Introduction

Circuit City became the largest retailer to be a victim of the economic meltdown with the announcement of its remaining 567 stores in the United States costing 34,000 more jobs after the company failed to find a buyer for its business. Circuit City, once the second largest electronics retailer with 720 stores in the United States and 770 stores in Canada filed bankruptcy petition under Chapter 11 on November 10, 2008. At that time, the company laid off 20% of its work force. Earlier in the same period, the company decided to close 155 of its stores across the United States (Mahalo).

Subsequently during January 2009, since the company was unable to find a buyer or arrive at a suitable refinancing solution Circuit City announced its decision to close all the remaining 567 stores in the United States. The company began its “going out-of business sales” in all its retail outlets. Analysts are of the opinion that stiff competition from larger retail chain stores like Wal-Mart and online stores like Amazon were instrumental in causing reduction in sales and huge losses to Circuit City. They also cite the general economic downturn and declining stock market as other reasons for the insolvency of the company. This paper presents an analytical report on the bankruptcy of Circuit City.

Circuit City – A Background

Circuit City was founded in the year 1949 by Samuel Wurtzel and emerged as a major consumer electronics trading company. The company specialized in computers, televisions, home entertainment, video games, cameras, movies, music and audio equipment. While the company normally trades in a wide range of branded consumer electronic goods, in the year 2004, the company started selling their own product line. The own product line included LCD computer monitors and other consumer electronic goods through their ESA brand. Circuit City witnessed a rapid growth during the period 1960s and 1980s. In the year 1999, the company’s revenue crossed $ 10 billion level (Szustek). The company tried to improve the profitability by eliminating certain product lines like appliances and by reducing the operating costs.

Over its life, the company transformed itself from a small local television store to an international electronic retail chain. However, due to the stiff competition from companies like Best Buy, Comp USA, Wal-Mart, Radio Shack and Amazon.com the company gradually lost its market share and finally filed the bankruptcy petition under chapter 11. The company had lost $ 5 billion in stock market value over the last two years.

Trend in US Retail Industry

The retail industry as reported by the Trading Group of the industry, a “deep recession deep recession, severe winter weather and five fewer shopping days” caused a decline of 2.8% in the 2008 holiday sales which turned out to be the first-ever decline in the sales over the period since 1995. Normally the sales during the holiday period would account for 50 % of annual sales and profits of the retailers. Lower sales in December 2008 marked a reduced sales level for the sixth consecutive month and the longest duration of declined sales in the last four decades (Kavilanz). It is feared that the prevailing trend in the retail industry would force many of the retailers to file bankruptcy under Chapter 11 following Circuit City and few other retailers.

Financial Issues faced by Circuit City

Due to sluggish growth and lower revenues, the company decided to close down 155 of its retail stores, which is approximately about 20% of its total number of stores. The company also decided to lay off a certain percentage of the staff working for the company in the United States. However, since these steps have not improved the financial position of the company and the company could not also find a suitor to take over the business. Circuit City was looking for all the available options for strengthening the financial position. The company received the final blow when several of the suppliers of the company cutoff their credit limits and demanded upfront cash settlement for any new orders in view of lagging sales and poor cash flow. Circuit City had made losses during the five of the six financial quarters prior to the filing of the bankruptcy petition.

In total, the company owed about $ 650 million to its suppliers. In the bankruptcy, filing the store had indicated asset value of $ 3.4 billion and liabilities of $ 2.32 billion. Among the suppliers to whom the company owed money, include electronic manufacturers Hewlett Packard, Samsung Electronics, Sony Computer and many others. The maximum amount due was to Hewlett Packard at $ 118 million and next to Samsung at $ 116 million.

Impact of Store Closings

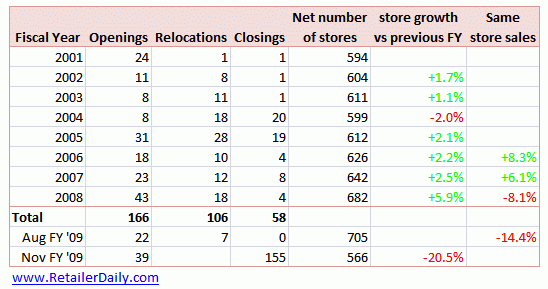

On November 3 2008, Circuit City confirmed the closure of 155 stores bringing down the total number of remaining stores to 566. The first two quarterly report in Form 10-Q for the fiscal year starting March 01, 2008 showed a quick reversal of same-store sales which drove the company to make the drastic decision of closing some of the stores and laying off workers. While the same-store sales grew by 8.3% in the Fiscal year 2006 and 6.1% in Fiscal Year 2007, it declined by 8.1% in the Fiscal Year 2008 and 14.4% during the first half of Fiscal year 2009. Although as of February 2007, Circuit City planned to open 100 stores during Fiscal Year 2009, the company cut down its plans to reduce the number to a modest 45-55 during February 2008.

