Over several years of its existence, Netflix has cemented its image as one of the best-recognized and most popular companies providing its customers with an opportunity to view original shows online. However, the recent hiccups in its operations indicate that there are certain issues that need to be addressed. Unless the organization considers applying the tools that will help it diversify its services and improve the overall quality of experience, new and more innovative firms may oust it from the top of the target market soon.

Introduction

History

Netflix was founded in 1997 by R. Hastings and M. Randolph (Lusted 8). The organization was originally supposed to produce videos in both online and DVD formats, yet the following drop in the DVD popularity made the owners of the company focus on online distribution as the main area of operations (Lusted 8-9).

Description of Main Competitors

Netflix was originally positioned as a unique service. However, a range of competitors appeared quite soon. Among the most powerful ones, Hulu and Amazon deserve to be mentioned (Lusted 50).

Current Events

Netflix has recently mentioned a range of new TV shows and movies that will be available to subscribers (“Netflix Inc.”). Thus, the company keeps the audience’s curiosity levels high.

Current Successes in Media

Netflix has been witnessing a string of success over the past few years because of the unique and well-received TV shows that it has been streaming, including both live-action TV series (e.g., Stranger Things) and animated shows (e.g., Bojack Horseman) (“Netflix Inc.”).

Furthermore, there have been indications of public interest toward old shows (McLaughlin et al.). The revival of the old and nostalgic TV shows, however, does not mean that Netflix is going to rely solely on rehashing the well-known and, therefore, very safe media. Instead, the company promises to deliver original content along with streaming famous TV series of the past:

“We’re looking, always, for the great stories,” said Netflix chief content officer Ted Sarandos. “We’re not setting out to find nostalgic projects, but sometimes in the hunt for great stuff, somebody has a great take on something that is hugely familiar.” (Butler)

Current Failures in Media

Much to its credit, Netflix has not done anything that can be deemed as atrocious in the global market over the course of its operation. However, the 2011 failure with the launch of a new DVD-rental service name “Qwikster” can be considered a blunder. The brand name was completely unmemorable and, with the drop in DVD sales, dead on arrival (Gilbert).

Analysis

Core Competence

Tangible Resources

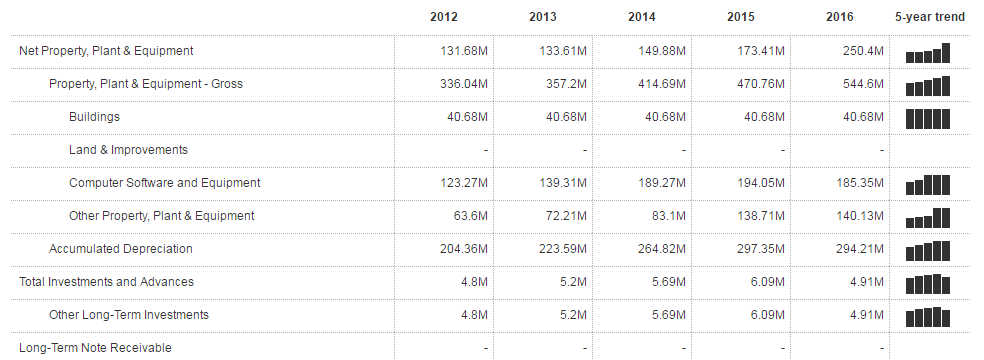

The company owns a land property and a range of equipment, which requires consistent maintenance, yet provides an opportunity to deliver the services of the required quality. While the accumulated depreciation levels have been on the rise, the tangible resources possessed by the company have also increased over the past few years (see Fig. 1). Therefore, there are reasons to invest in tangible assets and further maintenance.

Intangible Resources

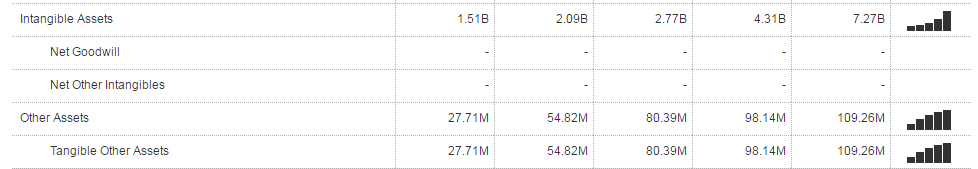

Similarly, the amount of intangible resources owned by the company has been growing significantly. The current approach toward managing the financial resources of the organization seems to have been working quite well, with the overall amount of assets rising from $3.97 billion to $13.59 billion (see Fig. 2) (Netflix Inc., 2017). That being said, it is advisable that a more economically sustainable approach should be used to increase the profitability of the company.

Organizational Capabilities

The company makes efficient use of its human resources. By using the leadership strategy aimed at motivating the staff members and promoting Corporate Social Responsibility, the company follows an exemplary leadership strategy. The current system of rewards allows keeping the staff engaged and competent.

