Introduction

The collapse of the US-based bank, Lehman Brothers, in 2008 led to a substantial ripple effect on the global financial markets because of the high level of financial contagion. One of the notable impacts entails a decline in the level of liquidity within the financial institutions. The risk premium applicable to interbank borrowing increased to over 5% while the risk premium applicable to corporate bonds increased to over 6%. The financial crisis led to a collapse of different economic activities such as manufacturing and trade. Governments implemented different fiscal and monetary policies such as the implementation of the economic stimulus package in the quest to restore their country’s economic performance (McKibbin and Stoeckel 1).

The occurrence of economic events such as the global financial crisis affects the attractiveness of a country to local and foreign investors. Additionally, financial crisis negatively affects an organization’s future sustainability. McKibbin and Stoeckel argue that a country that was attractive before the occurrence of the crisis might become unattractive in the future (3). The impact of the financial crisis varies across countries. Thus, the economic fallout arising from the global financial crisis varied substantially. The effects on some countries were considerably high while others were relatively resilient.

The Gulf Cooperative Council [GCC] countries were characterized by a strong performance during the period ranging between 2003 and 2008 because of the oil boom. Thus, the countries were characterized by abundant liquidity and high investor confidence. However, the GCC economies were affected by the financial crisis due to decline in oil demand and prices. Therefore, the liquidity and investor confidence were negatively affected. These aspects might influence the firms’ future performance.

The purpose of this paper is to evaluate the impact of the 2008 financial crisis on the UAE market. This goal is achieved by assessing the application of the concepts of financial analysis and forecasting, stocks (equity), bonds (debt), the cost of capital and budgeting decisions. The paper focuses the application of these concepts through the comparison of the Dubai Islamic Bank and the Emirates Islamic Banks.

Brief company profile

Dubai Islamic Bank

Since its establishment in 1975, the Dubai Islamic Bank [DIB] has been in operation in the United Arabs Emirates [UAE] for over three decades. The firm operates in the UAE financial services industry and specializes in the provision of banking and insurance services. The bank operates on the basis Islamic banking principles and ranks amongst the biggest Islamic banks in the United Arabs Emirates. The bank is listed in the Dubai Financial Market [DFM] and currently it owns 62 branches in the UAE. Moreover, the bank has extended its operations into the Pakistan financial market by establishing a network of 75 branches.

Emirates Islamic Bank [EIB]

The EIB was established in 1975 in Dubai, UAE. Similar to the DIB, the Emirates Islamic Bank operates on the principles of Islamic finance [Sharia’ principles], and it was established in 2004 in Dubai. The EIB also ranks amongst the largest banks in the United Arabs Emirates. The bank offers individual and institutional customers a wide range of financial products. The bank is of the view that the Islamic banking principles are essential in reducing uncertainty and providing consumers with the best financial solutions (“Emirates Islamic Bank” 3).

Analysis

The performance of a country’s financial institutions can be used in assessing the attractiveness of a particular market. The performance of large banks is highly reliable in assessing the health of a particular economy. The relevance of the large banks to a country’s market arises from the fact that they are extensively involved diverse market-based activities. McKibbin and Stoeckel affirm that large banks are riskier as compared to small banks (4). Moreover, the banks create highly systematic risk to a country’s risk due to their extensive involvement in market-based activities. Therefore, the failure of the large banks may lead to substantial disruptive effects on a country’s markets. For example, the failure of large banks may culminate in liquidity stress within an economy.

The occurrence of the financial crisis disrupts a country’s economic activities such slowdown in the level of investments and consumption. Subsequently, it is essential for banks management team to assess their financial performance prior and during the financial crisis using different financial concepts.

Financial analysis and forecasting

Financial forecasting is an essential aspect in organizations’ operation. Through financial forecasting, a firm can project and prepare for future occurrences. Conversely, financial analysis involves the process through which an organization’s management team evaluates its performance based on different financial numbers. Therefore, financial analysis and forecasting provide an organization’s leaders with insight on its capacity of achieving the predetermined goals and priorities. One of the techniques commonly applied in undertaking financial analysis entails the ratio analysis. The main categories of financial ratio include the profitability, liquidity, solvency, and efficiency ratios.

