Introduction

The United States is one of the leading importers of oil. Around 50 percent of its crude oil demand is acquired from different countries in the Middle East. When the prices of oil increase, many citizens become dissatisfied since they find it hard to achieve their economic goals. The government also tries to implement appropriate mechanisms to control supply and demand. Understanding how the country’s GDP has responded to changing oil prices in the past is an approach that can guide scholars to predict the potential effects of a new shock. The selected topic for this discussion focuses on the effect of a new oil shock on the United States’ gross domestic product (GDP).

Using past scenarios, this paper examines how oil price changes might affect economic performance and make it impossible for Americans to achieve their potential. To complete this research, a qualitative study relying on researches published within the past five years was used for the intended analysis. Graphical representation is also used to predict the potential impacts of a new oil shock on United States’ GDP.

Literature Review

Oil plays a significant role in the economic performance and growth of any nation. This resource fuels different sectors and industries, including transport, communication, manufacturing, processing, tourism, and agriculture. Recent studies have indicated that changes in oil prices within a given period can affect a wide range of aspects associated with every country’s economy. In the United States, the issue of oil shock is something that has attracted attention of many scholars, economists, researchers, and policymakers. Albaity and Mustafa (2018) observed that oil prices had been rising significantly in the US from 1970 (less than $8/gallon) to 2010 ($125/gallon).

Although inflation has been a leading determinant of this change, studies have revealed that a number of factors had a role to play (Albaity & Mustafa, 2018). For example, the infamous Yom Kippur War (1973) and the Iranian Revolution (1979) resulted in higher oil prices that had never been recorded in this country before. With sudden increases in oil prices becoming common in the 1970s, economists coined the word “oil shock”. Researchers use it widely to refer to a significant rise of oil prices within a short period of time (Albaity & Mustafa, 2018). Consequently, the subsequent impacts of oil shocks continue to inform many studies.

Most of the research findings presented in the recent past have linked oil shocks to various economic challenges. For example, Fueki et al. (2018) observed that many members of the G7 were all key importers of crude oil from different parts of the world. In such countries, the occurrence of an oil shock was found to have significant impacts on their GDPs within two years. Oladosu, Leiby, Bowman, Uría-Martínez, and Johnson (2018) also noted that inflation was an outstanding outcome recorded after a given developed country experienced a sudden change in oil prices. Similar developments have been made in several countries, including the United Kingdom, France, and Germany.

Although past studies have generalized the relationship between sudden oil shocks and economic performance, the findings from the United States have appeared to present divergent opinions. Most of the researches completed within the past six decades have presented inconclusive observations. For example, Kaplan (2018) indicates that the United States’ gross domestic product (GDP) was capable of recovering from any form of oil shock within a short period.

The outstanding observation was that the country’s economy was capable of recovering from sudden price changes and oil availability. The economic outcomes recorded in this country supported this assertion after the prices of oil increased significantly from 2002 to 2007 (Fueki et al., 2018). The absence of a noticeable recession explains why the country has been able to overcome oil shocks. According to Kaplan (2018), the events recorded during these five years could not be described as an oil shock.

Some analysts have gone further to present various ideas to link economic retardation to an oil shock in the United States. A study conducted by Krupnick et al. (2017) indicated that any oil price rise of about one percent resulted in about 0.30 percent reduction in real consumption in the country within a year. However, the rate decreased significantly in the subsequent years. Many scholars have indicated that the country’s GDP was now capable of responding positively to changes in oil prices (Fueki et al., 2018).

However, the recession experienced in 2007-2008 appears to challenge the ideas presented by earlier scholars. Using this information, Albaity and Mustafa (2018) was keen to indicate that the increasing prices of oil experienced from 2002 to 2007 could have played a unique role in the development of this recession that affected all aspects of the economy. Oladosu et al. (2018) refute this assertion by acknowledging that a recession would still have occurred in the absence of the oil prices changes experienced within the past six years.

The demand for oil is something that governments and economic experts take seriously. Krupnick et al. (2017) assert that the amount of oil required in a given country will be proportional to the size of its GDP or economy. An increase in GDP means that the amount of oil required will rise significantly. However, oil prices should remain constant throughout the targeted period if the rate of consumption is to increase steadily without disruption. The occurrence of an oil shock is something that will definitely have significant impacts on a country’s GDP.

Some experts have presented evidence-based insights to explain how sudden changes in oil prices will strain the economy, minimize consumption, and affect a wide range of sectors. Oladosu et al. (2018) observed that sudden oil price changes were capable of triggering negative effects on the economy. Failure to institute appropriate mechanisms to control such prices is a mistake that can eventually result in recession or reduced GDP. Irwin (2018) uses similar ideas to encourage policymakers and government economists to embrace superior mechanisms to control oil prices. Such a strategy will also safeguard the speed of economic growth.

