Executive Summary

The primary focus of this paper was to conduct a detailed industry and company analysis with the view of developing the most appropriate business strategy that First Gulf Bank can use to achieve success in the market where it operates. The review of the literatures and analysis of primary data shows that it will need a business strategy that will promote creativity and innovativeness when it comes to offering value to the customers. It will also need to embrace an open-door policy to promote interaction between the top managers and junior employees.

Abstract

Developing an effective business strategy requires an understanding of both the internal and external environment of a firm. In this study, the researcher looks at how First Gulf Bank can come up with effective business strategies to enable it manage the stiff market competition. Based on review of literatures and analysis of primary data, the report proposes a number of recommendations that the management of this company should consider.

Introduction

Background

Developing an effective business strategy is one of the most important leadership tasks that the top management has to fulfill in order to make their organizations successful. The strategy helps in creating a vision for a firm that defines its operation activities. First Gulf Bank is one of the leading financial institutions in GCC and MENA regions. Founded in 1979 in Abu Dhabi, United Arab Emirates (UAE), this firm has experienced tremendous growth and has expanded its operations beyond the borders of this country. Its management has been keen to ensure that it achieves success not only in the home market but also the foreign markets within the MENA region.

Although the headquarters of this firm is in Abu Dhabi, markets such as Qatar, Libya, India, South Korea, Hong Kong, and United Kingdom are also very critical for its success. Given that this company operates in the global market where competition is very stiff, having effective business strategies is very critical. The management of this company has been keen on ensuring that its market share is protected. This firm currently has about 2000 employees spread across MENA region, Asia, and Europe (Ignatiuk, 2008). Recent financial results given by the company show that it is making positive progress in the market. It is also one of the preferred employers in the region among the college graduates because of its friendly policies to the employees. In this paper, the researcher seeks to conduct a detailed industry and company analysis with the view of coming up with the most appropriate business strategy that First Gulf Bank can use to achieve success in the market where it operates.

Objectives of the study

When conducting a research project, it is important to come up with clear research objectives that will define the path to be taken when collecting and analyzing data. The following is the main objective of this study.

To come up with the most appropriate business strategy that First Gulf Bank can use to achieve success in the market.

Subsidiary objectives

Based on the above primary objective of this study, the research seeks to achieve the following subsidiary objectives.

- To determine the level of market competitiveness in the industry where First Gulf Bank operates

- To determine the current position of First Gulf Bank in the market.

- To identify the ways in which this bank can achieve competitive advantage in its current market.

Research questions

Research questions are critical because they help a researcher to determine the kind of data to be collected from the field and from the existing literatures. Based on the above research objectives, the following are the research questions that the study seeks to answer.

- What is the level of market competitiveness in the industry where First Gulf Bank operates?

- What is the current position of First Gulf Bank in the current market?

- How can this bank achieve competitive advantage in its current market?

Problem statement

The banking and finance industry has increasingly become competitive, and it forces players to come up with effective strategic plans to cope with such stiff competition. Globalization has made it easy for foreign firms to expand their operations to the local markets. First Gulf Bank finds itself in a stiff competition for its market share. Clients in the market have become very demanding. They know that whenever they have banking needs, they have a number of options to choose from in the market. They are very keen on determining the unique value that every financial institution has to offer. First Gulf Bank knows that its products must always appear attractive to its clients in order to retain them in the long-term. According to Eigenhuis and Dijk (2007), the emerging technologies and the stiff market competition has seen financial institutions coming up with very unique products as a way of gaining a competitive edge over other market rivals.

Significance of the study

This study is very important for First Gulf Bank that is currently operating in a highly competitive business environment. According to Moseley (2009), MENA region has experienced a massive growth of the finance and banking sector. New firms are coming up and large multinational corporations (MNC) are also finding their way into this single market. As such, First Gulf Bank needs a strategy that will make it more competitive in the market. It needs a strategy that will not only protect its current market share but also enable it to acquire new markets locally and at global level. This study is important because it offers insights on how this firm can develop actionable strategic business objectives.