Competitive Advantage

Internal

Resource-based view

What’s valuable?

- The fact that the company provides online streaming of original content can be deemed as valuable;

- The opportunities for shaping the user preferences, as well as receiving unique suggestions based on the latter, is very valuable;

- The large number of products offered by the organization is also rather valuable;

- The options for DVD rental and physical distribution can be listed among rare opportunities.

What’s rare?

- Original content streaming as a service is rare;

- Adjusting the content to user preferences is rare;

- Physical distribution opportunities are rare;

- Online streaming options are rare.

What’s difficult to imitate?

- Original content streaming as a service is difficult to imitate;

- Adjusting the content to user preferences is difficult to imitate;

- Physical distribution opportunities are difficult to imitate;

- Online streaming options are difficult to imitate.

What’s difficult to substitute?

- Original content streaming as a service is difficult to imitate;

- Adjusting the content to user preferences is difficult to imitate;

- Physical distribution opportunities are difficult to imitate;

- Online streaming options are difficult to imitate

Based on the analysis carried out above, most of the services provided by the organization are unique, valuable, and hardly substitutable. Thus, Netflix possesses a wide variety of resources that it can use to its advantage to attract an increasingly large number of customers. Furthermore, the current resources give the organization a huge competitive advantage that makes it unique in the target market.

External

Porter’s Five Forces

Threats of New Entrance

Seeing that the current entry barriers are rather low, there is a possibility for new companies to enter the target economic environment. However, Netflix remains the industry leader, which makes it problematic for new entrants to compete successfully. The low customer loyalty rates, however, level the chances for new entries to succeed. Therefore, the threat of new entrants is medium.

Bargaining Power of Buyers

Given the fact that the piracy levels are high, customers tend not to display high loyalty levels. Most of the company’s income, however, comes from its online viewers. Consequently, the bargaining power of buyers is very high.

Bargaining Power of Suppliers

Because of the dependency on the unique content produced by suppliers, Netflix needs to be very careful in its relationships with them. Therefore, the bargaining power of suppliers is very high.

Threat of Substitutes

There is currently a plethora of alternatives to Netflix, from cinemas to DVDs and other ways of purchasing legal content. Therefore, the threat of substitutes is extremely high.

The intensity of Rivalry Among Competitors

In light of the factors listed above, it will be reasonable to assume that the industry rivalry levels are medium to high. While there are aspects of the industry that Netflix can control, most of the external factors defining its performance are out of its reach.

SWOT Analysis

Strengths

- The pricing strategy of the company has been rather flexible;

- The fact that the organization produces original content gives it a competitive advantage;

- The customized setting allows providing the user suggestions about what to watch next based on their preferences.

Weaknesses

- The huge debt and liabilities makes the company financially unstable;

- The emphasis on expansion prevents the firm from focusing on the quality of the provided services;

- The company accepts only online payment;

- Only external organizations deliver original content to the company;

- Issues with product quality (damaged DVDs, lags in show streaming, etc.)

Opportunities

- Further expansion into other countries and different markets implies greater influence and profit margins;

- The increase in smart TVs implies a rise in customer numbers;

- New customers may emerge from the Virtual Reality Market.

Threats

- The increase in piracy levels may jeopardize the company’s’ success;

- The absence of control over the content providers may stall the firm’s progress;

- The competition levels are currently on the rise.

As the SWOT analysis shows, Netflix needs to pay special attention to the issues of piracy and control over the producers. In other words, the terms of services designed by Netflix need to be reconsidered. Thus, the foundation for tighter control can be created. As far as the piracy issue is concerned, it will be reasonable to focus on providing user benefits that people watching pirated videos cannot enjoy.

Recommendations: Diversifications

Product Quality

Even though the company has been operating quite successfully in the target market, there have been a few issues with the quality of the end product. Despite the admittedly innovative idea of streaming unique content, the organization has been having technical problems, which have led to a drop in customer loyalty rates. Furthermore, the fact that most of the videos can be pirated and, therefore, watched for free leads to an immediate reduction in the number of subscribers. Similarly, damaged DVDs do not make the company any more popular in the eyes of its customers.

In light of the issues mentioned above, it is strongly recommended that the company should consider altering its current approach toward quality management strategy. As far as the DVD issue is concerned, the redesign of the current production control and transportation processes should be viewed as a necessity. Particularly, the defective DVDs should be identified in a more careful and accurate manner, which means that the quality control standards should be reinforced. The repeatability and reproducibility of the production process must be enhanced through the introduction of the Six Sigma philosophy and the use of the DMAIC framework as the tool for identifying the cause of the problem, assessing the situation, implementing the suggested strategy, and controlling the further production process. The Total Quality Management (TQM) framework should also be viewed as an important part of the QM improvement process (Pyzdek and Keller 19).

