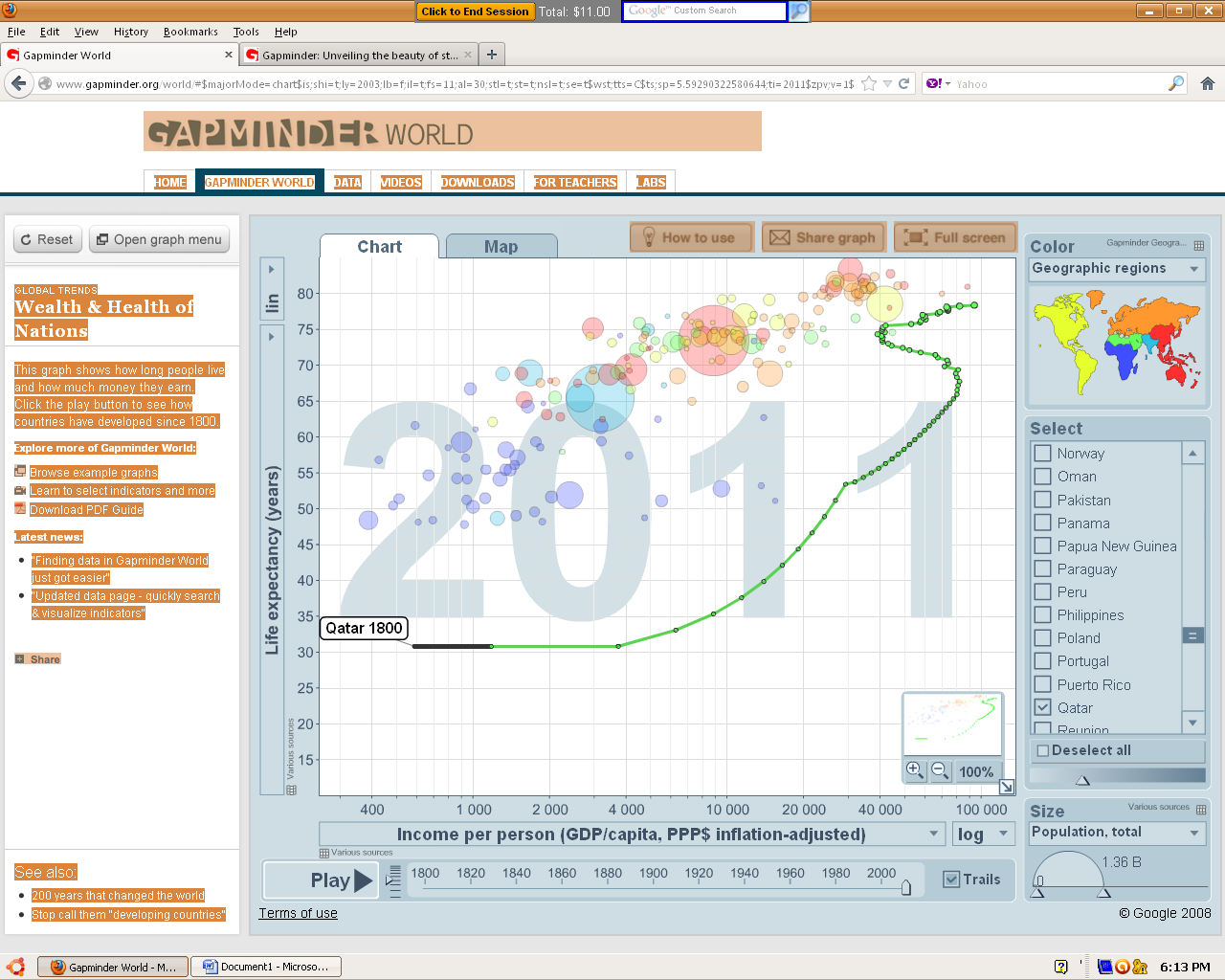

Figure 1: Qatar’s key macroeconomic data

Long Term Growth and Comparison between Qatar and Iraq

Qatar’s long term economic growth is illustrated in figure 2. The figure shows that there has been a catch-up effect in Qatar. According to the catch-up effect theory, the GDP per capita of poor countries is expected to grow faster than those of developed countries (Krugman and Wells 231). Consequently, all economies will have comparable incomes in the long run. Qatar’s GDP per capita remained flat in the early 1800 (Gap-minder). During this period, production was constrained by a lack of capital, technology, and ready markets. Hence, there was no significant growth in national income. Following the arrival of British colonials in late 1800, Qatar began to trade with the external world. Consequently, the country’s economy began to grow. The discovery of oil in 1939 led to rapid economic growth between 1940 and 1960.

