Overview of CSL

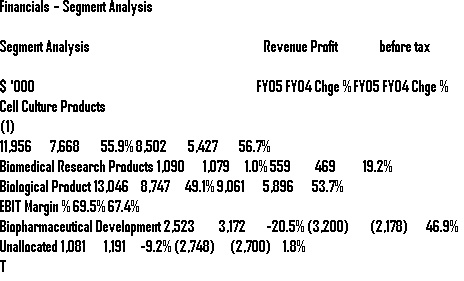

CSL is a big group of companies with an outstanding performance in the pharmaceutical industry. This company is based in Australia and was initially known as the Commonwealth Serum Labs. The company has been in operation for over 90 years now with a strong legacy in the production of pharmaceutical products for both human health and animal health. CSL has facilities across major countries in America and in Europe. Among major countries in which CSL operates are; Germany, Switzerland and Australia where it has a strong hold. The company has close to ten thousand employees that are based in over twenty seven different countries. Among the main bio-products produced by CSL are plasma products that are highly utilized in the management of various life threatening conditions. Among the key business ventures dealing with the production of plasma related products is CSL Behring a global producer of various biotechnology products based in Australia (“Annual Report 2009-2010” 1-124). CSL Biotherapies is the second in line with its operations in various European countries and in Asia. The later produces a variety bio products for in vitro diagnosis.

CSL is highly credited for the manufacture of the influenza vaccine that is globally distributed alongside various other vaccines and pharmaceutical products. This company is equally involved in various forms of research activities geared at the use of recombinant DNA technology in the management of health related complications. Over the years, CSL has exhibited a good partnership with various academic and research institutions around the globe. This is geared at supporting its research and new production processes. The company has a history of forming good partnerships to foster the production of novel products in the biotechnology industry that will meet the health needs of patients around the globe. CSL became a public company under the Australian law in the year 1991. The company has managed to successfully trade its shares on the Australian stock market as from the year 1994.

Among the major shareholders in CSL is Capital Group Companies which also doubles as the main foreign shareholder in CSL (“Annual Report 2009-2010” 1-124). CSL was privatized in the year 1994 when the government of Australia realized that it could no longer sustain it. The privatization of CSL in the year 1994 by the Australian government is an aspect that received a lot of criticism. Among the key issues that this move raised was the need to have tax payers earn as much as the private owners in returns following the privatization. However, in order to effectively attract more bidders, the government had to sell CSL at a relatively very low price. The private owners of the company subsequently increased the value of CSL moments after the privatization. The government on its part was not in a position to recoup any benefits on the assets of the company after privatization. This was despite the fact that the government effectively improved most operations of the company before its privatization. The commonwealth was however able to arrange for a means through which the government would still benefit from revenue collection in the form of taxes.

Since the operations of CSL over the past had highly benefited from funding by the Commonwealth bank, it’s take over may likely have imposed an extra $ 45 million on the Commonwealth bank. This basically implies that the proceeds from the takeover were likely to have been forfeited after about six years following the privatization (“Annual Report 2009-2010” 1-124). With regard to the funds from the Commonwealth, the acquisition of CSL could possibly have cost $45 million of the tax payers’ money following the privatization. In general, the net loss following the privatization in 1994 can be valued at approximately $ 607 million. With regard to the share price, it is likely that the loss that incurred following the privatization by the Commonwealth may not have meant a great gain for the acquiring firm. This is with regard to the nature of the business in which CSL operates. Equity holders are likely to have demanded a greater return on their shares compared to bond holders.

CSL as A Potential LBO Candidate

CSL exhibits a number of features that would make it a very suitable candidate for an LBO. For the financial year ended June 2011, the company posted a net profit of $ 941 million after tax. This profit margin is significantly attractive in the wake of the current economic climate even though it is a little lower when compared to the previous year. The company enjoys a relatively good flow of cash from its operations especially from sales made on products from CSL Behring. As at last year, these sales grew by 10% with another 25 % increase in the sale of Immunoglobulins. The profits of the company are expected to increase further especially with the withdrawal of a major competitor in the range of immunoglobulins. Currently the company uses very ideal strategies to effectively earn a competitive advantage over emerging rivals (Michel and Shaked 1-14). The only major problems that the company seems to be facing are such that can effectively be addressed through adoption of changes in the range of products to effectively address any shifts in demand on the market. The company on its part has managed to effectively address this problem via the use of the latest technology to meet the most threatening life problems through its products (“Annual Report 2009-2010” 1-124).

