Background

A project management office (PMO) is group that sets and maintains methods and standards for project management within a company. This is a new trend among medium and large businesses, as 85% of companies had a PMO as of 2016 (Miller, 2017). PMOs develop the best project management tactics and practices as well as oversee project status and direction, all under one department.

They ensure that company operations are optimal in terms of budget, time, and resources. PMOs exist to ensure project and program succeed which is important since that is how organizations typically create or deliver value. PMOs may be challenging to set up correctly, but they offer the benefits of efficiency and control over project management for long-term tangible benefits for the business. This paper will discuss the establishment of PMO at ABC Group that is currently struggling with project fulfillment and disorganization.

Functions

The PMO functions not only affect project specifically, but can positively impact a range of other departments and across the organizations. The main focus of the PMO is decreasing project failure rate and improving deadlines, adhering to costs, and presenting workable scopes. Overall, it contributes to the prioritization of projects that contributes to an improved an ROI on project investments (Meria, 2005).

Structure

As a large financial services organization, ABC Group has various departments, and then certain departments have multiple teams working on multiple projects or overseeing the various programs and services that the firm offers. It is a complex structure, so to be able to oversee and help in management of these diverse projects, a comprehensive and extensive PMO structure is needed. The best fitting structure in this case would be a Business Unit PMO, also known as a departmental PMO. This structure helps to oversee multiple projects across various assigned departments. The PMO team will have experts that are familiar with the work that each department is performing and can serve as advisors while having a comprehension of what is going on in the project.

They handle program and project management and report specifically to the department head. This choice of structure is also logical as each department in a financial organization may use different resources, project specifications, reporting standards, and governance. It allows to adapt to the nuances of the department develop project management standards which fit the specific type of work (i.e. IT obviously functions differently from HR, and while some standards will be established across the whole enterprise, scopes and approaches to projects differ).

Staffing

- PMO Director – project oversight in all areas of organization, managing any enterprise-level projects and company-wide resource distribution for all projects.

- Project Managers (one expert for each department) – Project experts that will oversee projects for teams in their respective departments.

- Project support (one attached to each project manager in each department) – complementing project managers to execute programs, such as with project planning, scheduling, and serving as controllers. They are the technical personnel and maintain key information on the project so that managers can make competent decisions.

- Administrative support – software support, report generation, back-office tasks, any type of support.

- Best practices expert – Develops methodology for PMO and best project oversight practices. Creates standards that must be followed. Creates training protocols and quality assurance.

- Knowledge management coordinator – maintains project records, methods, standards, and lessons learned. Archives organization.

- Resource manager – Working with the director and PMO committee to manage resource skills to project requirements. Forecasting and planning for acquisition of resources. Balancing scarce resources and ensuring key resources go to good use.

PM Methodology

The financial industry is known for being extremely complex and fast moving, with projects maintaining a lot of requirements while stakes and responsibility are high. According to Goulstone (2017), the agile methodology is the best to apply in the financial services industry. It allows for quality outcomes alongside a timely and manageable process for managers. It can offer transparency with client involvement in the project if necessary.

Agile methodology also allows for flexibility by shifting elements in the middle of the project and being able to achieve timely results. It remains an appropriate methodology for most financial organizations as it addresses most needs that it may have in developing and implementing a project. It is a sector that is sensitive and requires failproof systems that can deliver required results. Agile methods function in conditions that are fluid and lack clarity, as well as when timetables are aggressive or business cases uncertain which is the status quo for the financial industry (Goulstone, 2017). The success of the agile methodology relies heavily on the ability of those who are implementing it.

