Inventory Value Adjustment

At the end of year 4 the inventory for this organization was as follows:

- Initial inventory = $41,824,000

- Since the raw materials that cost $39,280,000 are only worth $10,000,000 now, then the inventory becomes:

- Inventory less raw materials $41,824,000 – $39,280,000 = $2,544,000

- Then, add the market value of the raw material now $ 2,544,000 + $10,000,000 = $12,544,000

- Inventory value is $ 12,544,000.

A depot with $2,500,000 worth of finished goods which was missed off the count must be included in the inventory. The inclusion of this depot will increase the inventory as follows:

- $ 12,544,000 + $ 2,500,000 = $ 15,044,000

- Inventory value becomes $15,044,000

- Returns with an original sale value of $19,990,000 have not been included in the inventory value. They have a resale value of $8,000,000 after repairs worth $120,000.

- The resale value less the cost of repairs will give $8,000,000 – $120,000 = $7,880,000

- The final inventory value becomes $ 15,044,000 + $ 7,880,000 = $ 22,924,000

Other Sundry Adjustments

Insurance of $ 9,300,000 runs from 1 December Year 5 to 30 November Year 6 was entered into the books and paid in December Year 5. Only one month in year 5 is catered for by the insurance. To find the amount used to pay insurance for year 5, the following calculations were computed: $ 9,300,000 / 12 = $ 775,000.

Rates are $7,200,000 and by the year end they have been fully paid until 31 March Year 6. Rent of $2,400,000 per quarter has been paid during the year to 31 March Year 6. All these figures are included in Administration expenses in the income statement. The rent paid should not be included in the accounts for year 5. This is because the rent is paid quarterly and has been paid up to 31st March year 6. The rates have been fully paid up to 31st March year 6. It is necessary to deduct the rates paid for the three months of year 6 before including this expense.

Share Capital and Dividends

Dividend payment is essential because dividends give certainty of the company’s well-being financially. Dividends encourage investors; the investors are able to get a secure current income through dividends. An organization that has been offering dividend will be affected negatively if it omits or lowers the value of the dividends. If an organization does not have a history of dividend payout, it will be affected positively if it declares dividend payment.

Methods of Paying Dividend

Residual Method

In this method, dividends are paid only if there is residual equity after the project has been financed. In this method, the organization has to maintain debt/equity ratios before any dividend payout. This method of divided payment leads to dividend fluctuation and cause uncertainty.

Stability Method

Stability method uses a cyclic method. Dividends are paid at a fraction of quarterly or annually earnings. The stability method provides the investors with an income and reduces uncertainty.

Hybrid Method

Hybrid method is a combination between the residual method and the stability method. In this method a company views the debt/equity ratio as a long term goal. Since an organization will sometimes experience fluctuations, the organization will have one set dividend. The dividend is set at a relatively low portion of the organizations yearly income. The organization must ensure that it can easily maintain the set dividend. The organization will offer extra dividend only when the income exceeds the set levels (Marshall, William, McManus, & Daniel, 2010, p. 58).

Recommendation for dividend payment

To pay dividend, the organization will choose one of the three methods. The method chosen will determine how beneficial the dividend payout will be to the investors. Debenture holders will be paid regardless of whether the organization makes a profit or a loss. A debenture holder is a creditor to the organization. Since there are no debentures or loan note, the organization does not does not have a lot of expenses. The organization should choose the hybrid method of paying dividends. This method will reduce investor uncertainty while providing them with a constant income. This will attract even more investors thus increasing the organizations revenue.

A rights issue is method of selling additional company shares. This is done with an aim of increasing the capital. The share holders are given an opportunity to buy more shares at a discount. The dividends acquired through a rights issue are transferable. This will encourage the existing shareholder to purchase more shares.

Bonus share are given to the current shareholders based on the shares owned by the shareholder. Bonus shares are given out by the company free of charge. Bonus shares are a mode of payment of dividend in the form of shares rather than cash. Through bonus shares, the organization’s issued capital will increase (Gelinas, Dull, & Wheeler, 2011, p. 69).

