Introduction

The performance of every organization involves many factors including cost minimization and revenue maximization. Firms aim at achieving these two major objectives. They use various means to monitor company performance such as a balanced scorecard and financial performance. Financial performance is not a reliable measure of performance because it only measures the financial perspective of the organization.

Due to this weakness, many firms utilize both financial measures and the balanced scorecard. This study examines performance measures that are used by Eastvaco Corporation, a U.S organization that operates in the timber processing and manufacturing industry. The paper also examines the cost and budgeting tools used in the company.

Managerial Communication

Managerial communication is a very important aspect of effective organizational management. Effective managerial communication is found on the premise that a successful business can only be built on a platform of proper communication, the transmission of information, opinions, and decisions, and a proper feedback mechanism. Managerial communication is a measure of how competent a manager employs his or her skills and executes his or her responsibilities to business partners.

When managers feel overlooked when it comes to the dissemination of vital company information, their performance is negatively affected. It is no surprise in the case of Eastvaco Bob complains of being left out with withholding of some information. While the communication process might be very expensive to the company, it vital as it saves the company cost associated with ineffective and redundant management (Camelia &Laura, 2008).

The fact that Bob and friends agree to use unofficial means to get the information they need to effectively deliver their duties, means that leaving managers out of the information loop could be even much more costly to the organization than it would have been if all managers were given access to all the information they require. It is therefore important that while Jane Goodman pursues a cost-effective communication policy, effective managerial communication is still integral to good business performance.

Performance Measurement-The Balanced Scorecard

Financial measures have been for a long time been used as the basic performance measures of business enterprises. However, financial measures like profit margins, mark-ups, and earnings per share have been criticized for not incorporating non-financial elements like customer and employee satisfaction, production efficiency in its evaluation of company performance.

The balanced scorecard is widely used to link a company’s actions to its strategic goals in strategic planning. As such, the balanced scorecard is used to “improve both the organization’s internal and external communication and monitor its strategic performance” (Kaplan &Norton, 200, p.56).

As a bottom line, the balanced scorecard goes beyond the traditional financial measures to incorporate strategic non-financial measures in evaluating company performance. The balanced scorecard has four diverse viewpoints from which an institute must be assessed, i.e. financial or monetary, client; in-house business; and education & development viewpoints.

Financial Perspective

The balanced scorecard emphasizes that managers should always aim at providing adequate and accurate financial data. Proper financial data will help the management evaluate how the company has been able to generate value over a certain period. There are several financial measures that Eastvaco can use to evaluate its performance. Firstly, the company can evaluate how much Return on Investment (ROI) it has been able to earn.

ROI is a percentage of what the company has earned a profit on the invested funds. The company will be deemed to have performed well if it earns ROI higher than the cost of capital. Secondly, the company can use Return on Equity (ROE). ROE is a percentage measure of how much profit has been earned on the funds contributed by common shareholders.

The company will have performed better if the ROE is greater than the cost of obtaining the equity funds. Finally, the company can use Economic Value Added (EVA). The EVA is the difference between profit after but before interest and the capital charges of invested capital, i.e. EVA = PBIT (1-T) – WACC* CE. The EVA should always be a positive for a company to be considered as having a better financial performance.

Customer Perspective

This perspective holds that companies should focus on customer satisfaction. A better-satisfied customer means a much larger customer following which increases revenue hence higher financial performance. Eastvaco can use a measure such as a Customer Satisfaction, Customer Retention, and Market Share to evaluate this perspective. Higher customer satisfaction, retention, and a large market share will highlight better performance.

Internal Business Process Perspective

The internal business process ensures that products produced and services by the company are of high quality. The Eastvaco management should make sure that the company is managed efficiently and effectively and that its output meets customer needs. The company should use measures such as Process Improvement, which assesses how well the company is run; Suppliers Retention, which evaluates the confidence of suppliers in the company’s processes and Customer Product Approval, which examines the quality of products the company produces.

Learning and Growth Perspective

Focuses on the ability of people in the organization to learn and grow for managing and sustaining change and improvement. It emphasizes training and building. The various performance measures the company can use to assess this perspective are employee satisfaction, employee retention, and employee productivity.