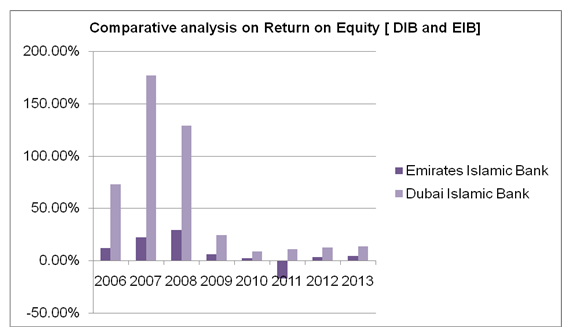

One of the profitability ratios entails the return on equity that assesses an organization’s capacity to utilize the shareholders equity in generating profits. Moreover, the return on equity is used in examining the shareholders’ earnings from their investments. A high return on equity ratio indicates a high degree of effectiveness in utilizing the equity base or the shareholders capital. Thus, investors can rely on the return on equity in making investment decisions. The chart below illustrates a comparison of the return on equity between Dubai Islamic Bank and Emirates Islamic Banks.

Table 1. Source:(“Abu Dhabi Securities Exchange” par. 1).

Table 1 and Graph 1 shows that the Dubai Islamic Bank is characterized by a relatively high rate of return on equity compared to the Emirates Islamic Bank before and after the occurrence of the global financial crisis. However, the rate of return on equity in the two banks was significantly affected from 2007 as illustrated by the graph. In 2011, the rate of ROE at EIB declined to -17%, which indicates the existence of inefficiency in the bank’s capacity to manage its equity. Based on the return on equity values, the Dubai Islamic Bank is more attractive to invest in due to the probable high return on equity capital.

Berger and Bouwman emphasize that the “return on equity is a comprehensive profitability measure since banks may have substantial off-balance sheet portfolio” (7). Furthermore, the analysis shows that the Emirates Islamic Bank experienced a negative rate of return on equity in 2011. This aspect indicates a considerable reduction in the bank’s capacity to survive the effects of a financial crisis.

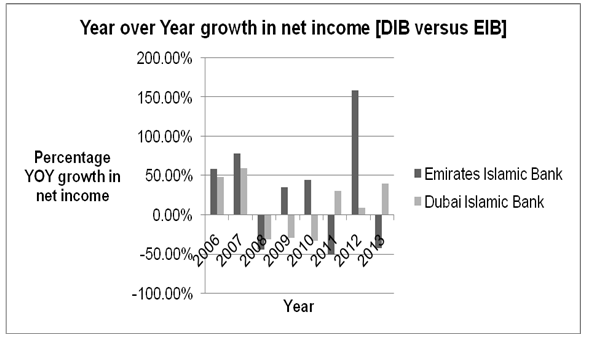

The performance of the two financial institutions during the period under consideration can be evaluated by examining the performance of their net income. One of the approaches in assessing a firm’s financial performance entails the trend in the banks year over year performance. The Dubai Islamic Banks and the Emirates Islamic Banks were characterized by varying degree of the year-over-year growth with reference to their net income.

Table 2. Source:( “Abu Dhabi Securities Exchange” par. 1).

According to graph 2 and table 2, the Dubai Islamic Bank underwent a remarkable decline in its year over year growth with reference to income between 2007 and 2010. Despite the decline in the year-over-year growth in 2008, the Emirates Islamic Bank has been able to maintain a strong year over year growth between 2008 and 2009. However, the Emirates Islamic Bank has not been able to maintain a stable year over year growth.

Despite the effects of financial crisis on the banks net income, the Dubai Islamic Bank was able to restore its year over year growth as illustrates by the positive trend between 2011 and 2013. However, in 2012, the rate of growth was below the recommended double digits. Investors are mainly attracted to companies characterized by double-digit growth in net income.

The evaluation of the rate of return on equity and the year over year growth on a bank’s net income can provide critical intelligence regarding a banks off and on-balance sheet activities. Thus, the probability of investors making feasible investment decisions based on these two measures is considerably high.