Literature Review

When conducting a research, Kourdi (2015) advises that it is important to come up with new knowledge that will help improve the existing literatures. Duplicating an already existing body of knowledge adds no value to the existing studies. A research project should be able to address the existing gaps in a research or address controversies in a given body of knowledge. As such, conducting a literature review is a critical component of a research study. It enables a researcher to know what other scholars have found out and to determine the areas that they propose further research is necessary. It also forms the basis of knowledge for the new research. In this project, the researcher focused on gathering knowledge about business strategy and strategic management as per the findings of other scholars who have published sources on this topic.

According to Mun (2010), developing an effective business strategy is very challenging. This is specifically so in the modern highly dynamic business environment. The emerging technologies keep on creating new challenges and opportunities that firms have to deal with to achieve success. When developing a strategic goal or a vision, there are some factors that the management may fail to put into consideration primarily because some environmental factors never existed at that time of its development. For instance, mobile banking is a relatively new concept that many banks are currently embracing because it has a great potential (Kourdi, 2015). It is possible that a financial institution that was developing its vision six years ago did not put such new potentials into consideration because it had not been created as a major product in the financial sector. However, many financial institutions have realized that they can no longer ignore the relevance of this new product. Many banks are now developing mobile banking products to meet the new need in the market.

Leadership

People trusted with top leadership within a firm play a significant role in determining the business strategies that a firm will use in its operations. These top managers are responsible for the development of strategic goals within a firm (Espinoza, Fayad, & Prasad, 2013). Having high academic qualifications or ambition to achieve success is not enough. It is also necessary for one to embrace an appropriate model of leadership. The model must allow close interaction between the top management unit and junior employees within a firm. The changing environmental forces require a close communication between the top management and the junior employees.

In case there is a need for change, communication can easily flow within the firm and necessary adjustments can be made within the required time (Espinoza et al., 2013). Such an enabling working environment can only be created by those in the top management positions. Transformational leadership model is one of the strategies that have been considered very appropriate in the current business environment (Mun, 2010). Having the ability to challenge the current capacities of employees and to convince them that they can deliver better results is very critical. In this model, a leader assigns some sense of responsibility on the employees instead of closely monitoring their work.

Theoretical framework

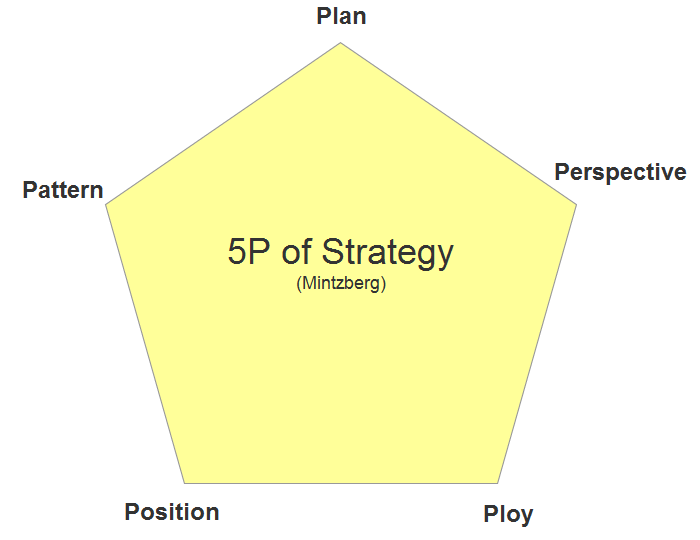

Scholars have come up with a number of theories to determine how firms can come up with appropriate strategies that can help them achieve success in the market. Looking at some of these theoretical models may be important in enabling a firm to come up with ways of remaining competitive through development of dynamic business models. According to Kourdi (2015), a number of theoretical models have been developed to help firms come up with strategic plans. In this paper, the researcher will look at one of these models which are very appropriate for a firm such as First Gulf Bank that operates in a highly competitive business environment. The study will focus on Mintzberg’s 5 Ps of Strategy shown in the figure below.

This model proposes five different approaches to a strategy that fully takes advantage of a company’s capabilities and strengths to help develop a robust business model (Hanieh, 2016). This model emphasizes on the need to look at the strategy as a plan. The management must come up with an appropriate plan when developing a strategy. The plan should define what should be done and how it should be done based on the available resources and time.

