A brief summary of the case

Enterprise Rent-A-Car is the largest car rental company in North America. Originally it was founded to meet the needs of local clients that needed car lease and rental services, the company has expanded and stretched its branches to more than 6000 places across the globe and a fleet of more than 800,000 vehicles. Additionally, the company employs more than 60,000 people in its various global branches. The growth is largely based on the founder’s client-focused and employee-focused philosophy. Other than the car lease and rental, the company also offers car sales, fleet management services, and Rideshare. Its offices are spread in North America but its headquarters is hosted at St Louis, Missouri office.

Enterprise Rent a Car has over the years focused its operations on off the airport car leasing services unlike most of its competitors that enjoy a huge airport presence. However, in the recent past, Hertz and Avis have heavily encroached into the off-airport car rental market while Enterprise Rent a Car still struggles to gain a footing in increasing its airport presence. Although still struggling to compete with Hertz and other brands in airport rental services, it still remains the most profitable car rental company. It is believed that Enterprise Rent a Car wields immense financial muscle both in terms of profit and capital. Its main strategy over the years has been to keep the employees motivated by allowing growth within the company while at the same time putting client satisfaction atop its agenda.

The company’s latest financial results reveal that it made a record $ 9 billion compared to Hertz’s $328 million globally. Over the past 30 years, the company has achieved an annual growth rate of above 20% opening an average of 400 branches annually over the past decade, a few of which were in airports. According to Forbes list of large American companies, Enterprise Rent a Car is ranked at no. 16. This makes it one of the biggest companies across the globe; a position that comes with immense financial ability.

Business strategy

The company has a business strategy unique to itself. Firstly, it understands and tries to derive optimal benefits from the power of networks. It has multiple locations within less than 15 miles spread across 90% of the United States. Enterprise Rent a Car operates close to 60,000 staff in its offices across the globe. In the United States, it does not matter where you are, how small the town is, or how accessible the place is, there is always a chance you will find Enterprise Rent a Car office. Its accessibility and proximity to the clients have helped it build a strong relationship with clients. Additionally, the company has heavily invested in customer services with an emphasis on having polite and friendly customer representatives in all its offices.

Service quality is an important component of the company’s business strategy. Emphasis is always placed on overcoming the expectations of clients. As a matter of fact, Enterprise Rent a Car can pick you from your doorstep; drive you to work, and later drive you back home, all at your convenience. Focus is always on ensuring clients understand that the company really cares for them. In a further bid to bring closer services clients may need, the company offers other services such as truck rental, fleet services, and sale of used vehicles. As a matter of fact, the main aim is to offer quality service that guarantees client satisfaction.

Clients are either classified as retail or corporate customers. Services are tailored to meet the respective needs of these groups of clients. Additionally, it is important to note that having grown as a neighborhood rental car service company; the company has lots of offices off the airports. This is unlike many car rental companies that focus on airports. This way, it is easy to think of the company each time one wants to rent a car.

SWOT Analysis

Product/market strategies

Enterprise Rent-A-Car has its own unique management approach that distinguishes it from other players in the market. These, among other factors have provided it with the much needed competitive advantage. Its decision to maintain a decentralized, professional and entrepreneurial minded team has no doubt worked to its advantage. Decisions are made at operation levels. Additionally, the company provides its employees with regular training. Unlike other companies, its management trainees as well as interns all begin at the lowest learning levels in order to understand the business in depth.

Industry overview

The non-airport market segment contributes a large portion of car rental business in the United States. The Airport based markets accounts for 49.3% while the rest are non-airport. The market constitutes both retail and corporate clients. It is important to note that the industry purely focuses on short-term rental. It is estimated that car rental service providers generate more than $20,000 million annually in revenues with non-airport service contributing a major portion.

On the other hand, statistics reveal that a large portion of the car rental market is situated in the United States.

Industry performance

In 2010, it was estimated that the value of car rental revenues hit $ $25.7 billion despite the slowing car rental market due to economic challenges in the United States and Europe.

