Introduction

Reebok International market is largely contained in three major regions; North America, Europe, and Asia. However, the company has indicated a steady growth in Australia and Africa markets over the last one decade. The company has 22% share of the total market after the market leader Nike which has 33 % share of the market. Reebok has a share of 16 % of the American market ahead of Adidas which has 11 percent market share (Dogiamis & Vijayashanker, 2009, p.8).

Reebok international Company was established in 1890 under the name of J. W. Foster and Sons. Two grandsons of the founder changed the name to Reebok. The company is headquartered in Carlton, Massachusetts (Reebok, 2004). Since 2006, the company has been operating as a subsidiary of Adidas, the giant German sportswear producer (Adidas, n.d, p.20). It primarily deals with the production of athletic footwear, apparel and accessories. Reebok made a massive shift of operations towards the global market in an effort to reconcile the failing business (Reebok, 2005, p.6). The company now uses footwear factories spread across 14 countries. The footwear production facilities are based in Asia, in China, Indonesia, Vietnam and Thailand.

This paper is intended to analyze the market environment, strategy, and strategic position of Reebok in order to recommend on the best strategic move that can position the company better in the competitive environment.

Market environment analysis

The purpose of this section is to identify Reebok’s market limitations, success factors, as well as the competitive advantage.

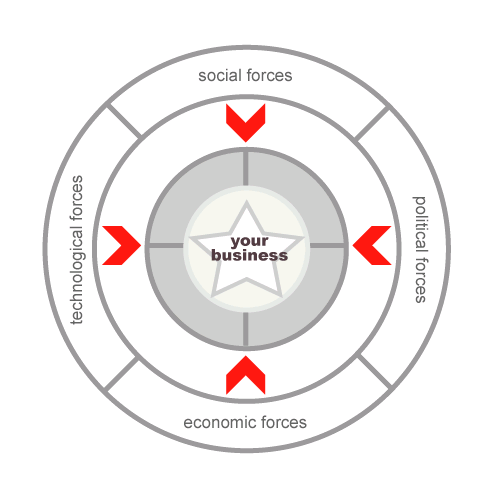

PESTLE analysis

Political

Outsourcing and Labor Practices are major political factors affecting Reebok’s operations across the world. Just like other business that outsource to regions outside US, fair labor practices become a major issue (O’Rouke, 2002, p.4). A report published by The Fair Labor Association (FLA) in 2003 showed that Reebok has labor issues within facilities outside US (Arbaugh, 2008, p.100). FLA is a non-profit network that monitors the practices of major footwear and clothing manufacturers. Indeed, most of the accusations met by the company are related to health and safety issues (Yu, 2008, p.515).

Economic

Weak economic conditions have generally led to fluctuations in investor confidence, a softening in demand and a retrenchment in spending. Consumer spending in U.S. which comprise of two-thirds of overall economic activity grew by just 1.0% in 2010, which was less than spending growth rate (Henderson et al. 2011, pp.1-7). Accordingly, in 2011, Reebok expects the market to be challenging and should be determined to maintain its image.

Social

The campaign for sportive life to promote a healthy living has resulted in an increase in the number of people purchasing Reebok products. A 2008 survey by FSPA indicated that in sports and equipment industry consumers have increased by 11%. This explains the 9% increase in sales for the company in the last quarter in 2010 compared to the first quarter (Adidas Group. 2010, p.6)

Technological

Reebok has continuously placed a strong emphasis to technology and has integrated various technologies into its production facilities. It is part of the sports equipment industry that is blowing up with new information technologies. The company maintains an internet site as a service to online community. The sales received through online selling are estimated to be $25 million annually (Adidas Group. 2010, p.156). The company has even introduced new technologies such as ‘balance ball inspired technology’ for their footwear products increasing sales significantly (Adidas Group. 2010, p.34).

Legal

The legal factors affecting Reebok business are associated with outsourcing malpractice, counterfeit products and advertising. The company has been encountering legal issues associated with the provision of healthy and safe workplace. Authorities have seized about 1.9 counterfeit sports products in 2008 (FSPA, 2008). In addition, advertisements of new technologies such as balance ball inspired technology faced legal criticism (Datamonitor, 2008). The advert that the shoes toned the bottom of a user 28% better than any other shoes was considered to be a lie (Anonymous, 2011, p.1).

