Introduction

In the competitive global marketplace, companies operate in different market structures. For instance, some companies operate in a monopolistic market while others work in an oligopolistic market. Every country has a monopoly firm that can control the prices of commodities and output. A firm is said to be a monopoly if it can influence the prices of products in the industry. Monopolies maintain their power by creating barriers to entry, which can be as a result of high startup costs.

Moreover, it can result from a lack of technological expertise to operate in the said market (Das & Ray, 2008). A monopolistic market resembles a perfect market competition but does not meet the perfect competition market’s ideal benchmark. Usually, monopolistic markets are characterized by a large number of small firms. These firms produce almost identical products. This means that firms in this industry are incredibly competitive, but have little control of the market. Therefore, a monopolistic market can be referred to as a hybrid between monopoly and perfect competition.

The difference between perfect competition and monopoly is in a monopolistic market. Many firms are competing in the same industry. In a monopoly, each firm has control over the market because it can determine prices and outputs.

There are some characteristics associated with monopolistic firms.

- Monopolistic firms exist where there are many small firms in an industry.

- The firms are similar, but not identical.

- There is stable resource mobility.

- There is extensive, but not perfect knowledge of the market.

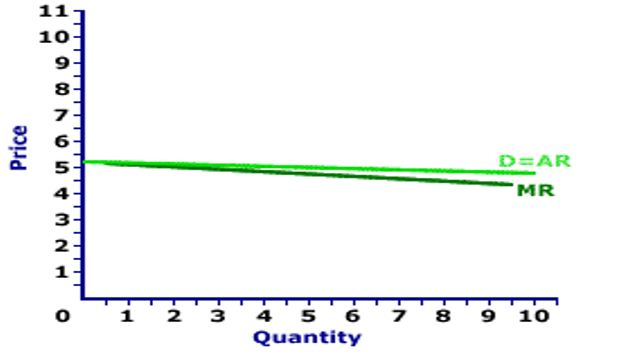

In a monopolistic firm, demand is relatively elastic because there are many competing firms in the industry with a close substitute. The elasticity of the application is shown in the graph below.

In a monopolistic market, the goods produced by the firms are close substitutes, but they can not correctly manage to perform this role. From the graph above, a monopolistic company can sell its products within the range of $5.5 to $6.5. However, if the price increases beyond $6.5, demand drops to zero. A monopolistic firm is said to be a price maker because it has some degree of control over the output and price.

This means that a monopolistic firm can raise and lower prices a little. It implies that the average revenue obtained from the market is higher than its marginal revenue. For instance, from the graph above, the marginal revenue curve lies below the average revenue curve. The demand is elastic because the price is higher than the revenue. In the real world, a monopolistic company generally produces light output and charges a high price.

The price is usually higher than it would have been in a perfect market. The price charged on goods and services in a monopolistic market is higher than the marginal cost. The unique aspect of the monopolistic market is that it violates the efficiency conditions of a perfect market. Resources in a monopolistic market are not utilized by the firm to generate the highest returns and satisfaction. The market’s inefficiency occurs because a monopolistic firm has control over a small part of the market. This leads to a negative sloping demand curve where the price is greater than marginal revenue. Although monopolistic markets are generally inefficient, they are less inefficient than other market structures such as the perfectly competitive market and oligopoly.

This paper critically analyses the monopolistic characteristics in the oil industry. To develop a better understanding of the existence of monopolistic characteristics in the oil industry, the paper refers to previous studies and theories.

For instance, several studies have shown the existence of corruption and lack of competition in the oil market, most notably monopolies in the oil industry. To achieve this goal, we look at several theories, such as Neo-classical, Franken’s perception of oligopoly, and Ricardian view of the monopolistic market. The objective of this case study is to show how monopolies restrict output to charge high prices. In this case study, it has been established that OPEC controls global oil prices to charge importer with high prices.

Monopolistic competition in the oil market

Introduction

The oil industry has been perceived to be operating in a monopolistic market. Specifically, OPEC plays a critical role in determining oil prices across the globe. Ryan noted that during 2010, research conducted in the US about the oil industry and the role of monopoly in determining global oil prices revealed that 53.7 percent of the respondents view OPEC as a monopoly, which harms the US oil industry. Some people believe that global politics influence oil prices.

However, a critical analysis of the oil industry shows that OPEC plays a critical role in determining oil prices, and it has positioned itself as a monopoly (p. 8). Some of the respondents believed that OPEC is a monopoly, which restricts output to charge high prices. In some cases, it increases output to lower oil prices. Global oil prices have been fluctuating depending on the level of the output. It is determined by the law of demand and supply.

When demand is high, prices go up. During this period, production is low, pushing the demand for oil up. OPEC controls a significant part of the oil supply in the world. OPEC produces more than 60 percent of all the oil exported internationally. To charge high prices, these countries lower their production output, which enables them to do than. The US government has been taking a leading role in creating subsidies for alternative energy sources to avoid the monopolistic market. Therefore, this study looks at the problem concerning the existence of a monopoly in the oil industry. Specifically, it focuses on the subjective high prices and corruption in the oil market. The actors in this market are the oil companies, importing nations, and producing countries.

