kong’s property market and an increase in financial upheavals directly targeting the market and other key sectors of the economy.

A large proportion of respondents were all in agreement that huge multinational corporations with interests in Hong Kong and private foreign investors controlled up to 66.7% of Hong Kong’s property market. Many respondents argued that there must have been a direct relationship between what happened in the US in late 2007 and what happened in Hong Kong in 2008. Many argued that Hong Kong’s real estate and property market over-reliance on foreign investors acted to fuel the economic crisis more since Hong Kong’s government is largely dependent on selling land to finance its activities. Other factors are shown in the following figure.

The real estate and property market in Hong Kong did not escape unscathed by the study findings. Indeed, many respondents argued that the market had contributed significantly to destabilize the economic dynamics in the region as over 67.8% was controlled by multinationals and other foreign interests. In the same vein, above half of the respondents felt that Hong Kong’s economy was being held hostage by these external influences to a point of introducing a lot of uncertainties and pessimism in the market. On a scale of 1-5, more than two-thirds of the subjects argued they would change the laws and regulations governing Hong Kong’s real estate and property market if they could be given a chance to do so.

During the study, a resounding 78% of the respondents felt that Hong Kong’s economy was overly relying on this particular sector at the expense of other sectors. A further 69% felt that such dependency on one particular sector is counterproductive to the wellbeing of the economy. This only serves to reinforce the assertion that Hong Kong’s real estate and property market contributed significantly to the economic recession that hit the country in 2008, and continues to bite. The figure below reveals the other details.

Volatile exchange rate fluctuations, dependence on land and property market by the government, and a large number of outsiders running key economic sectors in the country were chosen by the respondents as the most likely triggers of the current economic quagmire, among other factors that had been advanced in the questionnaire. All these factors are directly or indirectly linked to the huge concentration of foreign investors, especially in Hong Kong’s real estate and property market. However, Two-thirds of the respondents believed that Hong Kong’s banking rules and regulations were sound at the moment to cope with any emergencies, though room for improvement still existed.

Analysis and Discussion

This study had been initiated to evaluate if Hong Kong’s real estate and property sector had indeed acted as one of the triggers to the current economic crisis. According to the study findings, it can be argued beyond any reasonable doubt that the sector acted as a trigger to the economic recession. Four propositions had been formulated to back up the argument. Below, an analysis of the results based on the propositions is presented.

Foreign Investors and Hong Kong’s Property Sector

A strong relationship between the huge number of foreign investors in Hong Kong’s property sector and an increase in financial upheavals was discerned during the study.

According to information retrieved from the internet, many of these investors come from countries that had been largely affected by the economic recession prior to its landing in Hong Kong. Some of the leading countries in property ownership include the US, Britain, Spain, and Mainland China. Many of these foreign investors depend on funding from their domestic financial institutions to finance huge property development projects in Hong Kong.

According to Haila (2000), the real estate sector accounted for over 40% of the country’s GDP and total credit by 2000. Many of the foreign financial institutions went under with the burst of the property bubble, triggering a lot of uncertainties, lack of confidence, and plain pessimism among many foreign investors (Melton 2009). The Hong Kong property market, owned largely by foreign investors, must have undergone a tumultuous period that ignited more uncertainties in other areas of the economy such as export business and manufacturing. This fueled economic recession. This scenario amplifies Labonte’s assertion that recessions can be triggered by external shocks.

This does not mean that the huge concentration of foreign investors in Hong Kong’s property markets was the only cause of the ongoing financial crisis. The responses elicited by a large number of respondents revealed that a multiplicity of factors came into play to bring about the current economic recession. The intensity of the current round of recession is as perplexing as the complexity of factors ranked as the main causes of economic recession in Hong Kong. According to Davis (2009), an economic recession arising out of a multiplicity of factors is usually much more lethal than one which is occasioned by a single factor. This discussion successfully proves the first proposition.

Government Reliance on Property Sector

Although this hypothesis has been proved by the above discussion, it is imperative to note that Hong Kong’s government has often nurtured a high affinity for this particular sector of the economy. Hong Kong is a top investment destination especially in the property market (Haila 2000). As a matter of fact, a large proportion of profits of some of the largest corporations in Hong Kong come from real estate. In the same vein, property groups account for over 40 percent of Hong Kong’s stock market capitalization.

The property market is a major player in Hong Kong’s economy as it provides employment opportunities for over 20% of the country’s labor force. According to GPG (2009), land for construction is exceptionally limited and can only be released by Hong Kong’s government at will. This, therefore, means that an economic or financial upheaval in the sector will definitely trigger a slump in the economy, a factor that is known to cause a recession.

The government significantly depends on land-related sales such as profit taxes from private property developers and financial institutions, land-use premiums, and direct land auctions to finance its operations. This has served to complicate matters further for the economy.