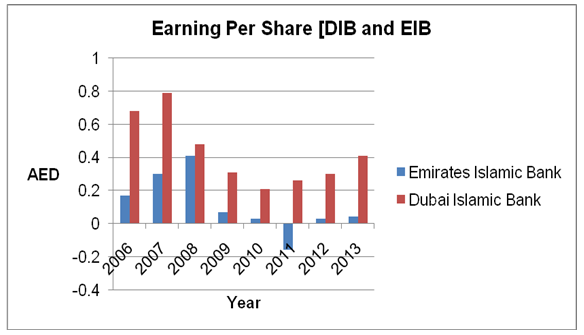

The financial performance of a company can further be assessed by examining the earning per share [EPS], which illustrates an organization’s actual growth (Chakrabarti and Chitrakalpa 52). The trend in earning per share is an essential source of intelligence on investment. The EPS provides valuable information on the likely future performance of an organization’s share price. Thukaram asserts that two “companies can generate the same EPS number, but one could do so with less equity or investment” (3). Such an outcome indicates that the firm with a relatively low level of equity is more efficient in utilizing capital to generate income.

Table 3. Source:( “Abu Dhabi Securities Exchange” par. 1).

According to table 3 and graph 3 above, the Dubai Islamic Bank has relatively higher earnings per share value compared to the Emirates Islamic Bank. The graph further shows that the two banks experience a significant reduction in the EPS values between 2008 and 2011 due to the global financial crisis. However, the DIB was relatively resilient as compared to the EIB. Between 2012 and 2013, the EPS values in the two banks improved substantially as illustrated by graph 2. The gradual recovery of the banks earning per share indicates that the UAE market is likely to achieve future growth. This aspect further indicates a considerably high degree of market attractiveness.

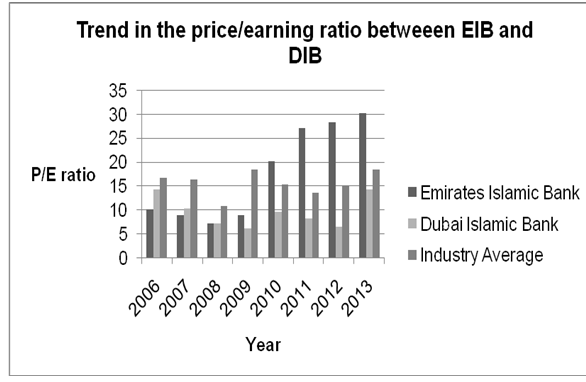

The banks performance can further be used to indicate the prevailing market situation in the UAE by examining the trend in the banks price/earnings ratio [P/E]. The ratio is calculated by dividing a company’s stock price and its respective earning per share. Therefore, the price/earnings ratio indicates the performance of a firm’s stocks. Ketz accentuates that a “high P/E often reflects the market’s perception of the firm’s growth prospects” (34). Consequently, if investors perceive the future P/E ratio to be characterized by a high potential for growth, they may offer a higher price hence boosting the price/earnings ratio. The table below illustrates the trend in the price/earnings ratio between the Dubai Islamic Bank and the Emirates Islamic Bank in comparison with the industry average.

Table 4.

Graph 4 shows a steady reduction in the value of price/earnings ratio between 2006 and 2008. However, the two banks have experienced a steady improvement in the price/earnings ratios. By comparing the value of the two banks EPS and P/E ratios in 2013, one can argue that investors are willing to willing to purchase EIB shares 30 times more as compared to that of DIB, which stands at 14 times.

Stocks (equity)

Organizations have different options from which they can source money to finance their business activities. However, the two main categories of sources of finance include debt and equity finance. The decision on the source of finance is influenced by different factors such as the cost of finance. The equity sources mainly entail issuance of common stocks or preferred shares. Ketz asserts that common equity sources of financing provide organizations with an opportunity to access long-term capital from the shareholders (34). Subsequently, an organization can be able to finance long-term investment projects at a relatively low cost. Conversely, preferred stocks are mainly issued when a firm encounters financial difficulties. Unlike common equity, an organization has the right to call back the preferred stocks in the event of developing a strong capital position. Alternatively, debt financing may entail short-term or long-term borrowing from individuals or financial institutions. The debt financing may either be in the form of bonds.

In the process of making investment decisions, the investors are concerned about the investment risk associated with a particular investment vehicle. Their concern emanates from the fact that the level of investment risk influences the expected returns (Ketz 34). One of the techniques that investors can use in evaluating the investment risk entails the financial advantage. The level of financial advantage provides insight on the effect of relying on debt on its financial structure. Increasing the debt increases an organization’s level of financial advantage hence diminishing the probability of attaining expected returns. The degree of financial advantage influences a firm’s stock prices. Therefore, a firm’s stock returns are directly correlated with the corporate risk.