The number of stores continued to grow steadily at an annual rate of 1.9% over the past nine years. The total number of stores stood at the peak above 700 during April/May 2008. However, with the decision to close down 155 stores in November 2008, the company would be having only around 566 stores much below the 574 stores it had in the year 2001. This implies that the company would be losing the sales growth it gained through its efforts during the last decade. The following table is illustrative of the changes in the number of stores and same-store sales during the past.

Comparison with Competitor Best Buy

As of the year 2003, Best Buy, the close competitor of Circuit City and Circuit City were competing with each other in respect of the number of stores neck to neck each having around 550-600 range. After five years, Best Buy is having almost 1000 stores in the United States, which is more by 40% in the number of stores Circuit City is operating (Retailer Daily). In a state-wise comparison where both companies have, their presence States of Florida and Pennsylvania remained equal while in all other states Best Buy was operating at least 60% or more stores than Circuit City calculated based on the total number of stores owned by both the companies. With the closure of 155 stores, Circuit City would also probably have lost its second position to the nearest rival Wal-Mart.

Borrowings

Circuit City informed that it had arranged a $ 1.1 billion in bankruptcy financing from Bank of America with which the company planned to replace the $ 1.3 billion credit line. From this credit line, the company had drawn $ 898 million up to the time of filing the bankruptcy petition. This implies that the company borrowed more than $ 675 million in the six weeks period prior to its reporting on the earnings in September 2008 (Clothier and McCarty). The company received a preliminary offer from Blockbuster Inc and Blockbuster withdrew its offer later. Circuit City lay off, high paid workers and opened smaller stores in order to reduce the costs. With a view to bring the company out of losses, the company took the initiatives of hiring a consulting company for restructuring and replaced the chief executive officer.

Circuit City reported a loss of $ 239.2 million for the quarter ending September 2008, which was more than three times and the sales were down for the sixth quarter consecutively. The company had lost its market share to its competitors who offered Apple Inc and Dell computers. Similarly, other competitors Best Buy and Wal-Mart offered flat-panel televisions to attract the US customers (Clothier and McCarty). Due to the economic recession, the customers have limited their spending due to massive job cuts and declining home values. Global economic meltdown has made it difficult for Circuit City to get stock replenishments and for the consumers to spend more on purchase of electronic goods.

Reasons for Failure

One of the reasons that caused the failure of Circuit City was the action of the company to bankroll “Digital Video Express” (DIVX) that the company started approximately ten years ago. This experimental digital videodisc format was supposed to compete with just started DVD concept. While with DVD the customers enjoy the ownership rights, DVIX offered a special digital right management system where the customers had to make telephone calls to centralized servers with their request to play a particular movie. Every time a request was made, the desired movie will be played to ensure that the viewers had permission to watch the movie within the stipulated time.

The idea was to compete with video rentals and to enable the customers to have a limited right over the video disc without physically moving from his/her house. However, the DVIX system proved to be a big failure with the DIVX authentication server going out of action and the DVIX discs sold becoming useless. This not only caused huge monetary loss to Circuit City but also large erosion in the goodwill of the company.

Another reason is the revision in the pay scales of sales people eliminating sales commissions and laying off, of sales people. The company laid off 3,900 sales personnel in the year 2003 and 3,400 highest paid sales staff in the year 2007 (Meadows). The management thought that these sales people were costing the company heavily. The layoff in the year 2007 was particularly harmful to the company as the expensive sales people would obviously represent most experienced and best sales people the company would have had. Losing the top ranking sales staff had resulted in a poor quality customer service and resultant decline in sales.

Especially, considering the fact that the experienced sales people were capable of selling expensive items like home theatre systems and large screen televisions, loss of such people has led to the failure of the business of Circuit city. Once the suppliers sense that the company is on the road to bankruptcy, they would not be inclined to sell to that company which also makes the company going out of stocks of more items in demand.

Apart from the above Circuit City had certain other shortcomings like old and outdated stores, which need to be remodeled or converted into bigger and spacious ones and poor selection of products leading to non-availability of prime products, which were in demand. Competitors like Best Buy, Target or Wal-Mart scored on this count. The rewards program of Circuit City was not attractive as compared to those offered by the competitors and due to the loss of experienced sales staff, customer service was very poor.

The company failed to recognize the fact the customers who purchase hardware to play movies, games and music would as well like to buy them to own permanently instead of for a short time. More than anything else, the company did not consider the competition from Best Buy seriously and failed to take necessary steps to combat the competition (Durazo).