Since most of these properties are owned by international corporations and investors as described above, Hong Kong’s economy is bound to be affected by the slightest realignment or upheaval in the sector. For instance, when the US Federal Reserve increased interest rates to curtail the potentially hazardous subprime lending in 2005-2006, Hong Kong’s economy felt the pitch since most of the corporations and individuals affected by the US regulation held massive interests, especially in real estate and property market, in Hong Kong (Melton 2009).

The above discussion proved the study’s hypothesis number two, that, Hong Kong’s overreliance on real estate and property market triggered the economic recession. It has been reviewed in the literature review that interest rate movements around global economies powerfully affect Hong Kong’s real estate and property market prices since more than 90% of the country’s mortgages are held at variable rates (GPG 2008).

Collapse of Foreign Lending Institutions

With the burst of the US housing bubble, many financial institutions approached the issue of mortgage lending with a lot of caution. Many institutions temporarily refused to finance housing projects because of the uncertainties and low confidence levels exhibited in the market. Big-time investment and financial organizations such as Merrill Lynch and the Lehman brothers were announcing bankruptcies (Beckford, Houlgate, & Cushing 2008). This had a spiral effect on the economic and financial scene in Hong Kong as most of the investors were relying on the collapsing firms for funding. According to study findings, this was a recipe for recession.

The majority of the respondents for this study firmly believed that what was happening in the US subprime and mortgage sector was remotely affecting Hong Kong’s own real estate sector to a point of near collapse. From the review of related literature, it is indeed clear that an increase in interest rates In the US subprime and mortgage sector prior to the onset of the financial crisis triggered the Bank of China in Hong Kong as well as HSBC to raise mortgage rates back in Hong Kong (Ralph 2009). In the same vein, the country must accept the US interest rates since it operates a system of fixed exchange rate regimes (GPG 2008).

It, therefore, follows that this hypothesis was proved beyond doubt by the study. The interrelationship between foreign investors and their overseas lenders almost jinxed the otherwise free-flowing market economy of Hong Kong. In this respective, all the respondents called for a rethink of how the Country’s major economic planners tie the HKD around other major currencies. Respondents believed that concerted efforts should be made to give HKD and the economy some operating space away from the uncalled-for influence and trivialities caused by external global influences.

Homegrown financial Laws and Regulations

Unregulated international banking laws had been blamed for the collapse of major financial institutions around Asia in the 1998 economic recession. Further a field, the US mortgage financiers and some commercial banks had been accused of flouting international banking standards to occasion the ongoing economic recession (Melton 2009). Based on the above observation, a hypothesis was made to link the current economic crisis in Hong Kong to some inept banking and financial laws that were in practice during the 1998 Asian economic crisis.

According to Labonte (2002), monetary and fiscal policy errors have been accused of causing economic recessions around the world. But this hypothesis remained largely unproven by the study since Hong Kong had undertaken to revolutionize its banking and financial laws and regulations to international standards, especially after the 1998 financial crisis. According to the respondents, what ailed the economy of Hong Kong during periods of financial and economic upheavals came from external factors rather than internal influences. These responses worked against the fourth hypothesis.

Conclusions and Recommendations

Conclusions

Most market economies around the world – from the most developed to the least developed – are definitely headed for much leaner times. The next couple of months, and even years, might prove challenging for world economies. No economy can claim to be playing safe at the moment due to the close interrelations existing between economies. No one would have ever imagined the possibility of a housing bubble in the US traveling all the way to affect the freest market economy in the world. But it certainly happened. This is a witness to the fact that we are living in a global village where everything is interconnected to everything else (Zubair 2009).

In hindsight, inept macroeconomic and financial regulatory policies practiced by major economies for the past few years allowed the global economy to surpass its capability to grow, contributing to an upsurge in economic discrepancies across asset and commodity markets. The imbalances created by the real estate and property market in Hong Kong contributed immensely to the sucking of the whole country into an economic quagmire. Shortcomings arising from policy indifferences and market polarization have prohibited world equilibrating mechanisms and legal frameworks from operating effectively.

This has unfortunately brought world economies to the position they are today. It is worth noting that these unfortunate errors that have left the world in one of the most dreadful financial crises since the 1930’s Great Depression have been contributed by all economies – advanced and emerging. So, there may be no need at the present to play blame games (Melton 2009). Nonetheless, the situation facing our economic systems can only be termed as severely serious

This study concluded that recessions caused by financial crises are particularly virulent and lethal as witnessed by the ongoing recession. The current economic recession in Hong Kong had been ignited by a multiplicity of factors, key among them the ownership and structuring of the real estate and property market in the country. There is so much undue interference in the sector from outside causes. The interference arises out of the fact that Hong Kong is one of the most appealing commercial hubs in the region.

The government’s overreliance on the real estate and property market was viewed as unhealthy for the economic prosperity of the country. Other institutions have an obsession with the country’s property sector. As such, the sector is subjected to wide-ranging oscillations and upheavals due to its global outlook. By 2008, about 51% of all loans advanced by banks and other financial institutions ended up in the property sector. The overreliance of one sector over the others is often counterproductive to the economy.