Costing, Budgeting, and Internal Reporting

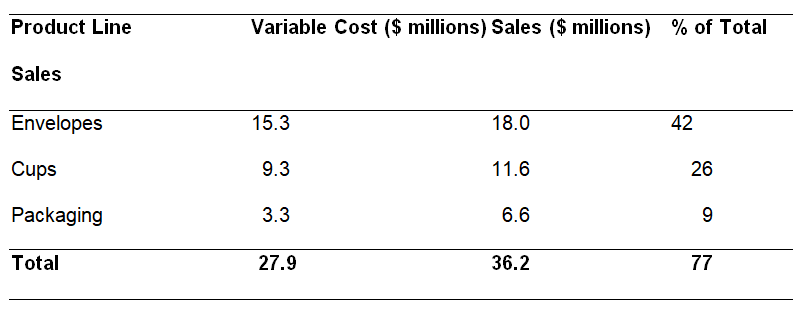

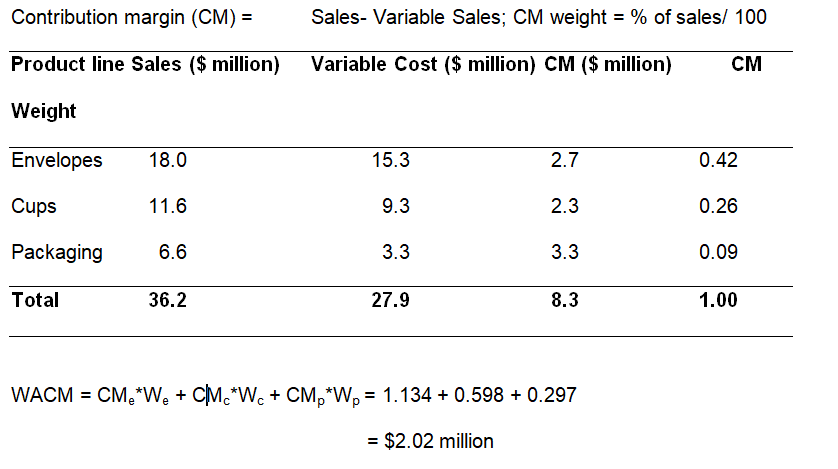

Variable Cots Schedule

Break even revenue = Fixed Cost/ P/V ratio = $ 6.5 million/$8.3 million * $36.2 million = $28.3 million

Increase in revenue

Variable Costs are 77% of sales, therefore for total sales = (19 + 13 + 8) $40 million dollars, Variable costs = 0.77*40 = $30.8 million. Contribution margin = 40-30.8 = $9.2 million

Marginal CM = $ 0.9 (9.2-8.3) million

Marginal Fixed Cost = $0.2 (3.8-3.6) million

Incremental profits = 0.9-0.2 = $ 0.7 million

Fixed manufacturing overhead allocation

While the above treatment of fixed manufacturing costs can be termed as absorption costing, other ways of allocating them have been developed. The above allocation is also called product costing where the fixed overheads are charged to the income when the product is sold. On the other hand, “the fixed expenditures can be directly expensed to the income statement in the period in which they are incurred” (Camelia & Laura2008, p.8). This approach is called period or marginal costing.

Variance Analysis

Material Price Variance (MPV)

MPC can be defined as the differences in the total money spend on actual inputs and the planned costs. MPV is calculated as MPV = (AP-SP)*AQ. A positive MPV is not good for the organization while a negative MPV is good for the organization. Positive MPV could result from quantity discounts.

Materials Quantity Variance (MQV)

MPC can be defined as the differences in the total actual materials used and planned material usage and it is calculated as MQV = (AQ-SQ)*SP. An unfavorable MQC is represented by a positive figure while a negative figure represents a favorable MQC. Eastvaco Corporation realized an unfavorable MQC due to the use of low-quality inputs hence large quantities being used.

Labor Rate Variance (LRV)

This is the difference between the actual labor costs and the budgeted costs. It is calculated as LRV = (AR-SR)*AH. A favorable variance to the organization is usually realized when AR>SR while an unfavorable LRV is realized whenever AR

Labor Efficiency Variance (LEV)

This is a measure of the disparities between actual labor hours and budgeted hours. The differences are calculated as LEV = (AH=SH)*SR. the variance is good when AH

The scraped material realized by Eastvaco decreased because of the high production efficiency and utilization of high-quality inputs. Return orders increased due to low-quality output while the rework period was reduced because of quality output. Unfavorable MQL, LEV and led to an increase in average unit cost while demand overestimation and ineffective marketing campaigns led to reduced sales.

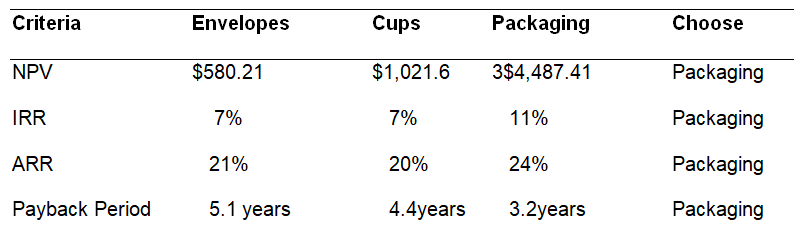

Investment Decision

In capital budgeting, when choosing between mutually exclusive projects, certain criteria are used in the analysis. The include payback period, net present value, accounting rate of return, or the internal rate of return. While using NPV, IRR, or ARR, the viable project that should be selected by the organization is usually the project that has the highest values. However, the projects should only be if they have positive NPV, IRR greater than the cost of capital, and ARR higher than management minimum established rate. For the payback period method, the project that pays off early should be chosen.