Theories

Ricardian view of monopoly

Various theories explain how monopolistic firm restricts production to charge high prices. According to Ricardian theory, a monopolistic market exists when production generates surplus if commercial rent exists. According to Fiocco (2013, p. 194), this theory mainly focuses on the supply conditions in the market rather than the demand conditions. It means that every oilfield has its specific physical makeup and crude oil.

Moreover, every country uses a different extraction method, which determines the total costs of refined products. Ideally, this means that an increase in transportation costs will directly affect the prices of oil. This concept is referred to as the residual rent concept. The Ricardian theory argues that there will be a gradual increase in oil prices over time. However, this theory assumes less exploitable oilfields will be discovered in the future. This theory might be true considering exploited oilfields, but cannot be proven regarding unexploited oilfields.

Frankel theory of oligopoly

According to Frankel’s argument, competitive conditions in the oil industry can be achieved by increasing production capacity. However, it is impossible to achieve a competitive market with the intervening rationing system or by forming an oligopoly. This theory is supported by Kim & Sim, who noted that technology barriers could prevent new entrants in the oil industry. Frankel argued that intervention forcing in the market could be used to prevent monopolistic competition in the market.

Marshallian and Neoclassical theory

According to the theory of Marshallian and neoclassicists, monopolies occur when a firm can control the commodity’s output or price. This notion seems to converge with Adam Smith, who argued that monopolies have economic freedom because they can determine the price and output. However, there are major differences between Adam Smith and Marshall’s argument that forms the basis of policymakers’ historical context.

Fiocco argued that oil prices would decrease with the establishment of new and cheaper oilfields in the future that would push market prices down. The down pressure on oil would resist attempts to eliminate competition. This notion can be used to explain how monopolies restrict output to charge the customer’s high prices. Moreover, it shows how monopolistic firms create barriers to entry by using their predatory behavior. However, Kim and Sim (2015) argue that this notion cannot support the existence of barriers to entry, such a startup capital.

Case study application

Since the organization produces more than 60 percent of all the oil exported globally, it has monopolized the oil industry. This monopoly is achieved by decreasing production to increase the prices of oil per barrel. In this case, we shall assume that oil prices naturally evolve to become competitive. The congressional decision not to follow standard was an irony of modern misinterpretation about monopolies as a government given privilege.

The US government made the market less competitive because it allowed Middle East countries to join. This led to the creation of OPEC, which plays a critical role in setting oil prices today. For instance, in 2011, Saudi Arabia intended to expand its budget to stimulate growth. The only way these goals could have been achieved was by influencing the other Gulf States to lower oil production.

When the Gulf States lowered oil production, demand increased, causing oil prices to go up significantly. Although some people argue that the law of demand and supply regulates oil prices, OPEC plays a monopoly by setting the market (Peress, 2010, p. 32). Today, oil prices have plummeted significantly. A critical analysis of the market shows that OPEC has lowered oil prices deliberately to punish some countries.

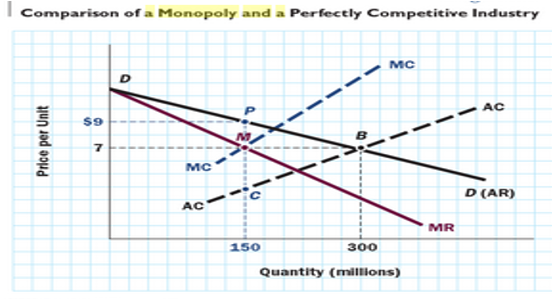

Due to the enmity between Iran and other Gulf states, Saudi Arabia, the largest oil producer, increased output to fence oil producers out of the market, such as Iran and Russia. The monopolistic nature of the oil industry is visible in OPEC’s ability to control oil prices and output. OPEC has previously used its ability to control global oil output to manipulate it (Ryan, 2011). In a competitive market, oil prices should be controlled by the law of demand and supply. However, today, OPEC tends to sign agreements with other Gulf states to produce few outputs when they intend to increase prices. Thus, OPEC’s demand curve is similar to that of a monopolistic firm, as shown in the diagram below.

From the graph above, it can be observed that OPEC produces fewer units of output than it would have in a competitive industry. The demand curve of oil slopes downwards, which means that the production of fewer units allows the monopolistic firm to get away with high prices. The price per barrel of oil indicated by P is above M. Choudhary et al. (2015) noted that this price is higher than what firms in the same industry would charge in a competitive market. This notion converges with the popular view that monopolies exploit the public—the monopolistic firm’s deliberate action to cut down production to increase the demand for the product.

Consequently, the prices of goods and services increase until supply is equal to demand. The same theory can be used by monopolistic firms to increase output to lower prices. Many factors could compel a monopoly to lower prices, such as eliminating competitors in the market. OPEC has been at the center of the US strategy to eliminate the Russian government’s power, which highly depends on oil revenues for its military modernization. Since the US government understands monopolies’ power, it influences OPEC to increase oil production to lower prices.

