Introduction

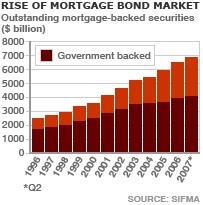

The United States of America and global house market has been encountering problems for a number of reasons. These problems have been negatively affecting business activities in the US and around the world weakening most of the financial systems. The failure of the major financers in America has affected economic growth both in America and other states that largely depend on America for financial aid and grants as well as markets for their products. This is because majority of industries from various parts of the world that offers services rely on US markets and would greatly be affected. For example, the outsourcing industry largely depends on the demand level from US. Events that have occurred recently have clearly disclosed that, the financial systems in America are not stable and have failed to reflect past economic projections. Past records have shown that, American financial system has in past been admired by other state in the world to an extent of being copied. The efficiency of American market in general has in past been measured in terms of the stability of stock markets that have been the major source of capital. The impact of the efficient stock market in America is normally felt especially in controlling the flow of capital for major investments. However, for the last few years, financial systems in America have been encountering serious problems as will be discussed in the rest of this paper. This has been attributed to the recent changes in mortgage bond market. The trend of the mortgage bond market for the last five years has been as illustrated in the graph below. (Monahan, 2008).

Overview of the crisis in American markets

The global financial crisis became more felt in September 2008 because of reduced cash flow in various financial markets. Since then, there has been a sharp fall in equity prices causing several financial institutions either to become bankrupt or collapse. The impact of the mortgage crisis has also been felt by other nations that relied on America for trade and it negatively affected their economic activities. Today, most of developed economies are in economic recession due to the crisis and there is also a notable slow economic growth in most of the developing countries worldwide. The major contributing factor to the problem of mortgage crisis was financial instability experienced by the major financial institutions in the United States towards the month of September 2008. These were, Fannie, Freddie and Lehman Brothers as well as American international group. The two enterprises, Freddie and Fannie are normally sponsored by the US government and they hold more than 50% of total mortgage loans in US. They have capacity to issue bonds worth of multi-trillion dollars to financial institutions such as central banks in several countries as well as pension funds in the rest of the world. (Rey, 2007).

The US government considered the failure of the two institutions and quickly responded to avoid further disruptions that were likely to result from the failure of these institutions. On the other hand, AIG which is the largest global insurer with assets worth of one trillion dollars and operations spreading in more than 100 countries was also at a risk. It risked collapsing from the effects of financial crisis in Fannie and Freddie institutions. The government of US intervened and extended an emergency credit to AIG to as an immediate solution to the problem. Lehman Brothers also risked collapsing and this would have been the largest firm in the US history to collapse followed by Washington mutual which would have been the largest bank in the history of America to fail. The failure of Fannie and Freddie would also have consequently led to the failure of various other investment banks. (Rosen, 2008).

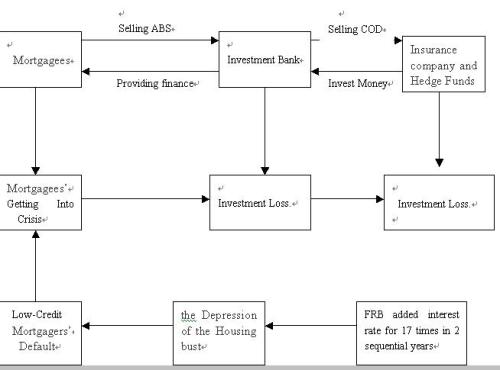

The following is an illustration of the relationship of all the institutions that were affected by the sub-prime crisis in mortgages as provided by mortgage bankers association.

Several banks would have either gone bankrupt or converted to operate as commercial banks if this crisis continued. Most developed countries have since then ensured their central banks have taken appropriate actions towards increasing liquidity as well as making their markets stable to prevent future impacts of the crisis. The same action is being taken by the US Federal Reserve but studies indicate that, there is still a lot of financial stress being experienced in the global markets. Towards the end of September 2008, the US government formed an emergency economic stabilization act with several measures to create a quick solution to its financial institutions. These included a plan to obtain $700billion that would enable purchase of assets that had been troubled from the affected financial institutions in effort to revive the banks.