After gaining independence in 1971, the government focused on expanding the energy sector by increasing oil and gas production. Proceeds from the energy industry were used to develop infrastructure and key sectors such as manufacturing (Muhannad and Star 147-154). Unlike other Arab countries such as Iraq, Qatar had a stable political environment that attracted foreign direct investment. As a result, Qatar’s economy expanded faster than that of Iraq and other Middle East countries. From 2000, Qatar’s economy grew faster than that of the US, Japan, and the UK. Consequently, the country has been able to catch-up with the developed world. Iraq, on the other hand, has not been able to catch up due to political instability, corruption, poor infrastructure, and lack of economic freedom.

Living Standards in Qatar

Qatar has emerged as the richest country in the Arab world. The country owes its economic fortunes to the vast oil and natural gas reserves at its disposal. The country has been able to increase its oil exports over the years, thereby increasing its export earnings. Unlike other Arab countries such as Iraq, Saudi Arabia, and Kuwait, proceeds from oil exports have been used prudently in Qatar (Cunado 101-117). Low levels of corruption and good governance have led to equitable distribution of national income. The government invests a better part of its revenue on human capital development in order to spur economic growth and improve the standards of living. Qatar’s literacy level of 89% as of 2009 is one of the highest in the Middle East region. The government provides free primary and secondary education to all citizens. Furthermore, university education is subsidized. Through partnerships with American universities, the government has been able to offer excellent higher education. In Iraq, the quality of education is still very low due to long years of war that led to the destruction of learning facilities and the flight of human capital (UNDP).

Qatar’s healthcare system is also better than that of Iraq. Healthcare is provided through government-sponsored hospitals. Consequently, the majority of the citizens have access to healthcare irrespective of their ability to pay (Zuhar 231-235). The quality of Qatar’s healthcare system is comparable to those of developed countries such as the UK. Whereas life expectancy in Qatar is 75 years, in Iraq, it is 70 years. The infant mortality rate in Qatar is 6.4 deaths per 1000 live births, while in Iraq, the rate is as high as 44 deaths for male children (World Bank). These differences demonstrate the superiority of Qatar’s healthcare system. Nonetheless, the country is still among those with the highest cases of lifestyle-related diseases such as obesity and diabetes in the world.

Through rapid economic growth, the government has been able to reduce poverty significantly. Approximately 25% of Iraq’s population lives in poverty. However, nearly all of Qatar’s citizens live above the poverty line. Low inflation rate and effective social safety nets have enabled the majority of the citizens to access basic needs such as housing, clothing, and healthcare (Opresca 123-137). In 2011, Qatar had a human development indicator of 0.831 compared to Iraq’s 0.573, the world’s average of 0.682, and the Arab states’ average of 0.641. This implies that the standards of living in Qatar are much better than those in Iraq and other Arab countries.

Achievement of Macroeconomic Goals

Economic Growth

Qatar has experienced rapid economic growth in the last decade, as illustrated by figure 3. This growth is underpinned by high foreign exchange earnings through oil exports and massive capital inflows through foreign direct investments. The oil and gas sector contributes 50% of the country’s GDP and 85% of its total export earnings. Overall, 70% of the government’s revenue is obtained from oil exports. Qatar expects to deplete its oil resources in the next three decades. Consequently, the current economic policy aims at developing non-energy sectors. Moreover, the government is implementing policies that will attract more local and foreign direct investments. The government considers industry, financial services, and tourism to be the most important sectors in its diversification plan. In 2010, industrial production expanded by 27.1% and is currently the leading non-oil source of revenue. Qatar has one of the best performing financial sectors in the Arab World.

