Perfect Economy

A Perfect economy is an economy that is characterized by several unique conditions. For instance, in a perfect economy, there is perfect rationality of consumers, most of the agents in the economy are price takers, and there are transitive and stable preferences. The economy has perfect information that is simultaneously made available to all the agents (Keen 2). There is also certainty and severability of production. The economy has no distortions, direct transaction costs, economies of scale, and no crime or war. This kind of economy does not exist in reality. However, it plays a major role in analyzing markets. It helps measure the level of perfection or imperfections of the other economies (Clifton 152). It is an extreme case that does not exist in the real world.

Imperfect competition

This is a kind of a market where the rules are a bit easy. The rules of perfect competition are not rigid in this kind of market. In perfect competition, there are no single suppliers who can take part in price setting (Frank 7). There are barriers to entry, the number of buyers and sellers are many among other restrictions. These rules are absent in the case of imperfect competition (McNulty 195). According to Roberts (839), the forms of imperfectly competitive markets are several. The main five areas listed below

- Monopoly.

- Oligopoly.

- Monopolistic competition.

- Monopsony.

- oligopsony.

The suppliers have a say in the setting of prices of the commodity offered in the market.

Role of government in imperfect markets

The government intervenes in the case of imperfection and tries to save the affected parties in taxes, subsidies, bailouts, and sometimes wage controls and price controls. This helps in correcting the effects of imperfections.

Price controls as a way of forbidding unfair competition in the market

The government may use price controls to control unfair competition in the market. The government may set a price above equilibrium to ensure that the firms do not collapse as a result of unfair competition. It may also set the price below equilibrium when the firms are exploiting the consumers especially when a commodity is scarce in the market.

Three examples of abusive behaviors that can arise when a firm dominates a market

When a firm dominates a market, it enjoys monopoly powers. In this case, the firm becomes the only price setter. The firm makes other firms to be faced out of the market because they have a very small market share. The firm can set a price that is too low for other firms to operate. In that case, they collapse because they do not make a profit that can sustain it.

The firm also becomes the only seller of the commodity. The firm is also the main controller of quality and quantity to supply. The firm puts barriers to entry into that market and other firms are locked out. They may even be forced to sell their assets to the dominating firm.

Who is the “Economic Man”

- Homo economicus or ‘economic man’ is a term used by some of the economic theories to describe the man. In these theories, man is described as someone who can make sound judgments and seeks wealth to satisfy his interests.

- According to Kurz and Salvadori (12), the ability to make sound judgments helps the economic man to avoid any work that is not necessary. Many economic theories propagate the notion that human behavior is identical to that of the economic man.

- The term was first used in the 19th century by John Stewart Mills. He came up with the definition of the economic man. He defined the economic man as one who obtains luxuries in life without putting much effort. The idea that the economic man seeks after his interests were propagated by other scholars such as Adam Smith.

- Adam Smith believes that the pursuit of individual self-interest can lead to benefits for society as a whole through occasions when a person helps another. One does this in full recognition that whatever they do to the other person will pay someday when they will also need help from another person.

- 4 criticisms of economic man ideology.

This ideology has been criticized on the basis that it assumes that business people make rational investment choices. This has been proven untrue because investors in any business seem to overlook the minor risks associated with their investments. This shows how investors act irrationally at times when making their investment choices.

The ideology has also been criticized because of overly emphasizing external motivation for human behavior at the expense of internal motivation. For instance, the theory would fail to accurately define the motivation for any person to take part in the war to become a hero. Emphasizing a lot on extrinsic factors as the only motivation for human action overlooks the important role played by intrinsic motivation for human behavior (Aumann 38).

Sociologists also criticize this ideology because it fails to capture the important role played by preferences that one has as a result of influence from the society where one lives, one’s education, and other experiences in life.

Finally, this ideology has been criticized because it does not take into account the internal conflicts that an individual faces when making choices. For instance, there are situations when one is required to make choices based on the long or short-term effects of the choices (Aumann 2).

Public administrators need to be aware of this model because it will help them understand the behavior of the people they are dealing with. It will also help them understand why people are always on the lookout for opportunities and information that will help them achieve their desired goals.

Write a detailed description of the concept of supply and demand

Supply and demand are market forces whose interaction determines the demand of commodities in the market. Supply is the willingness of the owners of goods and services to bring them from the exchange in the market for some specified price. According to Kirzner (112), the amount of goods and services that they are willing to sell at that price is referred to as the quantity supply. The suppliers are reluctant to take their goods into the market when the prices are low.