Share Price Movements of Circuit City

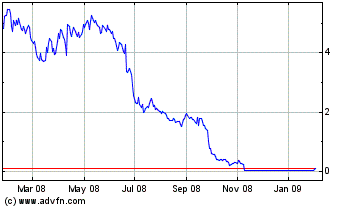

In a press release on January 16, 2009 Circuit City announced that the company did not have any hope that there would remain any value from the bankruptcy estate for the common equity holders of the company. The value of shares lost 73% during the day and remained at $ 0.04 during the day (Pajamadeen).

The stock price of Circuit City, which was $18.53 during January 2007, came down by 78% to $ 4.15 due to the wrong management decision to lay off 3,400 of its best workers. With the continued dismal performance in sales and service and loss of vendor confidence, the share price reached $ 0.10 during November 2008, which was a decline of 99.5 % within a short span of about 23 months. The company took the wrong move of firing the best of their sales staff who would be able explain the complicated technology to the customers just at the time when most of the customers had started to move to using High Definition Television (HDTV), which involved complicated technology.

The move of firing experienced people resulted in the complete destruction of the competitiveness of Circuit City. The job cuts had their effect on the morale of the remaining employees of the company and resulted in a deterioration of the customer service. This caused the company to lose almost two-thirds of the market value of its stocks by the end of 2007.

Impact of the Bankruptcy of Circuit City

The closing down of Circuit City will not only hurt the employees who lost the job but also the consumers as competition always help the prices to be kept under control. Bankruptcy of Circuit City will be a big blow to several malls as the retail units of Circuit City normally occupy a store area of 20,000 to 25,000 square foot and the malls would find it difficult to find alternative tenants with the current economic situation (Felberbaum and Tong).

There will be an estimated 18.71 million square feet of store space that would be left vacant after the closure of 567 remaining stores of Circuit city. The bankruptcy thus would be adding to the problems of the real estate market. In addition the closure will also give a sharp rise in unemployment with 30,000 and odd workers forced to leave their jobs. Apart from the national unemployment, the job cut would pinch the individual employees in meeting their bills, mortgages, credit cards that would add the pressure on the housing and credit markets. The suppliers of the company would also be seriously hit with companies like HP and Samsung unable to collect millions of dollars owed by Circuit City.

Smaller companies located in the shopping centers occupied by Circuit will also realize a reduction in their sales as customers visiting Circuit City would wind up visiting these smaller stores. The newspapers and magazines will also feel the brunt in the form of reduced advertising revenues. The only entity that will be benefited is Best Buy with an expected increase in sales of over 30%who has been stealing the market share of Circuit City (Fowlkes).

Conclusion

Circuit City thus had become the first major casualty resulting from the economic recession that happened after the holiday season. Though there were many reasons for the company to reach the position of filing bankruptcy petition the laying off 3,400 experienced employees in the year 2007 on the plea that they were earning too much money was considered a key reason for the downturn of the company.

The then CEO of the company Philip Schoonover wanted to replace these experienced employees with less expensive inexperienced people and analysts consider this as one of the major causes of decline in the sales of the company as this had its adverse impact in the customer service. In addition to poor management decisions the retailers in general were having a bad time since the 2006 Christmas holiday shopping season. With Wal-Mart breaking the $ 1000 price-point on the 43 inches flat-screen television, several electronic traders had lost huge sales. At this point Circuit City had to close 70 stores in the US and sell its 800 stores in Canada due to stiff competition and lower sales revenue.

However, at a point of time when the economic recession took its toll, no measures like bankruptcy protection, layoffs, price reductions and store closings could save Circuit City. According to Company Chief Financial Officer Bruce Besanko as quoted by Reuters, “In large part, a Chapter 11 filing is due to three factors, all of which contributed to a liquidity crisis that prevented the company from completing its turnaround goals outside of formal proceedings: erosion of vendor confidence, decreased liquidity and a global economic crisis.”

Works Cited

Clothier, Mark and Dawn McCarty. Circuit City, Electronics Retailer Seeks Bankruptcy. 2008. Web.

Durazo, Daniel. Top 10 Reasons Circuit City Will Go out of Business. 2008. Web.

Felberbaum, Michael and Vinnee Tong. Circuit City Liquidation: 567 US Stores Closing. 2009. Web.

Fowlkes, Michael. Circuit City Impact will be Deeply felt. 2009. Web.

Kavilanz, Parija B. Holiday Sales: Much worse than Feared. 2009. Web.

Mahalo. Circuit City Bankruptcy. 2009. Web.

Meadows, Chris. Lessons from Circuti City’s Bankruotcy. 2009. Web.

Pajamadeen. Circuit City Pulls th Plug: More than 30,000 Lose Jobs. 2009. Web.

RetailerDaily. Data Drill Down: Circuit City’s Store Closings Focus on Specific Markets. 2008. Web.

Szustek, Anne. Circuit City Goes in to Liquidation. 2009. Web.