PMO Governance

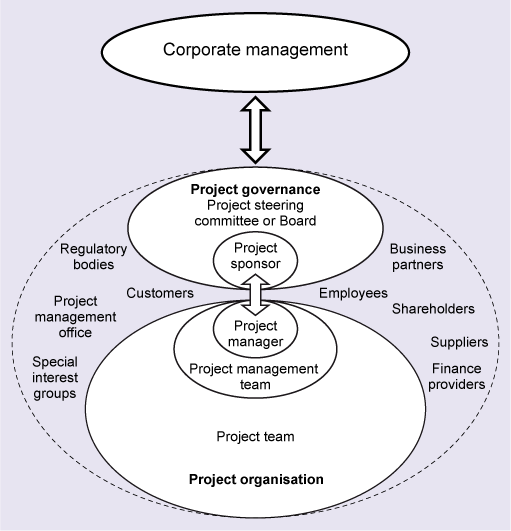

The PMO’s value can be increased through a standardized framework of governance. The PMO governance defines the PMO authority and the resources and support it needs for project management capabilities within a business. Project governance is a “The set of policies, regulations, functions, processes, and procedures and responsibilities that define the establishment, management and control of projects, programs or portfolios” (OpenLearn, n.d.).

The PMO should have an executive control board or steering committee providing direction and guidance on the application of the PMO environment. The governance structure seen in the image below is standard for a business of the ABC Group’s size. The project sponsor, the one who initiated the project in the department has the executive say, while the Board provides senior level guidance to the project.

Training

Specialized training will have to be provided for staff selected for the PMO team, as well as general training for managers in all departments on their future collaboration with PMO in the organization. Offering training to managers and team members in the PMO is a good business investment as they will be critical to project completion and evaluation for years to come. Their expertise, along with soft and hard skills application, will be invaluable to the operation of the firm. Training not only leads to improvement in skills, but also better productivity, higher retention rates, and stronger brand loyalty. PMO teams must not only have competency in project management and delivery, but a range of supplemental skills such as excellent communication, coaching, and working with individuals of diverse backgrounds and specializations. That will contribute greatly to the PMO managers and their staff integrating into the departments in the enterprise to work cohesively with the respective project teams and implementing the standards and oversight necessary.

As a manager, it is important to set up training that will allow the PMO team to learn on how to successfully set up, implement, and manage a PMO office that fits to organizational parameters. An example of this would be the PMO team members shadowing their respective departments to understand their project management and planning processes in order to identify current and weaknesses. All modern project planning is done via software. It can be effective to first, ensure that project planning is standardized across ABC Group. Then, PMO staff is trained in expert utilization of said software and its functionalities. In turn, when working with managers and team leaders, the PMO staff will directly educate and guide on the use of the project management software to ensure compliance and effectiveness in real-life application.

Risk Analysis

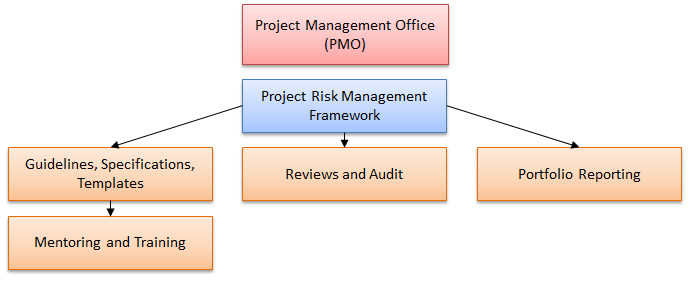

Projects are being worked on in an environment that is affected by multiple constraints and risks, especially in larger organizations where it is one of many in a portfolio being planned or executed at a given time. Projects typically share the common risks and uncertainties with the limitations and objectives of the organization at large. Given this context, the PMO can provide risk analysis and risk management governance on projects to ensure that risks are mitigated, and the project aligns with the organization’s objectives.

The PMO can ensure consistent risk management is practiced throughout the organization by developing and distributing standardized templates and specifications, with guidelines on standard risk management processes. The PMO can provide training to project team members if necessary to ensure each professional understands their role and how to perform it correctly. Further, the PMO will conduct periodic reviews and audit of the risk management measures being taken and ensuring protocol is followed. Finally, the PMO can provide risk management assessment at the portfolio level. The analysis at the general level can help identify common risks across various projects and make organizational changes to protect the projects effectively.