Environmental

Like any other manufacturing company, Reebok operations are influenced by environmental regulations and standards. In fact, the policy that has continued to leverage the business is on waste disposal. This led to the company opting to recycle all the factory waste products in 2001 (Reebok, 2004). The recycling program was estimated to save the company about 1.1% of the total cost in production (Reebok, 2004). With the rising prices of raw materials, the recycling program is associated with the efficiency of the company.

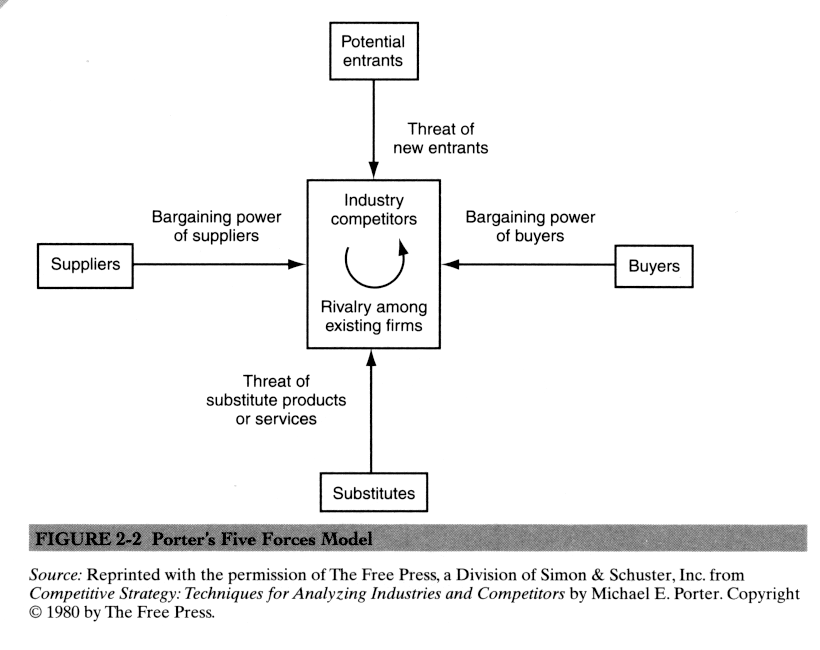

Porter’s five-force analysis

There is strong rivalry among the existing firms due to the increasing competition in the sports industry. Nike dominated the market in 2009 with a share of 33% of the global market and is the greatest rival for Reebok (Dogiamis & Vijayashanker, 2009, p.8). After Adidas acquired Reebok, the market share in the US market increased intensifying the rivalry between the two firms (Dogiamis & Vijayashanker, 2009, p.8). Other firms like PUMA, Ascics, Lotto and Fila are competing to be the market leaders in future.

The threat of new entrant is increasing due to the pressure imposed by Chinese manufacturers and their cheap products. The average price of Reebok sport shoes is US$60 while that of the Chinese manufacturers can go as low as US$35 (Datamonitor, 2008). This price gap is pushing the cost sensitive consumers towards the Chinese manufacturers and marketers. In addition, the market price of Reebok is relatively high in the American market when compared to local manufacturers (Datamonitor, 2008).

Buyers for sports products and equipment have a high bargaining power due to the stiff competition. In US market alone, Reebok is competing with about 20 manufacturing firms including 5 branded manufacturers (Dogiamis & Vijayashanker, 2009, p.8). This high bargaining power of the buyers has influence Reebok to reduce its market price by 2.1% since 2008 (Dogiamis & Vijayashanker, 2009, p.8). The cheap products being offered in the market will force Reebok and other top brands to lower their prices as well.

Reebok relies heavily on suppliers to provide the best prices in order to keep costs down and encourage consumers to purchase. However, Reebok has a wide supplier base covering more than ten countries including China, India, Canada, Australia, Pakistan, Singapore, and United States. About 40% of Reebok supplies are from China and 30% from India giving other supplies a very little power to influence the operations (Yu, 2008, p.512).