For the organisation to issue bonus shares the following conditions must be met:

- The organization must have sufficient undistributed profits.

- The articles must allow the organization to issue bonus shares.

- Board or Directors must pass an appropriate resolution.

- The shareholders receiving the share bonus must be approved in a formal general meeting.

- Controller of Capital must permit the bonus issue in accordance with Capital Issue Control Act, 1947.

Due to the competition from other organizations, and the need to reward the shareholders through dividends without compromising the state of the organization, the organization must ensure that revenues exceed expenses. The organization must also improve the efficiency of the employees (Clyde, Roman, Katherine, & Jennifer, 2009, p. 92).

Management must ensure that employee spend their time doing the required job. It is evident in this and other organizations that employee spend a great deal of their time on social media websites. This should be discouraged to ensure maximum efficiency. The management must also clarify roles, tasks, and priorities.

Some of areas that will lead to increased profit are as follows:

- Increase Revenue

- Reduce Expenses

Increase Revenue

To make paying dividends possible the organization will have to increase the revenue. For this organization to increase revenue it requires to do the following:

- Increase the number of customers

- Increase the number and value of each sale

- Ensure that clients return by improving customer services.

Reduce Expenses

The organization must reduce expenses to improve on profitability. The organization will achieve this through proper management of suppliers, cost, and purchases. The performance of this organization depends on its cash flow. The money acquire through sales and then spent as wages, inventory, bills, rent, insurance must be controlled to maximize the profit. The organization requires reducing the overhead expenses which are not essential to the operations of the business (Steven, 2010, p.55).

The organization must also reduce the expenses by making use of the internet. Through the internet, the organization can get better prices on equipment and office supplies. The organization is responsible for installation, repairs, maintenance and insurance for the new Tiber project. The board members

PPE and Revaluations

Property, Plant and Equipment are tangible assets held by the organization for administrative purpose, delivery of services, or production of goods. These assets are non-current; they are used for more than one accounting period. Buildings, motor vehicles, furniture, and plant and machinery are examples of PPE.

The model for initial recognition of PPE is at cost. This is the only allowable model as per IAS 16. After initial recognition, there are two allowable models for measurement of PPE. These are:

- Cost model

- Revaluation model

Revaluation model

In this model, PPE is carried at a re-valued amount if the fair value can be measured reliably after the initial recognition. The re-valued amount is the fair value of the PPE at the time of evaluation less the subsequent accumulated depreciation and impairment losses. Revaluation has to be made with satisfactory regularity to make sure that carrying value is not different materially from the value that may be determined at the end of the reporting period using fair value.

Changes in the fair value of the asset of PPE determine the frequency of revaluation. Further revaluation may be necessary if the re-valued asset differs materially from the carrying value. If the fair value of a PPE experiences volatile changes then it is essential to revalue at an annual basis. If its fair value does not experience significant and volatile changes; the revaluation may be done after every three to five years. When revaluing an asset of PPE, the commonly used method is whereby the accumulated depreciation is reduced against the gross carrying value. The net amount is then restated to the re-valued amount of the item of PPE (Douglas, Kieso, Paul, Kimmel, & Donald, 2012, p. 59).

Finance or Operation Lease

Included in Administrative expenses are $ 2,360,000 of lease costs for a machine that will speed up production to enable the company to fulfil the largest contract the company has ever won. This machine will start operating in March Year 6. Since the first three months of the lease has been paid starting from September year 5, then the lease expense of $ 2,360,000 will be included in the year 5 accounts. Since the delivery of the new order will start on June year 6, the organization is not liable to paying the lease until the delivery has been satisfactorily completed. The terms of the lease are 60 equal monthly instalments. Thus, the first instalment will be paid on June year 6.Therefore, this administrative expense should not be include in the accounts of year 4 and year 5.