Problems due to sub-prime crisis

Fannie and Freddie mortgage institutions that failed had their securities guaranteed by the state and mainly two contributing factors caused the great impact when these institutions failed. On one had, they had engaged in bulky mortgage lending in United States of America and on the other hand they had a lot of pulling power on several central banks all over the world that invested in debt securities in the collapsing institutions. Various central banks from different parts of the world were encouraged to invest in these institutions because they were aware the debts by the Fannie and Freddie institutions were guaranteed by the United States’ government. (Jack, 2008)

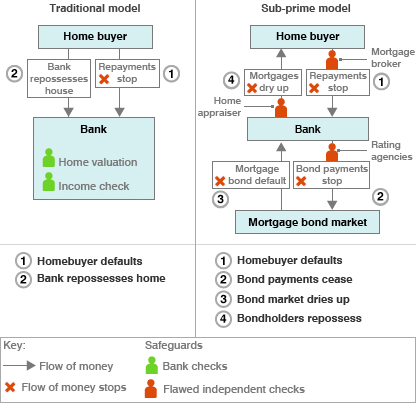

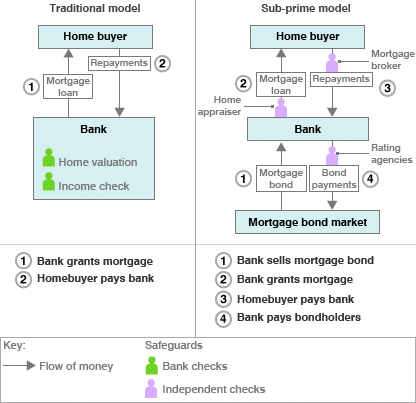

Initially, mortgages were financed by banks using deposits from customers and this limited the amount that could be lent. Today, mortgages are sold to bond markets and this has consequently led to increased borrowing power. The following is a flow chart showing the new model of mortgage lending as provided by the American bankers mortgage association.

The New Model of Mortgage Lending

How it went wrong:

Despite the guarantee, when Fannie and Freddie collapsed, the situation turned out to be a national crisis as the government did not have enough cash to clear the deficit in the two major financial institutions. The treasury secretary in the US, Hank Paulson, as well as US administration however considered the importance of the institutions domestically and globally and made a decision to bail them out. This decision by the United States financial managers was considered as a government’s victory over the financial crisis by various economic observers in several states all over the world.

US tax payers are burdened

The heavy burden that was introduced to the US tax payers by the government after Fannie and Freddie institutions collapsed was meant to save several international investment banks that had invested in the collapsed securities. However, the bail out has now left a heavy burden on he US tax payers because even the house prices, which are the key determinants of the securities cannot meet value that can sustain the debt. The gab between the two has now become a heavy burden on the tax payers in the United States. (Ackermann, 2008).

Even though the US treasury managers did their level best to save Fannie and Freddie crisis from being felt by the international investors, the same response was not extended to Lehman brothers which are an old century investment bank. Various financial institutions in the US and other parts of the world that are linked with Lehman Brothers had a similar experience to Fannie and Freddie. The Lehman brothers equally deserved government’s intervention as was the case of Fannie and Freddie. However, financial managers had reached a conclusion that, no more help would be extended for the US financial market crisis beyond the one that ha already been given. The managers argued that, markets should learn to adapt with the outcomes of their actions and therefore Lehman Brothers were left to manage their own problems. The American financial markets have consequently suffered a slow growth as a result of this decision by the American government not to financially help Lehman Brothers. The American market has therefore experienced very low cash flow because of the weakening of its stock markets. This has caused further failures for various banks as well as other financial institutions both in and outside America. The American Internationals Group (AIG) which was the main insurer has since been bailed out at a cost amounting to $85-billion by the Federal Reserve which has intervened by extending a loan to AIG for two years in return for a 79.9% stake in equity of the company. (Victor, 2008).