Substitute products threaten Reebok and services especially form the new manufacturers. For instance, the company was threatened by the revolution of brown shoes in 2003 which declined its revenue in European market by 2.2% (Datamonitor, 2008). Similarly, the revolution of government and team-based instructions are likely substitutes of the instruction programs offered by Reebok. There are such programs in 16 European countries where the threat is inevitable. The programs are targeted for educating the people about recreation and physical activities especially in France and Germany.

Sport equipment market is an oligopoly market with Adidas, Reebok, Nike and Puma controlling the majority of the market share. By 2009, Nike had a share of 32% followed by Reebok with 22% while PUMA and Fila lag in the least with 3% and 2% respectively (Dogiamis & Vijayashanker, 2009, p.8). The rest of the competitors share the remaining 46% of the global market. Reebok operation in European and American market is of significance in its market structure. It has been reported that 75% of the people within the two regions engage in sportive activities either as professional or for leisure (Datamonitor, 2008). Reebok command this market through product differentiation according to the differing needs of the consumers.

The strategic group for Reebok is defined by similar product differentiation strategies focused on the same market place. The key products in this group include sports and fitness footwear, equipments, apparel, accessories, and instructional programs (Adidas Group, 2010, p.136). The footwear portfolio is much differentiated but not as that of Nike and the price is relatively cheaper. For instance, women shoes average $40 per pair as compare to the same products for Nike which average $42 (Adidas Group, 2010). Other competitors like PUMA have cheaper prices but their products are not much differentiated. For instruction programs, Reebok leads the group with such programs in all major store outlets (Adidas Group, 2010, p.120)

Reebok market segmentation is of two types (Datamonitor, 2008, p.8). First the segmentation is based on the geographical regions. The company markets its products in four major regions; North America, Europe, Asia, and Latin North America accounted for 52.3% of the total revenues while Europe, Asia, and Latin America accounted for 32.7%, 11.4%, and 3.6% respectively in 2007 (Adidas Group, 2010, p.150). The consumer according to benefit seeks the other segmentation. This segment includes weekend warriors, casual wearers, and serious athletes. The casual wearers are the largest segment in terms of sales comprising of 80% of the total revenue got from sales (Adidas Group, 2010). Serious athlete is the fastest growing segment with a rate of 16% as per the end of 2010(Adidas Group, 2010)

Strategic analysis

Reebok’s threshold resources are centered on its outsourcing capability (Sheehan et al, 2002, p.25-43). The company has its production facilities in over 46 countries across the world. These resources are facilitated by ample skills and production technologies to enhance production and operations. The company is responsible for the design and specification of the products manufactures in all facility. This control has enabled the company to save production costs, increase productivity, and maintain high level of innovation (Adidas Group, 2010, p.110). The facilities are close to raw material and thus giving Reebok the advantage of acquiring them even during the times of scarcity. During recession period of 2009, the company was able to maintain its production level due to the strategic location of its factories (Adidas Group, 2010, p.106).

One of the distinctive characteristics for Reebok is the sponsorship strategy for major sports events across the countries it operates in (Amis et al, 1999, p.251). For instance, the company sponsors more than 30 national and international cricketers in India (Sewra, n.d, p.2). The company is also the official partner if International Cricket Council Sewra, n.d, p.2). Another distinctive resource for the company is Adidas, the parent company. This resource has enabled Reebok to outdo some key players like Nike in terms of market share is certain markets (Dogiamis & Vijayashanker, 2009). For example, the acquisition of the company increased Reebok’s American market share to 57% (Dogiamis & Vijayashanker, 2009). These resources appear to have differentiated the company among its competitors and are key sales movers.

Core competencies

One of the core competencies for Reebok is centered on Research and Development which has continuously shown innovative capability. This area enabled the company to be innovative as was evident in 2002 advent of the aerobic shoe as well as the fitness crazes that the business inspired (Utrafit.com, 2010, p.25-27). This innovation made sales revenue to shoot from $2 billion in 2001 to $2.8 billion by the end of 2002 (Utrafit.com, 2010, p.25-27). Still, R&D has leveraged other innovations especially in technology such as the 2010 balance ball inspired technology. This technology attracted a substantial number of consumers especially the younger people making sales of about four million items in the first quarter of 2011 (Reebok, n.d).