Intangible Non Current Assets

Administrative expenditures are considered as part of operating expenses. Administrative expenditures are not directly connected with a specific function in the business such as sales or manufacturing. They include the administration of the business. Examples of administrative expenditures include the depreciation expense for space and equipment, utilities, accounting, and salaries (Robert, L, Patricia, L, & Daniel, G 2008, p. 97).

The research and development costs in Year 5 were $12,880,000. The research costs for the previous 5 years totalled $27.2 million and were included in administration expenditure in prior years. This was not correct since Administrative Expenditures are supposed to be considered as operating cost. Research and development cost should considered this as good will. This is because; although this cost is quantifiable it is not tangible. In the balance sheet, ‘good will’ reflects as an intangible asset. The research and development cost should be considered as the cost used to develop a strong brand name for the new product (Carole, Kang, & Petzke, 2008, p. 187).

Since research has resulted in a viable product with a definite market, the ‘Good will’ is calculated as follows:

- Research and development costs in Year 5 plus

- The research costs for the previous 5 years

- $ 12,880,000 + $ 27,200,000 = $ 40,080,000

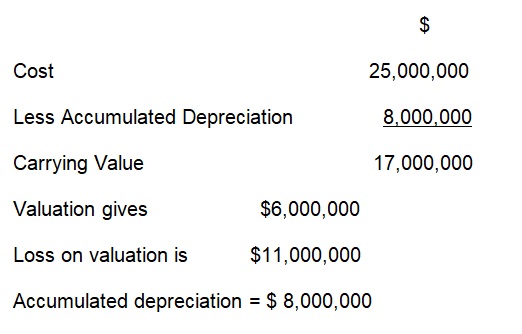

- Plant and equipment cost $25,000,000.

- (Re-valued Amount – Residual Value) / (Remaining Useful Life) = (25,000,000 – 5,000,000) / 10 = $ 2,000,000 depreciation per year

For the 4 years, the asset has depreciated by $ 2,000,000 per year. Therefore, the accumulated depreciation is $ 2,000,000 * 4 = $8,000,000. According to IAS 16, this accumulated depreciation is netted against the cost as follows;

Revaluation and recalculation of the depreciation charge for the Y5 is as follows:

(Re-valued Amount – Residual Value) / (Remaining Useful Life) = ($6,000,000 – $1,000,000)/ 5 = $1,000,000 depreciation per year.

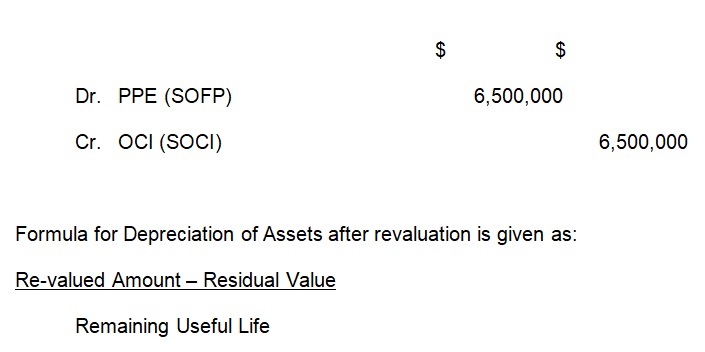

This carrying value of $12,500,000 is compared against the re-valued amount of $6,000,000 and revaluation of $6,500,000 needs to be accounted for.

If the carrying amount increases as a result of a revaluation, the increase must be noted in the OCI (Other Comprehensive Income) section in the SOCI (Statement of Comprehensive Income). This increase must also be included in the Equity section of the SOFP (Statement of Financial Position). Under the SOFP, it is recognized under the heading of a revaluation surplus (Albrecht, Earl, James, Stice, & Monte. 2010, p. 89).