(N/B calculations for the above results available on the excel sheet provided).

Using the traditional decision rules discussed above, the packaging product line dominates Envelopes and Cups product lines registering the highest NPV ($4,487.41), IRR (11%), and ARR (24%) of return. The product line also has the lowest payback period of 3.2 years. Therefore, the company should choose to package the proposed investment.

Company Comparison and Evaluation- Ratio Analysis

Ratios are financial tools that are used by the organization to establish the financial performance of the firm especially after comparison with previous performance, other firms in the industry, or the industry. An organization should aim at having higher and better ratios compared to the industry or the competitors in the industry. Table 1 below indicates a comparison of Eastvaco ratios, the industry, and MeadWestvaco.

(N/B refer to the excel sheet to see the calculations).

The outcome from the above table indicates that Eastvaco has a higher and better liquidity position compared to MeadWestvaco. This is significant to the firm implying that the company can meet its short-term obligations as they fall due. Eastgate has better coverage of its current liabilities when compared to MeadWestvaco.

Asset efficiency ratios place the company in a better position than MeadWestvaco and the industry. The comparison of profitability ratios indicates that Eastvaco has lower profitability than MeadWestvaco. In summary, Eastvaco is in a better financial position compared to the industry and MeadWestvaco. The company’s ratios are better than the ratios of MeadWestvaco and the industry.

Organizational Structure and Inter-company Transfers

Responsibility centers are important to an organization in the sense that they help in the decentralization of responsibility. Being used as an investment center, the Charlotte facility is responsible for calculating the working capital and the physical assets of the organization. Its management is answerable to the top management of Eastvaco. Metrics such as ROI and ROA will be used to measure the performance of the facility.

Firm decentralization is the ability of an organization to diversify its decision-making to various responsibility centers. The level of decentralization is evaluated by the level at which the firm has delegated its duties. Firm decentralization and diversity of importance to an organization in various ways such as allowing the low-level management team to gain experience in decision making in preparation for promotions and managing the entire firm. Through brainstorming sessions in the responsibility centers, the organization can make informed decisions.

Despite the benefits that an organization can realize from decentralization, some disadvantages could be realized too. For instance, lower-level management might not have a strategic inclination in their decisions. Sometimes, conflicting objectives may affect the decisions made and it is difficult to coordinate the decision-making process in the whole organization. Eastvaco should sell the Cremoduim to Charlotte facility at a market price of $120.

As a profit center, the manager of the South Carolina facility is responsible for the productivity of the plant, sales, and overall plant performance. By selling the facility at the given market price, the company will make a profit.

Global Commerce

The Asian investment report should contain information about the size of the company’s target market. This will enable the board to decide on the market feasibility of the project. The report should also contain a projected level of sales for the first few years of operations, information about materials and labor costs in the market, and the cost of vital utilities like electricity, water, and transportation in the Asian market. The report should include industry analysis, Asian economic outlook, political and regulatory issues, and social-cultural dimensions of the market and the level of technology in the region.

The company’s major strengths are its superior liquidity position, efficiency in asset management, and good leverage position which means that it can still raise its debt level without causing solvency problems. The major weakness of Eastvaco is low profitability levels, especially when compared to MeadWestvaco and the industry.

The Asian investment should only be undertaken if it has the potential of improving the company’s profitability while at the same time maintaining its superior level of liquidity, asset management, and leverage. The company still has a considerable level of debt capacity and can therefore borrow from the Asian Markets to finance the expansion.

Controlling Cost and Performance Measures

While financial measures are very vital to measuring performance and controlling costs, several non-financial measures should be carefully examined. Non-financial issues focus on the existing activities that would impact future financial measures. These non-financial issues include customer-related issues, internal business processes, and learning and growth issues. This non-financial have a visible impact on the financial measures and therefore their proper consideration guides in putting in place plans to anticipate their impact of financial issues and company performance.

If purely financial measures are used in cost control and performance assessment, then the management should be aware of the fact that financial measures alone are not adequate to guide performance in creating value. However, the financial measures should be used within the strategic standpoint of the company.

References

Camelia, S. & Laura, P. (2008). Managerial communication, Romain Journals, 7172(23), 1-12.

Kaplan, S.R. & Norton, D.P. (2002).The balanced scorecard. New York, NY: Harvard Business School Press.