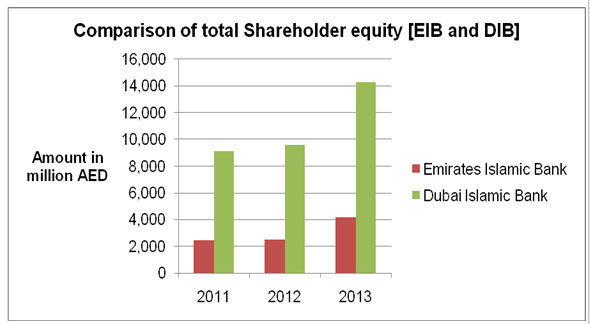

The occurrence of financial crisis affects an organization’s capital structure. One of the effects relates to the reduction in the nature of capital structure such as the retained earnings. Subsequently, the total shareholder equity is adversely affected. Regulators in the financial markets are increasingly formulating policies advocating for utilization of equity funding and reduction in debt finance. Graph 5 and table 5 indicate that the Emirates Islamic Bank and the Dubai Islamic Bank have managed to maintain a positive value of the total shareholder equity. One of the factors that contributed to the improvement in the size of the total shareholder equity entails an increase in the retained earnings. Therefore, one can assert that the UAE market is experiencing improvement in the business environment. Additionally, the growth in the size of total shareholder equity indicates an increase in the investor confidence on the recovery of the UAE market from the effects of the financial crisis.

Table 5.

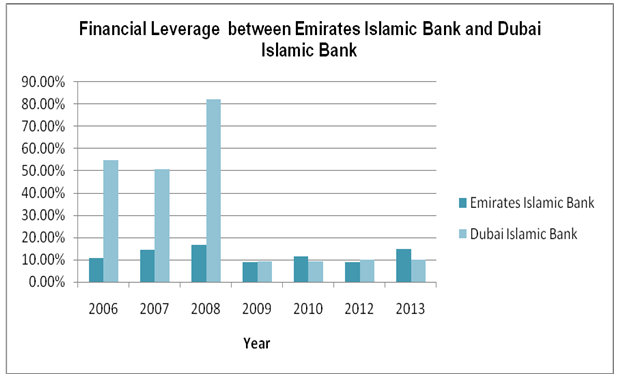

The banks effectiveness in managing their capital structure during the financial crisis as indicated by the growth in the size of shareholder equity is further supported by the fact that the banks experienced a significant reduction in the level of their financial leverage as depicted by table 6 and graph 6. Between 2006 and 2008, the banks level of financial leverage was considerably high. This aspect indicates that the banks were relying on debt sources of finance to support their operations due to the general decline in the level of liquidity within the country. However, the two banks have managed to maintain their level of financial leverage at a considerably low level.

Table 6.

Bonds, budgeting decisions and cost of capital

Despite the banks capacity to manage their operations by relying on equity, the two banks are appreciating the role of bonds in boosting their capital structure. Bonds involve a long-term source of debt finance hence improving an organization’s capacity to improve their operational efficiency. According to Kabir and Mervyn, banks have diversified their sources of finance by including bonds (53). To boost its tier 1 capital, the Dubai Islamic Bank issued a $1 billion bond in 2013. The bonds are in accordance with the Islamic finance principles and they are commonly referred to sukuk. The bond is expected to be repaid in 6 years and will generate a 6.25% profit for the investors. Similarly, the Emirates Islamic Bank issued a $500 million sukuk bond in 2012. The bond was intended to facilitate the bank’s expansion plans. The Emirates Islamic Bank further sold 5-year $ 500 million benchmark-sized Islamic bond. The bond is expected to generate a 4.72% profit for the investors (“Gulf News” par. 3).