- Dr. PPE – Non-Current Assets (SOFP) X

- Cr. OCI (SOCI)

In this case, the organization has re-valued the plant and equipment from $6,000,000 to $12,500,000

Therefore, the ledger entry is:

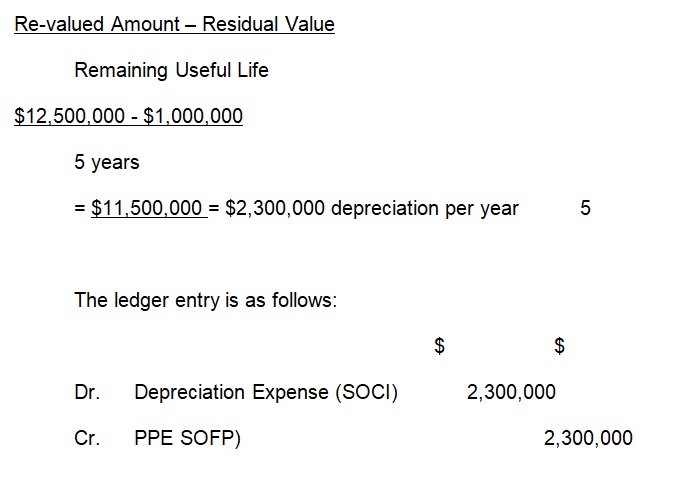

The re-valued amount is $12,500,000 the residual value is $1,000,000.

The remaining useful life is 5 years. This shows that the original useful life does not change as a result of revaluation. Thus, the remaining useful life for the plant and equipment is 5 years.

(10 years of original useful life – 5 years of the plant and equipment being depreciated).

Using the formula stated above one can calculate the depreciation of the re-valued building as follows:

Insurance 9,300,000/12months = 775,000

Admini expenses = 12,000,000

Purchases = 3,600,000

Sales Commission $15,000

Revaluation = $6,000,000

Good Will = 12,880,000 + 27,200,000 = $40,080,000

Financial Ratio Analysis

This is a popular way to analyze financial statements. The financial statement for year 4 and year 5 were analyzed using the financial ratios. After obtaining the financial statement for year 4, the appropriate financial statement adjustments were made. A financial statement for year 5 was obtained. Due to the adjustments made, there are a number of differences between the financial statement of year 4 and year 5. Therefore, it is necessary to compare the performance of year 4 and year 5.

Limitations of Ratio Analysis

In the analysis of the organization between year 4 and year 5, it is evident that the organization is growing; however, the organization has not started making enough profit to start paying dividends. There is no theory that defines the right ratios for this organization. The board members should consider what is in their best interest when making the decision as to which method they will use when they start paying dividend. The decision will also be influence by the current situation of the organization (Label 2010, p. 34).

The board members need to consider whether the shareholders are impatient as they wait to receive dividends. If the shareholders are impatient and want to earn income from their investment, the board members will have to start paying dividends. The best method to use is the hybrid method. The hybrid method will ensure that the shareholders are getting some cash even if the company has not started making profit. As the profits increase, the dividend payout will increase accordingly.

Reference List

Albrecht, W, Earl, K, James, S, Stice, D, & Monte, R. 2010, Accounting: Concepts and Application, Cengage Learning, Belmon.

Carole, A, Kang, H, & Petzke, S. 2008, Accounting: Building Business Skills, John Wiley & Sons, Australia.

Clyde, P, Roman, L, Katherine, S, & Jennifer, F. 2009, Financial Accounting: An Introduction to Concepts, Methods, and Use, South-Western College, Los Angeles.

Douglas, W, Kieso, J, Paul, D, Kimmel, & Donald, E. 2012, Financial Accounting. John Wiley & Sons, 350 Main Street Malden MA.

Gelinas, J, Dull, B, & Wheeler. R 2011, Accounting Information Systems, Cengage Learning, Belmont.

Label, W 2010, Accounting for Non-Accountants: The Fast and Easy Way to Learn the Basics, Sourcebooks, Inc, Chicago.

Marshall , D, William, W, McManus, W, & Daniel, V. 2010, Accounting: What the Numbers Mean, McGraw-Hill Irwin, Boston.

Robert, L, Patricia, L, & Daniel, G. 2008, Financial accounting. McGraw-Hill Irwin, Boston.

Steven, M 2010, Accounting Best Practices, John Wiley & Sons, 350 Main Street Malden MA.