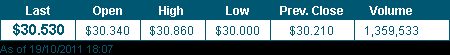

Most of the products manufactured by the company have a ready market in the health industry. Like any other good candidate for an LBO, CSL is generally characterized by an excellent growth over the period of time that the company has been in operation (Michel and Shaked 1-14). The evident drop in the profit margin experienced this year while compared to the profits last year can be blamed on unfavorable foreign exchange rates. The company has also managed to maintain a relatively good return on shares for both the 2009-2010 and the 2010-2011 financial years. The figure below illustrates the CSL share price as at the 19th of October this year.

The company also exhibits a very strong commitment towards the remuneration of its work force through the use of ideal rewards that are fairly distributed. CSL has a very effective frame work for the remuneration of its work force. This framework is geared at aligning rewards to outcomes in businesses in order to create value especially for its shareholders (“Annual Report 2009-2010” 1-124). Through the use of this remuneration framework, the company also creates a high culture of employee performance specifically by giving rewards to measures geared at attaining the main objectives in the business. Since the company has various investment ventures on the international market, the use of this remuneration framework ensures effective competition. Through the use of this framework, CSL is able to effectively motivate and subsequently retain most of its high performing employees. CSL highly considers the alignment of its shareholder’ interests with the interests of its top management. Among the major aspects to be considered is that the current owners of the company enjoy a ten year contract to manufacture various products for the Commonwealth (“Annual Report 2009-2010” 1-124). It also emerges that the current owners were possibly indemnified against any claims following malpractices by CSL in its past operations before privatization.

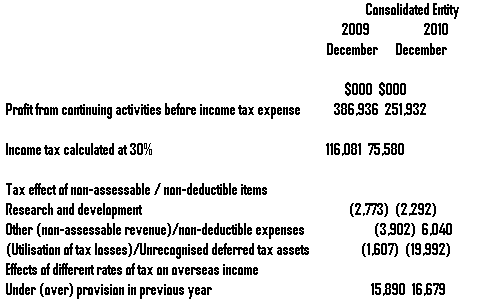

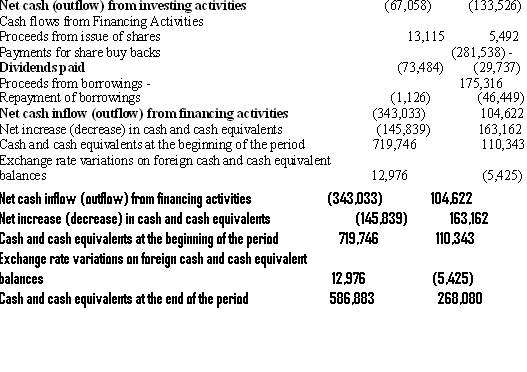

It is expected of any suitable LBO candidate to exhibit the following attributes; very stable form of cash flows, a strong leadership team, good profit margins, a good competitive advantage coupled with low capital expenditure. All of these aspects are common to CSL. CSL has a very excellent management team with a relatively good work force (Hamilton and Quiggin 1-20). The company has recently reviewed and subsequently increased the number of its top executives. This is a move that is geared at empowering these top executives with the responsibility of effectively controlling the activities of the company. The cash flow from most of its operations especially from the sale of products from CSL Behring is very promising. The figure below depicts the company’s consolidated equity.

For this year alone, CSL has recorded excellent growth in revenue from sales alongside NPAT at the rates of 9% and 14% for sales revenue and NPAT respectively.