Effects of the sub-prime crisis

Although the government intervened to save the collapsing financial institutions, the financial system of America which is the main determinant of the world’s economy, is really troubled and the consequences are disturbing both Americans as well as rest of the world’s market. Financial systems of America are now expecting sovereign wealth funds to intervene and save them from the situation. The financial systems in America are also considering nationalizing private sectors so as to increase their financial stability and in the long run increase cash flow in the market. The situation in America has given rise to the analysis of the impact it has on India and other parts of the world. Although India has always made effort to disassociate itself from American economy, the truth is, India just like other countries in Asia, is heavily dependent on the stability of American financial system. Such dependence is easily felt in the capital flows in its stock market that are easily influenced by the liquidity of the financial systems in America. For example, financial problems that occurred in America blocked the flow of cash and consequently, there were corresponding adverse effects on the stock markets in US and Asia as well as Europe. Another impact of the problem being experienced in American market is a failure to its economic growth projections which was a major component of America’s long term plan. Majority of industries in the rest of the world that are in the service sector and are associated with high dependence on US markets will also receive a similar share of the adverse effects as the markets in the United States. (Ken, 2007).

Effects of crisis on Outsourcing industry

The current slow growth on the outsourcing industry is a clear reflection of the effects of markets globalization and the sub-prime crisis in America. In India, outsourcing industry is to a great extent influenced by the choice of American International Group and Citibank as well as Lehman Brothers. This means the service industry in India will experience a substantial loss in business if the problems in the American financial institutions persist. A similar effect will be felt in the textile exports from India that are largely influenced by the health demands in US as well as Europe. However, one advantage of the current situation in America to the Indian economy is reduction in oil prices caused by poor growth of economy in America. Another down-side to the current situation is that, the stock market is experiencing falls in the capital flows due to the fall in the prices of shares. This is impacting a lot on the exchange rate as well as a decline of the rupee versus dollar. Such effects would definitely be good news for countries relying on imports but it would not have the same effects for the countries relying on bulk exports to America. If the Indian rupee falls, the price of imports will rise and subsidies on crude oil may fail to decline. (Kane, 2008).

The current problems encountered in America are impacting to a large extent negatively on India’s economy as well as that of other countries. The rest of the world may have a lesson to learn from crisis in America but the answer to such a problem may not be easy and direct to get. Opting for better regulation may not be the best answer for such future problems as the research has shown that, the problem was caused by the complex nature of the mortgage housing. It is believed that, when the America introduced a lot of complex innovation in its financial systems, it partly contributed to the current financial crisis. The lesson for the rest of the world to learn is that, introducing complex innovation in a country’s financial systems without clear possible outcomes can cause disastrous results. The current problems in the financial systems of America should be used as a guide by other countries in the world to avoid such experiences. Reddy, the governor still encourage innovations but warned that, enough safeguards must be taken before such measures are implemented. (Edward, 2008).

Problem of counterfeit goods on the global market

Research done by the world custom organization as well as the organization for co-operation and development has shown that, about10% of trade globally counts for counterfeit products. For the last more than one decade, there has been a tremendous growth rated at 400% on the revenue generated from these sales. These have consequently cost global economy more than US$400 billion per year according to the statistics provided by the international chamber of commerce. The counterfeiting problem has been increasing in the industry and this has impacted negatively on the global economy. This has brought a lot of concern regarding how to combat the problem through a close analysis of its origin. The analysis is geared towards stopping counterfeiting and weakening recent methods used by the operators. (Edward, 2008).

Legitimate business in US are encountering problems caused by the global market for counterfeit and the future of the business seem to be losing profit and getting associated with increased operational risks. The practice of counterfeiting is highly networked causing lot of impact on the attitude of consumers in such market as Mexico, United States and Brazil as well as European markets towards the quality of the counterfeit. Regarding the origin of the problem, most of the quantities seized are from china which is classified as the main source of such goods. However, the source is more widespread with each country worldwide participating in its unique way. (Monahan, 2008).