The management team is also a core competency in Reebok that has been driving performance throughout the history (Weiss, 2009). Uli Becker the president and CEO is an experienced marketer who has held previous senior positions in brand communication, advertising/media, product marketing, and sales on local, regional, and global levels. Matt O’Toole the Chief Marketing Officer has a long and impressing track record in the industry. Jim Gabe the senior manager has served as the boss of Adidas Canada after serving as a senior manager for Mizuno Canada and Champion Canada (Datamonitor, 2008). The company was ranked among the top ten best managed organizations in the category of foreign US based organization (Datamonitor, 2008).

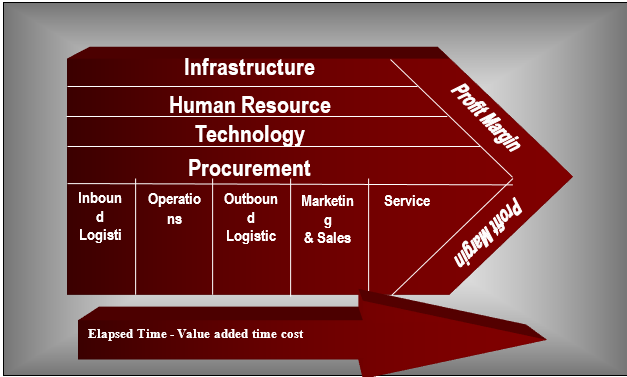

Value chain analysis

Reebok value chain is organized in four major parts: supply of raw materials, including synthetic and natural fibers; provision of components like fabrics and yarns by textile firms; production networks, including overseas contractors; export channels set up by trade liaisons; and marketing networks at the retail level (Adidas Group, 2010). For the primary activities, inbound logistics involves manufacturing units in Asia, Europe, and America. Manufacturing facilities are spread across 14 countries, though Asia has the majority (Adidas Group, 2010, p.78. China leads in footwear production while India leads in apparel Adidas Group, 2010, p.107. About 50% of the total apparel sold in United States is manufactured in India. Company operations involve several distribution channels and internal creative team. Reebok distributes its products through selected stores in America as well as own stores in Asian countries. For example, Reebok India has over 1000 stores across the urban regions of the country (Sewra, n.d).

Outbound logistics are facilitated through a comprehensive distribution and dispatch systems, as well as warehousing and invoicing programs. The company ships about 80% of the products made from the factories to destination markets (Adidas Group, 2010). The rest is either delivered through air or surface routes. Sales and marketing activities are tailored to suit diversified markets and the different segments as well as increasing sales growth (Datamonitor, 2008). Products are positioned according to the needs of the target market while the company engages in promotion activities to market the products. The company partners with design celebrities such as Pharrell Williams to attract more customers (Hall, 2004, p.6). After sale servicing of the sports equipment is targeted at enhancing the brand image and emotional connection with the customers.

Supportive activities in the Reeboks value chain includes administrative and finance infrastructure that is supported by Business Intelligence applications, SAP information management, retail back office, and ability to finance foreign operations (Reebok, 2004, p.16). Human resource activities involves the management of about 8,000 employees, work councils, trade unions, long-term plans, acquisition risk, and work stoppage (Adidas Group, 2010). Product and development activities are focused on developing diversified network of products, specialized designers, and products customized for special needs. The company has about 200 different products in its product portfolio (Edwards & Tsouros, 2006)

VRIN framework

Reebok derives value by outsourcing production operations to countries where the input cost is low. Asian countries especially China and India have skilled, cheap labor that ensures the company’s attainment of quality production process (Subramanian, 2009, p.15). This capability reduces cost by approximately 30% of the total production cost and hence the resource increases the revenue (Reebok, 2004).