However, at high prices, they take advantage to make as much profit as possible. That is what defines the law of supply that is illustrated using the supply curve. Supply, therefore, increases as the prices of commodities in the market increases. The relationship between the price and supply is, therefore, direct or positive (Arrow 43).

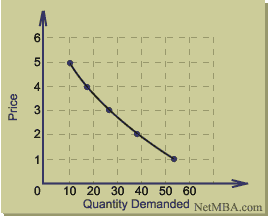

The supply curve would therefore be positively sloping due to this relationship. Demand, on the other hand, denotes the desire of consumers to buy goods and services at the price given in the market. Consumers tend to demand more of a commodity when the price of that commodity is low. The relationship between the demand and the price of a commodity is negative or inverse. According to Velupillai (5), more is demanded of a commodity when its price is low and vice versa. The curve showing the relationship between price and demand is negatively sloped.

This curve is called a demand curve. It depicts the relationship between demand and price. The curve is downward sloping to demonstrate what the law of demand states that demand decreases with a price increase. At a higher price on the curve, the demand is too low (Garegnani 23). For instance, picking several points on the curve, the following observation will be made:

The schedule above shows that the demand for this commodity increases from 10 to 55 units when the price is lowered from $5 to $1. This shows the law of demand is obeyed in this case. The commodity in question is a normal god because it obeys the law of demand.

Increase in literacy level means that more entrepreneurs are in the economy. People can secure salaries that will earn them an income and as a result, increase their purchasing power (Hoffman 314). Demand and supply will increase as the level of literacy increases. Some specific commodities that are associated with the learned people like books will also increase.

An increase in educated workforce and computer literate people in the workforce will lead to reducing output cost because they increase efficiency. Companies can avoid wastage during production and also the level of production is high. The learned workforce is also able to make use of current and most recent technology to improve efficiency (Massimiliano 223).

The demand for heavy jackets increases during the rainy seasons. During such seasons, more and more heavy clothes are bought. The available quantity is reduced and demand may exceed quantity. One will have to pay more to obtain such heavy clothes wherever they are available.

Sometimes it may happen in a city that it rains unexpectedly. The suppliers may not have stocked umbrellas. When it rains at such a time, the demand of suppliers immediately rises and the suppliers do not have enough to satisfy the demand. When the demand is not met, the prices are increased so that some people are not able to buy (Kreps 9). Demand will go down when the price is increased and eventually it matches what is supplied.

Trade restrictions may ban imports and as a result, increase the demand for locally produced goods (Kurz and Salvadori 23). When that happens, the imports reduce and closes the deficit. The local industries will increase the prices when demand increases. This may also ruin the relationship with other countries and may divert their commodities to other markets where there are no restrictions. When the local industries can no longer manage the demand, the problem is enormous because the commodity may not be available elsewhere.

Works Cited

Arrow, Kevin. Toward a theory of price adjustment, Stanford: Stanford University Press, 1959. Print.

Aumann, Robert. “Existence of Competitive Equilibria in Markets with a Continuum of Traders”, Econometrica, 34.1 (1966): pp. 1–17.

Aumann, Ross. “Markets with a Continuum of Traders”, Econometrica, 32.2 (1994): 39–50.

Clifton, John. “Competition and the evolution of the capitalist mode of production”, Cambridge Journal of Economics, 1.2 (1997): 137–151.

Frank, Rose. Microeconomics and Behavior 7th ed, London: Routledge, 2006. Print.

Garegnani, Philip. Sraffa: classical versus marginalist analysis. Routledge: London, 1990. Print

Hoffman, Binger. Microeconomics with Calculus, Wesley: Addison-Wesley, 1998. Print.

Keen, Steve. Debunking Economics: The Naked Emperor of the Social Sciences, Australia: Pluto Press Australia, 2001. Print.

Kirzner, Ian. The ‘Austrian’ perspective on the crisis: The Crisis in Economic Theory, New York: Basic Books, 1981. Print.

Kreps, David. A Course in Microeconomic Theory, New York: Harvester, 1990.

Kurz, Heinz and W. Salvadori. Theory of Production: A Long- Period Analysis, Cambridge: Cambridge University Press, 1995. Print.

Massimiliano, Vatiero. “An Institutionalist Explanation of Market Dominances”. World Competition. Law and Economics Review, 32.2 (2009):221-6.

McNulty, James. “A note on the history of perfect competition”, Journal of Political Economy, 75.4 (1967): 395–399

Roberts, John. “Perfectly and imperfectly competitive markets”, The New Palgrave. A Dictionary of Economics, 3.1 (1987): 837–41.

Velupillai, Vela. “Uncomputability and Undecidability in Economic Theory”, Applied Mathematics and Computation, 34.1 (2009): 12–117.