Conclusion

A Monopolistic market only exists if a firm can be able to control the output and the price. Different economic hypotheses have explained the theory of the monopolistic market. OPEC has previously used its ability to control global oil prices to manipulate the market. However, this should not be the case because the law of demand and supply controls the market price. For instance, in a competitive market, oil prices should be controlled by the law of demand and supply rather than by individual firms.

However, today, there is a tendency of OPEC to sign agreements with other Gulf states to produce lower outputs when it intends to increase the price of oil. This can be explained by different theories that study monopolistic markets such as neoclassical theory. Although there is evidence of monopoly in the oil industry, OPEC has little or no control over oil prices in the market. Oil prices seem to be more regulated by the law of demand and supply.

Recommendation

From the case study, it can be seen that OPEC has been able to control oil prices. This organization has been able to monopolize the market since it can control oil prices. For a monopoly to control prices in the market, it has to be able to control the level of output. Bykadorov, Kokovin, and Zhelobod’ko (2014) noted, customers, are exploited in a monopolistic market when prices rise beyond acceptable levels due to low production.

To achieve this goal, OPEC usually lowers oil production to reduce supply, which causes prices to rise. For instance, Saudi Arabia encouraged the other Gulf States to lower oil production in 2011 to encourage economic development by increasing cash flow.

In some cases, a monopoly can be used as a political weapon to eliminate competitors in the market. For example, many oil-producing companies in the US cannot make profits because it is expensive to produce one barrel of oil compared to production costs in the Gulf States. A monopoly has been used as a political weapon to compel Iran and Russia to withdraw their support for Assad in Syria. Therefore, the only way to eliminate this monopoly is through government interventions. Since all the OPEC members are sovereign states whose decision must be respected, each government can be able to control oil production without taking into consideration the organization’s overall decision. However, achieving this goal is almost impossible because the many Gulf States rely on oil revenues to fund their budgets.

Gulf State can develop policies that can be implemented effectively to prevent oil companies from lowering oil production when demand is still high. Each state can compel oil-producing companies to produce oil-depending ones on the level of demand and supply in the market. In a competitive market, prices are determined by demand and supply, which should be used as a benchmark to determine the amount of oil produced in a given period.

To eliminate this monopoly, OPEC, in conjunction with other oil-producing countries, should develop new regulations to discourage monopolistic behavior. For instance, OPEC can set the production level in each country at any given period, which should be based on demand and supply, to eliminate the monopolistic behavior of some Gulf States. However, some countries might reject this goal out of fear that they will lose many billions in revenues.

Critique

Neoclassicists such as Ely argued that natural monopoly does not experience the pressure of competition in the market because it can determine prices and outputs in the market. This means that competition cannot be sustainable on its own but might include outside forces. The argument of neoclassicist seems to support economic interventionism. However, some economists such as Ludwig argued that such interventions are bound to fail due to spontaneous market forces. Moreover, external forces will exert pressure on these interventions until socialism and interventionism are outnumbered.

Moreover, intervener cannot control the outcome of a monopolistic market. Today, there are many monopolistic companies in the world. It is estimated that half of the total global production output comes from the monopolistic firm (Yılmaz, 2016).

Monopolies can exist in any industry, such as retail clothing, the oil industry, and convenience stores. Although the oil industry has a monopolistic aspect, OPEC’s ability to exercise its monopolistic characteristics in the market is limited because many players in the industry can increase oil production to the levels of the Gulf States. OPEC members are the largest oil producers globally, but they cannot determine oil prices in the market.

Moreover, lowering production to charge high prices cannot be sustainable in the long-run, considering that new oilfields are being discovered every year. Therefore, OPEC has very limited control over oil prices. Thus, the oil industry only depicts minimal monopolistic characteristics.

References

Bykadorov, I., Kokovin, S., & Zhelobod’ko, E. (2014). Product diversity in a vertical distribution channel under monopolistic competition. Automation & Remote Control, 75(8), 1503-1524.

Choudhary, A., Suman, R., Dixit, V., Tiwari, M., Fernandes, K. J., & Chang, P. (2015). An optimization model for a monopolistic firm serving an environmentally conscious market: Use of chemical reaction optimization algorithm. International Journal Of Production Economics, 16(4), 409-420.

Das, T. K., & Ray, I. D. (2008). The monopolistic competitive market in religion: a case study of Hindu temples. Applied Economics Letters, 15(1), 69-72.

Fiocco, R. (2013). The Optimal Institutional Design of Vertically Related Markets with Unknown Upstream Costs. Review of Network Economics, 12(2), 183-210.

Kim, H., & Sim, S. (2015). Price discrimination and sequential contracting in monopolistic input markets. Economics Letters, 12(8), 39-42.

Peress, J. (2010). Product market competition, insider trading, and Stock Market Efficiency. Journal of Finance, 65(1), 1-43.

Ryan, J. (2011). Oil monopoly: A market process analysis. Web.

Yılmaz, E. (2016). Market Imperfections and Income Distribution. B.E. Journal of Economic Analysis & Policy, 16(2), 1147-1167.