The process should involve all the stakeholders irrespective of their positions within the firm because it involves brainstorming and discussing the idea that looks most appropriate compared to other strategies. Mintzberg also proposes the need to look at a strategy as a ploy to get the best of the competitors. Sometimes a firm may come up with a plot specifically meant to disrupt the competitors or to discourage them from getting into a given market. This strategy is specifically appropriate when a firm is trying to defend its local markets’ share against foreign firms planning to gain entry into the local market. Giving an image that the local market is flooded and highly competitive may be the best strategy of discouraging these foreign firms from entering the local market.

In this model, strategy can also be looked at as a pattern. As Kourdi (2015) says, every firm has a given organizational behavior that defines how it approaches various tasks. Organizational culture defines how a firm addresses various tasks and environmental forces. The approach used within such a firm turns out to be a pattern. As such, the strategy of such a firm has to follow a pattern based on the firm’s past way of doing things. The approach can only be embraced if it is confirmed that the pattern has been successful in the past. Strategy as a position is the other angle that this model proposes.

A firm should decide how it wishes to position itself in the market (Bricault, 2012). The approach that a firm takes in positioning itself will define the kind of customers it attracts. In this case, the firm identifies an appropriate market segment and positions itself in a way that the market will find attractive. Finally, the model looks at strategy as a perspective (Espinoza et al., 2013). The choices that a company makes shape its perspective and what it is capable of doing well. For instance, if an organization embraces risk taking, then employees are likely to be innovative. On the other hand, a firm that is keen on eliminating risks is less likely to be creative because of the constant fear of making losses.

Banking industry in UAE

According to a report by Kourdi (2015), the United Arab Emirates has the most robust banking sector in the entire of MENA region in terms of the number of fully instituted banks which are in the country. The growing relevance of Dubai as an international business hub and the massive development of infrastructure in the country are some of the factors that have led to massive growth of the industry. As the industry grows, the level of competition also gets higher as firms struggle to control the market. First Gulf Bank is one of the leading financial institutions in the country. Other top firms within the United Arab Emirates include National Bank of Abu Dhabi, Abu Dhabi Commercial Bank, Al Hilal Bank, Dubai Islamic Bank, Sharja Islamic Bank, Commercial Bank of Dubai, United Arab Bank, and Invest Bank among others (Hanieh, 2016). The industry has also attracted foreign multinational corporations from Europe and North America because of liberalized trade policies. The industry is very competitive, and firms are keen on identifying and taking full advantage of every little opportunity they have to protect their market share.

First Gulf Bank

First Gulf Bank was founded in 1979 as a financial institution with its headquarters in Abu Dhabi, United Arab Emirates (Hanieh, 2016). The firm achieved massive growth in the 1990s and early 2000s as the government started spending heavily in the service industry to reduce the country’s reliance on the oil sector. In this period, this firm was able to expand its operations to the entire country as the demand for financial services grew (Bricault, 2012). The company currently has over 2000 employees and has spread its operations to the entire MENA region. It also has branches in Europe and East Asia.

Methodology

When conducting a research, it is important to come up with an appropriate method of data collection and analysis. In this project, the researcher used both the primary and secondary sources of data. Secondary data was collected from books, journals, company’s website, and other reliable sources. The information obtained from these sources is available in the literature review section above. Primary data was collected from a sample of respondents who participated in this study.

Research method and design

Kourdi (2015) says that when choosing research design, emphasis should be laid on the objective of the study. The selected design should be one that is capable of achieving the set objective. In this project, the primary objective was to come up with the most appropriate business strategy that First Gulf Bank can use to achieve success in the market. To achieve this objective, the researcher will need both qualitative and quantitative research designs. Qualitative methods will help in explaining why a given model is appropriate by providing descriptive statistics. On the other hand, quantitative method will help in giving the magnitude of the importance of various models to help in justifying, through mathematical methods, why a given strategy was chosen over others. This way, there will be a comprehensive analysis of why the study will recommend one method and not the others.