As a financial institution, ABC group faces different risks at various areas and levels of its organization. These can be strategic, credit, market, liquidity, and operational risks. Risk management systems exist at all banks with the aim to support decision-making from negative outcomes. PMOs can contribute to building and maintaining an effective risk management framework. This is done through analysis of discrepancies when compared to most effective global risk management practices and assistance of developing and implementation of appropriate methodologies and risk management structures via quantitative and qualitative approaches such as scoring models. Similar to the principles of project management, the PMO at ABC would create an effective internal control framework (Deloitte, 2007). It would identify and assess risks related to the operations of ABC group, evaluate efficiency of design and implementation of controls, and review effectiveness of said controls. In other words, tools utilized to maximize project efficiency through particular controls or tools can potentially be applied to risk management as well with supporting activities such as internal audits and methodological support.

Tools/Management Information System

Modern financial organizations are increasingly digitized. Therefore, for the PMO, it is important to use a digital management information system that will help gather and oversee all data on the specific projects, alongside all the key metrics, timetables, costs, and other valuable information. That type of software is common, and large organizations typically use a centralized program for this. A project management information system (PMIS) is logical organization of information that can be used for companies to complete projects, as software methodically collects and analyzes data. PMIS is not a replacement for PMO, but a supplemental tool. It aids in tasks such as scheduling, storing documents data, creating and monitoring metrics on dashboards. While this information is critical, it also needs to be implemented correctly which is where PMO professionals come into play, and aid in applying the data to the improvement of the project management and completion process.

Schedule

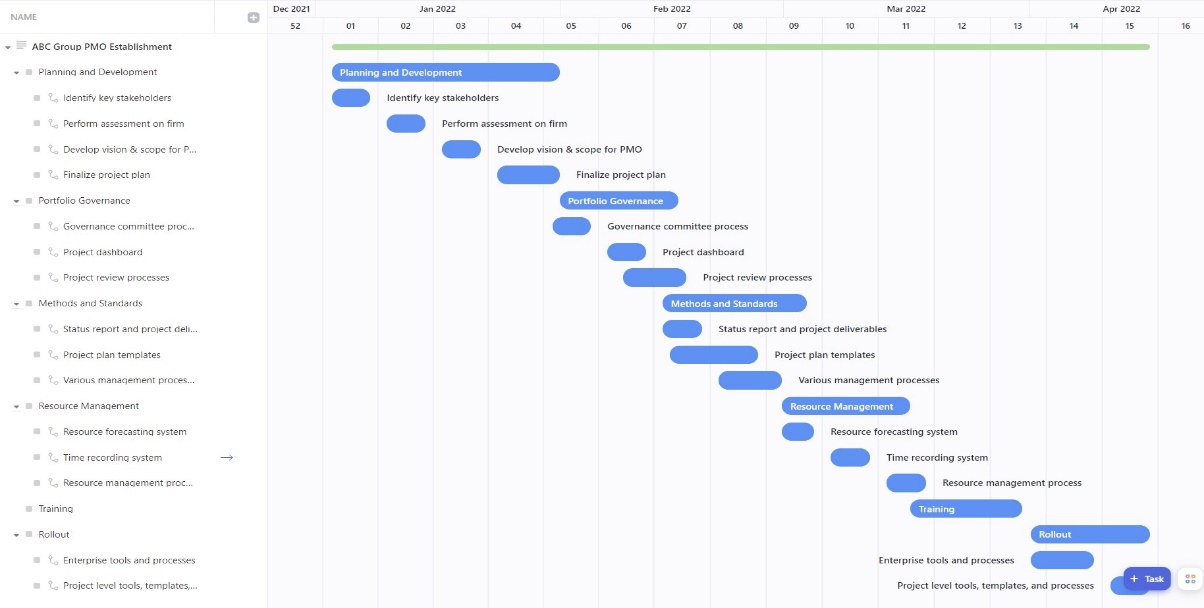

The Gantt Chart can be seen below:

References

Deloitte. (2007). Enterprise risk management. Web.

Goulstone, P. (2017). Project management. Deloitte. Web.

Merla, E. (2005). From zero to PMO in thirty days. Paper presented at PMI® Global Congress 2005—Latin America, Panama City, Panama. Newtown Square, PA: Project Management Institute. Web.

Miller, J.A. (2017). What is a project management office (PMO) and do you need one?. CIO. Web.

OpenLearn. (n.d.). Project governance and Project Management Office (PMO). Web.