Reebok’s rare capabilities are associated with the powerful brand and excessive offering rights in the North America market (Adidas Group, 2010). This global brand echoes in the minds of all consumers in the main market for sports products. Royal customers contribute about 50% of the total sale in America (Dogiamis & Vijayashanker, 2009. The company has also been given exclusive rights to produce and market authentic and replica products of several teams of National Football league (NFL) in North America.

Inimitable capabilities for Reebok are associated with the management, development, and deployment of resources (Datamonitor, 2008). Starting from research to the marketing of a product, the company has a systematic approach that links the processes with the core competences. An example is observed in the single supplier paradigm that avoids the dynamics associated with the supply of law materials. This has saved the company from the effects of low supply of materials experienced by other competitors (Reebok, 2004).

Reebok has many resources and competencies including design, product supplies, sufficient customers, inspirational leaders, always surprising to name a few. However, the company has over-relied on high research and development as the sole competency for its strategies (Adidas Group, 2010, p.110).

Strategic fit analysis

Reebok has strategic core competencies and resources that can be applied to create a competitive advantage in the dynamic market environment. Apart from unavoidable political factors such as security, other factors like strict trade regulations can be avoided by moving operations to more environments that are lenient (Phatak, Bhagay & Kashlak, 2009). The company is full of financial capabilities and expertise that can facilitate such an endeavor. The management aptness and competency can enhance the performance in new environments where economic growth is perceived.

For Reebok, there are threats of new entrants especially in the countries where operations are outsourced (Dogiamis & Vijayashanker, 2009). The company should increase its brand awareness in such regions and wade off such threats. The many resources available can serve as the gear towards achieving better performance in threatened markets. Innovative capabilities will leverage product position and differentiate the brand among other competing brands (Phatak, Bhagay & Kashlak, 2009). As the customer becomes loyal to the brand, more chances of expanding to new markets emerge. The company can use its research and developments capabilities to create value through quality products. The policy to link the resources and competencies to the dynamics of market environment should be focused on the strengths and opportunities in place for Reebok while fighting against threats and weaknesses associated with the company (Datamonitor, 2008).

SWOT Analysis

Reebok is a leader in the sporting goods industry operating 142 model stores and 288 factory outlets across the world (Adidas, 2010). It is the leading sporting products company in United States and is ranked second after Nike (Dogiamis & Vijayashanker, 2009). The company has emerged as the performance-oriented brand as it has been developing and marketing the custom engineered shores. The company has also a solid focus on advertising as it has continued to endorse celebrities to improve the market image (Datamonitor, 2008). Reebok offers a broad range product portfolio that includes footwear, equipments, sports and fitness, apparel, accessories and instructional programs. The Greg Norman Collection is the world’s leading marketer and distributor of sportswear and golf apparel for men targeting active, sophisticated consumers. The company is a partnership business between Reebok and the golfer Greg Norman.

A weakness in Reebok is associated with recalls of some products. The company recalled about 510,000 heart shaped bracelets which were produced in China and distributed across the world. The bracelets which had been given as gift with purchase had lead poisoning. It also recalled about 55,000 wind suits made for children which posed respiration and choking hazards in June 2006 (Datamonitor, 2008). In addition, the company has weak growth revenue. In 2007, the revenues showed a decline of 5.7% compared to 2006 (Datamonitor, 2008). This decline can be attributed to Rockport division’s weak performance. This division indicated revenues of 291 million Euros in 2007 which was a decrease of about 0.7% over 2006. Such weak revenue could impact on Reebok’s growth plans (Datamonitor, 2008).

There is an opportunity for Reebok in the growing footwear market. The global branded market is projected to grow by 3.7% between 2005 and 2015, to US$321.5 billion (Datamonitor, 2008). The footwear market in US generated revenue of US$62.6 billion in 2007 indicating a compound growth rate of 5.1% (Datamonitor, 2008). The market performance is projected to grow by 3.7% between 2007 and 2012 which is expected to increase the market value to US$75.2 billion (Datamonitor, 2008). The global sports market is buoyant with an asset base of US$64.2 billion in 2007 indicating a growth rate of 1.4% between 2001 and 2007(Datamonitor, 2008).