Data collection and data analysis

Primary data was collected from the sampled respondents. The method of selecting the respondents from the entire population has been discussed in the section below. After sampling, the selected participants were briefed about the project and informed about the day of the interview. They were informed that the research will use face-to-face interview to collect data from them. On the day of collecting data, the respondents were contacted over the phone to remind them of the study. The interview was conducted within the premises of this company. Questionnaires were used to collect the desired data. Analysis of the data was conducted both qualitatively and quantitatively.

Sample and sampling strategy

The researcher selected a sample of participants from the population of employees of First Gulf Bank in its branch in Dubai. To achieve the set objectives, the researcher decided to collect data from the employees in both management and non-management positions. The average age of the participants was 35 years. Both male and female employees of the firm were included in the sample. In total, ten participants took part in the data collection process. The researcher used simple random sampling method to select the participants in the two groups stated above.

The rational of the strategic analysis

The researcher used mixed method of analysis because of the research objective in this study. To achieve the set objective, it was not only necessary to provide explanations, but also statistical proof of why a given method was considered superior as opposed to others. The chosen method of analysis was also considered appropriate because of the delicate nature of the industry and the level of competitiveness.

Ethical considerations

According to Bricault (2012), ethical considerations are important when conducting a research. One of the most important factors that a researcher must do before collecting data from an institution is to seek for the relevant approvals. The researcher sought for the management’s approval before selecting a sample to take part in the study. Those who participated in the study were duly informed and assured that their identity will be protected from third parties.

Analysis of Findings

Data collected from the respondents was analyzed using both quantitative and qualitative methods. In this section, the researcher will present the findings of the analysis of the primary data. In this section, the researcher will respond to the research questions based on the information gathered from the participants.

Banking industry in UAE

Banking industry in the United Arab Emirates is very competitive. The researcher collected data from the respondents to determine how First Gulf Bank compares with other banks. The figure below shows how the bank compares with others in terms of current market capital. This helps in answering the first question of this study.

What is the level of market competitiveness in the industry where First Gulf Bank operates?

As shown in the figure above, FGB tops other banks in terms of market capitalization. It is followed closely by top rivals such as Emirates Bank, NBAD, and ADCB. In terms of market share, FGB is outsmarted by its two archrivals as shown in the figure below. It will help in answering the following research question.

What is the current position of First Gulf Bank in the current market?

As the data in the figure above shows Emirates Bank has about 26% of the market share, followed by NBAB at 24%. FGB is a distant third at 15% of the market share in the country. It shows that a lot still needs to be done by this firm. In terms of growth in asset, FGB is performing fairly good compared to its archrivals as shown in the figure below.

As shown above, small financial institutions are growing at a faster rate compared to the larger financial institutions. UAB, NBF, and MASQ are some of the best performing banks in terms of asset growth rate. CBI AND CBD are also performing better than FGB which is ranked sixth among the banks with the fastest growth rate of assets.

Critical analysis of the current company’s strategy

As shown in the statistical analysis above, First Gulf Bank is one of the largest financial institutions in this country. However, it is facing stiff market competition and needs to come up with an appropriate strategy that will assure it of its survival in the market. As shown in the data above, this bank has focused on increasing market capital to surpass that of its top competitors in the market. One of the respondents stated that the top management has been keen on expanding the market share of this firm by seeking new markets in foreign countries within the region, in Europe, and East Asia. When asked the following question, the respondents gave the answers given below.

How can this bank achieve competitive advantage in its current market?

“The management should consider giving more emphasis on new products such as mobile and internet banking to reach out to new clients and to prevent a possibility of the existing clients going to other firms,” (TN 1). This respondent emphasized on the need to focus on new emerging products that meet clients’ needs in a special way. Another respondent had an idea closely related to the one above.

“FGB should be keen on embracing the emerging technologies and redefining its strategies regularly based on the changes they bring about. Currently, this firm is not quick in embracing the emerging technologies” (TN2).

Embracing the emerging technologies is another approach that this firm should consider, as stated by one of the respondents. There was another proposal given by a third participant that was in a way related to the response given by the first two participants.