Counterfeit goods have become a genuine problem in global markets especially in the United States of America. One survey by Gallup indicated that, 13% of Americans have at least once bought copied products or downloaded imitated product in just one year. At least 6% of this group confirmed that, they were aware when they were buying these counterfeits. In the year 2004, a report regarding adequacy of property protection from the trader representatives in the United States showed that, US industries had lost more than $200 billion due to counterfeit products. This loss resulted in a huge loss and a poor growth of the US economy. This has affected negatively the individuals who end up buying counterfeit pharmaceuticals as well as other products requiring certification regarding quality and safety. (Rosen, 2008).

Counterfeiting has also played a major role in promoting terrorism and other forms of organized crime in America and other parts of the world. The same problem has been felt in the US entertainment industry. The industry has suffered illegal downloading as well as distribution of music and popular movies pirated in form of VCDs, CDs and VHS. The study conducted by Gallup estimated that, 6% of Americans buy pirated music that is in different forms every year and a further 3% buys counterfeit movies annually. The study reveled that, more than half of those admitting to have purchased counterfeit goods also admitted that, they were aware at least one of them was not genuine even before they purchased. Although the brand-name of the counterfeited goods and clothing as well as jewelry may not cause physical damage to the user, when the goods happen to be pharmaceuticals or tools, physical harm can easily result. The situation is worsened by the fact that, even those who purchase such sensitive counterfeit products also admit their awareness even before they buy them. The problem of counterfeit pharmaceuticals in America is so serious that, world health organization has intervened with the help of food and drug administration in the United States in forming a taskforce that will eliminate the problem. (Rosen, 2008).

counterfeit medicine accounts for more than 10% globally with an associated earning of about $30billion.The problem of the counterfeit goods has impacted negatively on the US market as it is amounting to a loss of multibillion-dollar and this is a serious threat to all sectors in the United States and the global economy. The health of the consumers of counterfeit goods especially pharmaceuticals is also under serious threat. Even though the current technology is increasing the problem of counterfeiting, anti-counterfeiting agents should also snatch the opportunity and use it in recording their trademarks and labels of their products in global database. They should be having a direct connection with other industries as well as governments in the rest of the world. (Ackermann, 2008).

Conclusion

Since the great depression that was encountered during the last century, the global economy is facing severest crisis financially. Global recession has been experienced in the developed countries and price of commodities has continued to increase every day. If this problem continues being encountered, there will be very low progress in achieving future economic objectives in the major markets. However, the United States’ government has intervened early enough to help the situation and to minimize the effect of the crisis being felt by the external markets in the rest of the world. Nevertheless, the burden is still being felt so much by US citizens as they are being taxed heavily to allow the US governments obtain enough cash to restore the major financial institutions’ stability. Chances of additional financial institutions not surviving the present situation are also high because of the overall crisis experienced in the financial sector in many US markets. As a lesson to the rest of the world, any sector that is planning to expand must balance all its plans with the effectiveness of its financial systems because, drifting too far to either side may have severe long-term consequences. Policies that shape global market need to be coherent as well as consistent to guarantee effectiveness and the international monetary fund should always be ready to intervene to its members every time they are faced with exceptional challenges. (Ken, 2007).

References

Monahan P. (2008): Restoring Banking Stability: Blackwell Synergy pp19-26.

Rey H. (2007): International Financial Adjustment: Journal of Political Economy: University of Chicago Press pp32-39.

Rosen S. (2008): Journal of Political Economy: University of Chicago Press pp18-27.

Jack M. (2008): Standardization towards Global Best Practices: Elsevier pp32-45.

Ackermann J. (2008): consequences: Journal of Financial Stability: Elsevier pp34-43.

Victor R. (2008): European Journal of Political Economy: Elsevier pp54-65.

Pang J. (2008): Journal of Banking and Finance: Elsevier pp20-27.

Ken J. (2007): Derivatives and global capital flows: Cambridge University press pp35-44.

Kane E. (2008): Journal of Financial Services Research: Springer pp28-35.

Edward J. (2008): The Gathering Crisis in Federal Deposit Insurance: Cambridge University press pp65-75.