The same strategy should be applied to managing the issues associated with technical problems. For instance, the execution challenges that the company admits having the need to be managed with the help of a more elaborate crisis management strategy (Gilbert). At present, the company offers a 24/7 technical support for users that experience difficulties with watching movies and TV series. However, the identified tool needs to be supported by another one that allows preventing the problem.

In order to improve its technical infrastructure and provide assistance to the users that experience difficulties using the firm’s services, its leaders should reconsider the current approach toward expansion and, instead, focus on developing the tools for quality improvement. While exploring new markets is an enticing and important process, making sure that the competitiveness levels remain high is also crucial for Netflix, especially nowadays, when new competitors appear on a regular basis.

Future Diversifications

Netflix should consider offering a wider range of products and services. For instance, producing the content that is only starting to grow in popularity should be considered a possible investment area.

Weakness Resolutions

As stressed above, the lack of control over content producers and the issues associated with piracy levels should be viewed as the primary issues that the organization needs to address in order to function successfully in the target environment. As far as the content issue is concerned, it may be possible to create unique content along with providing the content of other organizations. It should be noted, though, that the specified approach will require the reconsideration of the current budget since the new content must have certain production values.

The recent approach used by the company and involving the promotion of a more ethical stance on the issue of pirating, while noble, is rather pointless. Calling to the viewers’ senses only achieves so much as long as people have the chance to watch the content illegally by typing the required keywords in the Google Search box. Therefore, instead of preaching to the audience, Netflix will have to appeal to its curiosity and lust for unique and fun content.

New Products

As stressed above, Netflix is currently highly dependent on the organizations that deliver unique content. While the identified characteristics of the firm cannot be deemed as a huge flaw, it still puts considerable constraints on the company’s use of resources and its competitiveness in the global market. Therefore, to get rid of the dependence on the content creators and make sure that there should be an internal support system for maintaining customers’ loyalty, the organization should consider producing original content independently. It would be wrong to use a big budget on the development of new products seeing that there is still a plethora of suppliers willing to use the services of the organization. That being said, designing a TV show that could become the competitive advantage of Netflix is a sensible step to take.

For this purpose, the company should consider designing a branding strategy and creating the brand image that could remain memorable and immediately recognizable. It is suggested that a live TV show could become the brand product that Netflix can represent as its unique product. Granted that an animated TV show offers more opportunities for creativity since its design allows for making literally anything as far as the plot and characters are concerned, a live-action TV series is likely to be less expensive.

Furthermore, even with a restricted budget, the production values of the show may be quite high as long as a sufficient effort is made to produce special effects and work on the characters, the plot, the story, etc. The idea of using CGI as the means of improving the production values, however, should be taken with a grain of salt, however. Indeed, given the recent technological breakthrough, the incorporation of CGI effects has become a staple of the modern cinema and, therefore, may possibly face negative reactions from the lack of interest to a significant backlash (White). Therefore, it is desirable that live action combined with models and other tools for creating the necessary atmosphere and objects should be considered a possibility. Thus, the TV series that would attract people’s attention can be created.

Implementation: Diversifications

Product Quality

When implementing the strategy designed for the product quality improvement, one must make sure that the appropriate leadership strategy is chosen. Particularly, it is recommended that the transformational framework is applied to maintain the significance of product quality improvement. The emphasis on repeatability and reproducibility, in its turn, will also require that significant improvements of the control strategies should be made.

Future Diversifications

In case the series become a success, original animated series with higher production values may become an opportunity in the future.

Weakness Resolutions

The emphasis on quality management should become one of the driving forces behind Netflix’s renaissance.

New Products

It is expected that the production of original series will help Netflix attract new customers.

Conclusion

Summary

Netflix has been operating in the global economy quite successfully for a while. However, with the recent increase in competition and the emergence of similar services, the company needs improvements. Better quality management and the production of original content should be viewed as the primary tools.

Implications

Therefore, the organization must focus on reconsidering its approach toward the use of resources. Thus, the budget for the brand design can be created. Afterward, Netflix will have to deal with quality issues to build a competitive advantage. Thus, the basis for success will be provided.

Works Cited

Butler, Bethonie. “Netflix Sees Success in Viewers’ Recent Interest in Old Shows”. Valley News. 2016. Web.

Gilbert, Jason. “Qwikster Goes Qwikly: A Look Back At A Netflix Mistake.” Huffington post. 2011. Web.

Lusted, Marcia. Netflix: The Company and Its Founders. ABDO Publishing Company, 2013.

McLaughlin, Khaleb, et al. “Review: With ‘Stranger Things,’ Netflix Delivers an Eerie Nostalgia Fix”. New York Times. Web.

“Netflix Inc.” New York Times. 2017. Web.

Pyzdek, Thomas, and Paul Keller. The Six Sigma Handbook. McGraw-Hill, 2014.

White, Arnold. “Cinema Is About Humanity, Not Fireballs”. New York Times. Web.