Moreover, the performance of the apparel market is growing along with fabric technology and is forecasted to be worth US$4.3 billion by 2012 (Datamonitor, 2008). Counterfeit goods and accessories is a big threat for Reebok which can affect the sales of branded goods. More than 9,614 occurrence s of counterfeiting were recorded by Gieschen Consultancy. Gieschen consultancy is a firm that monitors and advices on business operations across the world. In total, more than 1.9 billion counterfeit items were seized by authorities and valued a US$7.6 trillion (Datamonitor, 2008). Another threat is the rising costs of raw materials.

The rising oil prices, the prices of plastic-based products and synthetic rubber had increased significantly. Since the end of 2009, crude oil prices have rose by more than 250%. Some of the Reebok’s factories are run on fuel products and may be affected by price fluctuations or scarcity. The sports industry is also facing high competition and Reebok has to compete with many companied having diversified lines of products such as Nike, PUMA Rudolf, Fila USA, Callaway Golf Company, New Balance Athletic Shoe and Dassler Sport (Datamonitor, 2008).

Recommendations

Reebok International Company must cultivate for a competitive advantage through the implementation of a turn-around strategy. The company is strategically positioned to implement the strategy effectively through the use off the vast competences and resources. Instead of following the norm of the industry, the firm should seek to create new market strengths by exploiting the many opportunities created by the changing market trend. With globalization dictating the way firms should operate, Rebook management team has a role of creating a culture that embraces the change effectively. As a result, the market strategy to be implemented will be implemented with a global view that will ensure a sustainable competitive advantage.

References

Adidas Group n.d, the Adidas Group at a Glance. Web.

Adidas Group. 2010. Annual report. Web.

Amis, J., Slack, T. & Berrett, T. 1999. Sports sponsorship as distinctive competence. European Journal of marketing, Vol.33 (3/4), pp.250-272. Web.

Anonymous. 2004. Sports wear industry data and company profiles background information for the play fair at the Olympics campaign. Web.

Arbaugh, R. J. 2008. International Economics. Florence: Cengage Learning. Web.

Datamonitor. 2008. Reebok International Ltd. Web.

Dogiamis, G. & Vijayashanker, N. 2009. Adidas: sprinting ahead of Nike. Web.

Edwards, P. & Tsouros, A. 2006. Promoting physical activity and active learning in urban environments. Web.

Haag, S., Baltzan, P. & Phillips, A. 2006. Business driven technology. New York, NY: The McGraw-Hill Companies, Inc. Web.

Hall, R. 2004. Pharrell Williams slips into Reebok partnership. Billboard, Vol.116 (3), pp.1-63. Web.

Henderson, S. et al. 2011. Consumer expenditure survey (CE) data requirements. Web.

O’Rouke, D. 2002. Struggling to be a good global citizen. The Mercury News. Web.

Phatak, A. V., Bhagay, R. S. & Kashlak, R. J. 2009. International management: managing in a diverse and dynamic global environment. McGraw-Hill Company. Web.

Porter, M. E. 1980. Competitive strategy: techniques for analyzing industry and competitors. London, UK: The Free Press. Web.

Reebok Inc. 2004. Annual report. Web.

Reebok International Company 2005. Reebok International Ltd. Web.

Reebok. n.d. Easytone technology overview. Web.

Sewra, Puneet. n.d. Reebok India case study. Web.

Sheehan, C., Nelson, L. & Holland, P. 2002. Human resource management and outsourcing: the impact of using consultants. International Journal of Employment Studies, Vol.10(1), pp.25-43. Web.

Subramanian, A 2009, A nation of digital natives. Business Today, Vol. 18 (18), pp.15. Web.

The Federation of Sports and Play Association (FSPA). 2008. The sports goods market in South Eastern and South Western Europe. Web.

Utrafit. 2010. The Reebok journey. Web.

Weiss, J. W. 2009. Business ethics: A stakeholder and issues management approach with cases. Florence, KY: Cengage Learning. Web.

Yu, X. Impacts of corporate code of conduct on labor standards: a case study of Reebok’s athletic footwear supplier factory in China. Journal of Business Ethics 81.3 (2008), pp. 513-529. Web.