Interest rates fluctuations caused by the composition and structuring of the real estate sector are adequate recipes for an economic downturn. Due to the complex interrelationship, global economic turbulence happening in one part of the global economic scale will definitely shake Hong Kong’s economy since the autonomous region has the greatest concentration of multinational and corporate headquarters in the whole Asia-Pacific region

In open economies such as Hong Kong, a quick and unprecedented change in commodity prices or the exchange rate is enough to ignite such a recession. Such changes are a daily occurrence in the real estate and property market, making the economy to become more vulnerable to economic downturns. Prices in the property market are largely dependent on what is happening at the international scene since the sector has been overly penetrated by foreign investors. This coupled with volatile exchange rate fluctuations have often proved costly for Hong Kong’s economy.

Recommendations

As such, concerted efforts are needed from all stakeholders to remedy the situation. In Hong Kong’s case, the government must first find a way of running its own affairs pragmatically without over-relying on the land, real estate, and property market. Hong Kong is a country that has been blessed with so many opportunities, including being the most strategically placed for doing business in the whole of Asia and the Pacific (GPG 2008). The government should use such opportunities to explore the variety of economic choices that exist instead of relying on one major sector at the expense of others.

The financial managers of the economy must also come up with tangible ways of shielding the Hong Kong Dollar from acute external vagrancies. This doesn’t mean that the currency market should be controlled. On the contrary, the market should be given more independence but adequate financial forecasts should always be undertaken to shield the economy from potentially hazardous vagrancies in the financial markets. This is important to avoid uncertainties in the market.

The economic outlook of Hong Kong is based on capitalist orientation. As such, anybody is free to own property anywhere in Hong Kong. This is perhaps what has brought many problems for the country, as foreign investors fight to own a piece of Hong Kong. According to the study, this has been proved as a trigger factor that catapults economic recessions. As a precautionary measure, the government should introduce some form of legislation to streamline the real estate and property market from abuse.

There should be a limit to everything, no matter how good it is. If all the above is reformulated and reshaped into one all-inclusive all-encompassing stimulus package for Hong Kong, then the country should brace itself for a brighter future.

List of References

- Brown, S.V 2008. “Global financial Crisis Hits Hong Kong’s Tai Lin Radio Service.” China Tech News.

- Beckford, V., Houlgate, J., & Cushing, P 2008. 2008 Financial Crisis.

- Cruz, P.C 2008. The global Property Housing Boom. Web.

- Dobson, W 2009. The Financial Crisis of East Asia. Web.

- Global Property Guide (GPG) 2008. Hong Kong: Housing Market on Balance? Web.

- Handley, C 2005. Validity and Reliability in Research.

- Hall, R., Feldstein, M., Frankel, J., Gordon, R., Romer, C., Romer, D., & Zarnowitz, V 2003. NBER’s Recession Dating Procedure.

- Haila, A 2000.”Real Estate in Global Cities: Singapore and Hong Kong as Property States.” Urban Studies, Vol. 37, No. 12, 2241-2256

- Hopkins, W. G 2000. Quantitative Research Design. Web.

- Hong Kong Themes 2008. How Hong Kong Tackles Financial Crisis.

- Krugman, P 2009. What Caused the Financial Meltdown? The Claremont Institute. Web.

- Kifle, Y 2009. Hong Kong Real Estate: Slowing Down with the Economy. Web.

- Labonte, M 2002. The Current Economic Recession: How Long, How Deep, and How Different from the Past?

- Law, C.K 2008. Weakness of Hong Kong’s Financial System.

- Loser, C.M 2008 Global Financial Turmoil and Emerging Market Economies: Major.

- Contagion and a Shocking Loss of Wealth? Asian Development Bank.

- Melton, W.R 2009. How to Eliminate Fear of Global Recession and Terrorism. Fix Bay Inc Publishing. Web.

- Mills, D.Q 2009. The World financial Crisis of 2008-2010: What Happened, Who is to Blame, and How to protect your Money. Create Space. Web.

- Mulhaupt, R., & Dyck, S 2009. Hong Kong’s Banks during Financial Crisis. Deutsche Bank Research.

- Park, C 2009. “Global Economic Crisis: Impacts and Policy Options.” Asia Pacific Social Science Review, vol. 9, no.1.

- Ralph, W 2009. Pessimistic Hong Kong’s Real Estate Forecast.

- Shah, A 2009. Global Financial Crisis. Web.

- Sekaran, U 2006. Research Methods for Business: A Skill Building Approach, 4th Ed. Wiley-India. Web.

- Shiller, R.J 2008. The Subprime Solution: How today’s Global Financial Crisis Happened, and What to Do about It. Princeton University Press. Web.

- Stewart, D.W., & Kamins, M.A 1993. Secondary Research: Information Sources and Methods, 2nd Ed. SAGE: 9780803950375 Unrivalled Location 2009.

- Zubair, M 2009. “Impact of Global Recession.” The Dawn Media Group.