The sector managed to survive the 2007/2008 financial crisis, with most commercial banks recording huge profits. However, the sector still grapples with challenges such as declining customer confidence, low liquidity, and inadequate supply of credit. These challenges are also experienced in other Arab countries such as Iraq, Saudi Arabia, and Egypt (Metwally 12-15). The government is currently implementing a five-year plan that aims at expanding the tourism sector. The country has a keen interest in niche tourism and expects to double its hotel capacity and tourists in the next five years. Unlike Qatar, Iraq has not focused on diversifying its economy (Speiser 97-98). Oil exports continue to be Iraq’s main source of revenue. Furthermore, political instability has led to massive capital outflow, thereby discouraging economic growth.

Full Employment

In 2011, Qatar’s unemployment rate of 0.4% was the lowest in the world. This indicates that the country is about to achieve its goal of attaining full employment. In Iraq, the rate of unemployment is still more than 10%. Qatar’s low unemployment rate is attributed to the following factors. First, the country’s economy has been expanding faster than the growth rate of its population. Thus, the economy has been able to create enough jobs for the population. Second, rapid economic growth has increased demand for skilled labor. As the economy expands, more labor is needed to increase production and innovation (Amjad and Julian 76-78). Consequently, the expansion of sectors such as manufacturing, energy, and services has enabled the government to create more jobs. Third, the attractiveness of Qatar as an overseas investment destination has resulted in an increase in the number of foreign corporations operating in the country (Shotar 34-45). These firms have helped to create jobs in the economy. Lack of technical skills is one of the main challenges in Qatar’s labor market. The government has responded to this challenge by increasing investment in education and allowing expatriates to work in the country.

Stable Prices

The government of Qatar has been able to maintain relatively stable prices in the last decade. Figure 4 illustrates the variations in the country’s inflation rate and consumer price index. Between 2002 and 2005, the country maintained a single-digit inflation rate. Following the sharp increase in oil prices during the 2007 financial crisis, the inflation rate rose above 10%, reaching a peak of 15% in 2008. High inflation rate hurts consumers by reducing their purchasing power (Arnold 91). However, it is also a sign of economic growth, especially if aggregate demand increases due to an expansionary fiscal policy. Iraq, on the other hand, has had huge fluctuations in its inflation rate. For instance, the inflation rate was as high as 53.2% in 2006. However, the inflation rate decreased to -10.1% in 2007. This kind of price instability normally hurts the economy since it is likely to trigger capital flight and loss of investor confidence. In conclusion, the economy of Qatar performs better than that of Iraq. Qatar has not only caught up with the developed world but has also implemented policies that will enable it to maintain rapid economic growth. Iraq, on the other hand, has not been able to catch-up with the developed countries due to low economic growth.

Works Cited

Amjad, Rashid and Havers Julian. “Jobs for Iraq: An Employment and Decent Work Strategy.” Journal of Applied Economics 3.1(2010): 76-78. Print.

Arnold, Rashid. Macroeconomics. New York: McGraw-Hill, 2010. Print.

Cunado, Juncal. “Structural Breaks and Real Convergence in OPEC Countries.” Journal of Applied Economics 14.1(2011): 101-117. Print.

Gap-minder. Growth in Wealth since 1800. Gap-minder, 10 Oct. 2012. Web.

Krugman, Paul and Robin Wells. Macroeconomics. New York: McGraw-Hill, 2009. Print.

Metwally, Mokhtar. “Potential Benefits to the State of Qatar from Membership in the GCC Custom Union.” Applied Econometrics and Applied Development 2.2(2002): 12-15. Print.

Muhannad, El-Mufleh and Manhal Shotar. “A Contribution to the Analysis of the Economic Growth of Qatar.” Applied Economic and International Development 8.1(2008): 147-154. Print.

Opresca, Raluca. “An Insight on the Economic Development Patterns in the Gulf Countries.” Euro-Economia 30.2(2011): 123-137. Print.

Shotar, Manhal. “The Attractiveness of Qatar to Foreign Direct Investment: 1980-2002.” Applied Econometrics and International Development 5.3(2005): 34-45. Print.

Speiser, Edward. “The Economic Development of Iraq.” Journal of Economic History 14.1(2000): 97-98. Print.

UNDP. Human Development Indicators. UNDP. 2011. Web.

World Bank. World Development Indicators. World Bank. 2011. Web.

Zuhar, Usama. “The Impact of Oil Shocks on Qatar’s GDP.” Applied Econometrics and International Development 4.3(2009): 231-235. Print.