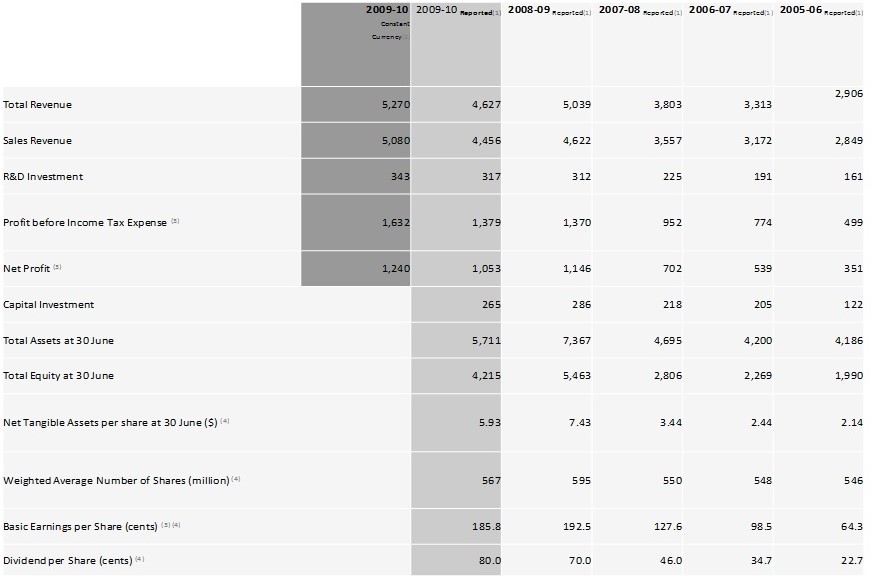

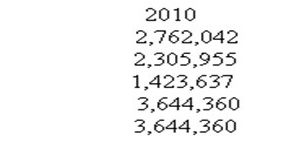

This is a company that has the potential to make up to $10 million in direct investments. These investments can emerge from the sale of its shares or possibly from the injection of more capital (Hamilton and Quiggin 1-20). In its own capacity, CSL is capable of meeting the needs of several business operations in need of equity up to a limit of about $ 10 million. In most of its operations, CSL takes a very active interest in pursuing investment ventures that can possibly add more value to the company than the mere provision of capital (Hamilton and Quiggin 1-20). The company has a very flexible approach to the industry in which it operates and does not consider investment opportunities that do not have any potential for its range of products. The management team in CSL has very clear strategies of identifying profitable ventures for the company to possibly invest in. The table below depicts a performance summary of CSL from 2005-2010.

CSL as a company enjoys a relatively low debt profile. Just recently, the company was able to conclude most of its newly acquired debts in several American banks. The company has also successfully cleared most of the debts borrowed from various private investors. At the moment, CSL is the second leading maker of blood related products in the entire globe. The company also looks forward to buying back more than $900 million of its shares (Hamilton and Quiggin 1-20). This according to the top management of CSL is a move that will effectively ensure that the company returns most of the capital back to its shareholders. It is also expected that the shareholders in CSL will highly benefit from the buyback of shares following better investment return rations. These are benefits that are bound to be earned per every share and also in the form of returns on equity. A buy back of about $900 million in Australian currency of the company’s shares is close to about six percent of the shares of the company issued in the form of share capital. This would be the company’s fifth buy back of shares moments after about 20 percent of the company’s shares were returned to its shareholders in the year 2005. These returns emerged from both the vaccine making and plasma therapies ventures (“Annual Report 2009-2010” 1-124).

A message from the company’s top executive indicated that CSL is almost concluding its negotiations with various banking institutions for new credit measures. In these negotiations, the company is hoping to get an equivalent of up to $ 750 million in Australian currency. Prior to the closure of the negotiation, the company was also able to raise over $ 750 million in a private placement. This was a placement that received a lot of credit among investors in the company and was equally oversubscribed. With the use of the new credit facilities, the company is in a better position to spread its debt profile and subsequently enjoy very good interests rates for a long period of time.

This will possibly enable the company to attain its goal of about 0.7-1.2 with regard to the leverage Net debt and the EBIDTA (Hamilton and Quiggin 1-20). In the wake of the current financial market, this is a very attractive outcome. It is equally an indication of the strength of the balance sheet of CSL. As a company, this is also a good indication of its operation position. Following the acquisition of the expected new funds, the company will be in a better position to clear its debts and subsequently manage its capital.

CSL Limited

Consolidated cash flow statement

For the half-year ended 31 December 2010

Consolidated Entity

The Value of CSL

Based on the figures presented in the table below for the financial year ending June 2011, the company has a projected net worth of $292.4 million rated at about 7 percent. This is with regard to its assets and the value of all its major operations. However, the value of the shares in CSL has rapidly increased after its privatization in the year 1994. This is an aspect that seems to have occurred as a result of a number of activities. Following its privatization, various changes were adopted especially in the top management roles (Hamilton and Quiggin 1-20). Though the managing director was maintained, the rest of the management roles were changed. The value of CSL has also increased since 1994 as a result of the acquisition of various ventures. Among its major acquisitions are the Biocor Animal Health in the USA and the JRH Biosciences also based in the USA. Yet another acquisition that subsequently increased the market value of CSL is the ZLB plant in Switzerland. The later was acquired in the year 2000. The activities of CSL in collaboration with R&D have also added some significant value to the market price of the shares of this company. The figure below depicts the value of CSL shares as in the month of October this year.

Among its major collaboration with R&D is the manufacture of the human Papilloma vaccine with Merck alongside the collaboration with Astra-Zeneca in the production of the Pylori Vaccine (Hamilton and Quiggin 1-20). The collaboration in the manufacture of the fibrin bandage with the American Red cross in the year 1999 equally increased the value of its share prices. In general the various major investments following its privatization and the new purchases coupled with the 10 years commonwealth contract are key aspects that have subsequently added value to CSL. These aspects have also helped to foster the confidence of its shareholders in the company. At the moment, the company is in a relatively good position to subsequently increase its profit margins over time. Taking these aspects into account alongside the most recent capital injection rated at $ 192 million, a value of about $ 30.070 for each share will be appropriate for a volume of 1,414,652 shares.