“The management should be ready to identify change, willing to embrace it, and capable of promoting it effectively among the employees and other stakeholders without creating negative disruptions in the firm’s operations or resistance among the stakeholders” (TN 4).

This respondent provided a comprehensive approach of redefining the strategies of this firm and coming up with new ones which are dynamic and capable of achieving success in the challenging business environment.

Key assumptions

The researcher made a number of assumptions when collecting and analyzing primary data. One of the main assumptions made was that products offered by these financial institutions are almost the same hence issues such as branding, price reduction, and the manner of service delivery are some of the assumptions made. It was also assumed that the external environmental factors affect these firms almost in the same manner. The study also assumed that the foreign firms are capable of operating in the local market without facing either unfair treatment or favors over the local firms.

Discussion

Strategic management issues

The primary data collected from the respondents identified a number of issues that the management of this company will need to address. One of the major issues is the slow pace of embracing the emerging technologies. The firm is not quick enough when it comes to embracing new technologies. It was also noted that the structured communication system hinders creativity within the firm. It was blabbed for slowing change initiatives.

Organization’s strategic decisions

The management will need to come up with strategic decisions that will enable it overcome the issues raised. One of the strategic decisions that it will have to put into consideration is introduction of a new communication strategy. The firm needs to embrace an open-door policy where the junior employees can easily interact with the top managers. It will also have to be more dynamic and ready to embrace change.

Strategic advantages of the alternative

The strategic choices above have a number of advantages worth noting. The following are some of the main advantages of the alternatives above.

- It promotes creativity within the firm, especially when it comes to addressing new market challenges.

- It makes it easy to embrace change because the top managers and junior employees will have an excellent platform of sharing ideas.

Strategic disadvantages of the alternatives

The choices above may have disadvantages that the management will need to put into consideration when applying them. They include the following.

- It may be time consuming to consult everyone, especially on decisions that may appear controversial among the employees.

- Sometimes employees may take advantage of the freedom given to push personal agenda instead of focusing on a common good for all.

Recommended scenarios and Implementation

The firm will need to change its communication strategies and approach of managing change. This should be done in a way that makes every employee responsible for their individual actions. The management should inform all the stakeholders about the planned strategic change. It should also inform every one of the changes in their roles and responsibilities.

Conclusion and Recommendations

It is clear from the analysis above that developing an effective business strategy requires great leadership within this company. Employees are motivated to be ambitious and responsible whenever they are entrusted with any responsibility. With effective model of sharing knowledge, it is possible for employees to come up with innovative ways of addressing the challenges they face in their operations. The communication will also help the leaders to understand how the environment is changing and when it is appropriate to adjust strategic goals and strategies to be in line with the changing forces in the market. FGB is currently under pressure to be very innovative in its product delivery approach. The management must understand how to remain dynamic enough because of the changing forces in the market. The following are some of the recommendations that the management of this company should consider.

- The management should introduce an open-door policy in its organizational culture to improve interaction between the top managers and junior employees

- The management should be capable of detecting change early enough and convincing all the stakeholders to embrace it without any unnecessary resistance.

- The firm should always focus on creativity and innovativeness as a way of addressing challenges in the market.

References

Bricault, G. C. (2012). Major companies of the Arab World. Dordrecht, Netherlands: Springer Netherlands.

Eigenhuis, A., & Dijk, R. (2007). High performance business strategy: Inspiring success through effective human resource management. London, UK: Kogan Page.

Espinoza, R. A., Fayad, G., & Prasad, A. (2013). The macroeconomics of the Arab States of the Gulf. Oxford, UK: Oxford University Press.

Hanieh, A. (2016). Capitalism and class in the Gulf Arab states. New York, NY: Palgrave Macmillan.

Ignatiuk, A. (2008). Analysis of Dell’s business strategy: Research paper. New York, NY: Springer.

Kourdi, J. (2015). The Economist: A guide to effective decision-making. London, UK: Profile Books.

Moseley, G. B. (2009). Managing health care business strategy. Sudbury, MA: Jones and Bartlett.

Mun, H. (2010). Global business strategy: Asian perspective. New York, NY: World Scientific.