The issuance of the corporate bond (sukuk) by the two banks indicates the emergence of a trend whereby banks in the UAE are sourcing long term capital from the local market. In order to improve the attractiveness of the bonds as a source of debt finance, the Emirates Islamic Bank and Dubai Islamic Bank have offered the creditors attractive rate of return. The banks recognize the fact that the interest paid on debt is a critical aspect of cost. The cost of capital applicable to the bonds issued by Dubai Islamic Bank and the Emirates Islamic Bank are 6.25% and 4.72% respectively. Glen and Pinto further affirm that as “the cost of capital moves, the attractiveness of debt relative to equity and internal funds changes” (7). The cost of capital applicable on debt influences the volume of debt issued. Therefore, the two banks can successfully manage the cost of capital depending on the amount of debt capital required. Based on the cost of capital amongst the banks, the investors will generate substantial returns from the purchase of the bonds. This aspect shows that the UAE market is undergoing considerable improvement from the financial crisis. Therefore, the future prospects in the UAE market are relatively strong.

Furthermore, financial innovation amongst the banks as evidenced by the development of corporate bonds has changed the banks budgeting activities, specifically with reference to capital budgeting. Khan and Jain affirm that capital budgeting “relates to the selection of an asset or investment proposal or course of action whose benefits are likely to be available in the future over the lifetime of the project” (8). Through the issuance of the corporate bonds, the banks have been able to improve their investment in long-term development projects. Through the issuance of the corporate bonds, the banks expect to improve their liquidity substantially.

Conclusion

Effective financial management is vital in the operation of organizations. The relevance of financial management arises from the fact firms are established with the objective of surviving into the future. However, occurrences in the macro business environment might diminish the chances of achieving this goal. One of the notable changes entails the occurrence of negative economic events such as a financial crisis or recession. Such events impact the attractiveness of a country to domestic and international investors. Therefore, it is imperative for investors to develop sufficient understanding the impact of financial crisis on the economy. Assessing the health of the economy can be attained by analayzing the performance of economic sectors. The banking industry is one of the most reliable sources of the impact of financial crisis on the economy.

This report entails a review of the impact of the 2008 financial crisis on the UAE market. The report’s objective is achieved by assessing the performance of the Dubai Islamic Bank and the Emirates Islamic Bank with reference to the application of different financial management concepts. The concepts examined include financial analysis and forecasting, stocks (equity) and bonds, cost of capital and budgeting decision. The comparative analysis of these concepts indicate that the banks were affected by the financial crisis. For example, the financial analysis shows that the banks performance with reference to return on equity, growth in net income and earnings per share declined during the financial crisis. Moreover, the financial crisis affected the banks liquidity and hence their financial stability. However, the banks experienced remarkable performance between 2009 and 2012.

This aspect is illustrated by the improvement in the shareholders equity. To overcome the financial challenge, the banks resulted in debt financing through the issuance of bonds. These concepts have improved the banks’ capacity to finance capital projects such as expansion. To improve the attractiveness of their debt instruments, the banks have applied the attractive cost of capital, which serves as the rate of return for investors. In summary, the comparative analysis of the performance of the two banks indicates that the UAE is undergoing remarkable recovery from the financial crisis. Thus, the markets’ future prospects are substantially high.

Works Cited

Abu Dhabi Securities Exchange: Listed Companies Disclosure 2016. Web.

Berger, Allen, and Christa Bouwman. Bank Capital, Survival, and Performance Around Financial Crisis, South Carolina: Tilburg University, 2009. Print.

Chakrabarti, Gagari, and Sen Chitrakalpa. Green Investing; The Case Of India, New Delhi: Springer, 2015. Print.

Emirates Islamic Bank: Consolidated Financial Statements 2011. Web.

Glen, Jack, and Brian Pinto. Debt Or Equity? How Firms In Developing Countries Choose, New York: World Bank Publication, 2009. Print.

Gulf News: Dubai Islamic Bank Issues $ 1 Billion Bonds; Sukuk Launched At 6.25% Profit Rate. 2013. Web.

Kabir, Hassan, and Lewis Mervyn. Handbook Of Islamic Banking. Cheltenham, UK: Edward Elgar, 2007. Print.

Ketz, Edward. Hidden Financial Risk, New Jersey: John Wiley and Sons, 2006. Print.

Khan, Michael, and Phillis Jain. Financial Management, New Delhi: Tata McGraw-Hill, 2007. Print.

Moody’s Investor Service: Dubai Islamic Bank PJSC. 2012. Web.

McKibbin, Warwick, and Andrew Stoeckel. Global Financial Crisis; Causes And Consequences, New York: Lowy Institute, 2009. Print.

Thukaram, Rao. Management Accounting, New Delhi: New Age, 2009. Print.