Competitive forces

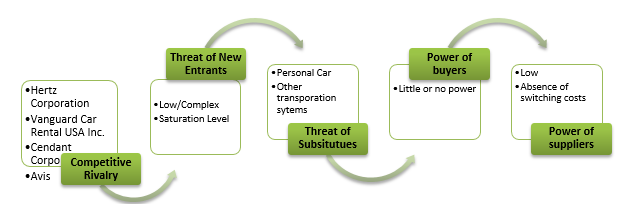

Competitive Rivalry

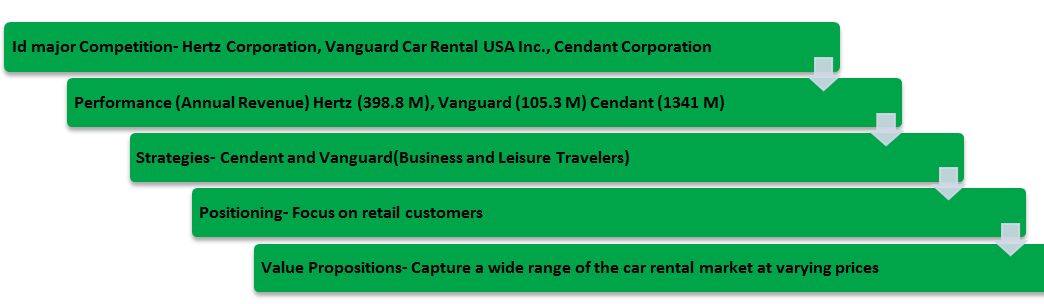

There are lots of factors that shape competition in the industry. Although the price may not be of importance, companies must focus on value systems and strategies that yield long-term profitability. Competitive rivalry in the industry largely stems from other major players including Hertz, Vanguard car rental, Cendant Corporation, and Avis. There are also other smaller players competing for clients.

The threat of new entrants

The threat of potential new entrants is extremely reduced due to capital requirements and hence there is potential to increase market share. However, there are always private car owners who choose to engage in the Taxi business and as such encroach on a segment of the client.

Threat of substitutes

There are lots of substitutes in the market within which the enterprise operates. Alternatives such as video conferences, virtual services, collaboration software, personal autos as well as other forms of transportation continuously threaten the delicate market dynamics.

Power of buyers

The car rental market is largely client-driven. As a matter of fact, the companies are often forced to make adjustments in response to changing buyer trends.

Power of suppliers

Suppliers lack substantial influence on the company while agents can potentially influence the lowering of rental costs.

Competitor analysis

The industry has some major competitors to watch out for including Cendant Co, Hertz Co, as well as Vanguard Car Rental USA. Other competitors in car rental business include Avis Group Holdings Inc.

Industry trends

Consumer analysis

Enterprise Rent a Car’s rental market has four major client categories. The company has classified and prepared tailor-made packages to meet the needs of this diverse and unique market. The client categories include leisure clients, business clients, sharing clients, and leasing clients. The consumers’ service preferences and desires largely differ based on the category of clients within which they fall. While business consumers often go for classy, high-end cars, leisure consumers may opt for smaller, affordable cars. Such are the dynamics that shape the car rental industry.

Sustainability of the business

The current model employed by the company has so far been a success. Consequently, the company will most likely retain the system. As a matter of fact, the online platform has remained a pillar to the company in communicating its objectives as well as marketing. Additionally, the decision to market through repair shops, policyholders, and insurance companies has opened a new segment of clients to the business.

Alternative strategy

Airport Locations

The website reveals that the company will continuously attempt to increase its presence in airports. The strategy is likely to complement the existing business strategy and hence open doors for further growth. Its reduced airport presence has time and again limited the company’s ability to offer its clients a holistic service. Furthermore, most companies such as Avis are already encroaching into off the airport markets.

International Locations

The company’s website reveals that it will continue to focus on expanding into international markets as part of its growth strategy. Having recorded successes in Canada, the United Kingdom, and Ireland, it is evident that the company is ready to explore more international markets and lay the foundation for a better future globally.

The company’s growth cannot be guaranteed if new market segments are not identified. While there is the option of expanding internationally, there are still a lot of unexplored markets locally such as ferrying school children, expanding its fleet business, gracing events such as weddings, and offering relocation services, among others. Its heavy presence in the United States can make it a choice company for families intending to relocate.

TOWS Matrix

Conclusion

It is expected that Enterprise Rent a Car will continue to flourish as the choice neighborhood car rental service provider. Its successes in the United are likely to be replicated in its new markets. Further, the need to offer complete service packages is likely to see the company put more effort into increasing its presence at the airports. This will most likely see it establish a stronger market position. It is expected that strengthening its airport presence will also strengthen the company’s position as the market leader in all areas through the delivery of holistic services. Lastly, market penetration is important more especially in emerging markets.

As the global economy becomes intertwined, its international presence will no doubt continue being of great importance. As a matter of fact, the strategies adopted by the company will largely shape its continued growth strategy. So far, its strategy has worked well, and hence in addition to new strategies, the company will most likely continue to expand.