The Potential Risks of the LBO

With regard to the credit risk, the top management at CSL has promptly identified measures to track and reduce exposure to credit related risks. Various transactions on financial matters are held by counterparties in an agreement with the company under good credit rates (Anson 68). None of the counterparties is expected to fail when it comes to meeting its obligations. CSL thus highly considers investment of its finances in assets that have relatively good credit rates following assessment by various rating agencies. In order to reduce on the number of credit risks, CSL undertakes various transactions in numerous countries. CSL is also faced with both a funding and liquidity risk especially with regard to the spread of credit. It is feared that CSL may likely face a high credit risk in the process of refinancing most of its debts (“Financial Report 2010-2011” 1-94). There is also a fear that CSL may not meet its debt obligations hence resulting into a liquidity risk. Among its objectives as far as liquidity risks are concerned is to ensure proper management of its cash flows. The company ensures that it has enough funds to enable it meet its investment goals and sustain its working capital.

Sensitivity Analysis

In order to limit the effect of fluctuations in its earnings, CSL has an effective measure of managing currency related risks and interest rates. As at the expiry of the financial year that ended in June this year, CSL profit margins may have been changed by fluctuation in the interest rates on loans from banks. It was estimated that the profit margins may possibly have been altered by a difference of about $ 1.5 million (“Annual Report 2009-2010” 1-124). This was a move in relation to all the unsecured loans from banking institutions. Any changes in the rating of the Australian dollar against other currencies in the near future are most likely to impose some changes in the profit margins of CSL if protective measures are not taken. However most of these sensitivity estimates may likely not affect CSL because of a number of changes in its profits earned in various other forms of currencies (Hamilton and Quiggin 1-20).

Possible Exit Strategies and Potential Returns For the LBO Investors

The strategy in Australia is geared at successfully rolling out one of Merck’s products that the company has rights to own the domestic market. It is equally fortunate that the collaboration with Merck in the manufacture of the HPV vaccine has gained a lot of support from the government of Australia with regard to the public vaccination program. CSL at the moment highly considers the move to effectively invest more in the use of recombinant DNA technology and the diversification of risks in order to foster the production of outstanding novel products.

Among its strategies on the international market is to effectively sustain and retain the competitive advantage by possibly increasing gains on its products from blood (Hamilton and Quiggin 1-20). The later will possibly be sustained by various research activities geared at promoting the use of blood products in the management of various medical conditions. The company also plans to use more funds in order to invest more in the use of modern biotechnology in its production processes in order to increase profits. The later is a strategy that is geared at not only earning a competitive advantage but also cutting down on production costs. This explains why the company highly considers funding research in the use of Biotechnology which is relatively cheaper in the production of products compared to conventional technologies (Hamilton and Quiggin 1-20).

The company is shown to have reported a 19% decrease in NPAT at the end of last year as a result of the existence of poor foreign exchange rates. Most revenues generated from numerous activities amounted to $2.11 billion which implied a 9.3% decrease from the previous year. As at this year, the company had 91.23 cents in diluted EPS compared to last year where it had about 106 cents. While comparing the net flow of cash, CSL recorded a drop from $491.17 last year to $ 408.8 million this year.

Conclusion

Among the major problems regarding the offer process that is likely to be encountered is the relatively large float held by the foreign investors. The shares are thus most likely to be offered at a price that will possibly attract very many potential buyers. This implies that the offer may likely experience an over subscription with most of the buyers being persuaded by the likely promotion of the shares. This is following the fact that the company is still in a relatively good position to subsequently increase its profit margins. The existence of the generous terms coupled with the injection of $192 million in capital and the contract by the Commonwealth to supply most of the products is likely to lure very many potential buyers. A most likely criticism that may be directed to analysts on the share market might be related to any decision to underwrite the shares being floated. This is likely to arise in the event that interest rates on the shares rise resulting in a drop in the share prices. When this happens, the present owners of the company may likely to be faced with numerous shares that will remain unsold. Since CSL has previously operated as a public domain in Australia, an LBO would possibly need to impose a number of changes in its objectives. There is thus a high need to consider the path to be taken in order to attain the expected profits following the LBO. If a critical examination of a number of issues mentioned about the company is not taken, it might prove to be hard for the debt to be paid back following the LBO.

Works Cited

Anson, Mark. Handbook of Alternative Assets. New Jersey: John Wiley & Sons Inc., 2006. Print.

Hamilton, Clive, and John Quiggin. The Privatization of CSL. The Australian Institute Discussion Paper Number 4.1 (1995): 1-20.

CSL Limited. Annual Report 2009-2010. csl, 2011. Web.

CSL Limited. Financial Report 2010-2011. Annual report, 2011. Web.

Michel, Allen, & Israel Shaked. RJR Nabisco: A case Study of a Complex Leveraged Buyout. Financial Analysts Journal 15.1 (1991):1-14.