Economic Analysis

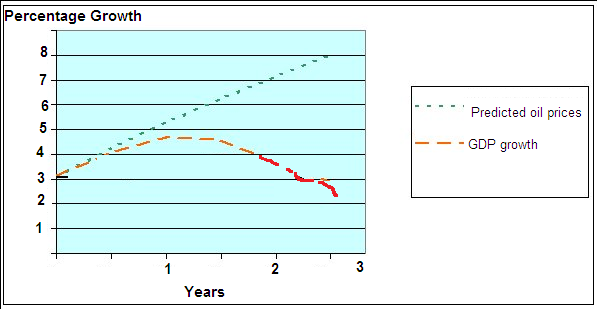

The completed study has indicated that a sudden increment in oil price has the potential to affect the economy of the United States and its GDP. There are several outcomes associated with a sudden oil shock. Some of them include transfer of a country’s wealth to oil exporters or producers, increased production costs for services and goods, reduced consumer confidence, and inflation (Kaplan, 2018). With the United States recording increased dependence on oil, the impacts of increased prices can be disastrous on the economy (see Figure 1). A negative co-relationship will exist between oil price and GDP growth after an oil shock.

Whenever there is an oil shock, the costs for production increase, thereby reducing the rate of supply. These developments affect the ability of a given economy to perform positively. The outcome is that the level of growth will be limited. Such changes can eventually result in slowed GDP growth rate (see Chart 1). Researchers use the GDP metric to monitor the health of a given economy. Reduced GDP means that the economy is not performing positively.

Albaity and Mustafa (2018) believe that the situations arising from oil shocks are worsened by different monetary policies the government put in place to reduce the potential impacts of oil-related inflation rates. Additionally, an unexpected rise in oil prices will result in increased unemployment.

According to this analysis, increased prices for oil can affect stock market index and returns negatively in the United States. According to Irwin (2018), theorists have managed to link stock price behavior and oil shock. Past analyses have showed that oil shocks are usually capable of impacting equity markets. When the price of oil increases due to the expansion of a given economy, the corresponding stock prices tend to increase significantly. These aspects explain why researchers and policymakers should formulate appropriate equity pricing mechanisms.

Chart 1: Hypothetical oil shock scenario.

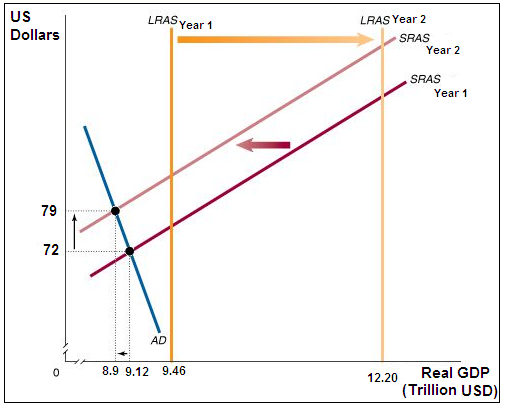

From the presented scenario, macroeconomic equilibrium happens when the SRAS curves intersect the AD line (see Figure 2). When there is an oil shock, the targeted economy can move from the potential GDP for year 1 to one that is far below the potential GDP for year 2 (see Figure 2). This is a clear indication that sudden changes in oil prices can have negative effects on the country’s GDP, thereby affecting economic performance (Albaity & Mustafa, 2018). This is exactly what happened following the infamous oil shock experienced in 1974.

It is evident that the study approach has presented evidence-based insights and ideas regarding the potential effects of a new oil shock on the United States’ GDP. However, the selected model presents several limitations. For example, it fails to consider other potential variables that might affect GDP growth rate at a time when a country is experiencing an oil shock (Oladosu et al., 2018). The price of crude oil as a tradable commodity is also something that has the potential to affect stock returns. The emerging volatility in prices is capable of creating uncertainty, thereby resulting in unfair or unequal allocation of labor or factors of production.

Conclusion and Summary

Past studies and analyses have indicated that changes in oil prices can trigger new developments and affect the economy of a given country. An oil shock is also expected to have far-reaching consequences on GDP and can make it impossible for many citizens to achieve their potential. The completed aggregate demand and supply graphical analysis has also revealed that the occurrence of an oil shock can have detrimental impacts on this country’s GDP. The outcome can also affect various aspects of the economy, including employment, availability of resources, service delivery, and manufacturing. The insights gained from this research paper should, therefore, guide researchers and policymakers to formulate superior models to ensure that the US is prepared for any oil shock.

References

Albaity, M., & Mustafa, H. (2018). International and macroeconomic determinants of oil price: Evidence from Gulf Cooperation Council countries. International Journal of Energy Economics and Policy, 8(1), 69-81.

Fueki, T., Higashi, H., Higashio, H., Nakajima, J., Ohyama, S., & Tamanyu, Y. (2018). Identifying oil price shocks and their consequences: The role of expectations in the crude oil market. Web.

Irwin, N. (2018). The most important least-noticed economic event of the decade. The New York Times. Web.

Kaplan, R. S. (2018). A perspective on oil. Web.

Krupnick, A., Morgenstern, R., Balke, N., Brown, S. P., Herrera, A. M., & Mohan, S. (2017). Oil supply shocks, US gross domestic product, and the oil security premium. Web.

Oladosu, G. A., Leiby, P. N., Bowman, D. C., Uría-Martínez, R., & Johnson, M. M. (2018). Impacts of oil price shocks on the United States economy: A meta-analysis of the oil price elasticity of GDP for net oil-importing economies. Energy Policy, 115, 523-544. Web.